Noticias del mercado

-

20:20

American focus: Dollar falls to eight-week low on US consumer confidence

The dollar dropped to an eight-week low on Tuesday after an unexpectedly weak U.S. consumer confidence report for April, with investors growing cautious about a Federal Reserve meeting starting later in the day.

That meeting could reinforce the view that the pace of U.S. interest rate increases would be slower than initially thought. The Fed is expected to keep interest rates on hold, but the main focus will be on the statement at the end of its policy meeting on Wednesday.

Worries that the U.S. economy is stalling, following a run of soft data, have seen the dollar lose 4 percent in the past six weeks as expectations of a rate rise in June have faded. But many still expect the Fed to lift rates in September.

A weaker-than-expected U.S. consumer confidence number further undermined the dollar. U.S. consumer confidence unexpectedly slumped in April, according to a private sector report released on Tuesday.

The Conference Board said its index of consumer attitudes fell to 95.2 from an upwardly revised 101.4 in March. Economists were looking for a reading of 102.5.

"The current period of dollar weakness appears to be gaining momentum and accordingly likely has further to run," said Camilla Sutton, chief currency strategist at Scotiabank in Toronto. "A test of another 1 percent in dollar weakness is likely in the near-term."

She added, however, that over the medium term, Scotiabank continues to believe U.S. growth and the Fed's tightening policy will favor a stronger dollar.

In mid-morning trading, the dollar index fell 0.7 percent to 96.105 .DXY. It fell as low as 96.078, the weakest level since March 5.

Benefiting from the dollar's weakness, the euro gained 0.8 percent to $1.0971 EUR=. It earlier rose to $1.0973, the highest level since April 6.

The euro was also boosted by hopes cash-strapped Greece could secure extra funding. That followed news Prime Minister Alexis Tsipras had reshuffled his team handling talks with European and IMF lenders, effectively sidelining Finance Minister Yanis Varoufakis.

Tsipras said he was confident of reaching a deal before a meeting of euro zone finance ministers on May 11, a day before Greece must pay 700 million euros to the International Monetary Fund.

The Australian dollar, meanwhile, was the biggest gainer, rising 1.7 percent to US$0.79807, after earlier hitting a three-month high. A rally in iron ore prices raised expectations the Reserve Bank of Australia will not cut rates next week.

-

17:02

Sentix’s survey: around half of investors expect that Greece will leave the Eurozone within the next 12 months

The research group Sentix released its survey on Tuesday. Around half of investors expect that Greece will leave the Eurozone within the next 12 months. The Sentix's Eurozone breakup index for Greece climbed to 48.3% in April from 35.5% in March.

The Sentix's breakup index for the euro zone as a whole soared to 49% in April from 36.8% a month ago.

The Sentix's survey was conducted between April 23 and 25 among 1,023 investors.

-

16:45

Richmond Fed Manufacturing Index rises to −3 in April

The Federal Reserve Bank of Richmond released its survey of manufacturing activity. The lender said that "manufacturing activity remained soft in April".

The composite index for manufacturing rose to −3 in April from −8 in March.

The increase was driven by higher manufacturing employment and higher wages.

Manufacturers expect shipments and in the volume of new orders to grow.

-

16:23

U.S. consumer confidence index drops to 95.2 in April

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 95.2 in April from 101.4 in March, missing expectations for a rise to 102.6. March's figure was revised up from 101.3.

It was the lowest level since December 2014.

The increase was driven by the weaker outlook for the labour market and business conditions. The percentage of consumers expecting more jobs in the coming months declined to 13.8% in April from 15.3% in March.

The percentage of consumers expecting business conditions to improve over the next six months fell to 16.0% in April from 16.8% in March.

"This month's retreat was prompted by a softening in current conditions, likely sparked by the recent lackluster performance of the labor market, and apprehension about the short-term outlook," the director of economic indicators at The Conference Board, Lynn Franco, said.

The Conference Board's consumer expectations index for the next six months decreased to 87.5 in April from 96.0 in March.

The present conditions index plunged to 106.8 in April from 109.5 in March. It was the consecutive decline.

-

16:02

U.S.: Richmond Fed Manufacturing Index, April -3

-

16:02

U.S.: Consumer confidence , April 95.2 (forecast 102.6)

-

15:57

Bank of Canada Governor Stephen Poloz: Canada’s economy is supported by stronger U.S. demand for non-energy exports, the weaker Canadian dollar and interest rate cut in January

The Bank of Canada (BoC) Governor Stephen Poloz testified before the House of Commons Standing Committee on Finance in Ottawa on Tuesday. He noted that Canada's economy is "doing well" outside of the energy sector, supported by stronger U.S. demand for non-energy exports, the weaker Canadian dollar and interest rate cut in January.

Poloz expects that the Canadian economy starts to grow in the second quarter.

"Our outlook is for the positives to begin to reassert themselves during the second quarter, and to do so clearly in the second half of the year," the BoC governor said.

Poloz pointed out that impact of falling oil prices on Canada's economy is happening faster than the central bank expected.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0795-1.0800(E670mn), $1.0885(E747mn), $1.0900(E400mn)

USD/JPY: Y119.00($530mn), Y120.00($610mn)

EUR/JPY: Y130.70(E330mn)

GBP/USD: $1.5150(Gbp267M), $1.5185(Gbp235M), $1.5250(Gbp1.16bn)

EUR/GBP: Gbp0.7190 (E257mn), Gbp0.7345 (E600mn)

AUD/USD: $0.7790(A$530mn), $0.8000(A$539mn), $0.7830(A$300mn)

NZD/USD: $0.7500(NZ$565mn).

USD/CAD: C$1.2250($518mn)

-

15:31

S&P/Case-Shiller home price index rises 5.0% in February

The S&P/Case-Shiller home price index increased 5.0% in February, exceeding expectations for a 4.7% rise, after a 4.5% gain in January.

January's figure was revised down from a 4.6% rise.

Chairman of the index committee at S&P Dow Jones Indices David Blitzer said that "home prices continue to rise and outpace both inflation and wage gains".

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, February 5.0% (forecast 4.7%)

-

14:47

European Central Bank Executive Board member Benoit Coeure: the central bank is not preparing for the Greek exit from the Eurozone

The European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview to the French magazine Alternatives Economiques., published on Tuesday, that the central bank is not preparing for the Greek exit from the Eurozone. He added that the ECB is working on the strengthening the relationship with Greece.

Couere also said that "there is no reason to worry about the recovery of the euro area in 2015 and 2016".

-

14:25

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar despite the weaker-than-expected economic growth in the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:45 France Consumer confidence April 93 91.15 94

08:30 United Kingdom BBA Mortgage Approvals March 37.3 Revised From 38.75K 38.8K

08:30 United Kingdom GDP, q/q (Preliminary) Quarter I 0.6% 0.7% 0.3%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter I 3.0% 2.82% 2.4%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. economic data. The S&P/Case-Shiller home price index is expected to rise by 4.7% in February, after a 4.6% gain in January.

The U.S. consumer confidence is expected to increase to 102.6 in April from 101.3 from March.

The euro traded higher against the U.S. dollar. The euro was supported by yesterday's news that Greek Prime Minister Alexis Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

Friday's Eurogroup meeting ended without any results as widely expected. Discussions between the Greek government and its creditors will continue at the next Eurogroup meeting on May 11.

The European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview, published on Tuesday, that the central bank is not preparing for the Greek exit from the Eurozone.

The French consumer confidence index climbed to 94 in April from 93 in March, exceeding expectations for a decline to 92.5. It was the highest level since January 2010.

Households in France were more willing to make significant purchases.

The British pound traded higher against the U.S. dollar despite the weaker-than-expected economic growth in the U.K. The preliminary U.K. gross domestic product (GDP) climbed 0.3% in the first quarter, missing expectations for a 0.7% gain, after a 0.6% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction, industrial, and services sectors. Construction fell 1.6% in the first quarter, production declined 0.1%, while services rose 0.5%.

On a yearly basis, the preliminary U.K. GDP increased 2.4% in the first quarter, missing forecasts of a 2.8 rise, after a 3.0% gain in the fourth quarter.

The Canadian dollar traded higher against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz.

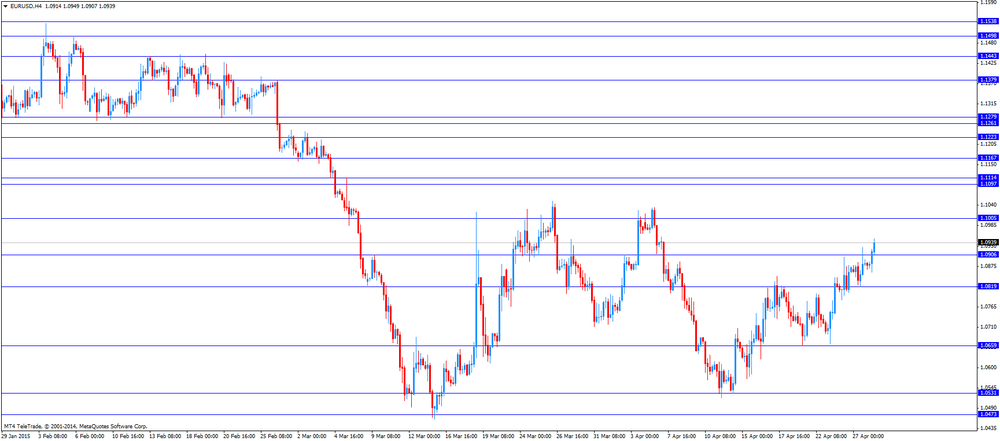

EUR/USD: the currency pair increased to $1.0949

GBP/USD: the currency pair rose to $1.5304

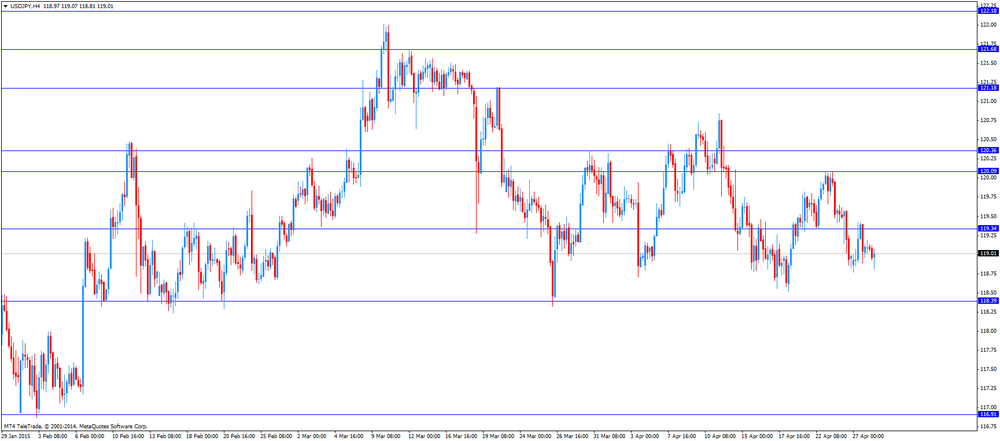

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:45 Canada BOC Gov Stephen Poloz Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y February 4.6% 4.7%

14:00 U.S. Consumer confidence April 101.3 102.6

-

14:04

Consumer confidence index in France reaches the highest level since January 2010

The French statistical office Insee released consumer confidence index for France on Tuesday. The consumer confidence index climbed to 94 in April from 93 in March, exceeding expectations for a decline to 92.5. It was the highest level since January 2010.

Households in France were more willing to make significant purchases.

The indicator for past financial situation increased to -25 in April from -27 in March.

The indicator for future situation rose to -13 in April.

-

14:00

Orders

EUR/USD

Offers 1.0900 1.0920 1.0950 1.0980 1.1000 1.1030 1.1050

Bids 1.0860 1.0830 1.0815-20 1.0800 1.0785 1.0750

GBP/USD

Offers 1.5280 1.5300 1.5325-30 1.5350 1.5380 1.5400

Bids 1.5220 1.5200 1.5185 1.5165 15150 1.5130 1.5100-10 1.5080 1.5065 1.5050

EUR/JPY

Offers 129.80 130.00 130.30 130.80 131.00

Bids 129.20 129.00 128.80 128.40 128.00

USD/JPY

Offers 119.40 119.60 119.75-80 120.00 120.20 120.50

Bids 118.80-85 118.65 118.50 118.25-30 118.00

EUR/GBP

Offers 0.7155-60 0.7180 0.7200 0.7220-25 0.7235 0.7250

Bids 0.7125-30 0.7100-10 0.7085 0.7065 0.7050

AUD/USD

Offers 0.7900 0.7925-30 0.7950 0.7965 0.7980 0.8000

Bids 0.7850 0.7830 0.7800 0.7780-85 0.7760 0.7725 0.7700

-

11:43

Number of mortgage approvals in the U.K. is up to 38,751 in March

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 38,751 in March from 37,453 in February, the highest reading since September 2014.

According to the BBA, the increase was driven by the low mortgage rates on offer.

The BBA noted that house purchase approvals were 14% lower than in 2014.

-

11:24

Australia’s leading economic index rises 0.5% in February

The Conference Board released its leading economic index for Australia on Tuesday. The leading economic index rose 0.5% in February, after a 0.4% gain in January.

It was the third consecutive rise.

The increase was driven by rural goods exports, money supply, share prices, gross operating surplus and the yield spread.

Five of the seven components gained in February.

-

11:01

U.K. gross domestic product (GDP) climbs 0.3% in the first quarter

The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.3% in the first quarter, missing expectations for a 0.7% gain, after a 0.6% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction, industrial, and services sectors. Construction fell 1.6% in the first quarter, production declined 0.1%, while services rose 0.5%.

On a yearly basis, the preliminary U.K. GDP increased 2.4% in the first quarter, missing forecasts of a 2.8 rise, after a 3.0% gain in the fourth quarter.

-

10:59

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0795-1.0800(E670mn), $1.0885(E747mn), $1.0900(E400mn)

USD/JPY: Y119.00($530mn), Y120.00($610mn)

EUR/JPY: Y130.70(E330mn)

GBP/USD: $1.5150(Gbp267M), $1.5185(Gbp235M), $1.5250(Gbp1.16bn)

EUR/GBP: Gbp0.7190 (E257mn), Gbp0.7345 (E600mn)

AUD/USD: $0.7790(A$530mn), $0.8000(A$539mn), $0.7830(A$300mn)

NZD/USD: $0.7500(NZ$565mn).

USD/CAD: C$1.2250($518mn)

-

10:41

Number of unemployed people in France rises 0.4% in March

The French labour ministry released its unemployment figures on Monday. The number of unemployed people in France climbed 0.4% in March from February to 3,509,800.

The number of job seekers under 25 increased 1%.

"The start of 2015 still marks a period of improvement in the trend, even if it is for the moment insufficient to ensure a regular decline in the number of jobseekers," French Labour minister François Rebsamen said in a statement.

-

10:31

United Kingdom: BBA Mortgage Approvals, March 38.75K

-

10:30

United Kingdom: GDP, q/q, Quarter I 0.3% (forecast 0.7%)

-

10:30

United Kingdom: GDP, y/y, Quarter I 2.4% (forecast 2.82%)

-

10:14

European Central Bank Governing Council Member Erkki Liikanen: there is a risk of bubbles in financial markets

The European Central Bank Governing Council Member and the governor of Finland's central bank Erkki Liikanen said on Sunday that if interest rates remain low for a long period, there is a risk of bubbles in financial markets.

He pointed out that central banks should set regulatory and supervisory rules to avoid risks.

Liikanen noted that there is no need for a debate on whether the ECB should reduce its asset purchases.

-

08:45

France: Consumer confidence , April 94 (forecast 91.15)

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

22:40 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Retail sales, y/y March -1.7% Revised From -1.8% -7.4% -9.7%

The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 major peers, was little changed

Fed policy makers meeting on Tuesday and Wednesday in Washington will assess the impact of a harsh winter and a stronger dollar, which may have helped reduce the pace of economic growth to the lowest in a year. The liftoff on the Fed's benchmark interest rate won't happen until September, according to economists surveyed by Bloomberg News, after the economy stumbled in the first quarter.

Japan's currency is set to resume its descent in the coming months as the BOJ will probably add to stimulus as early as July, said Ray Attrill, global co-head of currency strategy at National Australia Bank Ltd. in Sydney. Twenty-two of 34 economists in a Bloomberg survey conducted March 31 to April 3 forecast the BOJ will expand easing by the end of October. Three estimate the central bank will make a move on April 30.

EUR / USD: during the Asian session, the pair fell to $1.0865

GBP / USD: during the Asian session the pair traded in the range of $1.5215-35

USD / JPY: during the Asian session the pair traded in the range Y119.00-20

-

08:15

Options levels on tuesday, April 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0999 (3562)

$1.0956 (3394)

$1.0927 (1364)

Price at time of writing this review: $1.0884

Support levels (open interest**, contracts):

$1.0829 (1115)

$1.0788 (1640)

$1.0731 (3010)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 63283 contracts, with the maximum number of contracts with strike price $1,1200 (6767);

- Overall open interest on the PUT options with the expiration date May, 8 is 76934 contracts, with the maximum number of contracts with strike price $1,0000 (9281);

- The ratio of PUT/CALL was 1.22 versus 1.24 from the previous trading day according to data from April, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5504 (1151)

$1.5407 (834)

$1.5311 (1061)

Price at time of writing this review: $1.5243

Support levels (open interest**, contracts):

$1.5186 (971)

$1.5090 (1004)

$1.4993 (1999)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 24151 contracts, with the maximum number of contracts with strike price $1,5000 (2797);

- Overall open interest on the PUT options with the expiration date May, 8 is 34557 contracts, with the maximum number of contracts with strike price $1,4700 (2866);

- The ratio of PUT/CALL was 1.43 versus 1.39 from the previous trading day according to data from April, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:50

Japan: Retail sales, y/y, March -9.7% (forecast -7.4%)

-

00:29

Currencies. Daily history for Apr 27’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0883 +0,11%

GBP/USD $1,5228 +0,26%

USD/CHF Chf0,9553 +0,21%

USD/JPY Y119,09 +0,09%

EUR/JPY Y129,61 +0,25%

GBP/JPY Y181,36 +0,40%

AUD/USD $0,7846 +0,31%

NZD/USD $0,7634 +0,46%

USD/CAD C$1,2089 -0,69%

-

00:03

Schedule for today, Tuesday, Apr 28’2015:

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence April 93 91.15

08:30 United Kingdom BBA Mortgage Approvals March 37.3K

08:30 United Kingdom GDP, q/q (Preliminary) Quarter I 0.6% 0.7%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter I 3.0% 2.82%

12:45 Canada BOC Gov Stephen Poloz Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y February 4.6%

14:00 U.S. Richmond Fed Manufacturing Index April -8

14:00 U.S. Consumer confidence April 101.3

22:45 New Zealand Trade Balance, mln March 50 78.9

-