Noticias del mercado

-

22:18

U.S. stocks closed

The Standard & Poor's 500 Index rose as Merck & Co.'s boosted profit outlook and a dividend increase from IBM Corp. helped lift equities while the Federal Reserve began its two-day meeting.

The S&P 500 Index rose 0.3 percent to 2,114.90 at 4 p.m. in New York. The Nasdaq Composite Index slipped 0.1 percent, while the Russell 2000 Index advanced 0.5 percent.

"Earnings is driving most everything that's going on right now," said Tom Wirth, senior investment officer for Chemung Canal Trust Co., which manages $1.9 billion in Elmira, New York. "When I look at the stocks that are doing well and those that aren't doing so well, it's mostly earnings driven here."

In the midst of the corporate earnings season, investors are also awaiting the outcome of the Fed's meeting, which begins today, for more clues on the timing of interest rate increases.

The Fed won't hike rates until its September meeting, according to 73 percent of 59 economists in a survey, up from 37 percent in the March survey, when the majority said the first increase would likely come in June or July.

Most Fed policy makers expect to raise the benchmark interest rate by the end of 2015. With economic data missing estimates this month by the most in more than six years, some officials have said they are wary of lifting rates too soon.

The Fed last month dropped an assurance that it will be "patient" in raising rates. Instead, officials said they want to see further labor-market gains and be "reasonably confident" inflation will move back up toward their 2 percent goal before tightening policy.

The Conference Board's index of consumer confidence unexpectedly decreased to 95.2 in April from 101.4 a month earlier, the New York-based private research group said Tuesday. The median forecast of 77 economists called for the gauge to climb to 102.2 after a previously reported 101.3 a month earlier.

Data tomorrow may show U.S. economic growth slowed to a 1 percent pace in the first quarter, from 2.2 percent in the previous three months.

Selling in U.S. equities Tuesday briefly accelerated, sending the S&P 500 as much as 0.7 percent lower, after Al Arabiya reported that Iranian forces seized a U.S. cargo vessel, without saying where it obtained the information.

Pfizer, Ford and Kraft Foods Group Inc. are among 40 S&P 500 companies releasing results today. Of index members that have already reported this season, about three quarters beat profit projections and about half topped sales estimates.

U.S. stocks retreated from records yesterday, with biotechnology companies leading losses. The Nasdaq Composite Index topped its dot-com-era high last week and the S&P 500 closed at a record as Google Inc., Microsoft Corp. and Amazon.com Inc. rallied after posting financial results. U.S. shares have still lagged most developed-market indexes this year.

-

21:00

S&P 500 2,112.03 +3.11 +0.15 %, NASDAQ 5,057.2 -3.05 -0.06 %, Dow 18,095.42 +57.45 +0.32 %

-

19:15

Wall Street. Major U.S. stock-indexes edged up

Major U.S. stock edged up in volatile trading, reversing earlier declines, on strong earnings from Merck (MRK), better-than-expected housing data and a dividend hike from IBM (IBM).

Single-family home prices in USA rose more than expected in February from a year earlier, according to a closely watched survey.

Most of the Dow stocks are trading in positive area (19 из 30). Top looser - Nike, Inc. (NKE, -1.00%). Top gainer - Merck & Co. Inc. (MRK, +5.18%).

Most of S&P index sectors also in positive area. Top gainer - Utilities (+0,7%). Top looser - Consumer goods (-0.2%).

At the moment:

Dow 18037.00 +47.00 +0.26%

S&P 500 2108.75 +4.00 +0.19%

Nasdaq 100 4527.75 +3.00 +0.07%

10-year yield 1.97% +0.05

Oil 57.20 +0.21 +0.37%

Gold 1212.90 +9.70 +0.81%

-

18:04

European stocks close: stocks closed lower on the weaker-than-expected corporate updates

Stock indices closed lower on the weaker-than-expected corporate updates.

The Greek debt crisis remains in focus. Greek Prime Minister Alexis Tsipras said on Tuesday that he expects an agreement between Greece and its creditors could be reached within two weeks. He also said that he would could a referendum if creditors insisted on demands deemed unacceptable by his government.

Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

Investors are awaiting the results of the Fed's monetary policy on Wednesday.

The preliminary U.K. gross domestic product (GDP) climbed 0.3% in the first quarter, missing expectations for a 0.7% gain, after a 0.6% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction, industrial, and services sectors. Construction fell 1.6% in the first quarter, production declined 0.1%, while services rose 0.5%.

On a yearly basis, the preliminary U.K. GDP increased 2.4% in the first quarter, missing forecasts of a 2.8 rise, after a 3.0% gain in the fourth quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,030.53 -73.45 -1.03 %

DAX 11,811.66 -227.50 -1.89 %

CAC 40 5,173.38 -95.53 -1.81 %

-

18:00

European stocks closed: FTSE 100 7,016.18 -87.80 -1.24 %, CAC 40 5,168.27 -100.64 -1.91 %, DAX 11,807.8 -231.36 -1.92 %

-

17:02

Sentix’s survey: around half of investors expect that Greece will leave the Eurozone within the next 12 months

The research group Sentix released its survey on Tuesday. Around half of investors expect that Greece will leave the Eurozone within the next 12 months. The Sentix's Eurozone breakup index for Greece climbed to 48.3% in April from 35.5% in March.

The Sentix's breakup index for the euro zone as a whole soared to 49% in April from 36.8% a month ago.

The Sentix's survey was conducted between April 23 and 25 among 1,023 investors.

-

16:45

Richmond Fed Manufacturing Index rises to −3 in April

The Federal Reserve Bank of Richmond released its survey of manufacturing activity. The lender said that "manufacturing activity remained soft in April".

The composite index for manufacturing rose to −3 in April from −8 in March.

The increase was driven by higher manufacturing employment and higher wages.

Manufacturers expect shipments and in the volume of new orders to grow.

-

16:23

U.S. consumer confidence index drops to 95.2 in April

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 95.2 in April from 101.4 in March, missing expectations for a rise to 102.6. March's figure was revised up from 101.3.

It was the lowest level since December 2014.

The increase was driven by the weaker outlook for the labour market and business conditions. The percentage of consumers expecting more jobs in the coming months declined to 13.8% in April from 15.3% in March.

The percentage of consumers expecting business conditions to improve over the next six months fell to 16.0% in April from 16.8% in March.

"This month's retreat was prompted by a softening in current conditions, likely sparked by the recent lackluster performance of the labor market, and apprehension about the short-term outlook," the director of economic indicators at The Conference Board, Lynn Franco, said.

The Conference Board's consumer expectations index for the next six months decreased to 87.5 in April from 96.0 in March.

The present conditions index plunged to 106.8 in April from 109.5 in March. It was the consecutive decline.

-

15:57

Bank of Canada Governor Stephen Poloz: Canada’s economy is supported by stronger U.S. demand for non-energy exports, the weaker Canadian dollar and interest rate cut in January

The Bank of Canada (BoC) Governor Stephen Poloz testified before the House of Commons Standing Committee on Finance in Ottawa on Tuesday. He noted that Canada's economy is "doing well" outside of the energy sector, supported by stronger U.S. demand for non-energy exports, the weaker Canadian dollar and interest rate cut in January.

Poloz expects that the Canadian economy starts to grow in the second quarter.

"Our outlook is for the positives to begin to reassert themselves during the second quarter, and to do so clearly in the second half of the year," the BoC governor said.

Poloz pointed out that impact of falling oil prices on Canada's economy is happening faster than the central bank expected.

-

15:34

U.S. Stocks open: Dow +0.21%, Nasdaq -0.03%, S&P -0.04%

-

15:31

S&P/Case-Shiller home price index rises 5.0% in February

The S&P/Case-Shiller home price index increased 5.0% in February, exceeding expectations for a 4.7% rise, after a 4.5% gain in January.

January's figure was revised down from a 4.6% rise.

Chairman of the index committee at S&P Dow Jones Indices David Blitzer said that "home prices continue to rise and outpace both inflation and wage gains".

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:29

Before the bell: S&P futures -0.17%, NASDAQ futures -0.06%

U.S. index futures retreated amid concern that better-than-expected earnings won't be enough to trigger more gains.

Global markets:

Nikkei 20,058.95 +75.63 +0.38%

Hang Seng 28,442.75 +9.16 +0.03%

Shanghai Composite 4,476.21 -51.18 -1.13%

FTSE 7,029 -74.98 -1.06%

CAC 5,186.34 -82.57 -1.57%

DAX 11,883.18 -155.98 -1.30%

Crude oil $57.08 (+0.16%)

Gold $1203.50 (+0.01%)

-

15:21

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

AT&T Inc

T

34.10

+0.03%

8.2K

General Motors Company, NYSE

GM

35.80

+0.06%

5.5K

The Coca-Cola Co

KO

40.86

+0.07%

2.6K

Exxon Mobil Corp

XOM

87.08

+0.08%

6.0K

Walt Disney Co

DIS

110.26

+0.09%

0.5K

American Express Co

AXP

77.57

+0.10%

1.1K

Chevron Corp

CVX

109.85

+0.14%

0.2K

Procter & Gamble Co

PG

80.71

+0.14%

3.1K

Amazon.com Inc., NASDAQ

AMZN

439.22

+0.15%

7.3K

ALCOA INC.

AA

13.48

+0.22%

18.0K

Yahoo! Inc., NASDAQ

YHOO

44.48

+0.27%

10.3K

UnitedHealth Group Inc

UNH

116.61

+0.32%

1.8K

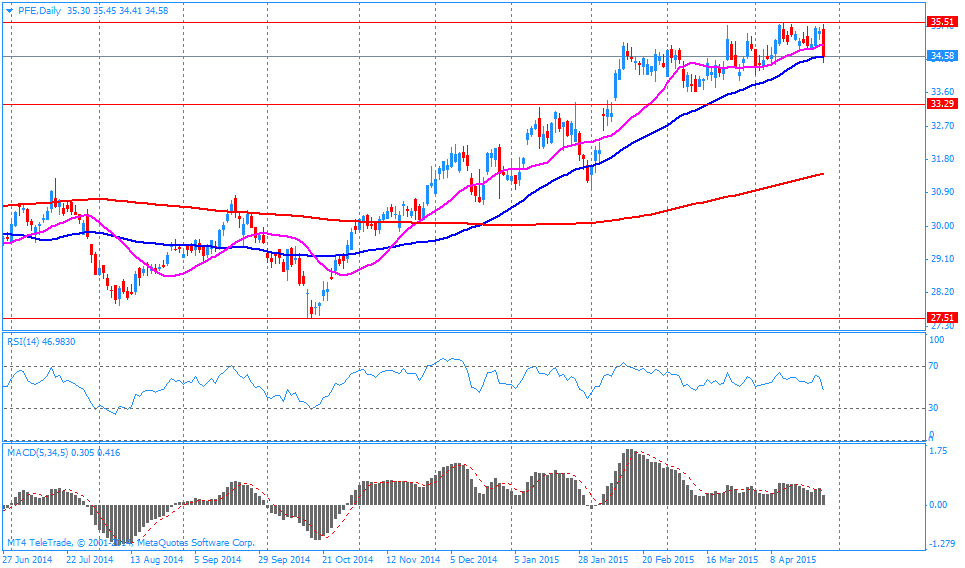

Pfizer Inc

PFE

34.71

+0.35%

81.5K

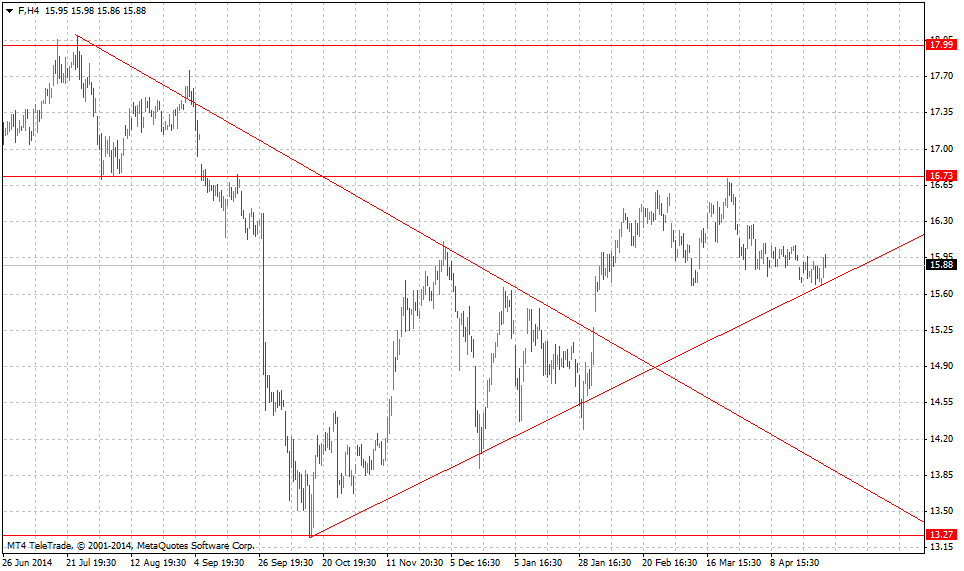

Ford Motor Co.

F

15.96

+0.38%

859.1K

ALTRIA GROUP INC.

MO

51.60

+0.39%

1.3K

Visa

V

67.50

+0.60%

6.1K

Tesla Motors, Inc., NASDAQ

TSLA

233.90

+1.01%

40.6K

Twitter, Inc., NYSE

TWTR

52.20

+1.05%

100.1K

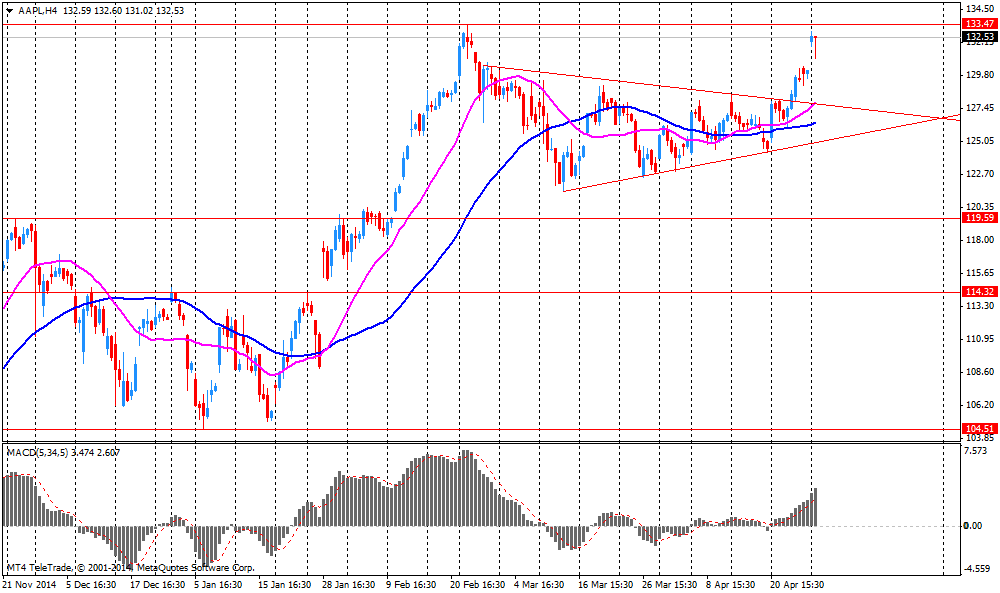

Apple Inc.

AAPL

134.33

+1.27%

2.4M

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

22.37

+2.52%

63.9K

Merck & Co Inc

MRK

60.16

+5.36%

549.6K

Boeing Co

BA

147.75

-0.03%

1.8K

E. I. du Pont de Nemours and Co

DD

74.77

-0.05%

1.5K

Johnson & Johnson

JNJ

100.53

-0.05%

1.2K

Facebook, Inc.

FB

81.87

-0.05%

51.3K

General Electric Co

GE

26.86

-0.07%

6.0K

Verizon Communications Inc

VZ

50.03

-0.10%

1K

Citigroup Inc., NYSE

C

52.72

-0.15%

9.2K

Google Inc.

GOOG

554.55

-0.15%

0.2K

AMERICAN INTERNATIONAL GROUP

AIG

56.90

-0.18%

0.1K

Caterpillar Inc

CAT

85.16

-0.20%

7.3K

JPMorgan Chase and Co

JPM

62.21

-0.21%

1.9K

International Business Machines Co...

IBM

170.25

-0.28%

2.1K

McDonald's Corp

MCD

96.16

-0.29%

4.5K

Cisco Systems Inc

CSCO

28.80

-0.31%

0.7K

Home Depot Inc

HD

111.05

-0.31%

3.0K

Starbucks Corporation, NASDAQ

SBUX

50.71

-0.31%

1.4K

3M Co

MMM

157.31

-0.42%

0.7K

Intel Corp

INTC

32.36

-0.43%

2.8K

Nike

NKE

100.50

-0.44%

0.7K

Travelers Companies Inc

TRV

102.88

-0.44%

0.2K

Microsoft Corp

MSFT

47.78

-0.52%

43.9K

United Technologies Corp

UTX

115.07

-0.58%

1.3K

Barrick Gold Corporation, NYSE

ABX

12.67

-1.02%

108.0K

Yandex N.V., NASDAQ

YNDX

19.24

-5.08%

17.3K

-

15:12

Upgrades and downgrades before the market open

Upgrades:

DuPont (DD) upgraded from Underperform to Outperform at Credit Agricole

Freeport-McMoRan (FCX) upgraded from Equal-Weight to Overweight at Morgan Stanley

Downgrades:

Other:

Apple (AAPL) target raised from $150 to $155 at Canaccord Genuity, from $134 to $155 at Robert W. Baird, from $180 to $195 at Cantor Fitzgerald, from $142 to $150 at RBC Capital Mkts, from $150 to $155 at Susquehanna

Starbucks (SBUX) reiterated at Buy at Argus, target raised from $54 to $59

-

14:56

Company News: Merck (MRK) beats expectation

Company reported Q1 earnings of $0.85 per share versus $0.75 consensus. Revenues fell 8.2% year/year to $9.43 bln versus $9.06 bln consensus.

Company issueed in-line guidance for FY15, sees EPS of $3.35-$3.48 versus $3.37 consensus and revenue of $38.3-$39.8 bln versus $39.23 consensus.

MRK rose to $59.66 (+4.48%) on the premarket.

-

14:50

-

14:47

European Central Bank Executive Board member Benoit Coeure: the central bank is not preparing for the Greek exit from the Eurozone

The European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview to the French magazine Alternatives Economiques., published on Tuesday, that the central bank is not preparing for the Greek exit from the Eurozone. He added that the ECB is working on the strengthening the relationship with Greece.

Couere also said that "there is no reason to worry about the recovery of the euro area in 2015 and 2016".

-

14:44

-

14:37

-

14:04

Consumer confidence index in France reaches the highest level since January 2010

The French statistical office Insee released consumer confidence index for France on Tuesday. The consumer confidence index climbed to 94 in April from 93 in March, exceeding expectations for a decline to 92.5. It was the highest level since January 2010.

Households in France were more willing to make significant purchases.

The indicator for past financial situation increased to -25 in April from -27 in March.

The indicator for future situation rose to -13 in April.

-

12:03

European stock markets mid session: stocks traded lower after trading higher on Monday

Stock indices traded lower after trading higher on Monday on news that the Greek Prime Minister Alexis Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

Friday's Eurogroup meeting ended without any results as widely expected. Discussions between the Greek government and its creditors will continue at the next Eurogroup meeting on May 11.

The head of the Eurogroup Jeroen Dijsselbloem rejected the idea of a "Plan B" for Greece if the debt talks are not successful.

The idea was raised by ministers from Slovenia, Slovakia and Lithuania at the Eurogroup's meeting on Friday.

Investors are awaiting the results of the Fed's monetary policy on Wednesday.

The preliminary U.K. gross domestic product (GDP) climbed 0.3% in the first quarter, missing expectations for a 0.7% gain, after a 0.6% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction, industrial, and services sectors. Construction fell 1.6% in the first quarter, production declined 0.1%, while services rose 0.5%.

On a yearly basis, the preliminary U.K. GDP increased 2.4% in the first quarter, missing forecasts of a 2.8 rise, after a 3.0% gain in the fourth quarter.

Current figures:

Name Price Change Change %

FTSE 100 7,047.17 -56.81 -0.80 %

DAX 11,946.57 -92.59 -0.77 %

CAC 40 5,212.63 -56.28 -1.07 %

-

11:43

Number of mortgage approvals in the U.K. is up to 38,751 in March

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 38,751 in March from 37,453 in February, the highest reading since September 2014.

According to the BBA, the increase was driven by the low mortgage rates on offer.

The BBA noted that house purchase approvals were 14% lower than in 2014.

-

11:24

Australia’s leading economic index rises 0.5% in February

The Conference Board released its leading economic index for Australia on Tuesday. The leading economic index rose 0.5% in February, after a 0.4% gain in January.

It was the third consecutive rise.

The increase was driven by rural goods exports, money supply, share prices, gross operating surplus and the yield spread.

Five of the seven components gained in February.

-

11:01

U.K. gross domestic product (GDP) climbs 0.3% in the first quarter

The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.3% in the first quarter, missing expectations for a 0.7% gain, after a 0.6% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction, industrial, and services sectors. Construction fell 1.6% in the first quarter, production declined 0.1%, while services rose 0.5%.

On a yearly basis, the preliminary U.K. GDP increased 2.4% in the first quarter, missing forecasts of a 2.8 rise, after a 3.0% gain in the fourth quarter.

-

10:45

Asia Pasific Stocks:

Asian stocks rose, with the regional benchmark index extending a seven-year high, as investors weighed company profits.

HANG SENG 28,316.92 -116.67 -0.41%

S&P/ASX 200 5,948.5 -34.19 -0.57%

TOPIX 1,627.43 +8.36 +0.52%

SHANGHAI COMP 4,482.5 -44.90 -0.99%

-

10:41

Number of unemployed people in France rises 0.4% in March

The French labour ministry released its unemployment figures on Monday. The number of unemployed people in France climbed 0.4% in March from February to 3,509,800.

The number of job seekers under 25 increased 1%.

"The start of 2015 still marks a period of improvement in the trend, even if it is for the moment insufficient to ensure a regular decline in the number of jobseekers," French Labour minister François Rebsamen said in a statement.

-

10:14

European Central Bank Governing Council Member Erkki Liikanen: there is a risk of bubbles in financial markets

The European Central Bank Governing Council Member and the governor of Finland's central bank Erkki Liikanen said on Sunday that if interest rates remain low for a long period, there is a risk of bubbles in financial markets.

He pointed out that central banks should set regulatory and supervisory rules to avoid risks.

Liikanen noted that there is no need for a debate on whether the ECB should reduce its asset purchases.

-

08:07

Apple (AAPL) will be on focus today

The company posted second-quarter earnings of $2.33 per share versus consensus of $2.16. Sales came in at $58.01 bln, also exceeding analyst forecasts of $56.1 bln. Q2 gross margins was of 40.8% versus guidance of 38.5-39.5% and 39.3% last year.

Company reported following numbers on sales:

Q2 iPhones 61.2 mln versus 57 mln estimates and 43.7 mln last year;

Q2 iPads 12.6 mln versus 14 mln estimates and 16.4 mln last year;

Q2 Macs 4.6 mln versus 4.6 mln estimates and 4.1 mln last year.

Company expect Q3 revenues of $46-48 bln versus $47.09 bln consensus.

Apple announced increased share repurchase authorization to $140 bln from $90 bln raised quarterly dividend to $0.52/share from $0.47/share.

AAPL advanced to $132.53 (+1.82%) on Monday.

-

04:01

Nikkei 225 20,086.97 +103.65 +0.52 %, Hang Seng 28,378.7 -54.89 -0.19 %, Shanghai Composite 4,536.7 +9.31 +0.21 %

-

00:30

Stocks. Daily history for Apr 27’2015:

(index / closing price / change items /% change)

HANG SENG 28,572.9 +511.92 +1.82%

TOPIX 1,619.07 +0.23 +0.01%

SHANGHAI COMP 4,523.69 +130.00 +2.96%

FTSE 100 7,103.98 +33.28 +0.47 %

CAC 40 5,268.91 +67.46 +1.30 %

Xetra DAX 12,039.16 +228.31 +1.93 %

S&P 500 2,108.92 -8.77 -0.41 %

NASDAQ Composite 5,060.25 -31.84 -0.63 %

Dow Jones 18,037.97 -42.17 -0.23 %

-