Noticias del mercado

-

22:06

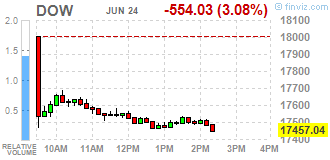

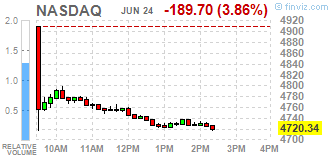

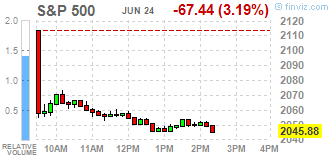

Major US stock indexes finished trading massive decline

On Friday, the major US stock indexes fell sharply against the background of the results of voting in the UK to leave the European Union. Most of Britons supported the "Brexit" although voiced after the voting results of the exit poll company YouGov pointed to a landslide victory the country's conservation supporters in the EU (52% vs. 48%). According to data after counting 100% of the vote for secession from the EU in favor 51.9% of the British and 48.1% of the population were in favor of the fact that Britain should remain in the European Union. The victory of the supporters of "Brexit" is a historic event, the consequences of which are yet highly uncertain. British Prime Minister David Cameron, who is a staunch supporter of preservation of the UK in the EU, announced his forthcoming resignation in connection with the referendum results. According to Cameron, the current government in the current line-up will work in the next three months. Some media reports suggest that another consequence of the support of the country to secede from the Union could be a second referendum in Scotland, which in 2014 voted against independence from the United Kingdom. Also can not lag behind in this area, and Northern Ireland.

In addition, as shown by the final results of the studies submitted by Thomson-Reuters and Institute of Michigan, in June consumer sentiment index fell to 93.5 compared with a final reading of 94.7 in May and the preliminary value of 94.3 in June. It was expected that the index will be 94 points.

Almost all the components of DOW index closed in negative territory (29 of 30). Outsider were shares of The Goldman Sachs Group, Inc. (GS, -6,88%). Shares rose only Wal-Mart Stores Inc. (WMT, + 0,01%).

All business sectors S & P index showed a decline. financial sector (-5.7%) fell the most.

-

21:00

Dow -3.03% 17,465.54 -545.53 Nasdaq -3.85% 4,720.80 -189.24 S&P -3.18% 2,046.06 -67.26

-

20:30

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell sharply on Friday, with the Dow Jones industrial average dropping as much as 538 points, as Britain's vote to quit the European Union roiled global financial markets. The S&P 500 index and Dow were on track for their biggest one-day percentage drop since September, while the Nasdaq was headed for its worst day since January. All three indexes were set to post their second weekly decline in a row.

Almost all Dow stocks in negative area (28 of 30). Top looser - The Goldman Sachs Group, Inc. (GS, -6,70%). Top gainer - Wal-Mart Stores Inc. (WMT, +0,36%).

All S&P sectors in negative area. Top gainer - Financial (-5,2%).

At the moment:

Dow 17392.00 -523.00 -2.92%

S&P 500 2040.25 -65.50 -3.11%

Nasdaq 100 4293.00 -169.50 -3.80%

Oil 47.88 -2.23 -4.45%

Gold 1320.40 +57.30 +4.54%

U.S. 10yr 1.58 -0.16

-

18:00

European stocks closed: FTSE 100 6,162.97 -175.13 -2.76% CAC 40 4,106.73 -359.17 -8.04% DAX 9,557.16 -699.87 -6.82%

-

17:45

WSE: Session Results

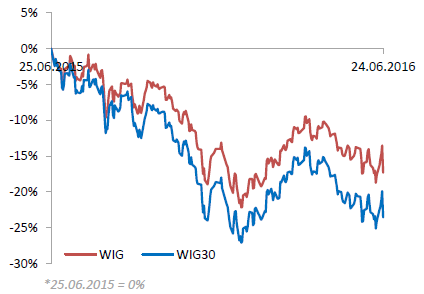

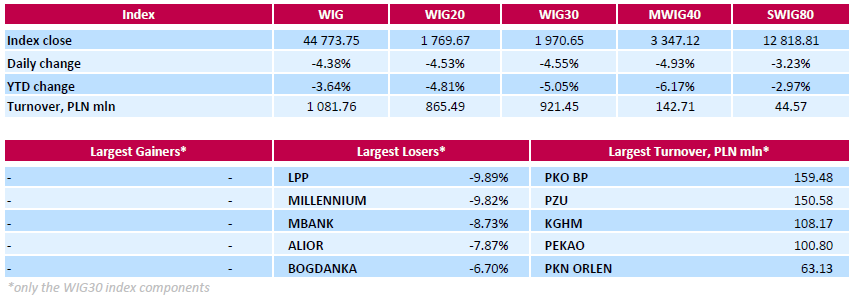

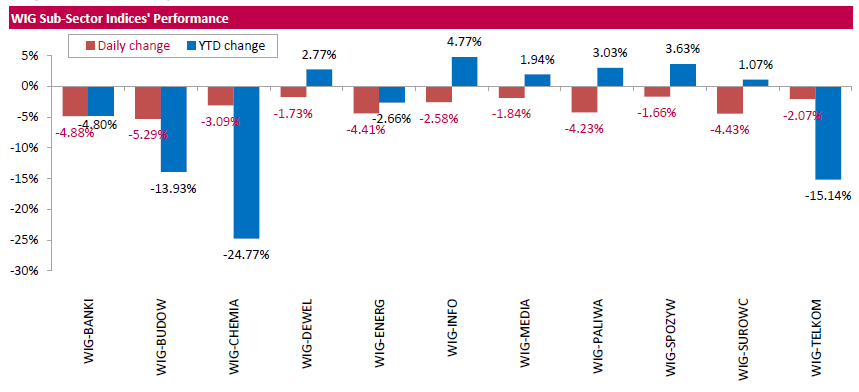

Polish equities plunged on Friday on news that Britain voted to leave the European Union in yesterday's referendum. As measured by the WIG Index, the Polish market collapsed by 4.38%. All sectors in the WIG generated negative returns, with construction (-5.29%) and banking sector (-4.88%) underperforming.

The large-cap stocks' measure, the WIG30 Index, tumbled by 4.55%. All index components slumped. Clothing retailer LPP (WSE: LPP) was the weakest performer, dropping by 9.89%. Banking sector names also suffered significantly, with MILLENNIUM (WSE: MIL), MBANK (WSE: MBK), ALIOR (WSE: ALR), ING BSK (WSE: ING) and BZ WBK (WSE: BZW) declining in a range between 5.57% and 9.82%. Other noticeable losses were thermal coal miner BOGDANKA (WSE: LWB), oil refiner LOTOS (WSE: LTS) and genco ENEA (WSE: ENA), which fell by 6.7%, 6.35% and 5.93% respectively.

-

17:41

Gold prices soared by 8%

Gold prices soared by 8%, reaching the highest level in more than two years, which was due to increased demand for safe-haven assets.

"Brexit had strong support for gold as a wave of risk aversion prompted investors to turn to safe assets such as gold and yen - said Marie Owens Thomsen, chief economist at Indosuez Wealth Management -. Now, when the United Kingdom voted in favor of withdrawal from the EU, we think that there is a high probability of a rise in price of gold to $ 1,400. "

The World Gold Council said that it is difficult to find an event comparable to the outcome of the British referendum. "Although the trade unions broke up before, even once the collapse was not so important for the world economy, as the collapse in Europe", - stated the council.

In addition, the increased market expectations that the Federal Reserve may cut interest rates to help shield the economy from any global shocks are helping gold prices. "It is not necessarily linked with the Great Britain, we are talking about the uncertainties in the world's largest economy - said Amanda van Dijk, head of Peterhouse Asset Management Fund -. analysts believe that the Fed will not raise rates as fast, because the dollar is gaining,"

The cost of the August gold futures on the COMEX rose to $ 1317.6 per ounce.

-

17:16

There will be some good “lights out” stories after today’s moves

For those of you smart/inspired/lucky enough to foresee this moves the rewards are great but for those with "lights out" stories it can be a tough experience.

If you had losses remember that Jesse Livermore made and lost several multimillion-dollar fortunes (billions in today's money) and he was, probably, the best trader that ever lived, one of the first to decipher the language of supply and demand.

Every trader has losses. You can't control what happens with your trade after it's placed but you can control the most important things: your risk, the stop loss and when you chose to trade.

-

16:57

S & P preparing UK rating revisions

Rating agency S & P Global Ratings said today that is preparing to revise the highest credit rating of Britain after the country voted for withdrawal from the EU. Recall, 52 percent of Britons preferring to leave the EU.

"S & P will notify the country in 24 hours that will reduce the rating at least one notch, from" AAA, "" - said Moritz Kramer, a spokesman for S & P. Recall, the other major rating agencies, namely Fitch Ratings and Moody 's Investors Service, have already revised their ratings.

Earlier Kremer has warned this week that the decision to withdraw from the trade bloc would lead to a rather sad end, against which the UK will lose the highest rating. Meanwhile, the head of the Bank of England said that Brexit is the biggest risk to the country's domestic financial stability, which could lead to a recession.

-

16:16

US: consumer sentiment little changed for now

According to the University of Michigan consumer sentiment weakened in June as Americans' views of the economy darkened. Its final reading for June fell to 93.5 from 94.7 in May. In a MarketWatch survey, economists had forecast a 94.0 reading. That was also well below its level a year ago, when it touched 96.1. Consumers were more bearish about expectations for the economy. That gauge fell to 82.4 from 84.9. Views of current conditions perked up, rising to 110.8 from 109.9. Such readings point to a 2.5% gain in consumer spending in 2016, survey director Richard Curtin said in a statement.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, June 93.5 (forecast 94)

-

15:50

WSE: After start on Wall Street

The Americans entered the game with falling by 2.7% the S&P500 index, which may not be regarded as a symptom of panic. If Americans do not panic, and it looks at the moment, on the European exchanges may appear an opportunity to further reduce the scale of decline. The fall in share prices on the US market closes the first phase of response to events in Europe. Today it is difficult to count on new content, but on Monday, the markets will have the opportunity to look at the condition of Europe also through the prism of the election results in Spain. The course of trading during the day leaves no doubt that on the threshold of the final hour of the session and at the beginning of the new week, the WSE remains on the pressure from the environment.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1200 (EUR 212m) 1.1275 (207m) 1.1530 (479m)

USD/JPY 105.00 (USD 211m) 107.00 (382m) 108.00 (240m)

GBP/USD 1.4200 (GBP 429m)

AUD/USD 0.7425 (AUD 773m) 0.7525 (350m)

USD/CAD 1.2640 (USD 240m) 1.2675 (331m)

-

15:41

USD dynamics - Credit Agricole

This year's USD dynamic in our view resemble a familiar 'smile' pattern whereby the dollar strengthened on the initial dip in risk appetite early in the year, weakened as the Fed turned more dovish and should start strengthening again as the economy picks up and tightening expectations are rebuilt.

In her semi-annual testimony Chair Yellen pointed to a "sharp" increase in consumer spending, which should be confirmed by a solid May personal income and spending report next week. Meanwhile, the broader labour market indicators have been supportive of the Fed's view that the very soft May payrolls report was somewhat of an aberration and our economists still expect two rate hikes to be delivered in H2.

However, with a Brexit having materialised and as global growth expectations may turn more muted on the back of it, it appears more unlikely that the Fed will consider higher rates anytime soon. This does not need to dampen the outlook for the USD, which anew benefits from rising safe haven appeal in an environment of EU driven risk aversion.

We remain long USD versus AUD and CAD via options. In an environment of unstable risk sentiment and a stronger USD, the commodity bloc is likely to suffer more considerably.

-

15:33

U.S. Stocks open: Dow -2.28%, Nasdaq -3.73%, S&P -2.12%

-

15:16

Before the bell: S&P futures -3.36%, NASDAQ futures -3.45%

U.S. stock-index futures plunged.

Global Stocks:

Nikkei 14,952.02 -1,286.33 -7.92%

Hang Seng 20,259.13 -609.21 -2.92%

Shanghai Composite 2,853.63 -38.33 -1.33%

FTSE 6,106.24 -231.86 -3.66%

CAC 4,100.51 -365.39 -8.18%

DAX 9,581.4 -675.63 -6.59%

Crude $47.88 (-4.45%)Gold $1326.80 (+5.04%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

170.35

-3.76(-2.1596%)

14807

ALCOA INC.

AA

9.6

-0.55(-5.4187%)

238716

ALTRIA GROUP INC.

MO

65.1

-1.21(-1.8248%)

30865

Amazon.com Inc., NASDAQ

AMZN

697.7

-24.38(-3.3764%)

153190

American Express Co

AXP

60.88

-2.37(-3.747%)

7261

AMERICAN INTERNATIONAL GROUP

AIG

52.5

-2.21(-4.0395%)

25145

Apple Inc.

AAPL

93.55

-2.55(-2.6535%)

805628

AT&T Inc

T

41.07

-0.81(-1.9341%)

177859

Barrick Gold Corporation, NYSE

ABX

21.2

1.85(9.5607%)

609919

Boeing Co

BA

129.52

-4.03(-3.0176%)

10856

Caterpillar Inc

CAT

75.1

-3.12(-3.9888%)

45063

Chevron Corp

CVX

101.75

-2.69(-2.5756%)

39998

Cisco Systems Inc

CSCO

28.35

-0.87(-2.9774%)

48879

Citigroup Inc., NYSE

C

41.24

-3.22(-7.2425%)

1018374

Deere & Company, NYSE

DE

81.79

-2.50(-2.9659%)

4020

E. I. du Pont de Nemours and Co

DD

66.71

-2.50(-3.6122%)

9863

Exxon Mobil Corp

XOM

89.79

-2.01(-2.1895%)

187466

Facebook, Inc.

FB

111.3

-3.78(-3.2847%)

725419

FedEx Corporation, NYSE

FDX

152.75

-5.14(-3.2554%)

9618

Ford Motor Co.

F

12.85

-0.55(-4.1045%)

435065

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.1

-0.67(-5.6924%)

380833

General Electric Co

GE

30.11

-1.08(-3.4626%)

258850

General Motors Company, NYSE

GM

28.77

-1.05(-3.5211%)

58649

Goldman Sachs

GS

143.9

-8.76(-5.7382%)

93606

Google Inc.

GOOG

678.42

-23.45(-3.3411%)

41994

Hewlett-Packard Co.

HPQ

12.4

-0.55(-4.2471%)

16016

Home Depot Inc

HD

125.55

-2.74(-2.1358%)

385620

HONEYWELL INTERNATIONAL INC.

HON

113.98

-3.34(-2.8469%)

1023

Intel Corp

INTC

32.12

-0.87(-2.6372%)

68210

International Business Machines Co...

IBM

150.95

-4.40(-2.8323%)

25773

International Paper Company

IP

41.22

-2.07(-4.7817%)

2276

Johnson & Johnson

JNJ

115

-2.38(-2.0276%)

19387

JPMorgan Chase and Co

JPM

60.45

-3.60(-5.6206%)

310456

McDonald's Corp

MCD

118.6

-2.61(-2.1533%)

18723

Merck & Co Inc

MRK

56.03

-1.65(-2.8606%)

7116

Microsoft Corp

MSFT

50.46

-1.45(-2.7933%)

109654

Nike

NKE

52.6

-1.52(-2.8086%)

61054

Pfizer Inc

PFE

33.95

-0.64(-1.8502%)

86571

Procter & Gamble Co

PG

82.75

-1.46(-1.7338%)

20364

Starbucks Corporation, NASDAQ

SBUX

54.7

-1.43(-2.5477%)

60690

Tesla Motors, Inc., NASDAQ

TSLA

189.4

-7.00(-3.5642%)

191813

The Coca-Cola Co

KO

44.15

-0.93(-2.063%)

32301

Travelers Companies Inc

TRV

109.32

-4.53(-3.9789%)

507

Twitter, Inc., NYSE

TWTR

16.34

-0.70(-4.108%)

474097

United Technologies Corp

UTX

99.33

-3.00(-2.9317%)

1797

UnitedHealth Group Inc

UNH

136.97

-2.22(-1.5949%)

5570

Verizon Communications Inc

VZ

53.7

-0.97(-1.7743%)

45615

Visa

V

75.35

-2.88(-3.6815%)

38352

Wal-Mart Stores Inc

WMT

70.82

-1.28(-1.7753%)

22006

Walt Disney Co

DIS

96.5

-2.52(-2.5449%)

44282

Yahoo! Inc., NASDAQ

YHOO

36.6

-1.18(-3.1233%)

84874

Yandex N.V., NASDAQ

YNDX

21.21

-0.87(-3.9402%)

7500

-

14:48

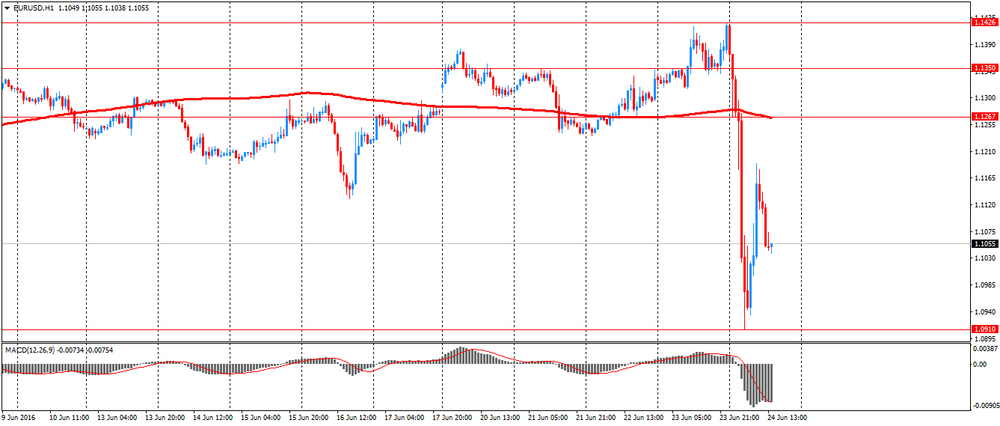

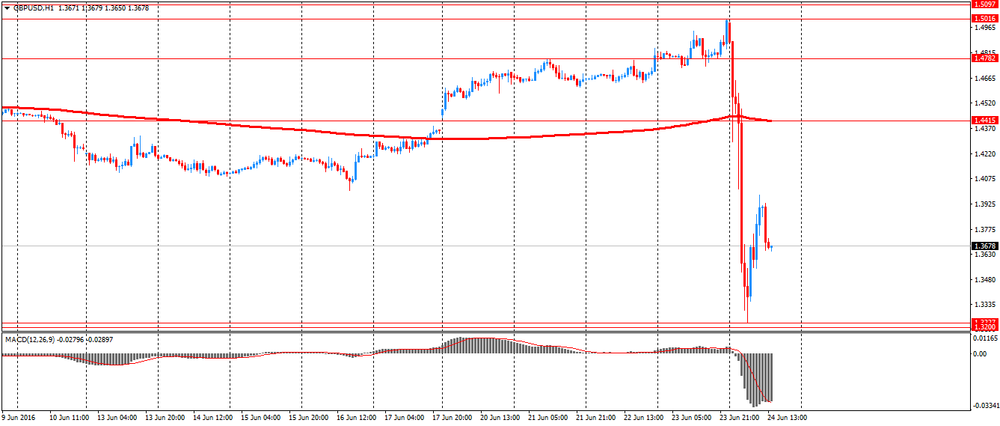

European session: one of the most volatile sessions for the pound in modern history

The pound sterling is experiencing one of the most volatile session in modern history, and reached the lowest level since 1985, as the British voted for withdrawal from the EU, triggering a flight to safer assetsas the yen, gold and the dollar.

Scotland and London by an overwhelming majority voted in favor of EU membership, but Wales and the rest of the United Kingdom voted in favor of Brexit.

The turnout at the referendum was 72% (more than 30 million people).

The head of the Bank of England Governor Mark Carney said that the central bank is ready to provide additional funds in the amount of 250 billion pounds ($ 345.93 billion) to support the financial markets after the British decision.

He also said that in the coming weeks, the regulator will consider the possibility of adopting additional measures of support.

Earlier, the Bank of England said it would take all necessary steps to ensure monetary and financial stability after the referendum.

"The Bank of England is closely monitoring the situation," - said in a statement the regulator.

According to BOE the decision to withdraw from the EU can cause a severe blow to the British economy and push up inflation due to a sudden fall in the value of sterling.

Euro fell more than 3% against the dollar, the Swiss franc has appreciated along with the yen, however, swings made traders wary of intervention by the G7.

The pound fell more than 10% to $ 1.3227, the lowest level since September 1985.

Eur/gbp rose 6.1% to 83.12, reaching a peak of more than two years.

However, euro came under pressure as investors feared that Brexit provoke secessionism in other European countries.

The euro fell 3.7% against the dollar to $ 1.0910, the lowest level since March.

The collapse of the European currency pushed the dollar index up by 2.9%. If the trend continues, it will be the highest one-day growth since 1978.

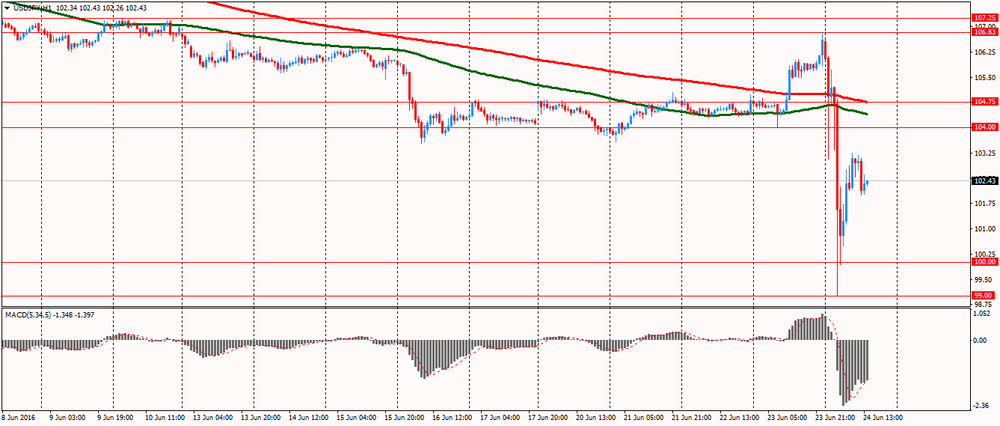

Along with the increasing concerns for Brexit demand for safer yen jumped, which surged against the euro and the dollar.

The dollar fell to 99.00 yen, having lost 6.7%, and then slightly recovered to 102.40. Dropped below 100 yen for the first time since the end of 2013.

The euro fell to 109.45 yen, the first time since the end of 2012.

Switzerland's central bank confirmed that intervened in the currency market to weaken the Swiss franc after Britain decided to withdraw from the EU.

Usually SNB declined to comment if is active or not in the currency market, but sometimes confirmes the moves.

EUR / USD: fell to $ 1.0911 and then rebounded to $ 1.1189

GBP / USD: fell to $ 1.3227 and then rebounded to $ 1.3979

USD / JPY: fell to Y98.99, and then recovered to Y103.25

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

AT&T (T) downgraded to Neutral from Buy at Buckingham Research

Other:

-

14:35

Durable goods orders in US declined

According to Bloomberg, orders for U.S. business equipment unexpectedly declined in May by the most in three months, pointing to weakness in investment even before the likely damage to confidence stemming from U.K. voters' decision to leave the European Union.

Bookings for non-military capital goods excluding aircraft dropped 0.7 percent after falling 0.4 percent in April, data from the Commerce Department showed Friday. Demand for all durable goods -- items meant to last at least three years -- slumped a more-than-expected 2.2 percent.

Sluggish global demand, the lingering effects of last year's surge in the dollar, weaker corporate profits and a sharp drop in spending in the energy sector have weighed on companies' investment decisions. American factories are now faced with a new challenge -- the fallout from the U.K.'s decision to exit the EU.

Once this shock ripples through financial markets, Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York said he will be watching manufacturing surveys and jobless claims "for any evidence that businesses are getting more cautious."

"Most consumers aren't going to have Brexit front and center of their economic decisions, whereas companies, particularly ones that are globally exposed, are going to have to reassess the situation," Feroli said.

-

14:30

U.S.: Durable Goods Orders , May -2.2% (forecast -0.5%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , May -0.3% (forecast 0.0%)

-

14:30

U.S.: Durable goods orders ex defense, May -0.9%

-

14:00

Orders

EUR/USD

Offers : 1.1170 1.1200 1.1230-40 1.1280 1.1300 1.1350 1.1400

Ордера на покупку: 1.1050 1.1000 1.0975-80 1.0930 1.0900

USD/JPY

Offers : 104.00 104.40-50 104.80 105.00 105.50-60 106.00

Ордера на покупку: 102.00 101.30-40 101.00 100.00

-

13:38

Scottish First Minister Nicola Sturgeon says option of second independence referendum is on the table - Reuters

-

13:12

WSE: Mid session comment

From the perspective of the final of the forenoon phase of the session, course of trading was relatively simple to describe. The opening gap and a rebound of morning slump brought correction of weaknesses and return to the area of 1,750 points on the WIG20 index. Still, the index lost nearly 7 percent, so the fall is greater than a rebound. Same like in Western Europe, the strongest overrated sector today are banks. The first three places in line of companies in the classification of the depth of repricing are occupied by PKO BP, BZ WBK and mBank. In the components of the mWIG40 index the leader of decrease (-11.8 %) is the Bank Millennium, but at the forefront is also Getin Noble Bank and Bank Handlowy. In this sector are committed foreign investors, which explains the aggressiveness of supply.

Nevertheless, the market is slowly stabilizing. Bargain hunters receive shares from players who are trying to sell on the correction of earlier weakness. In a wider perspective, the fall may appear in terms of investment opportunity. At the halfway point of the session the WIG20 Index was at the level of 1,725 points (-6.92%) and with the relatively high turnover of PLN 460 mln.

-

12:41

Major stock indices in Europe show big losses

Today's European stock trading started with a strong fall after Britons voted for the UK's withdrawal from the European Union.

European stocks show today the most significant drop since October 1987, in response to the results of the referendum.

In this trading conditions many shares have been suspended in the first minutes after the opening due to sharp fluctuations.

The composite index Stoxx Europe 600 of the largest companies in the region fell by 6.8% - to 323 points.

As reported, during the referendum 51.9% of Britons voted for the UK out of the EU (Brexit), which caused increased volatility in global financial markets. On Friday, British Prime Minister David Cameron has announced his forthcoming resignation in connection with the referendum results.

The UK banks lost in over a minute about a third of the capitalization, but then the rate of decline slowed down: the price of securities of Royal Bank of Scotland fell by 16,1%, Barclays - at 14,3%, HSBC Holdings - by 3.6% .

The capitalization of the Spanish Banco Santander fell by 18.4%, German Commerzbank and Deutsche Bank - more than 10.7%.

In addition, the price of the British developer Taylor Wimpey dropped by 23.1% due to the fear of reduction in demand for UK property.

In this case the share of gold mining company Randgold Resources Ltd. soared 15.1% after the increase in the price of gold, which enjoys demand among investors as a safe asset.

At the moment

FTSE 6033.39 -304.71 -4.81%

DAX 9602.90 -654.13 -6.38%

CAC 4122.31 -343.59 -7.69%

-

12:05

Fitch Ratings: UK’s exit from UE - moderately negative factor for the UK's rating

- sovereign rating of the UK will soon be analyzed.

- the result are negative for credit ratings of companies in most sectors of the economy.

-

11:54

Pound Sterling could fall by 10-15% - Savings

British pound sterling due to the exit of Great Britain from the EU (Brexit) could lose 10-15 percent, and world markets waiting period of turbulence, although in Russia it will be reflected to a lesser extent due to less dependence on capital flows, said director of the center of macroeconomic Sberbank Yulia Tseplyaeva.

"The pound will fall in price vs the major currencies by 10-15% in the medium term, Britain will lose a few percentage points of GDP growth for the UK obvious economic benefits not defeated populism", - Said in a statement Savings Bank representative.

"All markets are waiting for turbulence, but oil prices have a fundamental influence: less dependence on capital inflows, the less influence from Brexit" - said Tseplyaeva.

-

11:24

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1200 (EUR 212m) 1.1275 (207m) 1.1530 (479m)

USD/JPY 105.00 (USD 211m) 107.00 (382m) 108.00 (240m)

GBP/USD 1.4200 (GBP 429m)

AUD/USD 0.7425 (AUD 773m) 0.7525 (350m)

USD/CAD 1.2640 (USD 240m) 1.2675 (331m)

-

11:05

Oil is trading lower

This morning, New York crude oil futures for WTI fell by -5.19% to $ 47.52 per barrel. At the same time, Brent oil futures were down -5.15% to $ 48.25 per barrel. Thus, the black gold is sold, on the background of UK's exit from the UE.

-

10:29

Bank of England Governor, Mark Carney: BOE ready to provide GBP 250bln of additional funds

- economic adjustments will be supported by resilient banking system

- UK economy will adjust to new trading relationships

- extensive contingency plans in place

- best contribution BOE can make is to pursue relentlessly monetary and financial responsibilities

- in coming weeks BOE will re-assess and consider any additional policy adjustments

-

10:24

Italian retail trade lower than forecasts

The retail trade index measures the monthly evolution of the turnover at current prices of enterprises with retail sale outlets. With effect from January 2013 the indices are calculated with reference to the base year 2010 using the Ateco 2007 classification (Italian edition of Nace Rev. 2). In April 2016 the seasonally adjusted retail trade index increased by 0.1% with respect to March 2016 (+0.2% for food goods and 0.0% for non-food goods). The average of the last three months decreased with respect to the previous three months (-0.3%). The unadjusted index decreased by 0.5% with respect to April 2015.

-

10:01

Germany: IFO - Expectations , June 103.1 (forecast 101.2)

-

10:00

Germany: IFO - Business Climate, June 108.7 (forecast 107.5)

-

10:00

Germany: IFO - Current Assessment , June 114.5 (forecast 114)

-

09:37

UK PM, Cameron: in the best interests now to have stability then a new leadership

- wants to reassure markets and investors that UK economy is fundamentally strong

- in the best interests now to have stability then a new leadership

- new PM should decide when to invoke Article 50

-

09:17

WSE: After opening

Futures market began the day with a delay and opened by decrease of 10 percent. At the opening of trading on the spot market only one company was able to perform a turnover. The first minutes will be chaotic and calculate of the indices will have little in common with the real value, because some companies will not have any transactions. Just such a situation occurs in the case of WIG20 index, which lost 2 percent, but barely with transactions on some companies. Taking into account the decline taking place in Europe the WIG20 should, however, lost about 10 percent.

-

08:49

Official results: UK leaves UE - 51.9% leave, 48.1% remain

-

08:44

Gold apreciated sharply

The price of gold rose to over 100$/ounce on the background of the Brexit results and the withdrawal of Great Britain from the European Union. Gold has risen in price by 7% to $ 1358 per ounce.

It is estimated nearly 99% of the vote was counted. Turnout was 72.2%. According to the results, for the "remain" of the UK in the EU voted 48.1%, against 51.8% in favor of leaving.

The price of Brent crude oil fell below $ 48 per barrel.

-

08:34

Options levels on friday, June 24, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1480 (1836)

$1.1455 (1717)

$1.1411 (35)

Price at time of writing this review: $1.1056

Support levels (open interest**, contracts):

$1.0966 (7020)

$1.0921 (5476)

$1.0876 (15553)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 35825 contracts, with the maximum number of contracts with strike price $1,1500 (4392);

- Overall open interest on the PUT options with the expiration date July, 8 is 87631 contracts, with the maximum number of contracts with strike price $1,0900 (15553);

- The ratio of PUT/CALL was 2.45 versus 2.44 from the previous trading day according to data from June, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.4187 (123)

$1.4096 (65)

$1.3912 (20)

Price at time of writing this review: $1.3703

Support levels (open interest**, contracts):

$1.3493 (3277)

$1.3394 (449)

$1.3295 (714)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 22111 contracts, with the maximum number of contracts with strike price $1,5000 (4086);

- Overall open interest on the PUT options with the expiration date July, 8 is 41353 contracts, with the maximum number of contracts with strike price $1,4100 (3336);

- The ratio of PUT/CALL was 1.87 versus 1.83 from the previous trading day according to data from June, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:30

Finance Minister of Japan Taro Aso: Japan's government is taking measures to calm the markets

- Sharp fluctuations in the currency market are threatening the stability of the world economy.

- The Japanese government is taking steps to calm the situation on the market.

- The Bank of Japan uses its available mechanisms to saturate the necessary amount of liquidity for private financial institutions.

-

08:10

Bank of England will soon make a statement

-

will take all necessary steps to ensure monetary and financial stability

-

has undertaken extensive contingency planning

-

working closely with UK Treasury, other domestic authorities and other central banks

-

-

08:09

WSE: Before opening

Thursday's session on Wall Street ended with increases of indices, but this morning it does not matter.

Friday morning trading on financial markets brings a crash due to the fact that preliminary results of the referendum in the UK indicate Brexit.

The effects may be seen most strongly in the currency market, where the pound against the dollar has lost about 5 percent and was at the lowest level for more than two months, the euro lost against the dollar 4 percent. The Polish zloty going through hard time, the dollar strengthened by 7 percent, while the euro by 3.5 percent.

Nikkei index loses 8 percent, futures on the DAX lost even nearly 9 percent, and the contract on the S&P500 going down about 5 percent. Gold increases by 6 percent, and oil drops by 6 percent. Escape from risk is broad, and if the final results of the referendum confirm the estimates, is actually the result of European session is doomed.

In short, this day promises to be nervous and does not appear in this field greater relief.

Looking at the Warsaw market, the decline of the WIG20 by a few percent seems obvious. In the following hours the Warsaw Stock Exchange will have to move in the shadow of other indices and the mood in the world will determine the outcome of the day. If Britain really comes out from the European Union, it will be an unprecedented event, and to refer to the models from the past do not actually make sense.

-

07:25

Great Britain votes to leave the European Union

Majority of the votes were counted (98.1%, turnout 72.2%) and "leave" has a 3.6 points lead. The official and final results are expected this morning. What a shock for the financial markets as the pound sinks to multi year lows. Gbp/Usd down 1.800 pips, Gbp/Jpy lost 2.700 points and gold is up more than 100$/ounce.

Remains to be seen what will happen when London opens and what BoE Governor, Carney will say at a scheduled press conference (monetary policy changes can occur).

-

07:06

Global Stocks

European stocks rallied Thursday on expectations U.K. voters will choose to stick with membership in the European Union.

The Stoxx Europe 600 SXXP, +1.47% popped up 1.5% to 346.34, its strongest close since May 31, according to FactSet data. It was the fifth consecutive rise for the pan-European index. All sectors gained ground, led by financial SXFR, +2.18% telecommunications and oil and gas shares SXER, +1.91%

U.S. stocks closed higher Thursday, with all three indexes rallying, as investors wagered that the U.K. will choose to remain in the European Union in a historic referendum with far-reaching implications.

The S&P 500 index SPX, +1.34% gained 27.87 points, or 1.3%, to close at 2,113.32, regaining the psychologically important 2,100 level. Financial stocks led the gains, advancing 2.1%.

The Dow Jones Industrial Average DJIA, +1.29% jumped 230.24 points, or 1.3%, to finish at 18,011.07. Goldman Sachs Group Inc.. GS, +3.05% rose 3.1%, leading the gainers in the blue-chip index.Frederick, managing director of trading and derivatives at Schwab Center for Financial Research.

Carnage came to world markets on Friday as major television networks said Britain had voted to leave the European Union, sending sterling on a record plunge and pummelling share markets around the globe.

Such a body blow to global confidence could well prevent the Federal Reserve from raising interest rates as planned this year, and might even provoke a new round of emergency policy easing from the major central banks.

Risk assets were scorched as investors fled to the safety of top-rated government debt and gold. Billions were wiped from share values as FTSE futures fell 7 percent FFIc1, EMINI S&P 500 futures ESc1 4.4 percent and Japan's Nikkei .N225 7 percent.

The British pound had collapsed no less than 17 U.S. cents, easily the biggest fall in living memory, to hit its lowest since 1985. The euro in turn slid 3.4 percent to $1.0997 EUR= as investors feared for its very future.

While vote counting had not been concluded, major British television networks including ITV, the BBC and Sky News all called the result as a "Leave" and betting firm BetFair estimated the probability of leaving as high as 94 percent.

-

03:57

Nikkei 225 16,184.25 -54.10 -0.33 %, Hang Seng 20,812.28 -56.06 -0.27 %, Shanghai Composite 2,883.76 -8.20 -0.28 %

-

00:32

Commodities. Daily history for Jun 23’2016:

(raw materials / closing price /% change)

Oil 49.84 -0.54%

Gold 1,268.40 +0.42%

-

00:31

Stocks. Daily history for Jun 23’2016:

(index / closing price / change items /% change)

Nikkei 225 16,238.35+172.63+1.07%

S&P/ASX 200 5,280.7+9.75+0.19%

Topix 1,298.71+14.10+1.10%

FTSE 100 6,338.1 +76.91 +1.23 %

CAC 40 4,465.9 +85.87 +1.96 %

Xetra DAX 10,257.03 +185.97 +1.85 %

S&P 500 2,113.32 +27.87 +1.34 %

NASDAQ Composite 4,910.04 +76.72 +1.59 %

Dow Jones 18,011.07 +230.24 +1.29 %

-

00:29

Currencies. Daily history for Jun 23’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1422 +0,79%

GBP/USD $1,5005 +1,37%

USD/CHF Chf0,9631 +0,47%

USD/JPY Y106,59 +1,69%

EUR/JPY Y121,36 +2,15%

GBP/JPY Y159,86 +2,97%

AUD/USD $0,7625 +4,00%

NZD/USD $0,7249 +1,03%

USD/CAD C$1,2739 -0,57%

-

00:03

Schedule for today, Friday, Jun 24’2016:

(time / country / index / period / previous value / forecast)

08:00 Germany IFO - Business Climate June 107.7 107.5

08:00 Germany IFO - Current Assessment June 114.2 114

08:00 Germany IFO - Expectations June 101.6 101.2

12:30 U.S. Durable Goods Orders May 3.4% -0.5%

12:30 U.S. Durable Goods Orders ex Transportation May 0.4% 0.0%

12:30 U.S. Durable goods orders ex defense May 3.7%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 94.7 94

-