Noticias del mercado

-

17:33

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data. The U.S. consumer price inflation fell 0.7% in January, missing expectations for a 0.6% decrease, after a 0.4% decline in December. That was largest decline since December 2008.

The declines was driven by lower gasoline prices. Gasoline prices dropped 18.7 in January, the biggest decline since December 2008.

On a yearly basis, the U.S. consumer price index fell to -0.1% in January from 0.8% in December. That was the lowest level since October 2009.

The U.S. consumer price inflation excluding food and energy gained 0.2% in January, exceeding expectations for a 0.1% increase, after a flat reading in December.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.6% in January.

The U.S. durable goods orders rose 2.8% in January, exceeding expectations for a 1.7% increase, after a 3.7% decline in December. December's figure was revised down from a 3.3% decrease.

The decline was driven by increasing demand for computers and machinery.

The U.S. durable goods orders excluding transportation climbed 0.3% in January, missing expectations for a 0.6% gain, after a 0.9% decrease in December. December's figure was revised down from a 0.8% fall.

The number of initial jobless claims in the week ending February 21 in the U.S. climbed by 31,000 to 313,000 from 282,000 in the previous week, missing expectations for a rise by 3,000. The previous week's figure was revised up from 283,000.

The euro dropped against the U.S. dollar. The number of unemployed people in Germany declined by 20,000 in February, exceeding expectations for a 10,000 decline, after a 10,000 drop in January. January's figure was revised up from a 9,000 decrease.

Germany's adjusted unemployment rate remained unchanged at 6.5% in February, in line with expectations.

The Gfk German consumer confidence index increased to 9.7 in March from 9.3 in February, beating forecasts for a rise to 9.6.

Eurozone's adjusted M3 money supply rose 4.1% in January, exceeding expectations for a 3.8% increase, after a 3.6 gain in December.

Concerns over Greek bailout programme still weigh on the euro.

The British pound decreased against the U.S. dollar. The U.K. revised GDP (gross domestic product) climbed by 0.5% in the fourth quarter, in line with expectations and the previous estimate.

On a yearly basis, the U.K. revised GDP gained 2.7% in the fourth quarter, in line with expectations and the previous estimate.

The U.K. business investment fell 1.4% in the fourth quarter, missing forecasts for a 2.3% gain, after a 1.2% decline in the third quarter. The third quarter's reading was revised up from a 1.4% drop.

The Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian consumer price inflation data. Canadian consumer price inflation decreased 0.2% in January, beating expectations for a 0.3% decline, after a 0.7% drop in December.

On a yearly basis, the consumer price index fell to 1.0% January from 1.5% in December. That was the lowest level since November 2013.

The consumer price index was driven by lower gasoline prices. Gasoline prices plunged 12.4% in January from a month earlier.

Canadian core consumer price index, which excludes some volatile goods, increased 0.2% in January, exceeding expectations for a 0.1%, after a 0.3% decrease in December.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.2% in January.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback after the better-than-expected trade data from New Zealand. New Zealand's trade surplus was NZ$56 million in January, up from a deficit of NZ$195 million in December. December's figure was revised down from a deficit of NZ$159 million. Analysts had expected a deficit of NZ$157 million.

The Australian dollar declined against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback. Private capital expenditure in Australia dropped 2.2% in the fourth quarter, missing expectations for a 1.1% decline, after a 0.6 gain in the third quarter. The third quarter's figure was revised up from a 0.2% increase.

The Japanese yen fell against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback in the absence of any major economic reports from Japan.

-

16:39

U.S. durable goods orders rises 2.8% in January

The U.S. Commerce Department released durable goods orders data on Thursday. The U.S. durable goods orders rose 2.8% in January, exceeding expectations for a 1.7% increase, after a 3.7% decline in December. December's figure was revised down from a 3.3% decrease.

The decline was driven by increasing demand for computers and machinery.

The U.S. durable goods orders excluding transportation climbed 0.3% in January, missing expectations for a 0.6% gain, after a 0.9% decrease in December. December's figure was revised down from a 0.8% fall.

The U.S. durable goods orders excluding defence increased 0.6% in January.

-

16:02

U.S. consumer price inflation fell 0.7% in January

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation fell 0.7% in January, missing expectations for a 0.6% decrease, after a 0.4% decline in December. That was largest decline since December 2008.

The declines was driven by lower gasoline prices. Gasoline prices dropped 18.7 in January, the biggest decline since December 2008.

On a yearly basis, the U.S. consumer price index fell to -0.1% in January from 0.8% in December. That was the lowest level since October 2009.

The U.S. consumer price inflation excluding food and energy gained 0.2% in January, exceeding expectations for a 0.1% increase, after a flat reading in December.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.6% in January.

Energy costs dropped 9.7% in January, the largest drop since November 2008.

-

15:43

Canadian consumer price inflation declines 0.2% in January

Statistics Canada released consumer price inflation data on Thursday. Canadian consumer price inflation decreased 0.2% in January, beating expectations for a 0.3% decline, after a 0.7% drop in December.

On a yearly basis, the consumer price index fell to 1.0% January from 1.5% in December. That was the lowest level since November 2013.

The consumer price index was driven by lower gasoline prices. Gasoline prices plunged 12.4% in January from a month earlier.

Canadian core consumer price index, which excludes some volatile goods, increased 0.2% in January, exceeding expectations for a 0.1%, after a 0.3% decrease in December.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.2% in January.

The Bank of Canada's inflation target is 2.0%.

-

15:04

U.S.: Housing Price Index, y/y, December +5.4%

-

15:02

U.S.: Housing Price Index, m/m, December +0.8% (forecast +0.5%)

-

14:46

Option expiries for today's 10:00 ET NY cut

USDJPY 119.50 (USD 711m) 120.00 (USD 605m)

EURUSD 1.1505-10 (EUR 1bln) 1.1550 (EUR 1.2bln)

EURGBP 0.7400 (EUR 1bln)

USDCAD 1.2300 (USD 515m) 1.2375 (USD 302m) 1.2450 (USD 320m) 1.2525 (USD 580m) 1.2550 (EUR 486m) 1.2600 (USD 561m) 1.2675 (USD 800m)

AUDUSD 0.7755 (AUD 348m) 0.7885 (AUD 313m) 0.7900 (AUD 303m) 0.7980 (AUD 313m)

-

14:34

U.S.: CPI excluding food and energy, Y/Y, January +1.6%

-

14:34

U.S.: CPI excluding food and energy, m/m, January +0.2% (forecast +0.1%)

-

14:33

U.S.: Durable Goods Orders ex Transportation , January +0.3% (forecast +0.6%)

-

14:33

Canada: Consumer price index, y/y, January +1.0%

-

14:33

U.S.: CPI, m/m , January -0.7% (forecast -0.6%)

-

14:32

U.S.: CPI, Y/Y, January -0.1%

-

14:32

U.S.: Durable Goods Orders , January +2.8% (forecast +1.7%)

-

14:31

Canada: Bank of Canada Consumer Price Index Core, m/m, January +0.2% (forecast +0.1%)

-

14:31

Canada: Bank of Canada Consumer Price Index Core, y/y, January +2.2%

-

14:30

U.S.: Initial Jobless Claims, February 313 (forecast 285)

-

14:30

Canada: Consumer Price Index m / m, January -0.2% (forecast -0.3%)

-

14:24

Gfk German consumer confidence index climbed to the highest level since October 2001

Market research company GfK released its consumer confidence index for Germany on Wednesday. The Gfk German consumer confidence index increased to 9.7 in March from 9.3 in February, beating forecasts for a rise to 9.6. That was the highest level since October 2001.

Gfk said that "the drop in energy prices is boosting the purchasing power of private households and opening up room for further spending ".

A weaker euro and falling oil prices boost consumers' purchasing power and German exporters.

-

14:05

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the mostly better-than-expected data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Private Capital Expenditure Quarter IV +0.6% Revised From +0.2% -1.3% -2.2%

07:00 United Kingdom Nationwide house price index February +0.3%

07:00 United Kingdom Nationwide house price index, y/y February +6.8%

07:00 Germany Gfk Consumer Confidence Survey March 9.3 9.6 9.7

08:55 Germany Unemployment Change February -10 Revised From -9 -10 -20

08:55 Germany Unemployment Rate s.a. February 6.5% 6.5% 6.5%

09:00 Eurozone M3 money supply, adjusted y/y January +3.6% +3.8% +4.1%

09:00 Eurozone Private Loans, Y/Y January -0.5% -0.3% -0.1%

09:30 United Kingdom Business Investment, q/q Quarter IV -1.2% Revised From -1.4% +2.3% -1.4%

09:30 United Kingdom Business Investment, y/y Quarter IV +6.3% Revised From +2.7% +2.1%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV +0.5% +0.5% +0.5%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV +2.7% +2.7% +2.7%

10:00 Eurozone Business climate indicator February 0.16 0.1

10:00 Eurozone Economic sentiment index February 101.4 Revised From 101.2 102.0

10:00 Eurozone Industrial confidence February -5 -4.7

The U.S. dollar traded mixed to higher against the most major currencies ahead the U.S. economic data. The U.S. durable goods orders are expected to increase 1.7% in January, after a 3.3% drop in December.

The U.S. durable goods orders excluding transportation are expected to rise 0.6% in January, after a 0.8% fall in December.

The U.S. consumer price inflation is expected to decline 0.6% in January, after a 0.4% drop in December.

The U.S. consumer price index excluding food and energy is expected to rise 0.1% in January, after a flat reading in December.

The number of initial jobless claims in the U.S. is expected to rise by 2,000 to 285,000.

The euro traded lower against the U.S. dollar despite the mostly better-than-expected data from the Eurozone. The number of unemployed people in Germany declined by 20,000 in February, exceeding expectations for a 10,000 decline, after a 10,000 drop in January. January's figure was revised up from a 9,000 decrease.

Germany's adjusted unemployment rate remained unchanged at 6.5% in February, in line with expectations.

The Gfk German consumer confidence index increased to 9.7 in March from 9.3 in February, beating forecasts for a rise to 9.6.

Eurozone's adjusted M3 money supply rose 4.1% in January, exceeding expectations for a 3.8% increase, after a 3.6 gain in December.

Concerns over Greek bailout programme still weigh on the euro.

The British pound fell against the U.S. dollar after the U.K. economic data. The U.K. revised GDP (gross domestic product) climbed by 0.5% in the fourth quarter, in line with expectations and the previous estimate.

On a yearly basis, the U.K. revised GDP gained 2.7% in the fourth quarter, in line with expectations and the previous estimate.

The U.K. business investment fell 1.4% in the fourth quarter, missing forecasts for a 2.3% gain, after a 1.2% decline in the third quarter. The third quarter's reading was revised up from a 1.4% drop.

The Canadian dollar fell against the U.S. dollar ahead of Canadian consumer price inflation data. The consumer price index in Canada is expected to decline to 0.6% in January, after a 0.4% fall in December.

The core consumer price index in Canada is expected to rise 0.1% in January, after a 0.3 decline in December.

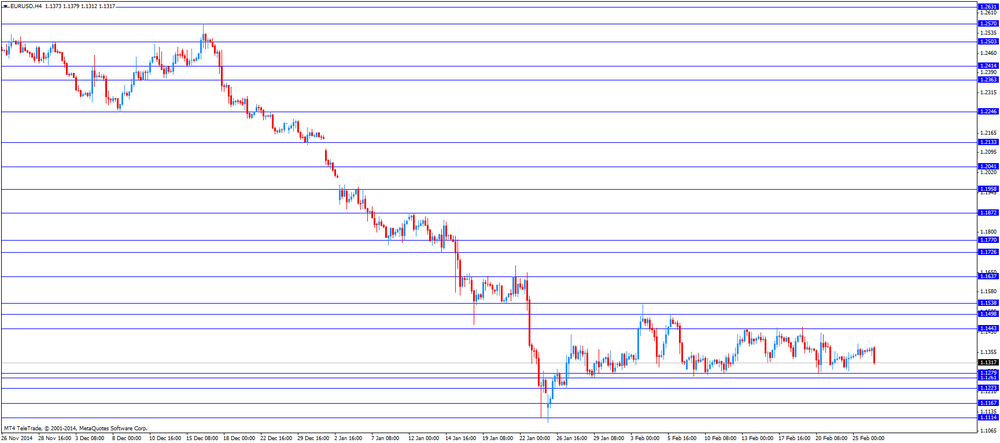

EUR/USD: the currency pair fell to $1.1312

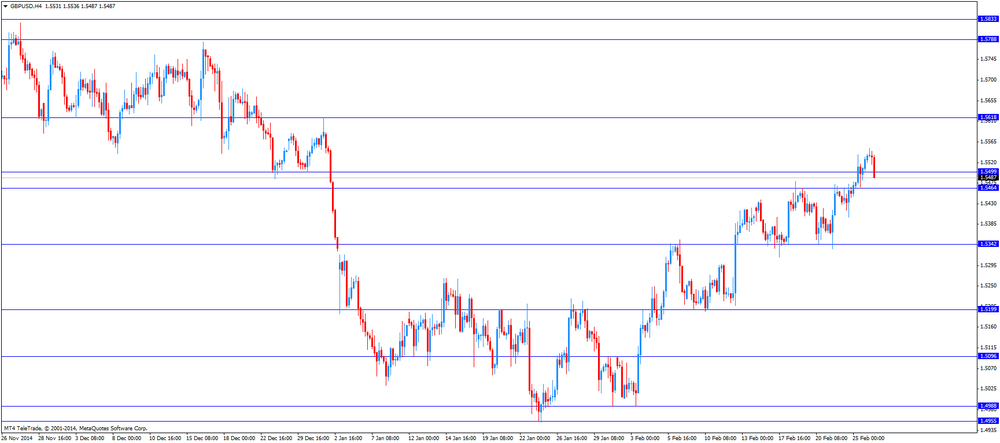

GBP/USD: the currency pair declined to $1.5487

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Consumer Price Index m / m January -0.7% -0.3%

13:30 Canada Consumer price index, y/y January +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m January -0.3% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January +2.2%

13:30 U.S. Durable Goods Orders January -3.3% Revised From -3.4% +1.7%

13:30 U.S. Durable Goods Orders ex Transportation January -0.8% +0.6%

13:30 U.S. Initial Jobless Claims February 283 285

13:30 U.S. CPI, m/m January -0.4% -0.6%

13:30 U.S. CPI, Y/Y January +0.8%

13:30 U.S. CPI excluding food and energy, m/m January 0.0% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y January +1.6%

18:00 U.S. FOMC Member Dennis Lockhart Speaks

21:45 New Zealand Building Permits, m/m January -2.1%

23:30 Japan Unemployment Rate January 3.4% 3.4%

23:30 Japan Household spending Y/Y January -3.4% -4.0%

23:30 Japan Tokyo Consumer Price Index, y/y February +2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y February +2.2% +2.2%

23:30 Japan National Consumer Price Index, y/y January +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y January +2.5% +2.4%

23:50 Japan Retail sales, y/y January +0.1% Revised From +0.2% -1.1%

23:50 Japan Industrial Production (MoM) (Preliminary) January +0.8% +3.1%

23:50 Japan Industrial Production (YoY) (Preliminary) January +1.0%

-

14:00

Orders

EUR/USD

Offers 1.1380 1.1400 1.1425 1.1445-50 1.1485 1.1500 1.1530

Bids 1.1340 1.1320 1.1300 1.1290 1.1270-75 1.1240-50 1.1225 1.1200

GBP/USD

Offers 1.5550-55 1.5580 1.5600 1.5625-30 1.5650

Bids 1.5500 1.5480 1.5450 1.5425 1.5400 1.5375-80 1.5350

EUR/JPY

Offers 135.00 135.50 135.80 136.00 136.20

Bids 134.70 134.50 134.00 133.80 133.50

USD/JPY

Offers 119.00 119.20 119.35 119.50 119.80 120.00 120.25-30

Bids 118.60 118.40 118.20 118.00 117.85 117.60

EUR/GBP

Offers 0.7325-30 0.7345-50 0.7385 0.7400 0.7420-25 0.7440 0.7450-55

Bids 0.7300-05 0.7285 0.7250-55 0.7230 0.7200-10

AUD/USD

Offers 0.7900-10 0.7930 0.7975 0.8000

Bids 0.7860 0.7840 0.7825 0.7800 0.7780 0.7760

-

11:50

U.K.: GDP unchanged / Business Investment declines / Sterling almost unchaged

The U.K. economy grew as expected by +0.5% in the fourth quarter of 2014, compared to +0.7% in the previous quarter. The figure was unrevised from the Office for National Statistics original estimate. Year on year the economy expanded +2.7%, also in line with expectations. The data underlined the optimism about the country's economy.

Business Investment fell at the fastest pace in almost six years by -1.4%, far below estimates of an increase of +2.3% and below a revised previous reading of -1.2% (revised from -1.4%). Lower oil prices led to declining investments in the energy sector. Year on year Business Investment rose less at a pace of +2.3% compared to revised +6.3% (+2.7%).

-

11:22

Option expiries for today's 10:00 ET NY cut

USDJPY 119.50 (USD 711m) 120.00 (USD 605m)

EURUSD 1.1505-10 (EUR 1bln) 1.1550 (EUR 1.2bln)

EURGBP 0.7400 (EUR 1bln)

USDCAD 1.2300 (USD 515m) 1.2375 (USD 302m) 1.2450 (USD 320m) 1.2525 (USD 580m) 1.2550 (EUR 486m) 1.2600 (USD 561m) 1.2675 (USD 800m)

AUDUSD 0.7755 (AUD 348m) 0.7885 (AUD 313m) 0.7900 (AUD 303m) 0.7980 (AUD 313m)

-

11:00

Eurozone: Economic sentiment index , February 102.0

-

11:00

Eurozone: Industrial confidence, February -4.7

-

11:00

Eurozone: Business climate indicator , February 0.1

-

11:00

German Unemployment drops in February

Today the Federal Labor Agency in Nürnberg reported that the number of unemployed people sank twice the forecasted amount. Economists predicted a drop of 10,000 but data showed it declined by seasonally adjusted 20,000 to 2.8 million - a proof that Eurozone's biggest economy is growing.

The Unemployment Rate remained unchanged at 6.5%, in line with forecasts and at a record low.

Frank-Juergen Weise, president of Germany's Federal Labour Agency, confirmed at a press conference the optimistic view of the labour market and said that companies will expand activity.

-

10:31

United Kingdom: Business Investment, q/q, Quarter IV -1.4% (forecast +2.3%)

-

10:31

United Kingdom: Business Investment, y/y, Quarter IV +2.1%

-

10:30

United Kingdom: GDP, q/q, Quarter IV +0.5% (forecast +0.5%)

-

10:30

United Kingdom: GDP, y/y, Quarter IV +2.7% (forecast +2.7%)

-

10:20

Press Review: German conservatives back Greek aid extension in test vote

BLOOMBERG

Yellen Says 'Audit the Fed' Would Politicize Monetary Policy

(Bloomberg) -- Chair Janet Yellen strongly criticized a proposal to allow congressional audits of the Federal Reserve's monetary policy and lawmakers from both parties agreed that it was a bad idea to expose the Fed to political meddling.

"Audit the Fed is a bill that would politicize monetary policy, would bring short-term political pressures to bear on the Fed," Yellen said Tuesday during testimony to the Senate Banking Committee. She said such a law isn't needed because the Fed already is "extensively audited."

Republicans who now control both chambers of Congress for the first time in eight years have proposed bills to put the Fed under more scrutiny.

REUTERS

German conservatives back Greek aid extension in test vote

Reuters) - An overwhelming majority of German Chancellor Angela Merkel's conservatives supported an extension of the Greek bailout in a test ballot on Thursday, one day before a vote in the Bundestag lower house of parliament, according to participants.

In the test ballot, 22 lawmakers in the conservative bloc opposed the extension and five abstained. In total, there are 311 lawmakers in the bloc, which includes members of the chancellor's Christian Democratic Union (CDU) and its sister party, the Bavarian Christian Social Union (CSU).

Source: http://www.reuters.com/article/2015/02/26/us-eurozone-greece-germany-idUSKBN0LU0MQ20150226

BLOOMBERG

The Japanese Aren't Benefiting from Cheaper Oil - The Yen Is the Reason Why

Spare a thought for Japan -- the nation imports almost all its energy and stood to make windfall gains from the collapse in oil prices, only to see the benefits slip away as the yen slumped to near seven-year lows.

This means that Japanese consumers and companies aren't getting as big a boost as in the U.S. and elsewhere, even as the government is counting on them to increase spending to help boost an economy recovering from a recession.

Brent, the benchmark contract for more than half the world's oil, has fallen more than 40 percent from a June peak, while gasoline in Japan dropped just 11 percent over the same period, according to data from the economy ministry. The yen has weakened more than 14 percent against the dollar over that period, making imports more expensive.

Source: http://www.bloomberg.com/news/articles/2015-02-26/oil-s-impact-muted-by-yen

-

10:00

Eurozone: M3 money supply, adjusted y/y, January +4.1% (forecast +3.8%)

-

10:00

Eurozone: Private Loans, Y/Y, January -0.1% (forecast -0.3%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers on mixed data and Yellen commments

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Private Capital Expenditure Quarter IV +0.2% -1.3%

07:00 United Kingdom Nationwide house price index February +0.3%

07:00 United Kingdom Nationwide house price index, y/y February +6.8%

07:00 Germany Gfk Consumer Confidence Survey January 9.3 9.6

The U.S. dollar traded mixed against its major peers, adding gains against the Japanese yen and the Australian dollar. Yesterday FED Chair Janet Yellen testified before the House Financial Services Committee and reiterated that it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings" as the labour market is improving but inflation and wage growth are too low. A rate hike in June is seen less likely. The FED's policy is in contrast to those of its counterparts in Europe, China and Japan as they boost their economies with loose monetary policy. The euro traded almost flat against the greenback.

The Australian dollar declined versus the U.S. dollar after yesterday's gains and retreated from a one-month high. Private Capital Expenditure declined -2.2% in the fourth quarter. Analysts expected a decline of -1.2%. Data for the previous quarter was revised up from +0.2% to +0.6%.

New Zealand's dollar rose against the greenback. Visitor arrivals that came in at +3.4% compared to -1.3% in December. Data on New Zealand's Trade balance came in better-than-expected and swung to a surplus supported by increases in the exports of fruit and wine while imports declined sharply. The country recorded a 56 million surplus in January, beating forecasts of a deficit of 157 million NZD. Data on Building Permits is due at 21:45 GMT.

The Japanese yen traded lower against the greenback on Thursday on comments of BoJ board member Koji Ishida, one of the four who voted against further easing, that further changes to the monetary policy should not only aim at reaching the 2% inflation-target but to ensure long-term economic stability. He further said that it is too early to discuss an exit from the monetary easing but the BoJ should be careful in extending the monetary stimulus.

EUR/USD: the euro traded almost flat against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:55 Germany Unemployment Change February -9 -10

08:55 Germany Unemployment Rate s.a. February 6.5% 6.5%

09:00 Eurozone M3 money supply, adjusted y/y January +3.6% +3.8%

09:00 Eurozone Private Loans, Y/Y January -0.5% -0.3%

09:30 United Kingdom Business Investment, q/q Quarter IV -1.4% +2.3%

09:30 United Kingdom Business Investment, y/y Quarter IV +2.7%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV +0.5% +0.5%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV +2.7% +2.7%

10:0 Eurozone Business climate indicator February 0.16

10:00 Eurozone Economic sentiment index February 101.2

10:00 Eurozone Industrial confidence February -5

10:15 Eurozone Targeted LTRO 129.8

13:30 Canada Consumer Price Index m / m January -0.7% -0.3%

13:30 Canada Consumer price index, y/y January +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m January -0.3% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January +2.2%

13:30 U.S. Durable Goods Orders January -3.3% Revised From -3.4% +1.7%

13:30 U.S. Durable Goods Orders ex Transportation January -0.8% +0.6%

13:30 U.S. Initial Jobless Claims February 283 285

13:30 U.S. CPI, m/m January -0.4% -0.6%

13:3 U.S. CPI, Y/Y January +0.8%

13:30 U.S. CPI excluding food and energy, m/m January 0.0% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y January +1.6%

14:00 U.S. Housing Price Index, m/m December +0.8% +0.5%

14:00 U.S. Housing Price Index, y/y December +5.3%

18:00 U.S. FOMC Member Dennis Lockhart Speaks

21:45 New Zealand Building Permits, m/m January -2.1%

23:30 Japan Unemployment Rate January 3.4% 3.4%

23:30 Japan Household spending Y/Y January -3.4% -4.0%

23:30 Japan Tokyo Consumer Price Index, y/y February +2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y February +2.2% +2.2%

23:30 Japan National Consumer Price Index, y/y January +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y January +2.5% +2.4%

23:50 Japan Retail sales, y/y January +0.1% Revised From +0.2% -1.1%

23:50 Japan Industrial Production (MoM) (Preliminary) January +0.8% +3.1%

23:50 Japan Industrial Production (YoY) (Preliminary) January +1.0%

-

08:13

Options levels on thursday, February 26, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1481 (2842)

$1.1448 (3329)

$1.1403 (1874)

Price at time of writing this review: $1.1368

Support levels (open interest**, contracts):

$1.1343 (3547)

$1.1314 (4996)

$1.1259 (4675)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 106872 contracts, with the maximum number of contracts with strike price $1,1500 (6220);

- Overall open interest on the PUT options with the expiration date March, 6 is 109754 contracts, with the maximum number of contracts with strike price $1,1200 (5527);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from February, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.5800 (644)

$1.5701 (1132)

$1.5604 (2317)

Price at time of writing this review: $1.5536

Support levels (open interest**, contracts):

$1.5495 (1479)

$1.5398 (1683)

$1.5299 (2081)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 29935 contracts, with the maximum number of contracts with strike price $1,5500 (2791);

- Overall open interest on the PUT options with the expiration date March, 6 is 35714 contracts, with the maximum number of contracts with strike price $1,5300 (2081);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from February, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Gfk Consumer Confidence Survey, January 9.7 (forecast 9.6)

-

01:30

Australia: Private Capital Expenditure, Quarter IV -2.2% (forecast -1.3%)

-

00:36

Currencies. Daily history for Feb 25’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1361 +0,20%

GBP/USD $1,5527 +0,48%

USD/CHF Chf0,9482 -0,24%

USD/JPY Y118,85 -0,09%

EUR/JPY Y135,00 +0,07%

GBP/JPY Y184,54 +0,40%

AUD/USD $0,7886 +0,71%

NZD/USD $0,7554 +0,85%

USD/CAD C$1,2434 -0,39%

-

00:01

Schedule for today, Thursday, Feb 26’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Private Capital Expenditure Quarter IV +0.2% -1.3%

07:00 United Kingdom Nationwide house price index February +0.3%

07:00 United Kingdom Nationwide house price index, y/y February +6.8%

07:00 Germany Gfk Consumer Confidence Survey January 9.3 9.6

08:55 Germany Unemployment Change February -9 -10

08:55 Germany Unemployment Rate s.a. February 6.5% 6.5%

09:00 Eurozone M3 money supply, adjusted y/y January +3.6% +3.8%

09:00 Eurozone Private Loans, Y/Y January -0.5% -0.3%

09:30 United Kingdom Business Investment, q/q Quarter IV -1.4% +2.3%

09:30 United Kingdom Business Investment, y/y Quarter IV +2.7%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV +0.5% +0.5%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV +2.7% +2.7%

10:0 Eurozone Business climate indicator February 0.16

10:00 Eurozone Economic sentiment index February 101.2

10:00 Eurozone Industrial confidence February -5

10:15 Eurozone Targeted LTRO 129.8

13:30 Canada Consumer Price Index m / m January -0.7% -0.3%

13:30 Canada Consumer price index, y/y January +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m January -0.3% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January +2.2%

13:30 U.S. Durable Goods Orders January -3.3% Revised From -3.4% +1.7%

13:30 U.S. Durable Goods Orders ex Transportation January -0.8% +0.6%

13:30 U.S. Initial Jobless Claims February 283 285

13:30 U.S. CPI, m/m January -0.4% -0.6%

13:3 U.S. CPI, Y/Y January +0.8%

13:30 U.S. CPI excluding food and energy, m/m January 0.0% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y January +1.6%

14:00 U.S. Housing Price Index, m/m December +0.8% +0.5%

14:00 U.S. Housing Price Index, y/y December +5.3%

18:00 U.S. FOMC Member Dennis Lockhart Speaks

21:45 New Zealand Building Permits, m/m January -2.1%

23:30 Japan Unemployment Rate January 3.4% 3.4%

23:30 Japan Household spending Y/Y January -3.4% -4.0%

23:30 Japan Tokyo Consumer Price Index, y/y February +2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y February +2.2% +2.2%

23:30 Japan National Consumer Price Index, y/y January +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y January +2.5% +2.4%

23:50 Japan Retail sales, y/y January +0.1% Revised From +0.2% -1.1%

23:50 Japan Industrial Production (MoM) (Preliminary) January +0.8% +3.1%

23:50 Japan Industrial Production (YoY) (Preliminary) January +1.0%

-