Noticias del mercado

-

21:00

Dow +1.75% 17,468.68 +300.07 Nasdaq +1.46% 4,910.80 +70.68 S&P +1.58% 2,050.84 +31.90

-

18:35

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rallied after two days of losses, boosted by strong results from McDonald's and Dow Chemicals and hints of the European Central Bank extending its stimulus program.

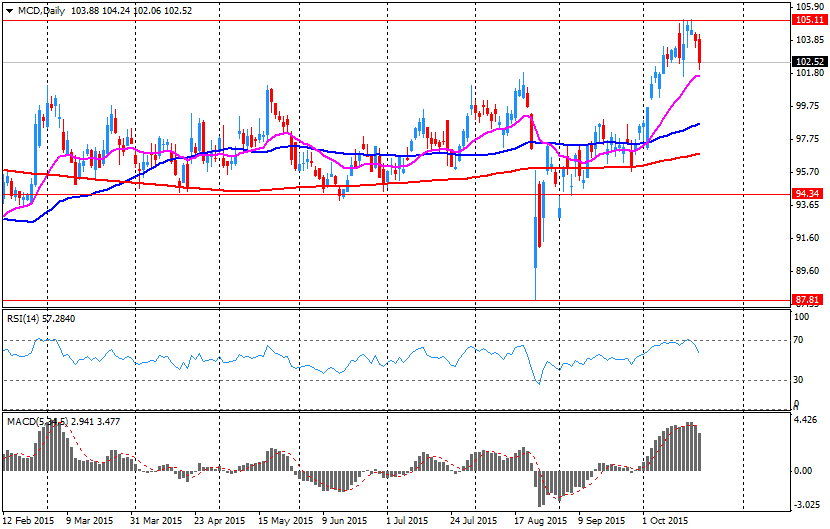

Shares of McDonald's (MCD) jumped 7% after its quarterly earnings and revenue beat estimates as demand recovered in China. The stock gave the biggest boost to the Dow.

European Central Bank President Mario Draghi said the bank could extend its stimulus program beyond 2016 as part of its efforts to boost euro-zone growth and bring inflation closer to its target of close to 2%.

Almost all of Dow stocks in positive area (26 of 30). Top looser - American Express Company (AXP, -5.76%). Top gainer - McDonald's Corp. (MSFT, +7.32%).

Most of S&P index sectors in positive area. Top looser - Healthcare (-1.2%). Top gainer - Industrial goods (+2,6%).

At the moment:

Dow 17363.00 +307.00 +1.80%

S&P 500 2043.25 +34.75 +1.73%

Nasdaq 100 4484.75 +85.50 +1.94%

10 Year yield 2,04% +0,01

Oil 45.25 +0.05 +0.11%

Gold 1166.70 -0.40 -0.03%

-

18:00

European stocks close: stocks closed higher on comments by the European Central Bank's President Mario Draghi

Stock indices closed higher on comments by the European Central Bank's (ECB) President Mario Draghi. He said at a press conference that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December. He noted that the Governing Council discussed the possibility to cut interest rates, but the decision was not made. Draghi pointed out that the central bank will expand its asset-buying programme if needed to boost inflation toward the 2% target.

Earlier, the ECB kept its interest rate unchanged at 0.05%.

Meanwhile, the economic data from the Eurozone was mixed. The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index decreased to 103 in October from 104 in September. September's reading was the highest level since August 2011.

The Spanish statistical office INE released its labour market figures on Thursday. The number of registered unemployed people fell by 298,200 in the third quarter to 4.85 million.

The unemployment rate was 21.2% in the third quarter, down from 22.4% in the second quarter. It was the lowest level in four years.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 1.9% in September, exceeding expectations for a 0.3% gain, after a 0.4% decline in August. August's figure was revised down from a 0.2% increase.

The Rugby World Cup in England and Wales supported the retail sales in September.

Food prices climbed 2.3% in September. It was the highest gain since April 2014.

On a yearly basis, retail sales in the U.K. climbed 6.5% in September, beating forecasts of 4.8% increase, after a 3.5% rise in August. August's figure was revised down from a 3.7% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,376.28 +27.86 +0.44 %

DAX 10,491.97 +253.87 +2.48 %

CAC 40 4,802.18 +107.08 +2.28 %

-

18:00

European stocks closed: FTSE 100 6,376.28 +27.86 +0.44% CAC 40 4,802.18 +107.08 +2.28% DAX 10,491.97 +253.87 +2.48%

-

17:51

WSE: Session Results

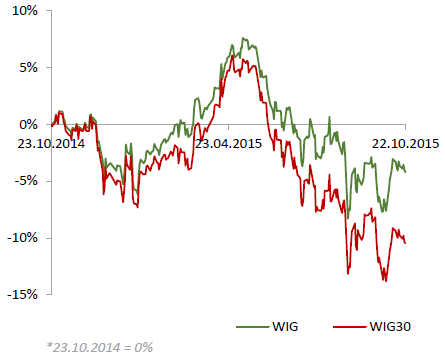

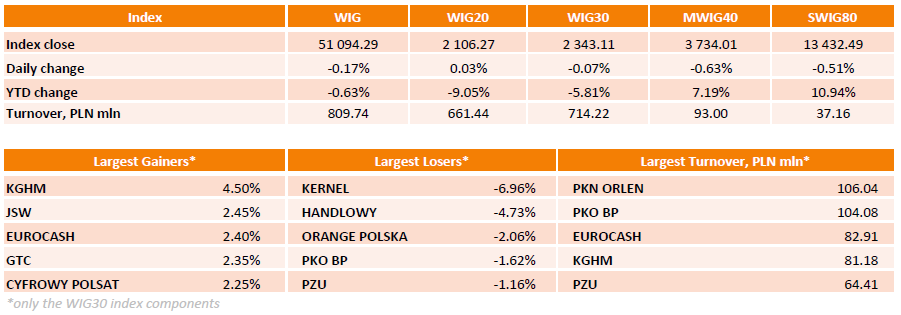

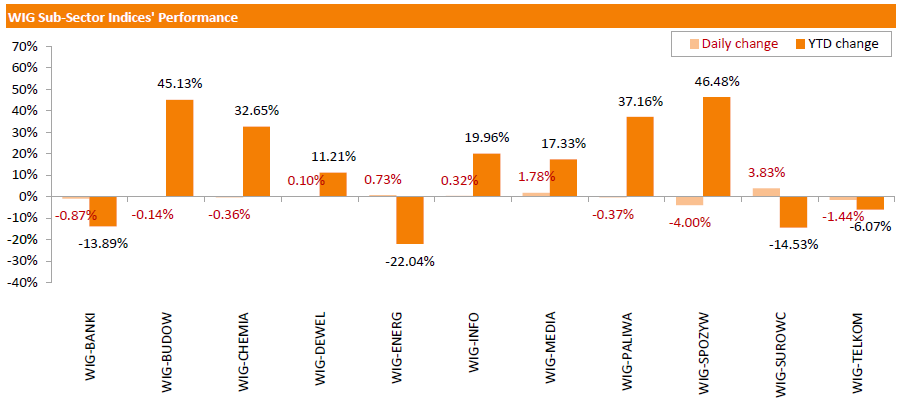

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, lost 0.17%. Sector-wise, materials (+3.83%) fared the best, while food sector (-4%) lagged behind.

The large-cap stocks' benchmark, the WIG30 Index, inched down 0.07%. Within the WIG30 Index components, KERNEL (WSE: KER) topped the list of underperformers as its stock collapsed by 6.96% after the company posted worse-than-expected FY2015 financials and weak Q1 FY2016 operational update. Other major laggards included financials names HANDLOWY (WSE: BHW), PKO BP (WSE: PKO) and PZU (WSE: PZU), slumping by 1.16%-4.73%. Elsewhere, ORANGE POLSKA (WSE: OPL) fell sharply, down 2.06%, after the company stated it might cut its dividend by half in 2016 after it agreed to pay the equivalent of nearly all its 2014 core profit for new mobile broadband frequencies. PKN ORLEN (WSE: PKN) plunged by 0.84% as the company's Q3 FY 2015 profit missed forecasts. On the contrary, KGHM (WSE: KGH) led the gainers pack with a 4.5% advance, supported by uptick in copper prices. It was followed by JSW (WSE: JSW), EUROCASH (WSE: EUR), GTC (WSE: GTC) and CYFROWY POLSAT (WSE: CPS), adding 2.25%-2.45%.

-

17:21

NAB business confidence index for Australia declines to 0 in the third quarter

The National Australia Bank (NAB) released its Quarterly Business Confidence Survey on Thursday. The NAB business confidence index declined to 0 in the third quarter from 4 in the second quarter.

But leading indicators were positive in the third quarter, while forward orders rose to their highest level since late 2009.

"Lower interest rates and AUD depreciation appear to be having the desired effects, although this varies by industry," the NAB said in its statement.

-

17:08

The Greek government removes General Secretary of the Public Revenues Authority Ekaterini Savvaidou from her position

The Greek government removed General Secretary of the Public Revenues Authority Ekaterini Savvaidou from her position. The government argued that she breached her duties.

Earlier, Savvaidou refused to resign.

-

16:55

Greek third bailout programme already falls behind the schedule

The Greek third bailout programme already falls behind the schedule. Greece and its lenders agreed that Greece will implement a package of economic overhauls and austerity measures. But only a few reforms have been implement so far.

The Greek third bailout programme's worth is €86 billion.

-

16:46

European Central Bank President Mario Draghi: the value of the ECB’s asset-buying programme will be discussed at the monetary policy meeting in December

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- Domestic demand in the Eurozone remains resilient,

- There are risks to the outlook for growth and inflation from a slowdown in emerging economies and from developments in financial and commodity markets;

- The value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December;

- The central bank will expand its asset-buying programme if needed to boost inflation toward the 2% target;

- The economy in the Eurozone is expected to recover slower due to weaker than expected foreign demand;

- The low inflation is driven by lower energy prices;

- Inflation is expected to rise during 2016 and 2017;

- Lending continued to improve;

- The Governing Council discussed the possibility to cut interest rates, but the decision was not made.

- Domestic demand in the Eurozone remains resilient,

-

16:25

U.S. leading economic index decreases 0.2% in September

The Conference Board released its leading economic index for the U.S. on Thursday. The leading economic index decreased by 0.2% in September, missing expectations a flat reading, after a flat reading in August. August's figure was revised down from a 0.1% increase.

"The recent weakness in stock markets, the manufacturing sector and housing permits was offset by gains in financial indicators, and to a lesser extent improvements in consumer expectations and initial claims for unemployment insurance. The U.S. economy is on track for moderate growth of about 2.5 percent in the coming quarters, despite the mixed global economic landscape," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:19

U.S. existing homes sales increase 4.7% in September

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes rose 4.7% to a seasonally adjusted annual rate of 5.55 million in September from 5.30 million in August. August's figure was revised down from 5.31 million units.

Analysts had expected an increase to 5.38 million units.

"While current price growth around 6 percent is still roughly double the pace of wages, affordability has slightly improved since the spring and is helping to keep demand at a strong and sustained pace," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers decreased to 29% in September from 32% in August.

"Unfortunately, first-time buyers are still failing to generate any meaningful traction this year," Yun said.

-

16:12

Eurozone’s preliminary consumer confidence index declines to -7.7 in October

The European Commission released its preliminary consumer confidence figures for the Eurozone on Thursday. Eurozone's preliminary consumer confidence index fell to -7.7 in October from -7.1 in September, missing expectations for a decline to -7.35.

European Union's consumer confidence index declined by 0.2 points to -5.7 in October.

-

15:46

Spain’s trade deficit widens to €3.19 billion in August

Spain's Economy Ministry released its trade data on Thursday. The trade deficit widened to €3.19 billion in August from €2.77 billion in August a year ago.

Exports declined at an annual rate of 0.8% in August, while imports rose 1.5%.

In the January to August period, the trade deficit totalled €16.07 billion, down 2.5% from the same period of 2014.

Exports increased 4.9% in the January to August period, while imports gained 4.2%.

-

15:38

U.S. house price index rise 0.3% in August

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Thursday. The U.S. house price index rose 0.3% on a seasonally adjusted basis in August, after a 0.5% gain in July. July's figure was revised down from a 0.6% increase.

On a yearly basis, U.S. house prices climbed 5.5% in August.

-

15:33

U.S. Stocks open: Dow +0.76%, Nasdaq +0.83%, S&P +0.67%

-

15:25

Before the bell: S&P futures +0.61%, NASDAQ futures +0.74%

U.S. stock-index futures rose amid corporate earnings.

Global Stocks:

Nikkei 18,435.87 -118.41 -0.64%

Hang Seng 22,845.37 -143.85 -0.63%

Shanghai Composite 3,369.58 +48.90 +1.47%

FTSE 6,361.04 +12.62 +0.20%

CAC 4,765.5 +70.40 +1.50%

DAX 10,390.17 +152.07 +1.49%

Crude oil $45.84 (+1.42%)

Gold $1163.40 (-0.28%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

110.25

7.52%

765.7K

Boeing Co

BA

142.49

0.92%

0.2K

Amazon.com Inc., NASDAQ

AMZN

560.41

0.83%

8.5K

ALCOA INC.

AA

9.18

0.77%

2.8K

Intel Corp

INTC

33.60

0.69%

7.0K

Starbucks Corporation, NASDAQ

SBUX

60.95

0.69%

2.1K

Tesla Motors, Inc., NASDAQ

TSLA

211.50

0.67%

12.4K

Yahoo! Inc., NASDAQ

YHOO

31.30

0.58%

1.8K

Google Inc.

GOOG

646.10

0.54%

0.6K

Exxon Mobil Corp

XOM

80.63

0.52%

1.5K

Home Depot Inc

HD

123.94

0.52%

0.2K

Ford Motor Co.

F

15.49

0.52%

0.1K

Apple Inc.

AAPL

114.32

0.49%

50.7K

Facebook, Inc.

FB

97.52

0.42%

16.2K

E. I. du Pont de Nemours and Co

DD

57.51

0.40%

0.6K

Nike

NKE

133.00

0.40%

0.1K

Visa

V

75.75

0.38%

0.8K

General Motors Company, NYSE

GM

35.55

0.37%

20.9K

Cisco Systems Inc

CSCO

28.38

0.35%

0.1K

United Technologies Corp

UTX

98.30

0.34%

23.8K

Verizon Communications Inc

VZ

45.00

0.31%

2.1K

Microsoft Corp

MSFT

47.34

0.30%

0.3K

Chevron Corp

CVX

89.57

0.27%

19.6K

Wal-Mart Stores Inc

WMT

58.79

0.26%

16.3K

Citigroup Inc., NYSE

C

51.92

0.21%

5.7K

The Coca-Cola Co

KO

42.27

0.19%

2.1K

General Electric Co

GE

28.89

0.14%

1.8K

Goldman Sachs

GS

179.92

0.12%

3.6K

Twitter, Inc., NYSE

TWTR

29.33

0.10%

23.0K

Procter & Gamble Co

PG

73.65

0.08%

4.1K

ALTRIA GROUP INC.

MO

59.86

0.03%

1.1K

Travelers Companies Inc

TRV

110.72

0.02%

0.1K

Barrick Gold Corporation, NYSE

ABX

7.51

0.00%

5.3K

3M Co

MMM

149.60

-0.15%

2.6K

Walt Disney Co

DIS

109.90

-0.17%

20.0K

AT&T Inc

T

33.47

-0.39%

11.7K

Johnson & Johnson

JNJ

97.12

-0.52%

0.2K

UnitedHealth Group Inc

UNH

117.33

-0.66%

1K

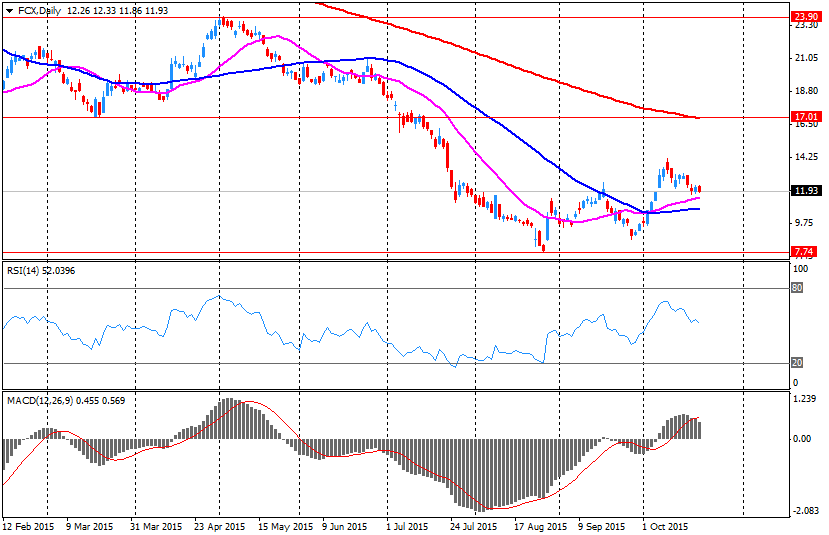

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.86

-0.75%

9.6K

Deere & Company, NYSE

DE

76.00

-0.85%

0.8K

Caterpillar Inc

CAT

68.10

-1.16%

64.6K

American Express Co

AXP

73.40

-4.06%

25.2K

-

14:53

Chicago Fed National Activity Index rises to -0.37 in September

The Federal Reserve Bank of Chicago released its National Activity Index on Thursday. The index increased to -0.37 in September from -0.39 in August. August's figure was revised up from -0.41.

The slight increase was mainly driven by a rise in the production.

The production-related indicator rose to -0.18 in September from -0.21 in August.

The employment-related indicator dropped to -0.11 in September from -0.08 in August.

The personal consumption and housing indicator was down to -0.08 in September from -0.06 in August.

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Visa (V) resumed with an Outperform at Wells Fargo

-

14:46

Initial jobless claims increase by 3,000 to 259,000 in the week ending October 17

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 17 in the U.S. rose by 3,000 to 259,000 from 256,000 in the previous week. The previous week's figure was revised up from 255,000.

Analysts had expected the initial jobless claims to increase to 265,000.

Jobless claims remained below 300,000 the 33th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 6,000 to 2,170,000 in the week ended October 10.

-

14:41

Canadian retail sales gain 0.5% in August

Statistics Canada released retail sales data on Thursday. Canadian retail sales rose by 0.5% in August, exceeding expectations for a 0.1% gain, after a 0.6% increase in July. July's figure was revised up from a 0.5% gain.

The rise was driven by higher sales at motor vehicle and parts sales. Motor vehicle and parts sales rose 2.0% in August.

Sales at gasoline stations declined 0.6% in August, while sales at furniture and home furnishings stores climbed 3.0%.

Sales at food and beverage stores were up 0.5% in August.

Sales rose in 4 of 11 subsectors.

Canadian retail sales excluding automobiles were flat in August, missing expectations for a 0.1% rise, after a flat reading in July.

-

14:34

-

14:30

European Central Bank keeps its interest rate unchanged at 0.05% in October

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

The interest rate remains unchanged since September 2014.

Market participants speculate that the ECB may extend its asset-buying programme as the inflation in the Eurozone remains at low levels.

-

14:23

-

14:15

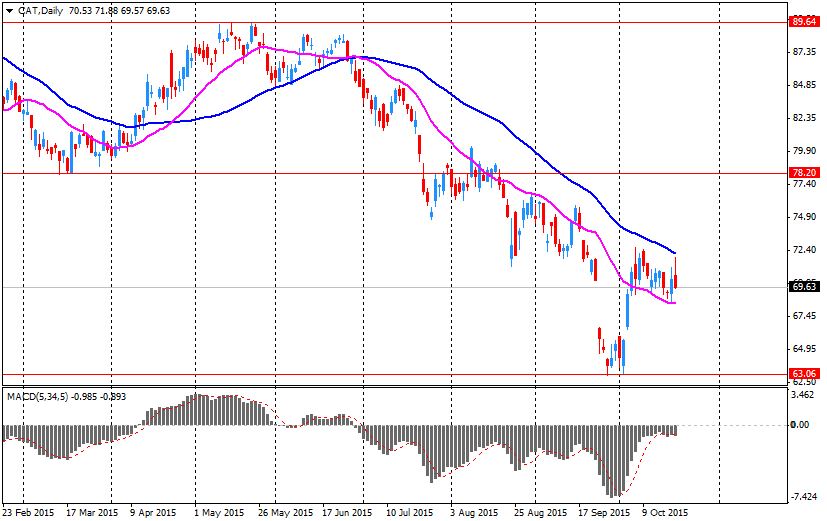

Company News: Caterpillar (CAT) Q3 results miss consensus

Caterpillar reported Q3 earnings of $0.75 per share (versus $1.72 in Q3 FY 2014), missing analysts' consensus of $0.79.

Its revenues amounted to $10.962 bln (-19.1% y/y), missing consensus estimate of $11.196 bln.

The company expects FY15 EPS of $4.60 (slightly below consensus of $4.67) and revenues of $48 bln (in line with consensus).

CAT fel to $67.50 (-2.03%) in pre-market trading.

-

14:11

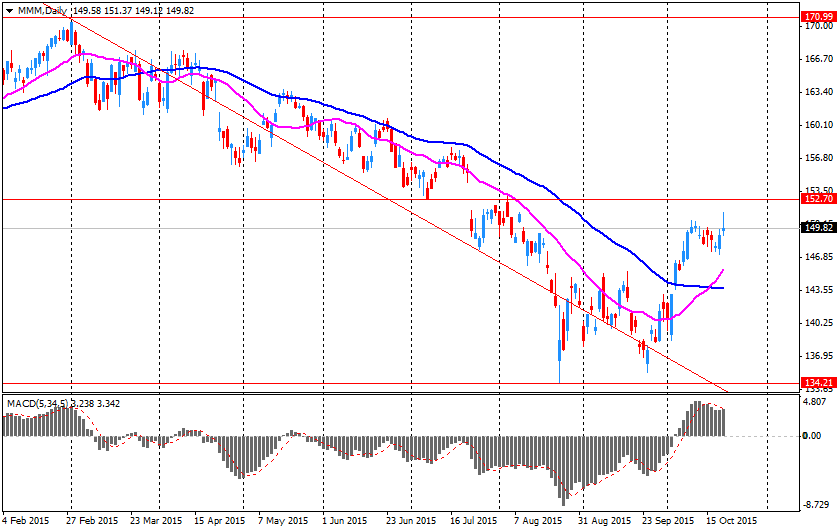

Company News: 3M (MMM) Q3 profit beats expectations

3M Company reported Q3 earnings of $2.05 per share (versus $1.98 in Q3 FY 2014), beating analysts' consensus of $2.01.

The company's revenues amounted to $7.712 bln (-5.2% y/y), slightly missing consensus estimate of $7.845 bln.

3M downgraded its EPS FY15 guidance to $7.73-7.78 from $7.73-7.93. The analysts' consensus forecast for the company's EPS FY15 stands at $7.78.

MMM fell to $148.17 (-1.10%) in pre-market trading.

-

12:01

European stock markets mid session: stocks traded mixed ahead of the release of the European Central Bank's monetary meeting results

Stock indices traded mixed ahead of the release of the European Central Bank's (ECB) monetary meeting results. A speech by the ECB President Mario Draghi will be closely monitored for signals of further quantitative easing. The inflation in the Eurozone remains at low levels, and several ECB officials expressed concerns over the low inflation.

Meanwhile, the economic data from the Eurozone was mixed. The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index decreased to 103 in October from 104 in September. September's reading was the highest level since August 2011.

The Spanish statistical office INE released its labour market figures on Thursday. The number of registered unemployed people fell by 298,200 in the third quarter to 4.85 million.

The unemployment rate was 21.2% in the third quarter, down from 22.4% in the second quarter. It was the lowest level in four years.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 1.9% in September, exceeding expectations for a 0.3% gain, after a 0.4% decline in August. August's figure was revised down from a 0.2% increase.

The Rugby World Cup in England and Wales supported the retail sales in September.

Food prices climbed 2.3% in September. It was the highest gain since April 2014.

On a yearly basis, retail sales in the U.K. climbed 6.5% in September, beating forecasts of 4.8% increase, after a 3.5% rise in August. August's figure was revised down from a 3.7% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,340.83 -7.59 -0.12 %

DAX 10,254.69 +16.59 +0.16 %

CAC 40 4,690.43 -4.67 -0.10 %

-

11:55

Unemployment rate in Spain decline to 21.2% in the third quarter, the lowest level in four years

The Spanish statistical office INE released its labour market figures on Thursday. The number of registered unemployed people fell by 298,200 in the third quarter to 4.85 million.

The unemployment rate was 21.2% in the third quarter, down from 22.4% in the second quarter. It was the lowest level in four years.

-

11:45

French manufacturing confidence index declines to 103 in October

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index decreased to 103 in October from 104 in September. September's reading was the highest level since August 2011.

Past change in production index was down to 7 in October from 11 in September.

Personal production expectations index fell to 13 in October from 14 in September, while general production outlook index dropped to 2 from 5.

-

11:31

UK retail sales rise 1.9% in September

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 1.9% in September, exceeding expectations for a 0.3% gain, after a 0.4% decline in August. August's figure was revised down from a 0.2% increase.

The Rugby World Cup in England and Wales supported the retail sales in September.

Food prices climbed 2.3% in September. It was the highest gain since April 2014.

"Falling in-store prices and promotions around the Rugby World Cup are likely to be the main factors why the quantity bought in the retail sector increased in September at the fastest monthly rate seen since December 2013," ONS statistician Kate Davies said.

On a yearly basis, retail sales in the U.K. climbed 6.5% in September, beating forecasts of 4.8% increase, after a 3.5% rise in August. August's figure was revised down from a 3.7% gain.

-

11:12

Greece’s economy is expected to contract 1.4% in 2015

Reuters reported that sources close to bailout talks said that Greece's economy is expected to contract 1.4% in 2015, slower than the previous estimate of a 2.3% decline. Greece economy is expected to contract 1.3% next year.

Greek Economy Minister George Stathakis said on October 07 that the Greek economy will decline about 1.5% this year.

-

09:38

The People's Bank of China (PBoC) and the Bank of England (BoE) agree to renew the existing reciprocal sterling/renminbi currency swap line

The People's Bank of China (PBoC) and the Bank of England (BoE) said on Wednesday that they agreed to renew the existing reciprocal sterling/renminbi currency swap line for a further three years. The maximum value of the swap line was raised to 350 billion yuan from 200 billion yuan (this value has been agreed in June 2013).

"The renewal of this swap line and its increased size reflect the constructive approach that the Bank of England and the People's Bank of China are taking to support the development of an effective and resilient renminbi market in London," the BoE Governor Mark Carney said.

-

09:21

Chinese President Xi Jinping: there will be "no hard landing" in China despite the downward pressure

Chinese President Xi Jinping said during a state visit to the U.K. that there will be "no hard landing" in China despite the downward pressure.

"The Chinese economy does face some downward pressure and structural problems, but such adjustments look inevitable when the economy reaches a certain stage after years of high growth," he said.

Xi noted that the economic development in China is "a new normal".

-

08:21

Global Stocks: U.S. stock indices posted moderate declines

U.S. stock indices declined on Wednesday with health-care companies leading declines after a negative report on Canadian drugmaker Valeant Pharmaceuticals International (the company denied this report).

The Dow Jones Industrial Average fell 48.50, or 0.3%, to 17168.61. The S&P 500 declined 11.83 points, or 0.6%, to 2018.94 (its health-care sector fell 0.9%). The Nasdaq Composite Index lost 40.85, or 0.8%, to 4840.12.

Meanwhile Boeing reported that its third-quarter earnings rose 25% on continued growth in deliveries of commercial jetliners. This report pushed the company's shares up by 2.31, or 1.7%, to 141.19.

General Motors' third quarter profits exceeded expectations. Its shares rose 5.8%.

Coca-Cola Co.'s shares lost 0.2% amid weaker-than-expected revenues.

This morning in Asia Hong Kong Hang Seng fell 0.92%, or 211.54, or 22,777.68. China Shanghai Composite Index gained 0.24%, or 7.81, to 3.328.49. The Nikkei fell 0.85%, or 157.53, to 18,396.75.

Asian indices outcide China fell, while Chinese stocks climbed with small-caps leading the gains.

Shares of Air China and China Southern Airline rose 4.9% and 2.8% after the Shanghai Securities News reported that the carriers were considering a merger.

-

04:04

Nikkei 225 18,544.97 -9.31 -0.05 %, Hang Seng 22,763.84 -225.38 -0.98 %, Shanghai Composite 3,307.55 -13.13 -0.40 %

-

00:31

Stocks. Daily history for Sep Oct 21’2015:

(index / closing price / change items /% change)

Nikkei 225 18,554.28 +347.13 +1.91 %

S&P/ASX 200 5,248.3 +12.73 +0.24 %

Shanghai Composite 3,306.52 -118.81 -3.47 %

Topix 1,526.81 +27.53 +1.84 %

FTSE 100 6,348.42 +3.29 +0.05 %

CAC 40 4,695.1 +21.29 +0.46 %

Xetra DAX 10,238.1 +90.42 +0.89 %

S&P 500 2,018.94 -11.83 -0.58 %

NASDAQ Composite 4,840.12 -40.85 -0.84 %

Dow Jones 17,168.61 -48.50 -0.28 %

-