Noticias del mercado

-

17:41

Crude oil prices are up on lower U.S. crude oil inventories

Crude oil prices increased on lower U.S. crude oil inventories. The U.S. Energy Information Administration (EIA) said on Wednesday that U.S. commercial crude inventories rose by 1.9 million barrels last week. Analysts had expected a gain of 2.3 million barrels.

The EIA also said that crude oil inventories at the oil hub at Cushing, Oklahoma, fell for the first time since November 28, 2014.

These figures may indicate that an oil glut starts to ease.

WTI crude oil for June delivery increased to $58.55 a barrel on the New York Mercantile Exchange. Brent crude oil for June climbed to $65.14 a barrel on ICE Futures Europe.

-

17:24

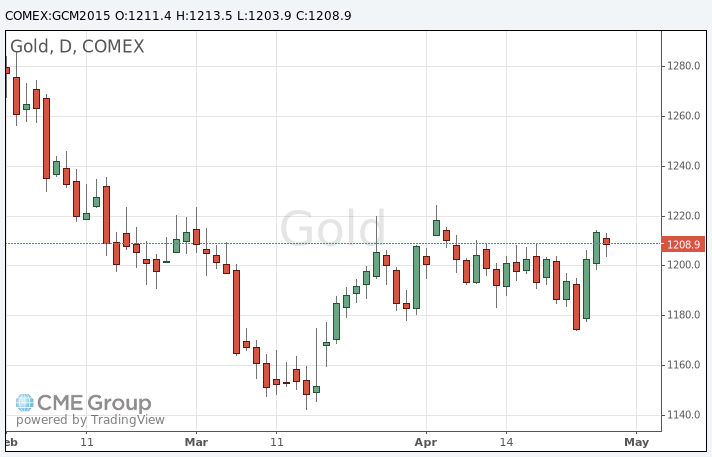

Gold price rises on the weaker-than-expected U.S. GDP data

Gold price rose on the weaker-than-expected U.S. GDP data. The U.S. preliminary gross domestic product increased at an annual rate of 0.2% in the first quarter, missing expectations for a 1.3% gain, after a 2.2% rise in the fourth quarter.

Consumers spending slowed in the first quarter due to cold weather. Energy companies cut spending due to lower low prices.

A strong U.S. dollar also weighed on GDP.

Consumer spending grew 1.9% in the first quarter, after a 4.4% increase in the fourth quarter. The harsh weather weighed on the consumer spending.

The personal consumption expenditures (PCE) price index dropped at an annual rate of 2.0% in the first quarter. That was the weakest reading since the first quarter of 2009.

The personal consumption expenditures (PCE) price index excluding food and energy increased 0.9%.

Investors are awaiting the results of the Fed's monetary policy meeting later in the day. It is likely that the Fed will delay its first interest rate hike due to the recently released soft U.S. economic data.

June futures for gold on the COMEX today increased to 1213.50 dollars per ounce.

-

00:36

Commodities. Daily history for Apr 28’2015:

(raw materials / closing price /% change)

Oil 57.06 +0.12%

Gold 1,213.90 +0.89%

-