Noticias del mercado

-

22:09

U.S. stocks closed

U.S. stocks declined after the economy barely grew in the first quarter and investors weighed the timing for a possible interest-rate increase as the Federal Reserve said part of the weakness was transitory.

The Standard & Poor's 500 Index slipped 0.4 percent to 2,106.80 at 4 p.m. in New York, after earlier falling as much as 0.8 percent.

"It confirms people's view that the Fed won't raise interest rates in June - that's certainly driven home today by GDP growth," said Kristina Hooper, a U.S. investment strategist at Allianz Global Investors in New York. The firm oversees $499 billion. "But there is still some question mark because the Fed is blaming part of downturn in the first quarter on transitory factors."

Fed officials have said they expect to raise rates this year for the first time since 2006 as the economy nears full employment, and that their decision will be guided by the latest data. They had said last month that they would be unlikely to raise rates at their April meeting.

A run of disappointing economic data has cast doubt on how quickly the Fed can meet its goals for full employment and stable prices.

"Economic growth slowed during the winter months, in part reflecting transitory factors," the Federal Open Market Committee said in a statement Wednesday. "The pace of job gains moderated," it said, and "underutilization of labor resources was little changed."

A report earlier Wednesday showed growth almost ground to a halt in the first quarter, held back by severe winter weather and slumping business spending and exports.

Gross domestic product, the volume of all goods and services produced, rose at a 0.2 percent annualized rate after advancing 2.2 percent the prior quarter. The median forecast of 86 economists surveyed by Bloomberg called for a 1 percent gain.

"If they had taken out the word 'transitory,' you probably would have had the equity market turn positive," said Quincy Krosby, a market strategist at Prudential Financial Inc., in Newark, New Jersey. Prudential oversees more than $1 trillion in assets. "Just having that in there shows the Fed does believe it was, in fact, transitory i.e. we are going to be pushing into a rebound soon."

The S&P 500 has risen 1.9 percent this month, rebounding from a drop in March, after earnings from companies including Merck & Co. and Microsoft Corp. beat analysts' estimates. About 74 percent of the S&P 500 companies that have reported earnings this season have beaten analysts' profit projections, while 48 percent topped sales estimates.

-

21:00

S&P 500 2,108.5 -6.26 -0.30 %, NASDAQ 5,043.52 -11.90 -0.24 %, Dow 18,093.45 -16.69 -0.09 %

-

18:00

European stocks closed: FTSE 100 6,957.74 -72.79 -1.04 %, CAC 40 5,055.76 -117.62 -2.27 %, DAX 11,463.12 -348.54 -2.95 %

-

18:00

European stocks close: stocks closed lower on a stronger euro

Stock indices closed lower on a stronger euro. The euro rose against the U.S. dollar as the U.S. GDP was weaker than expected. The U.S. preliminary gross domestic product increased at an annual rate of 0.2% in the first quarter, missing expectations for a 1.3% gain, after a 2.2% rise in the fourth quarter.

U.S. consumers spending slowed in the first quarter due to cold weather. Energy companies in the U.S. cut spending due to lower low prices.

A strong U.S. dollar also weighed on GDP.

Investors are awaiting the results of the Fed's monetary policy meeting later in the day. They are awaiting signs when the Fed will start to hike its interest rate. It is unlikely that the Fed will start to raise its interest rate in June as the recently released U.S. economic data was weaker than expected.

The Greek debt focus remains in focus. Greek Finance Minister Yanis Varoufakis denied in an interview to the German newspaper Die Zeit on Wednesday that he was sidelined from debt talks between Greece and its creditors.

Greek Prime Minister Alexis Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index declined to 103.7 in April from 103.9 in March, missing expectations for a rise to 104.1. It was the first decline in five months.

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 4.6% in March from last year, exceeding expectations for a 4.2% gain, after a 4 % increase in February.

On a yearly basis, M3 money supply in the Eurozone climbed to 4.1% from 3.8% in the period from December to February.

Loans to the private sector in the Eurozone increased 0.1% in March from the last year, in line with expectations, after a 0.1% decline in February. It was the first increase since March 2012.

The rise was driven by ECB's quantitative easing.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,946.28 -84.25 -1.20 %

DAX 11,432.72 -378.94 -3.21 %

CAC 40 5,039.39 -133.99 -2.59 %

-

17:14

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Wednesday after data showed that economic growth braked more sharply than expected in the first quarter. U.S. gross domestic product grew at only 0.2% annual rate in the quarter as harsh weather dampened consumer spending and energy companies struggling with low prices cut spending.

Most of the Dow stocks are trading in negative area (23 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -2.87%). Top gainer - Visa Inc. (V, +1.32%).

All S&P index sectors in negative area. Top looser - Utilities (-0.8%).

At the moment:

Dow 18000.00 -58.00 -0.32%

S&P 500 2102.25 -9.75 -0.46%

Nasdaq 100 4493.00 -23.00 -0.51%

10-year yield 2.06% +0.09

Oil 58.43 +1.37 +2.40%

Gold 1209.60 -4.30 -0.35%

-

17:02

Greek Finance Minister Yanis Varoufakis denied that he was sidelined from debt talks

Greek Finance Minister Yanis Varoufakis denied in an interview to the German newspaper Die Zeit on Wednesday that he was sidelined from debt talks between Greece and its creditors.

"Yes, I'm in charge. I'm still responsible for the talks with the Eurogroup," Varoufakis said.

Greek Prime Minister Alexis Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

-

16:45

CBI retail sales balance declines to +12% in April

The Confederation of British Industry released its retail sales balance data on Wednesday. The CBI retail sales balance was down to +12% in April from +18% in March.

"With shopping habits changing so dramatically in the last few years underlying consumer confidence is hard to read, but both retailers and wholesalers are optimistic there will be a spring in their customers' steps, and therefore their sales, in the near future," the CBI survey chairman and Asda's Chief Customer Officer Barry Williams said.

Sales expectations for next month jumped to +40% in April from +21% in March.

-

16:25

U.S. pending home sales climbs 1.1% in March

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Wednesday. Pending home sales in the U.S. rose 1.1% in March, after a 3.6% gain in February. February's figure was revised up from a 3.1% rise.

The NAR's chief economist Lawrence Yun said that the activity this year was driven by more long-term homeowners.

"Demand appears to be stronger in several parts of the country, especially in metro areas that have seen solid job gains and firmer economic growth over the past year," he noted.

-

15:50

German consumer price inflation rises 0.4% in April

Destatis released its consumer price data for Germany on Wednesday. German consumer prices fell 0.1% in April, missing expectations for a 0.4% rise, after a 0.5% gain in March.

On a yearly basis, German consumer price inflation climbed to 0.4% in April from a 0.3% gain in March, but missing expectations for a 0.5% increase. It was the fastest pace since November 2014.

-

15:32

U.S. Stocks open: Dow -0.29%, Nasdaq -0.48%, S&P -0.30%

-

15:28

U.S. economy expands at 0.2% in the first quarter

The U.S. Commerce Department released gross domestic product data on Wednesday. The U.S. preliminary gross domestic product increased at an annual rate of 0.2% in the first quarter, missing expectations for a 1.3% gain, after a 2.2% rise in the fourth quarter.

Consumers spending slowed in the first quarter due to cold weather. Energy companies cut spending due to lower low prices.

A strong U.S. dollar also weighed on GDP.

Consumer spending grew 1.9% in the first quarter, after a 4.4% increase in the fourth quarter. The harsh weather weighed on the consumer spending.

The personal consumption expenditures (PCE) price index dropped at an annual rate of 2.0% in the first quarter. That was the weakest reading since the first quarter of 2009.

The personal consumption expenditures (PCE) price index excluding food and energy increased 0.9%.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation.

-

15:27

Before the bell: S&P futures -0.64%, NASDAQ futures -0.62%

U.S. stock-index futures maintained losses as data showed the economy barely grew in the first quarter and investors awaited the Federal Reserve's policy decision.

Global markets:

Nikkei 20,058.95 +75.63 +0.38%

Hang Seng 28,400.34 -42.41 -0.15%

Shanghai Composite 4,476.62 +0.41 +0.01%

FTSE 6,981.95 -48.58 -0.69%

CAC 5,108.13 -65.25 -1.26%

DAX 11,644.4 -167.26 -1.42%

Crude oil $56.85 (-0.40%)

Gold $1211.20 (-0.21%)

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Exxon Mobil Corp

XOM

87.86

+0.07%

2.2K

McDonald's Corp

MCD

96.94

+0.11%

0.1K

Boeing Co

BA

147.75

+0.16%

0.7K

Apple Inc.

AAPL

130.85

+0.22%

415.6K

Visa

V

67.12

+0.52%

2.7K

E. I. du Pont de Nemours and Co

DD

75.26

+0.59%

0.1K

Yandex N.V., NASDAQ

YNDX

19.40

+1.04%

4.1K

UnitedHealth Group Inc

UNH

117.58

-0.01%

0.1K

Ford Motor Co.

F

15.90

-0.06%

86.2K

AMERICAN INTERNATIONAL GROUP

AIG

56.75

-0.09%

0.4K

Chevron Corp

CVX

111.00

-0.11%

0.2K

Home Depot Inc

HD

110.45

-0.12%

4.5K

Wal-Mart Stores Inc

WMT

79.00

-0.13%

9.4K

Barrick Gold Corporation, NYSE

ABX

13.28

-0.15%

47.2K

General Electric Co

GE

27.06

-0.22%

3.6K

Starbucks Corporation, NASDAQ

SBUX

50.50

-0.22%

11.6K

Johnson & Johnson

JNJ

100.50

-0.24%

1.5K

International Business Machines Co...

IBM

173.45

-0.27%

0.5K

The Coca-Cola Co

KO

40.66

-0.27%

3.8K

ALCOA INC.

AA

13.44

-0.30%

27.0K

Nike

NKE

99.54

-0.32%

10.7K

Citigroup Inc., NYSE

C

52.85

-0.32%

11.6K

General Motors Company, NYSE

GM

35.60

-0.34%

0.2K

American Express Co

AXP

77.22

-0.35%

0.9K

Procter & Gamble Co

PG

80.14

-0.35%

9.4K

Walt Disney Co

DIS

109.52

-0.36%

5.5K

Google Inc.

GOOG

551.69

-0.36%

0.2K

JPMorgan Chase and Co

JPM

62.50

-0.41%

5.9K

Intel Corp

INTC

32.88

-0.42%

5.0K

Amazon.com Inc., NASDAQ

AMZN

427.50

-0.42%

0.3K

Verizon Communications Inc

VZ

50.32

-0.45%

4.7K

AT&T Inc

T

34.70

-0.46%

15.5K

3M Co

MMM

157.56

-0.49%

1.0K

Cisco Systems Inc

CSCO

29.17

-0.51%

28.1K

Facebook, Inc.

FB

80.24

-0.55%

112.4K

Microsoft Corp

MSFT

48.88

-0.56%

44.5K

Caterpillar Inc

CAT

85.68

-0.60%

0.7K

Merck & Co Inc

MRK

59.54

-0.73%

0.7K

Tesla Motors, Inc., NASDAQ

TSLA

228.78

-0.74%

10.3K

Pfizer Inc

PFE

34.21

-0.78%

49.8K

Yahoo! Inc., NASDAQ

YHOO

43.88

-1.04%

6.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

22.43

-1.10%

9.8K

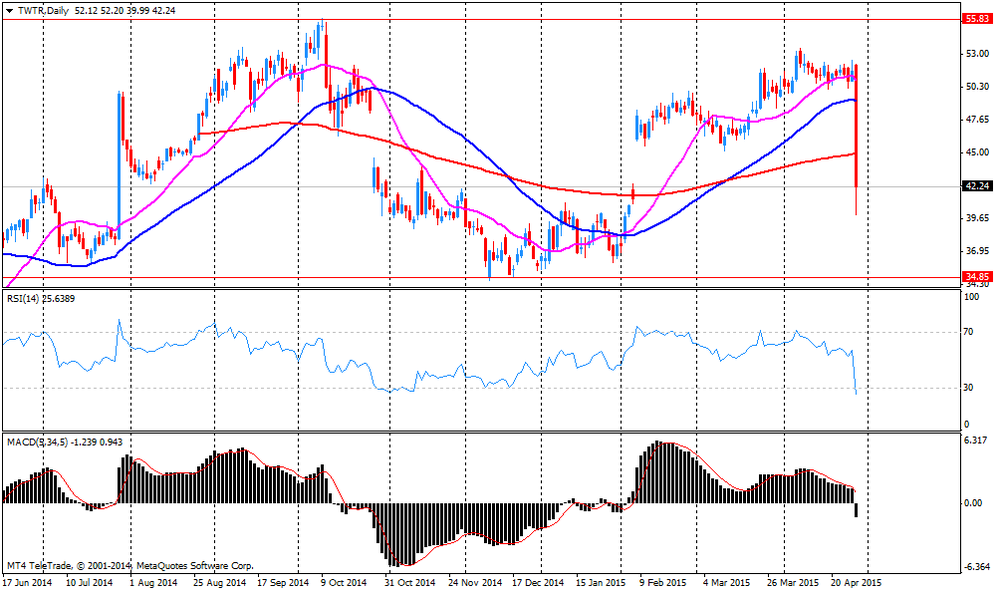

Twitter, Inc., NYSE

TWTR

41.17

-2.60%

2.0M

-

15:09

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Twitter (TWTR) downgraded to Neutral from Buy at Janney, target lowered to $44 from $53

Twitter (TWTR) downgraded to Equal Weight from Overweight at Barclays, target lowered to $44 from $60

Other:

Twitter (TWTR) target lowered to $55 from $61 at Brean Capital, to $47 from $54 at RBC Capital Mkts, to $50 from $62 at Cantor Fitzgerald

-

15:01

Canadian industrial product and raw materials price indexes are mixed in March

Statistics Canada released its industrial product and raw materials price indexes on Wednesday. The Industrial Product Price Index (IPPI) rose 0.3% in March, after a 1.8% increase in February. January's figure was revised up from a 0.4% decline.

The increase was driven by higher prices for energy and petroleum products. Energy and petroleum products gained 1.8% in March.

11 of the 21 commodity groups rose, 7 decreased and 3 were unchanged.

The Raw Materials Price Index (RMPI) fell 0.9% in March, missing expectations for a 4.5% rise, after a 5.9% gain in February. February's figure was revised down from a 6.1% increase.

The decline was driven by lower prices for crude energy products. Crude energy products were down 2.8% in March.

4 of the 6 commodity groups rose, 1 decreased and 1 were unchanged.

-

14:52

Company News: Twitter (TWTR) realesed mixed report and lowered guidance for FY15

Company reported Q1 earnings of $0.07 per share versus $0.04 consensus. Revenues rose 74.0% year/year to $435.9 mln versus $456.55 mln consensus.

Company lowered FY15 revenue guidance to $2.17-$2.27 bln from $2.3-$2.35 bln versus $2.38 bln consensus and EBITDA guidance to $510-$535 mln from $550-$575 mln.

TWTR fell to $41.24 (-2.44%) on the premarket.

-

14:43

European Central Bank raised the amount the Greek central bank can lend its banks to €76.9 billion

The European Central Bank (ECB) on Wednesday raised the amount the Greek central bank can lend its banks to €76.9 billion from €75.5 billion the previous week, according to news sources. The ECB declined to comment.

The ECB's data showed that deposit outflow from Greek banks slowed in March. Greek banks' deposits declined to 145 billion in March from 147.5 billion euros in February.

-

12:02

European stock markets mid session: stocks traded little changed as investors are awaiting the results of the Fed’s monetary policy meeting

Stock indices traded little changed as investors are awaiting the results of the Fed's monetary policy meeting. Investors are awaiting signs when the Fed will start to hike its interest rate. It is unlikely that the Fed will start to raise its interest rate in June as the recently released U.S. economic data was weaker than expected.

The Greek debt focus remains in focus. Greek Prime Minister Alexis Tsipras said on Tuesday that he expects an agreement between Greece and its creditors could be reached within two weeks. He also said that he would could a referendum if creditors insisted on demands deemed unacceptable by his government.

Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index declined to 103.7 in April from 103.9 in March, missing expectations for a rise to 104.1. It was the first decline in five months.

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 4.6% in March from last year, exceeding expectations for a 4.2% gain, after a 4 % increase in February.

On a yearly basis, M3 money supply in the Eurozone climbed to 4.1% from 3.8% in the period from December to February.

Loans to the private sector in the Eurozone increased 0.1% in March from the last year, in line with expectations, after a 0.1% decline in February. It was the first increase since March 2012.

The rise was driven by ECB's quantitative easing.

Current figures:

Name Price Change Change %

FTSE 100 7,034.78 +4.25 +0.06 %

DAX 11,808.8 -2.86 -0.02 %

CAC 40 5,166.85 -6.53 -0.13 %

-

11:42

Eurozone’s economic sentiment index declines to 103.7 in April

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index declined to 103.7 in April from 103.9 in March, missing expectations for a rise to 104.1.

It was the first decline in five months.

The consumer confidence index dropped to -4.6 in April from -3.7 in March due to faltering optimism about the level of future unemployment and the future general economic situation index.

The industrial confidence index decreased to -3.2 in April from -2.9 the previous month as production expectations declined.

The services sentiment index climbed to 6.7 in April from 6.1 in March.

The construction confidence index fell to -25.6 in April from -24.2 in March due to the weaker employment expectations.

The business climate index increased to 0.32 in April from 0.23 in March, exceeding forecasts of a drop to 0.12. It was the highest level since May 2014.

-

11:18

UBS consumption index climbs to 1.35 in March

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.35 in March from 1.21 in February.

February's figure was revised up from 1.19.

The increase was driven by a rise in new car registrations. New car registrations jumped 24.0% in March.

The retailer sentiment index dropped to -13 in March from -3 in the previous month, the lowest level since the end of 2011.

-

10:48

M3 money supply in the Eurozone rises 4.6% in March from last year

The European Central Bank (ECB) released its M3 money supply figures on Wednesday. M3 money supply rose 4.6% in March from last year, exceeding expectations for a 4.2% gain, after a 4 % increase in February.

On a yearly basis, M3 money supply in the Eurozone climbed to 4.1% from 3.8% in the period from December to February.

Loans to the private sector in the Eurozone increased 0.1% in March from the last year, in line with expectations, after a 0.1% decline in February.

It was the first increase since March 2012.

The rise was driven by ECB's quantitative easing.

-

10:39

Asia Pasific Stocks closed:

HANG SENG 28,324.09 -118.66 -0.42%

S&P/ASX 200 5,838.6 -109.94 -1.85%

TOPIX closed

SHANGHAI COMP 4,474.09 -2.12 -0.05% -

10:02

European Central Bank (ECB) Executive Board Member Jens Weidmann: the situation in Greece is precarious

The European Central Bank (ECB) Executive Board Member and Bundesbank President Jens Weidmann said on Tuesday that the situation in Greece is precarious. He added that Greece's debt continued to increase despite the haircut in 2012 and was now more than 170% of GDP.

Weidmann pointed out that the Eurozone is better prepared to fight off contagion from a Greek exit from the Eurozone than in previous years. But the Bundesbank president warned against underestimating the risks of such a scenario.

-

04:01

Hang Seng 28,334.36 -108.39 -0.38 %, Shanghai Composite 4,437.07 -39.15 -0.87 %

-

00:35

Stocks. Daily history for Apr 28’2015:

(index / closing price / change items /% change)

Nikkei 225 20,058.95 +75.63 +0.38 %

Hang Seng 28,442.75 +9.16 +0.03 %

S&P/ASX 200 5,948.54 -34.15 -0.57 %

Shanghai Composite 4,476.21 -51.18 -1.13 %

FTSE 100 7,030.53 -73.45 -1.03 %

CAC 40 5,173.38 -95.53 -1.81 %

Xetra DAX 11,811.66 -227.50 -1.89 %

S&P 500 2,114.76 +5.84 +0.28 %

NASDAQ Composite 5,055.42 -4.82 -0.10 %

Dow Jones 18,110.14 +72.17 +0.40 %

-