Noticias del mercado

-

16:55

Spanish Prime Minister Mariano Rajoy said on Monday that the Spanish economy is expected to expand at 2.9% in 2015, up from a previous estimate of a 2.4% rise

-

16:27

U.S. preliminary services purchasing managers' index (PMI) climbs to 57.8 in April

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary services purchasing managers' index (PMI) declined to 57.8 in April from 59.2 in March, beating expectations for a decrease to 57.4.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a decrease in new business growth.

The Markit Chief Economist Chris Williamson said that "he economy as a whole picking up speed again after a temporary soft patch at the start of the year".

The preliminary employment at service companies climbed to 55.4 in April from 54.0 in March.

-

15:52

Germany’s economy is expected to expand at around 2.25% in 2015

German IW economic institute released its growth forecast for Germany on Monday. Germany's economy is expected to expand at around 2.25% in 2015.

The growth will be driven by "numerous positive special effects" such as low oil prices, low interest rates and a weaker euro.

The director of the IW economic institute Michael Huether noted that these "positive special effects" are short-lived.

The German government expects the economy to grow 1.8%.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E848mn), $1.0900 (E1.3bn)

USD/JPY: Y119.00($768mn), Y120.00($1.7bn)

GBP/USD: $1.5080-90(Gbp420mn), $1.5200(Gbp264mn)

AUD/USD: $0.7780-90(A$560mn)

NZD/USD: $0.7575(NZ$283mn)

USD/CAD: C$1.2000($700mn), C$1.2035-50($700mn), C$1.2165($869mn), C$1.2200($710mn)

-

15:45

U.S.: Services PMI, April 57.8 (forecast 57.37)

-

15:11

German import prices fall 1.4% in March

Destatis released its import prices data for Germany on Monday. German import prices declined by 1.4% in March from last year, after a 3% fall in February.

Import prices decline since January 2013.

On a monthly base, import prices increased 1% in March, after a 1.4% in February.

On a monthly base, import prices excluding crude oil and mineral oil products climbed by 1% in March.

Export prices climbed to 1.4% year-on-year in March from 0.7% in February.

On a monthly base, export prices rose 0.6% in March.

-

14:41

Greek President Prokopis Pavlopoulos said in an interview with Spiegel Online Greece will pay back all its debt

-

14:32

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the CBI industrial order books balance data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand Bank holiday

10:00 United Kingdom CBI industrial order books balance April 0 1

The U.S. dollar traded higher against the most major currencies ahead of the U.S. preliminary services purchasing managers' index (PMI). The U.S. preliminary services PMI is expected to decline to 57.4 in April from 59.2 in March.

The euro traded lower against the U.S. dollar as the Greek debt crisis continues to weigh on the euro. Friday's Eurogroup meeting ended without any results as widely expected. Discussions between the Greek government and its creditors will continue at the next Eurogroup meeting on May 11.

The head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a "Plan B" for Greece if the debt talks are not successful.

The idea was raised by ministers from Slovenia, Slovakia and Lithuania at the Eurogroup's meeting on Friday.

The Prime Minister Alexis Tsipras held phone calls with German Chancellor Angela Merkel and Dijsselbloem on Sunday to discuss speeding up the negotiations. According to the Greek government, Greece will resume talks with its creditors today.

German Finance Minister Wolfgang Schaeuble hinted on Saturday that Germany was preparing for a possible Greek default.

The British pound traded lower against the U.S. dollar after the CBI industrial order books balance data from the U.K. The CBI industrial order books balance rose to +1% in April from +0% in March.

The increase was driven by a higher output and new orders expectation.

In the first quarter of 2015, the balance of firms reporting a rise in order books was at 13%.

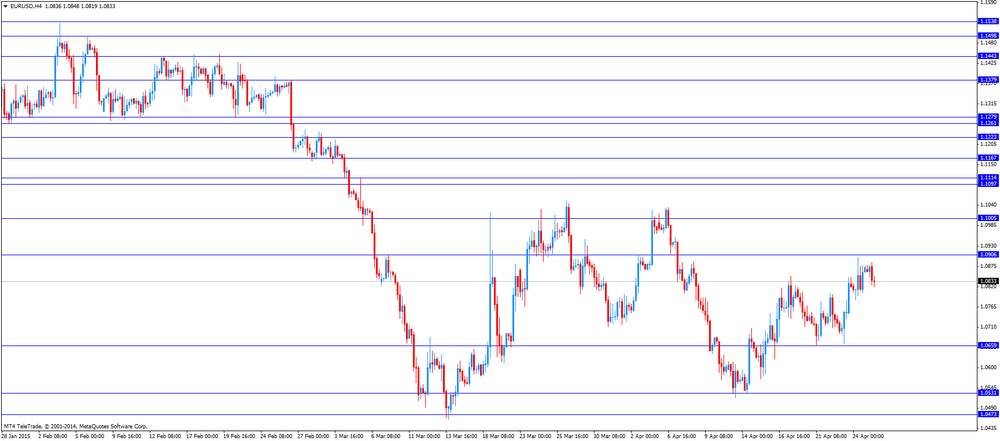

EUR/USD: the currency pair decreased to $1.0819

GBP/USD: the currency pair fell to $1.5106

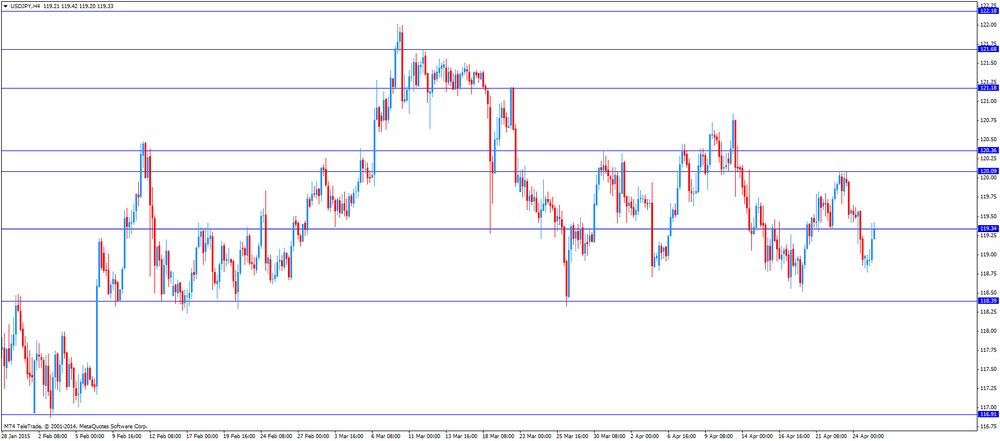

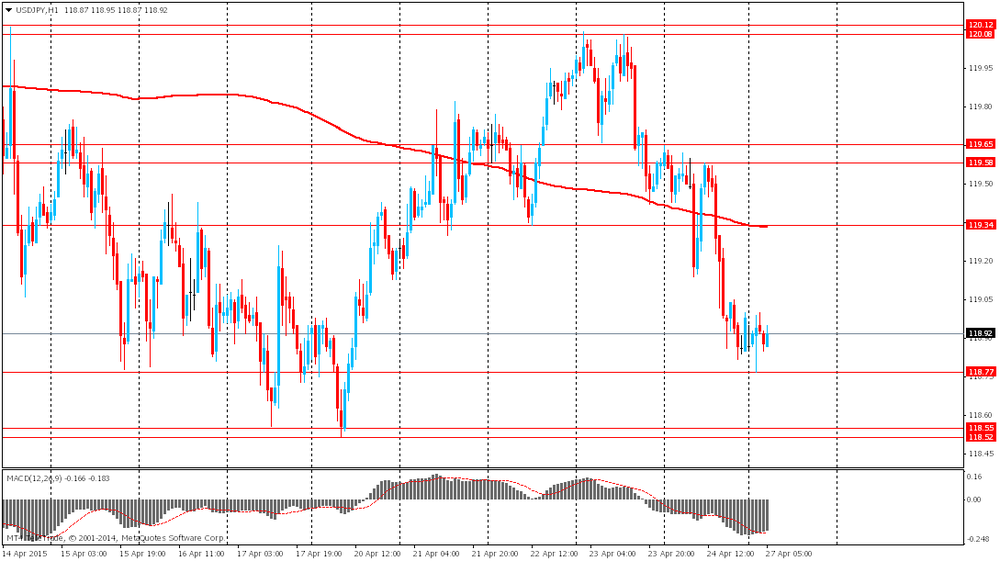

USD/JPY: the currency pair rose to Y119.42

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Preliminary) April 59.2 57.37

22:40 Australia RBA's Governor Glenn Stevens Speech

-

14:10

Orders

EUR/USD

Offers 1.0880-85 1.0900 1.0920 1.0950 1.0980 1.1000

Bids 1.0830 1.0815-20 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.5185 1.5200 1.5220 1.5250 1.5280 1.5300 1.5325-30

Bids 1.5130 1.5100-10 1.5080 1.5065 1.5050 1.5030 1.5000 1.4980 1.4960

EUR/JPY

Offers 129.80 130.00 130.30 130.80 131.00 131.30 131.50

Bids 129.20 129.00 128.80 128.40 128.00

USD/JPY

Offers 119.40 119.60 119.75-80 120.00 120.20 120.50 120.80 121.00

Bids 119.00 118.80-85 118.65 118.50 118.25-30 118.00

EUR/GBP

Offers 0.7180 0.7200 0.7220-25 0.7235 0.7250 0.7265

Bids 0.7150 0.7125-30 0.7100-10 0.7085

AUD/USD

Offers 0.7830 0.7850-60 0.7875 0.7900 0.7925-30

Bids 0.7800 0.7780-85 0.7760 0.7725 0.7700 0.7675-80 0.7650

-

14:08

CBI industrial order books balance rises to +1% in April

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance rose to +1% in April from +0% in March.

The increase was driven by a higher output and new orders expectation.

In the first quarter of 2015, the balance of firms reporting a rise in order books was at 13%.

The CBI Deputy Director-General Katja Hall said that manufacturers in the U.K. expect the growth to continue.

"Exports keep dragging at the heels of growth: firms are finding the recent rise in the Pound against the Euro challenging, making them less competitive in Europe, while the unravelling situation in Greece is creating uncertainty," Hall said.

-

12:00

United Kingdom: CBI industrial order books balance, April 1

-

11:37

Fitch Ratings downgrades Japan's rating to 'A' from 'A+'

Fitch Ratings has downgraded Japan's rating to 'A' from 'A+' on Monday. The outlook is stable.

The downgrade was driven by the lack of "sufficient structural fiscal measures" in the Japanese government's budget for the fiscal year ending March 31, 2016 (FY15) "to replace a deferred consumption tax increase".

Fitch placed Japan's rating on negative as the Japanese government had decided to delay the scheduled consumption tax rise.

-

11:15

Head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a „Plan B“ for Greece

The head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a "Plan B" for Greece if the debt talks are not successful.

The idea was raised by ministers from Slovenia, Slovakia and Lithuania at the Eurogroup's meeting on Friday.

The Prime Minister Alexis Tsipras held phone calls with German Chancellor Angela Merkel and Dijsselbloem on Sunday to discuss speeding up the negotiations. According to the Greek government, Greece will resume talks with its creditors today.

-

11:01

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E848mn), $1.0900 (E1.3bn)

USD/JPY: Y119.00($768mn), Y120.00($1.7bn)

GBP/USD: $1.5080-90(Gbp420mn), $1.5200(Gbp264mn)

AUD/USD: $0.7780-90(A$560mn)

NZD/USD: $0.7575(NZ$283mn)

USD/CAD: C$1.2000($700mn), C$1.2035-50($700mn), C$1.2165($869mn), C$1.2200($710mn)

-

10:51

Industrial profits in China fall 2.7% in the first quarter of 2015

China's National Bureau of Statistics released its industrial profits data for China on Monday. Industrial profits in China fell 2.7% year-over-year in the first quarter of 2015 to 1.25 trillion yuan.

Industrial profits declined 0.4% from a year ago to 508.61 billion yuan.

Mining profits plunged 61% in the first quarter of 2015 from a year earlier, while manufacturing profits rose by 4.9%.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand Bank holiday

The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 major peers, was little changed at 1,180.62, after sliding 0.4 percent last week as orders of durable goods, manufacturing, and new home sales all came in weaker-than-projected.

Federal Reserve officials will decide on monetary policy on April 29, the same day a report is projected to show economic growth slowed. The Federal Open Market Committee was split at its meeting in March on when to begin raising rates, which have been held in a range of zero to 0.25 percent since 2008 to support the economy.

Japan's currency is set to resume its descent in the coming months as the BOJ will probably add to stimulus as early as July, said Ray Attrill, global co-head of currency strategy at National Australia Bank Ltd. in Sydney. Twenty-two of 34 economists in a Bloomberg survey conducted March 31 to April 3 forecast the BOJ will expand easing by the end of October. Three estimate the central bank will make a move on April 30.

EUR / USD: during the Asian session, the pair was trading around $1.0860

GBP / USD: during the Asian session the pair traded in the range of $1.5160-85

USD / JPY: during the Asian session the pair traded in the range of Y119.00

-

08:09

Options levels on monday, April 27, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0979 (2467)

$1.0940 (2530)

$1.0903 (2996)

Price at time of writing this review: $1.0871

Support levels (open interest**, contracts):

$1.0812 (1106)

$1.0772 (1644)

$1.0717 (3119)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 62546 contracts, with the maximum number of contracts with strike price $1,1200 (6845);

- Overall open interest on the PUT options with the expiration date May, 8 is 77313 contracts, with the maximum number of contracts with strike price $1,0000 (9281);

- The ratio of PUT/CALL was 1.24 versus 1.23 from the previous trading day according to data from April, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5504 (977)

$1.5406 (924)

$1.5309 (1001)

Price at time of writing this review: $1.5171

Support levels (open interest**, contracts):

$1.5088 (883)

$1.4992 (1932)

$1.4894 (1686)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 23948 contracts, with the maximum number of contracts with strike price $1,5000 (2801);

- Overall open interest on the PUT options with the expiration date May, 8 is 33233 contracts, with the maximum number of contracts with strike price $1,4700 (2713);

- The ratio of PUT/CALL was 1.39 versus 1.37 from the previous trading day according to data from April, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:00

Currencies. Daily history for Apr 24’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0871 +0,47%

GBP/USD $1,5188 +0,87%

USD/CHF Chf0,9533 -0,09%

USD/JPY Y118,98 -0,50%

EUR/JPY Y129,29 -0,08%

GBP/JPY Y180,63 +0,33%

AUD/USD $0,7822 +0,56%

NZD/USD $0,7599 +0,04%

USD/CAD C$1,2173 +0,20%

-

00:01

Schedule for today, Monday, Apr 27’2015:

(time / country / index / period / previous value / forecast)

00:00 New Zealand Bank holiday

06:00 United Kingdom Nationwide house price index, y/y April 5.1%

06:00 United Kingdom Nationwide house price index April 0.1%

10:00 United Kingdom CBI industrial order books balance April 0

13:45 U.S. Services PMI (Preliminary) April 59.2 57.37

22:40 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Retail sales, y/y March -1.8% -8%

-