Noticias del mercado

-

18:00

European stocks closed: FTSE 100 6,348.42 +3.29 +0.05% CAC 40 4,695.1 +21.29 +0.46% DAX 10,238.1 +90.42 +0.89%

-

17:01

Eurozone’s revised government deficit to GDP ratio in 2014 is 2.6%

Eurostat released its revised government deficit data for 2014 on Wednesday. Eurozone's government deficit to GDP ratio fell to 2.6% (preliminary reading: 2.4%) in 2014 from 3.0% in 2013. The government debt to GDP ratio rose to 92.1% in 2014 (preliminary reading: 91.9%) from 91.1% in 2013.

Only Germany (+0.3%), Estonia (+0.7%) and Luxembourg (+1.4%) registered a government surplus in the Eurozone in 2014.

The lowest ratios of government debt to GDP in the Eurozone in 2014 were registered in Estonia (10.4%) and Luxembourg (23.0%)

-

16:42

Largest U.K. banks will undergo more stringent “stress tests”

Largest U.K. banks will undergo more stringent "stress tests", the Bank of England (BoE) said in a statement on Wednesday. Smaller U.K. banks and British units of foreign investment banks are not affected by this central bank's decision.

"The United Kingdom needs banks than can weather shocks without cutting lending to the real economy," the BoE Governor Mark Carney said.

"The Bank of England is taking steps to ensure we can assess a range of future risks from a number of different sources to inform our micro- and macro-prudential policy decisions," he added.

-

16:30

U.S.: Crude Oil Inventories, October 8.028 (forecast 3.65)

-

16:29

Bank of Canada keeps its interest rate unchanged at 0.50%, but cuts its growth forecasts

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy is appropriate. This decision was expected by analysts.

The BoC said that inflation in Canada was driven by lower consumer energy prices.

The central bank noted that the Canadian economy rebounded, supported by household spending.

The BoC lowers its growth forecasts for 2016 and 2017 as lower prices for oil and other commodities weigh on the Canadian economy. The real GDP growth is expected to be 2% in 2016, down from the previous estimate of 2.3%, and 2.5% in 2017, down from the previous estimate of 2.6%.

"The Canadian economy can be expected to return to full capacity, and inflation sustainably to target, around mid-2017," the BoC said in its statement.

Risks to the country's financial stability are evolving as expected, and risks around the inflation are roughly balanced, the central bank said.

-

16:05

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:47

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1300 (EUR 653m) 1.1325 (1.5bln) 1.1400 (678m) 1.1475 (2bln)

GBP/USD 1.5300 (GBP 255m) 1.5375 (155m)

USD/CAD1.3000 (USD 380m) 1.3025 (200m)

AUD/USD 0.7145 (AUD 548m) 0.7200 (314m) 0.7260 (300m) 0.7350 (300m)

EUR/JPY 136.00 (EUR 220m)

NZD/USD 0.7000 (NAD 250m)

-

14:44

China’s central bank issues the first yuan bonds outside China

The People's Bank of China (PBoC) has issued its first yuan bonds in London, the first yuan bonds outside China. The central bank hopes to get 5 billion yuan ($787 million). The rate is 3.1% and mature in 2016.

-

14:32

China’s central bank supplies 105.5 billion yuan to 11 commercial lenders

The People's Bank of China (PBoC) said on Wednesday that it supplied 105.5 billion yuan ($16.6 billion) to 11 commercial lenders via the Medium-term Lending Facility. The rate was 3.35%.

The central bank's action aims to keep interbank rates low and to boost the country's economic growth.

-

14:13

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of U.K. public sector net borrowing data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m August -0.1% Revised From 0.2% -0.2%

08:30 United Kingdom PSNB, bln September 10.8 Revised From 10.9 9.4 8.63

11:00 U.S. MBA Mortgage Applications October -27.6% 11.8%

The U.S. dollar traded mixed against the most major currencies in the absence of any major U.S. economic reports.

The euro traded mixedagainst the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded higher against the U.S. dollar after the release of U.K. public sector net borrowing data. The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Bank of Canada's interest rate decision. Analysts expect the central bank to keep its monetary policy unchanged.

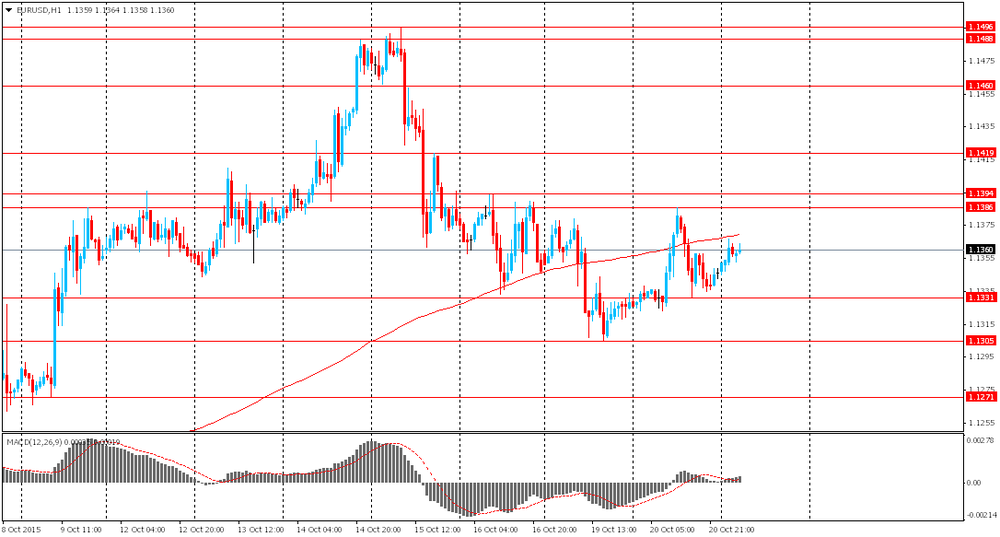

EUR/USD: the currency pair traded mixed

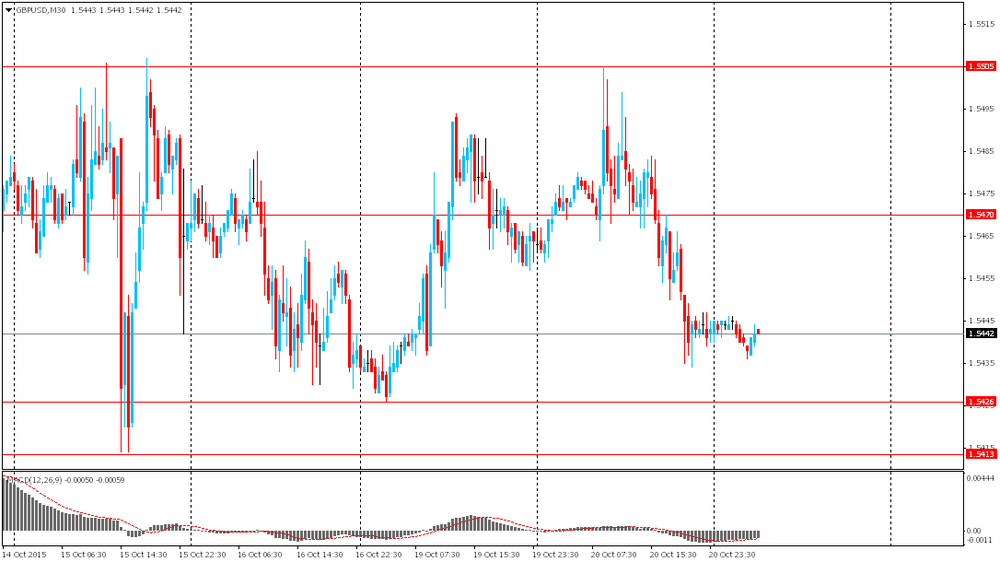

GBP/USD: the currency pair rose to $1.5460

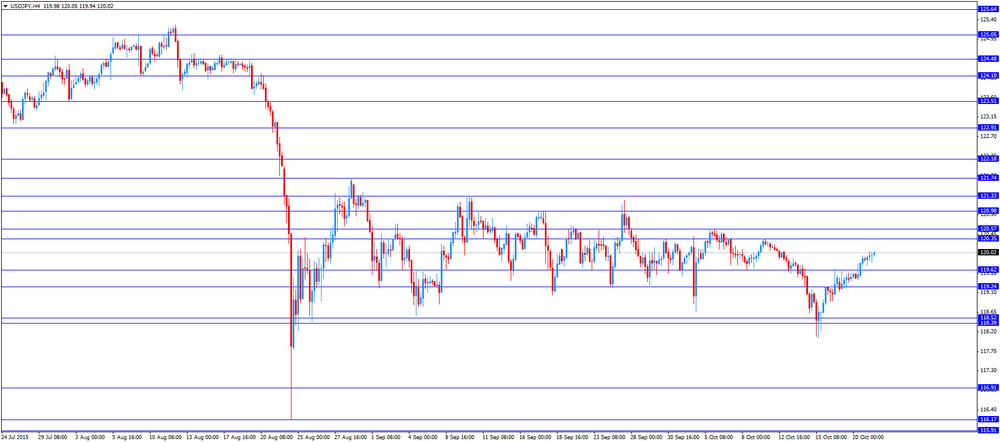

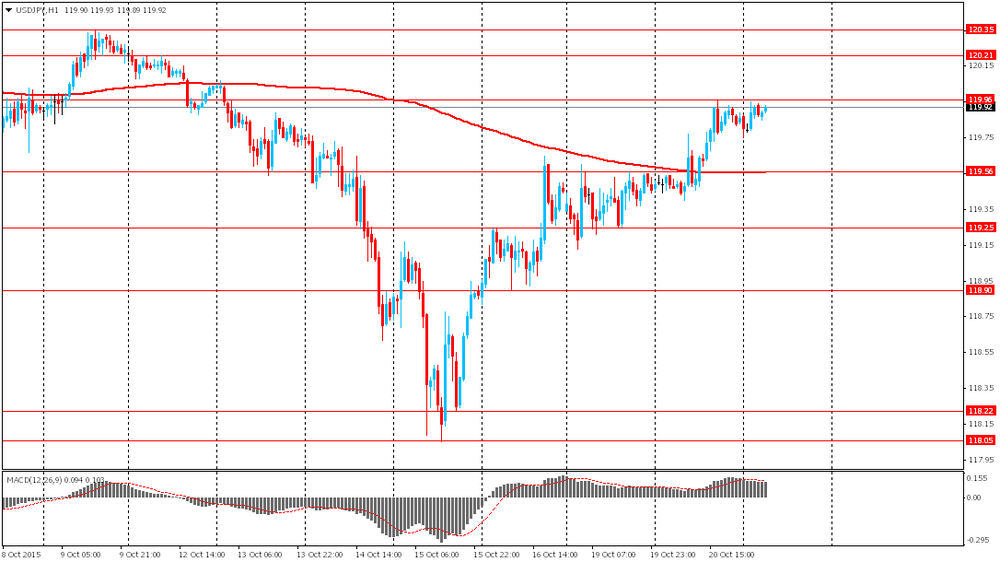

USD/JPY: the currency pair increased to Y120.05

The most important news that are expected (GMT0):

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Monetary Policy Report

15:15 Canada BOC Press Conference

17:30 U.S. FOMC Member Jerome Powell Speaks

22:45 Australia RBA Assist Gov Edey Speaks

-

13:50

Orders

EUR/USD

Offers 1.1380-85 1.1400 1.1425-30 1.1455-60 1.1485 1.1500

Bids 1.1350 1.1325-30 1.1300 1.1285 1.1265 1.1250 1.1230 1.1200

GBP/USD

Offers 1.5450 1.5480 1.5500-10 1.5525-30 1.5550 1.5565 1.5585 1.5600 1.5620

Bids 1.5415-20 1.5400 1.5380 1.5350 1.5330 1.5300 1.5285 1.5265 1.5250

EUR/GBP

Offers 0.7375-80 0.7400 0.7425-30 0.7450 0.7475-80 0.7500

Bids 0.7350 0.7330-35 0.7300 0.7285 0.7265 0.7250 0.7230 0.7200

EUR/JPY

Offers 136.50 136.75 137.00 137.25 137.50 137.75-80 138.00

Bids 136.00 135.80 135.50 135.25-30 135.00 134.80 134.50 134.30 134.00

USD/JPY

Offers 120.00 120.20 120.35 120.50 120.80 121.00

Bids 119.65 119.50 119.25-30 119.00 118.85 118.65-70 118.50 118.30 118.00

AUD/USD

Offers 0.7235 0.7250-55 0.7275 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400

Bids 0.7200 0.7185 0.7150 0.7125-30 0.7100

-

13:00

U.S.: MBA Mortgage Applications, October 11.8%

-

11:39

M3 money supply in Switzerland rises 1.2% in September

The Swiss National Bank (SNB) released its money supply data on Wednesday. M3 money supply in Switzerland increased 1.2% year-on-year in September, after a 1.4% rise in August.

M1 money supply was up 0.7% year-on-year in September, after a 0.5% increase in August.

-

11:30

Greece’s current account surplus falls to €2.09 billion in August

The Bank of Greece released its current account data on Wednesday. Greece's current account surplus fell to €2.09 billion in August from €1.86 billion in August last year.

The Greek deficit on trade in goods declined by €268 million year-on-year in August, while the services surplus declined by €142 million.

The deficit on primary income decreased to €140.5 million in August from €249.8 million last year, while the deficit on secondary income climbed to €71.4 million from €69.1 million last year.

The capital account surplus remained almost unchanged in August.

-

11:19

Public sector net borrowing in the U.K. declines to £8.63 billion in September

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

-

11:01

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1300 (EUR 653m) 1.1325 (1.5bln) 1.1400 (678m) 1.1475 (2bln)

GBP/USD 1.5300 (GBP 255m) 1.5375 (155m)

USD/CAD1.3000 (USD 380m) 1.3025 (200m)

AUD/USD 0.7145 (AUD 548m) 0.7200 (314m) 0.7260 (300m) 0.7350 (300m)

EUR/JPY 136.00 (EUR 220m)

NZD/USD 0.7000 (NAD 250m)

-

10:54

Less than €20 million will be needed for recapitalisation of four main Greek banks

Reuters reported on Tuesday two senior bankers with knowledge of the matter said that less than €20 million will be needed for recapitalisation of four main Greek banks.

"The capital shortfall for the four systemic banks should be less than 20 billion euros," one senior banker said.

The European Central Bank declined to comment.

-

10:30

United Kingdom: PSNB, bln, September -8.63 (forecast -9.4)

-

10:20

Japan's trade deficit narrows to ¥114.5 billion in September

The Ministry of Finance released its trade data for Japan on the late Tuesday evening. Japan's trade deficit narrowed to ¥114.5 billion in September from a deficit of ¥569.6 billion in August. Analysts had expected a surplus of ¥84.0 billion.

The adjusted trade deficit was ¥355.7 billion in September, down from a deficit of ¥373.5 billion in August. August's figure was revised down from a deficit of ¥358.8 billion.

Exports rose 0.6% year-on-year in September, while imports dropped 11.1% year-on-year.

Exports to Asia decreased by 0.9% year-on-year, exports to the United States increased by 10.4%, exports to China dropped by 3.5%, while exports to the European Union were up 5.1%.

Imports from Asia fell 1.0% year-on-year, imports from the United States declined 0.1%, and imports from China gained 0.9%, while imports from the European Union slid 3.5%.

-

10:10

Australian leading economic index rises 0.2% in May

The Conference Board (CB) released its leading economic index for Australia on late Tuesday evening. The leading economic index decreased 0.4% in August, after a 0.3% rise in July.

The decrease was driven by a drop in building approvals, money supply, share prices and the sales to inventories ratio.

The coincident index was up 0.2% in August, after a 0.2% gain in July.

The rise was driven by employment, household disposable income and industrial production.

-

08:27

Foreign exchange market. Asian session: the euro advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan All Industry Activity Index, m/m August 0.2% -0.2%

The euro rose against the U.S. dollar amid data on loans in the single currency area. Data showed that banks made more efforts lending to companies using cheap liquidity available due to ECB's asset purchase program. These data suggest that the QE program stimulates economic growth and further monetary policy easing might not be necessary.

The yen slightly declined amid Japanese September international trade data. Exports rose by 0.6% vs 3.4% expected. Exports to China fell by 3.5% after a 4.6% decline in August. Imports fell by 11.1%. Declines in exports might intensify expectations for a monetary policy easing when Bank of Japan Board members meet on October 30.

The New Zealand dollar continued declining amid weaker-than-expected results of the GlobalDairyTrade auction. Global dairy prices declined by 3.1% after rising for four straight auctions before.

EUR/USD: the pair rose to $1.1365 in Asian trade

USD/JPY: the pair rose to Y120.00

GBP/USD: the pair traded within $1.5435-45

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom PSNB, bln September -11.31 -9.4

11:00 U.S. MBA Mortgage Applications October -27.6%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories October 7.562 3.65

15:15 Canada BOC Press Conference

17:30 U.S. FOMC Member Jerome Powell Speaks

22:45 Australia RBA Assist Gov Edey Speaks

-

08:24

Options levels on wednesday, October 21, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1475 (2439)

$1.1425 (1098)

$1.1392 (1048)

Price at time of writing this review: $1.1348

Support levels (open interest**, contracts):

$1.1290 (933)

$1.1248 (2835)

$1.1189 (2542)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 37192 contracts, with the maximum number of contracts with strike price $1,1500 (3374);

- Overall open interest on the PUT options with the expiration date November, 6 is 46974 contracts, with the maximum number of contracts with strike price $1,1000 (4814);

- The ratio of PUT/CALL was 1.26 versus 1.25 from the previous trading day according to data from October, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5702 (918)

$1.5604 (1256)

$1.5507 (2170)

Price at time of writing this review: $1.5423

Support levels (open interest**, contracts):

$1.5392 (549)

$1.5295 (2841)

$1.5198 (2880)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20776 contracts, with the maximum number of contracts with strike price $1,5350 (2600);

- Overall open interest on the PUT options with the expiration date November, 6 is 20918 contracts, with the maximum number of contracts with strike price $1,5200 (2880);

- The ratio of PUT/CALL was 1.00 versus 1.02 from the previous trading day according to data from October, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:16

Japan: All Industry Activity Index, m/m, August -0.2%

-

01:50

Japan: Trade Balance Total, bln, September 114.5 (forecast 84.4)

-

00:30

Currencies. Daily history for Oct 20’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,1346 +0,16%

GBP/USD $1,5443 -0,14%

USD/CHF Chf0,956 -0,02%

USD/JPY Y119,86 +0,33%

EUR/JPY Y135,99 +0,49%

GBP/JPY Y185,09 +0,20%

AUD/USD $0,7260 +0,25%

NZD/USD $0,6747 -0,65%

USD/CAD C$1,2984 -0,22%

-

00:03

Schedule for today, Wednesday, Oct 21’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m August 0.2%

08:30 United Kingdom PSNB, bln September -11.31 -9.4

11:00 U.S. MBA Mortgage Applications October -27.6%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories October 7.562

15:15 Canada BOC Press Conference

17:30 U.S. FOMC Member Jerome Powell Speaks

22:45 Australia RBA Assist Gov Edey Speaks

-