Noticias del mercado

-

20:21

American focus: Dollar rises off lows on early glimpse of a second-quarter rebound

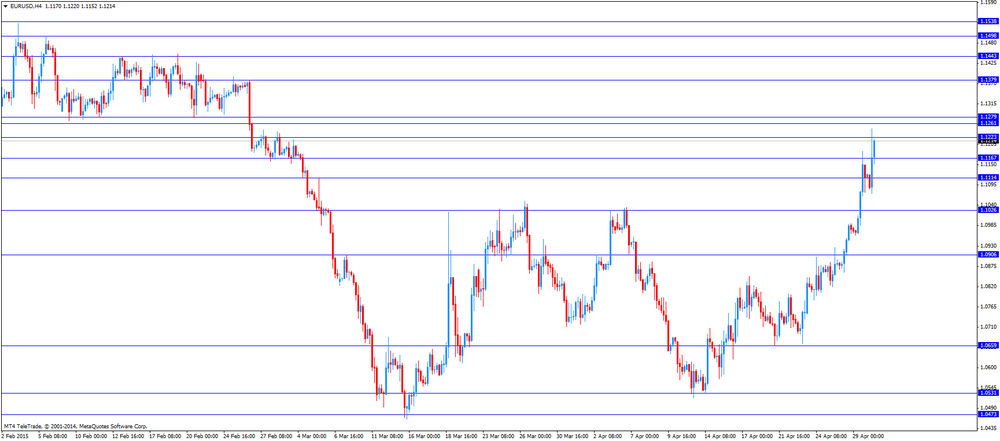

The U.S. dollar rose off its lows against the euro Thursday after signs of rising wages and falling unemployment offered a glimpse of a second-quarter rebound, lending credibility to the Federal Reserve's argument that the first quarter's slowdown was largely due to transitory factors.

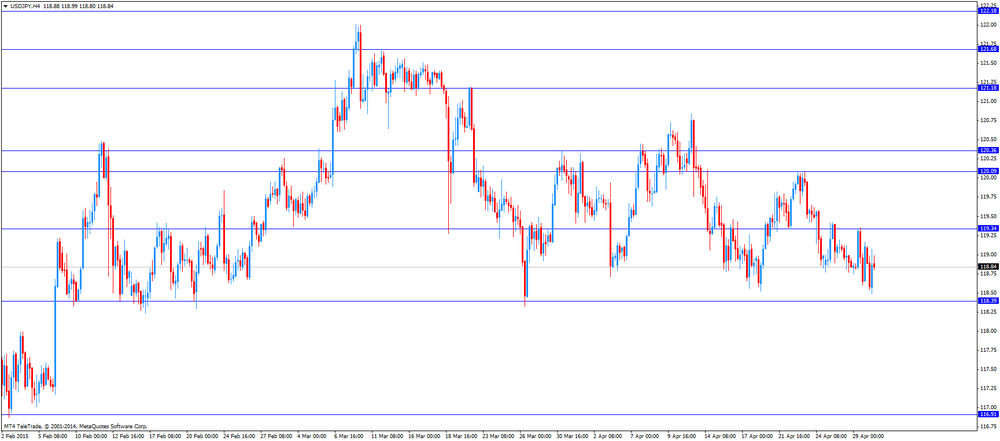

The dollar shot higher against the Japanese yen and British pound after the reports, as investors bet the strong data enhance the likelihood that Fed policy makers could vote to raise interest rates at their June policy meeting.

In an updated policy statement, released Wednesday, Fed policy makers implied that an interest-rate increase in June remained a possibility.

The dollar USDJPY, +0.55% traded as high as ¥119.54 after the data, its highest level against the yen in four sessions, from ¥119.05 late Wednesday in New York. The pound GBPUSD, -0.72% weakened to $1.5364, compared with $1.5428 Wednesday.

The yen had strengthened against the dollar earlier in the global day after the Bank of Japan left monetary policy unchanged.

The euro EURUSD, +0.68% fell to $1.1128 from a session-high of $1.1256, which also was the shared currency's highest level since late February. It traded at $1.1117 late Wednesday.

The employment cost index, a closely watched measure of wage inflation, climbed 0.7% in the first quarter, beating economists' expectations for a 0.6% gain.

According to the Department of Labor, jobless claims fell to a seasonally adjusted 262,000 last week, the lowest number in 15 years.

Earlier in the session, the euro held its ground after a gauge of eurozone inflation showed no growth in April, up from negative 0.1% in March, and German jobless claims fell by a smaller-than expected 8,000.

In other currency trading, the New Zealand dollar softened after policy makers from the Reserve Bank of New Zealand decided to keep rates on hold. It USDNZD, +0.55% fell to NZDJPY, -0.32% 75.85 cents, from 76.87 cents before the announcement.

Graeme Wheeler, the governor of New Zealand's central bank, said in a statement that the New Zealand dollar remains unjustifiably overvalued.

-

17:10

Eurozone's unemployment rate remains unchanged at 11.3% in March

Eurostat released its unemployment data for the Eurozone on Thursday. Eurozone's unemployment rate remained unchanged at 11.3% in March, in line with expectations. It was the lowest level since May 2012.

There were 18.105 million unemployed in the Eurozone in March, down 36,000 from February.

The lowest unemployment rate in the Eurozone in March was recorded in Germany (4.7%), and the highest in Greece (25.7% in January 2015) and Spain (23.0%).

The youth unemployment rate remained unchanged at 22.7% in the Eurozone in March.

-

16:57

German unemployment reaches the lowest level since December 1991

Destatis released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany declined by 8,000 in April, missing expectations for a 13,000 decline, after a 14,000 drop in March.

March's figure was revised down from a 15,000 fall.

The number of unemployed people was 2.792 million in April, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in April, in line with expectations.

-

16:42

Central Bank of Russia lowers its key interest rate to 12.5%

The Central Bank of Russia (CBR) lowered its key interest rate from 14% to 12.5% on Thursday. This decision indicates that inflation in Russia is under control.

It was the third cut in 2015.

"Amid ruble appreciation and significant contraction in consumer demand in February-April 2015, monthly consumer price growth declines and annual inflation tends to stabilise," the central bank said.

-

16:17

Chicago purchasing managers' index rises to 52.3 in April

The Institute for Supply Management released its Chicago purchasing managers' index on Thursday. The index climbed to 52.3 in April from 46.3 in March.

A reading above the 50 mark indicates expansion.

4 of 5 components increased in April.

The production subindex was above 50, while order backlog index remained below 50 despite the significant increase.

-

15:57

Initial jobless claims hit the lowest reading since April 2000

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 25 in the U.S. fell by 34,000 to 262,000 from 296,000 in the previous week, beating expectations for a rise by 4,000.

It was the lowest reading since April 2000.

The previous week's figure was revised down from 295,000.

Initial jobless claims remained below 300,000 the eighth straight week.

-

15:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E590mn), $1.1000(E2.3bn), $1.1050(E746mn), $1.1100(E412mn)

USD/JPY: Y118.00($886mn), Y118.50($1.3bn), Y119.00($546mn), Y119.15($326mn), Y119.55($617mn), Y120.00($2.8bn)

EUR/JPY: Y132.95(E270mn)

GBP/USD: $1.5400(Gbp395mn)

USD/CHF: Chf0.9550($242mn)

AUD/USD: $0.7950(A$605mn), $0.8050(A$398mn)

AUD/JPY: Y93.00(A$607mn)

NZD/USD: $0.7500(NZ$526mn), $0.7650(NZ$752mn), $0.7720-25(NZ$500mn)

USD/CAD: C$1.2150($420mn)

-

15:45

U.S.: Chicago Purchasing Managers' Index , April 52.3

-

15:28

U.S. personal spending climbs 0.4% in March

The U.S. Commerce Department released personal spending and income figures on Thursday. Personal spending was up 0.4% in March, exceeding expectations for 0.3% gain, after a 0.2% increase in February. February's figure was revised up from a 0.1% rise.

Consumer spending makes more than two-thirds of U.S. economic activity.

The increase was driven by higher purchases of durable goods (like automobiles), which climbed 1.8%.

Spending on goods rose 1.0% in March, while spending on services gained 0.2%.

Personal income was flat in March, missing expectations for a 0.2% increase, after a 0.4% rise in February. It was the weakest reading since December 2013.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in March, after a 0.1% gain in February.

On a yearly basis, the PCE price index excluding food and index rose 1.3% in March, after a 1.4% increase in February.

The PCE index are below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

15:05

Canada's GDP growth is flat in February

Statistics Canada released GDP (gross domestic product) growth data on Thursday. Canada's GDP growth was flat in February, after a 0.2% decline in January.

January's figure was revised down from a 0.1% decrease.

The GDP growth was driven by a rise in the retail sector. Retail-sector output jumped 1.5% in February. It was the first rise in three months.

Resource-sector output declined 0.6% in February as support activities for mining and oil and gas extraction plunged 15.4%.

Manufacturing output fell 0.8% in February.

-

14:44

Preliminary consumer price inflation in the Eurozone rises to 0.0% in April

Eurostat released its consumer price inflation data for the Eurozone on Thursday. The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.0% in April from -0.1% in March, in line with expectations. The increase was driven by ECB's quantitative easing programme.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.6% in April, missing expectations for a 0.7% rise.

Food, alcohol and tobacco and services prices in April were up 0.9% each, non-energy industrial goods prices gained 0.1%, while energy prices dropped 5.8%.

-

14:30

U.S.: PCE price index ex food, energy, m/m, March 0.1%

-

14:30

U.S.: Personal Income, m/m, March 0.0% (forecast 0.2%)

-

14:30

Canada: GDP (m/m) , February 0.0%

-

14:30

U.S.: Initial Jobless Claims, April 262 (forecast 300)

-

14:30

U.S.: Personal spending , March 0.4% (forecast 0.3%)

-

14:30

U.S.: Continuing Jobless Claims, April 2253 (forecast 2406)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, March 1.3%

-

14:21

Foreign exchange market. European session: the euro traded higher against the U.S. dollar as the consumer price inflation increased slightly

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Import Price Index, q/q Quarter I 0.9% -0.2%

01:30 Australia Export Price Index, q/q Quarter I 0.0% -0.8%

01:30 Australia Private Sector Credit, y/y March 6.2% 6.2%

01:30 Australia Private Sector Credit, m/m March 0.5% 0.59% 0.5%

03:00 Japan BoJ Interest Rate Decision 0% 0% 0%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275 275

05:00 Japan Housing Starts, y/y March -3.1% 1.66% 0.7%

05:00 Japan Construction Orders, y/y March 1.0% 1.04% 8.2%

06:00 Germany Retail sales, real unadjusted, y/y March 3.3% Revised From 3.6% 3% 3.5%

06:00 Germany Retail sales, real adjusted March -0.1% Revised From -0.5% 0.7% -2.3%

06:00 Japan BOJ Outlook Report

06:30 Japan BOJ Press Conference

06:45 France Consumer spending March 0.1% Revised From 0.2% -0.5% -0.6%

06:45 France Consumer spending, y/y March 3.0% 2.1%

07:00 Switzerland KOF Leading Indicator April 90.9 Revised From 90.8 89.5

07:55 Germany Unemployment Change April -14 Revised From -15 -13 -8

07:55 Germany Unemployment Rate s.a. April 6.4% 6.4% 6.4%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) April -0.1% 0.0% 0.0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) April 0.6% 0.68% 0.6%

09:00 Eurozone Unemployment Rate March 11.3% 11.3% 11.3%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. Personal income in the U.S. is expected to rise 0.2% in March, after a 0.4% gain in February.

Personal spending in the U.S. is expected to gain 0.3% in March, after a 0.1% increase in February.

The number of initial jobless claims in the U.S. is expected to rise by 5,000 to 300,000.

The results of the Fed's monetary policy meeting weighed on the greenback. The Fed kept its monetary policy unchanged, but it did not rule out the interest rate hike in June.

The euro traded higher against the U.S. dollar as the consumer price inflation increased slightly. The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.0% in April from -0.1% in March, in line with expectations. The increase was driven by ECB's quantitative easing programme.

Eurozone's unemployment rate remained unchanged at 11.3% in March, in line with expectations.

The number of unemployed people in Germany declined by 8,000 in April, missing expectations for a 13,000 decline, after a 14,000 drop in March. March's figure was revised down from a 15,000 fall.

Germany's adjusted unemployment rate remained unchanged at 6.4% in April, in line with expectations.

German adjusted retail sales dropped 2.3% in March, missing forecasts of a 0.7% rise, after a 0.1% gain in February. February's figure was revised up from a 0.5% decrease.

French consumer spending decreased 0.6% in March, missing expectations for a 0.5% fall, after a 0.2% rise in February. February's figure was revised up from a 0.1% increase.

The British pound traded mixed against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian GDP growth data and a speech by the Bank of Canada Governor Stephen Poloz.

The Swiss franc traded higher against the U.S. dollar despite the weaker-than-expected KOF leading indicator from Switzerland. The KOF leading indicator decreased to 89.5 in April from 90.9 in March. March's figure was revised up from 90.8.

EUR/USD: the currency pair increased to $1.1248

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y119.07

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) February -0.1%

12:30 U.S. Initial Jobless Claims April 295 300

12:30 U.S. Personal spending March 0.1% 0.3%

12:30 U.S. Personal Income, m/m March 0.4% 0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y March 1.4%

12:30 U.S. PCE price index ex food, energy, m/m March 0.1%

13:45 U.S. Chicago Purchasing Managers' Index April 46.3

14:30 Canada BOC Gov Stephen Poloz Speaks

23:30 Japan Household spending Y/Y March -2.9% -10%

23:30 Japan Tokyo Consumer Price Index, y/y April 2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y April 2.2%

23:30 Japan National Consumer Price Index, y/y March 2.2% 2.3%

23:30 Japan National CPI Ex-Fresh Food, y/y March 2% 2.1%

-

14:00

Orders

EUR/USD

Offers 1.1250-60 1.1280 1.1300 1.1320 1.1350 1.1385 1.1400

Bids 1.1200 1.1180 1.1165 1.1140 1.1120 1.1100 1.1050 1.1050

GBP/USD

Offers 1.5500 1.5525 1.5560 1.5585 1.5600

Bids 1.5420-30 1.5400 1.5380 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7280 0.7300 0.7320-25 0.7350

Bids 0.7220-30 0.7200 0.7185 0.715-60

-

11:47

Bank of Japan Governor Haruhiko Kuroda: there's no change to the plan to achieve 2% inflation target

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a post-meeting press conference on Thursday that there's no change to the plan to achieve 2% inflation target. He pointed out that the BoJ will adjust its monetary policy if needed.

Kuroda noted that consumer remained firm, while exports rose moderately.

The BoJ expects that inflation will continue to improve, but it will reach 2% target in the first half of fiscal year 2016, not in the fiscal year 2015.

-

11:33

Bank of Japan keeps its monetary policy unchanged, but lowers its consumer inflation and economic growth forecasts

The Bank of Japan (BoJ) released its interest rate decision on Thursday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The central bank voted 8-1 to keep its monetary policy unchanged. The BoJboard member, Takahide Kiuchi, said the central bank should cut its asset purchases to 45 trillion yen annually.

The BoJ lowered its forecast for core consumer price index (CPI) to 0.8% for fiscal year 2015, down from its previous estimate of a 1.0 gain in January. The central bank also downgraded its forecast for this fiscal year's gross domestic product (GDP) to 2.0%, down from its previous estimate of a 2.1 rise in January.

Core CPI forecast was downgraded to 2.0% fiscal year 2016, down from the previous estimate of a 2.2% increase in January. The GDP growth forecast was cut to 1.5% for fiscal year 2016, down January's estimate of a 1.6% rise.

The BoJ pointed out that the second sales tax hike slated for 2017 is a potential risk to Japan's economy.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E590mn), $1.1000(E2.3bn), $1.1050(E746mn), $1.1100(E412mn)

USD/JPY: Y118.00($886mn), Y118.50($1.3bn), Y119.00($546mn), Y119.15($326mn), Y119.55($617mn), Y120.00($2.8bn)

EUR/JPY: Y132.95(E270mn)

GBP/USD: $1.5400(Gbp395mn)

USD/CHF: Chf0.9550($242mn)

AUD/USD: $0.7950(A$605mn), $0.8050(A$398mn)

AUD/JPY: Y93.00(A$607mn)

NZD/USD: $0.7500(NZ$526mn), $0.7650(NZ$752mn), $0.7720-25(NZ$500mn)

USD/CAD: C$1.2150($420mn)

-

11:12

Reserve Bank of New Zealand kept its interest rate unchanged at 3.50%, hints for possible interest rate cut

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 3.50%.

The RBNZ Governor Graeme Wheeler said that the New Zealand dollar remained unjustifiably high.

He noted that the central bank may cut it interest rate "if demand weakens, and wage and price-setting outcomes settle at levels lower than is consistent with the inflation target".

Wheeler reiterated that monetary policy adjustments "will depend on the emerging flow of economic data", he added.

-

11:00

Eurozone: Unemployment Rate , March 11.3% (forecast 11.3%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, April 0.0% (forecast 0.0%)

-

10:57

The Fed kept its monetary policy unchanged, did not rule out the interest rate hike in June

The Fed released its interest rate decision on Wednesday. The Fed kept its monetary policy unchanged.

The central bank said that the U.S. economy slowed down during the winter months, but the slowdown was driven by "transitory factors".

The Fed pointed out that consumer spending declined despite higher real incomes, which increased due to lower energy prices.

The Fed noted that it will start to hike its interest rate if there is further improvement in the labour market and if the central bank is confident that inflation will move back to its 2% target over the medium term.

The central bank expects the U.S. economy to expand moderately.

The Fed did not rule out the interest rate hike in June.

-

10:33

Moody's lowers Greece's government bond rating to Caa2 from Caa1

Ratings agency Moody's has cut Greece's government bond rating to Caa2 from Caa1 on Wednesday due to uncertainty that Greece can reach a new agreement with its creditors in time to make upcoming debt payments. The outlook is negative.

"The Greek government and its official creditors remain far apart on key objectives, with no immediate prospect of agreement being reached on a new financing package", Moody's noted.

-

10:14

Conference Board’s leading economic index for the Eurozone rises 0.7% in March

The Conference Board released its leading economic index for the Eurozone on Wednesday. The leading economic index rose 0.7% in March, after a 0.6% increase in February. It was the fifth consecutive increase.

The Conference Board Senior Economist Bert Colijn said that the outlook for the Eurozone continued to improve in March.

"Despite the large downside risks of a possible Grexit, the Euro Area's economy appears to be strengthening," he added.

-

09:55

Germany: Unemployment Rate s.a. , April 6.4% (forecast 6.4%)

-

09:55

Germany: Unemployment Change, April -8K (forecast -13K)

-

09:16

Switzerland: KOF Leading Indicator, April 89.5 (forecast 0.7)

-

08:45

France: Consumer spending , March -0.6% (forecast -0.5%)

-

08:45

France: Consumer spending, y/y, March 2.1%

-

08:23

Options levels on thursday, April 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1228 (3001)

$1.1182 (1971)

$1.1141 (3360)

Price at time of writing this review: $1.1081

Support levels (open interest**, contracts):

$1.1015 (1283)

$1.0953 (1842)

$1.0917 (1811)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 63541 contracts, with the maximum number of contracts with strike price $1,1200 (7152);

- Overall open interest on the PUT options with the expiration date May, 8 is 79073 contracts, with the maximum number of contracts with strike price $1,0000 (9280);

- The ratio of PUT/CALL was 1.24 versus 1.24 from the previous trading day according to data from April, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (663)

$1.5606 (1038)

$1.5509 (2813)

Price at time of writing this review: $1.5408

Support levels (open interest**, contracts):

$1.5292 (739)

$1.5195 (1018)

$1.5097 (1063)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 26371 contracts, with the maximum number of contracts with strike price $1,5500 (2813);

- Overall open interest on the PUT options with the expiration date May, 8 is 35335 contracts, with the maximum number of contracts with strike price $1,4700 (2721);

- The ratio of PUT/CALL was 1.34 versus 1.41 from the previous trading day according to data from April, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Germany: Retail sales, real unadjusted, y/y, March 3.5% (forecast 3%)

-

07:10

Japan: Housing Starts, y/y, March 0.7% (forecast 1.66%)

-

07:10

Japan: Construction Orders, y/y, March 8.2% (forecast 1.04%)

-

05:31

Japan: BoJ Interest Rate Decision, 0% (forecast 0%)

-

03:32

Australia: Import Price Index, q/q, Quarter I -0.2%

-

03:32

Australia: Export Price Index, q/q, Quarter I -0.8%

-

03:32

Australia: Private Sector Credit, y/y, March 6.2%

-

03:31

Australia: Private Sector Credit, m/m, March 0.5% (forecast 0.59%)

-

01:53

Japan: Industrial Production (YoY), March -1.2%

-

01:52

Japan: Industrial Production (MoM) , March -0.3% (forecast -3.4%)

-

01:05

United Kingdom: Gfk Consumer Confidence, April 4 (forecast 5)

-

01:00

Currencies. Daily history for Apr 29’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1116 +1,27%

GBP/USD $1,5428 +0,59%

USD/CHF Chf0,9402 -1,60%

USD/JPY Y119,09 +0,21%

EUR/JPY Y132,39 +1,48%

GBP/JPY Y183,73 +0,81%

AUD/USD $0,7992 -0,36%

NZD/USD $0,7604 -1,67%

USD/CAD C$1,2015 -0,10%

-

00:45

New Zealand: Building Permits, m/m, March 11%

-

00:01

Schedule for today, Thursday, Apr 30’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Import Price Index, q/q Quarter I 0.9%

01:30 Australia Export Price Index, q/q Quarter I 0.0%

01:30 Australia Private Sector Credit, y/y March 6.2%

01:30 Australia Private Sector Credit, m/m March 0.5% 0.59%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275

05:00 Japan Housing Starts, y/y March -3.1% 3.66%

05:00 Japan Construction Orders, y/y March 1.0% -1.04%

06:00 Germany Retail sales, real unadjusted, y/y March 3.6% 1.89%

06:00 Germany Retail sales, real adjusted March -0.5% 0.7%

06:00 Japan BOJ Outlook Report

06:30 Japan BOJ Press Conference

06:45 France Consumer spending March 0.1% -0.5%

06:45 France Consumer spending, y/y March 3.0%

07:00 Switzerland KOF Leading Indicator April 0.5 0.7

07:55 Germany Unemployment Change April -15 -13

07:55 Germany Unemployment Rate s.a. April 6.4% 6.4%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) April -0.1% 0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) April 0.6% 0.68%

09:00 Eurozone Unemployment Rate March 11.3% 11.3%

12:30 Canada GDP (m/m) February -0.1%

12:30 U.S. Continuing Jobless Claims April 2325 2406

12:30 U.S. Initial Jobless Claims April 295 300

12:30 U.S. Personal spending March 0.1% 0.27%

12:30 U.S. Personal Income, m/m March 0.4% 0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y March 1.4%

12:30 U.S. PCE price index ex food, energy, m/m March 0.1%

13:45 U.S. Chicago Purchasing Managers' Index April 46.3

14:30 Canada BOC Gov Stephen Poloz Speaks

23:30 Australia AIG Manufacturing Index April 46.3

23:30 Japan Unemployment Rate March 3.5% 3.5%

23:30 Japan Household spending Y/Y March -2.9% -11.7%

23:30 Japan Tokyo Consumer Price Index, y/y April 2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y April 2.2%

23:30 Japan National Consumer Price Index, y/y March 2.2%

23:30 Japan National CPI Ex-Fresh Food, y/y March 2.0% 2.0%

-