Noticias del mercado

-

22:06

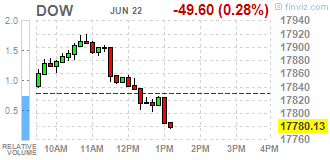

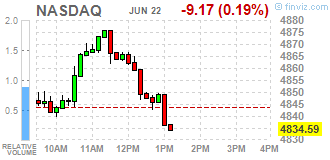

Major US stock indexes finished trading in the red zone

Major US stock indexes fell slightly on Wednesday, despite a positive start to trading. Market participants continue to assess the likelihood of Britain continued membership in the EU on the basis of the referendum, which will take place tomorrow. On the eve of the popular vote, most opinion polls indicate that the majority of respondents support the option to "stay."

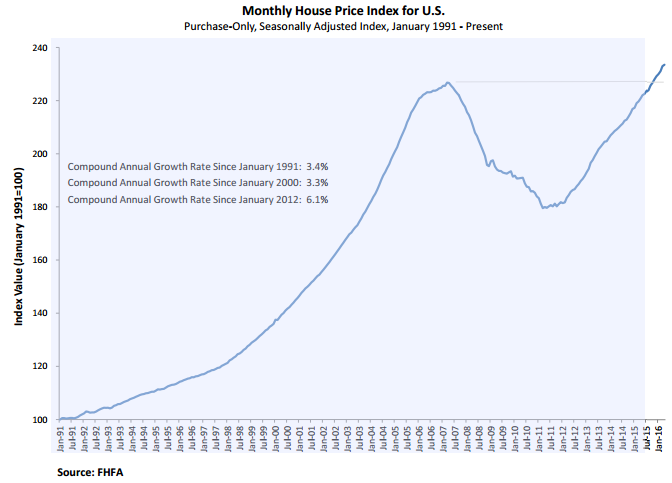

In addition, increased in April by 0.2% in US housing prices, seasonally adjusted, compared with the previous month, according to the Federal Agency for Housing Finance (FHFA). Previously reported increase of 0.7% in March was revised upwards and reflected an increase of 0.8%.

At the same time, the volume of home sales in the US secondary market up to May results, reaching its highest level in more than nine years, as the increase in inventories of homes provided a wider range of customers. The National Association of Realtors reported that sales of existing homes increased in May by 1.8%, to 5.53 million. Units (in terms of annual growth). The last reading was the highest since February 2007. Meanwhile, the volume of home sales in April was revised down - to 5.43 million units from 5.45 million units... Economists had forecast sales growth of 1.1% to 5.54 million. Units.

Oil prices fell more than 2%, being under pressure due to oil product inventories report in the United States, which did not meet forecasts. On the trading dynamics also affect expectations of a referendum on Britain's membership of the EU. US Department of Energy reported that in the week of June 11-17, oil inventories fell by 917,000 barrels to 530.6 million barrels. It was predicted a decline of 1.67 million barrels. Oil reserves in Cushing terminal fell by 1.3 million barrels to 65.2 million barrels.

DOW index components decreased mainly (21 vs. 9 in the red in the black). Outsider were shares of McDonald's Corp. (MCD, -1,69%). Most remaining shares rose Merck & Co. Inc. (MRK, + 1,56%).

Almost all sectors of the S & P zaershili trading down. conglomerates (-0.4%) sectors fell most. The leader turned out to be the health sector (+ 0.4%).

At the close:

Dow -0.28% 17,780.63 -49.10

Nasdaq -0.22% 4,833.32 -10.44

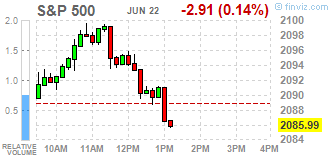

S & P -0.17% 2,085.44 -3.46

-

21:00

Dow -0.11% 17,809.80 -19.93 Nasdaq -0.01% 4,843.35 -0.41 S&P +0.03% 2,089.56 +0.66

-

19:16

Wall Street. Major U.S. stock-indexes fell

Mojor U.S. stock-indexes slightly fell on Wednesday after a new poll moderated expectations that Britain will vote to remain in the European Union. A survey by polling firm Opinium showed the campaign for Britain to leave the EU holds a one-point lead over the "In" camp ahead of Thursday's referendum. Though polls are extremely close, bookmakers had been pointing to betting patterns in favor of the U.K. remaining in the EU.

Dow stocks mixed (15 in positive area, 15 in negative). Top looser - McDonald's Corp. (MCD, -1,77%). Top gainer - Merck & Co. Inc. (MRK, +1,05%).

Almost of all S&P sectors also mixed. Top looser - Conglomerates (-0,3%). Top gainer - Healthcare (+0,5%).

At the moment:

Dow 17715.00 -22.00 -0.12%

S&P 500 2080.50 0.00 0.00%

Nasdaq 100 4405.00 +4.75 +0.11%

Oil 49.12 -0.73 -1.46%

Gold 1271.30 -1.20 -0.09%

U.S. 10yr 1.70 +0.01

-

18:00

European stocks closed: FTSE 100 6,303.03 +76.48 +1.23% CAC 40 4,380.03 +12.79 +0.29% DAX 10,071.06 +55.52 +0.55%

-

17:52

Oil prices down moderatly

Oil prices have fallen by about 2%, and have come under pressure due to report on petroleum inventories in the United States, which did not meet forecasts.

US Department of Energy reported that in the week of June 11-17, oil inventories fell by 917,000 barrels to 530.6 million barrels. Forecasts shown a reduction of 1.67 million barrels. Oil reserves in Cushing terminal fell by 1.3 million barrels to 65.2 million barrels. Gasoline stocks unexpectedly rose by 627,000 barrels to 237.6 million barrels. Distillate stocks rose by 151,000 barrels to 152.3 million barrels. Analysts expected an increase in distilate stocks at 100,000 barrels. The utilization of refining capacity increased by 1.1% to 91.3%. Analysts expected an increase of 0.7%. Meanwhile, oil production fell to 8.677 million barrels per day versus 8.716 million barrels per day in the previous week.

The cost of the August futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 49.43 dollars per barrel.

The price of August futures for Brent fell to 49.90 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:39

New Brexit poll: 45% leave, 44% remain

-

17:37

WSE: Session Results

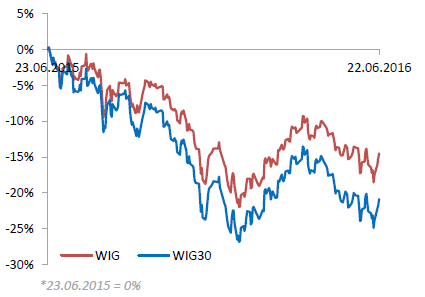

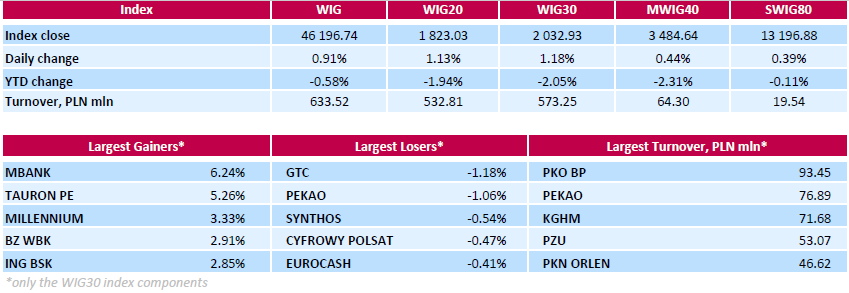

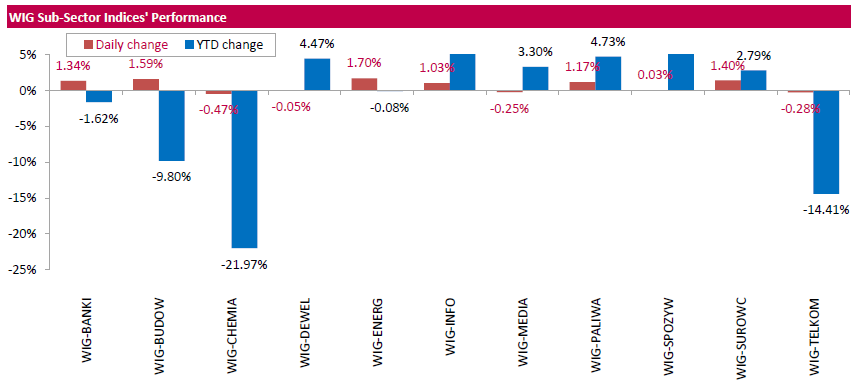

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, rose by 0.91%. Sector performance within the WIG Index was mixed. Utilities sector (+1.70%) was the strongest group, while materials (-0.47%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, surged by 1.18%. In the index basket, the day's strongest performers included genco TAURON PE (WSE: TPE) and four banking sector stocks, namely MBANK (WSE: MBK), MILLENNIUM (WSE: MIL), BZ WBK (WSE: BZW) and ING BSK (WSE: ING), which gained between 2.85% and 624%. On the other side of the ledger, property developer GTC (WSE: GTC) and bank PEKAO (WSE: PEO) were hit the hardest, down 1.18% and 1.06% respectively. Other biggest losers were chemical producer SYNTHOS (WSE: SNS) and media group CYFROWY POLSAT (WSE: CPS), which fell by 0.54% and 0.47% respectively.

-

17:02

Tight range on Gold preparing the next sharp move

So far today's range is just 5$/ounce but things will change for sure tomorrow because of the Brexit referendum. Gold will move regardless of the Brexit outcome because of its safe heaven status. A remain vote will lower the demand for safer assets while the big (enormous) move will come if UK votes to leave. Then, the majority of inverstors will turn to gold and the price will quickly go up.

-

16:50

US housing sales in the secondary market reached a 9 year high

Existing-home sales sprang ahead in May to their highest pace in almost a decade, while the uptick in demand this spring amidst lagging supply levels pushed the median sales price to an all-time high, according to the National Association of Realtors®. All major regions except for the Midwest saw strong sales increases last month.

Total existing-home sales1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 1.8 percent to a seasonally adjusted annual rate of 5.53 million in May from a downwardly revised 5.43 million in April. With last month's gain, sales are now up 4.5 percent from May 2015 (5.29 million) and are at their highest annual pace since February 2007 (5.79 million).

Lawrence Yun, NAR chief economist, says existing sales continue to hum along, rising in May for the third consecutive month. "This spring's sustained period of ultra-low mortgage rates has certainly been a worthy incentive to buy a home, but the primary driver in the increase in sales is more homeowners realizing the equity they've accumulated in recent years and finally deciding to trade-up or downsize," he said. "With first-time buyers still struggling to enter the market, repeat buyers using the proceeds from the sale of their previous home as their down payment are making up the bulk of home purchases right now."

-

16:30

U.S.: Crude Oil Inventories, June -0.917 (forecast -1.67)

-

16:21

The International Monetary Fund lowered forecasts for 2016 US GDP growth by 0.2% to 2.2%

- energy sector is weak, the dollar, instability abroad, as forecast downgrade reasons for the US.

- US data give a clear argument in favor of "a very gradual increase in interest rates".

- Fed should accept the moderate and temporary excess of the inflation target.

- the overshoot of the inflation target will insure further economic weakness.

- weak economic activity in the United States in recent years may indicate a potential slowdown in economic growth.

- Fed may face significant long-term challenges in regard to economic growth, debt.

- Fed should reform the tax code, to increase investment in infrastructure.

-

16:14

-

16:00

U.S.: Existing Home Sales , May 5.53 (forecast 5.54)

-

16:00

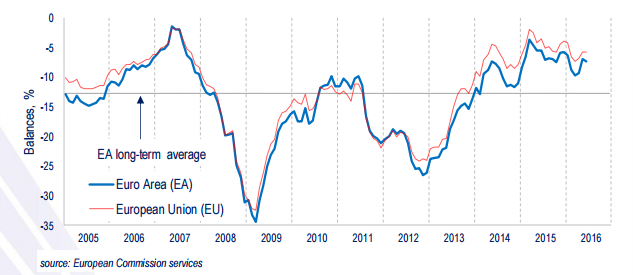

Eurozone: Consumer Confidence, June -7.3 (forecast -7)

-

15:50

WSE: After start on Wall Street

Despite the apparent today's continuing of growth in Euroland, there is still no particular move on the US indexes, which is de facto the more or less similar to yesterday's situation. In the short term, we may note that fluctuations on Wall Street begin to be increasingly narrow, suggesting that soon we may expect any decision, and by the way delicate hint for other markets. Taking into account the fact that Wall Street was far from the last optimism of European markets, the Friday's trading - in case when the United Kingdom will stay in the EU - can bring a meeting with resistance in the region of 2,134 points. On the Warsaw market the still problem is the activity of investors and the level of transactions volume, which is barely PLN 380 mln. This is not an activity that makes credible uplift of 1.0 per cent.

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1245-50 (EUR 800m) 1.1265 (387m) 1.1320 (350m) 1.1380 (348m)

USD/JPY 104.00 (USD 1.1bln) 105.00 (1.5bln)

GBP/USD 1.4500 (GBP 289m) 1.4710 (175m) 1.5000 (302m)

EUR/GBP 0.7900 (EUR 341m)

AUD/USD 0.7250 (AUD 700m) 0.7525 (333m) 0.7605 (689m) 0.7725 (976m)

USD/CAD 1.2775 (USD 430m) 1.3100 (690m)

-

15:33

U.S. Stocks open: Dow +0.13%, Nasdaq +0.12%, S&P +0.19%

-

15:28

Before the bell: S&P futures +0.12%, NASDAQ futures +0.22%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,065.72 -103.39 -0.64%

Hang Seng 20,795.12 +126.68 +0.61%

Shanghai Composite 2,905.77 +27.21 +0.95%

FTSE 6,266.42 +39.87 +0.64%

CAC 4,396.84 +29.60 +0.68%

DAX 10,120.84 +105.30 +1.05%

Crude $50.07 (+0.44%)

Gold $1268.30 (-0.33%)

-

15:23

Tesla shares crashed 11% premarket

Tesla Motors (TSLA) stocks fallen premarket 11% after the statements that indicate the intentions to buy the company SolarCity.

SolarCity Company is engaged in the production, financing and installation of solar energy systems. The head of Tesla Motors Elon Musk owns the shares and is the head of the board of directors of this company. It is expected that the deal could reach 2.8 bln dollars.

TSLA shares fell in premarket trading to $ 195.72 (-10.88%).

-

15:15

House price index in the US rose less then forecasts

U.S. house prices rose in April, up 0.2 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly (HPI). The previously reported 0.7 percent increase in March was revised upward to reflect a 0.8 percent increase. The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From April 2015 to April 2016, house prices were up 5.9 percent.

Since October 2015, the national house price index level has surpassed the prior peak level from March 2007.

For the nine census divisions, seasonally adjusted monthly price changes from March 2016 to April 2016 ranged from -0.7 percent in the Middle Atlantic division to +1.4 percent in the New England division. The 12-month changes were all positive, ranging from +1.7 percent in the Middle Atlantic division to +8.6 percent in the Pacific division.

-

15:00

U.S.: Housing Price Index, m/m, April 0.2% (forecast 0.6%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.94

0.08(0.8114%)

15613

Amazon.com Inc., NASDAQ

AMZN

716.99

1.17(0.1634%)

1955

Apple Inc.

AAPL

96.5

0.59(0.6152%)

177040

AT&T Inc

T

41.07

-0.00(-0.00%)

250

Barrick Gold Corporation, NYSE

ABX

19.15

-0.01(-0.0522%)

49249

Boeing Co

BA

131.84

0.32(0.2433%)

100

Chevron Corp

CVX

103.5

0.26(0.2518%)

985

Cisco Systems Inc

CSCO

28.75

-0.02(-0.0695%)

200

Citigroup Inc., NYSE

C

43.06

0.14(0.3262%)

9381

Exxon Mobil Corp

XOM

91.66

0.13(0.142%)

910

Facebook, Inc.

FB

114.7

0.32(0.2798%)

21130

FedEx Corporation, NYSE

FDX

163

-0.95(-0.5794%)

1440

Ford Motor Co.

F

13.26

0.04(0.3026%)

6057

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.82

0.21(1.8088%)

151760

General Electric Co

GE

31

0.06(0.1939%)

1798

General Motors Company, NYSE

GM

29.3

-0.21(-0.7116%)

1290

Goldman Sachs

GS

148.4

0.05(0.0337%)

705

Google Inc.

GOOG

698.5

2.56(0.3678%)

1790

Hewlett-Packard Co.

HPQ

12.89

-0.44(-3.3008%)

15482

McDonald's Corp

MCD

121.3

-1.33(-1.0846%)

8782

Microsoft Corp

MSFT

51.23

0.04(0.0781%)

6161

Nike

NKE

54.39

-0.38(-0.6938%)

2400

Starbucks Corporation, NASDAQ

SBUX

55.88

0.07(0.1254%)

394

Tesla Motors, Inc., NASDAQ

TSLA

194.8

-24.81(-11.2973%)

1057769

The Coca-Cola Co

KO

45.13

0.00(0.00%)

225

Twitter, Inc., NYSE

TWTR

16.39

0.07(0.4289%)

36692

Wal-Mart Stores Inc

WMT

71.56

0.10(0.1399%)

300

Yahoo! Inc., NASDAQ

YHOO

37.32

-0.08(-0.2139%)

964

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

McDonald's (MCD) downgraded to Neutral from Buy at Nomura

Tesla Motors (TSLA) downgraded to Perform from Outperform at Oppenheimer

Other:

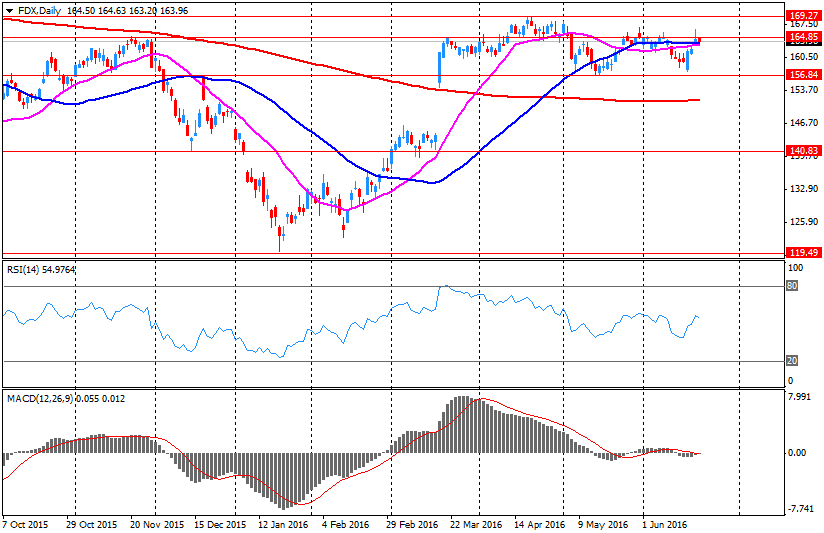

FedEx (FDX) target raised to $174 from $158 at RBC Capital Mkts

FedEx (FDX) target raised to $179 from $178 at Stifel

NIKE (NKE) target lowered to $69 from $72 at Telsey Advisory Group

-

14:49

Canada’s retail sales up 0.9% in April

Following a 0.8% decline in March, retail sales rose 0.9% to $44.3 billion in April. Sales were up in 7 of 11 subsectors, representing 64% of total retail sales.

Higher sales at gasoline stations were the main contributor to the gain. Excluding sales at gasoline stations, retail sales advanced 0.4%.

After removing the effects of price changes, particularly higher gasoline prices, retail sales in volume terms were relatively flat in April.

Sales at gasoline stations rose for the first time since June 2015, up 6.0% in April. This increase largely reflected higher prices at the pump. According to the Consumer Price Index, the price of gasoline was up 8.9% on an unadjusted basis in April, its largest monthly gain since February 2015.

-

14:31

Canada: Retail Sales YoY, April 4.6%

-

14:30

Canada: Retail Sales, m/m, April 0.9% (forecast 0.9%)

-

14:30

Canada: Retail Sales ex Autos, m/m, April 1.3% (forecast 0.6%)

-

14:27

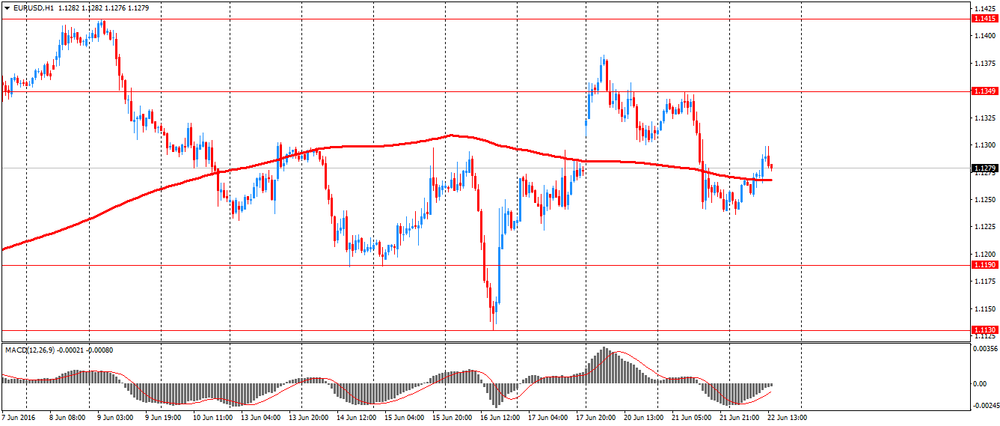

European session review: the US dollar declines against major currencies

The US dollar fell against other major currencies, as the opinion polls show almost parity between the supporters and opponents of Brexit on the eve of the referendum.

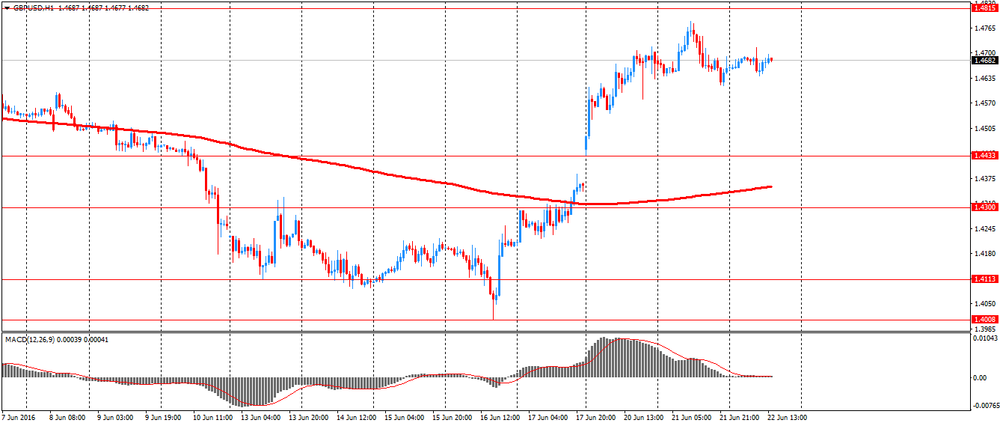

Some opinion poll showed that the "remain" camp has lost some support before the referendum on Thursday. Gbp/usd did not priced in this information.

The latest Survation poll showed that 45% of UK citizens prefer to stay in the EU, 44% choose to leave, and 11% were undecided.

In the previous survey 45% were EU supporters and 42% opponents.

The dollar lost some of yesturdays gains. Federal Reserve's Janet Yellen said during his speech in Congress that the rate will probably be necessary to increase gradually.

She added that the Fed "is closely monitoring global economic and financial developments", adopting a cautious approach to raising interest rates.

Yellen also warned that Brexit could have serious economic consequences.

The Swiss franc was up against the US dollar after ZEW and Credit Suisse economic data. Swiss economic sentiment improved in June as investors expectations index rose 1.9 points to 19.4 in June. The index reached its highest level since February 2014.

Economic expectations continued the upward trend in the second quarter of 2016.

EUR / USD: during the European session rose to $ 1.1299

GBP / USD: during the European session, the pair traded in $ 1.4641 - $ 1.4714 range

USD / JPY: during the European session, the pair fell to Y104.30

-

14:24

Company News: FedEx (FDX) Q4 results beat analysts’ estimate

FedEx reported Q4 FY 2016 earnings of $3.30 per share (versus $2.66 in Q4 FY 2015), beating analysts' consensus of $3.28.

The company's quarterly revenues amounted to $12.979 bln (+7.1% y/y), beating consensus estimate of $12.771 bln.

FedEx issued in-line guidance for FY 2017, projecting adj. EPS of $11.75-12.25 versus analysts' consensus estimate of $12.07.

FDX fell to $163.00 (-0.58%) in pre-market trading.

-

14:17

Fed, Powell: Brexit may give rise to "significant volatility"

- we are ready for any outcome of the British referendum.

- the weakness of the world economy - an important factor for the Federal Reserve's policy.

- it is necessary to take a "wait and see attitude", to determine the dynamics of the US economy.

- monetary policy was in need of help from the fiscal, regulatory policies.

-

13:50

Orders

EUR/USD

Offers : 1.1285 1.1300 1.1320-25 1.1350-55 1.1375-80 1.1400 1.1420 1.1450

Bids: 1.1250 1.1235 1.1220 1.1200 1.1185 1.1150 1.1100

GBP/USD

Offers : 1.4720-25 1.4750 1.4770 1.4800 1.4830 1.4830 1.4850 1.4885 1.4900

Bids: 1.4645-50 1.4625-30 1.4600 1.4580 1.4550 1.4530-35 1.4500-05 1.4485 1.4450

EUR/GBP

Offers : 0.7700 0.7730 0.7750 0.7785 0.7800 0.7825-30 0.7850 0.7885 0.7900

Bids: 0.7650 0.7630 0.7600-05 0.7580 0.7550 0.7525-30 0.7500

EUR/JPY

Offers : 118.00-05 118.25 118.50 118.70-75 119.00 119.20 119.50 119.85 120.00

Bids: 117.45-50 117.30 117.00 116.85 116.50 116.00 115.50 115.00

USD/JPY

Offers : 104.50 104.80-85 105.00 105.30-35 105.50 105.80 106.00 106.50 106.85 107.00

Bids: 104.20 104.00 103.80-85 103.50 103.25 103.00

AUD/USD

Offers : 0.7480 0.7500 0.7520 0.7550 0.7570 0.7600

Bids: 0.7420-25 0.7400 0.7385 0.7370 0.7350 0.7300

-

13:08

WSE: Mid session comment

The morning phase of the session ended with approach of the WIG20 index in the region of 1,813 points, what sets the index of the prospect of a meeting with the level of 1,850 points. One problem is the size of the turnover, which was strong only in the first hour of trading. Part of the strength of the WIG20 also comes from observed appreciation of the zloty.

From some quarters on the Warsaw market happens practically nothing. In the case of Euroland the apathy has been going on practically since the beginning of the day.

In the mid-session, the WIG20 index reached the level of 1,814 points (+ 0.62%).

-

12:54

Major stock indices in Europe on the rise

European stocks rise fourth consecutive session on expectations that the UK will not withdraw from the European Union.

The composite index of the largest companies in the region, Stoxx Europe 600, rose during trading by 0.14% - to 340.52 points.

Today, rising raw material prices, including oil, are supporting the shares of mining, oil and gas companies.

ArcelorMittal securities and Anglo American Plc rose more than 1,9%, Tullow Oil capitalization has increased by 0.5%.

Merlin Properties SOCIM, spanish company, increased its market value by 4.5% on the news of a merger with Metrovacesa SA. The merger would form the largest company in the rent and property spanish markets.

H & M stocks fell by 0.8%. Quarterly profit of the second largest clothing retailer in Europe fell by 17% to a minimum of 3 years.

Shares of Swiss financial group Julius Baer rose by 1%, after Citigroup analysts raised their rating from "neutral" to "buy."

Shares of Infineon AG jumped 1.3% after reports that by the end of 2016 more than half of all new cars around the world will be equipped with chips of the German company.

Shares of InterContinental Hotels Group PLC fell 1.4% after Goldman Sachs analysts lowered their rating from "buy" to "neutral."

SSE's shares fell 0.8% after the British energy regulator Ofgem said on Wednesday that the measures taken by the company should be directed at solving the problems in the market of electrical connections.

At the moment

FTSE 6246.02 19.47 0.31%

DAX 10075.83 60.29 0.60%

CAC 4384.72 17.48 0.40%

-

12:32

Forget the polls. Gbp/Usd chart tells us what is likely to happen

The pound is very cheap right now. Historicaly we are at the inferior level of the 14 years trading range. We can see multiple false breakouts of this lower suport level followed by sharp rises.

If UK votes tomorrow to leave the European Union it will really be a shock and its consequences will be global, long lasting and difficult to anticipate.

UK did somenthing similar in 1992 when it broke the ERM treaty but there were very different conditions (no vote) and the blame can be put on Germany as well as UK. A "leave" vote would be something never seen so far and this is why it is less likely to happen. If it does, will bring huge risks but equal oportunities.

-

11:25

ZEW: Swiss economic outlook improves

The ZEW-CS-Indicator for the economic sentiment in Switzerland has increased slightly. With an improvement by 1.9 points, the indicator reaches a reading of 19.4 points in June 2016. Economic expectations thereby continue the upward trend already witnessed in Q2 2016. In June, Swiss economic expectations reached their highest assessment balance since February 2014. The ZEW-CS-Indicator reflects the expectations of the surveyed financial market experts regarding the economic development in Switzerland on a six-month time horizon.

Despite the moderate optimistic sentiment regarding Swiss economic expectations, a majority of 54.8 per cent of analysts currently expects a constant economic environment over a six-month horizon. Furthermore, survey participants show a strong agreement regarding the assessment of Switzerland's current economic situation: 93.8 per cent of analysts evaluate the situation as "normal". None of the surveyed experts considers the current economic conditions to be "bad". Consequently, the indicator which reflects Switzerland's current economic environment increased to 6.2 points in June 2016.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), June 19.4

-

10:57

Oil is trading higher

This morning, New York crude oil futures WTI rose by + 0.90% to $ 50.31 per barrel. At the same time, crude oil futures for Brent rose by 0.71% to $ 51.00 per barrel. Thus, the black gold is gaining, amid the the reduction of commercial stocks in the US. Investors also expect a recovery of production in Nigeria and Canada. There is a high probability of decline in oil inventories in the US market, although the reserves are at record highs, and drilling volumes began to grow again.

-

10:09

Review of financial and economic press: In London took place the "Big Debate" on EU membership

Newspaper. ru

China increased its oil imports from Russia by 34%, in the last month.

In May, China increased its oil imports from Russia by 34%, to 5.24 million tons. In April, the volume of oil imports from Russia amounted to 4, 81 million tons. In addition to Russia, the main suppliers of oil to China became Saudi Arabia and Iraq.

BBC

The "Big Debate" on EU membership

On Tuesday evening in London, in "Wembley Arena" took place "The Big Debate," devoted to the referendum on the UK's membership of the EU, which will be held tomorrow. The final debate before the referendum continued for almost two hours and was mainly devoted to the problems of the economy, sovereignty and migration.

Clinton: Donald Trump could bankrupt America

Hillary Clinton sharply criticized hers main rival in the US elections, Donald Trump, who, in her opinion, can "bankrupt America."

RBC

The Fed saw "considerable uncertainty" in the US economy

The head of the Federal Reserve System, Janet Yellen, told the Senate committee that she saw "considerable uncertainty" in the US economic outlook - Financial Times. As evidence of risk she said it will stick to a cautious approach in raising bank interest rates.

Traders prepared for the sharp collapse of the dollar after the US elections.

Trade conflicts and political uncertainty after the elections in the US may cause the flight of investors from the dollar, traders said.

The European Central Bank (ECB) is ready for a possible exit of the UK from the European Union. This was stated by the chairman of the ECB, Mario Draghi at a hearing in the European Parliament, reports Bloomberg. "The ECB is ready for any contingency after the referendum on the UK's membership of the EU".

The shareholder Mail.ru Group buys Clash of Clans maker for a record amount.

Chinese Internet holding company Tencent together with a group of investors acquired a 84% stake in the Finnish Supercell Oy, the developer of one of the world's most popular mobile games Clash of Clans, valued at $ 10.2 billion

-

10:01

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1245-50 (EUR 800m) 1.1265 (387m) 1.1320 (350m) 1.1380 (348m)

USD/JPY 104.00 (USD 1.1bln) 105.00 (1.5bln)

GBP/USD 1.4500 (GBP 289m) 1.4710 (175m) 1.5000 (302m)

EUR/GBP 0.7900 (EUR 341m)

AUD/USD 0.7250 (AUD 700m) 0.7525 (333m) 0.7605 (689m) 0.7725 (976m)

USD/CAD 1.2775 (USD 430m) 1.3100 (690m)

-

09:58

Major stock exchanges gained after opening: DAX 10,092.39 + 76.85 + 0.77%, FTSE 100 6,257.41 + 53.41 + 0.86%, CAC 40 4,395.33 + 28.09 + 0.64%

-

09:32

What would Brexit bring for AUD? - NAB

NAB with a client note regarding the aussie dollar:

In attempting to quantify the potential implications for the AUD, we note that last August when Chinese stock and currency market-related stresses saw the 'VIX' proxy for market risk aversion briefly above 50 from below 20, the AUD fell from above 0.74 to below 0.69.

If we go back to the collapse of Lehman brothers when the VIX rose as high as 90, AUD fell from 0.98 to 0.60 (Chart 1). Stressing our short term fair value model with similar levels for the VIX (50 and 90) keeping all else constant, we derive fair value estimates of 0.64 (Chart 2) and 0.52 respectively We'd emphasise these are not forecasts, but do serve to illustrate the potential for severe downward pressure in the event that global risk markets are freaked out by a vote for Brexit.

Our sense is that AUD would quickly revisit the current cycle lows in the 0.68-0.69 area in the case of 'Brexit' and rally to 0.75-0.76 (based on current levels) in the case of a vote for 'Remain' (Chart 3).

-

09:23

WSE: After opening

WIG20 index opened at 1801.47 points (-0.06%)*

WIG 45853.19 0.16%

WIG30 2013.18 0.20%

mWIG40 3472.03 0.08%

*/ - change to previous close

T

he German DAX began the day with the increases of 0.5% and behaves according to the latest polls about Brexit. Stock Exchange selects the neutral scenario and after the first exchanges WIG20 is slightly below the level of 1,800 points at the low level of turnover.

-

09:13

Today's events

In addition to the events mentioned in the economic calendar:

At 09:30 GMT Germany will hold an auction of 30-year bonds.

At 13:00 GMT quarterly inflation report from the SNB.

At 14:00 GMT FED Chairwoman, Janet Yellen, testifies .

-

08:53

Expected positive opening on the major stock exchanges in Europe: DAX + 0,6%, FTSE 100 + 0,2 %%, CAC 40 + 0.4%

-

08:48

Asian session: tight ranges across the board

During the Asian session, the currency pairs traded in narrow ranges as markets are waiting for the results of the referendum in the UK, which will be held tomorrow.

One of the polls showed majority for Brexit supporters camp - the UK out of the EU. Two polls on Monday indicated that Brexit opponents have restored the balance in the run-up to the referendum. The probability of "remain" on the vote on Thursday rose to 78% from 60% last week, according to the latest Betfair data. "Polls seem to indicate a growing support for" remain, "but we will not know anything for sure until we see the results," - said Kёsuke Suzuki from Societe Generale.

The euro is trading lower. The main pressure on the currency was a statement of ECB President Draghi, who hinted at a willingness to adopt new stimulus if needed. "Downside risks are still significant due to the continuing unstable situation of the global economy and geopolitical events. We will closely follow the development of price stability and we are ready to act, using all the tools available within our mandate, if necessary to achieve our objectives. The ECB is ready for any contingency after the referendum in the UK ", - said Draghi.

In addition, Fed Chaiwoman Yellen'n comments came in focus. "The FOMC will raise rates gradually, paying attention to both the current dynamics of the GDP, employment and consumer prices, and the prospects of macroeconomic indicators", - said Yellen. According to Yellen, the world economy is still vulnerable and a potential exit of Great Britain from the EU can have serious economic consequences not only for the country itself but also for the world, including the United States.

The Australian dollar strengthened slightly, which, to some extent was caused by data released today. The index of leading economic indicators from Australia rose in April by 0.20%. The previous value was revised from 0.25% to 0.1%.

On an annual basis, the pace of economic growth from Westpac rose from -1.19% in April to -0.42% in May. The index continues to point to sub-trend growth. In May there was a significant improvement and it was the best indicator since October 2015. Falling commodity prices, over the past two years, now have a neutral effect on the rate of growth of the index.

The Canadian dollar has risen little bit against the background of rising oil prices. Futures price for Brent crude oil for August delivery on the ICE exchange in London today was $ 51.07 per barrel.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1235-55 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.4655-80 range

USD / JPY: during the Asian session, the pair was trading in range Y104.35-50 range

-

08:32

Options levels on wednesday, June 22, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1449 (2514)

$1.1406 (2030)

$1.1375 (710)

Price at time of writing this review: $1.1258

Support levels (open interest**, contracts):

$1.1195 (1475)

$1.1168 (2553)

$1.1138 (2058)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 34664 contracts, with the maximum number of contracts with strike price $1,1500 (4155);

- Overall open interest on the PUT options with the expiration date July, 8 is 85706 contracts, with the maximum number of contracts with strike price $1,0900 (15878);

- The ratio of PUT/CALL was 2.47 versus 2.44 from the previous trading day according to data from June, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5021 (3581)

$1.4926 (372)

$1.4831 (1918)

Price at time of writing this review: $1.4682

Support levels (open interest**, contracts):

$1.4565 (475)

$1.4469 (650)

$1.4371 (741)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 20813 contracts, with the maximum number of contracts with strike price $1,5000 (3581);

- Overall open interest on the PUT options with the expiration date July, 8 is 39389 contracts, with the maximum number of contracts with strike price $1,4100 (3329);

- The ratio of PUT/CALL was 1.89 versus 1.93 from the previous trading day according to data from June, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:27

WSE: Before opening

Tuesday's session on Wall Street ended with a modest changes in the major indexes. In yesterday's speech the Fed Chairman Janet Yellen estimated that US interest rates should remain at current levels "for some time" and investors bought shares mainly in the hope that on Thursday the British vote for staying in the EU.

Suspension is also noticeable in the Asian markets, where the major averages record modest changes, a drop in the Nikkei index corresponds mainly to the strengthening of the yen.

As a result, the European markets may expect some stabilization in the morning, but there can be no doubt that most important will be the latest polls sending from London. After the recent rally, equity markets are arranged for the victory of supporters for Great Britain staying in the European Union.

We should slowly prepare for the fact that markets will be faded before tomorrow's vote, and the reactions will be postponed for another two sessions - on Thursday, the game will take place on the basis of leaks from the exit polls, and on Friday, based on preliminary results.

On the Warsaw market situation seems clear. Warsaw Stock Exchange remains in a strong correlation with core markets and equally turning to the equity markets and to the currency markets. Return of the WIG20 index above the level of 1,800 points is also significant for the further development of the situation.

-

08:10

6 Reasons EUR/USD won't collapse on Brexit - Deutsche Bank

6 Reasons EUR/USD won't collapse on Brexit:

1. Brexit will likely rule out a July Fed rate hike. US yields will drop. On the flipside, we are already pricing 15bps of depo cuts from the ECB and are unlikely to price more - Draghi has suggested that aggressive rate cuts are unlikely.

2. The euro out-performs on risk-aversion. Europeans have historically repatriated foreign assets during periods of uncertainty and the correlation between equity markets and the euro trade-weighted is negative.

3. The market may not only re-asses the "anti-establishment" political risk premium in Europe but also in the US ahead of the November Presidential election.

4. It is difficult to identify an immediately relevant liquidity or credit event in the financial system that causes systemic stress in the Euro-area. The central bank liquidity backstop is strong and public statements the day after the referendum will re-enforce this.

5. The time lags and inter-play between Brexit and other EU political events are long and unquantifiable. There is no other referendum planned in Europe. If the Spanish election this Sunday is close to expectations the market may struggle with identifying a catalyst for a continued re-pricing of risk.

6. After gapping lower EUR/USD rallied around the Grexit referendum experience last year (chart 1) - yet the direct knock-on effect on the Eurozone back then was even easier to identify.

In sum the outcome of the UK referendum would not change our medium-term bearish EUR/USD outlook: political and institutional uncertainty will likely weigh on Eurozone growth, defer ECB tightening and reduce the attractiveness of Euro assets at a time when outflows are at a record high (chart 2). But these factors will take time to play out, and in the near-term countervailing drivers may end up being supportive of EUR/USD.

We wouldn't anticipate a bigger than 2% initial move lower in EUR/USD on "Brexit" and the risk may be that EUR/USD ends up squeezing the other way.

-

08:05

Decrease of oil reserves - API

According to the American Petroleum Institute, US crude stocks fell last week by 5.2 mln barrels.

Inventories at Cushing tank decreased by 1.3 mln barrels. Petrol decreased by 1.47 mln barrels as distillate stocks fell by 1.7 mln barrels.

The cost of Brent futures for August on the stock exchange ICE in London was $ 51.07 per barrel.

-

07:57

Mixed trading of Asia-Pacific stocks:

Major stock indexes in the Asia-Pacific region are trading in different directions, uncertainty caused by the forthcoming referendum of Great Britain.

Quotations of the Tokyo Stock Exchange fell, ending a three-day winning streak, as investors took profits from recent gains associated with the upcoming risk.

Shares of Toyota Motor Corp fell by 0,8%, Honda Motor Co by 1.7%, and Panasonic Corp lost 1.3%.

Nikkei 225 16,002.6 -166.51 -1.03%

Hang Seng 20,745.48 +77.04 +0.37%

S & P / ASX 200 5,286.7 +12.34 +0.23%

Shanghai Composite 2,889.69 +11.13 +0.39%

Topix 1,285 -8.90 -0.69%

-

02:30

Australia: Leading Index, May 0.20%

-

01:07

Commodities. Daily history for Jun 21’2016:

(raw materials / closing price /% change)

Oil 50.29 +0.88%

Gold 1,271.90 -0.05%

-

01:05

Stocks. Daily history for Jun 21’2016:

(index / closing price / change items /% change)

Nikkei 225 16,169.11 +203.81 +1.28 %

Hang Seng 20,668.44 +158.24 +0.77 %

S&P/ASX 200 5,274.36 +17.60 +0.33 %

Shanghai Composite 2,878.9 -9.91 -0.34 %

FTSE 100 6,226.55 +22.55 +0.36 %

CAC 40 4,367.24 +26.48 +0.61 %

Xetra DAX 10,015.54 +53.52 +0.54 %

S&P 500 2,088.9 +5.65 +0.27 %

NASDAQ Composite 4,843.76 +6.55 +0.14 %

Dow Jones 17,829.73 +24.86 +0.14 %

-

01:04

Currencies. Daily history for Jun 21’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1249 -0,55%

GBP/USD $1,4660 -0,09%

USD/CHF Chf0,9622 +0,05%

USD/JPY Y104,76 +0,76%

EUR/JPY Y117,85 +0,21%

GBP/JPY Y153,59 +0,68%

AUD/USD $0,7453 -0,03%

NZD/USD $0,7121 +0,20%

USD/CAD C$1,2813 +0,09%

-

00:45

New Zealand: Visitor Arrivals, May 9.6%

-

00:04

Schedule for today, Wednesday, Jun 22’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index May 0.25%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June 17.5

12:30 Canada Retail Sales, m/m April -1.0% 0.9%

12:30 Canada Retail Sales YoY April 3.2%

12:30 Canada Retail Sales ex Autos, m/m April -0.3% 0.6%

12:30 U.S. Chicago Federal National Activity Index May 0.1

13:00 Switzerland SNB Quarterly Bulletin

13:00 U.S. Housing Price Index, m/m April 0.7% 0.6%

14:00 Eurozone Consumer Confidence (Preliminary) June -7 -7

14:00 U.S. Existing Home Sales May 5.45 5.54

14:00 U.S. Fed Chairman Janet Yellen Speaks

14:30 U.S. Crude Oil Inventories June -0.933

-