Noticias del mercado

-

17:29

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. economic data. New home sales declined 0.2% to a seasonally adjusted annual rate of 481,000 units in January from 482,000 units in December, the highest level since June 2008.

December's figure was revised up from 481,000 units.

Analysts had expected new home sales to reach 477,000 units.

The decline was driven by weaker sales in the Northeast.

The mortgage delinquency rate fell to 5.68% in the fourth quarter from 5.85% in the third quarter. That was the lowest reading the third quarter of 2007.

The Fed Chair Janet Yellen testified before the House Financial Services Committee on Wednesday. Her remarks were identical to yesterday's remarks.

Yesterday's comments by the Fed Chair Janet Yellen weighed on the greenback. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings".

The euro traded higher against the U.S. dollar. Concerns over Greek bailout programme still weighed on the euro.

The European Central Bank President Mario Draghi will speak at 16:30 GMT0.

The British pound traded higher against the U.S. dollar. The number of mortgage approvals increased to 36,700 in January from 35,800 in December, exceeding expectations for a rise to 36,200. December's figure was revised up from 35,700.

The Bank of England (BoE) Governor Mark Carney said nothing about the monetary policy at today's launch of the One Bank Research Agenda.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's UBS consumption indicator decreased to 1.24 points in January from 1.42 points in December.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the better-than-expected Chinese preliminary manufacturing PMI. Chinese preliminary manufacturing PMI increased to 50.1 in February from 49.7 in January, beating expectations for a decline to 49.6.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the mixed economic from Australia. Wage price index in Australia rose by 0.6% in the fourth quarter, missing expectations for a 0.7% gain, after a 0.6% increase in the previous quarter.

Construction work done in Australia fell 0.2% in the fourth quarter, beating expectations for a 0.8% decline, after a 2.8% drop in the third quarter. The third quarter's figure was revised down from 2.2% decrease.

Chinese preliminary manufacturing PMI supported the Aussie.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback in the absence of any major economic reports from Japan.

-

16:50

Mortgage delinquency rate declines to 5.68% in the fourth quarter

The Mortgage Bankers Association released its National Delinquency Survey on Wednesday. The mortgage delinquency rate fell to 5.68% in the fourth quarter from 5.85% in the third quarter. That was the lowest reading the third quarter of 2007.

The mortgage delinquency rate includes loans that are at least one payment past.

The vice president of the Mortgage Bankers Association Marina Walsh said that pre-crisis levels are reached.

-

16:40

New home sales declined 0.2% in January

The U.S. Commerce Department released new home sales data on Wednesday. New home sales declined 0.2% to a seasonally adjusted annual rate of 481,000 units in January from 482,000 units in December, the highest level since June 2008.

December's figure was revised up from 481,000 units.

Analysts had expected new home sales to reach 477,000 units.

The decline was driven by weaker sales in the Northeast. New home sales in the Northeast dropped 51.6%, the biggest drop since June 2012.

-

16:30

U.S.: Crude Oil Inventories, February +8.4

-

16:01

U.S.: Mortgage Delinquencies, Quarter IV 5.68%

-

16:00

U.S.: New Home Sales, January 481 (forecast 477)

-

14:49

Option expiries for today's 10:00 ET NY cut

USDJPY 118.00 (USD 577m) 119.40 (USD 506m) 120.00 (USD 1.1bln)

EURUSD 1.1200 (EUR 3.4bln) 1.1250 (EUR 5.4bln) 1.1300 (EUR 1.4bln) 1.1355 (EUR 995m) 1.1400 (1.59bln)

USDCAD 1.2500 (USD 765m) 1.2550 (USD 267m) 1.2560 (USD 200m) 1.2750 (USD 240m) 1.2800 (USD474m)

AUDUSD 0.7750 (AUD 435m) 0.7775 (AUD 496m) 0.7800 (AUD 690m) 0.7850 (AUD 449m)

NZDUSD 0.7450 (NZD 531m)

EURJPY 132.58 (EUR 760m) 133.85 (EUR 393m)

EURGBP 0.7325 (EUR 330m)

-

14:05

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the better-than-expected number of mortgage approvals from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Construction Work Done Quarter IV -2.8% Revised From -2.2% -0.8% -0.2%

00:30 Australia Wage Price Index, q/q Quarter IV +0.6% +0.7% +0.6%

00:30 Australia Wage Price Index, y/y Quarter IV +2.6% +2.5% +2.5%

01:45 China HSBC Manufacturing PMI (Preliminary) February 49.7 49.6 50.1

07:00 Switzerland UBS Consumption Indicator January 1.42 1.24

09:30 United Kingdom BBA Mortgage Approvals January 35.8 Revised From 35.7 36.2 36.4

10:00 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead the speech by the Fed Chair Janet Yellen. Yellen will testify before the House Financial Services Committee later in the day.

New home sales in the U.S. are expected to decline to 477,000 units in January from 484,000 units in December.

Yesterday's comments by the Fed Chair Janet Yellen weighed on the greenback. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings".

The euro traded lower against the U.S. dollar as concerns over Greek bailout programme still weigh on the euro.

The European Central Bank President Mario Draghi will speak at 16:30 GMT0.

The British pound traded lower against the U.S. dollar despite the better-than-expected number of mortgage approvals from the U.K. The number of mortgage approvals increased to 36,700 in January from 35,800 in December, exceeding expectations for a rise to 36,200. December's figure was revised up from 35,700.

The Bank of England (BoE) Governor Mark Carney said nothing about the monetary policy at today's launch of the One Bank Research Agenda.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator decreased to 1.24 points in January from 1.42 points in December.

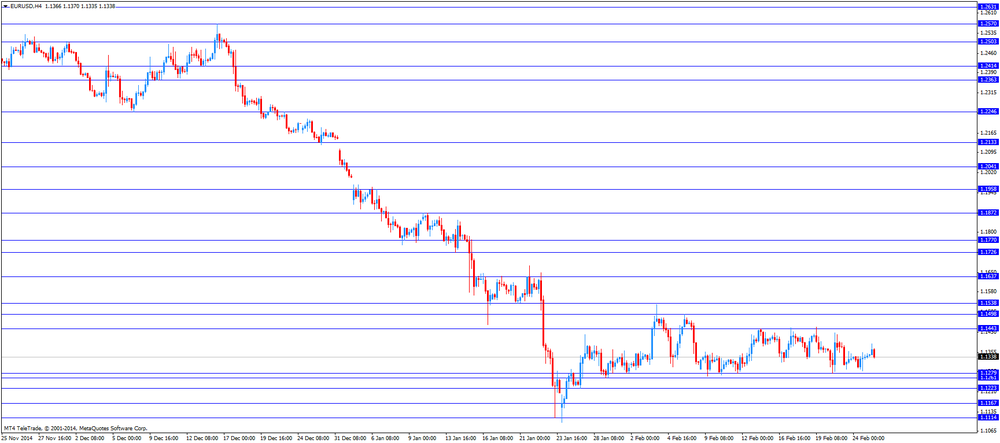

EUR/USD: the currency pair fell to $1.1335

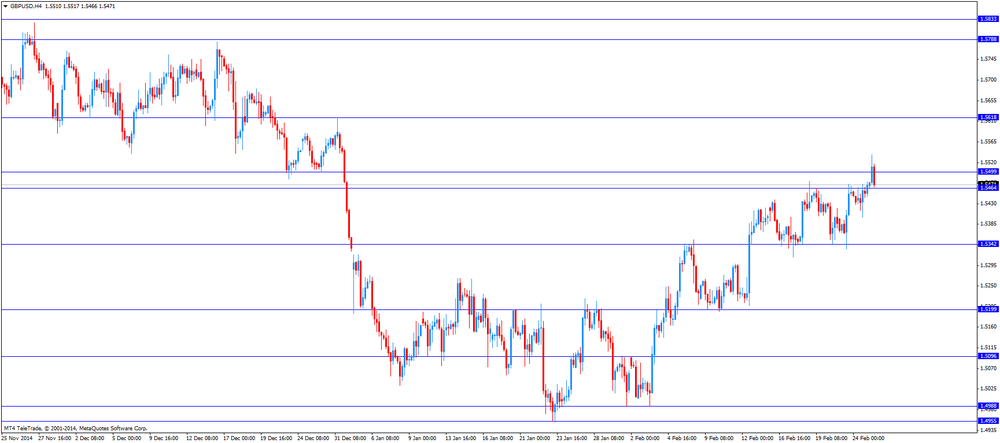

GBP/USD: the currency pair declined to $1.5466

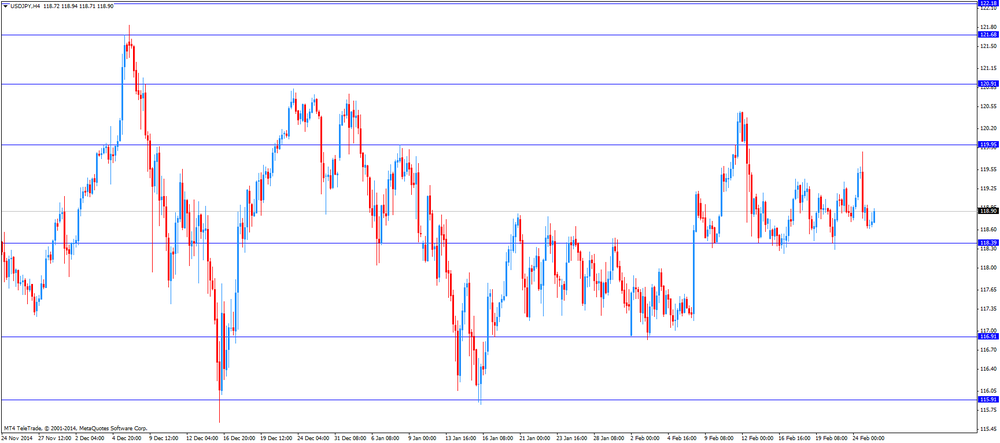

USD/JPY: the currency pair rose to Y118.94

The most important news that are expected (GMT0):

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. New Home Sales January 484 477

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

16:30 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Trade Balance, mln January -159 -157

-

13:30

U.K.: BBA Mortgage Approvals rose more-than-expected

Today the British Bankers' Association reported U.K. mortgage approvals rose more-than-expected last month. Approvals rose by 36,400 beating expectations of 36,200. In December 35,700 approvals were reported. The index reflects the number of issued mortgage credit permits. It is the leading indicator of the residential real estate market demand.

Fuelled by the better-than-expected data and Yellen's testimony before the Senate Banking Committee stating that it's unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings"cable rose to a two-month high against the greenback.

-

11:22

Option expiries for today's 10:00 ET NY cut

USDJPY 118.00 (USD 577m) 119.40 (USD 506m) 120.00 (USD 1.1bln)

EURUSD 1.1200 (EUR 3.4bln) 1.1250 (EUR 5.4bln) 1.1300 (EUR 1.4bln) 1.1355 (EUR 995m) 1.1400 (1.59bln)

USDCAD 1.2500 (USD 765m) 1.2550 (USD 267m) 1.2560 (USD 200m) 1.2750 (USD 240m) 1.2800 (USD474m)

AUDUSD 0.7750 (AUD 435m) 0.7775 (AUD 496m) 0.7800 (AUD 690m) 0.7850 (AUD 449m)

NZDUSD 0.7450 (NZD 531m)

EURJPY 132.58 (EUR 760m) 133.85 (EUR 393m)

EURGBP 0.7325 (EUR 330m)

-

10:40

China PMI back in positive territory

Data on the HSBC China PMI showed an increase of activity in the huge factory sector as the index is back into positive territory. Economic stimulus by the People's Bank of China and economic recovery in the U.S. seem to lend support.

The HSBC Manufacturing PMI rose from 49.7 to 50.1 to a four month-high, above the estimated reading of 49.6. A reading above 50 represents growth in activity. Readings of output and new orders both improved.

Domestic demand firmed while new export orders contracted for the first time since April 2014. Employment declined for a sixteenth consecutive month as companies reduced staff as a consequence of the economic slowdown.

The world's second largest economy grew at the slowest pace in 24 years in 2014.

-

10:30

United Kingdom: BBA Mortgage Approvals, January 36.4 (forecast 36.2)

-

10:15

Press Review: Brent inches up toward $59 on Fed flexibility, China factory growth

BLOOMBERG

Draghi Winning Greek Respite Shifts Focus to Inflation Battle

(Bloomberg) -- A respite in Greece's bailout talks allows Mario Draghi to return his attention to the region's dismal price outlook.

Reform proposals by the Greek government, which the European Central Bank president described as a "valid starting point," have freed the ECB from immediate concern over funding the country's banks. That will give the institution scope to elaborate on the details of a 1.1 trillion-euro ($1.3 billion) quantitative-easing program designed to stave off deflation.

Draghi, who will attend the European Parliament in Brussels on Wednesday, is about to get data from Germany, Spain and Italy that will show a continued slump in consumer prices. The reports are a preamble to region-wide figures on Monday forecast to show prices falling at a near-record pace and new ECB projections due next week after a Governing Council meeting in Cyprus.

REUTERS

Brent inches up toward $59 on Fed flexibility, China factory growth(Reuters) - Brent crude edged up toward $59 a barrel on Wednesday, helped by better-than-expected Chinese factory activity data, the Federal Reserve's flexible stance on U.S. interest rates and the euro zone's approval of reforms proposed byGreece.

But U.S. crude was weaker after settling lower for the fifth consecutive session on Tuesday on the back of a bigger-than- anticipated crude stock build-up.

Brent had climbed 11 cents to $58.77 a barrel by 0751 GMT (2.51 a.m. EST), while U.S. crude futures fell 17 cents to $49.11 a barrel.

Source: http://www.reuters.com/article/2015/02/25/us-markets-oil-idUSKBN0LT08620150225

REUTERS

Germany's Schaeuble: credibility of new Greek plan still in doubtFeb 25 (Reuters) - Germany's Wolfgang Schaeuble said on Wednesday it had not been an easy decision for euro zone finance ministers to extend the Greek rescue plan by four months and much doubt remained about how credible Athens' latest reform commitments really were.

"It wasn't easy an easy decision for us but neither was it easy for the Greek government because (they) had told the people something completely different in the campaign and afterwards," the German finance minister told SWR2 radio in an interview.

Source: http://www.reuters.com/article/2015/02/25/eurozone-greece-schaeuble-idUSB4N0PT01I20150225

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded weaker against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Construction Work Done Quarter IV -2.2% -0.8% -0.2%

00:30 Australia Wage Price Index, q/q Quarter IV +0.6% +0.7% +0.6%

00:30 Australia Wage Price Index, y/y Quarter IV +2.6% +2.5% +2.5%

01:45 China HSBC Manufacturing PMI (Preliminary) February 49.7 49.6 50.1

07:00 Switzerland UBS Consumption Indicator January 1.42 1.24

The U.S. dollar traded lower against its major peers after the speech by the Fed Chair Janet Yellen. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings" as wage growth remains too low even as the job market improves. The Fed Chair noted that the central bank will change the wording of the policy statement when it will raise its interest rate and that the FED will not rush into raising interest rates.

The euro traded moderately higher against the greenback after Eurozone's finance ministers approved the four-month bailout extension on Tuesday and accepted the list of reforms proposed by the Greek government.

The Australian dollar jumped as data on the HSBC China PMI showed an increase into positive territory. The HSBC Manufacturing PMI rose from 49.7 to 50.1 to a four month-high, above the estimated reading of 49.6. A reading above 50 represents growth in activity. Domestic demand firmed while new export orders contracted for the first time since April 2014. Both input and output prices remain in contraction, according to HSBC.China is Australia's biggest trade partner. Construction Work Done for the fourth quarter decreased less than expected by -0.2% compared to a forecast of -0.8% and a previous reading of -2.8% (revised from -2.2%). The Wage Price Index on a quarterly basis remained unchanged at +0.6%, analysts expected wages to rise by +0.7%. Year on year the Wage Price Index declined from +2.6% to +2.5% in line with expectations.

New Zealand's dollar rose against the greenback after the better-than expected HSBC China February flash manufacturing PMI. Today data on Visitor arrivals and New Zealand's Trade balance are due at 21:45 GMT.

The Japanese yen traded higher against the greenback on Wednesday in the absence of any major economic reports from Japan.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom BBA Mortgage Approvals January 35.7 36.2

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. New Home Sales January 484 477

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

15:30 U.S. Crude Oil Inventories February +7.7

16:30 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Visitor Arrivals January -1.3%

21:45 New Zealand Trade Balance, mln January -159 -157

-

08:13

Options levels on wednesday, February 25, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1484 (2512)

$1.1451 (3178)

$1.1402 (1965)

Price at time of writing this review: $1.1354

Support levels (open interest**, contracts):

$1.1316 (3577)

$1.1288 (5000)

$1.1237 (4545)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 106523 contracts, with the maximum number of contracts with strike price $1,1500 (6400);

- Overall open interest on the PUT options with the expiration date March, 6 is 109913 contracts, with the maximum number of contracts with strike price $1,1200 (5446);

- The ratio of PUT/CALL was 1.03 versus 1.04 from the previous trading day according to data from February, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5801 (676)

$1.5701 (1142)

$1.5603 (2338)

Price at time of writing this review: $1.5492

Support levels (open interest**, contracts):

$1.5394 (1580)

$1.5297 (2067)

$1.5198 (1992)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 29699 contracts, with the maximum number of contracts with strike price $1,5500 (2547);

- Overall open interest on the PUT options with the expiration date March, 6 is 35312 contracts, with the maximum number of contracts with strike price $1,5300 (2067);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from February, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Switzerland: UBS Consumption Indicator, January 1.24

-

02:45

China: HSBC Manufacturing PMI, February 50.1 (forecast 49.6)

-

01:31

Australia: Construction Work Done, Quarter IV -0.2% (forecast -0.8%)

-

01:31

Australia: Wage Price Index, q/q, Quarter IV +0.6% (forecast +0.7%)

-

01:31

Australia: Wage Price Index, y/y, Quarter IV +2.5% (forecast +2.5%)

-

00:30

Currencies. Daily history for Feb 24’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1338 +0,04%

GBP/USD $1,5452 -0,03%

USD/CHF Chf0,9505 +0,09%

USD/JPY Y118,96 +0,13%

EUR/JPY Y134,90 +0,19%

GBP/JPY Y183,81 +0,11%

AUD/USD $0,7830 +0,37%

NZD/USD $0,7490 -0,44%

USD/CAD C$1,2483 -0,70%

-

00:03

Schedule for today, Wednesday, Feb 25’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Construction Work Done Quarter IV -2.2% -0.8%

00:30 Australia Wage Price Index, q/q Quarter IV +0.6% +0.7%

00:30 Australia Wage Price Index, y/y Quarter IV +2.6% +2.5%

01:45 China HSBC Manufacturing PMI (Preliminary) February 49.7 49.6

07:00 Switzerland UBS Consumption Indicator January 1.42

09:30 United Kingdom BBA Mortgage Approvals January 35.7 36.2

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. New Home Sales January 484 477

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

15:30 U.S. Crude Oil Inventories February +7.7

16:30 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Visitor Arrivals January -1.3%

21:45 New Zealand Trade Balance, mln January -159 -157

-