Noticias del mercado

-

16:48

German construction orders increase 0.4% in August

Destatis released its construction orders data on Friday. German construction orders rose by a seasonally and working-day-adjusted rate of 0.4% in August.

On an annual basis, German construction orders climbed by a seasonally and working-day-adjusted rate of 0.9% in August

-

15:57

U.S. preliminary manufacturing purchasing managers' index climbs to 54 in October

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) climbed to 54 in October from 53.1 in September, beating expectations for a decline to 52.8.

A reading above 50 indicates expansion in economic activity.

The increase was driven by a faster pace of expansion in output and new orders volumes.

"The positive start to the fourth quarter suggests the economy may be picking up speed again after slowing in the third quarter, for which the PMI surveys pointed to annualised GDP growth of 2.2%," Markit Chief Economist Chris Williamson.

"The faster growth of export sales is particularly good news and will help to alleviate fears that the US economy is being hurt by the stronger dollar and slower growth in China," he added.

-

15:45

U.S.: Manufacturing PMI, October 54 (forecast 52.8)

-

15:43

European Central Bank’s Survey of Professional Forecasters: forecasters lower their inflation forecasts

The European Central Bank (ECB) released its Survey of Professional Forecasters for Q4 2015 on Friday. Forecasters cut their inflation forecasts. Eurozone's inflation is expected to be 0.1% in 2015, down from July estimate of 0.2%, 1.0% in 2016, down from July estimate of 1.3%, and 1.5% in 2016, down from July estimate of 1.6%.

Long-term inflation forecasts (for 2020) remained unchanged at 1.9%.

The economic growth in the Eurozone is expected to expand 1.5% this year, up from July estimate of 1.4%, 1.7% next year, down from July estimate of 1.8%, and 1.8% in 2017, unchanged from July estimate.

-

15:32

NBB business climate for Belgium rises to -4.0 in October

The National Bank of Belgium (NBB) released its business survey on Friday. The business climate rise to -4.0 in October from -6.8 in September.

All indicators increased in October.

The business climate index for the manufacturing sector climbed to -5.6 in October from -8.7 in September due to more favourable assessments of stock levels, and total order books, and more optimistic employment forecasts.

The business climate index for the services sector was up to 7.2 in October from 3.3 in September due to a more positive outlook for firms' own activity.

The business climate index for the building sector increased to -8.5 in October from -9.0 in September due to a rise in new orders.

The business climate index for the trade sector rose to -4.3 in October from -6.5 in September due to an increase in staff numbers and higher orders.

-

15:30

Option expiries for today's 10:00 ET NY cut

USD/JPY 119.50 (USD 467m) 120.00-05 (1.8bln)

EUR/USD 1.1000 (EUR 1.6bln) 1.1100 (1.2bln) 1.1250 (600m) 1.1275 (400m) 1.1300 (500m) 1.1350-60 (830m)

USD/CHF 0.9460 (USD 430m)

USD/CAD 1.3000 (USD 608m) 1.3060 (250m) 1.3200 (395m)

AUD/USD 0.7180 (AUD 290m) 0.7200 (367m) 0.7300 (300m)

-

15:00

Belgium: Business Climate, October 4

-

14:50

The People's Bank of China (PBoC) lowers its interest rates

The People's Bank of China (PBoC) announced on Friday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.35%. It was the sixth interest rate cut since last November.

The central bank hopes with this decision to support the country's economy.

The interest rate cut would be effective from October 24.

One-year benchmark deposit rates were cut by 25 basis point to 1.50%, reserve requirements (RRR) were lowered by 50 basis points to 17.5% for all banks.

New reserve requirements would be effective on October 24.

-

14:41

Canadian consumer price inflation drops 0.2% in September

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation fell 0.2% in September, missing expectations for a 0.1% decline, after a flat reading in August.

The monthly decline was driven by a drop in transportation prices, which slid 1.4% in September.

On a yearly basis, the consumer price index dropped to 1.0% in September from1.3% in August, missing expectations for a decrease to 1.1%.

The consumer price index was partly driven by higher food prices. Food prices climbed 3.5% year-on-year in September, while transportation prices decreased 3.5%.

Clothing and footwear prices climbed by 1.2% in September from the same month a year earlier, while gasoline prices dropped 18.8%.

The Canadian core consumer price index, which excludes some volatile goods, rose 0.2% in September, after a 0.2% gain in August.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.1% in September, in line with expectations.

The Bank of Canada's inflation target is 2.0%.

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, September 2.1% (forecast 2.1%)

-

14:30

Canada: Consumer price index, y/y, September 1.0% (forecast 1.1%)

-

14:30

Canada: Consumer Price Index m / m, September -0.2% (forecast -0.1%)

-

14:22

Contractual wages and salaries per hour in Italy are flat in September

The Italian statistical office ISTAT released its consumer confidence index for Italy on Friday. Contractual wages and salaries per hour in Italy were flat in September, after a flat reading in August.

On a yearly basis, contractual wages and salaries per hour increased 1.2% in September, after a 1.2% gain in August.

Contractual wages and salaries in the private sector jumped 1.8% in September, while wages in the public sector remained flat.

-

14:09

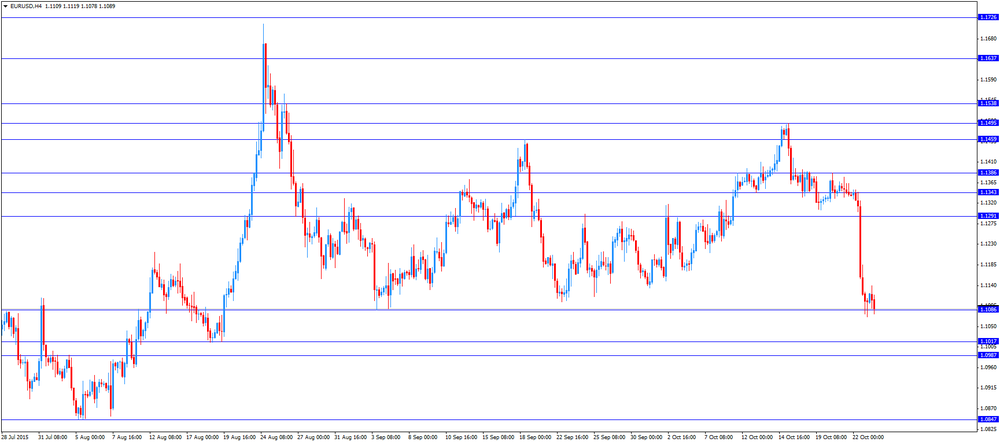

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) October 51 50.6 52.5

05:00 Japan Coincident Index (Finally) August 113.1 112.2

05:00 Japan Leading Economic Index (Finally) August 105 103.5

07:00 France Services PMI (Preliminary) October 51.9 51.6 52.3

07:00 France Manufacturing PMI (Preliminary) October 50.6 50.2 50.7

07:30 Germany Manufacturing PMI (Preliminary) October 52.3 51.6 51.6

07:30 Germany Services PMI (Preliminary) October 54.1 53.9 55.2

08:00 Eurozone Services PMI (Preliminary) October 53.7 53.5 54.2

08:00 Eurozone Manufacturing PMI (Preliminary) October 52 51.7 52.0

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. preliminary manufacturing PMI data. The U.S. preliminary manufacturing PMI is expected to decline to 52.8 in October from 53.1 in September.

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI remained unchanged 52.0 in October, beating expectations for a decline to 51.7.

Eurozone's preliminary services PMI rose to 54.2 in October from 53.7 in September. Analysts had expected the index to decrease to 53.5.

Markit's Chief Economist Chris Williamson said that Eurozone's economy "picked up some momentum in October".

"The PMI remains at a level signalling a modest 0.4% quarterly rise in GDP, suggesting the region will struggle to attain more than 1.5% overall growth in 2015. The rate of job creation, although on the rise, remains insufficient to make serious headway into reducing unemployment," he added.

Germany's preliminary manufacturing PMI declined to 51.6 in October from 52.3 in September, in line with expectations.

Germany's preliminary services PMI was up to 55.2 in October from 54.1 in September. Analysts had expected index to decline to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by the services sector.

France's preliminary manufacturing PMI rose to 50.7 in October from 50.6 in September, beating forecasts of a fall to 50.2.

France's preliminary services PMI increased to 52.3 in October from 51.9 in September. Analysts had expected the index to decline to 51.6.

Comments by the European Central Bank's (ECB) President Mario Draghi weighed on the euro. He said at a press conference on Thursday that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December. He pointed out that the central bank will expand its asset-buying programme if needed to boost inflation toward the 2% target.

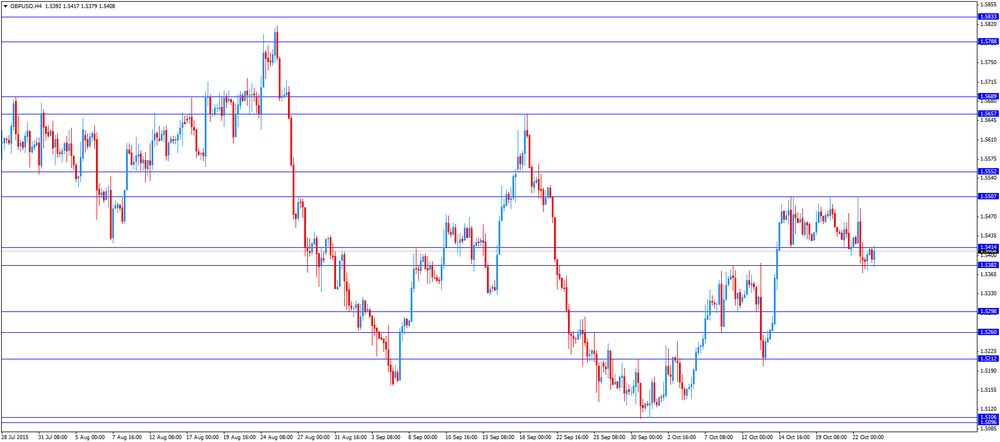

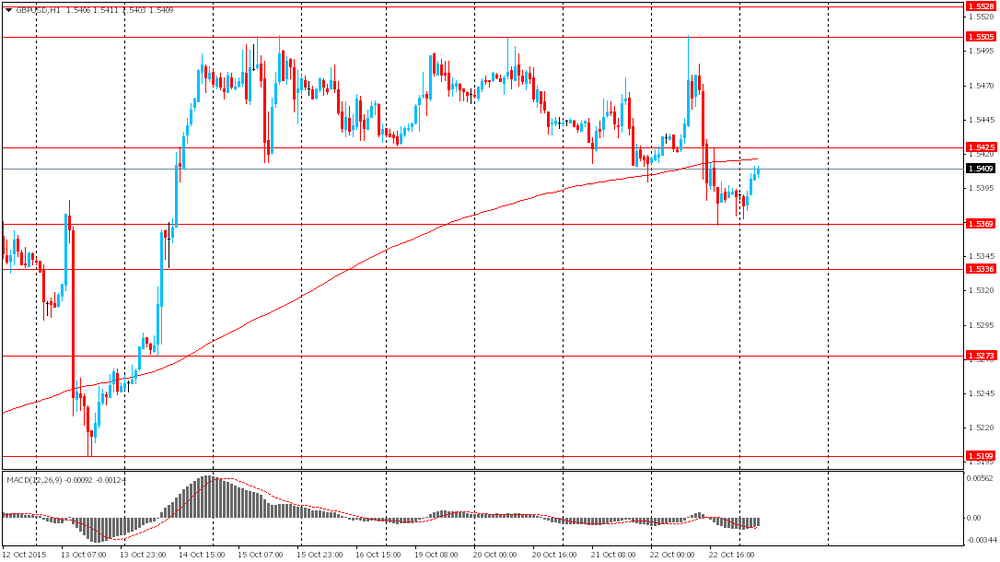

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the consumer price inflation data from Canada. The consumer price index in Canada is expected to fall to 1.1% year-on-year in September from 1.3% in August.

The core consumer price index in Canada is expected to remain unchanged at 2.1% year-on-year in September.

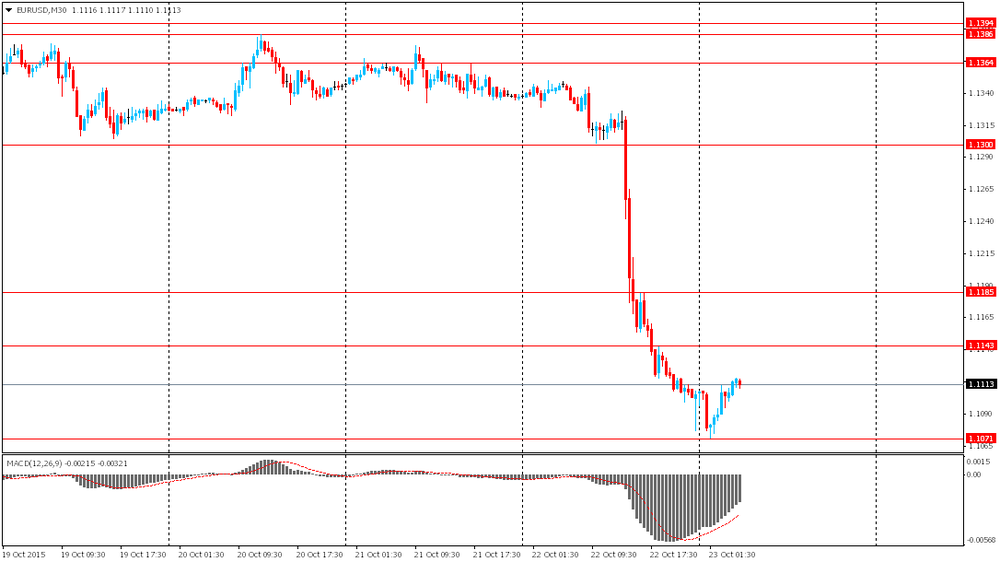

EUR/USD: the currency pair declined to $1.1078

GBP/USD: the currency pair traded mixed

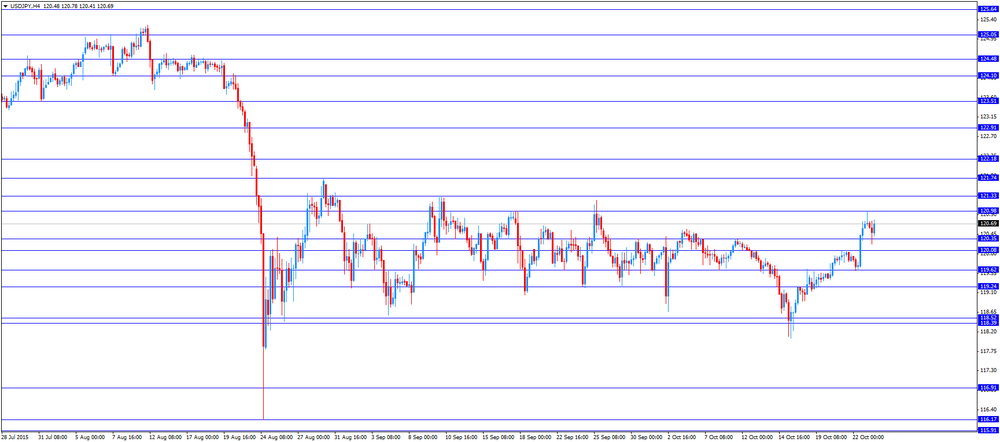

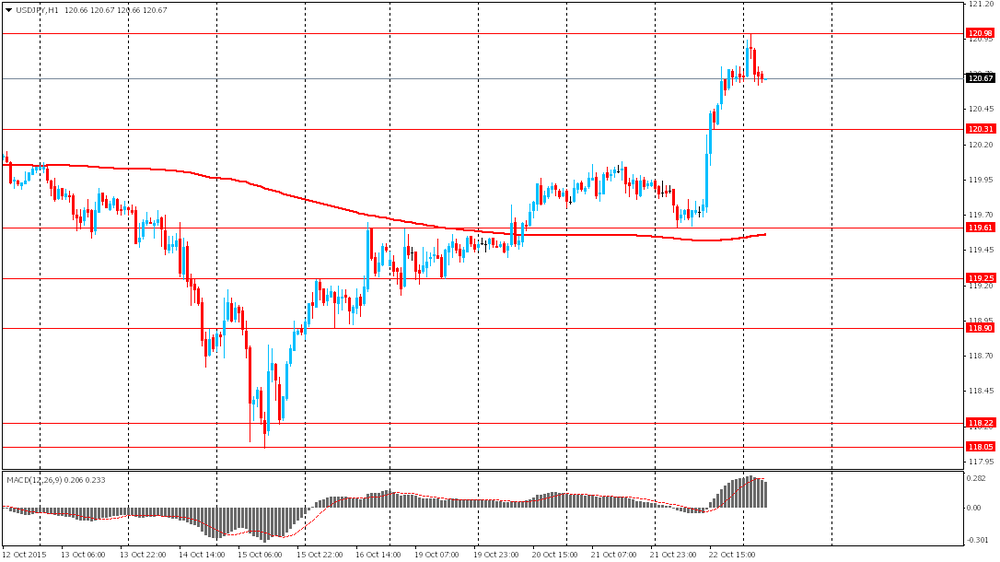

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m September 0.0% -0.1%

12:30 Canada Consumer price index, y/y September 1.3% 1.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September 2.1% 2.1%

13:00 Belgium Business Climate October -6.8

13:45 U.S. Manufacturing PMI (Preliminary) October 53.1 52.8

-

14:00

Orders

EUR/USD

Offers 1.1125 1.1150 1.1175-80 1.1200 1.1225-30 1.1250 1.1275 1.1300

Bids 1.1100 1.1070-75 1.1050 1.1025-30 1.1000 1.0985 1.0960 1.0930 1.0900

GBP/USD

Offers 1.5420-25 1.5445-50 1.5480 1.5500-10 1.5525-30 1.5550 1.5565 1.5585 1.5600 1.5620

Bids 1.5375-80 1.5350 1.5330 1.5300 1.5285 1.5265 1.5250 1.5220 1.5200

EUR/GBP

Offers 0.7225-30 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7200 0.7175-80 0.7165 0.7150 0.7130 0.7100 0.7085 0.7050

EUR/JPY

Offers 134.00 134.20-25 134.50 134.80 135.00 135.25 135.50

Bids 133.50-55 133.30 133.00 132.80 132.50 132.25-30 132.00

USD/JPY

Offers 120.60 12075-.80 121.00 121.30 121.50 121.80 122.00

Bids 120.20 120.00 119.80-85 119.50 119.25-30 119.00 118.85 118.65-70 118.50 118.30 118.00

AUD/USD

Offers 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400

Bids 0.7250 0.7230 0.7200 0.7180-85 0.7150 0.7125-30 0.7100

-

11:47

Italian retail sales climb at a seasonally adjusted rate of 0.3% in August

The Italian statistical office Istat released its retail sales data for Italy on Friday. Italian retail sales climbed at a seasonally adjusted rate of 0.3% in August, after a 0.3% increase in July. July's figure was revised down from a 0.4% rise.

Sales of food products were up 0.1% in August, while sales of non-food products climbed by 0.3%.

On a yearly basis, retail sales in Italy increased 1.3% in August, after a 1.6% rise in July. July's figure was revised down from a 1.7% gain.

-

11:42

Industrial turnover in Italy drops at a seasonally adjusted rate of 1.6% in August

The Italian statistical office Istat released its industrial orders data for Italy on Friday. Industrial turnover in Italy dropped at a seasonally adjusted rate of 1.6% in August, after a 1.1% decrease in July.

Domestic market orders plunged 2.2% in August, while demand from non-domestic markets fell by 0.5%.

On a yearly basis, the seasonally adjusted industrial turnover in Italy slid 2.4% in August, after a 2.3% gain in July.

The seasonally adjusted industrial new orders index dropped by 5.5% month-on-month in August.

-

11:29

France's preliminary manufacturing and services PMIs rise in October

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Friday. France's preliminary manufacturing PMI rose to 50.7 in October from 50.6 in September, beating forecasts of a fall to 50.2.

France's preliminary services PMI increased to 52.3 in October from 51.9 in September. Analysts had expected the index to decline to 51.6.

"French private sector output growth firmed slightly in October, underpinned by rising activity across both services and manufacturing. The data point to modest growth momentum at the start of the final quarter, following a likely small rise in GDP during Q3," the Senior Economist at Markit Jack Kennedy said.

-

11:26

Germany's preliminary manufacturing PMI declines in October, while services PMI climbs

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's preliminary manufacturing PMI declined to 51.6 in October from 52.3 in September, in line with expectations.

Germany's preliminary services PMI was up to 55.2 in October from 54.1 in September. Analysts had expected index to decline to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by the services sector.

"October's PMI results paint a fairly passive picture of the health of the German private sector economy at the start of the final quarter of 2015. Companies signalled a slight acceleration of output growth and were able to secure new contracts despite raising their charges to the greatest extent in 21 months," he noted.

-

11:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 119.50 (USD 467m) 120.00-05 (1.8bln)

EUR/USD 1.1000 (EUR 1.6bln) 1.1100 (1.2bln) 1.1250 (600m) 1.1275 (400m) 1.1300 (500m) 1.1350-60 (830m)

USD/CHF 0.9460 (USD 430m)

USD/CAD 1.3000 (USD 608m) 1.3060 (250m) 1.3200 (395m)

AUD/USD 0.7180 (AUD 290m) 0.7200 (367m) 0.7300 (300m)

-

11:09

Eurozone's preliminary manufacturing PMI remains unchanged in October, while services PMI rises

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI remained unchanged 52.0 in October, beating expectations for a decline to 51.7.

Eurozone's preliminary services PMI rose to 54.2 in October from 53.7 in September. Analysts had expected the index to decrease to 53.5.

Markit's Chief Economist Chris Williamson said that Eurozone's economy "picked up some momentum in October".

"The PMI remains at a level signalling a modest 0.4% quarterly rise in GDP, suggesting the region will struggle to attain more than 1.5% overall growth in 2015. The rate of job creation, although on the rise, remains insufficient to make serious headway into reducing unemployment," he added.

-

10:52

Fitch: emerging economies pose risk to the global economy

Ratings agency Fitch Ratings said in its report on Thursday that emerging economies pose risk to the global economy. The agency added that the slowdown in emerging economies was driven by a drop in commodity prices and political shocks.

The interest rate hike by the Fed will put more pressure on emerging economies, Fitch noted.

"Latin American countries, notably Brazil, also face headwinds challenges, but mainly due to weakening fundamentals rather than through high levels of unhedged US dollar funding," the agency said.

-

10:46

The German Chambers of Commerce lowers its 2015 growth forecast for Germany

The German Chambers of Commerce (DIHK) said in its survey on Thursday that the German economy will expand at lower pace than forecasted by the government. DIHK expect the economy to grow 1.7% in 2015, down from its previous estimate of 1.8%, and 1.3% in 2016.

The German government forecasted the country's economy to expand 1.7% in 2015 and 1.8% in 2016.

The weak growth in emerging economies is a risk to the German economy, according to DIHK.

"Several emerging markets, such as in South America, are weakening. Heavyweight China is entering a notable weaker growth path. The robust performance in the U.S. and Europe is supporting German export business, but can only partly compensate for their negative development," DIHK said.

-

10:36

Chinese Premier Li Keqiang: there is no basis for long-term depreciation of the yuan

Chinese Premier Li Keqiang said during a meeting with former U.S. treasury secretary Henry Paulson in Beijing on Thursday that there is no basis for long-term depreciation of the yuan.

Li also said that the country implemented measures to deal with unusual capital market fluctuations.

"We will continue to boost reform and institutional construction, fostering an open, transparent, stable and healthy multiple-level capital market," he said.

-

10:20

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan climbs to 52.5 in October

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan climbed to 52.5 in October from 51.0 in September, beating expectations for a decline to 50.6.

A reading below 50 indicates contraction of activity.

The index was partly driven by a rise in output and new orders.

"Latest survey data indicated a marked improvement in operating conditions at Japanese manufacturers. Production increased at the joint-sharpest rate since February and was marked in the context of historical data," economist at Markit, Amy Brownbill, said.

-

10:10

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 42 in October

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 42 in October from 44.5 in September. The decline was driven by a slower pace of job creation.

39% of respondents said that the U.S. economy was getting worse, while 23% of respondents noted that the economy was improving.

On a weekly basis, consumers' expectations for U.S. economy decreased to 43.5 in in the week ended October 18 from 45.2 the prior week. The decline was driven by a worse sentiment on spending.

The measure of views of the economy was little changed.

The buying climate index fell to 37.2 from 39.5.

The personal finances index was down to 58.4 from 60.5.

-

10:00

Eurozone: Manufacturing PMI, October 52.0 (forecast 51.7)

-

10:00

Eurozone: Services PMI, October 54.2 (forecast 53.5)

-

09:30

Germany: Manufacturing PMI, October 51.6 (forecast 51.6)

-

09:30

Germany: Services PMI, October 55.2 (forecast 53.9)

-

09:00

France: Manufacturing PMI, October 50.7 (forecast 50.2)

-

09:00

France: Services PMI, October 52.3 (forecast 51.6)

-

08:35

Options levels on friday, October 23, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1296 (2198)

$1.1234 (730)

$1.1189 (819)

Price at time of writing this review: $1.1105

Support levels (open interest**, contracts):

$1.1071 (2343)

$1.1054 (5242)

$1.1033 (3174)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 39859 contracts, with the maximum number of contracts with strike price $1,1500 (3307);

- Overall open interest on the PUT options with the expiration date November, 6 is 51088 contracts, with the maximum number of contracts with strike price $1,1200 (5242);

- The ratio of PUT/CALL was 1.28 versus 1.28 from the previous trading day according to data from October, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (835)

$1.5602 (1232)

$1.5505 (2287)

Price at time of writing this review: $1.5407

Support levels (open interest**, contracts):

$1.5294 (2813)

$1.5197 (2942)

$1.5098 (1749)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20678 contracts, with the maximum number of contracts with strike price $1,5350 (2600);

- Overall open interest on the PUT options with the expiration date November, 6 is 20924 contracts, with the maximum number of contracts with strike price $1,5200 (2942);

- The ratio of PUT/CALL was 1.01 versus 1.01 from the previous trading day according to data from October, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:19

Foreign exchange market. Asian session: the euro rose on ECB Draghi's comments

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) October 51 50.6 52.5

05:00 Japan Coincident Index (Finally) August 113.1 112.2

05:00 Japan Leading Economic Index (Finally) August 105 103.5

The euro rose on comments by European Central Bank President Mario Draghi. The EUR/USD pair is trading above Thursday close level, which can be explained by profit taking. Yesterday the ECB decided to keep its benchmark rate at 0.05%, where it had been over a year. The deposit rate was left at -0.2%. ECB President Draghi said that the central bank will assess sufficiency of current stimulus measures at the next meeting in December.

The yen rose on Japanese manufacturing activity data from Nomura/JMMA. The corresponding PMI rose to 52.5 in October vs 51.00 reported previously and 50.6 expected. This is the highest reading in 18 months.

The Australian dollar rose amid upbeat data on China's real estate market. An average price of a new home in China rose by 0.2% m/m in September compared to +0.1% in August. Prices rose in 39 towns out of 70. Prices in Beijing rose by 4.7%, while prices in Shanghai advanced by 8.3%.

EUR/USD: the pair fluctuated within $1.1070-20 in Asian trade

USD/JPY: the pair traded within Y120.60-00

GBP/USD: the pair rose to $1.5415

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 France Services PMI (Preliminary) October 51.9 51.6

07:00 France Manufacturing PMI (Preliminary) October 50.6 50.2

07:30 Germany Manufacturing PMI (Preliminary) October 52.3 51.6

07:30 Germany Services PMI (Preliminary) October 54.1 53.9

08:00 Eurozone Services PMI (Preliminary) October 53.7 53.5

08:00 Eurozone Manufacturing PMI (Preliminary) October 52 51.7

12:30 Canada Consumer Price Index m / m September 0.0% -0.1%

12:30 Canada Consumer price index, y/y September 1.3% 1.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September 2.1% 2.1%

13:00 Belgium Business Climate October -6.8

13:45 U.S. Manufacturing PMI (Preliminary) October 53.1 52.8

-

07:31

Japan: Coincident Index, August 112.2

-

07:17

Japan: Leading Economic Index , August 103.5

-

03:35

Japan: Manufacturing PMI, October 52.5 (forecast 50.6)

-

00:35

Currencies. Daily history for Oct 22’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1105 -2,09%

GBP/USD $1,5389 -0,16%

USD/CHF Chf0,9729 +1,40%

USD/JPY Y120,68 +0,62%

EUR/JPY Y134,03 -1,45%

GBP/JPY Y185,71 -0,08%

AUD/USD $0,7212 +0,01%

NZD/USD $0,6780 +1,02%

USD/CAD C$1,3092 -0,33%

-

00:04

Schedule for today, Friday, Oct 23’2015:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) October 51

05:00 Japan Coincident Index (Finally) August 113.1

05:00 Japan Leading Economic Index (Finally) August 105

07:00 France Services PMI (Preliminary) October 51.9 51.6

07:00 France Manufacturing PMI (Preliminary) October 50.6 50.2

07:30 Germany Manufacturing PMI (Preliminary) October 52.3 51.6

07:30 Germany Services PMI (Preliminary) October 54.1 53.9

08:00 Eurozone Services PMI (Preliminary) October 53.7 53.5

08:00 Eurozone Manufacturing PMI (Preliminary) October 52 51.7

12:30 Canada Consumer Price Index m / m September 0.0% -0.1%

12:30 Canada Consumer price index, y/y September 1.3% 1.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September 2.1% 2.1%

13:00 Belgium Business Climate October -6.8

13:45 U.S. Manufacturing PMI (Preliminary) October 53.1 52.8

-