Noticias del mercado

-

22:06

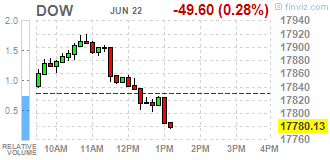

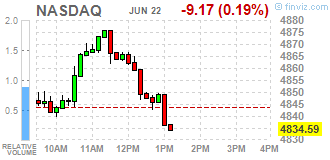

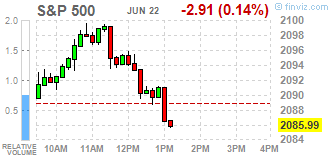

Major US stock indexes finished trading in the red zone

Major US stock indexes fell slightly on Wednesday, despite a positive start to trading. Market participants continue to assess the likelihood of Britain continued membership in the EU on the basis of the referendum, which will take place tomorrow. On the eve of the popular vote, most opinion polls indicate that the majority of respondents support the option to "stay."

In addition, increased in April by 0.2% in US housing prices, seasonally adjusted, compared with the previous month, according to the Federal Agency for Housing Finance (FHFA). Previously reported increase of 0.7% in March was revised upwards and reflected an increase of 0.8%.

At the same time, the volume of home sales in the US secondary market up to May results, reaching its highest level in more than nine years, as the increase in inventories of homes provided a wider range of customers. The National Association of Realtors reported that sales of existing homes increased in May by 1.8%, to 5.53 million. Units (in terms of annual growth). The last reading was the highest since February 2007. Meanwhile, the volume of home sales in April was revised down - to 5.43 million units from 5.45 million units... Economists had forecast sales growth of 1.1% to 5.54 million. Units.

Oil prices fell more than 2%, being under pressure due to oil product inventories report in the United States, which did not meet forecasts. On the trading dynamics also affect expectations of a referendum on Britain's membership of the EU. US Department of Energy reported that in the week of June 11-17, oil inventories fell by 917,000 barrels to 530.6 million barrels. It was predicted a decline of 1.67 million barrels. Oil reserves in Cushing terminal fell by 1.3 million barrels to 65.2 million barrels.

DOW index components decreased mainly (21 vs. 9 in the red in the black). Outsider were shares of McDonald's Corp. (MCD, -1,69%). Most remaining shares rose Merck & Co. Inc. (MRK, + 1,56%).

Almost all sectors of the S & P zaershili trading down. conglomerates (-0.4%) sectors fell most. The leader turned out to be the health sector (+ 0.4%).

At the close:

Dow -0.28% 17,780.63 -49.10

Nasdaq -0.22% 4,833.32 -10.44

S & P -0.17% 2,085.44 -3.46

-

21:00

Dow -0.11% 17,809.80 -19.93 Nasdaq -0.01% 4,843.35 -0.41 S&P +0.03% 2,089.56 +0.66

-

19:16

Wall Street. Major U.S. stock-indexes fell

Mojor U.S. stock-indexes slightly fell on Wednesday after a new poll moderated expectations that Britain will vote to remain in the European Union. A survey by polling firm Opinium showed the campaign for Britain to leave the EU holds a one-point lead over the "In" camp ahead of Thursday's referendum. Though polls are extremely close, bookmakers had been pointing to betting patterns in favor of the U.K. remaining in the EU.

Dow stocks mixed (15 in positive area, 15 in negative). Top looser - McDonald's Corp. (MCD, -1,77%). Top gainer - Merck & Co. Inc. (MRK, +1,05%).

Almost of all S&P sectors also mixed. Top looser - Conglomerates (-0,3%). Top gainer - Healthcare (+0,5%).

At the moment:

Dow 17715.00 -22.00 -0.12%

S&P 500 2080.50 0.00 0.00%

Nasdaq 100 4405.00 +4.75 +0.11%

Oil 49.12 -0.73 -1.46%

Gold 1271.30 -1.20 -0.09%

U.S. 10yr 1.70 +0.01

-

18:00

European stocks closed: FTSE 100 6,303.03 +76.48 +1.23% CAC 40 4,380.03 +12.79 +0.29% DAX 10,071.06 +55.52 +0.55%

-

17:37

WSE: Session Results

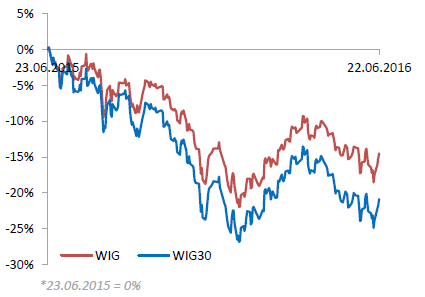

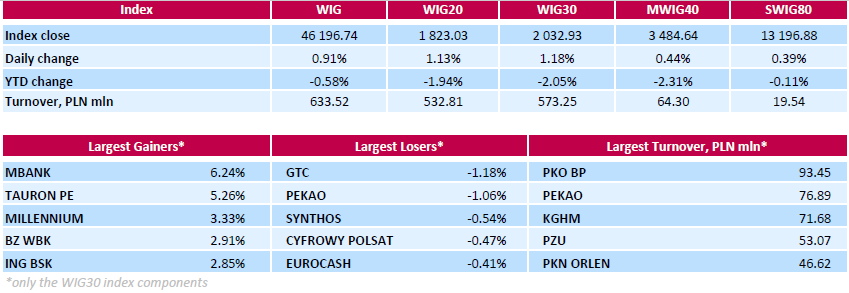

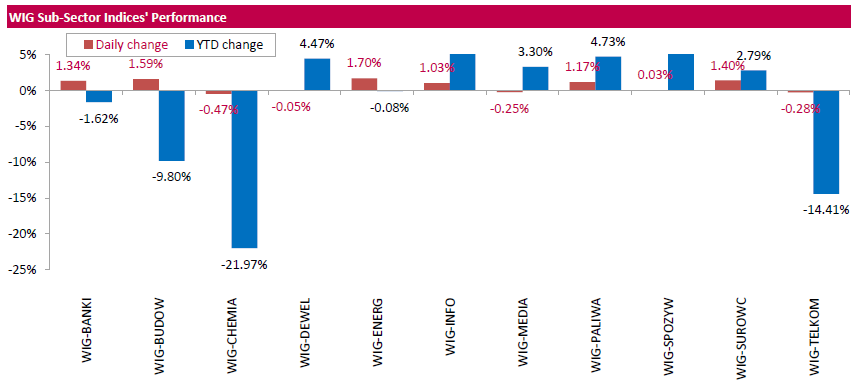

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, rose by 0.91%. Sector performance within the WIG Index was mixed. Utilities sector (+1.70%) was the strongest group, while materials (-0.47%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, surged by 1.18%. In the index basket, the day's strongest performers included genco TAURON PE (WSE: TPE) and four banking sector stocks, namely MBANK (WSE: MBK), MILLENNIUM (WSE: MIL), BZ WBK (WSE: BZW) and ING BSK (WSE: ING), which gained between 2.85% and 624%. On the other side of the ledger, property developer GTC (WSE: GTC) and bank PEKAO (WSE: PEO) were hit the hardest, down 1.18% and 1.06% respectively. Other biggest losers were chemical producer SYNTHOS (WSE: SNS) and media group CYFROWY POLSAT (WSE: CPS), which fell by 0.54% and 0.47% respectively.

-

15:50

WSE: After start on Wall Street

Despite the apparent today's continuing of growth in Euroland, there is still no particular move on the US indexes, which is de facto the more or less similar to yesterday's situation. In the short term, we may note that fluctuations on Wall Street begin to be increasingly narrow, suggesting that soon we may expect any decision, and by the way delicate hint for other markets. Taking into account the fact that Wall Street was far from the last optimism of European markets, the Friday's trading - in case when the United Kingdom will stay in the EU - can bring a meeting with resistance in the region of 2,134 points. On the Warsaw market the still problem is the activity of investors and the level of transactions volume, which is barely PLN 380 mln. This is not an activity that makes credible uplift of 1.0 per cent.

-

15:33

U.S. Stocks open: Dow +0.13%, Nasdaq +0.12%, S&P +0.19%

-

15:28

Before the bell: S&P futures +0.12%, NASDAQ futures +0.22%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,065.72 -103.39 -0.64%

Hang Seng 20,795.12 +126.68 +0.61%

Shanghai Composite 2,905.77 +27.21 +0.95%

FTSE 6,266.42 +39.87 +0.64%

CAC 4,396.84 +29.60 +0.68%

DAX 10,120.84 +105.30 +1.05%

Crude $50.07 (+0.44%)

Gold $1268.30 (-0.33%)

-

15:23

Tesla shares crashed 11% premarket

Tesla Motors (TSLA) stocks fallen premarket 11% after the statements that indicate the intentions to buy the company SolarCity.

SolarCity Company is engaged in the production, financing and installation of solar energy systems. The head of Tesla Motors Elon Musk owns the shares and is the head of the board of directors of this company. It is expected that the deal could reach 2.8 bln dollars.

TSLA shares fell in premarket trading to $ 195.72 (-10.88%).

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.94

0.08(0.8114%)

15613

Amazon.com Inc., NASDAQ

AMZN

716.99

1.17(0.1634%)

1955

Apple Inc.

AAPL

96.5

0.59(0.6152%)

177040

AT&T Inc

T

41.07

-0.00(-0.00%)

250

Barrick Gold Corporation, NYSE

ABX

19.15

-0.01(-0.0522%)

49249

Boeing Co

BA

131.84

0.32(0.2433%)

100

Chevron Corp

CVX

103.5

0.26(0.2518%)

985

Cisco Systems Inc

CSCO

28.75

-0.02(-0.0695%)

200

Citigroup Inc., NYSE

C

43.06

0.14(0.3262%)

9381

Exxon Mobil Corp

XOM

91.66

0.13(0.142%)

910

Facebook, Inc.

FB

114.7

0.32(0.2798%)

21130

FedEx Corporation, NYSE

FDX

163

-0.95(-0.5794%)

1440

Ford Motor Co.

F

13.26

0.04(0.3026%)

6057

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.82

0.21(1.8088%)

151760

General Electric Co

GE

31

0.06(0.1939%)

1798

General Motors Company, NYSE

GM

29.3

-0.21(-0.7116%)

1290

Goldman Sachs

GS

148.4

0.05(0.0337%)

705

Google Inc.

GOOG

698.5

2.56(0.3678%)

1790

Hewlett-Packard Co.

HPQ

12.89

-0.44(-3.3008%)

15482

McDonald's Corp

MCD

121.3

-1.33(-1.0846%)

8782

Microsoft Corp

MSFT

51.23

0.04(0.0781%)

6161

Nike

NKE

54.39

-0.38(-0.6938%)

2400

Starbucks Corporation, NASDAQ

SBUX

55.88

0.07(0.1254%)

394

Tesla Motors, Inc., NASDAQ

TSLA

194.8

-24.81(-11.2973%)

1057769

The Coca-Cola Co

KO

45.13

0.00(0.00%)

225

Twitter, Inc., NYSE

TWTR

16.39

0.07(0.4289%)

36692

Wal-Mart Stores Inc

WMT

71.56

0.10(0.1399%)

300

Yahoo! Inc., NASDAQ

YHOO

37.32

-0.08(-0.2139%)

964

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

McDonald's (MCD) downgraded to Neutral from Buy at Nomura

Tesla Motors (TSLA) downgraded to Perform from Outperform at Oppenheimer

Other:

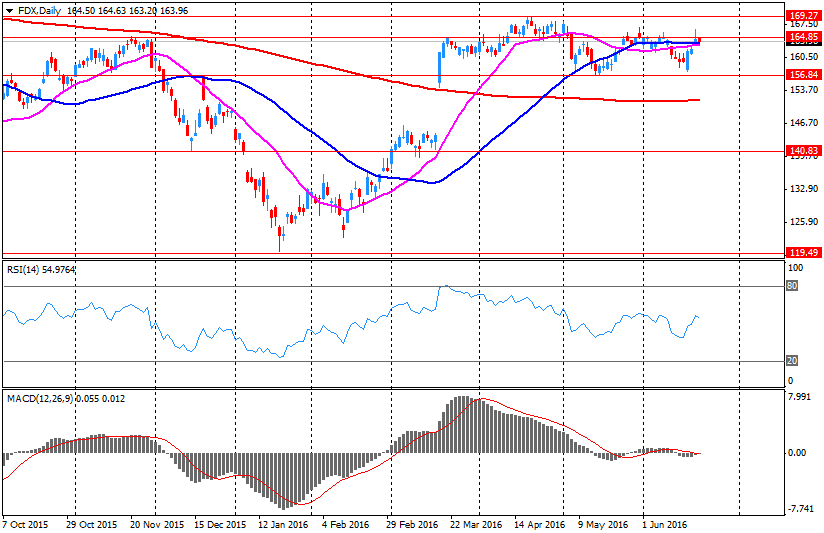

FedEx (FDX) target raised to $174 from $158 at RBC Capital Mkts

FedEx (FDX) target raised to $179 from $178 at Stifel

NIKE (NKE) target lowered to $69 from $72 at Telsey Advisory Group

-

14:24

Company News: FedEx (FDX) Q4 results beat analysts’ estimate

FedEx reported Q4 FY 2016 earnings of $3.30 per share (versus $2.66 in Q4 FY 2015), beating analysts' consensus of $3.28.

The company's quarterly revenues amounted to $12.979 bln (+7.1% y/y), beating consensus estimate of $12.771 bln.

FedEx issued in-line guidance for FY 2017, projecting adj. EPS of $11.75-12.25 versus analysts' consensus estimate of $12.07.

FDX fell to $163.00 (-0.58%) in pre-market trading.

-

13:08

WSE: Mid session comment

The morning phase of the session ended with approach of the WIG20 index in the region of 1,813 points, what sets the index of the prospect of a meeting with the level of 1,850 points. One problem is the size of the turnover, which was strong only in the first hour of trading. Part of the strength of the WIG20 also comes from observed appreciation of the zloty.

From some quarters on the Warsaw market happens practically nothing. In the case of Euroland the apathy has been going on practically since the beginning of the day.

In the mid-session, the WIG20 index reached the level of 1,814 points (+ 0.62%).

-

12:54

Major stock indices in Europe on the rise

European stocks rise fourth consecutive session on expectations that the UK will not withdraw from the European Union.

The composite index of the largest companies in the region, Stoxx Europe 600, rose during trading by 0.14% - to 340.52 points.

Today, rising raw material prices, including oil, are supporting the shares of mining, oil and gas companies.

ArcelorMittal securities and Anglo American Plc rose more than 1,9%, Tullow Oil capitalization has increased by 0.5%.

Merlin Properties SOCIM, spanish company, increased its market value by 4.5% on the news of a merger with Metrovacesa SA. The merger would form the largest company in the rent and property spanish markets.

H & M stocks fell by 0.8%. Quarterly profit of the second largest clothing retailer in Europe fell by 17% to a minimum of 3 years.

Shares of Swiss financial group Julius Baer rose by 1%, after Citigroup analysts raised their rating from "neutral" to "buy."

Shares of Infineon AG jumped 1.3% after reports that by the end of 2016 more than half of all new cars around the world will be equipped with chips of the German company.

Shares of InterContinental Hotels Group PLC fell 1.4% after Goldman Sachs analysts lowered their rating from "buy" to "neutral."

SSE's shares fell 0.8% after the British energy regulator Ofgem said on Wednesday that the measures taken by the company should be directed at solving the problems in the market of electrical connections.

At the moment

FTSE 6246.02 19.47 0.31%

DAX 10075.83 60.29 0.60%

CAC 4384.72 17.48 0.40%

-

09:58

Major stock exchanges gained after opening: DAX 10,092.39 + 76.85 + 0.77%, FTSE 100 6,257.41 + 53.41 + 0.86%, CAC 40 4,395.33 + 28.09 + 0.64%

-

09:23

WSE: After opening

WIG20 index opened at 1801.47 points (-0.06%)*

WIG 45853.19 0.16%

WIG30 2013.18 0.20%

mWIG40 3472.03 0.08%

*/ - change to previous close

T

he German DAX began the day with the increases of 0.5% and behaves according to the latest polls about Brexit. Stock Exchange selects the neutral scenario and after the first exchanges WIG20 is slightly below the level of 1,800 points at the low level of turnover.

-

08:53

Expected positive opening on the major stock exchanges in Europe: DAX + 0,6%, FTSE 100 + 0,2 %%, CAC 40 + 0.4%

-

08:27

WSE: Before opening

Tuesday's session on Wall Street ended with a modest changes in the major indexes. In yesterday's speech the Fed Chairman Janet Yellen estimated that US interest rates should remain at current levels "for some time" and investors bought shares mainly in the hope that on Thursday the British vote for staying in the EU.

Suspension is also noticeable in the Asian markets, where the major averages record modest changes, a drop in the Nikkei index corresponds mainly to the strengthening of the yen.

As a result, the European markets may expect some stabilization in the morning, but there can be no doubt that most important will be the latest polls sending from London. After the recent rally, equity markets are arranged for the victory of supporters for Great Britain staying in the European Union.

We should slowly prepare for the fact that markets will be faded before tomorrow's vote, and the reactions will be postponed for another two sessions - on Thursday, the game will take place on the basis of leaks from the exit polls, and on Friday, based on preliminary results.

On the Warsaw market situation seems clear. Warsaw Stock Exchange remains in a strong correlation with core markets and equally turning to the equity markets and to the currency markets. Return of the WIG20 index above the level of 1,800 points is also significant for the further development of the situation.

-

07:57

Mixed trading of Asia-Pacific stocks:

Major stock indexes in the Asia-Pacific region are trading in different directions, uncertainty caused by the forthcoming referendum of Great Britain.

Quotations of the Tokyo Stock Exchange fell, ending a three-day winning streak, as investors took profits from recent gains associated with the upcoming risk.

Shares of Toyota Motor Corp fell by 0,8%, Honda Motor Co by 1.7%, and Panasonic Corp lost 1.3%.

Nikkei 225 16,002.6 -166.51 -1.03%

Hang Seng 20,745.48 +77.04 +0.37%

S & P / ASX 200 5,286.7 +12.34 +0.23%

Shanghai Composite 2,889.69 +11.13 +0.39%

Topix 1,285 -8.90 -0.69%

-

01:05

Stocks. Daily history for Jun 21’2016:

(index / closing price / change items /% change)

Nikkei 225 16,169.11 +203.81 +1.28 %

Hang Seng 20,668.44 +158.24 +0.77 %

S&P/ASX 200 5,274.36 +17.60 +0.33 %

Shanghai Composite 2,878.9 -9.91 -0.34 %

FTSE 100 6,226.55 +22.55 +0.36 %

CAC 40 4,367.24 +26.48 +0.61 %

Xetra DAX 10,015.54 +53.52 +0.54 %

S&P 500 2,088.9 +5.65 +0.27 %

NASDAQ Composite 4,843.76 +6.55 +0.14 %

Dow Jones 17,829.73 +24.86 +0.14 %

-