Noticias del mercado

-

22:07

Major US stock indexes finished trading with an increase

Major stock indexes in Wall Street closed slightly higher, supported by statements of Fed Chairman Janet Yellen.

Yellen said the central bank will be cautious in raising interest rates against the background of the UK's membership of risks in the European Union and the slowdown in the US labor market. Recall, the Fed left interest rates unchanged and reduced its forecast for economic growth after unexpectedly weak monthly data on the labor market have put a question mark at the restoration of the economy last week.

Market participants also continued to closely monitor the polls in the UK, which in recent years point to a possible victory of supporters of preservation of the country in the EU over the adherents of "Breksita" (UK exit from the Union).

In addition, a report submitted by the Philadelphia Fed, rose sharply in June index of business activity in the services sector, reaching a level of 10.8 points compared with 4.6 points in May. The figures below zero are an indicator of a slowing economy. The indicator is published just before the ISM index of purchasing managers, and may give an idea of how will an indicator of business activity at the national level.

Oil prices fell on Tuesday, breaking a two-day rally, as some market players took profits on the background of approximation of the referendum in the UK and continued uncertainty in the market. The focus of investors also shifted to the oversupply.

Most DOW components of the index closed in positive territory (24 of 30). Outsider were shares of The Boeing Company (BA, -0,74%). More rest up shares Microsoft Corporation (MSFT, + 2,44%).

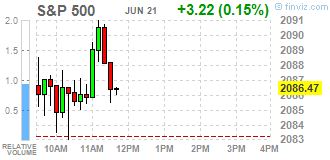

Sector S & P index closed trading mixed. conglomerates (-0.4%) sectors fell most. The leader turned out to be the basic materials sector (+ 0.9%).

At the close:

Dow + 0.13% 17,828.77 +23.90

Nasdaq + 0.14% 4,843.76 +6.55

S & P + 0.27% 2,088.90 +5.65

-

21:00

Dow +0.31% 17,860.79 +55.92 Nasdaq +0.18% 4,846.08 +8.87 S&P +0.41% 2,091.74 +8.49

-

18:00

European stocks closed: FTSE 100 6,226.55 +22.55 +0.36% CAC 40 4,367.24 +26.48 +0.61% DAX 10,015.54 +53.52 +0.54%

-

17:48

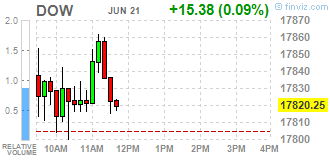

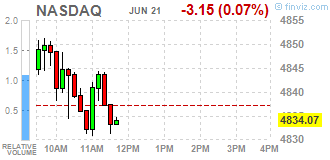

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Tuesday after Federal Reserve Chair Janet Yellen said the central bank would be cautious in raising interest rates given risks such as Britain's membership in the European Union and a slowdown in the U.S. labor market. The central bank left interest rates unchanged and cut the economy's growth forecast last week after surprisingly weak monthly hiring data put the economy's recovery in question. Britain's vote on its EU membership on Thursday has left investors nervous over its repercussions on the U.S. markets.

Most of all of Dow stocks in positive area (23 of 30). Top looser - McDonald's Corp. (MCD, -0,74%). Top gainer - Microsoft Corporation (MSFT, +1,84%).

S&P sectors mixed. Top looser - Healthcare (-0,3%). Top gainer - Consumer goods (+0,7%).

At the moment:

Dow 17723.00 +11.00 +0.06%

S&P 500 2077.50 +3.25 +0.16%

Nasdaq 100 4394.75 +4.75 +0.11%

Oil 49.27 -0.69 -1.38%

Gold 1273.70 -18.40 -1.42%

U.S. 10yr 1.68 +0.01

-

17:36

WSE: Session Results

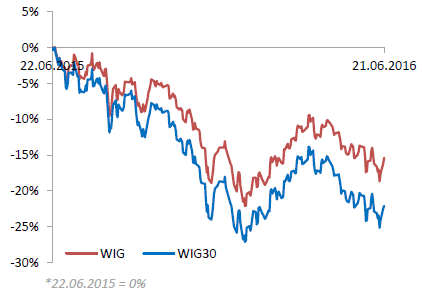

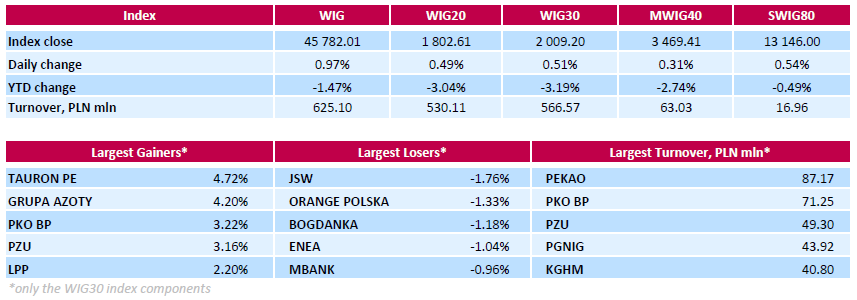

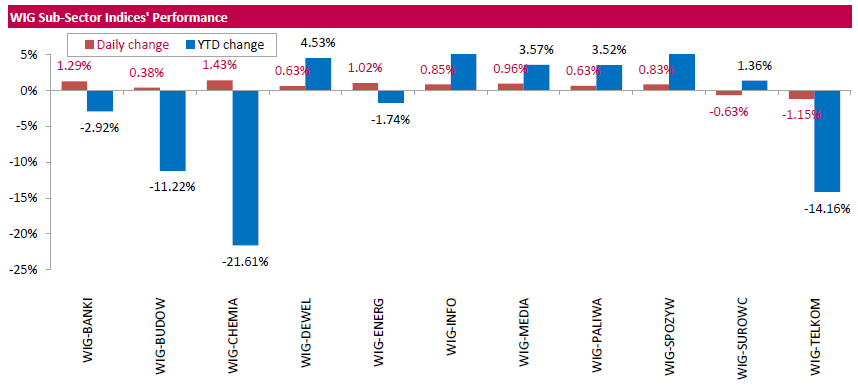

Polish equity market surged on Tuesday. The broad market measure, the WIG index, rose by 0.97%. Except for materials (-0.63%) and telecoms (-1.15%), every sector in the WIG Index rose, with chemicals (+1.43%) outperforming.

The large-cap stocks' measure, the WIG30 Index, gained 0.51%. In the index basket, genco TAURON PE (WSE: TPE) and chemical producer GRUPA AZOTY (WSE: ATT) were the biggest advancers, climbing by 4.72% and 4.2% respectively. Other noticeable risers were bank PKO BP (WSE: PKO), insurer PZU (WSE: PZU), railway freight transport operator PKP CARGO (WSE: PKP) and two retailers CCC (WSE: CCC) and LPP (WSE: LPP), which added between 1.96% and 3.22%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) and telecommunication services provider ORANGE POLSKA (WSE: OPL) led the decliners, dropping by 1.76% and 1.33% respectively. They were followed by thermal coal miner BOGDANKA (WSE: LWB) and genco ENEA (WSE: ENA), which tumbled by 1.18 % and 1.04% respectively.

-

15:55

WSE: After start on Wall Street

The US market has opened up with a small rise and behaves relatively poor compare to still optimistic Europe. It is clearly seen that the fears of the British referendum, is there much less popular. It should also be noted that the US market is relatively stronger than the Euroland, so the possible information about staying UK in the structures of the EU does not necessarily prove sufficient fuel to a permanent "dump" of the US indices to new highs of long-term bull market. From the other side, if the Brexit would happen, it might be the convenient excuse to expand downward.

On the Warsaw market we are dealing with a noticeable weakening of the zloty against the dollar. At first a little disappointing (after calming weekend) surveys vs. Brexit and later, debilitating Eurodollar, speech of Mario Dragi were translated into USDPLN upward motion.

-

15:33

U.S. Stocks open: Dow +0.23%, Nasdaq +0.24%, S&P +0.23%

-

15:11

Before the bell: S&P futures +0.25%, NASDAQ futures +0.24%

U.S. stock-index futures pared gains as oil extended losses.

Global Stocks:

Nikkei 16,169.11 +203.81 +1.28%

Hang Seng 20,668.44 +158.24 +0.77%

Shanghai Composite 2,878.9 -9.91 -0.34%

FTSE 6,194.16 -9.84 -0.16%

CAC 4,361.53 +20.77 +0.48%

DAX 10,005.19 +43.17 +0.43%Crude $49.10 (-1.72%)

Gold $1276.90 (-1.18%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.76

0.00(0.00%)

55350

Amazon.com Inc., NASDAQ

AMZN

716.93

2.92(0.409%)

9796

American Express Co

AXP

62.3

-0.00(-0.00%)

1044

Apple Inc.

AAPL

95.1

-0.00(-0.00%)

76164

AT&T Inc

T

40.87

0.09(0.2207%)

1993

Barrick Gold Corporation, NYSE

ABX

19.25

-0.51(-2.581%)

147620

Boeing Co

BA

133.85

1.10(0.8286%)

2730

Caterpillar Inc

CAT

76.75

0.32(0.4187%)

315

Chevron Corp

CVX

101.4

-1.21(-1.1792%)

228

Cisco Systems Inc

CSCO

28.84

0.04(0.1389%)

297

Citigroup Inc., NYSE

C

42.84

0.04(0.0935%)

40181

Exxon Mobil Corp

XOM

90.81

-0.31(-0.3402%)

2723

Facebook, Inc.

FB

113.7

0.33(0.2911%)

64924

FedEx Corporation, NYSE

FDX

165

0.53(0.3222%)

12020

Ford Motor Co.

F

13.42

0.00(0.00%)

27546

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.52

-0.03(-0.2597%)

298157

General Electric Co

GE

30.88

0.05(0.1622%)

16620

Goldman Sachs

GS

148.31

0.56(0.379%)

2383

Google Inc.

GOOG

697.93

4.22(0.6083%)

1775

International Business Machines Co...

IBM

153.96

0.35(0.2279%)

490

JPMorgan Chase and Co

JPM

62.6

0.23(0.3688%)

8110

Microsoft Corp

MSFT

50.24

0.17(0.3395%)

7765

Starbucks Corporation, NASDAQ

SBUX

55.43

0.05(0.0903%)

1840

Tesla Motors, Inc., NASDAQ

TSLA

221

1.30(0.5917%)

6161

The Coca-Cola Co

KO

44.8

-0.18(-0.4002%)

198

Twitter, Inc., NYSE

TWTR

16.42

0.08(0.4896%)

22531

United Technologies Corp

UTX

103.49

1.79(1.7601%)

200

Verizon Communications Inc

VZ

53.7

-0.06(-0.1116%)

1148

Visa

V

77.7

0.36(0.4655%)

2010

Wal-Mart Stores Inc

WMT

71

-0.10(-0.1406%)

1309

Walt Disney Co

DIS

99.75

0.18(0.1808%)

2532

Yahoo! Inc., NASDAQ

YHOO

37.4

0.11(0.295%)

3820

Yandex N.V., NASDAQ

YNDX

22

0.19(0.8712%)

700

-

14:41

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

NIKE (NKE) target lowered to $67 from $74 at Jefferies

-

13:09

WSE: Mid session comment

In the almost all markets we may see stagnation today, under which attaches the Warsaw Stock Exchange as well.

From the point of view of signals, it is important to defense the ground gained yesterday, but it was hard to expect a different scenario, when nothing has changed about the Brexit from yesterday. Yesterday's gap is a comfortable level of support, which break would spoil the climate again. There is also not particular desire to build any further movement. As usual, the only hope is that the Americans may enliven some volatility in the afternoon.

-

13:09

European stocks traded mixed. FTSE declined moderatly

European stocks traded mixt and in tight ranges, as markets took a pause after a sharp rise in the previous session, focused on the upcoming statement by European Central Bank President Mario Draghi and Federal Reserve's Janet Yellen. The risk is enhanced due to the possibility of UK withdrawal from the European Union (Brexit).

The composite index of the largest companies in the region Stoxx Europe 600 rose so far by 0.17% - to 338.25 points.

A referendum on Britain's membership in the EU will be held June 23 and the results of public opinion polls are also mixed.

For example, a survey conducted by ORB for the newspaper The Telegraph, showed that 53% of Brexit's supporters is 44%, remain - 42%.

"There is a feeling that in the last days before the referendum more Britons favored the remain within the EU, but the number of votes" for "and" against "seems almost equal", - stated in the review of research firm Davy Research, published on Tuesday.

Renowned investor George Soros waits for a sharp weakening of the pound sterling in the case of a leave vote..

"I expect that devaluation will be more powerful and more destructive than the 15% fall of the pound, in September 1992, when I was lucky enough to secure a substantial profit at the expense of the Bank of England and the British government," - he wrote in a newspaper column in The Guardian.

Mining companies stocks are falling. The price of BHP Billiton shares dropped to 1,6%, Rio Tinto - by 1.7%.

Rio Tinto, one of the largest mining companies in the world, announced the appointment of new heads of departments in the field of iron ore and copper mining.

Shares of the German manufacturer of forklifts Kion Group fell during trading by 2,8%. The company announced the acquisition of US logistics company Dematic Corp. for about $ 2.1 billion.

Volkswagen shares gained 1% after german prosecutors opened an investigation against the former Chief Executive Officer Martin Winterkorn, and the head of division of cars Herbert Diess because they failed to inform investors quickly enough of the potential losses associated with the scandal of falsified emissions level.

At the moment:

FTSE 6188.55 -15.45 -0.25%

DAX 9963.34 1.32 0.01%

CAC 4349.79 9.03 0.21%

-

09:50

Major stock markets after opening: DAX 9,939.37-22.65-0.23%, CAC 40 4,326.47-14.29-0.33%, FTSE 100 6,168.29-35.71-0.58%

-

09:25

WSE: After opening

WIG20 index opened at 1775.08 points (-1.05%)

WIG 45197.91 -0.32%

WIG30 1976.20 -1.14%

mWIG40 3459.70 0.03%

*/ - change to previous close

The cash market starts from a fall of -1.05% to 1,775 points at modest turnover and overpowering influence of cleaved dividends. The combination of these two companies (Orange Polska - WSE: OPL and Pekao - WSE: PEO) generate almost 1% disparity between the WIG20 and futures market. We may see it well on the smaller change of the WIG index, which lost about 0.3%. After all we need to underline the return to the area of yesterday's opening gap, which is the nearest support. Shares of Orange and Pekao after cutting dividends gain, which somewhat dampens the negative effect of dividend payments. At the current level of the WIG20 index the market returns to the framework of consolidation from the beginning of last week.

-

08:23

WSE: Before opening

Yesterday's session in the US ended with modest growth, a bit higher than 0.5%. The end of the session on Wall Street was not optimistic and proximity to historical records once again made itself felt. In Asia moods are correct, but beyond increasing by more than 1% of the Japanese Nikkei index the market is rather quiet. Contracts on the S&P500 are currently traded at a neutral level. So, everything points to the fact that today's session promises to be quieter.

In the macro calendar we will see today readings of the ZEW index, which is the initial announcement to be published later the Ifo index. It will not be a breakthrough in the course of the day, but a significant overshoot of expectations can cause a reaction. Later, the Fed chairman will present the semi-annual report on monetary policy in front ot the US Senate Banking committee. This report remains somewhat in the shadow of the Brexit risk on the one hand, and on the other we just had a meeting of the FOMC with press conference, so it is difficult to expect any new revelations.

On the Warsaw market today will be cut the dividend from the shares of Orange (WSE: OPL; dividend yield of 4.55%) and Pekao (WSE: PEO; dividend yield 5.86%). This will have a negative impact on the WIG20, which should in some way strengthen the resistance at around 1,800 points.

-

04:04

Nikkei 225 15,982.45 +17.15 +0.1 %, Hang Seng 20,617.89 +107.69 +0.5 %,Shanghai Composite 2,900.17 +11.36 +0.4 %

-

01:02

Stocks. Daily history for Jun 20’2016:

(index / closing price / change items /% change)

HANG SENG 20,519.83 +349.85 +1.73%

S&P/ASX 200 5,256.8 +94.14 +1.82%

TOPIX 1,279.19 +28.36 +2.27%

SHANGHAI COMP 2,888.59 +3.49 +0.12%

FTSE 100 6,204 +182.91 +3.04%

CAC 40 4,340.76 +146.93 +3.50%

Xetra DAX 9,962.02 +330.66 +3.43%

S&P 500 2,083.25 +12.03 +0.58%

NASDAQ Composite 4,837.21 +36.88 +0.77%

Dow Jones 17,804.87 +129.71 +0.73%

-