Noticias del mercado

-

21:00

Dow +0.02% 17,233.34 +2.80 Nasdaq -0.48% 4,882.15 -23.32 S&P -0.08% 2,032.13 -1.53

-

18:52

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Tuesday as third-quarter earnings season gathered momentum with Verizon, Travelers and United Technologies reporting their results.

U.S. housing starts rose solidly in September on soaring demand for rental apartments, a sign that the housing market continues to steadily improve even as economic growth has slowed. The Commerce Department said on Tuesday groundbreaking increased 6.5% to a seasonally adjusted annual pace of 1.21 million units.

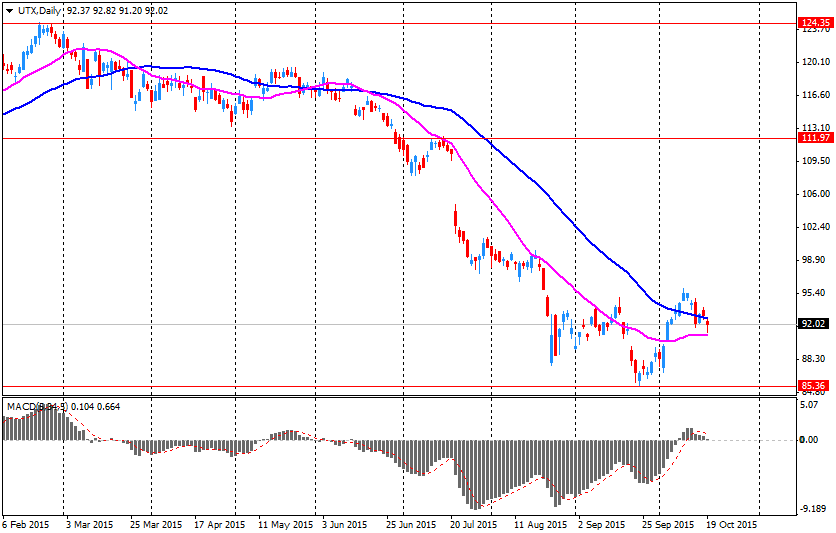

Dow stocks mixed (14 in positive area, 16 in negative area). Top looser - International Business Machines Corporation (IBM, -5.82%). Top gainer - United Technologies Corporation (UTX, +5.63%).

S&P index sectors also mixed. Top looser - Healthcare (-1.7%). Top gainer - Industrial goods (+0,6%).

At the moment:

Dow 17110.00 -7.00 -0.04%

S&P 500 2021.25 -6.25 -0.31%

Nasdaq 100 4426.00 -28.50 -0.64%

10 Year yield 2,07% +0,04

Oil 45.97 -0.31 -0.67%

Gold 1177.80 +5.00 +0.43%

-

18:05

WSE: Session Results

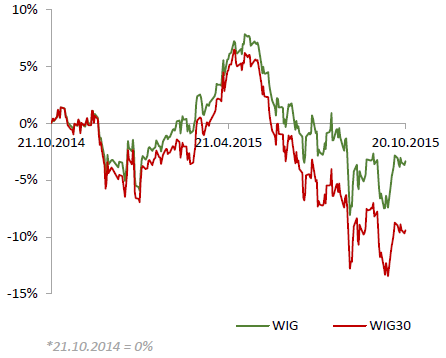

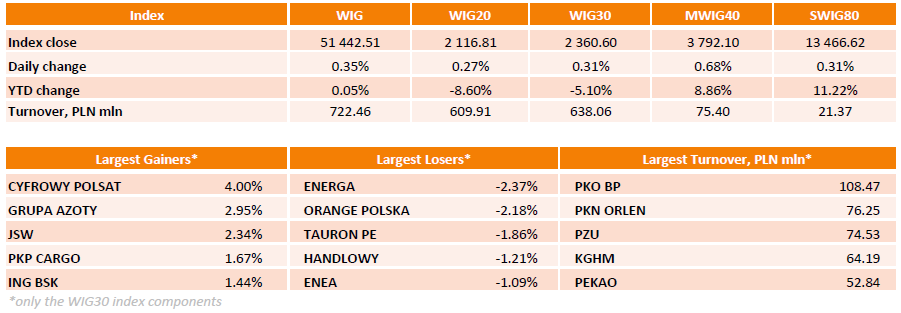

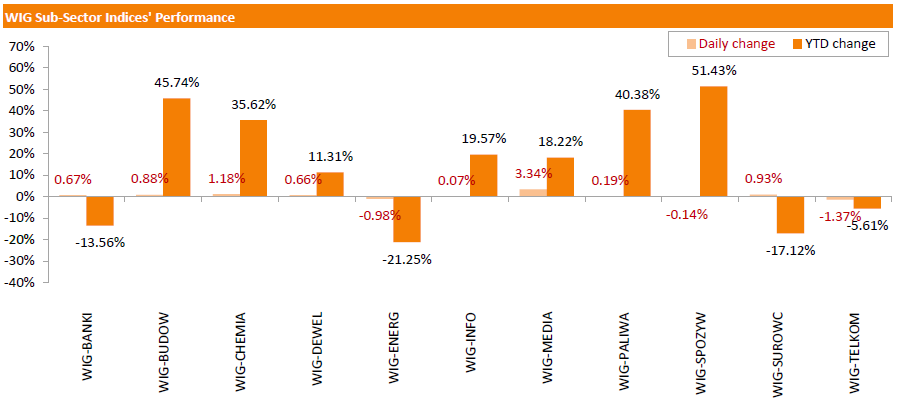

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.35%. Sector-wise, media sector (+3.34%) performed best, while telecommunication sector (-1.37%) and utilities (-0.98%) lagged.

Large-cap stocks added 0.31%, as measured by the WIG30 Index. CYFROWY POLSAT (WSE: CPS) led the way up with a 4% gain, rebounding from the previous session's sharp decline. It was followed by GRUPA AZOTY (WSE: ATT) and JSW (WSE: JSW), advancing 2.95% and 2.34% respectively. On the other side of the ledger, utilities names ENERGA (WSE: ENG), TAURON PE (WSE: TPE) and ENEA (WSE: ENA) were among the weakest performers, recording 1.09%-2.37% declines. Elsewhere, ORANGE POLSKA (WSE: OPL) continued to plunge, losing 2.18% on concerns that the company may cut the dividend due to expenses on the 4G rollout.

-

18:00

European stocks close: stocks closed lower as concerns over the slowdown in the Chinese economy still weighed

Stock indices closed lower as concerns over the slowdown in the Chinese economy still weighed. The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

Meanwhile, the economic data from the Eurozone was negative. The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus fell to a seasonally adjusted €17.7 billion in August from €25.6 billion in July. July's figure was revised up from a surplus of €22.6 billion.

The trade surplus declined to €21.2 billion in August from €28.2 billion in July.

The surplus on services rose to €4.3 billion in August from €3.8 billion in July.

The secondary income deficit increased by €11.6 billion in August, while the primary income surplus decreased by €3.8 billion.

Eurozone's unadjusted current account surplus dropped to €13.7 billion in August from EUR 37.9 billion in July. July's figure was revised up from a surplus of €33.8 billion.

Destatis released its producer price index (PPI) for Germany on Tuesday. German PPI producer prices declined 0.4% in September, missing expectations for a 0.1% fall, after a 0.5% drop in August.

On a yearly basis, German PPI dropped 2.1% in September, missing expectations for a 1.8% decrease, after a 1.7% fall in August.

PPI excluding energy sector fell by 0.6% year-on-year in September.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,345.13 -7.20 -0.11 %

DAX 10,147.68 -16.63 -0.16 %

CAC 40 4,673.81 -30.26 -0.64 %

-

17:02

New York Fed President William Dudley: the Treasury markets is a key for the implementation of monetary policy

New York Fed President William Dudley said on Tuesday that the Treasury markets is a key for the implementation of monetary policy.

"The Treasury market plays a unique and crucial role in our economy, and in global financial markets more broadly. Treasury securities serve as a liquid investment and hedging vehicle for global investors, a ready source of collateral for many financial transactions and serve as a risk-free benchmark for other financial instruments. The Treasury market is important for the Federal Reserve's implementation of monetary policy," he said.

-

15:34

U.S. Stocks open: Dow -0.24%, Nasdaq -0.11%, S&P -0.15%

-

15:28

Before the bell: S&P futures -0.14%, NASDAQ futures -0.07%

U.S. stock-index futures fluctuated amid corporate earnings.

Global Stocks:

Nikkei 18,207.15 +75.92 +0.42%

Hang Seng 22,989.22 -86.39 -0.37%

Shanghai Composite 3,424.33 +37.63 +1.11%

FTSE 6,341.9 -10.43 -0.16%

CAC 4,668.96 -35.11 -0.75%

DAX 10,149.89 -14.42 -0.14%

Crude oil $45.91 (+0.04%)

Gold $1174.40 (+0.14%)

-

15:27

Bank of England's Monetary Policy Committee Member Ian McCafferty: the central bank should start raising its interest rates if it wants to gradually hike its interest rates later

The Bank of England's (BoE) Monetary Policy Committee Member Ian McCafferty said at Bloomberg LP on Tuesday that the central bank should start raising its interest rates if it wants to gradually hike its interest rates later.

"If we on the MPC are to achieve our ambition of raising rates only gradually, so as to minimize the disruption to households and businesses of a normalization of policy after a long period in which interest rates have been at historic lows, we need to avoid getting behind the curve," he said.

McCafferty was only one member who voted to hike interest rate by 0.25% in October.

-

15:16

Construction production in Italy declines 0.3% in August

The Italian statistical office Istat released its construction output data on Friday. Construction production in Italy was down at on a seasonally adjusted rate of 0.3% in August, after a 0.8% rise in July.

On a yearly basis, construction output declined at a calendar-adjusted rate of 4.6% in August, after a flat reading in July.

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume))

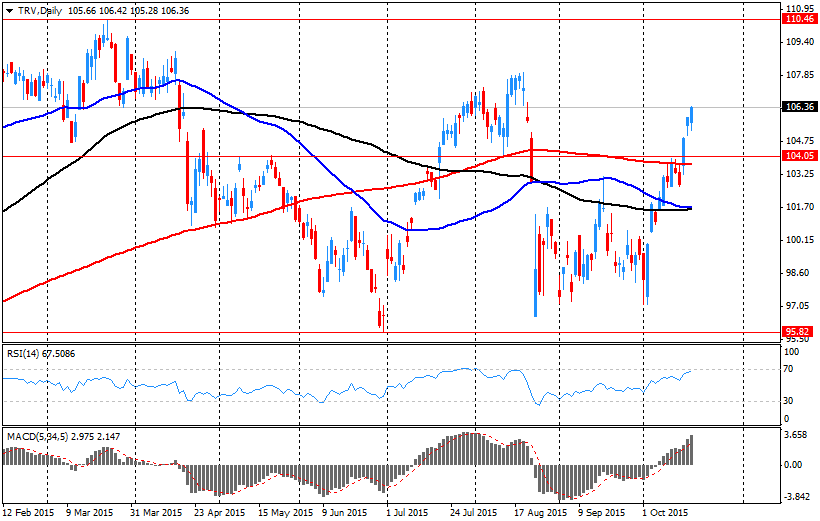

Travelers Companies Inc

TRV

110.07

3.53%

1.2K

United Technologies Corp

UTX

94.41

2.56%

3.1K

Barrick Gold Corporation, NYSE

ABX

7.64

1.06%

16.6K

Verizon Communications Inc

VZ

45.15

1.01%

114.8K

Yandex N.V., NASDAQ

YNDX

13.63

0.74%

1.0K

Pfizer Inc

PFE

34.75

0.72%

10.4K

Twitter, Inc., NYSE

TWTR

31.10

0.61%

19.5K

Facebook, Inc.

FB

99.05

0.59%

190.3K

AT&T Inc

T

33.80

0.51%

1.3K

Apple Inc.

AAPL

112.14

0.37%

123.7K

Walt Disney Co

DIS

109.85

0.35%

10.0K

Amazon.com Inc., NASDAQ

AMZN

574.00

0.15%

2.6K

Yahoo! Inc., NASDAQ

YHOO

33.55

0.15%

1.7K

Procter & Gamble Co

PG

75.24

0.11%

0.5K

Nike

NKE

133.25

0.03%

2.0K

Home Depot Inc

HD

123.13

0.02%

0.5K

The Coca-Cola Co

KO

42.00

0.02%

0.8K

Visa

V

76.99

0.00%

0.2K

Citigroup Inc., NYSE

C

52.85

-0.02%

6.5K

JPMorgan Chase and Co

JPM

62.20

-0.03%

1.2K

Microsoft Corp

MSFT

47.60

-0.04%

4.3K

Google Inc.

GOOG

665.50

-0.09%

0.5K

Caterpillar Inc

CAT

69.20

-0.10%

0.7K

ALCOA INC.

AA

9.41

-0.11%

4.4K

Starbucks Corporation, NASDAQ

SBUX

60.90

-0.11%

0.7K

McDonald's Corp

MCD

104.36

-0.12%

4.1K

Wal-Mart Stores Inc

WMT

58.75

-0.17%

2.0K

Cisco Systems Inc

CSCO

28.20

-0.18%

0.2K

Exxon Mobil Corp

XOM

80.82

-0.21%

1K

Intel Corp

INTC

33.51

-0.24%

3.2K

Hewlett-Packard Co.

HPQ

28.90

-0.28%

0.2K

General Electric Co

GE

28.90

-0.31%

28.7K

General Motors Company, NYSE

GM

33.11

-0.39%

0.3K

3M Co

MMM

147.40

-0.41%

1K

ALTRIA GROUP INC.

MO

59.40

-0.44%

0.2K

Tesla Motors, Inc., NASDAQ

TSLA

227.07

-0.45%

3.1K

Ford Motor Co.

F

15.29

-0.46%

0.5K

Chevron Corp

CVX

89.60

-0.48%

9.8K

Johnson & Johnson

JNJ

97.31

-0.64%

0.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.95

-0.67%

37.5K

International Business Machines Co...

IBM

142.00

-4.84%

140.2K

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Pfizer (PFE) upgraded to Outperform from Market Perform at Cowen

Downgrades:

Other:

IBM (IBM) reiterated at Sector Perform at RBC Capital Mkts; target lowered to $150 from $155

Facebook (FB) target raised to $130 from $120 at Jefferies

Honeywell (HON) target raised to $118 from $115 at Argus

Walt Disney Company (DIS) initiated with a Hold at Pivotal Research

-

14:48

Housing starts in the U.S. climb 6.5% in September

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. climbed 6.5% to 1.206 million annualized rate in September from a 1,132 million pace in August, exceeding expectations for an increase to 1.150 million.

August's figure was revised up from 1.126 million units.

The increase was driven by rises in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. declined 5.0% to 1.103 million annualized rate in September from a 1.161 million pace in August.

Analysts had expected building permits to climb to 1.164 million units.

Starts of single-family homes increased 0.3% in September. Building permits for single-family homes were down 0.3%.

Starts of multifamily buildings jumped 18.3% in September. Permits for multi-family housing slid 12.1%.

-

14:37

Canada’s wholesale sales decrease 0.1% in August

Statistics Canada released wholesale sales figures on Tuesday. Wholesale sales fell 0.1% in August, missing expectations for a 0.2% gain, after a 0.1% decline in July. July's figure was revised down from a flat reading.

Sales of automobiles and parts were down 1.2% in August.

Sales in the machinery, equipment and supplies subsector declined 2.4% in August, while sales in the food, beverage and tobacco subsector decreased 0.4%.

Inventories climbed by 0.6% in August.

-

14:32

Greek industrial turnover slides 18.3% in August

The Hellenic Statistical Authority released its industrial turnover data for Greece on Tuesday. Greek overall turnover index slid 18.3% year-on-year in August, after 15.4% drop in July.

Domestic market turnover fell at an annual rate of 18.2% in August, while foreign market turnover plunged by 18.5%.

Turnover in the manufacturing sector declined at an annual rate of 18.4% in August, while mining and quarrying turnover dropped by 12.8%.

-

14:26

Italy’s current account surplus falls to €1.39 billion in August

The Bank of Italy released its current account data on Tuesday. Italy's current account surplus declined to €1.39 billion in August from €1.53 billion in August last year.

The goods trade surplus decreased to €2.53 billion in August from €2.67 billion in August last year. The services trade balance turned to a surplus of €194 million from a deficit of €3.00 million.

The capital account surplus turned to a deficit of €59 million in August from a surplus of €157 million last year, while the financial account surplus rose to €4.42 billion from €4.09 billion.

-

14:25

-

14:20

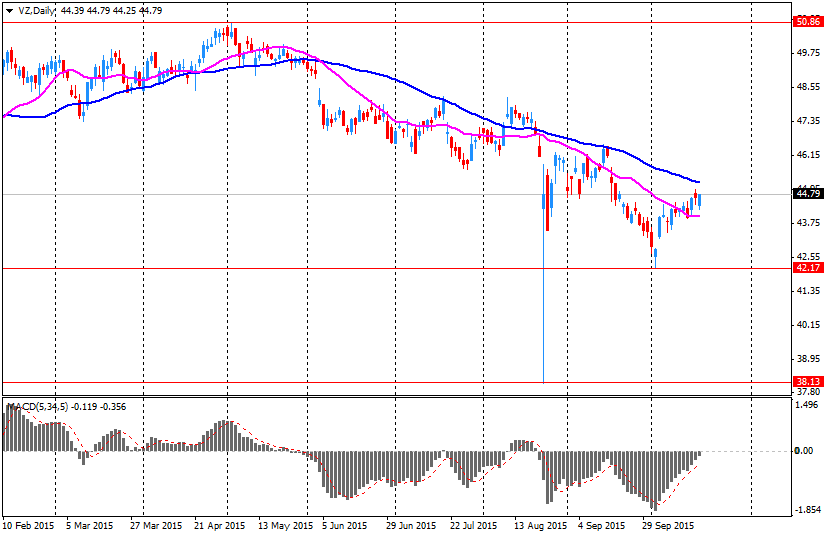

Company News: Verizon (VZ) Q3 results generally in line with consensus

Verizon reported Q3 earnings of $1.04 per share (+16.9% y/y), slightly beating analysts' consensus of $1.02.

The company's revenues amounted to $33.158 bln (+5% y/y), generally in-line with consensus estimate of $32.970 bln.

Verizon reaffirmed expectation for consolidated revenue growth of at least 3% for FY2015, in-line with expectations.

VZ rose to $45.50 (+1.79%) in pre-market trading.

-

14:08

-

11:59

European stock markets mid session: stocks traded lower on a fall in commodity shares

Stock indices traded lower on a fall in commodity shares. Commodity shares declined on concerns over the slowdown in the Chinese economy. The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

Meanwhile, the economic data from the Eurozone was negative. The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus fell to a seasonally adjusted €17.7 billion in August from €25.6 billion in July. July's figure was revised up from a surplus of €22.6 billion.

The trade surplus declined to €21.2 billion in August from €28.2 billion in July.

The surplus on services rose to €4.3 billion in August from €3.8 billion in July.

The secondary income deficit increased by €11.6 billion in August, while the primary income surplus decreased by €3.8 billion.

Eurozone's unadjusted current account surplus dropped to €13.7 billion in August from EUR 37.9 billion in July. July's figure was revised up from a surplus of €33.8 billion.

Destatis released its producer price index (PPI) for Germany on Tuesday. German PPI producer prices declined 0.4% in September, missing expectations for a 0.1% fall, after a 0.5% drop in August.

On a yearly basis, German PPI dropped 2.1% in September, missing expectations for a 1.8% decrease, after a 1.7% fall in August.

PPI excluding energy sector fell by 0.6% year-on-year in September.

Current figures:

Name Price Change Change %

FTSE 100 6,325.94 -26.39 -0.42 %

DAX 10,105.61 -58.70 -0.58 %

CAC 40 4,665.08 -38.99 -0.83 %

-

11:44

San Francisco Fed President John Williams: the timing of the interest rate hike by the Fed is nearing

San Francisco Fed President John Williams said in an interview with Bloomberg Television on Monday that the timing of the interest rate hike by the Fed is nearing.

"I do see the time to start raising rates in the near future, from my perspective," he said.

Williams noted that the U.S. economy continues to strengthen.

"My own view is that the economy is still on a good trajectory," San Francisco Fed president said.

-

11:22

European Central Bank Governing Council Member Luis Maria Linde: the central bank could adjust its asset-buying programme if needed

The European Central Bank (ECB) Governing Council Member Luis Maria Linde said on Tuesday that the central bank could adjust its asset-buying programme if needed.

The ECB could extend the asset-buying programme's size or modify its composition, he said.

Linde noted that the inflation in the Eurozone is well below the ECB's 2% target, and it is a cause for concern.

-

11:12

Swiss trade surplus rises to CHF3.05 billion in September

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus rose to CHF3.05 billion in September from CHF2.86 billion in the previous month. August's figure was revised down from a surplus of CHF2.87 billion.

Exports dropped 2.9% year-on-year in September, while imports were down 3.8% year-on-year.

The Swiss trade surplus climbed to CHF9.42 billion in the third quarter from CHF9.37 billion in the second quarter.

Exports slid 5.1% in the third quarter, while imports fell 2.5%.

-

11:01

German producer prices drop 0.4% in September

Destatis released its producer price index (PPI) for Germany on Tuesday. German PPI producer prices declined 0.4% in September, missing expectations for a 0.1% fall, after a 0.5% drop in August.

On a yearly basis, German PPI dropped 2.1% in September, missing expectations for a 1.8% decrease, after a 1.7% fall in August.

PPI excluding energy sector fell by 0.6% year-on-year in September.

Energy prices were down 6.1% year-on-year in September.

Consumer non-durable goods prices fell 1.0% year-on-year in September, intermediate goods sector prices decreased by 1.4%, while capital goods prices increased 0.7% and durable consumer goods sector prices rose 1.3%.

-

10:42

Eurozone’s current account surplus falls to a seasonally adjusted €17.7 billion in August

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus fell to a seasonally adjusted €17.7 billion in August from €25.6 billion in July. July's figure was revised up from a surplus of €22.6 billion.

The trade surplus declined to €21.2 billion in August from €28.2 billion in July.

The surplus on services rose to €4.3 billion in August from €3.8 billion in July.

The secondary income deficit increased by €11.6 billion in August, while the primary income surplus decreased by €3.8 billion.

Eurozone's unadjusted current account surplus dropped to €13.7 billion in August from EUR 37.9 billion in July. July's figure was revised up from a surplus of €33.8 billion.

-

10:11

October’s Reserve Bank of Australia monetary policy meeting: the GDP growth in the June quarter was weak, but in line with expectations

The Reserve Bank of Australia (RBA) released its minutes from October monetary policy meeting on Tuesday. The RBA said that the accommodative monetary policy was appropriate, adding that the monetary policy decision will depend on the incoming economic data, both domestically and abroad.

The central bank noted that the GDP growth in the June quarter was weak, in line with expectations. Weak resource exports and a decline in mining investment weighed on the GDP growth.

According to the minutes, board members noted that the interest rate cut this year "continued to provide support to demand, particularly dwelling investment and household consumption".

Members also said that the labour market strengthened in the recent months, but "spare capacity remained in the economy".

Risks to financial stability and stability of the economy in Australia revolved around local property markets.

The RBA kept unchanged its interest rate at 2.00% in October.

-

08:13

Global Stocks: U.S. indices posted slight gains

U.S. stock indices gained only slightly on Monday. Energy stocks were the biggest negative contributors.

Morgan Stanley raised concerns over quarterly earnings of U.S. companies after it reported a profit of $1.02 billion, or 48 cents a share compared with the $1.69 billion, or 83 cents a share a year ago.

This week 117 companies of the S&P 500 will publish their reports. A median forecast suggests a 6.7% decline in profits in the third quarter. Energy and commodity companies are likely to report the weakest results.

The Dow Jones Industrial Average climbed 14.57 points, or less than 0.1%, to 17,230.54. The S&P 500 advanced by less than a point to 2,033.66 (its energy sector fell by 1.9%). The Nasdaq Composite Index climbed 18.78, or 0.4%, to 4,905.47.

This morning in Asia Hong Kong Hang Seng declined 0.48%, or 110.63, to 22,964.98. China Shanghai Composite Index lost 0.09%, or 2.96, to 3.383.75. The Nikkei rose 0.44%, or 79.17, to 18,210.40.

Asian indices posted mixed results.

Japanese stocks advanced amid a weaker yen, which is favorable for exporters. Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group gained more than 1% each.

-

04:34

Nikkei 225 18,149.33 +18.10 +0.10 %, Hang Seng 22,918.71 -156.90 -0.68 %, Shanghai Composite 3,370.81 -15.89 -0.47 %

-

00:35

Stocks. Daily history for Sep Oct 19’2015:

(index / closing price / change items /% change)

Nikkei 225 18,131.23 -160.57 -0.88 %

Hang Seng 23,075.61 +8.24 +0.04 %

S&P/ASX 200 5,269.71 +1.50 +0.03 %

Shanghai Composite 3,387.46 -3.89 -0.11 %

FTSE 100 6,352.33 -25.71 -0.40 %

CAC 40 4,704.07 +1.28 +0.03 %

Xetra DAX 10,164.31 +59.88 +0.59 %

S&P 500 2,033.66 +0.55 +0.03 %

NASDAQ Composite 4,905.47 +18.78 +0.38 %

Dow Jones 17,230.54 +14.57 +0.08 %

-