Noticias del mercado

-

17:42

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the speech by the Fed Chair Janet Yellen

The U.S. dollar traded lower against the most major currencies after the speech by the Fed Chair Janet Yellen. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings".

The Fed Chair noted that the central bank will change the wording of the policy statement when it will raise its interest rate.

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index fell to 96.4 in February from 103.8 in January, missing expectations for a decline to 99.6. January's figure was revised up from 102.9.

The decline was driven by weaker short-term outlook.

The S&P/Case-Shiller home price index increased 4.5% in December, in line with expectations, after a 4.3% gain in November.

Chairman of the index committee at S&P Dow Jones Indices David Blitzer said that "the housing recovery is faltering". He noted that construction and new home sales is still weak.

The euro traded higher against the U.S. dollar after Greek proposal of economic reforms was approved by creditors.

Eurozone's consumer price index dropped 1.6% in January, after a 0.1% decrease in December.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.6% in January, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.6% in January, in line with expectations.

Germany's final GDP grew 0.7% in fourth quarter, in line with expectations.

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate rose to -8.3 in February from -8.8 in January.

The increase was driven by positive developments in the manufacturing industry, in business-related services and in trade.

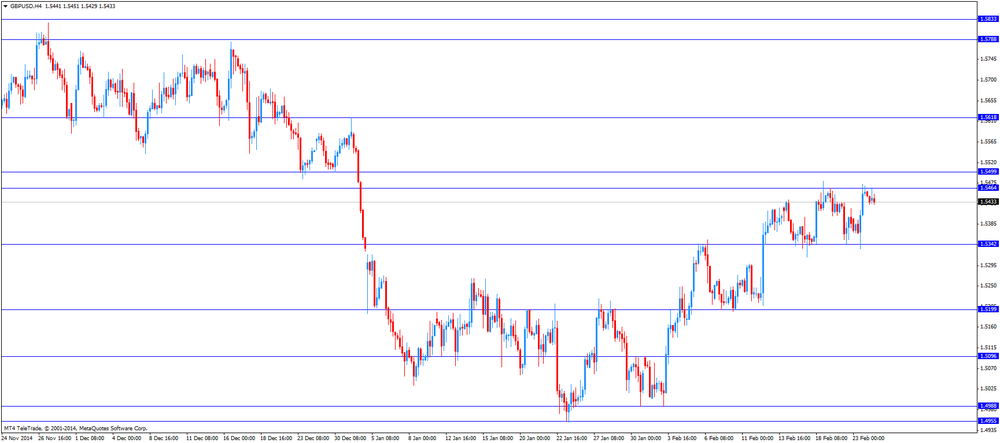

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K. The Bank of England (BoE) policymaker Martin Weale said today that the BoE could start hiking its interest rates sooner than expected.

The Canadian dollar traded higher against the U.S. dollar ahead of the speech by the Bank of Canada Governor Stephen Poloz.

The Swiss franc traded mixed against the U.S. dollar. The number of employed people climbed to 4,230 million in the fourth quarter from 4,227 million in the third quarter. Analysts had expected the number of employed people to decline to 4,220 million.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi declined against the greenback after the weak Reserve Bank of New Zealand' inflation expectations. Inflation expectations declined to 1.8% in the fourth quarter from 2.1% in the third quarter.

The Australian dollar rose against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback in the absence of any major economic reports from Japan.

-

17:15

Fed Chair Janet Yellen: the Fed will change the wording of the policy statement when it will raise its interest rate

The Fed Chair Janet Yellen testified before the Senate Banking Committee in Washington on Tuesday:

- "Too many Americans remain unemployed or underemployed, wage growth is still sluggish and inflation remains well below our longer-run objective";

- The labour market showed a strong recovery;

- Falling oil prices are "a significant overall plus" for the U.S. economy, supporting household spending;

- The weakness of other developed economies could slow growth in the U.S.;

- The Fed would not hike its interest rate until it "is reasonably confident that inflation will move back over the medium term toward our 2 percent objective";

- The word "patient" in the latest policy statement means that the Fed does not intend to hike its interest rate during the two meetings following the release of that statement;

- The Fed will change the wording of the policy statement when it will raise its interest rate;

- "If economic conditions continue to improve, as the committee anticipates, the committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis".

Yellen offered no clear signal on when the Fed will hike its interest rate.

The Fed Chair is scheduled to testify on Wednesday before the House Financial Services Committee.

- "Too many Americans remain unemployed or underemployed, wage growth is still sluggish and inflation remains well below our longer-run objective";

-

16:44

U.S. consumer confidence index declines to 96.4 in February

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index fell to 96.4 in February from 103.8 in January, missing expectations for a decline to 99.6. January's figure was revised up from 102.9.

The director of economic indicators at The Conference Board Lynn Franco said that consumer confidence "still remains at pre-recession levels".

The decline was driven by weaker short-term outlook. The expectations index decreased to 87.2 in February from 97.0 in January.

-

16:08

NBB business climate rises to -8.3 in February

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate rose to -8.3 in February from -8.8 in January.

The increase was driven by positive developments in the manufacturing industry, in business-related services and in trade.

-

16:00

U.S.: Consumer confidence , February 96.4 (forecast 99.6)

-

16:00

U.S.: Richmond Fed Manufacturing Index, February 0 (forecast 7)

-

15:45

U.S.: Services PMI, February 57.0 (forecast 54.5)

-

15:44

S&P/Case-Shiller home price index rises 4.5% in December

The S&P/Case-Shiller home price index increased 4.5% in December, in line with expectations, after a 4.3% gain in November.

Chairman of the index committee at S&P Dow Jones Indices David Blitzer said that "the housing recovery is faltering". He noted that construction and new home sales is still weak.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:00

Belgium: Business Climate, February -8.3 (forecast -8.4)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, December +4.5% (forecast +4.5%)

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY 117.50 (USD 675m) 118.00 (USD 428m) 118.50-60 (USD 290m) 119.55 (USD 300m) 119.75 (USD 517m)

EURUSD 1.1280-85 (EUR 1.3bln) 1.1300 (EUR 1.3bln) 1.1315 (EUR 543m

USDCAD 1.2330 (USD 280m) 1.2420 (USD 220m)

AUDUSD 0.7800-10 (AUD 325m)

-

14:02

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the consumer price inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

02:00 New Zealand Expected Annual Inflation 2y from now Quarter IV +2.1% +1.8%

07:00 Germany GDP (QoQ) (Finally) Quarter IV +0.7% +0.7% +0.7%

07:00 Germany GDP (YoY) (Finally) Quarter IV +1.6% +1.6% +1.6%

08:15 Switzerland Employment Level Quarter IV 4.23 4.22 4.23

10:00 Eurozone Harmonized CPI January -0.1% -1.6%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January -0.6% -0.6% -0.6%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y January +0.6% +0.6% +0.6%

The U.S. dollar traded mixed to higher against the most major currencies ahead the speech by the Fed Chair Janet Yellen. Yellen will testify before the Senate Banking Committee in Washington later in the day.

The S&P/Case-Shiller home price index is expected to rise by 4.5% in December, after a 4.3% gain in November.

The U.S. consumer confidence is expected to decline to 99.6 in February from 102.9 from January.

The euro traded mixed against the U.S. dollar after the consumer price inflation data from the Eurozone. Eurozone's consumer price index dropped 1.6% in January, after a 0.1% decrease in December.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.6% in January, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.6% in January, in line with expectations.

Germany's final GDP grew 0.7% in fourth quarter, in line with expectations.

The European Central Bank President Mario Draghi will speak at 14:00 GMT0.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the speech by the Bank of Canada Governor Stephen Poloz.

The Swiss franc traded mixed against the U.S. dollar. The number of employed people climbed to 4,230 million in the fourth quarter from 4,227 million in the third quarter. Analysts had expected the number of employed people to decline to 4,220 million.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y119.60

The most important news that are expected (GMT0):

14:00 Belgium Business Climate February -8.8 -8.4

14:00 Eurozone ECB President Mario Draghi Speaks

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y December +4.3% +4.5%

15:00 U.S. Consumer confidence February 102.9 99.6

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

19:00 Canada BOC Gov Stephen Poloz Speaks

-

14:00

Orders

EUR/USD

Offers 1.1340 1.1360 1.1400 1.1425 1.1445-50 1.1485 1.1500 1.1530

Bids 1.1300 1.1290 1.1270-75 1.1240-50 1.1225 1.1200

GBP/USD

Offers 1.5475-80 1.5500 1.5525-30 1.5550 1.5580 1.5600

Bids 1.5425-30 1.5400 1.5370 1.5350 1.5330-35 1.5300 1.5280-85 1.5250

EUR/JPY

Offers 135.50 135.80 136.00 136.20 136.50

Bids 134.70-75 134.50 134.00 133.80 133.50

USD/JPY

Offers 119.50 119.80 120.00 120.25-30

Bids 119.00-10 118.85-90 118.60 118.40 118.20 118.00

EUR/GBP

Offers 0.7345-50 0.7385 0.7400 0.7420-25 0.7440 0.7450-55

Bids 0.7320-25 0.7300-05 0.7285 0.7250-55 0.7230 0.7200-10

AUD/USD

Offers 0.7780 0.7800-10 0.7835-40 0.7850 0.7880 0.7900

Bids 0.7730 0.7700 0.7650 0.7625 0.7600

-

11:20

Eurozone January Inflation fell by -0.6% in line with expectations

Eurostat released data on Eurozone's Consumer Price Inflation today showing a decline by -0.6% in line with expectations further fuelling fears of deflation in the Eurozone as the rate is far below the targeted 2% the ECB is aiming for and the lowest since 2009. Lower oil prices are the main reason for the decline.

Month on month consumer prices declined by -1.6% in January compared to -0.1% in the previous month.

Core CPI excluding the volatile energy and food items, alcohol and tobacco costs rose +0.6% in January meeting forecasts.

-

11:19

Option expiries for today's 10:00 ET NY cut

USDJPY 117.50 (USD 675m) 118.00 (USD 428m) 118.50-60 (USD 290m) 119.55 (USD 300m) 119.75 (USD 517m)

EURUSD 1.1280-85 (EUR 1.3bln) 1.1300 (EUR 1.3bln) 1.1315 (EUR 543m

USDCAD 1.2330 (USD 280m) 1.2420 (USD 220m)

AUDUSD 0.7800-10 (AUD 325m)

-

11:02

Eurozone: Harmonized CPI, Y/Y, January -0.6% (forecast -0.6%)

-

11:02

Eurozone: Harmonized CPI ex EFAT, Y/Y, January +0.6% (forecast +0.6%)

-

11:02

Eurozone: Harmonized CPI, January -1.6%

-

10:30

Press Review: Yellen faces Senate grilling on Fed rate policy, transparency

BLOOMBERG

Greek Plan to Tackle Economy Goes Before Finance Chiefs

(Bloomberg) -- Greece's month-old government is about to find out whether a package of new economic measures sketched in recent days is enough to win more funding from the rest of the euro region to keep the country solvent.

A draft list of commitments was under discussion with the International Monetary Fund, the European Commission and the European Central Bank after Finance Minister Yanis Varoufakis sent it to the institutions and Jeroen Dijsselbloem, president of the euro-area finance ministers group, before the midnight deadline on Monday. The group is scheduled to hold a conference call on Tuesday to assess the measures.

REUTERS

Yellen faces Senate grilling on Fed rate policy, transparency(Reuters) - Federal Reserve Chair Janet Yellen is expected to face pointed questions this week from U.S. lawmakers aimed at revealing details about the Fed's timing on interest rate hikes, as well as fresh scrutiny about transparency at the central bank.

Yellen will likely give away little in her prepared testimony for the Senate Banking Committee on Tuesday, and the House Financial Services Committee on Wednesday. But her answers to lawmakers' questions will be parsed for insight into the her thinking about issues like persistently weak inflation, stagnant wage growth and whether she still feels the nation's falling unemployment rate disguises lingering ills in the labor market.

Source: http://www.reuters.com/article/2015/02/24/us-usa-fed-idUSKBN0LS0BD20150224

REUTERS

Brent falls toward $58 as supply fears linger

(Reuters) - Brent fell toward $58 a barrel on Tuesday, extending the 2-percent loss in the previous session, as oversupply fears lingered, overshadowing any optimism on the outlook for the global economy.

The oil benchmark had traded above $59 in early Asian trade before negative sentiment overtook, dragging prices 7-percent off its near two-month peak reached last Tuesday.

Brent LCOc1 fell 58 cents to $58.32 a barrel by 0704 GMT (2.04 a.m. EST), while U.S. crudeCLc1 was down 60 cents at $48.85.

U.S. crude stocks are expected to have increased by 4 million barrels to a record high in the week ending Feb. 20, a preliminary Reuters survey showed on Monday.

Refinery woes weighed on crude prices.

Source: http://www.reuters.com/article/2015/02/24/us-markets-oil-idUSKBN0LR01E20150224

-

09:25

German GDP rose +0.7% - in line with expectations

Germany's Federal Statistics Office released data on German Gross Domestic Product toady. The seasonally-adjusted data showed that the GDP rose +0.7% between October and December in line with expectations as domestic demand and foreign trade were the main drivers of growth in Europe's largest economy. Private consumption rose +0.8%, capital investment added +1.2% and exports increased by +1.3%. A lower oil price and a weaker euro had positive effects on the economy. In the preceding quarter the GDP rose by +0.7%.

-

09:15

Switzerland: Employment Level, Quarter IV 4.23 (forecast 4.22)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded stronger against most major peers ahead of FED chair Yellen testimony

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 China Bank holiday

02:00 New Zealand Expected Annual Inflation 2y from now Quarter I +2.1%

07:00 Germany GDP (QoQ) (Finally) Quarter IV +0.7% +0.7% +0.7%

07:00 Germany GDP (YoY) (Finally) Quarter I +1.6% +1.6% +1.6%

The U.S. dollar traded higher against its major peers ahead of US Federal Reserve chair Janet Yellen's semi-annual testimony to the Senate Banking Committee. Markets will closely watch the testimony for clues as to when the world's largest economy may raise interest rates. Yellen is to testify in the US today and tomorrow. Yesterday data showed Sales of existing homes fell 4.9% to a seasonally adjusted annual rate of 4.82 million in January from 5.07 million in December. That was the lowest level since April 2014.

The euro was under pressure as Greece missed yesterday's deadline to present a list of reforms, a condition for the extension of the international bailout, which is now scheduled for today according to Greek officials. The list will include plans on the governments fight against tax evasion and corruption. According to E.U. official the delay is not an issue as Greece was working closely with the E.U. elaborating the contents of the list.

The Australian dollar lost against the dollar for a second consecutive day in line with the kiwi. Worries about low commodity prices continue to weigh on the currency. Tomorrow the Australian Bureau of Statistics will release the wage growth index and construction data for the last quarter.

New Zealand's dollar declined against the greenback after the RBNZ revised its inflation outlook down. Expected Annual Inflation 2years from now, a survey of business managers and professionals declined from +2.1% to +1.8% in the first quarter.

The Japanese yen fell against the greenback on Tuesday before the testimony of FED Chair Janet Yellen. Yesterday minutes of the January policy meeting of the Bank of Japans showed that some members of the board questioned the extension of the massive quantitative easing program started in October this year and that the QE may need to stop before reaching the 2% inflation target. Three BoJ's board members expressed doubts the central bank will achieve its 2% inflation goal in the targeted period.The BoJ cut its consumer inflation forecast for fiscal 2015 starting in April to 1.0% from its previous estimate of 1.7%. For fiscal 2016, the central bank upgraded its inflation forecast to 2.2% from 2.1%.

EUR/USD: the euro traded weaker against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling traded lower against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Employment Level Quarter IV 4.23 4.22

10:00 Eurozone Harmonized CPI January -0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January -0.6% -0.6%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y January +0.6% +0.6%

14:00 Belgium Business Climate February -8.8 -8.4

14:00 Eurozone ECB President Mario Draghi Speaks

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y December +4.3% +4.5%

14:45 U.S. Services PMI (Preliminary) February 54.2 54.5

15:00 U.S. Richmond Fed Manufacturing Index February 6 7

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. Consumer confidence February 102.9 99.6

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

19:00 Canada BOC Gov Stephen Poloz Speaks

21:30 U.S. API Crude Oil Inventories February +14.3

-

08:13

Options levels on tuesday, February 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1437 (1628)

$1.1397 (752)

$1.1363 (457)

Price at time of writing this review: $1.1329

Support levels (open interest**, contracts):

$1.1291 (2211)

$1.1249 (2240)

$1.1221 (4503)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 106544 contracts, with the maximum number of contracts with strike price $1,1500 (6169);

- Overall open interest on the PUT options with the expiration date March, 6 is 110471 contracts, with the maximum number of contracts with strike price $1,1200 (5247);

- The ratio of PUT/CALL was 1.04 versus 1.10 from the previous trading day according to data from February, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (1160)

$1.5603 (2318)

$1.5507 (2939)

Price at time of writing this review: $1.5452

Support levels (open interest**, contracts):

$1.5393 (1655)

$1.5296 (2265)

$1.5198 (2107)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 30100 contracts, with the maximum number of contracts with strike price $1,5500 (2939);

- Overall open interest on the PUT options with the expiration date March, 6 is 35896 contracts, with the maximum number of contracts with strike price $1,5300 (2265);

- The ratio of PUT/CALL was 1.19 versus 1.15 from the previous trading day according to data from February, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: GDP (QoQ), Quarter IV +0.7% (forecast +0.7%)

-

08:00

Germany: GDP (YoY), Quarter I +1.6% (forecast +1.6%)

-

03:02

New Zealand: Expected Annual Inflation 2y from now, Quarter I +1.8%

-

00:29

Currencies. Daily history for Feb 23’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1333 -0,38%

GBP/USD $1,5456 +0,45%

USD/CHF Chf0,9496 +0,96%

USD/JPY Y118,80 -0,22%

EUR/JPY Y134,65 -0,59%

GBP/JPY Y183,6 +0,22%

AUD/USD $0,7801 -0,51%

NZD/USD $0,7523 -0,01%

USD/CAD C$1,2571 +0,22%

-

00:01

Schedule for today, Tuesday, Feb 24’2015:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

02:00 New Zealand Expected Annual Inflation 2y from now Quarter I +2.1%

07:00 Germany GDP (QoQ) (Finally) Quarter IV +0.7% +0.7%

07:00 Germany GDP (YoY) (Finally) Quarter I +1.6% +1.6%

08:15 Switzerland Employment Level Quarter IV 4.23 4.22

10:00 Eurozone Harmonized CPI January -0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January -0.6% -0.6%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y January +0.6% +0.6%

14:00 Belgium Business Climate February -8.8 -8.4

14:00 Eurozone ECB President Mario Draghi Speaks

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y December +4.3% +4.5%

14:45 U.S. Services PMI (Preliminary) February 54.2 54.5

15:00 U.S. Richmond Fed Manufacturing Index February 6 7

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. Consumer confidence February 102.9 99.6

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

19:00 Canada BOC Gov Stephen Poloz Speaks

21:30 U.S. API Crude Oil Inventories February +14.3

-