Noticias del mercado

-

17:21

NAB business confidence index for Australia declines to 0 in the third quarter

The National Australia Bank (NAB) released its Quarterly Business Confidence Survey on Thursday. The NAB business confidence index declined to 0 in the third quarter from 4 in the second quarter.

But leading indicators were positive in the third quarter, while forward orders rose to their highest level since late 2009.

"Lower interest rates and AUD depreciation appear to be having the desired effects, although this varies by industry," the NAB said in its statement.

-

17:08

The Greek government removes General Secretary of the Public Revenues Authority Ekaterini Savvaidou from her position

The Greek government removed General Secretary of the Public Revenues Authority Ekaterini Savvaidou from her position. The government argued that she breached her duties.

Earlier, Savvaidou refused to resign.

-

16:55

Greek third bailout programme already falls behind the schedule

The Greek third bailout programme already falls behind the schedule. Greece and its lenders agreed that Greece will implement a package of economic overhauls and austerity measures. But only a few reforms have been implement so far.

The Greek third bailout programme's worth is €86 billion.

-

16:46

European Central Bank President Mario Draghi: the value of the ECB’s asset-buying programme will be discussed at the monetary policy meeting in December

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- Domestic demand in the Eurozone remains resilient,

- There are risks to the outlook for growth and inflation from a slowdown in emerging economies and from developments in financial and commodity markets;

- The value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December;

- The central bank will expand its asset-buying programme if needed to boost inflation toward the 2% target;

- The economy in the Eurozone is expected to recover slower due to weaker than expected foreign demand;

- The low inflation is driven by lower energy prices;

- Inflation is expected to rise during 2016 and 2017;

- Lending continued to improve;

- The Governing Council discussed the possibility to cut interest rates, but the decision was not made.

- Domestic demand in the Eurozone remains resilient,

-

16:25

U.S. leading economic index decreases 0.2% in September

The Conference Board released its leading economic index for the U.S. on Thursday. The leading economic index decreased by 0.2% in September, missing expectations a flat reading, after a flat reading in August. August's figure was revised down from a 0.1% increase.

"The recent weakness in stock markets, the manufacturing sector and housing permits was offset by gains in financial indicators, and to a lesser extent improvements in consumer expectations and initial claims for unemployment insurance. The U.S. economy is on track for moderate growth of about 2.5 percent in the coming quarters, despite the mixed global economic landscape," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:19

U.S. existing homes sales increase 4.7% in September

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes rose 4.7% to a seasonally adjusted annual rate of 5.55 million in September from 5.30 million in August. August's figure was revised down from 5.31 million units.

Analysts had expected an increase to 5.38 million units.

"While current price growth around 6 percent is still roughly double the pace of wages, affordability has slightly improved since the spring and is helping to keep demand at a strong and sustained pace," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers decreased to 29% in September from 32% in August.

"Unfortunately, first-time buyers are still failing to generate any meaningful traction this year," Yun said.

-

16:12

Eurozone’s preliminary consumer confidence index declines to -7.7 in October

The European Commission released its preliminary consumer confidence figures for the Eurozone on Thursday. Eurozone's preliminary consumer confidence index fell to -7.7 in October from -7.1 in September, missing expectations for a decline to -7.35.

European Union's consumer confidence index declined by 0.2 points to -5.7 in October.

-

16:00

U.S.: Existing Home Sales , September 5.55 (forecast 5.38)

-

16:00

Eurozone: Consumer Confidence, October -7.7 (forecast -7.35)

-

16:00

U.S.: Leading Indicators , September -0.2% (forecast 0.0%)

-

15:51

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 1.1bln) 120.70-75 (1.2bln) 121.00 (652m)

EUR/USD 1.1200 (USD 2bln) 1.1300 (EUR 2.3bln) 1.1350 (626m) (1.5bln) 1.1380 (408m) 1.1400 (1.2bln)) 1.1500 (1.66bln)

GBP/USD 1.5250-55 (GBP 920m)

USD/CAD 1.3000 (USD 400m) 1.3025 (280m) 1.3300 (550m)

AUD/USD 0.7100 (AUD 939m) 0.7200 (484m) 0.7250 (891m) 0.7400 (587m)

NZD/USD 0.7000 (NZD 250m)

AUD/JPY 84.75 (AUD 501m) 86.35 (250m)

-

15:48

-

15:46

Spain’s trade deficit widens to €3.19 billion in August

Spain's Economy Ministry released its trade data on Thursday. The trade deficit widened to €3.19 billion in August from €2.77 billion in August a year ago.

Exports declined at an annual rate of 0.8% in August, while imports rose 1.5%.

In the January to August period, the trade deficit totalled €16.07 billion, down 2.5% from the same period of 2014.

Exports increased 4.9% in the January to August period, while imports gained 4.2%.

-

15:38

U.S. house price index rise 0.3% in August

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Thursday. The U.S. house price index rose 0.3% on a seasonally adjusted basis in August, after a 0.5% gain in July. July's figure was revised down from a 0.6% increase.

On a yearly basis, U.S. house prices climbed 5.5% in August.

-

15:16

U.S.: Housing Price Index, m/m, August 0.3%

-

14:53

Chicago Fed National Activity Index rises to -0.37 in September

The Federal Reserve Bank of Chicago released its National Activity Index on Thursday. The index increased to -0.37 in September from -0.39 in August. August's figure was revised up from -0.41.

The slight increase was mainly driven by a rise in the production.

The production-related indicator rose to -0.18 in September from -0.21 in August.

The employment-related indicator dropped to -0.11 in September from -0.08 in August.

The personal consumption and housing indicator was down to -0.08 in September from -0.06 in August.

-

14:46

Initial jobless claims increase by 3,000 to 259,000 in the week ending October 17

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 17 in the U.S. rose by 3,000 to 259,000 from 256,000 in the previous week. The previous week's figure was revised up from 255,000.

Analysts had expected the initial jobless claims to increase to 265,000.

Jobless claims remained below 300,000 the 33th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 6,000 to 2,170,000 in the week ended October 10.

-

14:41

Canadian retail sales gain 0.5% in August

Statistics Canada released retail sales data on Thursday. Canadian retail sales rose by 0.5% in August, exceeding expectations for a 0.1% gain, after a 0.6% increase in July. July's figure was revised up from a 0.5% gain.

The rise was driven by higher sales at motor vehicle and parts sales. Motor vehicle and parts sales rose 2.0% in August.

Sales at gasoline stations declined 0.6% in August, while sales at furniture and home furnishings stores climbed 3.0%.

Sales at food and beverage stores were up 0.5% in August.

Sales rose in 4 of 11 subsectors.

Canadian retail sales excluding automobiles were flat in August, missing expectations for a 0.1% rise, after a flat reading in July.

-

14:30

European Central Bank keeps its interest rate unchanged at 0.05% in October

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

The interest rate remains unchanged since September 2014.

Market participants speculate that the ECB may extend its asset-buying programme as the inflation in the Eurozone remains at low levels.

-

14:30

Canada: Retail Sales ex Autos, m/m, August 0% (forecast 0.1%)

-

14:30

Canada: Retail Sales, m/m, August 0.5% (forecast 0.1%)

-

14:30

U.S.: Initial Jobless Claims, October 259 (forecast 265)

-

14:30

U.S.: Chicago Federal National Activity Index, September -0.37

-

14:30

U.S.: Continuing Jobless Claims, October 2170 (forecast 2188)

-

14:30

Canada: Retail Sales YoY, August 2.8%

-

14:24

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of U.K. retail sales data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia NAB Quarterly Business Confidence Quarter III 4 0

08:30 United Kingdom Retail Sales (MoM) September -0.4% Revised From 0.2% 0.3% 1.9%

08:30 United Kingdom Retail Sales (YoY) September 3.5% Revised From 3.7% 4.8% 6.5%

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The existing home sales in the U.S. are expected to decrease to 5.38 million units in September from 5.31 million units in August.

The U.S. leading economic index is expected to be flat in September, after a 0.1% increase in August.

The number of initial jobless claims in the U.S. is expected to rise by 10,000 265,000 last week.

The euro traded lower against the U.S. dollar after the European Central Bank's (ECB) interest rate decision. The central bank kept its interest rate unchanged at 0.05%.

The ECB's press conference is scheduled to be at 12:30 GMT.

Meanwhile, the economic data from the Eurozone was mixed. The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index decreased to 103 in October from 104 in September. September's reading was the highest level since August 2011.

The Spanish statistical office INE released its labour market figures on Thursday. The number of registered unemployed people fell by 298,200 in the third quarter to 4.85 million.

The unemployment rate was 21.2% in the third quarter, down from 22.4% in the second quarter. It was the lowest level in four years.

The British pound traded higher against the U.S. dollar after the release of U.K. retail sales data. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 1.9% in September, exceeding expectations for a 0.3% gain, after a 0.4% decline in August. August's figure was revised down from a 0.2% increase.

The Rugby World Cup in England and Wales supported the retail sales in September.

Food prices climbed 2.3% in September. It was the highest gain since April 2014.

On a yearly basis, retail sales in the U.K. climbed 6.5% in September, beating forecasts of 4.8% increase, after a 3.5% rise in August. August's figure was revised down from a 3.7% gain.

The Canadian dollar traded mixed against the U.S. dollar ahead the release of the Canadian retail sales data. Canadian retail sales are expected to increase 0.1% in August, after a 0.5% rise in July.

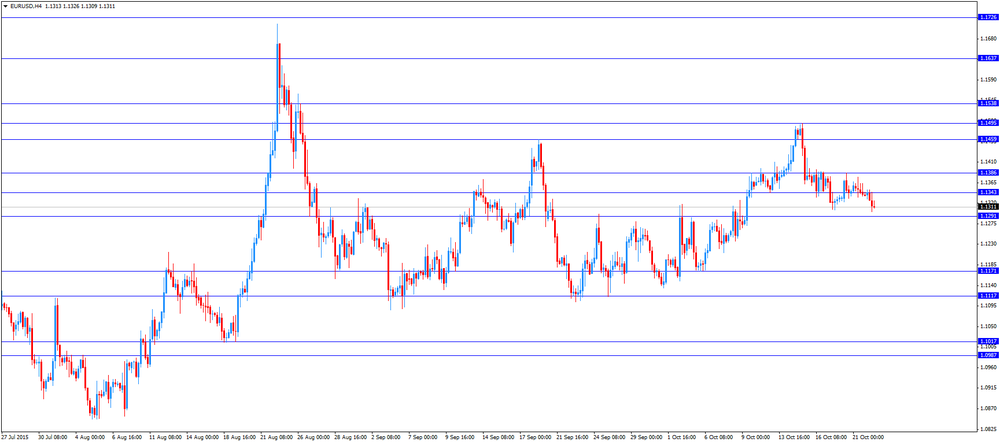

EUR/USD: the currency pair declined to $1.1301

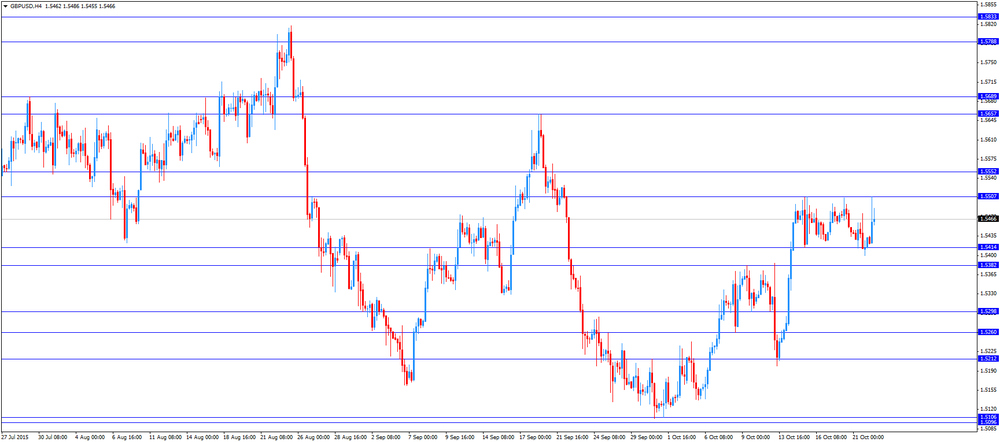

GBP/USD: the currency pair rose to $1.5507

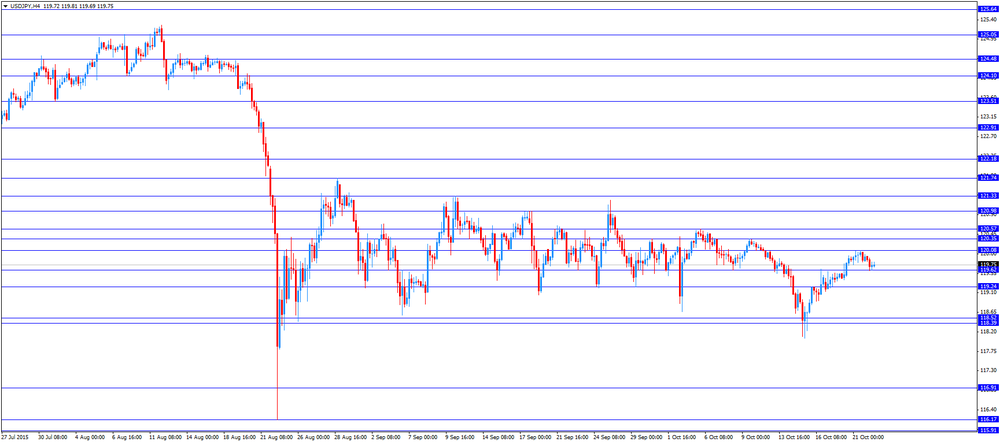

USD/JPY: the currency pair increased to Y119.81

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 Canada Retail Sales, m/m August 0.5% 0.1%

12:30 Canada Retail Sales YoY August 1.8%

12:30 Canada Retail Sales ex Autos, m/m August 0% 0.1%

12:30 U.S. Chicago Federal National Activity Index September -0.41

12:30 U.S. Initial Jobless Claims October 255 265

14:00 Eurozone Consumer Confidence (Preliminary) October -7.1 -7.35

14:00 U.S. Leading Indicators September 0.1% 0.0%

14:00 U.S. Existing Home Sales September 5.31 5.38

-

13:45

Eurozone: ECB Interest Rate Decision, 0.05%

-

11:55

Unemployment rate in Spain decline to 21.2% in the third quarter, the lowest level in four years

The Spanish statistical office INE released its labour market figures on Thursday. The number of registered unemployed people fell by 298,200 in the third quarter to 4.85 million.

The unemployment rate was 21.2% in the third quarter, down from 22.4% in the second quarter. It was the lowest level in four years.

-

11:45

French manufacturing confidence index declines to 103 in October

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index decreased to 103 in October from 104 in September. September's reading was the highest level since August 2011.

Past change in production index was down to 7 in October from 11 in September.

Personal production expectations index fell to 13 in October from 14 in September, while general production outlook index dropped to 2 from 5.

-

11:31

UK retail sales rise 1.9% in September

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 1.9% in September, exceeding expectations for a 0.3% gain, after a 0.4% decline in August. August's figure was revised down from a 0.2% increase.

The Rugby World Cup in England and Wales supported the retail sales in September.

Food prices climbed 2.3% in September. It was the highest gain since April 2014.

"Falling in-store prices and promotions around the Rugby World Cup are likely to be the main factors why the quantity bought in the retail sector increased in September at the fastest monthly rate seen since December 2013," ONS statistician Kate Davies said.

On a yearly basis, retail sales in the U.K. climbed 6.5% in September, beating forecasts of 4.8% increase, after a 3.5% rise in August. August's figure was revised down from a 3.7% gain.

-

11:12

Greece’s economy is expected to contract 1.4% in 2015

Reuters reported that sources close to bailout talks said that Greece's economy is expected to contract 1.4% in 2015, slower than the previous estimate of a 2.3% decline. Greece economy is expected to contract 1.3% next year.

Greek Economy Minister George Stathakis said on October 07 that the Greek economy will decline about 1.5% this year.

-

10:30

United Kingdom: Retail Sales (MoM), September 1.9% (forecast 0.3%)

-

10:30

United Kingdom: Retail Sales (YoY) , September 6.5% (forecast 4.8%)

-

09:38

The People's Bank of China (PBoC) and the Bank of England (BoE) agree to renew the existing reciprocal sterling/renminbi currency swap line

The People's Bank of China (PBoC) and the Bank of England (BoE) said on Wednesday that they agreed to renew the existing reciprocal sterling/renminbi currency swap line for a further three years. The maximum value of the swap line was raised to 350 billion yuan from 200 billion yuan (this value has been agreed in June 2013).

"The renewal of this swap line and its increased size reflect the constructive approach that the Bank of England and the People's Bank of China are taking to support the development of an effective and resilient renminbi market in London," the BoE Governor Mark Carney said.

-

09:21

Chinese President Xi Jinping: there will be "no hard landing" in China despite the downward pressure

Chinese President Xi Jinping said during a state visit to the U.K. that there will be "no hard landing" in China despite the downward pressure.

"The Chinese economy does face some downward pressure and structural problems, but such adjustments look inevitable when the economy reaches a certain stage after years of high growth," he said.

Xi noted that the economic development in China is "a new normal".

-

09:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1195-1.1200(E2.64n), $1.1300(E2.31bn), $1.1350(E646mn), $1.1380(E418mn), $1.1400(E1.3bn), $1.1500(E1.67bn)

USD/JPY: Y119.00($302mn), Y119.90-120.05($1.35bn), Y120.70-75($1.2bn), Y121.00($916mn)

GBP/USD: $1.5250-55(Gbp920mn), $1.5400(Gbp288mn)

EUR/GBP Gbp0.7207(E400mn), GBP0.7300(E200mn)

AUD/USD: $0.7000(A$1.43bn), $0.7080(A$422mn), $0.7100(A$939mn), $0.7200(A$484mn), $0.7250(A$891mn), $0.7400(A$587mn)

AUD/JPY: Y84.75(A$501mn), Y85.70-75(A$260mn), Y86.35(A$250mn)

USD/CAD: C$1.3000($400mn), C$1.3025($280mn), C$1.3075($350mn),

C$1.3250($500mn), C$1.3300($800mn)

-

08:24

Options levels on thursday, October 22, 2015:

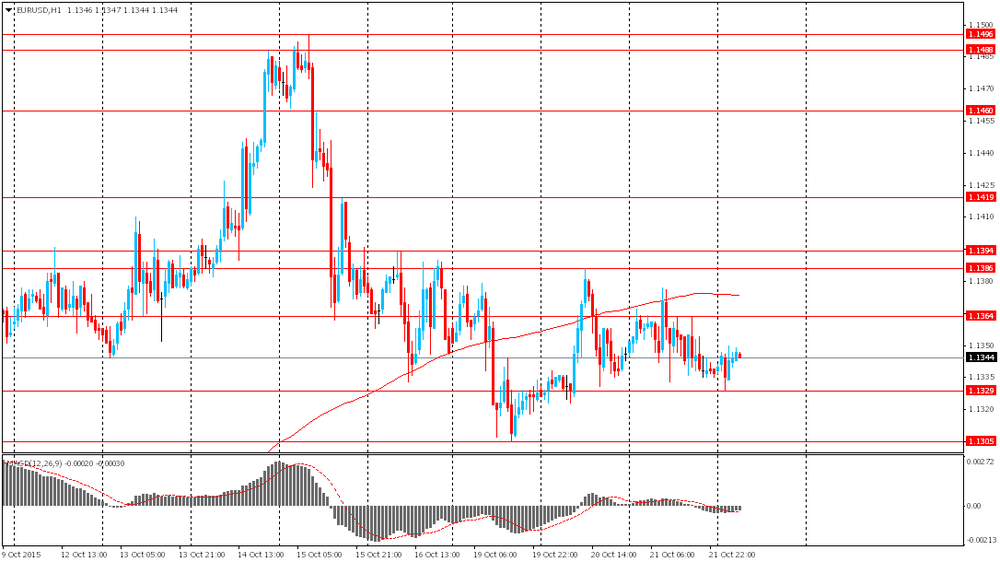

EUR / USD

Resistance levels (open interest**, contracts)

$1.1474 (2460)

$1.1425 (1099)

$1.1391 (1048)

Price at time of writing this review: $1.1331

Support levels (open interest**, contracts):

$1.1292 (965)

$1.1249 (2644)

$1.1190 (2562)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 37235 contracts, with the maximum number of contracts with strike price $1,1500 (3352);

- Overall open interest on the PUT options with the expiration date November, 6 is 47737 contracts, with the maximum number of contracts with strike price $1,1200 (4833);

- The ratio of PUT/CALL was 1.28 versus 1.26 from the previous trading day according to data from October, 21

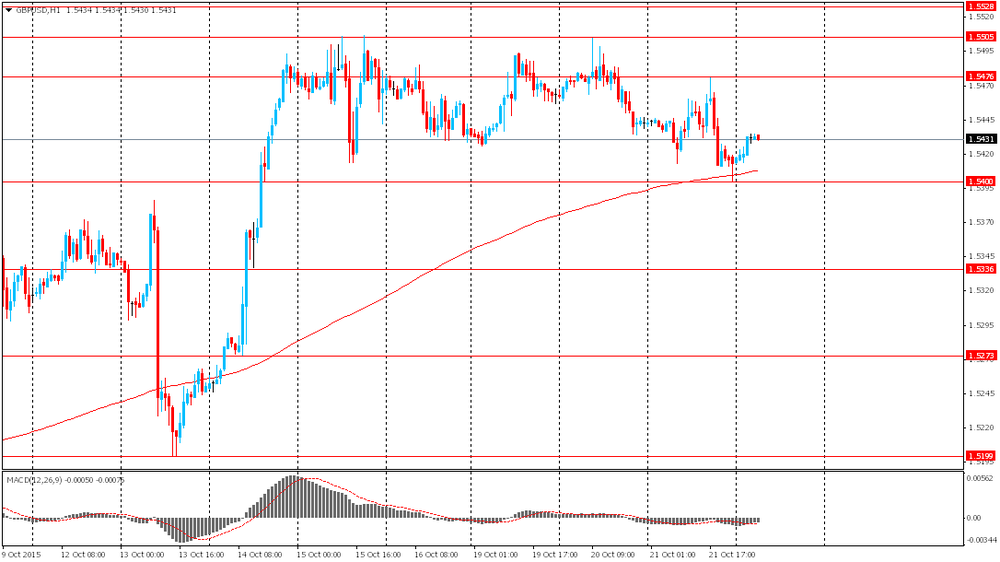

GBP/USD

Resistance levels (open interest**, contracts)

$1.5702 (825)

$1.5603 (1201)

$1.5506 (2165)

Price at time of writing this review: $1.5426

Support levels (open interest**, contracts):

$1.5391 (549)

$1.5295 (2842)

$1.5198 (2880)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20560 contracts, with the maximum number of contracts with strike price $1,5350 (2600);

- Overall open interest on the PUT options with the expiration date November, 6 is 20868 contracts, with the maximum number of contracts with strike price $1,5200 (2880);

- The ratio of PUT/CALL was 1.01 versus 1.00 from the previous trading day according to data from October, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:16

Foreign exchange market. Asian session: the euro is steady ahead of ECB's decision

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia NAB Quarterly Business Confidence Quarter III 4 0

The euro little changed ahead of results of the European Central Bank meeting. Analysts say that despite recent talks of expansion of the QE program ECB Governor Draghi is unlikely to change the program's "settings" and is likely to wait at least till December. Meanwhile Draghi may try to lower the euro verbally. The single currency's strength is unfavorable for domestic exporters. Analysts say that the ECB intends to maintain euro's low exchange rate in order to support competitiveness of exports. That's why the central bank may signal that it inclines towards softer policy.

The Australian dollar slightly rose at the beginning of the session after yesterday's decline, which was caused by declines in commodity prices. Meanwhile later the AUD fell amid news that one of Australia's major banks Commonwealth Bank decided to raise its standard interest rate by 15 basis points like Westpac.

EUR/USD: the pair fluctuated within $1.1330-50 in Asian trade

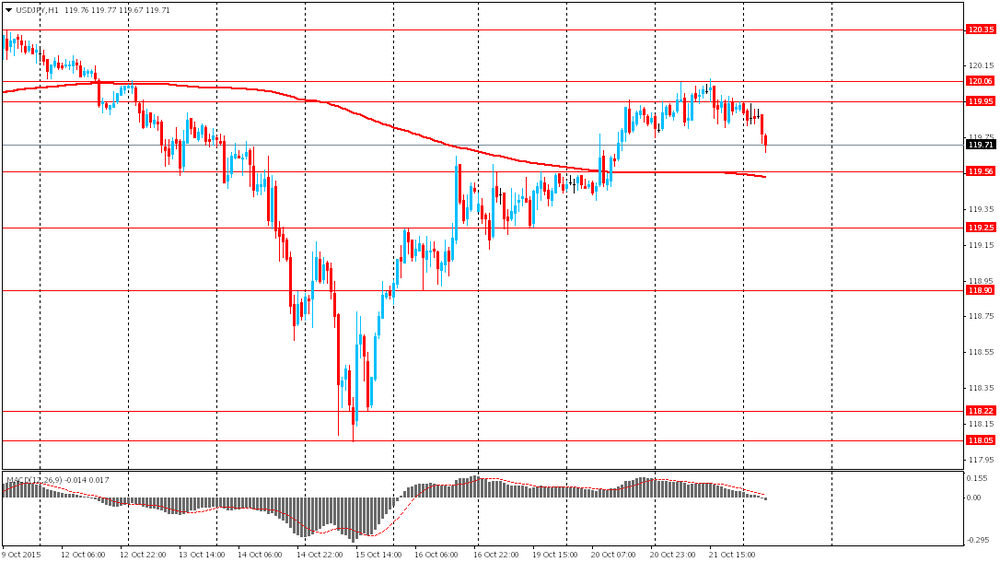

USD/JPY: the pair fell to Y119.60

GBP/USD: the pair rose to $1.5435

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Retail Sales (MoM) September 0.2% 0.3%

08:30 United Kingdom Retail Sales (YoY) September 3.7% 4.8%

11:45 Eurozone ECB Interest Rate Decision 0.05%

12:30 Eurozone ECB Press Conference

12:30 Canada Retail Sales, m/m August 0.5% 0.1%

12:30 Canada Retail Sales YoY August 1.8%

12:30 Canada Retail Sales ex Autos, m/m August 0% 0.1%

12:30 U.S. Chicago Federal National Activity Index September -0.41

12:30 U.S. Continuing Jobless Claims October 2158 2188

12:30 U.S. Initial Jobless Claims October 255 265

13:00 U.S. Housing Price Index, m/m August 0.6%

14:00 Eurozone Consumer Confidence (Preliminary) October -7.1 -7.35

14:00 U.S. Leading Indicators September 0.1% 0.0%

14:00 U.S. Existing Home Sales September 5.31 5.38

-

00:30

Currencies. Daily history for Oct 21’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1337 -0,08%

GBP/USD $1,5413 -0,19%

USD/CHF Chf0,9593 +0,34%

USD/JPY Y119,93 +0,06%

EUR/JPY Y135,97 -0,01%

GBP/JPY Y185,85 +0,41%

AUD/USD $0,7211 -0,68%

NZD/USD $0,6711 -0,54%

USD/CAD C$1,3135 +1,15%

-

00:01

Schedule for today, Thursday, Oct 22’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia NAB Quarterly Business Confidence Quarter III 4

08:30 United Kingdom Retail Sales (MoM) September 0.2% 0.3%

08:30 United Kingdom Retail Sales (YoY) September 3.7% 4.8%

11:45 Eurozone ECB Interest Rate Decision 0.05%

12:30 Eurozone ECB Press Conference

12:30 Canada Retail Sales, m/m August 0.5% 0.1%

12:30 Canada Retail Sales YoY August 1.8%

12:30 Canada Retail Sales ex Autos, m/m August 0% 0.2%

12:30 U.S. Chicago Federal National Activity Index September -0.41

12:30 U.S. Continuing Jobless Claims October 2158 2188

12:30 U.S. Initial Jobless Claims October 255 265

13:00 U.S. Housing Price Index, m/m August 0.6%

14:00 Eurozone Consumer Confidence (Preliminary) October -7.1 -7.35

14:00 U.S. Leading Indicators September 0.1% 0.0%

14:00 U.S. Existing Home Sales September 5.31 5.38

-