Noticias del mercado

-

20:20

American focus: The dollar fell against major currencies

Euro back previously lost ground against the dollar, and again rose to the session high. The focus continues to be Greece. German Chancellor Angela Merkel said that had a constructive meeting with Greek Prime Minister Alexis Tsipras, and that we must do everything we can to Greece will not be left without money. Meanwhile, the head of the Eurogroup Deysselblum said that Greece must still submit a comprehensive reform program before it receives the additional funds necessary to fulfill its obligations. Deysselblum pointed to the deep divisions on reforms from a position of Greece and its international lenders. He added that the Greek issue will be addressed at a scheduled meeting in May. The head of the EU noted that time is running out, and all the responsibility for progress in resolving the problem lies on the shoulders of Athens. Deysselblum during a press conference that Greece transfer of the funds is not planned, so it is necessary to reach an agreement by June. The course of trade also influenced the report on the United States. The Commerce Department reported that orders for durable goods rose a seasonally adjusted 4% in March compared to the previous month. Decline in February by 1.4% not revised. Economists had expected overall orders to grow by 0.7% in March. The rise in the last month reflects the growth in demand for cars and goods of military and civil aviation, volatile categories, which can hide the underlying strength in the economy. Excluding transportation goods, orders fell 0.2%, noting the sixth consecutive monthly decline. Orders for non-military capital goods excluding aircraft - an indicator of the company's spending on equipment and software - fell 0.5% in March.

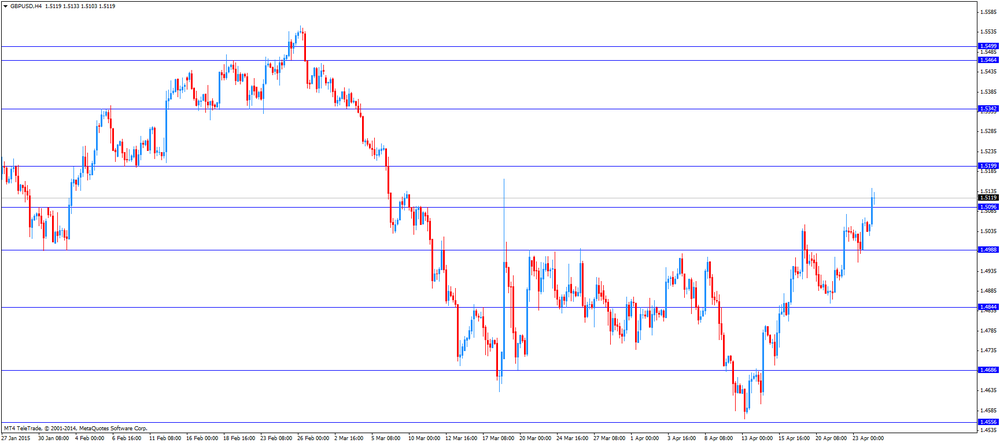

Pound continued to strengthen against the dollar, setting a new April high, due to the release of mixed US data. In addition, the market continues to follow the news on Greece. Experts note that the currency is showing resilience in the face of uncertainty surrounding the outcome of the election, which is due to the revision of expectations for the Bank of England. However, the markets to price in near-zero probability of a rate hike this year, the Central Bank.

The course of trade is also affected by expectations publication of data on Britain - on Tuesday released a report on GDP (expected to slow to 0.6% in Q4 to 0.5% in Q1), and on Friday - the manufacturing PMI, which can show a decline.

The Swiss franc strengthened slightly against the dollar, reaching at this level opening session. Influenced the course of trading statements of the SNB Thomas Jordan. Established by the Swiss National Bank (SNB) negative interest rates - is a tool necessary to limit the demand for a country's currency, which rate is overvalued, but they did not become a regular feature of the economy, the president said the SNB Thomas Jordan. According to him, low interest rates around the world have created a very difficult situation for the country's economy, the exchange rate is "much too high". This situation has forced the central bank to introduce in January negative interest rates to limit the demand for the franc, Jordan said. He also said that negative interest rates will play a "very important role" as long as the upward pressure on the franc not weaken further in terms of global economic recovery.

-

17:03

Bank of Canada Governor Stephen Poloz: Canadian economy starts to grow in the second quarter, benefiting from low oil prices

The Bank of Canada Governor Stephen Poloz expects that Canadian economy starts to grow in the second quarter, benefiting from low oil prices.

"Starting in the second quarter we think the positives will be more important than the negatives and certainly in the second half of the year the shock should be fully behind us," Poloz said on Friday.

-

16:44

European Economics Commissioner Pierre Moscovici: the progress is too slow

The European Economics Commissioner Pierre Moscovici in Riga on Friday that there is some progress, but the progress is too slow.

"Our message today is very clear: We need to accelerate, we need to accelerate from today," he noted.

-

16:17

Head of the Eurogroup Jeroen Dijsselbloem: Greece has to deliver a complete economic reform plan

The head of the Eurogroup Jeroen Dijsselbloem said at the press conference after the Eurogroup meeting in Riga on Friday that "time is running out". He pointed out that Greece has to deliver a complete economic reform plan to get a new tranche of loans (€7.2 billion).

"A comprehensive and detailed list of reforms is needed," Dijsselbloem noted.

Discussions between the Greek government and its creditors will continue at the next Eurogroup meeting on May 11.

-

15:53

NBB business climate rises to -6.2 in April

The National Bank of Belgium (NBB) released its business survey on Friday. The business climate rose to -6.2 in April from -6.3 in March, missing forecasts for an increase to -5.8. It was the third consecutive rise.

The increase was driven by much more favourable assessments of total order books. Forecasts for demand and employment were revised downwards.

Entrepreneurs In the business-related services sector are expecting activity to pick up over the next three months.

Business confidence fell in the building sector.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0650(E608mn), $1.0700(E400mn), $1.0735(E600mn), $1.0800(E717mn), $1.0835(E455mn)

USD/JPY: Y119.35($380mn), Y120.00($740mn), Y120.50($350mn)

EUR/JPY: Y129.00(E226mn)

GBP/USD: $1.4900(Gbp623mn)

USD/CHF: Chf0.9535($540mn)

AUD/USD: 0.7700(A$608mn), $0.7750(A$307mn), $0.7800(A$600mn)

AUD/NZD: NZ$1.0200(A$3bn)

NZD/USD: $0.7615(NZ$240mn)

USD/SGD: Sgd1.3500($1.3bn)

-

15:23

U.S. durable goods orders jump 4.0% in March

The U.S. Commerce Department released durable goods orders data on Friday. The U.S. durable goods orders jumped 4.0% in March, exceeding expectations for a 0.7% increase, after a 1.4% decline in February.

The increase was driven by higher orders for defence aircraft and parts. Orders for defence aircraft and parts soared by 112.8%, while orders for non-defence aircraft and parts climbed by 30.6%.

The U.S. durable goods orders excluding transportation declined 0.2% in March, missing expectations for a 0.2% gain, after a 1.3% decrease in February.

The decline was driven by lower orders for machinery and electrical equipment, appliances, and components.

-

15:00

Belgium: Business Climate, April -6.2 (forecast -5.8)

-

14:49

European Central Bank President Mario Draghi: time was running out in debt talks between Greece and its creditors

The European Central Bank (ECB) President Mario Draghi said on Friday that time was running out in debt talks between Greece and its creditors.

"There can't be an agreement if people don't have an adequate process to assess, quantify policy measures," Mr. Draghi noted.

He pointed out that Greek banks will be supplied with emergency liquidity from the Greek central bank as long as the banks were solvent.

-

14:30

U.S.: Durable goods orders ex defense, March 2.6%

-

14:30

U.S.: Durable Goods Orders , March 4.0% (forecast 0.7%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , March -0.2% (forecast 0.2%)

-

14:18

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the better-than-expected German German Ifo business climate index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m February 1.9% -0.9% 0.1%

08:00 Germany IFO - Business Climate April 107.9 108.5 108.6

08:00 Germany IFO - Current Assessment April 112.0 112.4 113.9

08:00 Germany IFO - Expectations April 103.9 104.5 103.5

09:00 Eurozone Eurogroup Meetings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. durable goods orders. The U.S. durable goods orders are expected to increase 0.7% in March, after a 1.1% drop in February.

The U.S. durable goods orders excluding transportation are expected to rise 0.2% in March, after a 0.6% fall in February.

Yesterday's weaker-than-expected U.S. economic data weighed on the greenback. New home sales dropped 11.4% to a seasonally adjusted annual rate of 481,000 units in March from 543,000 units in February.

The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 54.2 in April from 55.7 in March, missing expectations for a decline to 55.6.

The euro traded lower against the U.S. dollar despite the better-than-expected German German Ifo business climate index. German business confidence index climbed to 108.6 in April from 107.9 in March, exceeding expectations for a rise to 108.5. It was the sixth consecutive increase.

"The upswing in the German economy continues," Ifo President Hans-Werner Sinn said.

He added that manufacturers "expressed slightly less optimism about future business developments".

The Greek debt crisis weighs on the euro. Investors are awaiting results of today's Eurogroup meeting. Greece is running out of cash, and it needs a new tranche of loans. Athens and its creditors cannot reach a deal on the economic reforms needed to unlock a new tranche of loans (€7.2 billion).

German Finance Minister Wolfgang Schaeuble expressed concerns on Friday morning that an agreement between Greece and its creditors will be signed today.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar after comments by the Swiss National Bank (SNB) President Thomas Jordan. He said at the central bank's annual general meeting in Bern on Friday that the central bank is ready to intervene in the foreign exchange market. Jordan noted that the Swiss franc is overvalued.

The Canadian dollar traded higher against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz.

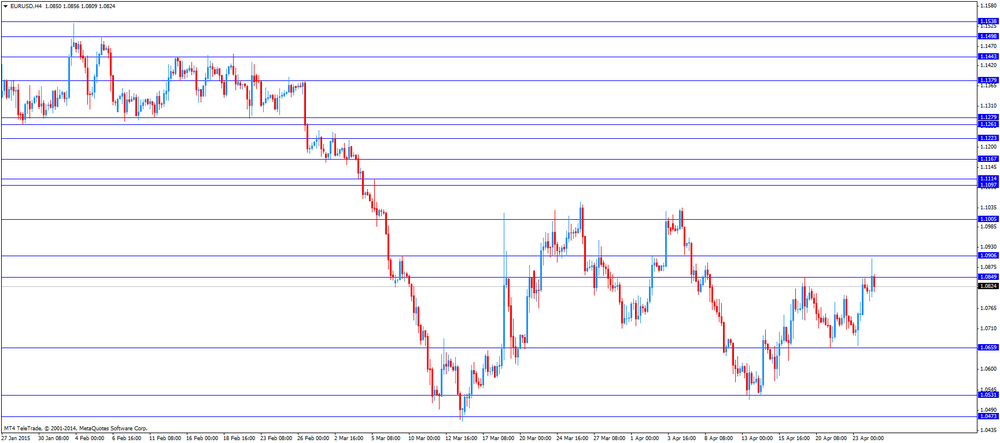

EUR/USD: the currency pair decreased to $1.0809

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y119.46

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders March -1.1% Revised From -1.4% 0.7%

12:30 U.S. Durable Goods Orders ex Transportation March -0.6% Revised From -0.4% 0.2%

12:30 U.S. Durable goods orders ex defense March -1.0%

13:00 Belgium Business Climate April -6.3 -5.8

14:30 Canada BOC Gov Stephen Poloz Speaks

-

14:00

Orders

EUR/USD

Offers 1.0900 1.0920 1.0950 1.0980 1.1000

Bids 1.0860 1.0830 1.0815-20 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.5135 1.5165-70 1.5185 1.5200 1.5220 1.5250

Bids 1.5100-10 1.5080 1.5065 1.5050 1.4980 1.4960 1.4940 1.4925 1.4900

EUR/JPY

Offers 130.30 130.80 131.00 131.30 131.50 131.80 132.00

Bids 129.80 129.60 129.20 129.00 128.80 128.40 128.00

USD/JPY

Offers 119.60 119.75-80 120.00 120.20 120.50 120.80 121.00

Bids 119.15-20 119.00 118.80 118.50 118.25-30 118.00

EUR/GBP

Offers 0.7220-25 0.7235 0.7250 0.7265 0.7285 0.7300

Bids 0.7185 0.7170 0.7150 0.7125-30 0.7100-10

AUD/USD

Offers 0.7825 0.7850-60 0.7875 0.7900 0.7925-30

Bids 0.7780 0.7760 0.7725 0.7700 0.7675-80 0.7650

-

11:27

Swiss National Bank President Thomas Jordan: the central bank is ready to intervene in the foreign exchange market

The Swiss National Bank (SNB) President Thomas Jordan said at the central bank's annual general meeting in Bern on Friday that the central bank is ready to intervene in the foreign exchange market.

"The Swiss franc is significantly overvalued overall," Jordan noted. He expects "a correction of this overvaluation". Jordan pointed out that the Swiss franc increased due to the Greek debt problem.

He outlined that the Swiss economy will successfully overcome its challenges, and added that the negative interest rates won't become the "new normal".

"The current low interest rate environment is a temporary phenomenon," the SNB president said.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0650(E608mn), $1.0700(E400mn), $1.0735(E600mn), $1.0800(E717mn), $1.0835(E455mn)

USD/JPY: Y119.35($380mn), Y120.00($740mn), Y120.50($350mn)

EUR/JPY: Y129.00(E226mn)

GBP/USD: $1.4900(Gbp623mn)

USD/CHF: Chf0.9535($540mn)

AUD/USD: 0.7700(A$608mn), $0.7750(A$307mn), $0.7800(A$600mn)

AUD/NZD: NZ$1.0200(A$3bn)

NZD/USD: $0.7615(NZ$240mn)

USD/SGD: Sgd1.3500($1.3bn) -

11:12

China's urban unemployment rate declines to 4.05% at the end of first quarter

China's labour ministry released its unemployment data on Friday. China's urban unemployment rate fell to 4.05% at the end of first quarter from 4.1% at the end of the fourth quarter.

The Chinese government aims to create at least 10 million new jobs in 2015 and keep the urban unemployment rate below 4.5%.

-

10:27

European Commission Vice President Jyrki Katainen: European partners' trust in Greece has decreased

The European Commission Vice President Jyrki Katainen said on Thursday that European partners' trust in Greece has decreased, and it is harder to find a solution.

"I am confident that Greece's economic problems are possible to solve if confidence levels rise and everybody does their share," he added.

-

10:10

German Finance Minister Wolfgang Schaeuble: Germany's fiscal consolidation has led to higher growth and lower unemployment

German Finance Minister Wolfgang Schaeuble said on Thursday that Germany's fiscal consolidation has led to higher growth and lower unemployment. "There is no better alternative to this," he noted.

Schaeuble also said that Germany has to continue to reduce its overall debt to reach the 60% of GDP threshold.

-

10:00

Germany: IFO - Business Climate, April 108.6 (forecast 108.5)

-

10:00

Germany: IFO - Current Assessment , April 113.9 (forecast 112.4)

-

10:00

Germany: IFO - Expectations , April 103.5 (forecast 104.5)

-

08:23

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m February 1.9% -0.9% 0.1%

The aussie started this morning at $0.7778, toward the upper end of the $0.7711 to $0.7791 range seen yesterday, demand in aussie-kiwi following dovish comments from RBNZ's McDermott, higher CRB index and weaker than expected US data all combining to push the aussie a little higher.

Cable closed in NY Thursday at $1.5057 after rate had been pushed higher, extending its recovery off UK retail sales data react lows of $1.4960, on general dollar sell off prompted by the release of weaker than forecast US home sales data which saw rate trade to a high of $1.5070 during the NY afternoon.

EUR / USD: during the Asian session the pair fell to $1.0785

GBP / USD: during the Asian session the pair fell to $ 1.5025

USD / JPY: during the Asian session the pair traded in the range Y119.40-60

A light UK data calendar for Friday with attention on Germany Ifo, as well as Greece developments. Into the afternoon focus will be on US durable goods and UST yield effects. Traders noting only a minor General Election effect felt in trade, but expect pressure on sterling to emerge closer to May7.

-

08:19

Options levels on friday, April 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0958 (2454)

$1.0914 (1368)

$1.0871 (2996)

Price at time of writing this review: $1.0804

Support levels (open interest**, contracts):

$1.0747 (1581)

$1.0698 (2747)

$1.0635 (6341)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 61705 contracts, with the maximum number of contracts with strike price $1,1200 (6762);

- Overall open interest on the PUT options with the expiration date May, 8 is 76085 contracts, with the maximum number of contracts with strike price $1,0000 (9296);

- The ratio of PUT/CALL was 1.23 versus 1.22 from the previous trading day according to data from April, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5305 (1244)

$1.5208 (1068)

$1.5112 (1642)

Price at time of writing this review: $1.5050

Support levels (open interest**, contracts):

$1.4987 (1857)

$1.4891 (1652)

$1.4794 (2372)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 24217 contracts, with the maximum number of contracts with strike price $1,5000 (2791);

- Overall open interest on the PUT options with the expiration date May, 8 is 33294 contracts, with the maximum number of contracts with strike price $1,4400 (2750);

- The ratio of PUT/CALL was 1.37 versus 1.40 from the previous trading day according to data from April, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:46

Japan: All Industry Activity Index, m/m, February 0.1% (forecast -0.9%)

-

00:28

Currencies. Daily history for Apr 23’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0820 +0,91%

GBP/USD $1,5056 +0,15%

USD/CHF Chf0,9542 -1,73%

USD/JPY Y119,58 -0,28%

EUR/JPY Y129,39 +0,63%

GBP/JPY Y180,04 -0,13%

AUD/USD $0,7778 +0,40%

NZD/USD $0,7596 -0,66%

USD/CAD C$1,2149 -0,79%

-

00:00

Schedule for today, Friday, Apr 24’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m February 1.9% -0.9%

08:00 Germany IFO - Business Climate April 107.9 108.5

08:00 Germany IFO - Current Assessment April 112.0 112.4

08:00 Germany IFO - Expectations April 103.9 104.5

09:00 Eurozone Eurogroup Meetings

12:30 U.S. Durable Goods Orders March -1.1% Revised From -1.4% 0.7%

12:30 U.S. Durable Goods Orders ex Transportation March -0.6% Revised From -0.4% 0.2%

12:30 U.S. Durable goods orders ex defense March -1.0%

13:00 Belgium Business Climate April -6.3 -5.8

14:30 Canada BOC Gov Stephen Poloz Speaks

-