Noticias del mercado

-

22:08

Major US stock indexes finished trading with a certain increase

Major US stock indices gained more percent on Thursday as England, it seems to lean toward membership in the European Union, which is a scenario that will avoid a possible financial crisis.

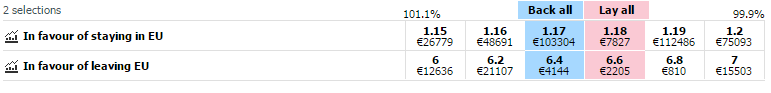

Markets around the world rang in the last two weeks as investors speculated on the implications of the UK release of the European soyuza.Sudya on the eve of the current situation of the popular vote, the more likely is the preservation of the country as part of the union, that is, the victory will win supporters version of "stay." Recent public opinion polls indicate that the majority of respondents are opposed to "Brexit".

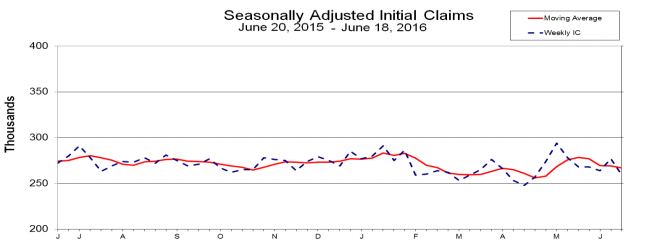

In addition, after reporting growth in the US initial claims for unemployment benefits in the previous week, the Labor Department released a report which showed that in the week ended June 18, the number of initial applications for unemployment benefits fell to 259,000, a decrease of 18,000 the level of the previous week's 277 000. Economists had expected the unemployment initial applications for benefits fall to 270,000.

It should also be noted that sales of new buildings in the US fell in May to a maximum of more than eight years amid weakness in the three regions, but in general the housing market remains unchanged. The Commerce Department reported that new home sales fell by 6.0% to a seasonally adjusted annual rate of up to 551,000 units. The April sales pace was revised to 586 000 units to 619 000 units, it is still the highest since February 2008.

However, preliminary data from Markit Economics, showed that the index of business activity in the manufacturing sector rose in June to 51.4 points compared to 50.7 points in May. The latter value was the highest in the last three months. Economists had expected the index to rise to only 50.8 points.

Almost all the components of DOW index closed in positive territory (28 of 30). Outsider were shares of NIKE, Inc. (NKE, -0,93%). More rest up shares The Goldman Sachs Group, Inc. (GS, + 2,78%).

All Sector S & P Index showed an increase. The leader turned out to be the basic materials sector (+ 2.1%).

At the close:

Dow + 1.29% 18,011.07 +230.24

Nasdaq + 1.59% 4,910.04 +76.72

S & P + 1.34% 2,113.31 +27.86

-

21:00

Dow +0.99% 17,957.07 +176.24 Nasdaq +1.25% 4,893.93 +60.61 S&P +1.02% 2,106.79 +21.34

-

18:33

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes recorded their biggest percentage gains in a month on Thursday as Britain seemed to swing toward remaining in the European Union, a scenario that would avert a possible financial crisis. Markets across the globe have been rattled over the past two weeks as investors speculated about the consequences of Britain's exit from the European union, including the unraveling of the bloc.

Almost all Dow stocks in positive area (29 of 30). Top looser - NIKE, Inc. (NKE, -0,54%). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,71%).

All S&P sectors in positive area. Top gainer - Basic Materials (+1,9%).

At the moment:

Dow 17858.00 +170.00 +0.96%

S&P 500 2097.50 +20.75 +1.00%

Nasdaq 100 4442.75 +48.25 +1.10%

Oil 49.42 +0.29 +0.59%

Gold 1265.40 -4.60 -0.36%

U.S. 10yr 1.73 +0.04

-

18:00

European stocks closed: FTSE 100 6,338.1 +76.91 +1.23% CAC 40 4,465.9 +85.87 +1.96% DAX 10,257.03 +185.97 +1.85%

-

17:57

Moderate increase of oil prices

Oil prices rose by almost 1% after improved risk sentiment.

Additional support was provided by Genscape report which showed that stocks of oil terminal in Cushing fell by almost 1 million barrels.

The dollar index fell 0.25 percent, as the pound peaked in 2016, while the euro has risen in price considerably. A weaker dollar makes purchasing oil, denominated in dollars, more profitable for the owners of other currencies. However, as prices have reached a level where drilling activity is profitable for some companies, the number of rigs may begin to grow and the reduction of production volumes in the United States may slow down.

The price of August futures for Brent crude rose to 50.45 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:56

WSE: Session Results

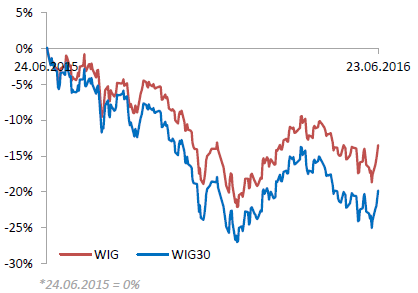

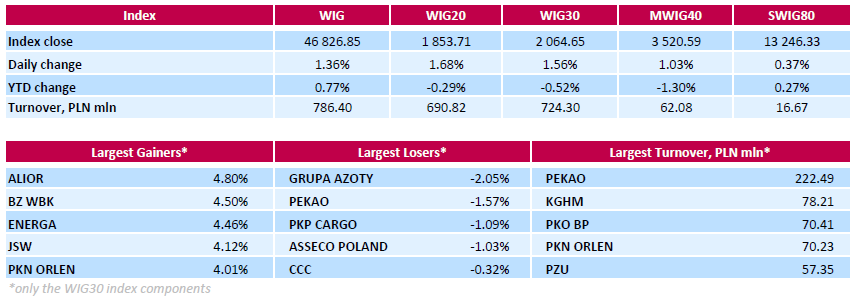

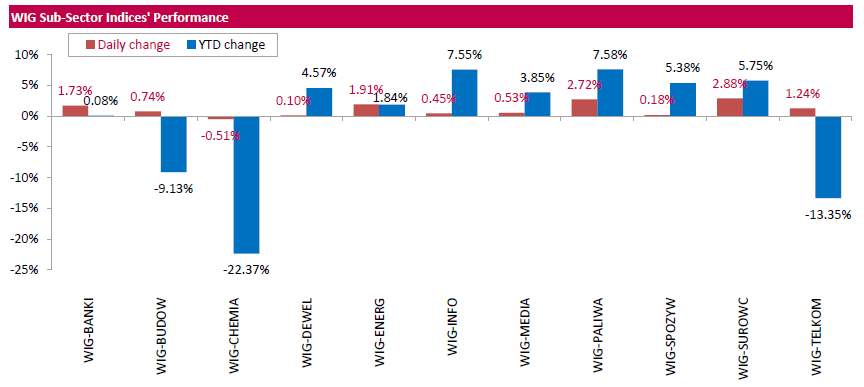

Polish equity market continued its upward surge on Thursday. The broad market measure, the WIG index, rose by 1.36%. Almost all sectors in the WIG generated positive returns. The only exception was chemicals sector (-0.51%). At the same time, materials (+2.88%) and oil and gas sector (+2.72%) were the best-performers.

The large-cap stocks' measure, the WIG30 Index, grew by 1.56%. Only six index constituents generated losses, with chemical producer GRUPA AZOTY (WSE: ATT) underperforming with a 2.05% decline. Bank PEKAO (WSE: PEO) emerged as the second worst-performing stock in the index basket, slumping by 1.57%. The stock came under pressure for the second straight day on the back of the announcement that Poland is interested in taking a controlling stake in the bank to increase its control over the Polish banking sector, currently 60-percent owned by foreign investors. On the plus side, banks ALIOR (WSE: ALR) and BZ WBK (WSE: BZW) were the biggest advancers, gaining 4.8% and 4.5% respectively. They were followed by genco ENERGA (WSE: ENG), coking coal miner JSW (WSE: JSW) and oil refiner PKN ORLEN (WSE: PKN), which grew by 4.46%, 4.12% and 4.01% respectively.

-

17:47

Gold little changed for the day

Gold fell slightly today, updating the two-week minimum but then retraced. The decline was due to the weakening concerns about Britain's exit from the EU.

Precious metal, which is seen as a hedge against economic and financial uncertainty, reached nearly two-year high on June 16 as the markets reacted to the growing concern about the prospect of Brexit.

"The fears that were present in the middle of last week seem to diminish, and gold is getting cheaper," - said Julius Baer, Carsten Menke.

Meanwhile, many analysts have pointed out that despite the outcome of the referendum gold prospects remain positive, mainly due to lower expectations about the Fed rate hike, as well as due to the slowdown of the world economy.

The assets of the world's largest gold exchange-traded fund SPDR Gold Trust rose on Thursday by 0.4 percent to 915.90 tons.

The cost of the August gold futures on the COMEX fell to $ 1266.3 per ounce.

-

17:36

A few thoughts before Brexit draws to a close

The big moves are coming in just a few hours. This is a certainty regardless of the vote's outcome.

First off all, you should trade what you see and not what you think or what the results show. Traders make money on markets movements not poll results. The market is always right. So..beware of "buy the rumors, sell the facts".

The liquidity will be very thin, this means that a smaller sum of money can move the market greater than in normal conditions.

"Remain" vote has, right now, a much bigger chance than "leave" so the markets can price in this information way ahead of the official results.

Look at the price action of gold or S&P 500. These are risk barometers so their price action could signal a reversal on Gbp pairs.

-

17:27

Tomorrow's main events

A small number of economic indicators will be released on Friday.

At 08:00 GMT Germany will publish the IFO Business Climate index, IFO index of current conditions, and the IFO expectations index for June. The first indicator reflects the situation and the optimism of the business community the EU's largest economy. To calculate the index about 7,000 business executives completes a survey who rate the relative level of current business conditions and expectations for the next 6 months. A value below 100 is an indicator of a slowing economy. A reading above 100 shows growing optimism among entrepreneurs. The indicator value may range from 80 to 120. It is expected that the business climate index will fell to 107.5 from 107.7 in May.

At 12:30 GMT the United States will publishe the change orders for durable goods in May. The indicator is important for the market, as it provides an indication of the confidence of consumers of these products in the current economic situation. Since durable goods are quite expensive, the increase in the number of orders for these shows consumers willingness to spend their own money.

At 14:00 GMT the United States will present a final consumer sentiment index from Reuters / Michigan for June. This index represents the results of a consumer survey on the subject of confidence in the current economic situation. The survey involves 500 respondents. With the help of this report, the desire of consumers to spend their money becomes clearer. The index is a leading indicator of consumer sentiment. The indicator is calculated by adding 100 to the difference between the number of optimists and pessimists, expressed as a percentage. It is expected that the index will fell to 94 from 94.7 in May.

And, of course, tonight around 2:00 gmt we will know is UK is still a member of the European Union.

-

16:43

USA: new home sales lower in May

New home sales in the US fell in May from a maximum of more than eight years amid weakness in the three regions, but in general the housing market remains unchanged.

The Commerce Department reported Thursday that new home sales fell by 6.0 percent to a seasonally adjusted annual rate of up to 551,000 units. The April sales pace was revised downwards to 586 000 units from the previously reported 619,000 units, it is still the highest since February 2008.

Economists had forecast that sales of new buildings, which accounted for about 9.1 percent of the housing market to fall to 560 000 units in the last month.

Sales rose by 8.7 percent compared to the previous year. Sales of new single-family homes are extremely volatile month-to-month and preliminary results are subject to significant revisions.

-

16:03

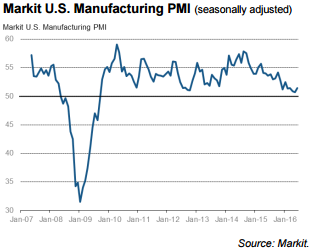

Increased activity in the manufacturing sector of US - Markit PMI

June data highlighted strengthening business conditions across the U.S. manufacturing sector. At 51.4, up from 50.7 in May, the seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers' Index crucial 50.0 no-change threshold and signalled the fastest improvement in operating conditions for three months.

Relatively weak PMI readings during April and May meant that the average for the second quarter of 2016 (51.0) was the lowest seen since Q3 2009.

However, the latest reading pointed to a recovery in growth momentum following the six-and-a-half year low recorded in May. Higher output levels provided a boost to the headline index in June, alongside faster growth of new orders and employment.

Manufacturers indicated a modest rise in production volumes during June, which survey respondents mainly linked to signs of a rebound in customer demand and a corresponding upturn in new work. The latest increase in new business was the strongest since March, although subdued

in comparison to the post-crisis average. New orders from abroad expanded at the fastest pace for almost two years, suggesting an additional boost to growth from greater export sales in June.

-

16:00

U.S.: Leading Indicators , May -0.2% (forecast 0.1%)

-

16:00

U.S.: New Home Sales, May 551 (forecast 560)

-

15:53

WSE: After start on Wall Street

The market in the US started trading from a growth forced by European stock markets. This is the result of investors optimism who are waiting for the results of the British referendum on Brexit. By this movement the S&P500 approaching to a key resistance level at 2,134 points, although today it's still too far to this level to be tested.

-

15:45

U.S.: Manufacturing PMI, June 51.4 (forecast 50.8)

-

15:32

U.S. Stocks open: Dow +0.80%, Nasdaq +0.81%, S&P +0.75%

-

15:31

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1260 (EUR 719m) 1.1300 (766m) 1.1315-25 (650m)

USD/JPY 104.25 (USD 230m) 105.00 (211m)

GBP/USD 1.4300 (GBP 337m) 1.4800 (244m) 1.4900 (385m)

AUD/USD 0.7400 (AUD 784m) 0.7450 (310m)

USD/CAD 1.2700 (USD 350m) 1.2800 (375m) 1.3080 (480m) 1.3200 (1.0bln)

-

15:16

At this link you can find real time results and latest informations about Brexit referendum

http://fingfx.thomsonreuters.com/gfx/rngs/1/792/1115/index.html

-

15:07

Before the bell: S&P futures +0.91%, NASDAQ futures +0.93%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,238.35 +172.63 +1.07%

Hang Seng 20,868.34 +73.22 +0.35%

Shanghai Composite 2,892.05 -13.50 -0.46%

FTSE 6,325.36 +64.17 +1.02%

CAC 4,450.06 +70.03 +1.60%

DAX 10,199.32 +128.26 +1.27%

Crude $49.82 (+1.40%)

Gold $1262.10 (-0.62%)

-

15:00

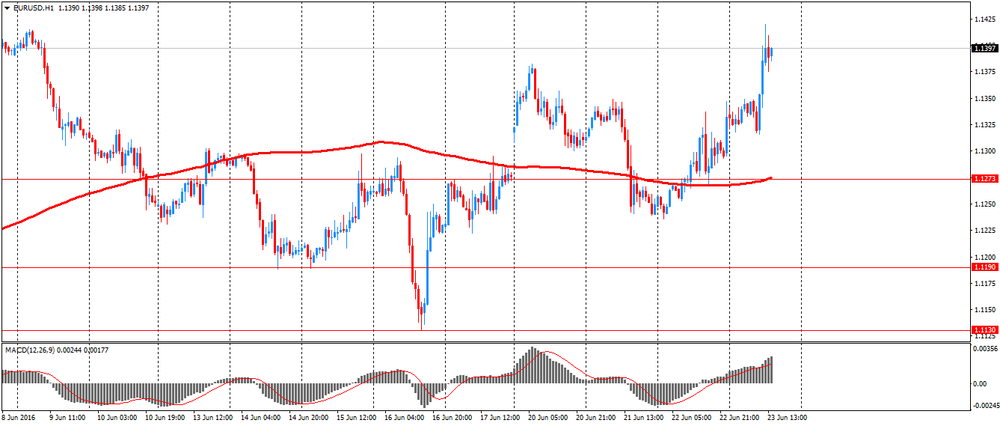

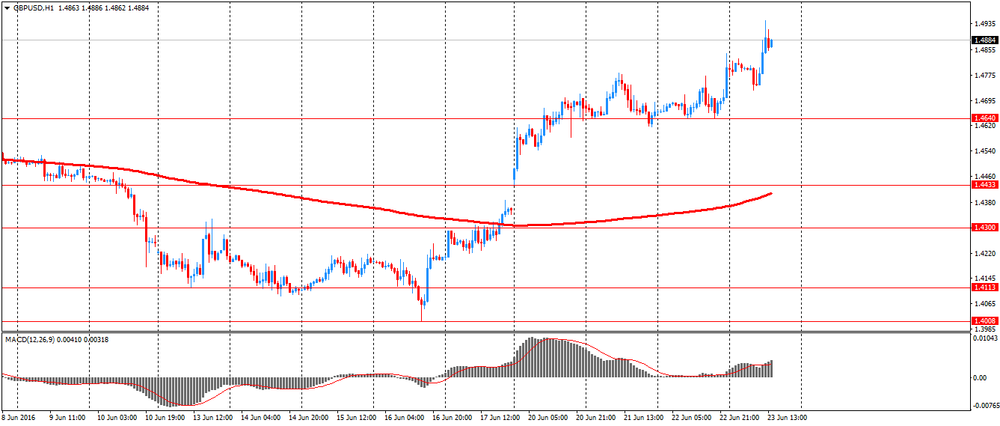

European session: the British pound rose to a fresh six-month high against the US dollar

The British pound rose to a fresh six-month high against the US dollar after an opinion poll in the UK has shown the "remain" camp in the lead.

GBP / USD pair reached a high of $ 1.4945, highest since December 18, showing a 2% jump on the day.

An opinion poll carried out by Ipsos MORI for the newspaper Evening Standard, has shown that the number of UK output opponents of the EU have 52% compared with 48% "leave" supporters.

The second survey, conducted by ComRes for the Daily Mail newspaper and television channel ITV, showed the advantage of remain camp - 48% against 42%.

Investors fear that the withdrawal from the EU will have dramatic consequences on the world's stocks, bonds and currencies, in particular the pound, which, according to the predictions of some analysts, may fall by 15%.

Reuters reported on Thursday that the G7 financial leaders are going to make a statement, which underlined its readiness to take all necessary measures to calm markets in the event of Brexit.

Rating agency Standard and Poor's said on Thursday that the credit rating of the UK will soon be reduced if the country will vote for the exit from the EU.

The euro rose against the US dollar on risk appetite after a decline earlier in the session on mixed data on business activity in the euro area.

Eurozone's manufacturing PMI in June was 52.8, below analysts' expectations and the previous value of 53.1.

The activity of services sector was also slightly below expectations (53.4) and amounted to 52.4 in June. In May, there was a increase in the index to 53.3.

The composite index is prepared by Markit Economics, based on a survey of 300 managers in the services sector and 300 managers in the manufacturing sector. The data is usually published on the third working day of the month. The results are correlated in size depending on the company and its significance. A result above 50 indicates an improvement in the economy, below 50 - the deterioration.

"Despite the slight decline in the overall index, performance is very good," - said in the report, Markit Economics

EUR / USD: during the European session, the pair rose to $ 1.1420

GBP / USD: during the European session, the pair rose to $ 1.4945

USD / JPY: during the European session, the pair rose to Y105.85

-

15:00

Belgium: Business Climate, June 0.7 (forecast -3)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

173

1.77(1.0337%)

300

ALCOA INC.

AA

10.05

0.16(1.6178%)

27119

ALTRIA GROUP INC.

MO

66.38

0.23(0.3477%)

1151

Amazon.com Inc., NASDAQ

AMZN

715.43

4.83(0.6797%)

9619

Apple Inc.

AAPL

95.98

0.43(0.45%)

76657

AT&T Inc

T

41.47

0.17(0.4116%)

9354

Barrick Gold Corporation, NYSE

ABX

19.36

-0.29(-1.4758%)

55551

Boeing Co

BA

133.5

1.73(1.3129%)

1327

Caterpillar Inc

CAT

77.07

0.64(0.8374%)

2085

Chevron Corp

CVX

103.21

0.92(0.8994%)

290

Cisco Systems Inc

CSCO

28.95

0.23(0.8008%)

7618

Citigroup Inc., NYSE

C

43.45

0.77(1.8041%)

123441

Deere & Company, NYSE

DE

84.99

1.07(1.275%)

460

E. I. du Pont de Nemours and Co

DD

68.5

0.43(0.6317%)

564

Exxon Mobil Corp

XOM

91.83

0.66(0.7239%)

3916

Facebook, Inc.

FB

114.55

0.64(0.5618%)

120023

FedEx Corporation, NYSE

FDX

156.51

-0.00(-0.00%)

708

Ford Motor Co.

F

13.26

0.08(0.607%)

26365

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.78

0.28(2.4348%)

181974

General Electric Co

GE

31.06

0.28(0.9097%)

13370

General Motors Company, NYSE

GM

29.5

0.18(0.6139%)

2593

Goldman Sachs

GS

150.35

2.21(1.4918%)

13602

Google Inc.

GOOG

696

-1.46(-0.2093%)

15772

Hewlett-Packard Co.

HPQ

12.68

0.07(0.5551%)

300

Home Depot Inc

HD

128.4

0.80(0.627%)

20431

HONEYWELL INTERNATIONAL INC.

HON

116.5

-0.07(-0.06%)

200

Intel Corp

INTC

32.55

0.26(0.8052%)

3527

International Business Machines Co...

IBM

153.46

0.54(0.3531%)

6552

Johnson & Johnson

JNJ

117.02

0.56(0.4808%)

1000

JPMorgan Chase and Co

JPM

63.57

0.86(1.3714%)

10323

McDonald's Corp

MCD

121.32

0.70(0.5803%)

1121

Merck & Co Inc

MRK

57.3

0.26(0.4558%)

100

Microsoft Corp

MSFT

51.37

0.38(0.7452%)

32262

Nike

NKE

55

0.43(0.788%)

3580

Pfizer Inc

PFE

34.67

0.20(0.5802%)

4500

Procter & Gamble Co

PG

83.9

0.33(0.3949%)

4095

Starbucks Corporation, NASDAQ

SBUX

56.09

0.48(0.8632%)

2265

Tesla Motors, Inc., NASDAQ

TSLA

195.4

-1.26(-0.6407%)

151680

The Coca-Cola Co

KO

45.07

0.21(0.4681%)

1567

Travelers Companies Inc

TRV

112.83

1.00(0.8942%)

685

Twitter, Inc., NYSE

TWTR

16.32

0.19(1.1779%)

144224

UnitedHealth Group Inc

UNH

139.17

1.27(0.921%)

1485

Verizon Communications Inc

VZ

54.3

0.27(0.4997%)

2000

Visa

V

77.41

0.88(1.1499%)

14718

Wal-Mart Stores Inc

WMT

72.25

0.50(0.6969%)

1906

Walt Disney Co

DIS

99.5

0.71(0.7187%)

296

Yahoo! Inc., NASDAQ

YHOO

37.65

0.29(0.7762%)

2690

Yandex N.V., NASDAQ

YNDX

22.25

0.45(2.0642%)

719

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Home Depot (HD) upgraded to Buy from Neutral at Nomura; target $155

Downgrades:

Tesla Motors (TSLA) downgraded to Equal-Weight from Overweight at Morgan Stanley; target lowered to $245 from $333

Other:

Amazon (AMZN) initiated with a Buy at Maxim Group; target $825

Boeing (BA) initiated with a Overweight at Morgan Stanley; target $153

Alphabet (GOOG) target lowered to $830 from $950 at Evercore ISI; maintain Buy

Wal-Mart (WMT) resumed with a Buy at Nomura; target $81

-

14:45

US insurance weekly claims lower than forecasts

In the week ending June 18, the advance figure for seasonally adjusted initial claims was 259,000, a decrease of 18,000 from the previous week's unrevised level of 277,000. The 4-week moving average was 267,000, a decrease of 2,250 from the previous week's unrevised average of 269,250.

There were no special factors impacting this week's initial claims. This marks 68 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

-

14:30

U.S.: Initial Jobless Claims, June 259 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, June 2142 (forecast 2150)

-

13:58

What Could Brexit Mean For The Euro? - according to Goldman Sachs

eFXnews quoting a Goldman Sachs's recommendation:

In the wake of last week's tragic events, the market has increasingly positioned for the "remain" camp to prevail in tomorrow's referendum, but in our view there remains ample room for risk premia to come off. Our preferred gauge for this is EUR/GBP, which we think should continue - based on our assessment of fundamentals to converge down towards 0.70

Today, we discuss how EUR/$ might behave in the event of a "leave" vote. Very short term, by which we mean the 24-48 hours after the vote.

The uncertainty around Grexit last summer provides a benchmark for how EUR/$ might behave in the event that "leave" prevails tomorrow. When risk aversion spiked on mounting Grexit fears, EUR/$ rallied on safe haven flows. It was only following the EU summit on July 11-12 (which reached a compromise on Greece) that EUR/$ fell meaningfully, going below 1.10 in fairly short order (Exhibit 1).

We think similar repatriation flows could again buoy the single currency in the very short term, by which we mean the 24-48 hours immediately after "leave" prevails. There is again potential for such repatriation flows, given that gross outflows have rebounded from last summer (Exhibit 2), when President Draghi confused markets with his statement in the June press conference that markets should get used to "higher volatility"

But beyond these short-term effects, we see Brexit, should it occur, as a clear catalyst for EUR/$ down, because it would represent a negative confidence shock to a region that is struggling to reflate. We think this would allow "doves" on the ECB Governing Council to shift back into proactive mode and pursue more activist monetary easing, setting the stage for a resumption of the Euro downtrend.

-

13:51

Orders

EUR/USD

Offers : 1.1350 1.1375-80 1.1400 1.1420 1.1450 1.1480 1.1500

Bids: 1.1320 1.1300 1.1285 1.1250 1.1235 1.12201.1200 1.1185 1.1150 1.1100

GBP/USD

Offers : 1.4785 1.4800 1.4825-30 1.4850 1.4865 1.4885 1.4900 1.4930 1.4950 1.4975 1.5000

Bids: 1.4720 1.4700 1.4675 1.4645-50 1.4625-30 1.4600 1.4580 1.4550 1.4530-35 1.4500-05

EUR/GBP

Offers : 0.7700 0.7730 0.7750 0.7785 0.7800 0.7825-30 0.7850 0.7885 0.7900

Bids: 0.7650 0.7635-40 0.7600-05 0.7580 0.7550 0.7525-30 0.7500

EUR/JPY

Offers : 118.50 118.80 119.00 119.20 119.50 119.85 120.00

Bids: 118.00 117.80-85 117.45-50 117.30 117.00 116.85 116.50 116.00 115.50 115.00

USD/JPY

Offers : 104.75-80 105.00 105.30-35 105.50 105.80 106.00 106.50 106.85 107.00

Bids: 104.20 104.00 103.80-85 103.50 103.25 103.00

AUD/USD

Offers : 0.7550 0.7570 0.7600 0.7630 0.7650 0.7700 0.7720

Bids: 0.7520 0.7500 0.7485 0.7450 0.7420-25 0.7400 0.7385 0.7370 0.7350

-

13:20

Central Bank of Rusia will develop an insurance mechanism of credit

The Bank of Russia is developing an insurance mechanism of consumer credit in the event of bankruptcy, by analogy with the current banking market deposit insurance system. This was presented at a conference on protecting the rights of consumers of financial services, said Head of the Service for Protection of rights of consumers of financial services and the minority shareholders of the Bank of Russia, Mikhail Mamut.

"We are now working on a mechanism to protect the rights of savers, and probably will be conceptually going to ensure that this system is extended to all segments of the financial market. It is not the fastest, not the easiest way, but it should be done." - Mamut said.

-

13:15

WSE: Mid session comment

After another survey, in which the preponderance of supporters to remain the UK in the Union grows to 52 percent versus 48 percent of opponents, we have further strengthen of the belief that there will be no Brexit. This belief is shed on the markets increasingly, so the capital waiting for the final outcome of the referendum partially comes already on the market. The result is obvious - more and more increases on the equity markets, and the stronger euro and the British pound.

Improvement of sentiment results in reaching by the WIG20 index the level of 1,850 points. Growing chances of avoidance of Brexit may bring less volatility on tomorrow's opening at the expense of today's, which discounts the victory of supporters of stay.

-

13:06

Stock indices in Europe increased for fifth consecutive session on Thursday, as investors expect the UK referendum results

The composite index of the largest companies in the region Stoxx Europe 600 rose during trading on 1,7% - to 347.10 points. Over the last four sessions the index jumped 6.2%, the week could be the best since 2011.

On Thursday, the British decide the fate of their country's future membership in the EU. Referendum kicked off at 06:00 GMT, the first results of individual constituencies will be announced around midnight.

On Wednesday, three of four opinion polls show only a minimal advantage for "remain", while the fourth shows significant advantages for those who want to stay in the EU.

The price of securities of the British department store chain Tesco has grown by 2.6%. The company reported a second consecutive quarterly increase in revenue.

The capitalization of the British manufacturer of packaging materials recycled DS Smith Plc rose by 4.7% due to an increase in data revenues and profits in the last quarter.

Shares of Italian Banco Popolare SC rose 2.4%. On Wednesday, the Bank completed the sale of new shares in the amount of EUR 990 million. Additional emission was carried out as part of the merger with Banca Popolare di Milano.

Volkswagen shares jumped 0.95% after shareholders were finally able to express criticism of the leadership of the automaker for the scandal-fraud level of emissions

.

At the same time, shares of BAE Systems fell 0.7% after the IBC Advanced Alloys Corp, announced a contract for the joint development of prototypes of products with the British defense company.

At the moment

FTSE 6360.81 99.62 1.59%

DAX 10297.37 226.31 2.25%

CAC 4475.85 95.82 2.19%

-

12:04

Latest Brexit Poll: 52% "remain" 48% "leave"

-

12:02

Review of financial and economic press: British banks accumulate funds in case of Brexit

D/W

UK citizens decide on the country's membership in the EU

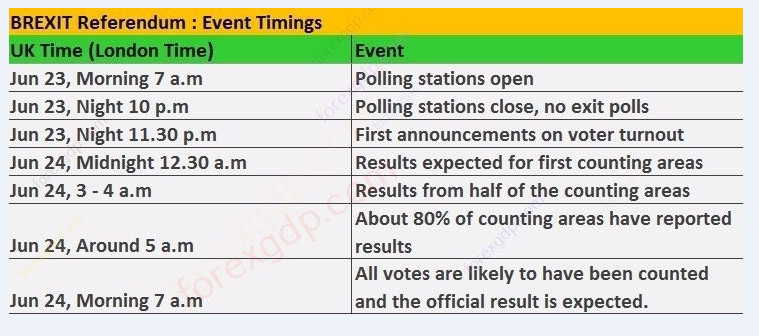

On June 23 began the referendum in which voters will decide the country's membership in the European Union. Polls in all 382 electoral districts are open from 7 am local time (09.00 MSK) until 22 pm (00:00 MSK). At the same time the official exit polls from polling stations will not be carried out. As expected, all the votes will be counted by the morning of June 24th. The Election Commission will announce the results of the referendum before the start of tomorrow's working day in the UK.

Turkish president threatens referendum on non-alignment to the EU

Turkish President, Erdogan, continued his verbal attacks on the EU. As reported by the state news agency Anadolu, speaking on Wednesday, June 22, in Istanbul, he accused Brussels that EU officials obstruct the process of Ankara's EU accession, because Turkey is a predominantly Muslim country.

Syrian President instructed to form a new government

Syrian President Bashar Assad instructed the Minister of Electricity Imad Mohammed Dibu Hamisu with the formation of a new government. This was reported by the state news agency Sana on Wednesday. The reasons for the formation of a new cabinet minister is not called.

Newspaper. ru

Tesla plans to buy energy SolarCity

The American company Tesla Motors, which manufactures electric vehicles, has sent an offer to buy the energy company SolarCity, which is engaged in the installation of solar power systems. This was reported in the company's tweets.

Fast-food chain McDonald's can earn up to $ 3 billion on the sale of business in China and Hong Kong, Reuters reported, citing sources.

FT: British banks accumulate funds on a case Brexit

The Bank of England informed the British banks to increase the volume of the order in the case that Great Britain leaving from the European Union may cause a massive withdrawal of deposits, writes Financial Times.

Deputy head of the US Department of State meets with the President of Venezuela

Deputy Head of the US State Department's Thomas Shannon meets with Venezuelan President Nicolas Maduro. As Reuters reported, citing a witness, talks began in the presidential palace in Caracas, less than an hour ago.

RBC

G7 will announce measures to calm markets in case of withdrawal of Britain from the EU

"Big Seven" will release a statement on the measures to be taken if UK leaves EU, the sources told Reuters.

-

11:35

-

11:27

Lukoil expects the average price of oil in 2016 at $ 50 per barrel

Lukoil expects the average price of oil at $ 50 a barrel in 2016, but does not exclude the worst-case scenario, company president Vagit Alekperov said at a meeting with shareholders.

"In 2015, we had to work in a two-fold drop in oil prices, we have developed scenarios of 40 and 30 dollars, they do not lose its relevance, although we expect that the average price will be $ 50 in 2016 per barrel, but we do not exclude the worst-case scenario, "- he said.

Alekperov said that "Lukoil" managed to triple the free cash flow in the last year - up to 248 billion rubles and in terms of net profit per employee the company occupies a leading position in Russia - 2.7 million rubles. Alekperov said that after the difficult conditions of the Tax Code has adopted a number of measures to improve operational and financial efficiency, optimizing general and administrative expenses. In particular, in some regions, Lukoil, was able to negotiate with contractors to reduce the cost of their services by 30-40%.

Alekperov also said that the company's debt load is relatively low. "We have managed to ensure stable funding for all expenses, including repayment of loans and payment of dividends," - he said.

-

11:04

Oil prices little changed

This morning, New York crude oil futures WTI rose by 0.37% to $ 49.33 per barrel. At the same time, crude oil futures for Brent rose by + 0.52% to $ 50.13 per barrel. Thus, the black recording some gains , on the background of today's referendum in the UK, as well as due to lower US fuel stocks. According to the US Department of Energy, oil inventories in the country decreased by 900K barrels.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1260 (EUR 719m) 1.1300 (766m) 1.1315-25 (650m)

USD/JPY 104.25 (USD 230m) 105.00 (211m)

GBP/USD 1.4300 (GBP 337m) 1.4800 (244m) 1.4900 (385m)

AUD/USD 0.7400 (AUD 784m) 0.7450 (310m)

USD/CAD 1.2700 (USD 350m) 1.2800 (375m) 1.3080 (480m) 1.3200 (1.0bln)

-

10:10

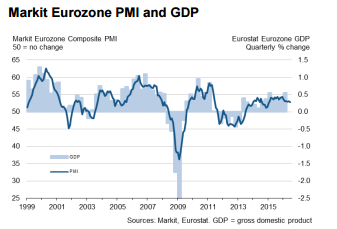

Euro area business activity growth slowed in June - PMI survey

Euro area business activity growth slowed slightly in June, according to the Markit Eurozone Flash PMI , which edged down to its lowest level since January of last year. The PMI fell from 53.1 in May to 52.8, rounding off the worst calendar quarter since the fourth quarter of 2014 amid signs of political and economic uncertainty dampening business activity. Moderate growth was recorded in both the manufacturing and service sectors, though an acceleration in the rate of goods production, to the best seen so far this year, was offset by a weakened pace of expansion in services, the slowest for 18 months.

Growth of new orders likewise accelerated in manufacturing, buoyed by the best export performance since December, but slowed in services. Overall growth of new business across both sectors consequently inched only slightly higher, remaining one of the weakest seen over the past year-and-a-half. Backlogs of work nevertheless rose to the greatest extent seen over the past nine months, prompting firms to take on additional staff at the fastest rate seen so far this year in order to expand capacity to meet demand. Stronger rates of job creation were seen in both manufacturing and services.

-

10:05

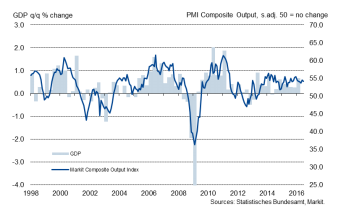

German manufacturing activity accelerates in June

The steady growth path of Germany's economy continued at the end of the second quarter, with the Markit Flash Germany Composite Output Index posting 54.1. Despite falling slightly from May's 54.5, the index was broadly in line with the average over the current 38-month sequence of expansion and indicative of moderate growth. June data signalled an acceleration in new business growth at German private sector companies. Some panellists attributed the latest expansion to a positive economic environment, while others specifically commented on rising demand from overseas markets. Indeed, manufacturers reported the strongest increase in new export orders for almost two-and-half years.

Survey participants commented on higher new business from a range of different countries, including China and the US. Growth trends in both output and new business diverged by sector, however. In particular, slower expansions in the service sector contrasted with accelerated growth at goods-producers, with the Manufacturing PMI reaching its highest level since early-2014. -

10:00

Eurozone: Manufacturing PMI, June 52.6 (forecast 51.3)

-

10:00

Eurozone: Services PMI, June 52.4 (forecast 53.1)

-

09:58

UK Referendum - market levels of the day according to UBS

In an attempt to reduce the uncertainty, we try to benchmark "levels for the day after". To be sure, we are not trying to predict where markets will trade in the hours that follow such a big event. There could be liquidity-driven dislocations, price spikes and large reversals. Rather, we attempt to answer a slightly easier question: at what level would we buy or sell each key asset class upon a Remain and a Leave scenario? At what level are the relevant risks likely priced in?

To do this, we ran a simple exercise. First, we computed a simple, model-based simulation across assets. The main assumption of this exercise was that the relationships between market-based "probabilities" of Brexit, the level of EUR/GBP, and the pricing of risks across assets persist. This served as a base-case. Then, we surveyed our strategists, who offered a more informed view of the balance of risks to different assets on a fundamental basis. The table on the following page shows the average range based on the two exercises.

In short:

1. In a vote to leave, GBP would come under significant pressure, while risk currencies (CHF and JPY) benefit. Potential policy responses limit the degree of strength. We expect the effects on EUR/USD to be relatively muted.

2. The payout for Bonds is asymmetric. In a vote to remain, yields would rise but not significantly, and mostly in the Euro-area core. Upon "Leave", the path of least resistance is for yields to drop substantially, especially in the UK & the US.

3. The bond yield/policy cushion, combined with the healthy distance from the macro shock, implies less downside for the S&P than for the FTSE or Eurostoxx upon "Leave". Upon "Remain", the S&P could plausibly make fresh highs.

4. Euro-area periphery yields and corporate credit spreads have significant room to widen in a decision to leave, although temporarily perhaps before a policy response is triggered. The upside is capped in an event to "stay".

5. Risk sentiment swings may affect emerging market assets, but much less so relative to Euro-area and UK assets, given the cushion from lower US yields.

6. Lastly, we anticipate limited pass-through to Oil prices. The broad decline in US real rates creates more upside than downside in Gold prices.

-

09:44

Today’s events:

In addition to the events mentioned in the economic calendar:

At 08:15 GMT RBA Assistant Governor Guy Debell deliver a speech.

In the 23:00 GMT FOMC members Robert Kaplan will deliver a speech.

At 23:50 GMT Japan will publish a summary of the views.

UK referendum on EU membership - all day.

-

09:30

Germany: Services PMI, June 53.2 (forecast 55)

-

09:30

Germany: Manufacturing PMI, June 54.4 (forecast 52)

-

09:27

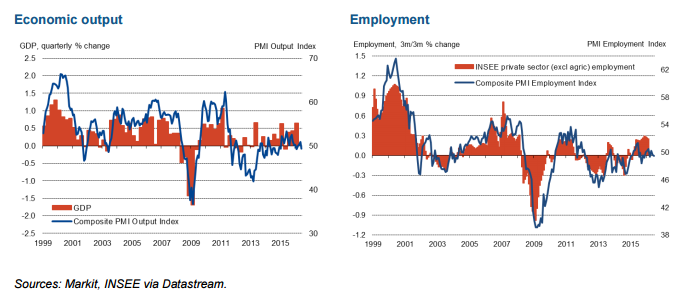

French flash PMI lower then forecasts

The latest flash France PMI data signalled that private sector output decreased for the first time in four months during June. The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 49.4, down from 50.9 in May. The latest reading pointed to a marginal rate of contraction.

In the service sector, activity broadly stagnated following two months of growth. In manufacturing, production decreased for the third month running, with the rate of contraction accelerating to the sharpest since April 2015.

Underlying the drop in output was a reduction in the level of new business received by French private sector firms. It was the first fall since March, albeit marginal overall. Whereas service providers indicated that new business was largely unchanged, manufacturers reported a sixth successive monthly drop, with the rate of decline accelerating since May.

Anecdotal evidence pointed to a tough demand climate, with clients often reluctant to commit to new contracts.

Employment in the French private sector fell for the second month running during June. That said, the rate of job shedding was little-changed from the marginal pace recorded in May. Manufacturers signalled a moderate rate of decline in staffing levels, whereas service providers indicated a fractional drop.

-

09:21

WSE: After opening

WIG20 index opened at 1820.28 points (-0.15%)*

WIG 46133.06 -0.14%

WIG30 2028.77 -0.20%

mWIG40 3488.48 0.11%

*/ - change to previous close

Neutral start, with the relatively low activity. A complete standstill takes place in the second and third line of values (the mWIG40 & sWIG80 indices). It may be assumed that if after the referendum the trading will begin sharply, for dating will be taken shares of relatively high liquidity. After 8 minutes of trading only KGH and Pekao exceed PLN one million of turnover. In Euroland the DAX gained approx. 0.6%.

-

09:00

France: Manufacturing PMI, June 47.9 (forecast 48.8)

-

09:00

France: Services PMI, June 49.9 (forecast 51.7)

-

08:43

Asian session: Brexit polls show “remain” with a significant lead

The pound traded near its yearly high in anticipation of today's referendum. Voting will end at 20:00 GMT, and the results will be announced at 02:00 GMT on Friday. In the case of a vote for "leave" leaders of the European countries and other organizations planning to hold a series of emergency meetings, the purpose of which - to calm the markets and prevent a domino effect in the weaker economies. EU leaders fear is particularly strong influence of the results on Ireland, as well as Portugal. According to the authorities, if the British vote for the exit from the EU, on Friday morning, the Central Bank will make a statement to reassure the markets.

The latest phone survey, conducted by ComRes show 48% remain against 42 leave, and YouGov (online) show 51% remain to 48% leave.

Meanwhile, bookmakers indicate a high probability (about 80%) that most Britons would vote for to stay in the EU.

The Yen traded lower beacause of today's high risk event. Markit economist Amy Braunbil said that the recent survey data point to a further deterioration of conditions of production in Japan. Both production and new orders indicate a sharp fall in global demand. She also said that the earthquake that took place in April, continues to have a negative impact on the manufacturing sector, although the uncertainty caused by negative interest rates may also be a weakening factor.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1320-35

GBP / USD: during the Asian session, the pair was trading in the $ 1.4740-70

USD / JPY: during the Asian session, the pair was trading in range Y104.00-40

-

08:33

Options levels on thursday, June 23, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1488 (2899)

$1.1451 (2030)

$1.1424 (710)

Price at time of writing this review: $1.1336

Support levels (open interest**, contracts):

$1.1259 (2348)

$1.1208 (1567)

$1.1178 (2595)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 35110 contracts, with the maximum number of contracts with strike price $1,1500 (4176);

- Overall open interest on the PUT options with the expiration date July, 8 is 85689 contracts, with the maximum number of contracts with strike price $1,0900 (16076);

- The ratio of PUT/CALL was 2.44 versus 2.47 from the previous trading day according to data from June, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5021 (3878)

$1.4926 (360)

$1.4832 (1922)

Price at time of writing this review: $1.4753

Support levels (open interest**, contracts):

$1.4661 (159)

$1.4564 (449)

$1.4467 (683)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 21839 contracts, with the maximum number of contracts with strike price $1,5000 (3878);

- Overall open interest on the PUT options with the expiration date July, 8 is 39928 contracts, with the maximum number of contracts with strike price $1,4100 (3326);

- The ratio of PUT/CALL was 1.83 versus 1.89 from the previous trading day according to data from June, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:30

-

08:23

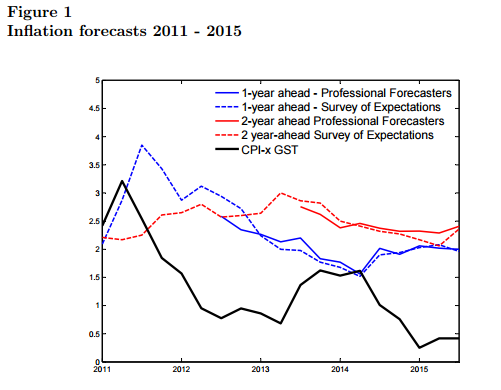

Inflation expectations in New Zeeland

New Zealand's annual consumer price inflation (CPI) has remained low over the past several years. In fact, inflation has been unusually lower given levels of economic activity and import price trends. The observed low inflation has surprised both the Reserve Bank of New Zealand (RBNZ) and the external/professional forecasters. Figure 1 shows that 1- and 2- year ahead inflation forecasts by both professional forecasters and businesses1 signifi- cantly overshot inflation out-turns over recent years.

-

08:21

WSE: Before opening

Finally we have this day, when the British vote in the nervously awaited referendum on staying or leaving the European Union. The referendum started at 8:00 (Warsaw time) and should be completed before 23:00. The first official message has to relate the attendance is expected half an hour after midnight. The first partial results are expected from 1:30 on Friday, where around 6:00 will be already known the result of the 80% of districts. The final result is expected at 8:00 (Warsaw time) on Friday, that is, before the opening of the next session.

The market should be calmer today and wait for the outcome of the vote, with the exception that some of its members may have information about the result earlier than others and this can disrupt the peace places.

The behavior of Asian parquets is balanced, where the Nikkei increases are offset by a worse behavior of other markets, led by a decline in China. Yesterday's session on Wall Street was not too good and ended up with cosmetic drop of the S&P500. In the morning, however, the contracts gain of approx. 0.5% and yesterday's declines are made up for.

The Warsaw market well behaved yesterday, especially banks sector excluding Pekao (WSE: PEO). Today, there is a information about the possibility of sale of the bank Pekao by UniCredit.

-

08:15

Asia-Pacific stock markets closed higher:

Major stock indices in Asia-Pacific region are traded in the green zone on the background of lower risk associated with the forthcoming referendum on the withdrawal of Great Britain from the European Union.

Quotes on the Tokyo Stock Exchange rise. Bidders also fear that the possible withdrawal of Great Britain from the EU structure will lead to a sharp appreciation of the yen and a negative impact on Japanese companies, whose business is closely linked to Europe.

During Asian session was published the preliminary data on the index of business activity in the manufacturing sector of Japan. The index of business activity was 47.8, below analysts' expectations of 48.2. The previous value was 47.7.

Shares of the largest exporters traded steadily: Toyota Motor Corp gained 0.4%, while Honda Motor Co and Panasonic Corp increased capitalization by 1.5% each.

Shares of Japan's largest financial corporations Sumitomo Mitsui Financial Group and Mitsubishi UFJ Financial Group rising 0.8%.

Nikkei 225 16,134.22 +68.50 +0.43%

Hang Seng 20,858.25 +63.13 +0.30%

S & P / ASX 200 5,278.9 +7.95 +0.15%

Shanghai Composite 2,881.64 -23.91 -0.82%

Topix 1,292.44 +7.83 +0.61%

-

04:00

Japan: Manufacturing PMI, June 47.8 (forecast 48.2)

-

00:34

Commodities. Daily history for Jun 22’2016:

(raw materials / closing price /% change)

Oil 49.00 -0.26%

Gold 1,268.90 -0.09%

-

00:32

Stocks. Daily history for Jun 22’2016:

(index / closing price / change items /% change)

Nikkei 225 16,065.72 -103.39 -0.64 %

Hang Seng 20,795.12 +126.68 +0.61 %

S&P/ASX 200 5,270.95 -3.41 -0.06 %

Shanghai Composite 2,905.77 +27.21 +0.95 %

FTSE 100 6,261.19 +34.64 +0.56 %

CAC 40 4,380.03 +12.79 +0.29 %

Xetra DAX 10,071.06 +55.52 +0.55 %

S&P 500 2,085.45 -3.45 -0.17 %

NASDAQ Composite 4,833.32 -10.44 -0.22 %

Dow Jones 17,780.83 -48.90 -0.27 %

-

00:30

Currencies. Daily history for Jun 22’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1332 +0,73%

GBP/USD $1,4799 +0,94%

USD/CHF Chf0,9586 -0,38%

USD/JPY Y104,79 +0,03%

EUR/JPY Y118,75 +0,76%

GBP/JPY Y155,11 +0,98%

AUD/USD $0,7320 -1,82%

NZD/USD $0,7174 +0,74%

USD/CAD C$1,2812 -0,01%

-

00:02

Schedule for today, Thursday, Jun 23’2016:

(time / country / index / period / previous value / forecast)

02:00 Japan Manufacturing PMI (Preliminary) June 47.7 48.2

07:00 France Services PMI (Preliminary) June 51.6 51.7

07:00 France Manufacturing PMI (Preliminary) June 48.4 48.8

07:30 Germany Services PMI (Preliminary) June 55.2 55

07:30 Germany Manufacturing PMI (Preliminary) June 52.1 52

08:00 Eurozone Manufacturing PMI (Preliminary) June 51.5 51.3

08:00 Eurozone Services PMI (Preliminary) June 53.3 53.1

08:00 United Kingdom EU Membership Vote

08:15 Australia RBA Assist Gov Debelle Speaks

12:30 U.S. Continuing Jobless Claims June 2157 2150

12:30 U.S. Initial Jobless Claims June 277 270

13:00 Belgium Business Climate June -2.8 -3

13:45 U.S. Manufacturing PMI (Preliminary) June 50.7 50.8

14:00 U.S. Leading Indicators May 0.6% 0.1%

14:00 U.S. New Home Sales May 619 560

-