Noticias del mercado

-

21:01

Dow +0.21% 17,253.65 +36.54 Nasdaq -0.29% 4,866.61 -14.36 S&P -0.11% 2,028.50 -2.27

-

18:00

European stocks close: stocks closed higher in the absence of any major economic reports from the Eurozone

Stock indices closed higher in the absence of any major economic reports from the Eurozone. Market participants are awaiting the European Central Bank's (ECB) monetary meeting tomorrow. A speech by the ECB President Mario Draghi will be closely monitored for signals of further quantitative easing. The inflation in the Eurozone remains at low levels, and several ECB officials expressed concerns over the low inflation.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,348.42 +3.29 +0.05 %

DAX 10,238.1 +90.42 +0.89 %

CAC 40 4,695.1 +21.29 +0.46 %

-

18:00

European stocks closed: FTSE 100 6,348.42 +3.29 +0.05% CAC 40 4,695.1 +21.29 +0.46% DAX 10,238.1 +90.42 +0.89%

-

17:53

WSE: Session Results

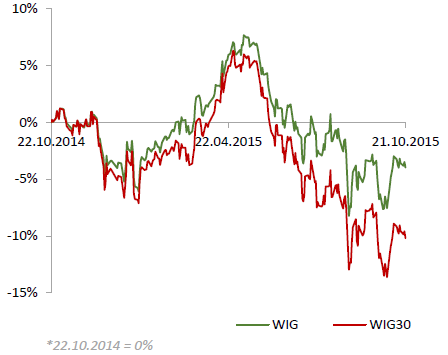

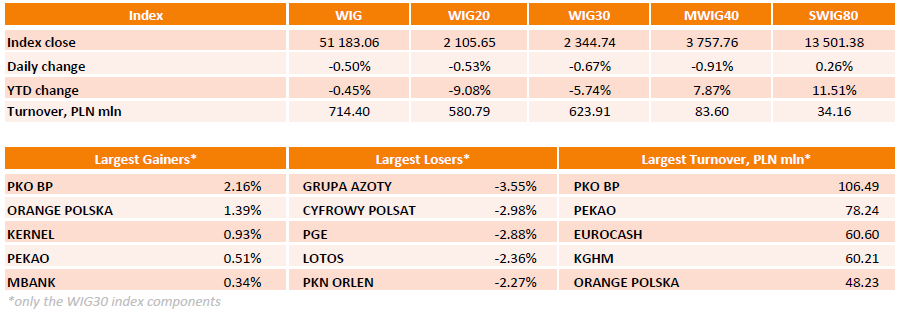

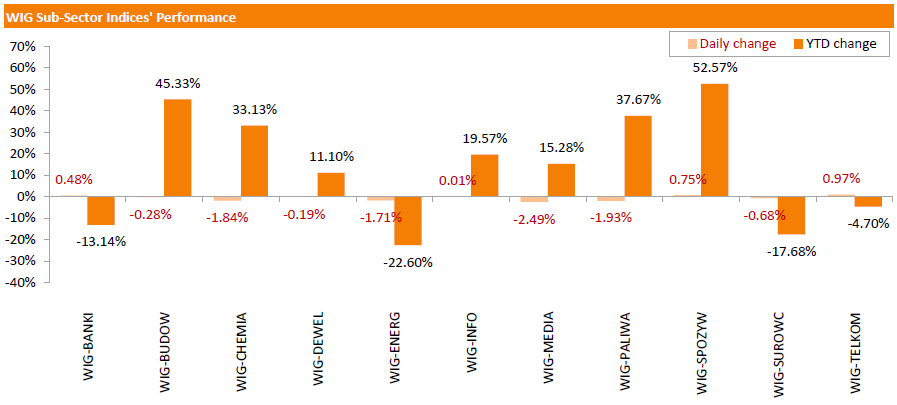

Polish equity market fell on Wednesday. The broad market benchmark, the WIG Index, lost 0.50%. Sector- wise, media sector (-2.49%) and oil and gas sector (-1.93%) lagged, while, telecommunication sector (+0.97%) performed best.

The large-cap stocks plunged by 0.67%, as measured by the WIG30 Index. Within the index components, GRUPA AZOTY (WSE: ATT) and CYFROWY POLSAT (WSE: CPS) fared the worst, plunging by 3.55% and 2.98% respectively. PGE (WSE: PGE) declined by 2.88%, depressed by news that the company would buy loss making Makoszowy coal mine. Other major laggards included LOTOS (WSE: LTS), PKN ORLEN (WSE: PKN) and PKP CARGO (WSE: PKP), slumping 2.26%-2.36%. On the other side of the ledger, PKO BP (WSE: PKO) led a handful of gainers, adding 2.16% after the bank's CEO maintained expectations for results improvement in H2 versus H1.

-

17:31

Oil prices fall on U.S. crude oil inventories data

Oil prices traded lower on U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 8.03 million barrels to 476.6 million in the week to October 16. It was the fourth consecutive increase. Analysts had expected U.S. crude oil inventories to rise by 3.65 million barrels.

Gasoline inventories decreased by 1.5 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 78,000 barrels.

U.S. crude oil imports climbed by 156,000 barrels per day.

Refineries in the U.S. were running at 86.4% of capacity, up from 86.0% the previous week.

The weak Japanese trade data also weighed on oil prices. The Ministry of Finance released its trade data for Japan on the late Tuesday evening. Japan's trade deficit narrowed to ¥114.5 billion in September from a deficit of ¥569.6 billion in August. Analysts had expected a surplus of ¥84.0 billion. Exports rose 0.6% year-on-year in September, while imports dropped 11.1% year-on-year.

Market participants are awaiting the results of the meeting between the Organisation of the Petroleum Exporting Countries (OPEC) and non-OPEC countries in Vienna today. Oil production cuts could be discussed at this meeting. But it is unlikely that concrete results will be achieved at this meeting.

WTI crude oil for December delivery declined to $45.28 a barrel on the New York Mercantile Exchange.

Brent crude oil for December decreased to $48.28 a barrel on ICE Futures Europe.

-

17:15

Gold price falls as the U.S. dollar strengthens and European stock indices rise

Gold price fell as the U.S. dollar strengthened and European stock indices rose. The uncertainty over the interest rate hike by the Fed this year also weighed on gold price.

Market participants are awaiting the European Central Bank's (ECB) monetary meeting tomorrow. A speech by the ECB President Mario Draghi will be closely monitored for signals of further quantitative easing. The inflation in the Eurozone remains at low levels, and several ECB officials expressed concerns over the low inflation.

December futures for gold on the COMEX today declined to 1165.40 dollars per ounce.

-

17:01

Eurozone’s revised government deficit to GDP ratio in 2014 is 2.6%

Eurostat released its revised government deficit data for 2014 on Wednesday. Eurozone's government deficit to GDP ratio fell to 2.6% (preliminary reading: 2.4%) in 2014 from 3.0% in 2013. The government debt to GDP ratio rose to 92.1% in 2014 (preliminary reading: 91.9%) from 91.1% in 2013.

Only Germany (+0.3%), Estonia (+0.7%) and Luxembourg (+1.4%) registered a government surplus in the Eurozone in 2014.

The lowest ratios of government debt to GDP in the Eurozone in 2014 were registered in Estonia (10.4%) and Luxembourg (23.0%)

-

16:50

U.S. crude inventories climb by 8.03 million barrels to 476.6 million in the week to October 16

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 8.03 million barrels to 476.6 million in the week to October 16. It was the fourth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 3.65 million barrels.

Gasoline inventories decreased by 1.5 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 78,000 barrels.

U.S. crude oil imports climbed by 156,000 barrels per day.

Refineries in the U.S. were running at 86.4% of capacity, up from 86.0% the previous week.

-

16:44

Wall Street. Major U.S. stock-indexes little changed

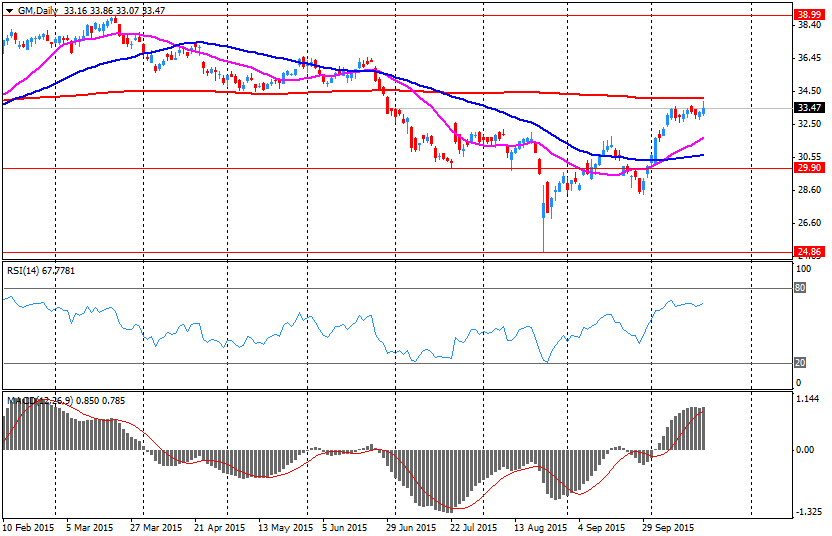

Mjor U.S. stock-indexes little changed on Wednesday as investors evaluate third-quarter results by industry heavyweights Boeing and General Motors. Of the S&P 500 companies that have reported results so far, 40 percent have exceeded revenue estimates. About 60 percent typically beat estimates in a quarter, according to Thomson Reuters data.

Dow stocks mixed (16 in positive area, 14 in negative area). Top looser - UnitedHealth Group Incorporated (UNH, -2.09%). Top gainer - The Travelers Companies, Inc. (TRV, +1.44%).

Most of S&P index sectors in negative area. Top looser - Healthcare (-1.9%). Top gainer - Utilities (+0,3%).

At the moment:

Dow 17128.00 +21.00 +0.12%

S&P 500 2020.50 0.00 0.00%

Nasdaq 100 4424.75 0.00 0.00%

10 Year yield 2,07% +0,04

Oil 45.05 -1.24 -2.68%

Gold 1164.70 -12.80 -1.09%

-

16:42

Largest U.K. banks will undergo more stringent “stress tests”

Largest U.K. banks will undergo more stringent "stress tests", the Bank of England (BoE) said in a statement on Wednesday. Smaller U.K. banks and British units of foreign investment banks are not affected by this central bank's decision.

"The United Kingdom needs banks than can weather shocks without cutting lending to the real economy," the BoE Governor Mark Carney said.

"The Bank of England is taking steps to ensure we can assess a range of future risks from a number of different sources to inform our micro- and macro-prudential policy decisions," he added.

-

16:30

U.S.: Crude Oil Inventories, October 8.028 (forecast 3.65)

-

16:29

Bank of Canada keeps its interest rate unchanged at 0.50%, but cuts its growth forecasts

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy is appropriate. This decision was expected by analysts.

The BoC said that inflation in Canada was driven by lower consumer energy prices.

The central bank noted that the Canadian economy rebounded, supported by household spending.

The BoC lowers its growth forecasts for 2016 and 2017 as lower prices for oil and other commodities weigh on the Canadian economy. The real GDP growth is expected to be 2% in 2016, down from the previous estimate of 2.3%, and 2.5% in 2017, down from the previous estimate of 2.6%.

"The Canadian economy can be expected to return to full capacity, and inflation sustainably to target, around mid-2017," the BoC said in its statement.

Risks to the country's financial stability are evolving as expected, and risks around the inflation are roughly balanced, the central bank said.

-

16:05

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:47

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1300 (EUR 653m) 1.1325 (1.5bln) 1.1400 (678m) 1.1475 (2bln)

GBP/USD 1.5300 (GBP 255m) 1.5375 (155m)

USD/CAD1.3000 (USD 380m) 1.3025 (200m)

AUD/USD 0.7145 (AUD 548m) 0.7200 (314m) 0.7260 (300m) 0.7350 (300m)

EUR/JPY 136.00 (EUR 220m)

NZD/USD 0.7000 (NAD 250m)

-

15:37

U.S. Stocks open: Dow +0.29%, Nasdaq +0.35%, S&P +0.27%

-

15:24

Before the bell: S&P futures +0.45%, NASDAQ futures +0.56%

U.S. stock-index futures advanced amid corporate earnings.

Global Stocks:

Nikkei 18,554.28 +347.13 +1.91%

Shanghai Composite 3,306.52 -118.81 -3.47%

FTSE 6,371.31 +26.18 +0.41%

CAC 4,705.74 +31.93 +0.68%

DAX 10,255.16 +107.48 +1.06%

Crude oil $45.45 (-1.81%)

Gold $1175.90 (-0.11%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

General Motors Company, NYSE

GM

34.93

4.33%

211.3K

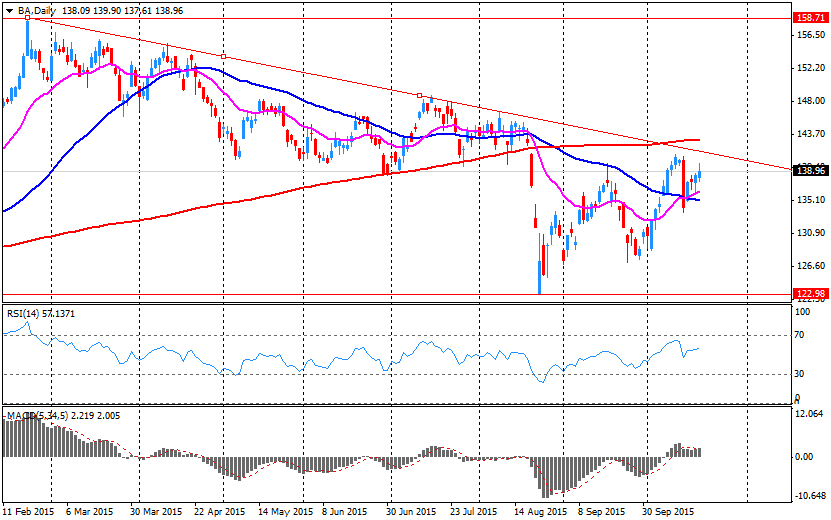

Boeing Co

BA

142.00

2.25%

29.3K

Ford Motor Co.

F

15.65

1.76%

88.0K

E. I. du Pont de Nemours and Co

DD

57.78

1.03%

37.3K

Merck & Co Inc

MRK

50.81

0.83%

0.1K

Facebook, Inc.

FB

97.64

0.66%

48.6K

Walt Disney Co

DIS

110.50

0.60%

0.4K

Visa

V

76.73

0.59%

1.0K

Google Inc.

GOOG

653.99

0.57%

0.1K

Amazon.com Inc., NASDAQ

AMZN

563.51

0.47%

3.0K

JPMorgan Chase and Co

JPM

62.80

0.45%

4.9K

Intel Corp

INTC

33.57

0.39%

3.5K

Microsoft Corp

MSFT

47.92

0.31%

15.3K

Citigroup Inc., NYSE

C

53.00

0.30%

12.7K

Procter & Gamble Co

PG

73.97

0.28%

0.9K

Wal-Mart Stores Inc

WMT

58.90

0.26%

0.6K

General Electric Co

GE

28.84

0.21%

3.0K

Home Depot Inc

HD

123.01

0.13%

0.3K

Nike

NKE

132.53

0.12%

1.0K

Starbucks Corporation, NASDAQ

SBUX

60.90

0.03%

0.5K

Chevron Corp

CVX

90.00

0.01%

7.6K

Caterpillar Inc

CAT

70.24

-0.04%

1.7K

Johnson & Johnson

JNJ

97.55

-0.04%

0.4K

Apple Inc.

AAPL

113.70

-0.06%

86.1K

Cisco Systems Inc

CSCO

28.48

-0.07%

3.2K

Verizon Communications Inc

VZ

45.20

-0.09%

0.9K

Exxon Mobil Corp

XOM

80.71

-0.15%

6.3K

American Express Co

AXP

76.80

-0.19%

1K

Hewlett-Packard Co.

HPQ

28.50

-0.21%

0.5K

Barrick Gold Corporation, NYSE

ABX

7.87

-0.25%

0.4K

Deere & Company, NYSE

DE

76.09

-0.39%

0.2K

ALCOA INC.

AA

9.36

-0.53%

32.3K

International Business Machines Co...

IBM

139.70

-0.67%

16.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.15

-0.74%

22.4K

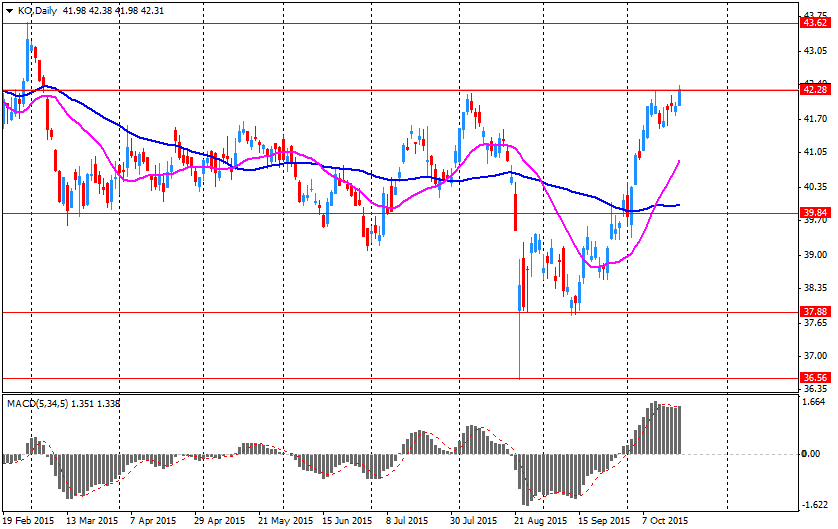

The Coca-Cola Co

KO

41.93

-0.85%

18.2K

International Paper Company

IP

41.00

-1.06%

0.5K

Yandex N.V., NASDAQ

YNDX

13.18

-1.27%

0.4K

Tesla Motors, Inc., NASDAQ

TSLA

209.73

-1.55%

22.3K

Yahoo! Inc., NASDAQ

YHOO

32.25

-1.77%

66.2K

Twitter, Inc., NYSE

TWTR

29.34

-5.08%

335.0K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Yahoo! (YHOO) downgraded to Neutral from Buy at Mizuho; target lowered to $37 from $40

Yahoo! (YHOO) downgraded to Neutral from Buy at B. Riley & Co.

Twitter (TWTR) downgraded to Underweight from Equal-Weight at Morgan Stanley; target lowered to $24 from $36

Other:

IBM (IBM) reiterated at a Neutral at UBS; target lowered to $145 from $170

Facebook (FB) reiterated at a Buy at Jefferies; target raised to $130 from $120

Yahoo! (YHOO) target lowered to $44 from $45 at Axiom Capital

Yahoo! (YHOO) target lowered to $35 from $49 at Cowen

Verizon (VZ) target lowered to $54 from $57 at FBR Capital

Verizon (VZ) target lowered to $53 from $59 at Argus

Travelers (TRV) target raised to $120 from $115 at RBC Capital Mkts

-

14:44

China’s central bank issues the first yuan bonds outside China

The People's Bank of China (PBoC) has issued its first yuan bonds in London, the first yuan bonds outside China. The central bank hopes to get 5 billion yuan ($787 million). The rate is 3.1% and mature in 2016.

-

14:32

China’s central bank supplies 105.5 billion yuan to 11 commercial lenders

The People's Bank of China (PBoC) said on Wednesday that it supplied 105.5 billion yuan ($16.6 billion) to 11 commercial lenders via the Medium-term Lending Facility. The rate was 3.35%.

The central bank's action aims to keep interbank rates low and to boost the country's economic growth.

-

14:27

-

14:15

-

14:13

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of U.K. public sector net borrowing data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m August -0.1% Revised From 0.2% -0.2%

08:30 United Kingdom PSNB, bln September 10.8 Revised From 10.9 9.4 8.63

11:00 U.S. MBA Mortgage Applications October -27.6% 11.8%

The U.S. dollar traded mixed against the most major currencies in the absence of any major U.S. economic reports.

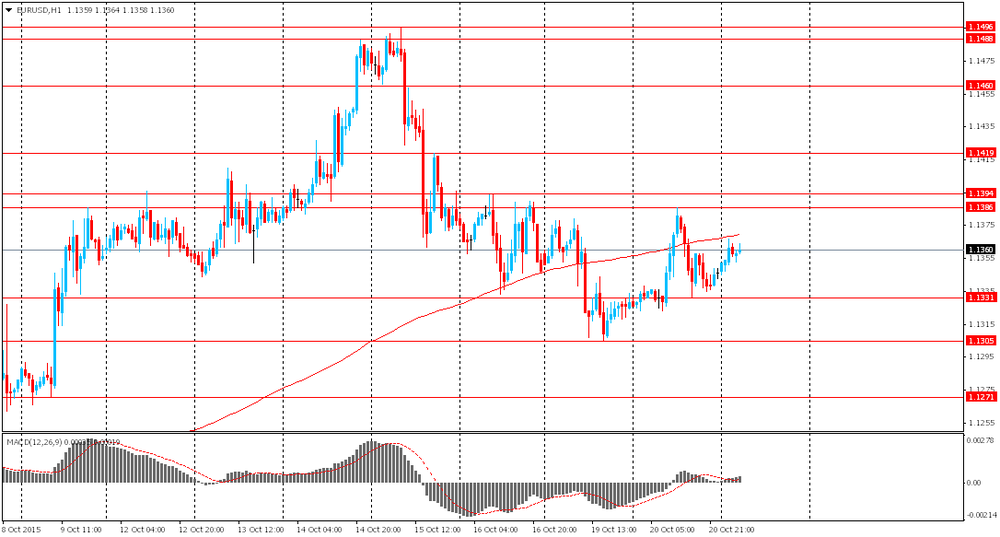

The euro traded mixedagainst the U.S. dollar in the absence of any major economic reports from the Eurozone.

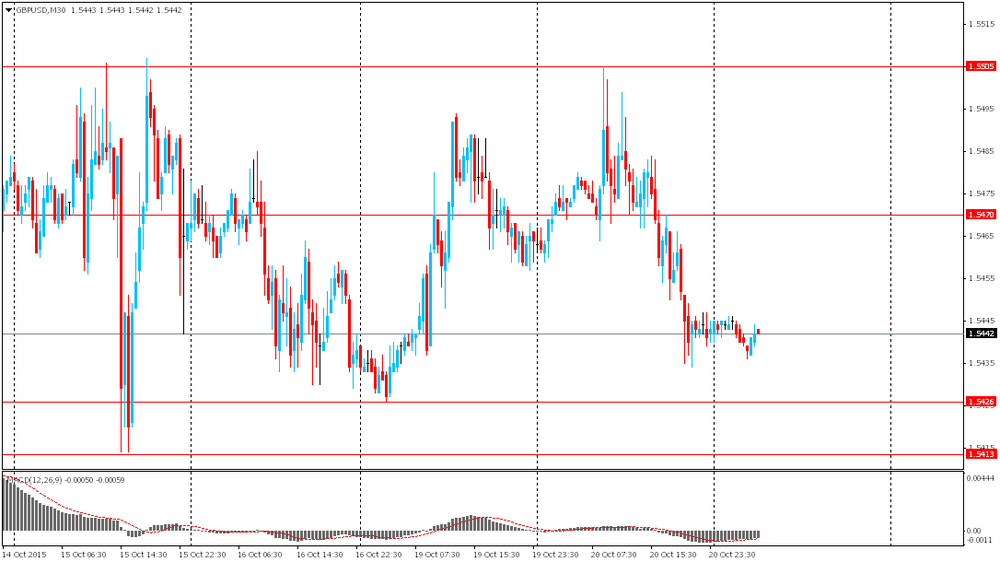

The British pound traded higher against the U.S. dollar after the release of U.K. public sector net borrowing data. The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Bank of Canada's interest rate decision. Analysts expect the central bank to keep its monetary policy unchanged.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.5460

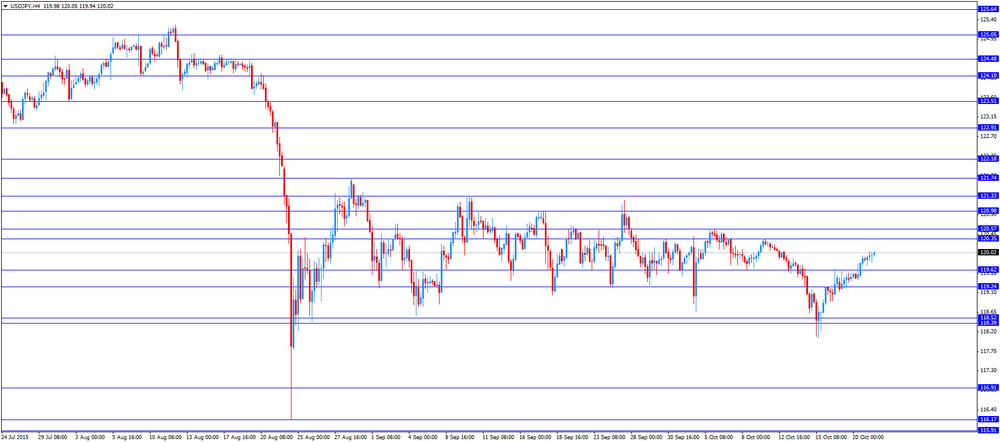

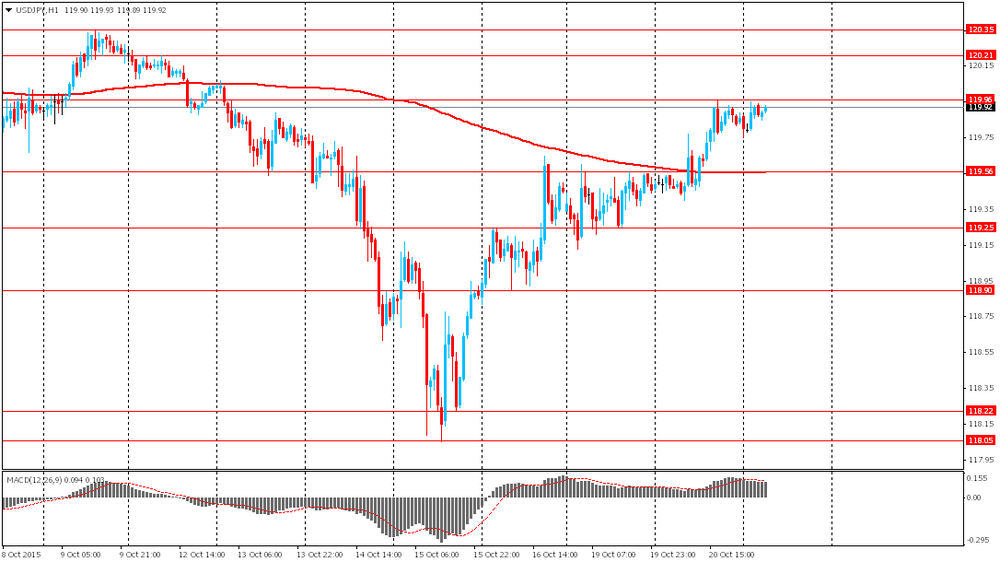

USD/JPY: the currency pair increased to Y120.05

The most important news that are expected (GMT0):

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Monetary Policy Report

15:15 Canada BOC Press Conference

17:30 U.S. FOMC Member Jerome Powell Speaks

22:45 Australia RBA Assist Gov Edey Speaks

-

14:12

Company News: Boeing (BA) posts strong Q3 results

Boeing reported Q3 earnings of $2.52 per share (+17.8% y/y), beating analysts' consensus of $2.20.

The company's revenues amounted to $25.849 bln (+8.7% y/y), beating consensus estimate of $24.781 bln.

Boeing revised upwards its EPS FY15 guidance to $16.20-16.50 from $15.50-15.95. The analysts' consensus forecast for the company's EPS FY15 stands at $15.81. The company also raised FY15 revenues to +8-9% (from +6-8%) to $10.48-10.58 bln versus consensus estimate of $10.47 bln.

BA rose to $143.00 (+2.97%) in pre-market trading.

-

13:50

Orders

EUR/USD

Offers 1.1380-85 1.1400 1.1425-30 1.1455-60 1.1485 1.1500

Bids 1.1350 1.1325-30 1.1300 1.1285 1.1265 1.1250 1.1230 1.1200

GBP/USD

Offers 1.5450 1.5480 1.5500-10 1.5525-30 1.5550 1.5565 1.5585 1.5600 1.5620

Bids 1.5415-20 1.5400 1.5380 1.5350 1.5330 1.5300 1.5285 1.5265 1.5250

EUR/GBP

Offers 0.7375-80 0.7400 0.7425-30 0.7450 0.7475-80 0.7500

Bids 0.7350 0.7330-35 0.7300 0.7285 0.7265 0.7250 0.7230 0.7200

EUR/JPY

Offers 136.50 136.75 137.00 137.25 137.50 137.75-80 138.00

Bids 136.00 135.80 135.50 135.25-30 135.00 134.80 134.50 134.30 134.00

USD/JPY

Offers 120.00 120.20 120.35 120.50 120.80 121.00

Bids 119.65 119.50 119.25-30 119.00 118.85 118.65-70 118.50 118.30 118.00

AUD/USD

Offers 0.7235 0.7250-55 0.7275 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400

Bids 0.7200 0.7185 0.7150 0.7125-30 0.7100

-

13:00

U.S.: MBA Mortgage Applications, October 11.8%

-

11:59

European stock markets mid session: stocks traded higher in the absence of any major economic reports from the Eurozone

Stock indices traded higher in the absence of any major economic reports from the Eurozone. Market participants are awaiting the European Central Bank's (ECB) monetary meeting tomorrow. A speech by the ECB President Mario Draghi will be closely monitored for signals of further quantitative easing. The inflation in the Eurozone remains at low levels, and several ECB officials expressed concerns over the low inflation.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

Current figures:

Name Price Change Change %

FTSE 100 6,368.82 +23.69 +0.37 %

DAX 10,193.17 +45.49 +0.45 %

CAC 40 4,693.81 +20.00 +0.43 %

-

11:39

M3 money supply in Switzerland rises 1.2% in September

The Swiss National Bank (SNB) released its money supply data on Wednesday. M3 money supply in Switzerland increased 1.2% year-on-year in September, after a 1.4% rise in August.

M1 money supply was up 0.7% year-on-year in September, after a 0.5% increase in August.

-

11:30

Greece’s current account surplus falls to €2.09 billion in August

The Bank of Greece released its current account data on Wednesday. Greece's current account surplus fell to €2.09 billion in August from €1.86 billion in August last year.

The Greek deficit on trade in goods declined by €268 million year-on-year in August, while the services surplus declined by €142 million.

The deficit on primary income decreased to €140.5 million in August from €249.8 million last year, while the deficit on secondary income climbed to €71.4 million from €69.1 million last year.

The capital account surplus remained almost unchanged in August.

-

11:19

Public sector net borrowing in the U.K. declines to £8.63 billion in September

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

-

11:01

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1300 (EUR 653m) 1.1325 (1.5bln) 1.1400 (678m) 1.1475 (2bln)

GBP/USD 1.5300 (GBP 255m) 1.5375 (155m)

USD/CAD1.3000 (USD 380m) 1.3025 (200m)

AUD/USD 0.7145 (AUD 548m) 0.7200 (314m) 0.7260 (300m) 0.7350 (300m)

EUR/JPY 136.00 (EUR 220m)

NZD/USD 0.7000 (NAD 250m)

-

10:54

Less than €20 million will be needed for recapitalisation of four main Greek banks

Reuters reported on Tuesday two senior bankers with knowledge of the matter said that less than €20 million will be needed for recapitalisation of four main Greek banks.

"The capital shortfall for the four systemic banks should be less than 20 billion euros," one senior banker said.

The European Central Bank declined to comment.

-

10:46

The World Bank cuts its oil price forecasts

The World Bank lowered its oil price forecasts for 2015 and 2016 on Tuesday. The lender expect the crude oil prices to be $52 per barrel in 2015, down from its July estimate of $57 per barrel. Crude oil prices are expected to be $51 per barrel in 2016.

The World Bank said that the downward revision was driven by a slowdown in the global economy, high current oil inventories, and expectations that Iran will boost its oil exports.

-

10:30

United Kingdom: PSNB, bln, September -8.63 (forecast -9.4)

-

10:20

Japan's trade deficit narrows to ¥114.5 billion in September

The Ministry of Finance released its trade data for Japan on the late Tuesday evening. Japan's trade deficit narrowed to ¥114.5 billion in September from a deficit of ¥569.6 billion in August. Analysts had expected a surplus of ¥84.0 billion.

The adjusted trade deficit was ¥355.7 billion in September, down from a deficit of ¥373.5 billion in August. August's figure was revised down from a deficit of ¥358.8 billion.

Exports rose 0.6% year-on-year in September, while imports dropped 11.1% year-on-year.

Exports to Asia decreased by 0.9% year-on-year, exports to the United States increased by 10.4%, exports to China dropped by 3.5%, while exports to the European Union were up 5.1%.

Imports from Asia fell 1.0% year-on-year, imports from the United States declined 0.1%, and imports from China gained 0.9%, while imports from the European Union slid 3.5%.

-

10:10

Australian leading economic index rises 0.2% in May

The Conference Board (CB) released its leading economic index for Australia on late Tuesday evening. The leading economic index decreased 0.4% in August, after a 0.3% rise in July.

The decrease was driven by a drop in building approvals, money supply, share prices and the sales to inventories ratio.

The coincident index was up 0.2% in August, after a 0.2% gain in July.

The rise was driven by employment, household disposable income and industrial production.

-

09:22

Oil prices fell amid increase in U.S. crude stocks

West Texas Intermediate futures for December delivery fell to $45.86 (-0.93%), while Brent crude fell to $48.43 (-0.57%) after data from the American Petroleum Institute showed a larger-than-expected increase in U.S. crude stocks.

The API reported on Tuesday that U.S. commercial crude stocks rose by 7.1 million barrels to 473 million barrels in the week ending October 16, while analysts had expected a more modest increase of 3.9 million barrels.

The Energy Information Administration is due to release its more precise inventory data later today.

Investors are also waiting for the result of today's meeting of the Organization of the Petroleum Exporting Countries and non-OPEC oil producers.

-

09:10

Gold declined slightly

Gold slid to $1,176.30 (-0.10%), although many analysts say that a weaker dollar is likely to support this dollar-denominated precious metal.

ANZ reported that physical demand improved with Russia increasing gold purchases for a second month in September. At the same time exports of the precious metal from Hong Kong to mainland China rose 65% on a monthly basis in September to 59.8 tons.

The median gold price forecast by members of London Bullion Market Association's conference suggests bullion to cost $1,159.88 an ounce (slightly lower than nowadays) in October 2016.

-

08:30

Global Stocks: Asian indices climbed despite declines in U.S. stocks

U.S. stock indices declined on Tuesday amid mixed earnings reports. Stocks of motorcycle maker Harley-Davidson Inc. fell 14% after its report showed a profit miss.

The Dow Jones Industrial Average slid 13.43 points, or less than 0.1%, to 17,217.11. The S&P 500 declined by 2.89, or 0.1%, to 2,030.77. The Nasdaq Composite Index fell 24.50, or 0.5%, to 4,880.97.

U.S. Department of Housing and Urban Development reported on Tuesday that housing starts rose by seasonally adjusted 6.5% to 1.21 million in September compared to the previous month.

U.S. stocks also continued to be influenced by concerns over global economy after Chinese GDP growth missed the 7% target in the third quarter.

This morning in Asia China Shanghai Composite Index rose 0.39%, or 13.45, to 3.438.78. The Nikkei rose 1.86%, or 339.31, to 18,546.46. Hong Kong market is on holiday.

Asian indices climbed despite declines in U.S. stocks.

Japanese stocks are supported by a weaker yen, which is favorable for exporters.

Meanwhile Japanese Ministry of Finance reported that the country's trade balance came in at ¥-114.5 billion in September, while economists had expected a surplus of ¥84.4 billion. Exports rose by 0.6% vs 3.4% expected. Exports to China fell by 3.5% after a 4.6% decline in August. Imports fell by 11.1%.

-

08:27

Foreign exchange market. Asian session: the euro advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan All Industry Activity Index, m/m August 0.2% -0.2%

The euro rose against the U.S. dollar amid data on loans in the single currency area. Data showed that banks made more efforts lending to companies using cheap liquidity available due to ECB's asset purchase program. These data suggest that the QE program stimulates economic growth and further monetary policy easing might not be necessary.

The yen slightly declined amid Japanese September international trade data. Exports rose by 0.6% vs 3.4% expected. Exports to China fell by 3.5% after a 4.6% decline in August. Imports fell by 11.1%. Declines in exports might intensify expectations for a monetary policy easing when Bank of Japan Board members meet on October 30.

The New Zealand dollar continued declining amid weaker-than-expected results of the GlobalDairyTrade auction. Global dairy prices declined by 3.1% after rising for four straight auctions before.

EUR/USD: the pair rose to $1.1365 in Asian trade

USD/JPY: the pair rose to Y120.00

GBP/USD: the pair traded within $1.5435-45

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom PSNB, bln September -11.31 -9.4

11:00 U.S. MBA Mortgage Applications October -27.6%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories October 7.562 3.65

15:15 Canada BOC Press Conference

17:30 U.S. FOMC Member Jerome Powell Speaks

22:45 Australia RBA Assist Gov Edey Speaks

-

08:24

Options levels on wednesday, October 21, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1475 (2439)

$1.1425 (1098)

$1.1392 (1048)

Price at time of writing this review: $1.1348

Support levels (open interest**, contracts):

$1.1290 (933)

$1.1248 (2835)

$1.1189 (2542)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 37192 contracts, with the maximum number of contracts with strike price $1,1500 (3374);

- Overall open interest on the PUT options with the expiration date November, 6 is 46974 contracts, with the maximum number of contracts with strike price $1,1000 (4814);

- The ratio of PUT/CALL was 1.26 versus 1.25 from the previous trading day according to data from October, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5702 (918)

$1.5604 (1256)

$1.5507 (2170)

Price at time of writing this review: $1.5423

Support levels (open interest**, contracts):

$1.5392 (549)

$1.5295 (2841)

$1.5198 (2880)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20776 contracts, with the maximum number of contracts with strike price $1,5350 (2600);

- Overall open interest on the PUT options with the expiration date November, 6 is 20918 contracts, with the maximum number of contracts with strike price $1,5200 (2880);

- The ratio of PUT/CALL was 1.00 versus 1.02 from the previous trading day according to data from October, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:16

Japan: All Industry Activity Index, m/m, August -0.2%

-

04:02

Nikkei 225 18,343.83 +136.68 +0.75 %, Shanghai Composite 3,424.35 -0.98 -0.03 %

-

01:50

Japan: Trade Balance Total, bln, September 114.5 (forecast 84.4)

-

00:32

Commodities. Daily history for Sep Oct 20’2015:

(raw materials / closing price /% change)

Oil 45.84 +0.64%

Gold 1,175.80 -0.14%

-

00:31

Stocks. Daily history for Sep Oct 20’2015:

(index / closing price / change items /% change)

Hang Seng 22,989.22 -86.39 -0.37 %

S&P/ASX 200 5,235.57 -34.14 -0.65 %

Shanghai Composite 3,424.33 +37.63 +1.11 %

Topix 1,499.28 +4.53 +0.30 %

FTSE 100 6,345.13 -7.20 -0.11 %

CAC 40 4,673.81 -30.26 -0.64 %

Xetra DAX 10,147.68 -16.63 -0.16 %

S&P 500 2,030.77 -2.89 -0.14 %

NASDAQ Composite 4,880.97 -24.50 -0.50 %

Dow Jones 17,217.11 -13.43 -0.08 %

-

00:30

Currencies. Daily history for Oct 20’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,1346 +0,16%

GBP/USD $1,5443 -0,14%

USD/CHF Chf0,956 -0,02%

USD/JPY Y119,86 +0,33%

EUR/JPY Y135,99 +0,49%

GBP/JPY Y185,09 +0,20%

AUD/USD $0,7260 +0,25%

NZD/USD $0,6747 -0,65%

USD/CAD C$1,2984 -0,22%

-

00:03

Schedule for today, Wednesday, Oct 21’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m August 0.2%

08:30 United Kingdom PSNB, bln September -11.31 -9.4

11:00 U.S. MBA Mortgage Applications October -27.6%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories October 7.562

15:15 Canada BOC Press Conference

17:30 U.S. FOMC Member Jerome Powell Speaks

22:45 Australia RBA Assist Gov Edey Speaks

-