Noticias del mercado

-

17:41

Gold prices soared by 8%

Gold prices soared by 8%, reaching the highest level in more than two years, which was due to increased demand for safe-haven assets.

"Brexit had strong support for gold as a wave of risk aversion prompted investors to turn to safe assets such as gold and yen - said Marie Owens Thomsen, chief economist at Indosuez Wealth Management -. Now, when the United Kingdom voted in favor of withdrawal from the EU, we think that there is a high probability of a rise in price of gold to $ 1,400. "

The World Gold Council said that it is difficult to find an event comparable to the outcome of the British referendum. "Although the trade unions broke up before, even once the collapse was not so important for the world economy, as the collapse in Europe", - stated the council.

In addition, the increased market expectations that the Federal Reserve may cut interest rates to help shield the economy from any global shocks are helping gold prices. "It is not necessarily linked with the Great Britain, we are talking about the uncertainties in the world's largest economy - said Amanda van Dijk, head of Peterhouse Asset Management Fund -. analysts believe that the Fed will not raise rates as fast, because the dollar is gaining,"

The cost of the August gold futures on the COMEX rose to $ 1317.6 per ounce.

-

17:16

There will be some good “lights out” stories after today’s moves

For those of you smart/inspired/lucky enough to foresee this moves the rewards are great but for those with "lights out" stories it can be a tough experience.

If you had losses remember that Jesse Livermore made and lost several multimillion-dollar fortunes (billions in today's money) and he was, probably, the best trader that ever lived, one of the first to decipher the language of supply and demand.

Every trader has losses. You can't control what happens with your trade after it's placed but you can control the most important things: your risk, the stop loss and when you chose to trade.

-

16:57

S & P preparing UK rating revisions

Rating agency S & P Global Ratings said today that is preparing to revise the highest credit rating of Britain after the country voted for withdrawal from the EU. Recall, 52 percent of Britons preferring to leave the EU.

"S & P will notify the country in 24 hours that will reduce the rating at least one notch, from" AAA, "" - said Moritz Kramer, a spokesman for S & P. Recall, the other major rating agencies, namely Fitch Ratings and Moody 's Investors Service, have already revised their ratings.

Earlier Kremer has warned this week that the decision to withdraw from the trade bloc would lead to a rather sad end, against which the UK will lose the highest rating. Meanwhile, the head of the Bank of England said that Brexit is the biggest risk to the country's domestic financial stability, which could lead to a recession.

-

16:16

US: consumer sentiment little changed for now

According to the University of Michigan consumer sentiment weakened in June as Americans' views of the economy darkened. Its final reading for June fell to 93.5 from 94.7 in May. In a MarketWatch survey, economists had forecast a 94.0 reading. That was also well below its level a year ago, when it touched 96.1. Consumers were more bearish about expectations for the economy. That gauge fell to 82.4 from 84.9. Views of current conditions perked up, rising to 110.8 from 109.9. Such readings point to a 2.5% gain in consumer spending in 2016, survey director Richard Curtin said in a statement.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, June 93.5 (forecast 94)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1200 (EUR 212m) 1.1275 (207m) 1.1530 (479m)

USD/JPY 105.00 (USD 211m) 107.00 (382m) 108.00 (240m)

GBP/USD 1.4200 (GBP 429m)

AUD/USD 0.7425 (AUD 773m) 0.7525 (350m)

USD/CAD 1.2640 (USD 240m) 1.2675 (331m)

-

15:41

USD dynamics - Credit Agricole

This year's USD dynamic in our view resemble a familiar 'smile' pattern whereby the dollar strengthened on the initial dip in risk appetite early in the year, weakened as the Fed turned more dovish and should start strengthening again as the economy picks up and tightening expectations are rebuilt.

In her semi-annual testimony Chair Yellen pointed to a "sharp" increase in consumer spending, which should be confirmed by a solid May personal income and spending report next week. Meanwhile, the broader labour market indicators have been supportive of the Fed's view that the very soft May payrolls report was somewhat of an aberration and our economists still expect two rate hikes to be delivered in H2.

However, with a Brexit having materialised and as global growth expectations may turn more muted on the back of it, it appears more unlikely that the Fed will consider higher rates anytime soon. This does not need to dampen the outlook for the USD, which anew benefits from rising safe haven appeal in an environment of EU driven risk aversion.

We remain long USD versus AUD and CAD via options. In an environment of unstable risk sentiment and a stronger USD, the commodity bloc is likely to suffer more considerably.

-

14:48

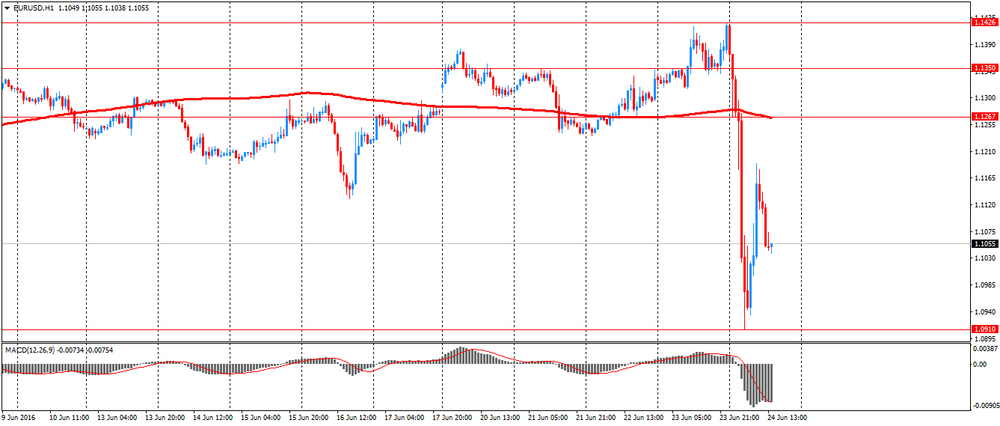

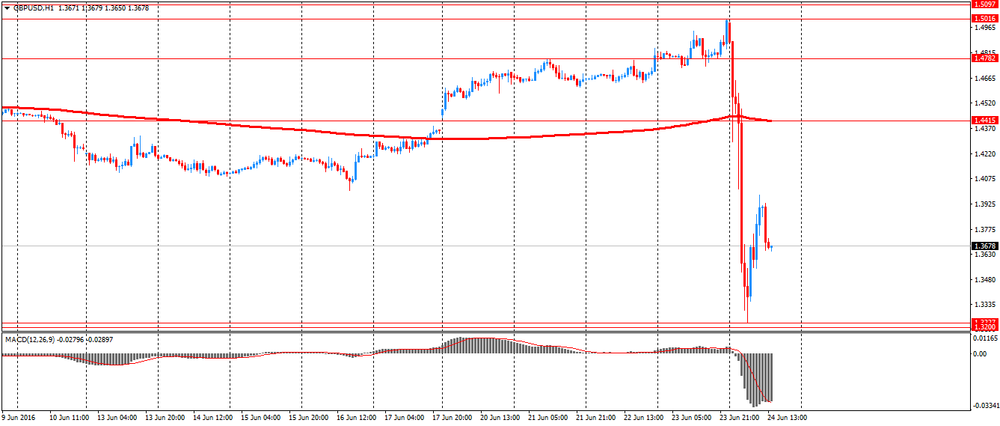

European session: one of the most volatile sessions for the pound in modern history

The pound sterling is experiencing one of the most volatile session in modern history, and reached the lowest level since 1985, as the British voted for withdrawal from the EU, triggering a flight to safer assetsas the yen, gold and the dollar.

Scotland and London by an overwhelming majority voted in favor of EU membership, but Wales and the rest of the United Kingdom voted in favor of Brexit.

The turnout at the referendum was 72% (more than 30 million people).

The head of the Bank of England Governor Mark Carney said that the central bank is ready to provide additional funds in the amount of 250 billion pounds ($ 345.93 billion) to support the financial markets after the British decision.

He also said that in the coming weeks, the regulator will consider the possibility of adopting additional measures of support.

Earlier, the Bank of England said it would take all necessary steps to ensure monetary and financial stability after the referendum.

"The Bank of England is closely monitoring the situation," - said in a statement the regulator.

According to BOE the decision to withdraw from the EU can cause a severe blow to the British economy and push up inflation due to a sudden fall in the value of sterling.

Euro fell more than 3% against the dollar, the Swiss franc has appreciated along with the yen, however, swings made traders wary of intervention by the G7.

The pound fell more than 10% to $ 1.3227, the lowest level since September 1985.

Eur/gbp rose 6.1% to 83.12, reaching a peak of more than two years.

However, euro came under pressure as investors feared that Brexit provoke secessionism in other European countries.

The euro fell 3.7% against the dollar to $ 1.0910, the lowest level since March.

The collapse of the European currency pushed the dollar index up by 2.9%. If the trend continues, it will be the highest one-day growth since 1978.

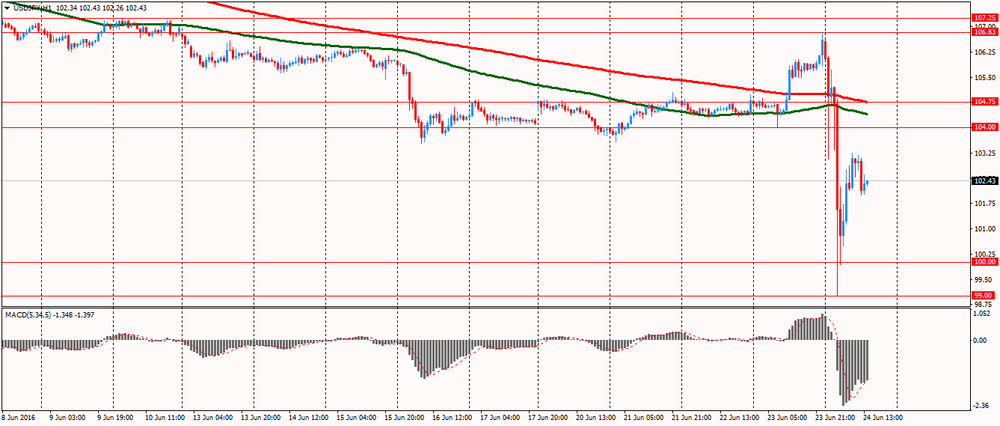

Along with the increasing concerns for Brexit demand for safer yen jumped, which surged against the euro and the dollar.

The dollar fell to 99.00 yen, having lost 6.7%, and then slightly recovered to 102.40. Dropped below 100 yen for the first time since the end of 2013.

The euro fell to 109.45 yen, the first time since the end of 2012.

Switzerland's central bank confirmed that intervened in the currency market to weaken the Swiss franc after Britain decided to withdraw from the EU.

Usually SNB declined to comment if is active or not in the currency market, but sometimes confirmes the moves.

EUR / USD: fell to $ 1.0911 and then rebounded to $ 1.1189

GBP / USD: fell to $ 1.3227 and then rebounded to $ 1.3979

USD / JPY: fell to Y98.99, and then recovered to Y103.25

-

14:35

Durable goods orders in US declined

According to Bloomberg, orders for U.S. business equipment unexpectedly declined in May by the most in three months, pointing to weakness in investment even before the likely damage to confidence stemming from U.K. voters' decision to leave the European Union.

Bookings for non-military capital goods excluding aircraft dropped 0.7 percent after falling 0.4 percent in April, data from the Commerce Department showed Friday. Demand for all durable goods -- items meant to last at least three years -- slumped a more-than-expected 2.2 percent.

Sluggish global demand, the lingering effects of last year's surge in the dollar, weaker corporate profits and a sharp drop in spending in the energy sector have weighed on companies' investment decisions. American factories are now faced with a new challenge -- the fallout from the U.K.'s decision to exit the EU.

Once this shock ripples through financial markets, Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York said he will be watching manufacturing surveys and jobless claims "for any evidence that businesses are getting more cautious."

"Most consumers aren't going to have Brexit front and center of their economic decisions, whereas companies, particularly ones that are globally exposed, are going to have to reassess the situation," Feroli said.

-

14:30

U.S.: Durable Goods Orders , May -2.2% (forecast -0.5%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , May -0.3% (forecast 0.0%)

-

14:30

U.S.: Durable goods orders ex defense, May -0.9%

-

14:00

Orders

EUR/USD

Offers : 1.1170 1.1200 1.1230-40 1.1280 1.1300 1.1350 1.1400

Ордера на покупку: 1.1050 1.1000 1.0975-80 1.0930 1.0900

USD/JPY

Offers : 104.00 104.40-50 104.80 105.00 105.50-60 106.00

Ордера на покупку: 102.00 101.30-40 101.00 100.00

-

13:38

Scottish First Minister Nicola Sturgeon says option of second independence referendum is on the table - Reuters

-

12:05

Fitch Ratings: UK’s exit from UE - moderately negative factor for the UK's rating

- sovereign rating of the UK will soon be analyzed.

- the result are negative for credit ratings of companies in most sectors of the economy.

-

11:54

Pound Sterling could fall by 10-15% - Savings

British pound sterling due to the exit of Great Britain from the EU (Brexit) could lose 10-15 percent, and world markets waiting period of turbulence, although in Russia it will be reflected to a lesser extent due to less dependence on capital flows, said director of the center of macroeconomic Sberbank Yulia Tseplyaeva.

"The pound will fall in price vs the major currencies by 10-15% in the medium term, Britain will lose a few percentage points of GDP growth for the UK obvious economic benefits not defeated populism", - Said in a statement Savings Bank representative.

"All markets are waiting for turbulence, but oil prices have a fundamental influence: less dependence on capital inflows, the less influence from Brexit" - said Tseplyaeva.

-

11:24

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1200 (EUR 212m) 1.1275 (207m) 1.1530 (479m)

USD/JPY 105.00 (USD 211m) 107.00 (382m) 108.00 (240m)

GBP/USD 1.4200 (GBP 429m)

AUD/USD 0.7425 (AUD 773m) 0.7525 (350m)

USD/CAD 1.2640 (USD 240m) 1.2675 (331m)

-

10:29

Bank of England Governor, Mark Carney: BOE ready to provide GBP 250bln of additional funds

- economic adjustments will be supported by resilient banking system

- UK economy will adjust to new trading relationships

- extensive contingency plans in place

- best contribution BOE can make is to pursue relentlessly monetary and financial responsibilities

- in coming weeks BOE will re-assess and consider any additional policy adjustments

-

10:24

Italian retail trade lower than forecasts

The retail trade index measures the monthly evolution of the turnover at current prices of enterprises with retail sale outlets. With effect from January 2013 the indices are calculated with reference to the base year 2010 using the Ateco 2007 classification (Italian edition of Nace Rev. 2). In April 2016 the seasonally adjusted retail trade index increased by 0.1% with respect to March 2016 (+0.2% for food goods and 0.0% for non-food goods). The average of the last three months decreased with respect to the previous three months (-0.3%). The unadjusted index decreased by 0.5% with respect to April 2015.

-

10:01

Germany: IFO - Expectations , June 103.1 (forecast 101.2)

-

10:00

Germany: IFO - Business Climate, June 108.7 (forecast 107.5)

-

10:00

Germany: IFO - Current Assessment , June 114.5 (forecast 114)

-

09:37

UK PM, Cameron: in the best interests now to have stability then a new leadership

- wants to reassure markets and investors that UK economy is fundamentally strong

- in the best interests now to have stability then a new leadership

- new PM should decide when to invoke Article 50

-

08:49

Official results: UK leaves UE - 51.9% leave, 48.1% remain

-

08:34

Options levels on friday, June 24, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1480 (1836)

$1.1455 (1717)

$1.1411 (35)

Price at time of writing this review: $1.1056

Support levels (open interest**, contracts):

$1.0966 (7020)

$1.0921 (5476)

$1.0876 (15553)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 35825 contracts, with the maximum number of contracts with strike price $1,1500 (4392);

- Overall open interest on the PUT options with the expiration date July, 8 is 87631 contracts, with the maximum number of contracts with strike price $1,0900 (15553);

- The ratio of PUT/CALL was 2.45 versus 2.44 from the previous trading day according to data from June, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.4187 (123)

$1.4096 (65)

$1.3912 (20)

Price at time of writing this review: $1.3703

Support levels (open interest**, contracts):

$1.3493 (3277)

$1.3394 (449)

$1.3295 (714)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 22111 contracts, with the maximum number of contracts with strike price $1,5000 (4086);

- Overall open interest on the PUT options with the expiration date July, 8 is 41353 contracts, with the maximum number of contracts with strike price $1,4100 (3336);

- The ratio of PUT/CALL was 1.87 versus 1.83 from the previous trading day according to data from June, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:30

Finance Minister of Japan Taro Aso: Japan's government is taking measures to calm the markets

- Sharp fluctuations in the currency market are threatening the stability of the world economy.

- The Japanese government is taking steps to calm the situation on the market.

- The Bank of Japan uses its available mechanisms to saturate the necessary amount of liquidity for private financial institutions.

-

08:10

Bank of England will soon make a statement

-

will take all necessary steps to ensure monetary and financial stability

-

has undertaken extensive contingency planning

-

working closely with UK Treasury, other domestic authorities and other central banks

-

-

07:25

Great Britain votes to leave the European Union

Majority of the votes were counted (98.1%, turnout 72.2%) and "leave" has a 3.6 points lead. The official and final results are expected this morning. What a shock for the financial markets as the pound sinks to multi year lows. Gbp/Usd down 1.800 pips, Gbp/Jpy lost 2.700 points and gold is up more than 100$/ounce.

Remains to be seen what will happen when London opens and what BoE Governor, Carney will say at a scheduled press conference (monetary policy changes can occur).

-

00:29

Currencies. Daily history for Jun 23’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1422 +0,79%

GBP/USD $1,5005 +1,37%

USD/CHF Chf0,9631 +0,47%

USD/JPY Y106,59 +1,69%

EUR/JPY Y121,36 +2,15%

GBP/JPY Y159,86 +2,97%

AUD/USD $0,7625 +4,00%

NZD/USD $0,7249 +1,03%

USD/CAD C$1,2739 -0,57%

-

00:03

Schedule for today, Friday, Jun 24’2016:

(time / country / index / period / previous value / forecast)

08:00 Germany IFO - Business Climate June 107.7 107.5

08:00 Germany IFO - Current Assessment June 114.2 114

08:00 Germany IFO - Expectations June 101.6 101.2

12:30 U.S. Durable Goods Orders May 3.4% -0.5%

12:30 U.S. Durable Goods Orders ex Transportation May 0.4% 0.0%

12:30 U.S. Durable goods orders ex defense May 3.7%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 94.7 94

-