Noticias del mercado

-

21:00

Dow +0.02% 18,213.55 +4.36 Nasdaq -0.07% 4,964.53 -3.59 S&P -0.11% 2,113.06 -2.42

-

18:10

European stocks close: most stocks closed lower as oil and banking shares declined

Most stock indices closed lower as oil and banking shares declined.

Investors are cautions despite new debt deal between Greece and the European Union.

The number of mortgage approvals increased to 36,700 in January from 35,800 in December, exceeding expectations for a rise to 36,200. December's figure was revised up from 35,700.

The Bank of England (BoE) Governor Mark Carney said nothing about the monetary policy at today's launch of the One Bank Research Agenda.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,935.38 14.25 -0.21 %

DAX 11,210.27 +4.53 +0.04 %

CAC 40 4,882.22 -4.22 -0.09 %

-

18:00

European stocks closed: FTSE 100 6,929.31 -20.32 -0.29% CAC 40 4,883.01 -3.43 -0.07% DAX 11,211.62 +5.88 +0.05%

-

17:40

Oil: а review of the market situation

Brent oil prices rose moderately, entrenched above $ 59 per barrel, which helped the data for China, as well as statements by the Minister of the oil industry in Saudi Arabia. Meanwhile, the price of WTI crude oil lost part of the earned positions on the background of the report on stocks.

Recall preliminary PMI index in the manufacturing sector of China from HSBC / Markit for February rose to 50.1 against 49.7 in January. It was expected that the rate will drop to 49.6 points. Expansion of production and overall new orders was more rapid than in the previous month, but up new export orders declined, while the employment sub-index showed a more rapid decline than in January. "The data indicate a slight improvement in the industrial sector in China during the New Year celebrations. However, economic activity is likely to remain sluggish, and external demand looks uncertain, "- said economist at HSBC Qu Hongbin China.

Meanwhile, today Saudi Oil Minister Ali al-Nuaimi said that the demand for oil is growing. He also said that the oil market all the "easy". Saudi minister comments are very similar to the report of the Organization of Petroleum Exporting Countries, published in February. According to the report, the cartel expects to increase fuel consumption in the United States that will strengthen the demand for oil and may contribute to higher prices later in the year.

Higher prices also helped statement Fed Chairman Janet Yellen that the US central bank is willing to discuss raising interest rates "from meeting to meeting." According to some investors, this means that rates will not rise in June, as predicted by most analysts and later.

Pressure on the price of WTI crude oil has had a report from the US Department of Energy, which showed that during the week February 14-20 oil reserves rose by 8.4 million barrels to 434.1 million barrels, while the expected increase of 4.7 million barrels. Now stocks are at historical highs from August 1982. Oil reserves in Cushing terminal rose by 2.4 million barrels to 48.7 million barrels. Gasoline inventories fell by 3.1 million barrels to 240 million barrels. Analysts had expected a decline of 1.1 million barrels. Distillate stocks fell by 2.7 million barrels to 124.7 million barrels, while analysts had expected a decline of 3.3 million barrels. Utilization rate of refining capacity decreased by 1.3% to 87.4%. Analysts expected a decline of 0.5%.

It is worth emphasizing, oil prices have stabilized in recent weeks. But analysts note that the decline may continue as global supply still exceeds demand.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) rose to 49.77 dollars per barrel on the New York Mercantile Exchange.

April futures price for North Sea petroleum mix of Brent increased by $ 0.93 to $ 59.63 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:29

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. economic data. New home sales declined 0.2% to a seasonally adjusted annual rate of 481,000 units in January from 482,000 units in December, the highest level since June 2008.

December's figure was revised up from 481,000 units.

Analysts had expected new home sales to reach 477,000 units.

The decline was driven by weaker sales in the Northeast.

The mortgage delinquency rate fell to 5.68% in the fourth quarter from 5.85% in the third quarter. That was the lowest reading the third quarter of 2007.

The Fed Chair Janet Yellen testified before the House Financial Services Committee on Wednesday. Her remarks were identical to yesterday's remarks.

Yesterday's comments by the Fed Chair Janet Yellen weighed on the greenback. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings".

The euro traded higher against the U.S. dollar. Concerns over Greek bailout programme still weighed on the euro.

The European Central Bank President Mario Draghi will speak at 16:30 GMT0.

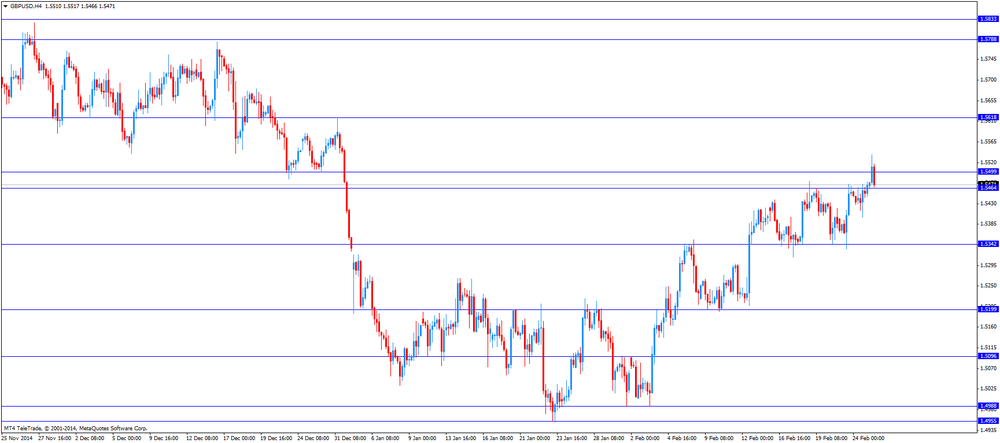

The British pound traded higher against the U.S. dollar. The number of mortgage approvals increased to 36,700 in January from 35,800 in December, exceeding expectations for a rise to 36,200. December's figure was revised up from 35,700.

The Bank of England (BoE) Governor Mark Carney said nothing about the monetary policy at today's launch of the One Bank Research Agenda.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's UBS consumption indicator decreased to 1.24 points in January from 1.42 points in December.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the better-than-expected Chinese preliminary manufacturing PMI. Chinese preliminary manufacturing PMI increased to 50.1 in February from 49.7 in January, beating expectations for a decline to 49.6.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the mixed economic from Australia. Wage price index in Australia rose by 0.6% in the fourth quarter, missing expectations for a 0.7% gain, after a 0.6% increase in the previous quarter.

Construction work done in Australia fell 0.2% in the fourth quarter, beating expectations for a 0.8% decline, after a 2.8% drop in the third quarter. The third quarter's figure was revised down from 2.2% decrease.

Chinese preliminary manufacturing PMI supported the Aussie.

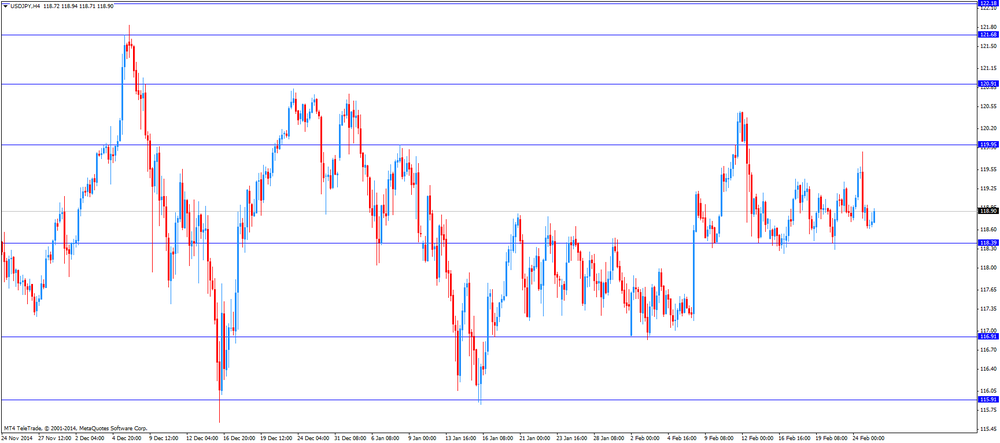

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback in the absence of any major economic reports from Japan.

-

17:20

Gold: а review of the market situation

Gold futures rose moderately, further retreating from a seven-week low, after the Fed chief signaled that the rate increase is not inevitable. Yesterday Yellen said that the Fed will show flexibility in the timing of raising the base interest rate. She also emphasized that the changes in the formulation of positions Fed monetary policy should not be interpreted as an intention to necessarily raise rates at the next meeting. She added that sounded a statement on the results of the January meeting of the word "patience" that the Fed will show leadership with regard to interest rates, mean that their increase is unlikely "in the next couple of meetings." Among other things, the head of the Federal Reserve said risks to the US economy from other regions of the world. It is worth emphasizing, gold has been under pressure in recent weeks amid lingering expectations that this year, the Federal Reserve will raise interest rates. Expectations rise in interest rates has a negative impact on the dynamics of the price of gold, because it can not compete with earning assets at high rates.

Had little effect as of today's US data. The Commerce Department reported that sales of newly built, single-family homes fell by 0.2% compared to the previous month and reached a seasonally adjusted annual rate of 481 000. Economists had expected sales to fall to 477 000. The figures for the previous month was revised up level of 482,000 to 481,000 initial value, making December the strongest month since June 2008. Sales of new buildings account for about one-tenth of the total housing market, and monthly figures are often revised. The data showed that the weather could keep the housing market in the northeast. Sales of newly built, single-family homes in the region fell by 51.6% to an annual rate of 15 000, the lowest figure ever recorded. Sales in the West were lower, while the Midwest and South have recorded growth. Nationwide, the stock remains constant. Given the pace in January, it would take 5.4 months to exhaust the supply of newly built homes on the market. The average price of a house under construction was $ 294,300 in January, up 9.1% compared to $ 269,800 a year earlier.

Higher prices also helped by the fact that today many Chinese market participants returned after celebrating the New Year according to the lunar calendar, which lasted about a week. Since the beginning of the new year in China, experts expect an increase in demand for metals, including gold. Margins on the Shanghai Gold Exchange rose to $ 5- $ 6 per ounce to the spot price from $ 3- $ 4 before the Christmas holidays a week ago.

April futures price of gold on the COMEX today rose to 1203.90 dollars per ounce.

-

16:50

Mortgage delinquency rate declines to 5.68% in the fourth quarter

The Mortgage Bankers Association released its National Delinquency Survey on Wednesday. The mortgage delinquency rate fell to 5.68% in the fourth quarter from 5.85% in the third quarter. That was the lowest reading the third quarter of 2007.

The mortgage delinquency rate includes loans that are at least one payment past.

The vice president of the Mortgage Bankers Association Marina Walsh said that pre-crisis levels are reached.

-

16:40

New home sales declined 0.2% in January

The U.S. Commerce Department released new home sales data on Wednesday. New home sales declined 0.2% to a seasonally adjusted annual rate of 481,000 units in January from 482,000 units in December, the highest level since June 2008.

December's figure was revised up from 481,000 units.

Analysts had expected new home sales to reach 477,000 units.

The decline was driven by weaker sales in the Northeast. New home sales in the Northeast dropped 51.6%, the biggest drop since June 2012.

-

16:30

U.S.: Crude Oil Inventories, February +8.4

-

16:01

U.S.: Mortgage Delinquencies, Quarter IV 5.68%

-

16:00

U.S.: New Home Sales, January 481 (forecast 477)

-

15:35

U.S. Stocks open: Dow -0.01%, Nasdaq -0.18%, S&P -0.09%

-

15:28

Before the bell: S&P futures -0.08%, Nasdaq futures -0.16%

U.S. stock futures slightly down as investors looked ahead to a second day of testimony from Federal Reserve Chairwoman Janet Yellen.

Global markets:

Nikkei 18,585.2 -18.28 -0.10%

Hang Seng 24,778.28 +28.21 +0.11%

Shanghai Composite 3,229.57 -17.33 -0.53%

FTSE 6,921.7 -27.93 -0.40%

CAC 4,873.37 -13.07 -0.27%

DAX 11,189.53 -16.21 -0.14%

Crude oil $49.54 (+0.55%)

Gold $1206.90 (+0.80%)

-

15:13

Stocks before the bell

(company / ticker / price / change, % / volume)

UnitedHealth Group Inc

UNH

115.45

+0.02%

2.4K

Amazon.com Inc., NASDAQ

AMZN

378.73

+0.04%

1.7K

Wal-Mart Stores Inc

WMT

84.63

+0.07%

0.1K

Twitter, Inc., NYSE

TWTR

48.73

+0.08%

11.7K

General Electric Co

GE

25.43

+0.16%

31.7K

United Technologies Corp

UTX

124.05

+0.21%

0.1K

Chevron Corp

CVX

108.20

+0.22%

1.1K

AT&T Inc

T

34.14

+0.26%

4.8K

Tesla Motors, Inc., NASDAQ

TSLA

204.64

+0.26%

12.4K

Exxon Mobil Corp

XOM

89.68

+0.29%

4.9K

Facebook, Inc.

FB

78.68

+0.29%

22.7K

Verizon Communications Inc

VZ

49.38

+0.33%

1.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

21.30

+0.38%

1.4K

FedEx Corporation, NYSE

FDX

178.50

+0.39%

0.3K

Walt Disney Co

DIS

105.18

+0.49%

2.7K

Home Depot Inc

HD

117.45

+0.60%

7.1K

Barrick Gold Corporation, NYSE

ABX

12.67

+1.12%

14.7K

Yandex N.V., NASDAQ

YNDX

16.55

+1.22%

8.8K

American Express Co

AXP

80.86

0.00%

6.7K

Starbucks Corporation, NASDAQ

SBUX

93.45

0.00%

4.1K

McDonald's Corp

MCD

94.96

-0.02%

0.2K

International Business Machines Co...

IBM

164.73

-0.06%

2.0K

Google Inc.

GOOG

535.50

-0.11%

1.9K

The Coca-Cola Co

KO

42.07

-0.14%

57.6K

Citigroup Inc., NYSE

C

51.81

-0.17%

1.0K

Boeing Co

BA

154.01

-0.24%

0.6K

ALCOA INC.

AA

15.70

-0.25%

4.5K

General Motors Company, NYSE

GM

37.65

-0.26%

2.7K

Pfizer Inc

PFE

34.24

-0.29%

4.5K

Ford Motor Co.

F

16.31

-0.31%

13.1K

Yahoo! Inc., NASDAQ

YHOO

43.20

-0.41%

2.4K

Goldman Sachs

GS

191.41

-0.42%

17.6K

Apple Inc.

AAPL

131.62

-0.42%

219.4K

JPMorgan Chase and Co

JPM

60.55

-0.44%

0.5K

Cisco Systems Inc

CSCO

29.45

-0.61%

13.8K

Microsoft Corp

MSFT

43.82

-0.61%

4.6K

Intel Corp

INTC

34.00

-1.19%

43.9K

Hewlett-Packard Co.

HPQ

35.91

-6.70%

208.3K

-

15:09

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Hewlett-Packard (HPQ) target lowered to $43 from $46 at Monness Crespi & Hardt, to $38 from $39 at RBC Capital Mkts, to $38 from $40 at Mizuho

Home Depot (HD) target raised from $110 to $130 at Argus, from $116 to $127 at RBC Capital Mkts

Starbucks (SBUX) target raised from $102 to $107 Piper Jaffray

Apple (AAPL) target raised from $130 to $150 at Stifel

-

14:59

Company News: Hewlett-Packard (HPQ) reported better than expected first fiscal quarter earnings, but revenue missed forecasts

Hewlett-Packard (HPQ) earned $0.92 per share in the first fiscal quarter, beating analysts' estimate of $0.91. Revenue in the first fiscal quarter decreased 4.7% year-over-year to $26.84 billion, missing analysts' estimate of $27.35 billion.

The company released its forecasts for second fiscal quarter. EPS is expected to be $0.84-$0.88 (analysts' estimate: $0.96).

The company expects EPS to be $3.53-$3.73 (revised down from $3.83-$4.03) in fiscal year 2015 (analysts' estimate: $3.95).

Hewlett-Packard (HPQ) shares decreased to $36.25 (-5.82%) prior to the opening bell.

-

14:49

Option expiries for today's 10:00 ET NY cut

USDJPY 118.00 (USD 577m) 119.40 (USD 506m) 120.00 (USD 1.1bln)

EURUSD 1.1200 (EUR 3.4bln) 1.1250 (EUR 5.4bln) 1.1300 (EUR 1.4bln) 1.1355 (EUR 995m) 1.1400 (1.59bln)

USDCAD 1.2500 (USD 765m) 1.2550 (USD 267m) 1.2560 (USD 200m) 1.2750 (USD 240m) 1.2800 (USD474m)

AUDUSD 0.7750 (AUD 435m) 0.7775 (AUD 496m) 0.7800 (AUD 690m) 0.7850 (AUD 449m)

NZDUSD 0.7450 (NZD 531m)

EURJPY 132.58 (EUR 760m) 133.85 (EUR 393m)

EURGBP 0.7325 (EUR 330m)

-

14:05

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the better-than-expected number of mortgage approvals from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Construction Work Done Quarter IV -2.8% Revised From -2.2% -0.8% -0.2%

00:30 Australia Wage Price Index, q/q Quarter IV +0.6% +0.7% +0.6%

00:30 Australia Wage Price Index, y/y Quarter IV +2.6% +2.5% +2.5%

01:45 China HSBC Manufacturing PMI (Preliminary) February 49.7 49.6 50.1

07:00 Switzerland UBS Consumption Indicator January 1.42 1.24

09:30 United Kingdom BBA Mortgage Approvals January 35.8 Revised From 35.7 36.2 36.4

10:00 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead the speech by the Fed Chair Janet Yellen. Yellen will testify before the House Financial Services Committee later in the day.

New home sales in the U.S. are expected to decline to 477,000 units in January from 484,000 units in December.

Yesterday's comments by the Fed Chair Janet Yellen weighed on the greenback. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings".

The euro traded lower against the U.S. dollar as concerns over Greek bailout programme still weigh on the euro.

The European Central Bank President Mario Draghi will speak at 16:30 GMT0.

The British pound traded lower against the U.S. dollar despite the better-than-expected number of mortgage approvals from the U.K. The number of mortgage approvals increased to 36,700 in January from 35,800 in December, exceeding expectations for a rise to 36,200. December's figure was revised up from 35,700.

The Bank of England (BoE) Governor Mark Carney said nothing about the monetary policy at today's launch of the One Bank Research Agenda.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator decreased to 1.24 points in January from 1.42 points in December.

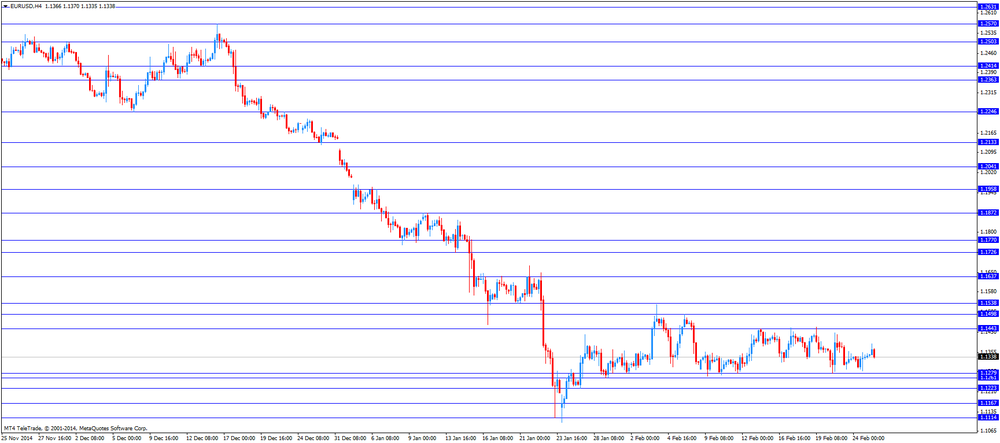

EUR/USD: the currency pair fell to $1.1335

GBP/USD: the currency pair declined to $1.5466

USD/JPY: the currency pair rose to Y118.94

The most important news that are expected (GMT0):

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. New Home Sales January 484 477

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

16:30 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Trade Balance, mln January -159 -157

-

13:30

U.K.: BBA Mortgage Approvals rose more-than-expected

Today the British Bankers' Association reported U.K. mortgage approvals rose more-than-expected last month. Approvals rose by 36,400 beating expectations of 36,200. In December 35,700 approvals were reported. The index reflects the number of issued mortgage credit permits. It is the leading indicator of the residential real estate market demand.

Fuelled by the better-than-expected data and Yellen's testimony before the Senate Banking Committee stating that it's unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings"cable rose to a two-month high against the greenback.

-

13:00

European stock markets mid-session: Indices decline moderately pausing after yesterday’s rally

European stocks moderately decline from highs hit yesterday on mixed corporate earnings after being almost flat in early trading. Yesterday markets were fuelled by FED chair Yellen's comments on the banks plans not to hike interest rates in the near future and Eurozone's extensions of the Greek bailout for four further months.

The FTSE 100 index is currently trading -0.35% quoted at 6,925.25. Germany's DAX 30 lost -0.06%, trading at 11,199.50. France's CAC 40 is currently trading at 4,875.66 points, -0.22%.

-

12:20

Oil: gains on comments of Saudi Arabia's oil minister on growing demand

Oil prices gained in today's trading on comments of Ali al-Naimi, Saudi Arabia's oil minister. He stated that markets are calm now and demand is growing. Better-than expected data from China, the world's second-largest oil consumer also supported prices. The HSBC Manufacturing PMI rose from 49.7 to 50.1 to a four month-high, above the estimated reading of 49.6. Brent Crude added +0.82%, currently trading at USD59.14 a barrel. On January 13th Crude hit a low at USD45.19. West Texas Intermediate added +0.63% currently quoted at USD49.59, still below USD50 a barrel. Prices were further supported by the FED's flexible approach to raise interest rates and by the fact Eurozone's finance ministers approved the four-month bailout extension on Tuesday and accepted the list of reforms proposed by the Greek government.

Today at 15:30 GMT Crude Oil Inventories will be closely watched. Yesterday API Crude Oil Inventories rose by 8.9 million barrels.

Still worldwide supply exceeds demand in a period of low global economic growth limiting the impact of positive macroeconomic news.

-

12:00

Gold prices back over USD1,200 after Yellen testimony

Gold halted a four-day decline and extended its rebound from 7-week lows in today's trading, back slightly above the USD1,200 threshold on FED rate outlook. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings". A broadly weaker U.S. dollar supported the price.

A stronger U.S. dollar and the prospect for higher U.S. rates recently weighed on the precious metal as the precious metal is dollar-denominated and not yield-bearing.

The precious metal is currently quoted at USD1,206.60 +0,60% a troy ounce. Gold fell 2.3% last week, a fourth straight loss. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40.

-

11:22

Option expiries for today's 10:00 ET NY cut

USDJPY 118.00 (USD 577m) 119.40 (USD 506m) 120.00 (USD 1.1bln)

EURUSD 1.1200 (EUR 3.4bln) 1.1250 (EUR 5.4bln) 1.1300 (EUR 1.4bln) 1.1355 (EUR 995m) 1.1400 (1.59bln)

USDCAD 1.2500 (USD 765m) 1.2550 (USD 267m) 1.2560 (USD 200m) 1.2750 (USD 240m) 1.2800 (USD474m)

AUDUSD 0.7750 (AUD 435m) 0.7775 (AUD 496m) 0.7800 (AUD 690m) 0.7850 (AUD 449m)

NZDUSD 0.7450 (NZD 531m)

EURJPY 132.58 (EUR 760m) 133.85 (EUR 393m)

EURGBP 0.7325 (EUR 330m)

-

10:40

China PMI back in positive territory

Data on the HSBC China PMI showed an increase of activity in the huge factory sector as the index is back into positive territory. Economic stimulus by the People's Bank of China and economic recovery in the U.S. seem to lend support.

The HSBC Manufacturing PMI rose from 49.7 to 50.1 to a four month-high, above the estimated reading of 49.6. A reading above 50 represents growth in activity. Readings of output and new orders both improved.

Domestic demand firmed while new export orders contracted for the first time since April 2014. Employment declined for a sixteenth consecutive month as companies reduced staff as a consequence of the economic slowdown.

The world's second largest economy grew at the slowest pace in 24 years in 2014.

-

10:30

United Kingdom: BBA Mortgage Approvals, January 36.4 (forecast 36.2)

-

10:15

Press Review: Brent inches up toward $59 on Fed flexibility, China factory growth

BLOOMBERG

Draghi Winning Greek Respite Shifts Focus to Inflation Battle

(Bloomberg) -- A respite in Greece's bailout talks allows Mario Draghi to return his attention to the region's dismal price outlook.

Reform proposals by the Greek government, which the European Central Bank president described as a "valid starting point," have freed the ECB from immediate concern over funding the country's banks. That will give the institution scope to elaborate on the details of a 1.1 trillion-euro ($1.3 billion) quantitative-easing program designed to stave off deflation.

Draghi, who will attend the European Parliament in Brussels on Wednesday, is about to get data from Germany, Spain and Italy that will show a continued slump in consumer prices. The reports are a preamble to region-wide figures on Monday forecast to show prices falling at a near-record pace and new ECB projections due next week after a Governing Council meeting in Cyprus.

REUTERS

Brent inches up toward $59 on Fed flexibility, China factory growth(Reuters) - Brent crude edged up toward $59 a barrel on Wednesday, helped by better-than-expected Chinese factory activity data, the Federal Reserve's flexible stance on U.S. interest rates and the euro zone's approval of reforms proposed byGreece.

But U.S. crude was weaker after settling lower for the fifth consecutive session on Tuesday on the back of a bigger-than- anticipated crude stock build-up.

Brent had climbed 11 cents to $58.77 a barrel by 0751 GMT (2.51 a.m. EST), while U.S. crude futures fell 17 cents to $49.11 a barrel.

Source: http://www.reuters.com/article/2015/02/25/us-markets-oil-idUSKBN0LT08620150225

REUTERS

Germany's Schaeuble: credibility of new Greek plan still in doubtFeb 25 (Reuters) - Germany's Wolfgang Schaeuble said on Wednesday it had not been an easy decision for euro zone finance ministers to extend the Greek rescue plan by four months and much doubt remained about how credible Athens' latest reform commitments really were.

"It wasn't easy an easy decision for us but neither was it easy for the Greek government because (they) had told the people something completely different in the campaign and afterwards," the German finance minister told SWR2 radio in an interview.

Source: http://www.reuters.com/article/2015/02/25/eurozone-greece-schaeuble-idUSB4N0PT01I20150225

-

10:00

European Stocks. First hour: Stocks almost flat after opening pausing the recent rally

European stocks are flat in early trading on Wednesday after rallying yesterday after Fed Chair Janet Yellen's speech. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings" as wage growth remains too low even as the job market improves. The Fed Chair noted that the central bank will change the wording of the policy statement when it will raise its interest rate and that the FED will not rush into raising interest rates.

Yesterday markets were supported after Eurozone's finance ministers approved the four-month bailout extension and accepted the list of reforms proposed by the Greek government including taxation, public spending and a reform of the pension system.

Today financials and the energy sector declined.

The FTSE 100 index is currently trading -0.02% quoted at 6,94805 points. Germany's DAX 30 is trading flat at 11,206 points. France's CAC 40 lost -0.02%, currently trading at 4,885.33 points.

-

09:00

Global Stocks: Wall Street closing at records, Asian indices decline

U.S. markets rose and closed at records on Tuesday after the speech of the Fed Chair Janet Yellen. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings" as wage growth remains too low even as the job market improves. The Fed Chair noted that the central bank will change the wording of the policy statement when it will raise its interest rate and that the FED will not rush into raising interest rates.

Yesterday Eurozone's finance ministers approved the four-month bailout extension on Tuesday and accepted the list of reforms proposed by the Greek government.

The DOW JONES index added +0.51% closing at 18,209.19 points. The S&P 500 closed +0.28% with a final quote of 2,115.48 points.

Chinese stocks declined after re-opening despite a better-than expected HSBC China PMI. The HSBC Manufacturing PMI rose from 49.7 to 50.1 to a four month-high, above the estimated reading of 49.6. A reading above 50 represents growth in activity. Domestic demand firmed while new export orders contracted for the first time since April 2014. Both input and output prices remain in contraction, according to HSBC. Hong Kong's Hang Seng is trading slightly negative -0.05% at 24,738.09 points. China's Shanghai Composite closed at 3,229.57 points -0.53%, the first retreat in eight days.

Japanese markets declined after a five day rally and closed below fresh 15-year highs hit yesterday. The Nikkei lost 18 points, closing -0.10% with a final quote of 18,585.20 points. Losses were limited after FED chair Yellen's speech as she stated that the bank's policy will be flexible.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded weaker against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Construction Work Done Quarter IV -2.2% -0.8% -0.2%

00:30 Australia Wage Price Index, q/q Quarter IV +0.6% +0.7% +0.6%

00:30 Australia Wage Price Index, y/y Quarter IV +2.6% +2.5% +2.5%

01:45 China HSBC Manufacturing PMI (Preliminary) February 49.7 49.6 50.1

07:00 Switzerland UBS Consumption Indicator January 1.42 1.24

The U.S. dollar traded lower against its major peers after the speech by the Fed Chair Janet Yellen. Yellen testified before the Senate Banking Committee in Washington on Tuesday. She said it is unlikely that the Fed will raise its interest rate in "the next couple of FOMC meetings" as wage growth remains too low even as the job market improves. The Fed Chair noted that the central bank will change the wording of the policy statement when it will raise its interest rate and that the FED will not rush into raising interest rates.

The euro traded moderately higher against the greenback after Eurozone's finance ministers approved the four-month bailout extension on Tuesday and accepted the list of reforms proposed by the Greek government.

The Australian dollar jumped as data on the HSBC China PMI showed an increase into positive territory. The HSBC Manufacturing PMI rose from 49.7 to 50.1 to a four month-high, above the estimated reading of 49.6. A reading above 50 represents growth in activity. Domestic demand firmed while new export orders contracted for the first time since April 2014. Both input and output prices remain in contraction, according to HSBC.China is Australia's biggest trade partner. Construction Work Done for the fourth quarter decreased less than expected by -0.2% compared to a forecast of -0.8% and a previous reading of -2.8% (revised from -2.2%). The Wage Price Index on a quarterly basis remained unchanged at +0.6%, analysts expected wages to rise by +0.7%. Year on year the Wage Price Index declined from +2.6% to +2.5% in line with expectations.

New Zealand's dollar rose against the greenback after the better-than expected HSBC China February flash manufacturing PMI. Today data on Visitor arrivals and New Zealand's Trade balance are due at 21:45 GMT.

The Japanese yen traded higher against the greenback on Wednesday in the absence of any major economic reports from Japan.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom BBA Mortgage Approvals January 35.7 36.2

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. New Home Sales January 484 477

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

15:30 U.S. Crude Oil Inventories February +7.7

16:30 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Visitor Arrivals January -1.3%

21:45 New Zealand Trade Balance, mln January -159 -157

-

08:13

Options levels on wednesday, February 25, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1484 (2512)

$1.1451 (3178)

$1.1402 (1965)

Price at time of writing this review: $1.1354

Support levels (open interest**, contracts):

$1.1316 (3577)

$1.1288 (5000)

$1.1237 (4545)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 106523 contracts, with the maximum number of contracts with strike price $1,1500 (6400);

- Overall open interest on the PUT options with the expiration date March, 6 is 109913 contracts, with the maximum number of contracts with strike price $1,1200 (5446);

- The ratio of PUT/CALL was 1.03 versus 1.04 from the previous trading day according to data from February, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5801 (676)

$1.5701 (1142)

$1.5603 (2338)

Price at time of writing this review: $1.5492

Support levels (open interest**, contracts):

$1.5394 (1580)

$1.5297 (2067)

$1.5198 (1992)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 29699 contracts, with the maximum number of contracts with strike price $1,5500 (2547);

- Overall open interest on the PUT options with the expiration date March, 6 is 35312 contracts, with the maximum number of contracts with strike price $1,5300 (2067);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from February, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Switzerland: UBS Consumption Indicator, January 1.24

-

03:21

Nikkei 225 18,622.69 +19.21 +0.10 %, Hang Seng 24,742.36 -7.71 -0.03 %, Shanghai Composite 3,250.35 +3.44 +0.11 %

-

02:45

China: HSBC Manufacturing PMI, February 50.1 (forecast 49.6)

-

01:31

Australia: Construction Work Done, Quarter IV -0.2% (forecast -0.8%)

-

01:31

Australia: Wage Price Index, q/q, Quarter IV +0.6% (forecast +0.7%)

-

01:31

Australia: Wage Price Index, y/y, Quarter IV +2.5% (forecast +2.5%)

-

00:32

Commodities. Daily history for Feb 24’2015:

(raw materials / closing price /% change)

Oil 49.28 -0.34%

Gold 1,200.80 +0.29%

-

00:31

Stocks. Daily history for Feb 24’2015:

(index / closing price / change items /% change)

Nikkei 225 18,603.48 +136.56 +0.74 %

Topix 1,508.28 +5.45 +0.36 %

FTSE 100 6,949.63 +37.47 +0.54 %

CAC 40 4,886.44 +24.14 +0.50 %

Xetra DAX 11,205.74 +74.82 +0.67 %

S&P 500 2,115.48 +5.82 +0.28 %

NASDAQ Composite 4,968.12 +7.15 +0.14 %

Dow Jones 18,209.19 +92.35 +0.51 %

-

00:30

Currencies. Daily history for Feb 24’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1338 +0,04%

GBP/USD $1,5452 -0,03%

USD/CHF Chf0,9505 +0,09%

USD/JPY Y118,96 +0,13%

EUR/JPY Y134,90 +0,19%

GBP/JPY Y183,81 +0,11%

AUD/USD $0,7830 +0,37%

NZD/USD $0,7490 -0,44%

USD/CAD C$1,2483 -0,70%

-

00:03

Schedule for today, Wednesday, Feb 25’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Construction Work Done Quarter IV -2.2% -0.8%

00:30 Australia Wage Price Index, q/q Quarter IV +0.6% +0.7%

00:30 Australia Wage Price Index, y/y Quarter IV +2.6% +2.5%

01:45 China HSBC Manufacturing PMI (Preliminary) February 49.7 49.6

07:00 Switzerland UBS Consumption Indicator January 1.42

09:30 United Kingdom BBA Mortgage Approvals January 35.7 36.2

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. New Home Sales January 484 477

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

15:30 U.S. Crude Oil Inventories February +7.7

16:30 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Visitor Arrivals January -1.3%

21:45 New Zealand Trade Balance, mln January -159 -157

-