Noticias del mercado

-

21:00

Dow 17,739.77 -74.21 -0.42%, Nasdaq 4,759.85 +9.45 +0.20%, S&P 500 2,056.85 -6.30 -0.31%

-

18:00

European stocks closed: FTSE 100 6,826.72 +30.09 +0.44%, CAC 40 4,643.27 +90.47 +1.99%, DAX 10,655.92 +220.30 +2.11%

-

18:00

European stocks close: stocks closed higher, the announcement of ECB’s further stimulus measures still supports

Stock indices traded higher. The announcement of ECB's further stimulus measures still supports The European Central Bank (ECB) President Mario Draghi said at the press conference yesterday that the central bank will launch an expanded asset purchase programme of 60 billion euro a month starting from March 2015 until September 2016.

The central bank kept its interest rate unchanged at 0.05%.

Eurozone's preliminary manufacturing PMI increased to 51.0 in January from 50.6 in November, in line with expectations.

Eurozone's preliminary services PMI rose to 52.3 in January from 51.6 in December. Analysts had expected the index to climb to 52.1.

Germany's preliminary manufacturing PMI decreased to 51.0 in January from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 52.7 in January from 52.1 in December, beating expectations for a gain to 52.6.

France's preliminary manufacturing PMI rose to 49.5 in January from 47.5 in December, exceeding forecasts of a rise to 48.1.

France's preliminary services PMI fell to 49.5 in January from 50.6 in December, missing expectations for a gain to 50.9.

Retail sales in the U.K. increased 0.4% in December, exceeding expectations for a 0.6% drop, after a 1.6% gain in November.

The increase was driven by lower petrol prices and higher demand in food.

On a yearly basis, retail sales in the U.K. climbed 4.3% in December, beating expectations for a 3.0% rise, after a 6.4% increase in November.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,832.83 +36.20 +0.53%

DAX 10,649.58 +213.96 +2.05%

CAC 40 4,640.69 +87.89 +1.93%

-

17:43

Foreign exchange market. American session: the Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data

The U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. economic data. Sales of existing homes climbed 2.4% to a seasonally adjusted annual rate of 5.04 million in December from 4.92 million in November. November's figure was revised down from 4.93 million units. Analysts had expected an increase to 5.08 million units.

The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in January from 53.9 in December, missing expectations for a rise to 54.1. The decline was driven by slower new business growth.

The Conference Board's leading economic index for the U.S. climbed by 0.5% in December, in line with expectations, after a 0.4% increase in November. November's figure was revised down from a 0.6% gain.

The euro traded higher against the U.S. dollar. The European Central Bank's decision to expand its asset purchase programme to 60 billion euro a month starting from March 2015 until September 2016 still weighed on the euro.

Eurozone's preliminary manufacturing PMI increased to 51.0 in January from 50.6 in November, in line with expectations.

Eurozone's preliminary services PMI rose to 52.3 in January from 51.6 in December. Analysts had expected the index to climb to 52.1.

Germany's preliminary manufacturing PMI decreased to 51.0 in January from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 52.7 in January from 52.1 in December, beating expectations for a gain to 52.6.

France's preliminary manufacturing PMI rose to 49.5 in January from 47.5 in December, exceeding forecasts of a rise to 48.1.

France's preliminary services PMI fell to 49.5 in January from 50.6 in December, missing expectations for a gain to 50.9.

The British pound traded higher against the U.S. dollar. Retail sales in the U.K. increased 0.4% in December, exceeding expectations for a 0.6% drop, after a 1.6% gain in November.

The increase was driven by lower petrol prices and higher demand in food.

On a yearly basis, retail sales in the U.K. climbed 4.3% in December, beating expectations for a 3.0% rise, after a 6.4% increase in November.

The Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data. Canadian consumer price inflation decreased 0.7% in December, missing expectations for a 0.5% decline, after a 0.4% drop in November.

On a yearly basis, the consumer price index fell to 1.5% December from 2.0% in November, in line with expectations. That was the lowest level since March 2014.

The consumer price index was driven by lower gasoline prices.

Canadian core consumer price index, which excludes some volatile goods, decreased 0.3% in December, in line with expectations, after a 0.2% decrease in November.

On a yearly basis, core consumer price index in Canada climbed to 2.2% in December from 2.1% in November. Analysts had expected the index to remain unchanged at 2.1%.

Canadian retail sales increased by 0.4% in November, beating expectations for a 0.1% gain, after a flat reading in October.

The increase was driven by promotions such as Black Friday and cold weather. M clothing and clothing accessories sales rose 5.2% in November, while electronic and appliance stores sales gained 4.6%.

The loonie dropped against the greenback on Wednesday as the Bank of Canada (BoC) cut its interest rate. The BoC lowered its interest rate to 0.75% from 1.0%.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded mixed against the greenback as falling commodity prices weighed on the kiwi.

The better-than-expected Chinese preliminary manufacturing PMI supported the kiwi. Chinese preliminary manufacturing PMI increased to 49.8 in January from 49.6 in December, exceeding expectations for a decline to 49.5.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia. In the overnight trading session, the Aussie traded lower against the greenback due to falling commodity prices.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback. Japan's preliminary manufacturing PMI increased to 52.1 in January from 52.0 in December.

-

17:40

Oil fell

The increase in oil prices after the death of Saudi Arabia's King Abdullah will probably be temporary amid an oversupply in the crude market.

Brent, the global oil benchmark, climbed as much as 2.6 percent on Friday while U.S. marker West Texas Intermediate jumped 3.1 percent after the king's death was announced by the Saudi royal court. The new King Salman bin Abdulaziz, Abdullah's half-brother, said he will maintain the policies of his predecessor in a speech on Saudi national television. Oil Minister Ali Al-Naimi will remain in his post, a royal decree announced.

Saudi Arabia, OPEC's biggest producer, has led the group's strategy of maintaining production levels amid a 58 percent drop in crude since its peak in June. While smaller producers including Venezuela called for action to prop up prices, Al-Naimi highlighted the need to preserve market share amid signs of slowing growth and as the U.S. pumps the most since 1983.

"There's still an overwhelming glut of supply in global markets," said Stephen Schork, president of Schork Group in Villanova, Pennsylvania. "Certainly this death matters but it doesn't fundamentally change anything. The Saudis are trying to preserve market share and have been quite clear about that."

-

17:28

U.S. leading economic index increased 0.5% in December

The Conference Board released its leading economic index for the U.S. on Friday. The leading economic index climbed by 0.5% in December, in line with expectations, after a 0.4% increase in November.

November's figure was revised down from a 0.6% gain.

The Conference Board economist Ataman Ozyildirim said that the increase of the index was driven by a majority of its components. He added that "a lack of growth in residential construction and average weekly hours in manufacturing remains a concern".

-

17:20

Gold fell

Gold prices are reduced from five-month high against the dollar strengthening after the announcement of the quantitative easing program of the European Central Bank.

Quotes rebounded on Thursday after the European Central Bank announced its intention to provide the market with more than 1 trillion euros in buying government bonds. But then, gold has become cheaper as the appreciation of the dollar against the euro.

"There are two forces: the first - technical as $ 1,300 looks very significant level of resistance at this stage. The second force - the strengthening of the dollar after the ECB," - said an analyst at OCBC Bank Barnabas Gan. He predicted that by the end of the year gold can fall in price up to $ 1,000.

Gold prices in euro rose to a maximum on the eve of April 2013 with a mark of 1.150,47 euros per ounce. Investors now await the outcome of the meeting of the Fed next week, hoping to hear hints of period of rising interest rates this year.

However, the supporting factor for gold may be uncertainty about the outcome of the elections in Greece.

The cost of the February gold futures on the COMEX today fell to 1284.30 dollars per ounce.

-

17:04

U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in January

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in January from 53.9 in December, missing expectations for a rise to 54.1.

A reading above 50 indicates expansion in economic activity.

The decline was driven by slower new business growth.

The Markit Chief Economist Chris Williamson said that the pace of expansion is slowing.

-

16:55

U.S. existing homes sales rose 2.4% in December

The National Association of Realtors released existing homes sales figures in the U.S. on Friday. Sales of existing homes climbed 2.4% to a seasonally adjusted annual rate of 5.04 million in December from 4.92 million in November.

November's figure was revised down from 4.93 million units.

Analysts had expected an increase to 5.08 million units.

For all of 2014, sales of existing home dropped to 4.93 million sales, a 3.1% decline from 2013, according to the National Association of Realtors (NAR). That was the first drop since 2010.

The NAR chief economist Lawrence Yun said that he expects sales to rebound in 2015.

The share of first-time buyers dropped in 2014.

-

16:08

Canadian consumer price inflation dropped 0.7% in December

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation decreased 0.7% in December, missing expectations for a 0.5% decline, after a 0.4% drop in November.

On a yearly basis, the consumer price index fell to 1.5% December from 2.0% in November, in line with expectations. That was the lowest level since March 2014.

The consumer price index was driven by lower gasoline prices.

Canadian core consumer price index, which excludes some volatile goods, decreased 0.3% in December, in line with expectations, after a 0.2% decrease in November.

On a yearly basis, core consumer price index in Canada climbed to 2.2% in December from 2.1% in November. Analysts had expected the index to remain unchanged at 2.1%.

The Bank of Canada's inflation target is 2.0%.

The Bank of Canada (BoC) lowered its interest rate to 0.75% from 1.0% on Wednesday. Falling oil price was the main reason behind the interest rate cut.

-

16:00

U.S.: Existing Home Sales , December 5.04 (forecast 5.08)

-

16:00

U.S.: Leading Indicators , December +0.5% (forecast +0.5%)

-

15:45

U.S.: Manufacturing PMI, January 53.7 (forecast 54.1)

-

15:44

Canadian retail sales rose by 0.4% in November

Statistics Canada released retail sales data on Friday. Canadian retail sales increased by 0.4% in November, beating expectations for a 0.1% gain, after a flat reading in October.

The increase was driven by promotions such as Black Friday and cold weather. M clothing and clothing accessories sales rose 5.2% in November, while electronic and appliance stores sales gained 4.6%.

Motor vehicles and parts dealers, food and beverage stores and gasoline stations sales fell slightly in November.

Canadian retail sales excluding automobiles increased 0.7% in November, exceeding expectations for a 0.5% rise, after a 0.1% gain in October. October's figure was revised down from a 0.2% increase.

-

15:36

U.S. Stocks open: Dow -0.20%, Nasdaq -0.06%, S&P -0.21%

-

15:29

Before the bell: S&P futures -0.13%, Nasdaq futures -0.06%

U.S. stock-index futures fluctuated as weaker-than-forecast results from United Parcel Service Inc. offset confidence that central banks will support global growth.

Global markets:

Nikkei 17,511.75 +182.73 +1.05%

Hang Seng 24,850.45 +327.82 +1.34%

Shanghai Composite 3,353.29 +9.95 +0.30%

FTSE 6,808.12 +11.49 +0.17%

CAC 4,628.44 +75.64 +1.66%

DAX 10,621.27 +185.65 +1.78%

Crude oil $46.15 (-0.35%)

Gold $1298.00 (-0.21%)

-

15:16

Stocks before the bell

(company / ticker / price / change, % / volume)

Deere & Company, NYSE

DE

89.99

+0.54%

0.2K

Yandex N.V., NASDAQ

YNDX

17.60

+0.80%

13.2K

Nike

NKE

96.67

+0.86%

2.4K

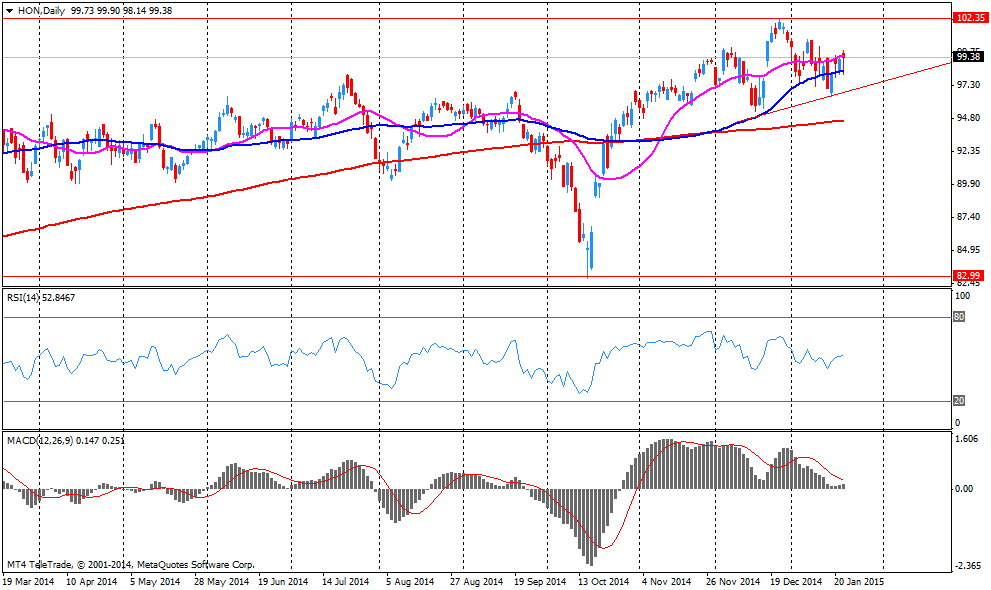

HONEYWELL INTERNATIONAL INC.

HON

101.00

+1.62%

16.0K

Starbucks Corporation, NASDAQ

SBUX

86.60

+4.67%

109.3K

International Business Machines Co...

IBM

155.39

0.00%

0.9K

General Motors Company, NYSE

GM

33.82

0.00%

0.6K

Citigroup Inc., NYSE

C

49.55

-0.04%

1.7K

International Paper Company

IP

55.16

-0.04%

0.4K

JPMorgan Chase and Co

JPM

57.55

-0.07%

1.0K

Hewlett-Packard Co.

HPQ

40.03

-0.07%

0.8K

Boeing Co

BA

135.50

-0.10%

4.8K

Walt Disney Co

DIS

95.03

-0.13%

1.8K

Procter & Gamble Co

PG

91.49

-0.14%

9.8K

Cisco Systems Inc

CSCO

28.45

-0.18%

10.7K

Apple Inc.

AAPL

112.18

-0.20%

302.2K

Pfizer Inc

PFE

32.74

-0.21%

2.7K

Ford Motor Co.

F

14.99

-0.27%

26.2K

Facebook, Inc.

FB

77.44

-0.27%

65.6K

Wal-Mart Stores Inc

WMT

88.01

-0.33%

10.4K

Amazon.com Inc., NASDAQ

AMZN

309.30

-0.33%

5.7K

Travelers Companies Inc

TRV

107.79

-0.35%

0.7K

Caterpillar Inc

CAT

86.50

-0.37%

1.2K

Tesla Motors, Inc., NASDAQ

TSLA

200.85

-0.38%

8.8K

Verizon Communications Inc

VZ

47.55

-0.52%

8.5K

Johnson & Johnson

JNJ

103.18

-0.56%

3.7K

Chevron Corp

CVX

108.30

-0.57%

6.8K

AT&T Inc

T

33.58

-0.62%

3.3K

Exxon Mobil Corp

XOM

92.06

-0.87%

40.6K

ALCOA INC.

AA

15.90

-0.87%

5.2K

Barrick Gold Corporation, NYSE

ABX

12.63

-1.25%

8.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.66

-1.80%

12.1K

FedEx Corporation, NYSE

FDX

177.00

-2.43%

0.2K

-

15:13

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Exxon Mobil (XOM) downgraded from Neutral to Underperform at Credit Suisse

Chevron (CVX) downgraded from Outperform to Neutral at Credit Suisse

Other:

Starbucks (SBUX) target raised from $88 to $94 at RBC Capital Mkts, from $93 to $101 at Telsey Advisory Group, from $86 to $95 at Oppenheimer

Amazon.com (AMZN) target raised from $372 to $396 at Oppenheimer

Visa (V) target raised from $250 to $290 at Oppenheimer

-

15:04

Company News: Honeywell International Inc (HON) reported better than expected fourth quarter profits

Honeywell International Inc (HON) earned $1.43 per share in the fourth quarter, beating analysts' estimate of $1.42. Revenue in the fourth quarter decreased 1.2% year-over-year to $10.27 billion, but beating analysts' estimate of $10.17 billion.

The company reaffirmed its forecasts for 2015. EPS is expected to be $5.95-$6.15 (analysts' estimate: $6.11), while revenue is expected to be $40.5-$41.1 billion in 2015 (analysts' estimate: $41.12 billion).

Honeywell International Inc (HON) shares rose to $101.00 (+1.62%) prior to the opening bell.

-

15:00

Belgium: Business Climate, January -8.8 (forecast -6.1)

-

14:53

Company News: General Electric (GE) reported better than expected fourth quarter earnings, but revenue missed forecasts

General Electric (GE) earned $0.56 per share in the fourth quarter, beating analysts' estimate of $0.55. Revenue in the fourth quarter increased 4.0% year-over-year to $42.00 billion, missing analysts' estimate of $42.16 billion.

General Electric (GE) shares decreased to $24.26 (-0.08%) prior to the opening bell.

-

14:48

Company News: McDonald's (MCD) reported weaker than expected fourth quarter profits

McDonald's (MCD) earned $1.22 per share in the fourth quarter, missing analysts' estimate of $1.23. Revenue in the fourth quarter dropped 7.3% year-over-year to $6.57 billion, missing analysts' estimate of $6.70 billion.

Company's global comparable sales fell 0.9% (company's estimate: -1.5%).

McDonald's (MCD) shares increased to $92.10 (+1.33%) prior to the opening bell.

-

14:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1400(E1.0bn), $1.1450 (E740mn), $1.1500 (E1.0bn), $1.1550(E2.2bn), $1.1600 (E1.1bn), $1.1650 (E822mn), $1.1700(E1.45bn)

USD/JPY: Y117.00($334mn), Y118.00($2.3bn), Y118.25($749mn), Y119.00($565mn)

GBP/USD: $1.5250(stg350mn)

EUR/GBP: Stg0.7500(E660mn), Stg0.7600(E270mn).

AUD/USD: $0.7900(A$456mn)

NZD/USD: $0.7500(N$500mn)

-

14:31

Canada: Consumer Price Index m / m, December -0.7% (forecast -0.5%)

-

14:31

Canada: Consumer price index, y/y, December +1.5% (forecast +1.5%)

-

14:31

Canada: Bank of Canada Consumer Price Index Core, y/y, December +2.2% (forecast +2.1%)

-

14:30

Canada: Retail Sales, m/m, November +0.4% (forecast +0.1%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, m/m, December -0.3% (forecast -0.3%)

-

14:30

Canada: Retail Sales ex Autos, m/m, November +0.7% (forecast +0.5%)

-

14:07

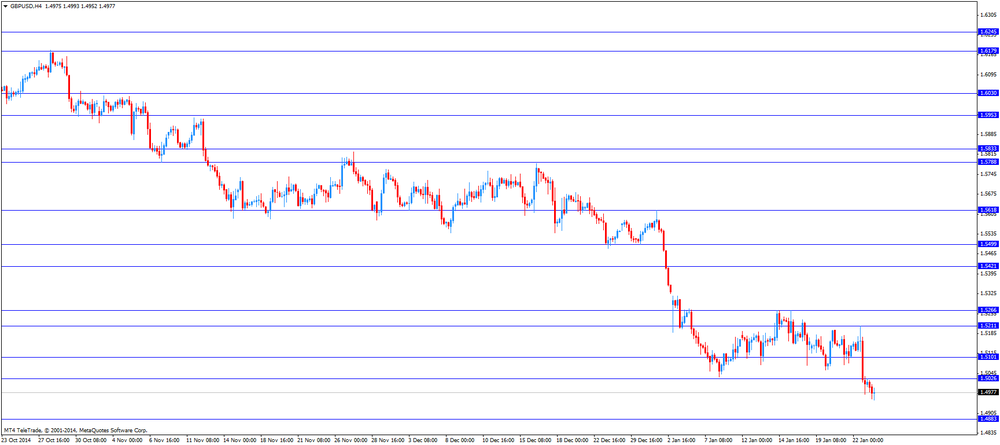

Foreign exchange market. European session: the British pound declined against the U.S. dollar despite the better-than-expected retail sales data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) January 52.0 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) January 49.6 49.5 49.8

07:58 France Services PMI (Preliminary) January 50.6 50.9 49.5

07:58 France Manufacturing PMI (Preliminary) January 47.5 48.1 49.5

08:28 Germany Manufacturing PMI (Preliminary) January 51.2 51.8 51.0

08:28 Germany Services PMI (Preliminary) January 52.1 52.6 52.7

08:58 Eurozone Manufacturing PMI (Preliminary) January 50.6 51.0 51.0

08:58 Eurozone Services PMI (Preliminary) January 51.6 52.1 52.3

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Retail Sales (MoM) December +1.6% -0.6% +0.4%

09:30 United Kingdom Retail Sales (YoY) December +6.4% +3.0% +4.3%

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The U.S. preliminary manufacturing purchasing managers' index is expected to climbs to 54.1 in January from 53.9 in December.

The existing home sales in the U.S. are expected to increase to 5.08 million units in December from 4.93 million units in November.

The euro fell against the U.S. dollar as the European Central Bank's decision to expand its asset purchase programme to 60 billion euro a month starting from March 2015 until September 2016 still weighed on the euro.

Eurozone's preliminary manufacturing PMI increased to 51.0 in January from 50.6 in November, in line with expectations.

Eurozone's preliminary services PMI rose to 52.3 in January from 51.6 in December. Analysts had expected the index to climb to 52.1.

Germany's preliminary manufacturing PMI decreased to 51.0 in January from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 52.7 in January from 52.1 in December, beating expectations for a gain to 52.6.

France's preliminary manufacturing PMI rose to 49.5 in January from 47.5 in December, exceeding forecasts of a rise to 48.1.

France's preliminary services PMI fell to 49.5 in January from 50.6 in December, missing expectations for a gain to 50.9.

The British pound declined against the U.S. dollar despite the better-than-expected retail sales data from the U.K. Retail sales in the U.K. increased 0.4% in December, exceeding expectations for a 0.6% drop, after a 1.6% gain in November.

The increase was driven by lower petrol prices and higher demand in food.

On a yearly basis, retail sales in the U.K. climbed 4.3% in December, beating expectations for a 3.0% rise, after a 6.4% increase in November.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian economic data. The consumer price index in Canada is expected to decline to an annual rate of 1.5% in December from 2.0% in November.

The core consumer price index in Canada is expected to remain unchanged at an annual rate of 2.1% in December.

Canadian retail sales are expected to increase 0.1% in November, after a flat reading in October.

Canadian retail sales excluding automobiles are expected to rise 0.5% in November, after a 0.2% rise in October.

The loonie dropped against the greenback on Wednesday as the Bank of Canada (BoC) cut its interest rate. The BoC lowered its interest rate to 0.75% from 1.0%.

EUR/USD: the currency pair fell to $1.1114

GBP/USD: the currency pair decreased to $1.4952

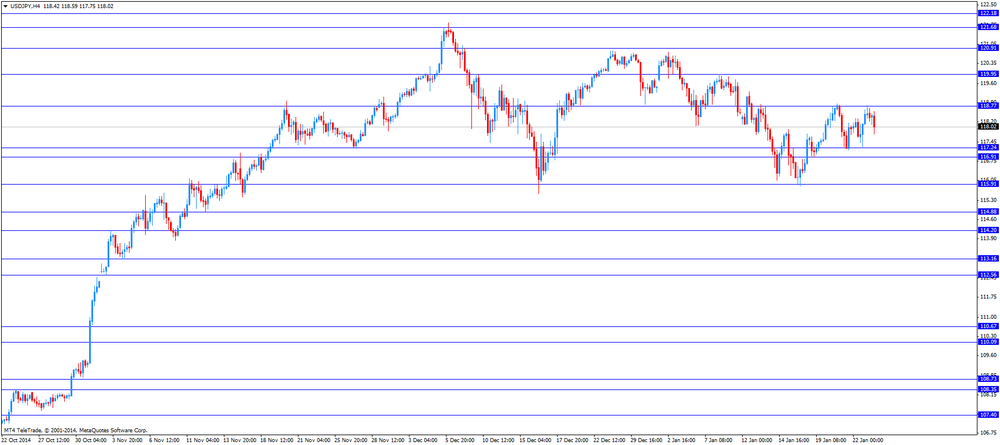

USD/JPY: the currency pair fell to $117.75

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m November 0.0% +0.1%

13:30 Canada Retail Sales ex Autos, m/m November +0.2% +0.5%

13:30 Canada Consumer Price Index m / m December -0.4% -0.5%

13:30 Canada Consumer price index, y/y December +2.0% +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m December -0.2% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December +2.1% +2.1%

14:45 U.S. Manufacturing PMI (Preliminary) January 53.9 54.1

15:00 U.S. Existing Home Sales December 4.93 5.08

-

14:00

Orders

EUR/USD

Offers $1.1710, $1.1700, $1.1680, $1.1500, $1.1460

Bids $1.1100, $1.1000

GBP/USD

Offers $1.5320, $1.5265, $1.5210, $1.5110/00, $1.5055

Bids $1.4970, $1.4900, $1.4810

AUD/USD

Offers $0.8350, $0.8300, $0.8230, $0.8135, $0.8100, $0.8030

Bids $0.7950, $0.7900

EUR/JPY

Offers Y139.00, Y137.90/00, Y137.65, Y136.60, Y135.00, Y134.00

Bids Y132.00, Y131.00

USD/JPY

Offers Y119.95, Y119.00, Y118.85

Bids Y117.65, Y116.90, Y116.50, Y116.20/00, Y115.85

EUR/GBP

Offers stg0.7800, stg0.7745, stg0.7715, stg0.7670, stg0.7600

Bids stg0.7400, stg0.7300

-

13:27

UK retail sales increased 0.4% in December

The Office for National Statistics released the retail sales data for the U.K. on Fridday. Retail sales in the U.K. increased 0.4% in December, exceeding expectations for a 0.6% drop, after a 1.6% gain in November.

The increase was driven by lower petrol prices and higher demand in food.

On a yearly basis, retail sales in the U.K. climbed 4.3% in December, beating expectations for a 3.0% rise, after a 6.4% increase in November.

Sales at department stores dropped 4.5% in December, the weakest performance since January 1996.

-

13:00

European stock markets mid-session: Indices continue to rally after ECB stimulus

European indices continue to rally after the ECB unveiled a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. The central bank kept its interest rate unchanged at 0.05%. Banks and cyclical stocks were among the best performers. A weaker euro is broadly seen as major boost to exports.

Although markets are supported by the ECB's unprecedented stimulus concerns over the outcome and the consequences of the Greek elections on January 25th are still weighing as the next Greek government will have to decide whether to extend the international bailout or not. The anti-austerity party Syriza leads in polls by almost 5%.

While the French Services PMI for January was below expectations with a reading of 49.5 compared to 50.9 German Services PMI improved from 52.1 to 52.7 beating estimates by 0.1.

The Manufacturing PMI in France improved according to Markit Economics with a reading of 49.5, compared to forecasts of 48.1 and a previous reading of 47.5.Whereas Germany's Manufacturing PMI fell unexpectedly last month. The index declined from 51.2 to 51.0. Economists expected a reading of 51.8.

Eurozone's PMI Services beat expectations by 0.1 points with a reading of 52.7. Manufacturing PMI was in line with forecasts at 51.0.

In today's session the FTSE 100 index is trading +0.16% quoted at 6,807.79. France's CAC 40 added +1.95% trading at 4,641.39. Germany's DAX 30 is currently trading +1.48% at 10,590.15 points, a new all-time high.

-

12:30

Oil: Prices continue to rebound after yesterday’s volatile trading

Brent crude and West Texas Intermediate continue to after the ECB bond buying decision. Brent Crude added +1.98%, currently trading at USD49.48 a barrel, still below the important USD50 level. West Texas Intermediate rose by +1.30% currently quoted at USD46.91. Yesterday prices spiked following the death of King Abdullah of Saudi Arabia. Later his successor Salman bin Abdulaziz stated that the policy of the world's largest exporter won't change. The OPEC will continue to fight for market share.

Oil prices fell by nearly 60 percent over the past six months, and both key brands of oil are currently trading below $ 50 a barrel as the supply of from the United States, Russia and Canada and other producers exceeded demand in a period of low global economic growth and the OPEC refusing to cut output rates to stabilize prices

-

12:00

Gold erases yesterday’s gains – back under USD1,300 again

Gold prices declined today after gaining yesterday as the ECB announced to launch a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. Market participants now try to assess whether global economic conditions will affect the timing of an interest-rate hike in the U.S. Market conditions may force the bank to wait longer than intended. Fed policy makers meet next week with inflation near the 2% target and a strengthening economic outlook.

A broadly stronger dollar also weighed on the precious metal as it makes dollar-nominated gold more expensive to buy for holders of other currencies and investors took profit after the recent rally of gold.

Investors' concerns over the outcome and the consequences of the Greek elections on January 25th are lending some support to gold as the next Greek government will have to decide whether to extend the international bailout or not. The anti-austerity party Syriza leads in polls by almost 5%, adding to uncertainty on the markets.

The precious metal is currently quoted at USD1,294.70, -0,51% a troy ounce.

-

10:30

United Kingdom: Retail Sales (MoM), December +0.4% (forecast -0.6%)

-

10:30

United Kingdom: Retail Sales (YoY) , December +4.3% (forecast +3.0%)

-

10:15

Press Review: ECB’s Quantitative Easing Program Is Open-Ended, Visco Says

BLOOMBERG

ECB's Quantitative Easing Program Is Open-Ended, Visco Says

The European Central Bank's asset-purchase program will continue past September 2016 if it hasn't met its inflation objectives by then, Governing Council member Ignazio Visco said.

"We are open-ended," Visco said on Friday in an interview with Bloomberg Television's Francine Lacqua and Guy Johnson at the World Economic Forum in Davos, Switzerland. "If we see that there are difficulties in achieving this target that we have, we have to continue."

ECB President Mario Draghi pledged on Thursday to buy 60 billion euros ($68 billion) a month of assets including government bonds through September 2016, adding that buying will "in any case be conducted until we see a sustained adjustment in the path of inflation." The quantitative-easing package is designed to stave off a deflationary spiral in the 19-nation currency bloc by flooding the region with liquidity and pushing investors into riskier assets.

REUTERS

Swedish central bank should consider weakening currency: Borg(Reuters) - Sweden's central bank should consider steps to weaken the crown to keep the economy competitive after the European Central Bank launched substantial bond-buying on Thursday, former finance minister Anders Borg told Reuters.

Borg, in government until last year and now chair of the Global Financial System Initiative at the World Economic Forum, said the currency was arguably too strong for the good of the economyand the Riksbank had tools to act.

Source: http://www.reuters.com/article/2015/01/22/us-sweden-currency-borg-idUSKBN0KV2A420150122

BLOOMBERG

Oil Climbs as Saudi King's Death Spurs Policy Speculation

Oil rose after the death of King Abdullah of Saudi Arabia, the biggest producer in the Organization of Petroleum Exporting Countries.

Futures rallied as much as 3.1 percent inNew York and 2.6 percent in London after the Saudi royal court announced the death in a statement. Crown Prince Salman bin Abdulaziz will succeed Abdullah on the throne. The kingdom, the world's largest crude exporter, led OPEC's decision to maintain its oil-production quota at a meeting in November, exacerbating a global glut that's driven prices lower.

-

10:00

Eurozone: Manufacturing PMI, January 51.0 (forecast 51.0)

-

10:00

Eurozone: Services PMI, January 52.3 (forecast 52.1)

-

10:00

European Stocks. First hour: Indices continue rally on ECB boost

European indices continue to rise after the European Central Bank (ECB) President Mario Draghi said at the press conference yesterday that the central bank will launch a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. The central bank kept its interest rate unchanged at 0.05%. Cyclical stocks were among the best performers.

PMI data for France, Germany and the Eurozone were mixed with Germany's Economy, the largest in the Eurozone, picking up momentum. Eurozone's Manufacturing PMI was in line with expectations at 51.0 in January compared to 50.6 in December. The Services PMI beat estimates with a reading of 52.3 compared to economist's forecasts of 52.1 adding 0.7 points.

The FTSE 100 index is currently trading +0.53% quoted at 6,832.90 points. Germany's DAX 30 added +1.40% trading at 10,582.23 at new all-time highs. France's CAC 40 added +1.33%, currently trading at 4,613.41 points.

-

09:38

French and German Manufacturing / Service PMI mixed

While the French Services PMI for January was below expectations with a reading of 49.5 compared to 50.9 German Services PMI improved from 52.1 to 52.7 beating estimates by 0.1.

The Manufacturing PMI in France improved according to Markit Economics with a reading of 49.5, compared to forecasts of 48.1 and a previous reading of 47.5.Whereas Germany's Manufacturing PMI fell unexpectedly last month. The index declined from 51.2 to 51.0. Economists expected a reading of 51.8.

Markets now await data on Eurozone's PMI due at 09:58 GMT.

-

09:30

Germany: Manufacturing PMI, January 51.0 (forecast 51.8)

-

09:30

Germany: Services PMI, January 52.7 (forecast 52.6)

-

09:01

France: Manufacturing PMI, January 49.5 (forecast 48.1)

-

09:00

France: Services PMI, January 49.5 (forecast 50.9)

-

09:00

Global Stocks: global indices continue rally on ECB stimulus

U.S. markets closed higher on Thursday for a fourth consecutive day despite the weaker-than-expected number of initial jobless claims. The number of initial jobless claims in the week ending January 17 in the U.S. fell by 10,000 to 307,000 from 317,000 in the previous week, missing expectations for a decline by 16,000. The previous week's figure was revised to 317,000 from 316,000. Markets were supported by the European Central Bank (ECB). President Mario Draghi said at the press conference yesterday that the central bank will launch a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. The DOW JONES index added +1.48%, closing at 17,813.98. The S&P 500 added +1.53% with a final quote of 2,063.15 points.

Chinese stock markets continued to rise. Hong Kong's Hang Seng is trading +1.16% at 24,806.51 points. China's Shanghai Composite closed at 3,353.29 points +0.30% almost erasing the first weekly loss since November 7th after 10 weeks of consecutive gains. The longest series since 2007.

Japan's Nikkei added gains on Friday rising to a near one-month high extending the global rally, closing +1.05% with a final quote of 17,511.75. The index ended the week with a plus of 3.8 percent after the BoJ left its economic stimulus program unchanged earlier this week but lowered the consumer inflation outlook for 2015 due to falling oil prices. The Japanese preliminary Manufacturing PMI improved from a reading of 52.0 in December to 52.1 in January.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly stronger against its major peers during the Asian

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) January 52.0 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) January 49.6 49.5 49.8

The U.S. dollar traded higher against the most major currencies despite the weaker-than-expected number of initial jobless claims from the U.S. The euro slumped against the greenback after the European Central Bank (ECB) President Mario Draghi said at the press conference yesterday that the central bank will launch a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. The central bank kept its interest rate unchanged at 0.05%. The single currency is heading for a sixth weekly decline against the U.S. dollar with upcoming Greek elections this weekend with polls indicating a win of the anti-austerity party Syriza.

The Australian dollar extended losses against the greenback and trading below its lows established in May 2010 although Chinese data on the HSBC Manufacturing PMI picked up as stimulus measures seem having stabilized the world's second largest economy. Data showed a reading of 49.8 in January, beating forecasts of 49.5 and adding 0.2 to the previous month's reading. Still, numbers below 50 indicate contraction. China is Australia's most important trade partner.

New Zealand's dollar continued its fall and traded at the weakest since 2012 against the greenback currently trading at USD0.7486 closing in on lows hit in July 2012.

The Japanese yen traded slightly higher against the greenback after the BoJ left its economic stimulus program unchanged earlier this week but lowered the consumer inflation outlook for 2015 due to falling oil prices. The Japanese preliminary Manufacturing PMI improved from a reading of 52.0 in December to 52.1 in January.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:58 France Services PMI (Preliminary) January 50.6 50.9

07:58 France Manufacturing PMI (Preliminary) January 47.5 48.1

08:28 Germany Manufacturing PMI (Preliminary) January 51.2 51.8

08:28 Germany Services PMI (Preliminary) January 52.1 52.6

08:58 Eurozone Manufacturing PMI (Preliminary) January 50.6 51.0

08:58 Eurozone Services PMI (Preliminary) January 51.6 52.1

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Retail Sales (MoM) December +1.6% -0.6%

09:30 United Kingdom Retail Sales (YoY) December +6.4% +3.0%

13:30 Canada Retail Sales, m/m November 0.0% +0.1%

13:30 Canada Retail Sales ex Autos, m/m November +0.2% +0.5%

13:30 Canada Consumer Price Index m / m December -0.4% -0.5%

13:30 Canada Consumer price index, y/y December +2.0% +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m December -0.2% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December +2.1% +2.1%

14:00 Belgium Business Climate January -6.9 -6.1

14:45 U.S. Manufacturing PMI (Preliminary) January 53.9 54.1

15:00 U.S. Leading Indicators December +0.6% +0.5%

15:00 U.S. Existing Home Sales December 4.93 5.08

-

07:27

Options levels on friday, January 23, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1640 (1660)

$1.1570 (787)

$1.1513 (181)

Price at time of writing this review: $1.1328

Support levels (open interest**, contracts):

$1.1293 (2247)

$1.1270 (4958)

$1.1244 (1026)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 65584 contracts, with the maximum number of contracts with strike price $1,2100 (6673);

- Overall open interest on the PUT options with the expiration date February, 6 is 71401 contracts, with the maximum number of contracts with strike price $1,1700 (6720);

- The ratio of PUT/CALL was 1.09 versus 1.11 from the previous trading day according to data from January, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5302 (435)

$1.5204 (870)

$1.5107 (254)

Price at time of writing this review: $1.4991

Support levels (open interest**, contracts):

$1.4893 (1363)

$1.4796 (1191)

$1.4698 (233)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 15908 contracts, with the maximum number of contracts with strike price $1,5600 (1117);

- Overall open interest on the PUT options with the expiration date February, 6 is 16703 contracts, with the maximum number of contracts with strike price $1,5100 (1596);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from January, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:58

Nikkei 225 17,491.93 +162.91 +0.94%, Hang Seng 24,852.55 +329.92 +1.35%, Shanghai Composite 3,357.1 +13.75 +0.41%

-

02:45

China: HSBC Manufacturing PMI, January 49.8 (forecast 49.5)

-

02:35

Japan: Manufacturing PMI, January 52.1

-

00:33

Commodities. Daily history for Jan 22’2015:

(raw materials / closing price /% change)

Light Crude 46.52 +0.45%

Gold 1,302.10 +0.11%

-

00:33

Stocks. Daily history for Jan 22’2015:

(index / closing price / change items /% change)

Nikkei 225 17,329.02 +48.54 +0.28%

Hang Seng 24,522.63 +170.05 +0.70%

Shanghai Composite 3,344.4 +20.79 +0.63%

FTSE 100 6,796.63 +68.59 +1.02%

CAC 40 4,552.8 +67.98 +1.52%

Xetra DAX 10,435.62 +136.39 +1.32%

S&P 500 2,063.15 +31.03 +1.53%

NASDAQ Composite 4,750.4 +82.98 +1.78%

Dow Jones 17,813.98 +259.70 +1.48%

-

00:32

Currencies. Daily history for Jan 22’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1364 -2,16%

GBP/USD $1,5009 -0,88%

USD/CHF Chf0,8709 +1,29%

USD/JPY Y118,48 +0,45%

EUR/JPY Y134,65 -1,70%

GBP/JPY Y177,82 -0,43%

AUD/USD $0,8025 -0,72%

NZD/USD $0,7502 -0,65%

USD/CAD C$1,2379 +0,33%

-

00:01

Schedule for today, Friday, Jan 23’2015:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) January 52.0

01:45 China HSBC Manufacturing PMI (Preliminary) January 49.6 49.5

07:58 France Services PMI (Preliminary) January 50.6 50.9

07:58 France Manufacturing PMI (Preliminary) January 47.5 48.1

08:28 Germany Manufacturing PMI (Preliminary) January 51.2 51.8

08:28 Germany Services PMI (Preliminary) January 52.1 52.6

08:58 Eurozone Manufacturing PMI (Preliminary) January 50.6 51.0

08:58 Eurozone Services PMI (Preliminary) January 51.6 52.1

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Retail Sales (MoM) December +1.6% -0.6%

09:30 United Kingdom Retail Sales (YoY) December +6.4% +3.0%

13:30 Canada Retail Sales, m/m November 0.0% +0.1%

13:30 Canada Retail Sales ex Autos, m/m November +0.2% +0.5%

13:30 Canada Consumer Price Index m / m December -0.4% -0.5%

13:30 Canada Consumer price index, y/y December +2.0% +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m December -0.2% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December +2.1% +2.1%

14:00 Belgium Business Climate January -6.9 -6.1

14:45 U.S. Manufacturing PMI (Preliminary) January 53.9 54.1

15:00 U.S. Leading Indicators December +0.6% +0.5%

15:00 U.S. Existing Home Sales December 4.93 5.08

-