Noticias del mercado

-

17:43

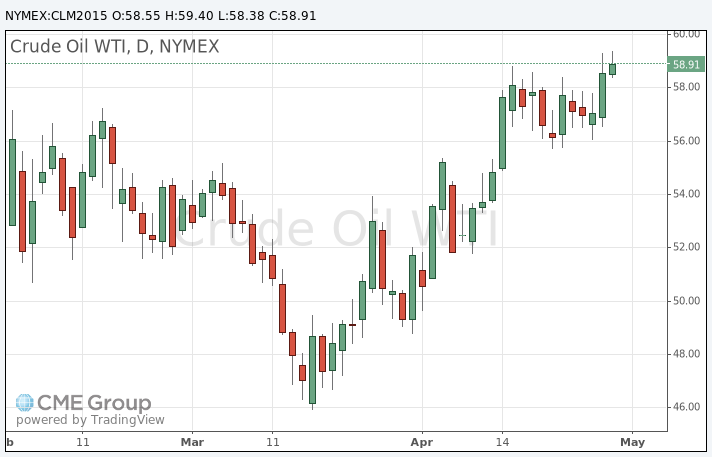

WTI crude oil rose, while Brent crude oil declined

WTI crude oil rose, while Brent crude oil declined. The U.S. economic data weighed on oil prices. The number of initial jobless claims in the week ending April 25 in the U.S. fell by 34,000 to 262,000 from 296,000 in the previous week, beating expectations for a rise by 4,000.

The news that crude oil inventories at the oil hub at Cushing, Oklahoma, fell for the first time since November 28, 2014 still supported oil prices.

WTI crude oil for June delivery increased to $59.40 a barrel on the New York Mercantile Exchange. Brent crude oil for June fell to $64.78 a barrel on ICE Futures Europe.

-

17:23

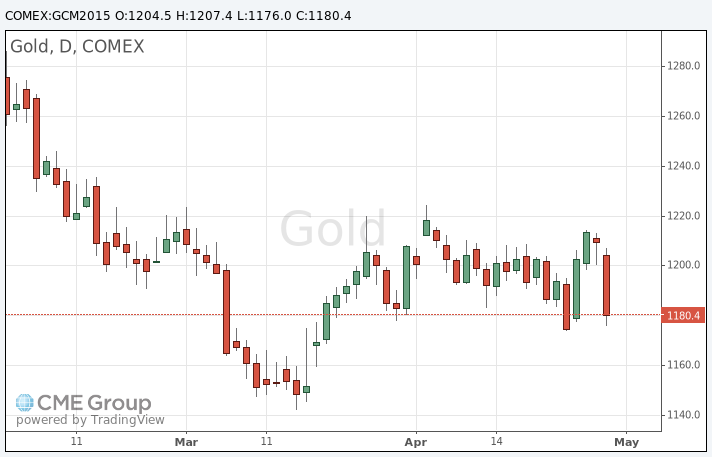

Gold price declines more than $20 on the better-than-expected U.S. initial jobless claims

Gold price dropped more than $20 on the better-than-expected U.S. initial jobless claims. The number of initial jobless claims in the week ending April 25 in the U.S. fell by 34,000 to 262,000 from 296,000 in the previous week, beating expectations for a rise by 4,000.

It was the lowest reading since April 2000.

The previous week's figure was revised down from 295,000.

Initial jobless claims remained below 300,000 the eighth straight week.

The Fed's monetary policy also weighed on gold price. The Fed kept its monetary policy unchanged, but it did not rule out the interest rate hike in June. The central bank said that the U.S. economy slowed down during the winter months, but the slowdown was driven by "transitory factors".

June futures for gold on the COMEX today increased to 1176.00 dollars per ounce.

-

01:02

Commodities. Daily history for Apr 29’2015:

(raw materials / closing price /% change)

Oil 58.58 +2.66%

Gold 1,204.10 -0.49%

-