Noticias del mercado

-

21:01

Dow +0.21% 17,253.65 +36.54 Nasdaq -0.29% 4,866.61 -14.36 S&P -0.11% 2,028.50 -2.27

-

18:00

European stocks close: stocks closed higher in the absence of any major economic reports from the Eurozone

Stock indices closed higher in the absence of any major economic reports from the Eurozone. Market participants are awaiting the European Central Bank's (ECB) monetary meeting tomorrow. A speech by the ECB President Mario Draghi will be closely monitored for signals of further quantitative easing. The inflation in the Eurozone remains at low levels, and several ECB officials expressed concerns over the low inflation.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,348.42 +3.29 +0.05 %

DAX 10,238.1 +90.42 +0.89 %

CAC 40 4,695.1 +21.29 +0.46 %

-

17:53

WSE: Session Results

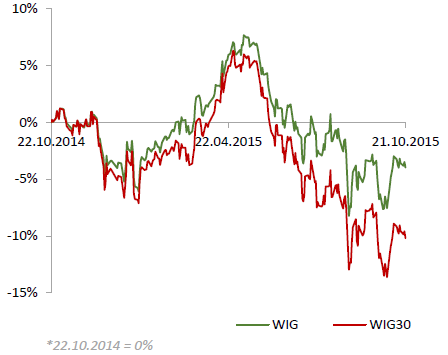

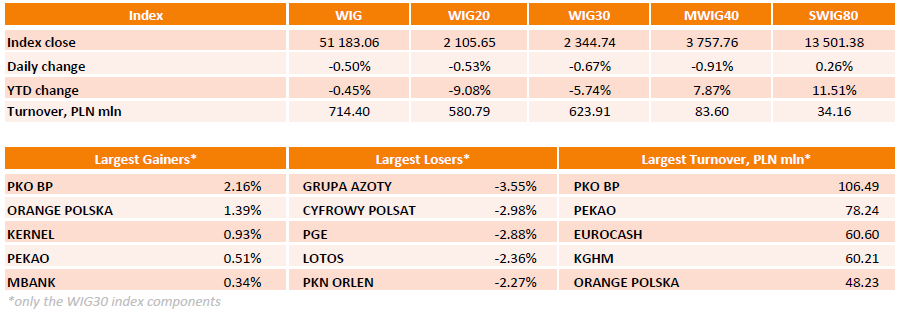

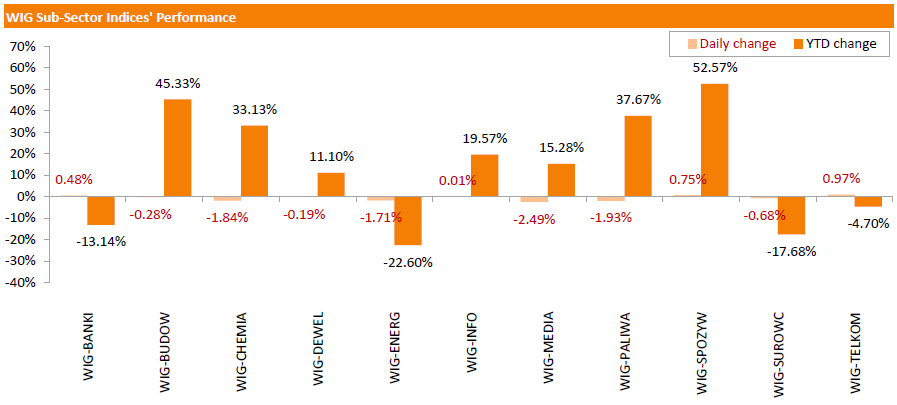

Polish equity market fell on Wednesday. The broad market benchmark, the WIG Index, lost 0.50%. Sector- wise, media sector (-2.49%) and oil and gas sector (-1.93%) lagged, while, telecommunication sector (+0.97%) performed best.

The large-cap stocks plunged by 0.67%, as measured by the WIG30 Index. Within the index components, GRUPA AZOTY (WSE: ATT) and CYFROWY POLSAT (WSE: CPS) fared the worst, plunging by 3.55% and 2.98% respectively. PGE (WSE: PGE) declined by 2.88%, depressed by news that the company would buy loss making Makoszowy coal mine. Other major laggards included LOTOS (WSE: LTS), PKN ORLEN (WSE: PKN) and PKP CARGO (WSE: PKP), slumping 2.26%-2.36%. On the other side of the ledger, PKO BP (WSE: PKO) led a handful of gainers, adding 2.16% after the bank's CEO maintained expectations for results improvement in H2 versus H1.

-

17:01

Eurozone’s revised government deficit to GDP ratio in 2014 is 2.6%

Eurostat released its revised government deficit data for 2014 on Wednesday. Eurozone's government deficit to GDP ratio fell to 2.6% (preliminary reading: 2.4%) in 2014 from 3.0% in 2013. The government debt to GDP ratio rose to 92.1% in 2014 (preliminary reading: 91.9%) from 91.1% in 2013.

Only Germany (+0.3%), Estonia (+0.7%) and Luxembourg (+1.4%) registered a government surplus in the Eurozone in 2014.

The lowest ratios of government debt to GDP in the Eurozone in 2014 were registered in Estonia (10.4%) and Luxembourg (23.0%)

-

16:44

Wall Street. Major U.S. stock-indexes little changed

Mjor U.S. stock-indexes little changed on Wednesday as investors evaluate third-quarter results by industry heavyweights Boeing and General Motors. Of the S&P 500 companies that have reported results so far, 40 percent have exceeded revenue estimates. About 60 percent typically beat estimates in a quarter, according to Thomson Reuters data.

Dow stocks mixed (16 in positive area, 14 in negative area). Top looser - UnitedHealth Group Incorporated (UNH, -2.09%). Top gainer - The Travelers Companies, Inc. (TRV, +1.44%).

Most of S&P index sectors in negative area. Top looser - Healthcare (-1.9%). Top gainer - Utilities (+0,3%).

At the moment:

Dow 17128.00 +21.00 +0.12%

S&P 500 2020.50 0.00 0.00%

Nasdaq 100 4424.75 0.00 0.00%

10 Year yield 2,07% +0,04

Oil 45.05 -1.24 -2.68%

Gold 1164.70 -12.80 -1.09%

-

16:42

Largest U.K. banks will undergo more stringent “stress tests”

Largest U.K. banks will undergo more stringent "stress tests", the Bank of England (BoE) said in a statement on Wednesday. Smaller U.K. banks and British units of foreign investment banks are not affected by this central bank's decision.

"The United Kingdom needs banks than can weather shocks without cutting lending to the real economy," the BoE Governor Mark Carney said.

"The Bank of England is taking steps to ensure we can assess a range of future risks from a number of different sources to inform our micro- and macro-prudential policy decisions," he added.

-

16:29

Bank of Canada keeps its interest rate unchanged at 0.50%, but cuts its growth forecasts

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy is appropriate. This decision was expected by analysts.

The BoC said that inflation in Canada was driven by lower consumer energy prices.

The central bank noted that the Canadian economy rebounded, supported by household spending.

The BoC lowers its growth forecasts for 2016 and 2017 as lower prices for oil and other commodities weigh on the Canadian economy. The real GDP growth is expected to be 2% in 2016, down from the previous estimate of 2.3%, and 2.5% in 2017, down from the previous estimate of 2.6%.

"The Canadian economy can be expected to return to full capacity, and inflation sustainably to target, around mid-2017," the BoC said in its statement.

Risks to the country's financial stability are evolving as expected, and risks around the inflation are roughly balanced, the central bank said.

-

15:37

U.S. Stocks open: Dow +0.29%, Nasdaq +0.35%, S&P +0.27%

-

15:24

Before the bell: S&P futures +0.45%, NASDAQ futures +0.56%

U.S. stock-index futures advanced amid corporate earnings.

Global Stocks:

Nikkei 18,554.28 +347.13 +1.91%

Shanghai Composite 3,306.52 -118.81 -3.47%

FTSE 6,371.31 +26.18 +0.41%

CAC 4,705.74 +31.93 +0.68%

DAX 10,255.16 +107.48 +1.06%

Crude oil $45.45 (-1.81%)

Gold $1175.90 (-0.11%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

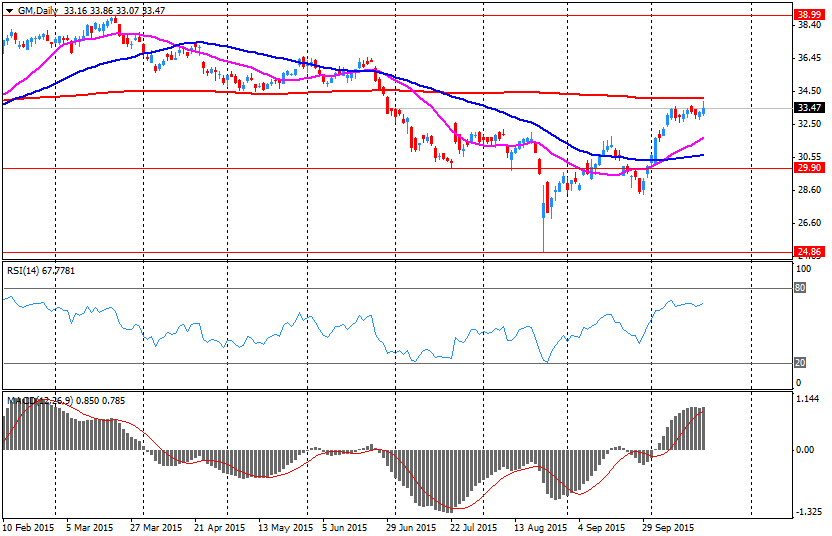

General Motors Company, NYSE

GM

34.93

4.33%

211.3K

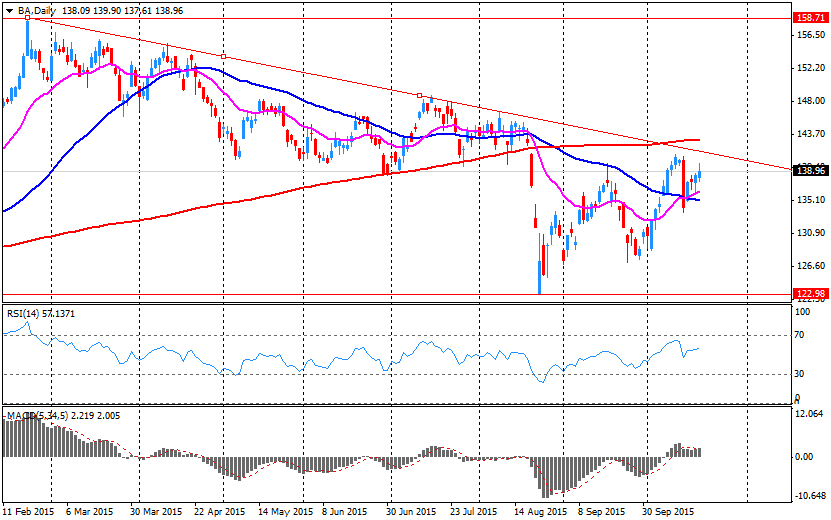

Boeing Co

BA

142.00

2.25%

29.3K

Ford Motor Co.

F

15.65

1.76%

88.0K

E. I. du Pont de Nemours and Co

DD

57.78

1.03%

37.3K

Merck & Co Inc

MRK

50.81

0.83%

0.1K

Facebook, Inc.

FB

97.64

0.66%

48.6K

Walt Disney Co

DIS

110.50

0.60%

0.4K

Visa

V

76.73

0.59%

1.0K

Google Inc.

GOOG

653.99

0.57%

0.1K

Amazon.com Inc., NASDAQ

AMZN

563.51

0.47%

3.0K

JPMorgan Chase and Co

JPM

62.80

0.45%

4.9K

Intel Corp

INTC

33.57

0.39%

3.5K

Microsoft Corp

MSFT

47.92

0.31%

15.3K

Citigroup Inc., NYSE

C

53.00

0.30%

12.7K

Procter & Gamble Co

PG

73.97

0.28%

0.9K

Wal-Mart Stores Inc

WMT

58.90

0.26%

0.6K

General Electric Co

GE

28.84

0.21%

3.0K

Home Depot Inc

HD

123.01

0.13%

0.3K

Nike

NKE

132.53

0.12%

1.0K

Starbucks Corporation, NASDAQ

SBUX

60.90

0.03%

0.5K

Chevron Corp

CVX

90.00

0.01%

7.6K

Caterpillar Inc

CAT

70.24

-0.04%

1.7K

Johnson & Johnson

JNJ

97.55

-0.04%

0.4K

Apple Inc.

AAPL

113.70

-0.06%

86.1K

Cisco Systems Inc

CSCO

28.48

-0.07%

3.2K

Verizon Communications Inc

VZ

45.20

-0.09%

0.9K

Exxon Mobil Corp

XOM

80.71

-0.15%

6.3K

American Express Co

AXP

76.80

-0.19%

1K

Hewlett-Packard Co.

HPQ

28.50

-0.21%

0.5K

Barrick Gold Corporation, NYSE

ABX

7.87

-0.25%

0.4K

Deere & Company, NYSE

DE

76.09

-0.39%

0.2K

ALCOA INC.

AA

9.36

-0.53%

32.3K

International Business Machines Co...

IBM

139.70

-0.67%

16.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.15

-0.74%

22.4K

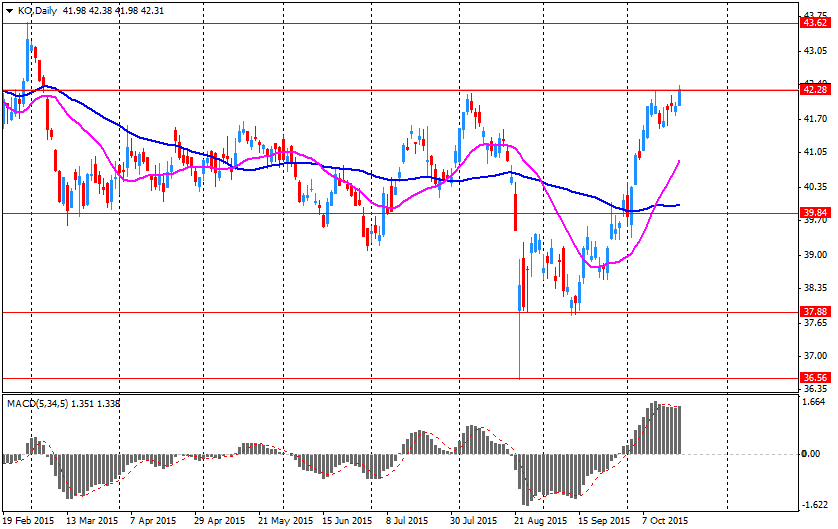

The Coca-Cola Co

KO

41.93

-0.85%

18.2K

International Paper Company

IP

41.00

-1.06%

0.5K

Yandex N.V., NASDAQ

YNDX

13.18

-1.27%

0.4K

Tesla Motors, Inc., NASDAQ

TSLA

209.73

-1.55%

22.3K

Yahoo! Inc., NASDAQ

YHOO

32.25

-1.77%

66.2K

Twitter, Inc., NYSE

TWTR

29.34

-5.08%

335.0K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Yahoo! (YHOO) downgraded to Neutral from Buy at Mizuho; target lowered to $37 from $40

Yahoo! (YHOO) downgraded to Neutral from Buy at B. Riley & Co.

Twitter (TWTR) downgraded to Underweight from Equal-Weight at Morgan Stanley; target lowered to $24 from $36

Other:

IBM (IBM) reiterated at a Neutral at UBS; target lowered to $145 from $170

Facebook (FB) reiterated at a Buy at Jefferies; target raised to $130 from $120

Yahoo! (YHOO) target lowered to $44 from $45 at Axiom Capital

Yahoo! (YHOO) target lowered to $35 from $49 at Cowen

Verizon (VZ) target lowered to $54 from $57 at FBR Capital

Verizon (VZ) target lowered to $53 from $59 at Argus

Travelers (TRV) target raised to $120 from $115 at RBC Capital Mkts

-

14:44

China’s central bank issues the first yuan bonds outside China

The People's Bank of China (PBoC) has issued its first yuan bonds in London, the first yuan bonds outside China. The central bank hopes to get 5 billion yuan ($787 million). The rate is 3.1% and mature in 2016.

-

14:32

China’s central bank supplies 105.5 billion yuan to 11 commercial lenders

The People's Bank of China (PBoC) said on Wednesday that it supplied 105.5 billion yuan ($16.6 billion) to 11 commercial lenders via the Medium-term Lending Facility. The rate was 3.35%.

The central bank's action aims to keep interbank rates low and to boost the country's economic growth.

-

14:27

-

14:15

-

14:12

Company News: Boeing (BA) posts strong Q3 results

Boeing reported Q3 earnings of $2.52 per share (+17.8% y/y), beating analysts' consensus of $2.20.

The company's revenues amounted to $25.849 bln (+8.7% y/y), beating consensus estimate of $24.781 bln.

Boeing revised upwards its EPS FY15 guidance to $16.20-16.50 from $15.50-15.95. The analysts' consensus forecast for the company's EPS FY15 stands at $15.81. The company also raised FY15 revenues to +8-9% (from +6-8%) to $10.48-10.58 bln versus consensus estimate of $10.47 bln.

BA rose to $143.00 (+2.97%) in pre-market trading.

-

11:59

European stock markets mid session: stocks traded higher in the absence of any major economic reports from the Eurozone

Stock indices traded higher in the absence of any major economic reports from the Eurozone. Market participants are awaiting the European Central Bank's (ECB) monetary meeting tomorrow. A speech by the ECB President Mario Draghi will be closely monitored for signals of further quantitative easing. The inflation in the Eurozone remains at low levels, and several ECB officials expressed concerns over the low inflation.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

Current figures:

Name Price Change Change %

FTSE 100 6,368.82 +23.69 +0.37 %

DAX 10,193.17 +45.49 +0.45 %

CAC 40 4,693.81 +20.00 +0.43 %

-

11:39

M3 money supply in Switzerland rises 1.2% in September

The Swiss National Bank (SNB) released its money supply data on Wednesday. M3 money supply in Switzerland increased 1.2% year-on-year in September, after a 1.4% rise in August.

M1 money supply was up 0.7% year-on-year in September, after a 0.5% increase in August.

-

11:30

Greece’s current account surplus falls to €2.09 billion in August

The Bank of Greece released its current account data on Wednesday. Greece's current account surplus fell to €2.09 billion in August from €1.86 billion in August last year.

The Greek deficit on trade in goods declined by €268 million year-on-year in August, while the services surplus declined by €142 million.

The deficit on primary income decreased to €140.5 million in August from €249.8 million last year, while the deficit on secondary income climbed to €71.4 million from €69.1 million last year.

The capital account surplus remained almost unchanged in August.

-

11:19

Public sector net borrowing in the U.K. declines to £8.63 billion in September

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

-

10:54

Less than €20 million will be needed for recapitalisation of four main Greek banks

Reuters reported on Tuesday two senior bankers with knowledge of the matter said that less than €20 million will be needed for recapitalisation of four main Greek banks.

"The capital shortfall for the four systemic banks should be less than 20 billion euros," one senior banker said.

The European Central Bank declined to comment.

-

10:20

Japan's trade deficit narrows to ¥114.5 billion in September

The Ministry of Finance released its trade data for Japan on the late Tuesday evening. Japan's trade deficit narrowed to ¥114.5 billion in September from a deficit of ¥569.6 billion in August. Analysts had expected a surplus of ¥84.0 billion.

The adjusted trade deficit was ¥355.7 billion in September, down from a deficit of ¥373.5 billion in August. August's figure was revised down from a deficit of ¥358.8 billion.

Exports rose 0.6% year-on-year in September, while imports dropped 11.1% year-on-year.

Exports to Asia decreased by 0.9% year-on-year, exports to the United States increased by 10.4%, exports to China dropped by 3.5%, while exports to the European Union were up 5.1%.

Imports from Asia fell 1.0% year-on-year, imports from the United States declined 0.1%, and imports from China gained 0.9%, while imports from the European Union slid 3.5%.

-

10:10

Australian leading economic index rises 0.2% in May

The Conference Board (CB) released its leading economic index for Australia on late Tuesday evening. The leading economic index decreased 0.4% in August, after a 0.3% rise in July.

The decrease was driven by a drop in building approvals, money supply, share prices and the sales to inventories ratio.

The coincident index was up 0.2% in August, after a 0.2% gain in July.

The rise was driven by employment, household disposable income and industrial production.

-

08:30

Global Stocks: Asian indices climbed despite declines in U.S. stocks

U.S. stock indices declined on Tuesday amid mixed earnings reports. Stocks of motorcycle maker Harley-Davidson Inc. fell 14% after its report showed a profit miss.

The Dow Jones Industrial Average slid 13.43 points, or less than 0.1%, to 17,217.11. The S&P 500 declined by 2.89, or 0.1%, to 2,030.77. The Nasdaq Composite Index fell 24.50, or 0.5%, to 4,880.97.

U.S. Department of Housing and Urban Development reported on Tuesday that housing starts rose by seasonally adjusted 6.5% to 1.21 million in September compared to the previous month.

U.S. stocks also continued to be influenced by concerns over global economy after Chinese GDP growth missed the 7% target in the third quarter.

This morning in Asia China Shanghai Composite Index rose 0.39%, or 13.45, to 3.438.78. The Nikkei rose 1.86%, or 339.31, to 18,546.46. Hong Kong market is on holiday.

Asian indices climbed despite declines in U.S. stocks.

Japanese stocks are supported by a weaker yen, which is favorable for exporters.

Meanwhile Japanese Ministry of Finance reported that the country's trade balance came in at ¥-114.5 billion in September, while economists had expected a surplus of ¥84.4 billion. Exports rose by 0.6% vs 3.4% expected. Exports to China fell by 3.5% after a 4.6% decline in August. Imports fell by 11.1%.

-

04:02

Nikkei 225 18,343.83 +136.68 +0.75 %, Shanghai Composite 3,424.35 -0.98 -0.03 %

-

00:31

Stocks. Daily history for Sep Oct 20’2015:

(index / closing price / change items /% change)

Hang Seng 22,989.22 -86.39 -0.37 %

S&P/ASX 200 5,235.57 -34.14 -0.65 %

Shanghai Composite 3,424.33 +37.63 +1.11 %

Topix 1,499.28 +4.53 +0.30 %

FTSE 100 6,345.13 -7.20 -0.11 %

CAC 40 4,673.81 -30.26 -0.64 %

Xetra DAX 10,147.68 -16.63 -0.16 %

S&P 500 2,030.77 -2.89 -0.14 %

NASDAQ Composite 4,880.97 -24.50 -0.50 %

Dow Jones 17,217.11 -13.43 -0.08 %

-