Noticias del mercado

-

22:07

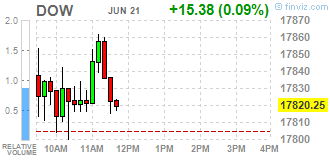

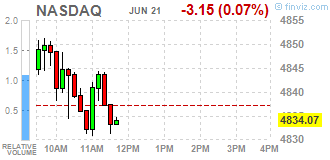

Major US stock indexes finished trading with an increase

Major stock indexes in Wall Street closed slightly higher, supported by statements of Fed Chairman Janet Yellen.

Yellen said the central bank will be cautious in raising interest rates against the background of the UK's membership of risks in the European Union and the slowdown in the US labor market. Recall, the Fed left interest rates unchanged and reduced its forecast for economic growth after unexpectedly weak monthly data on the labor market have put a question mark at the restoration of the economy last week.

Market participants also continued to closely monitor the polls in the UK, which in recent years point to a possible victory of supporters of preservation of the country in the EU over the adherents of "Breksita" (UK exit from the Union).

In addition, a report submitted by the Philadelphia Fed, rose sharply in June index of business activity in the services sector, reaching a level of 10.8 points compared with 4.6 points in May. The figures below zero are an indicator of a slowing economy. The indicator is published just before the ISM index of purchasing managers, and may give an idea of how will an indicator of business activity at the national level.

Oil prices fell on Tuesday, breaking a two-day rally, as some market players took profits on the background of approximation of the referendum in the UK and continued uncertainty in the market. The focus of investors also shifted to the oversupply.

Most DOW components of the index closed in positive territory (24 of 30). Outsider were shares of The Boeing Company (BA, -0,74%). More rest up shares Microsoft Corporation (MSFT, + 2,44%).

Sector S & P index closed trading mixed. conglomerates (-0.4%) sectors fell most. The leader turned out to be the basic materials sector (+ 0.9%).

At the close:

Dow + 0.13% 17,828.77 +23.90

Nasdaq + 0.14% 4,843.76 +6.55

S & P + 0.27% 2,088.90 +5.65

-

21:00

Dow +0.31% 17,860.79 +55.92 Nasdaq +0.18% 4,846.08 +8.87 S&P +0.41% 2,091.74 +8.49

-

18:06

Oil prices fell moderatly today

Oil prices fell on Tuesday, breaking a two-day rally, as some market players took profits on the background of a major risk event approaching (no prizes for those who guess which one).

Volatility may damage the prices of risky assets, which includes oil.

The focus shifted to the oversupply. Nigerian militants and the authorities have agreed to a cease-fire for a period of 30 days. Soon, however, this information has been denied.

In addition, it was reported that oil exports of Saudi Arabia in April decreased by 1.3% to 7.44 million barrels per day compared to March (7.54 million bpd). This is the lowest rate in the last six months. Meanwhile, US companies are increasing shale drilling - by Baker Hughes, the number of drilling in the country increases the third consecutive week. But many analysts and traders who hold positive outlook, are suggesting that the number of drilling rigs are still 80% below the peak reached in late 2014.

Trading is also affected by expectations about the oil inventories in the US data to be released tomorrow. According to forecasts, for the week ending June 17, oil inventories fell by 1.4 million barrels.

The cost of the August futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 49.26 dollars per barrel.

The price of August futures for Brent fell to 49.92 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

18:00

European stocks closed: FTSE 100 6,226.55 +22.55 +0.36% CAC 40 4,367.24 +26.48 +0.61% DAX 10,015.54 +53.52 +0.54%

-

17:48

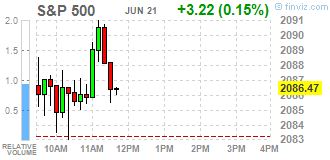

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Tuesday after Federal Reserve Chair Janet Yellen said the central bank would be cautious in raising interest rates given risks such as Britain's membership in the European Union and a slowdown in the U.S. labor market. The central bank left interest rates unchanged and cut the economy's growth forecast last week after surprisingly weak monthly hiring data put the economy's recovery in question. Britain's vote on its EU membership on Thursday has left investors nervous over its repercussions on the U.S. markets.

Most of all of Dow stocks in positive area (23 of 30). Top looser - McDonald's Corp. (MCD, -0,74%). Top gainer - Microsoft Corporation (MSFT, +1,84%).

S&P sectors mixed. Top looser - Healthcare (-0,3%). Top gainer - Consumer goods (+0,7%).

At the moment:

Dow 17723.00 +11.00 +0.06%

S&P 500 2077.50 +3.25 +0.16%

Nasdaq 100 4394.75 +4.75 +0.11%

Oil 49.27 -0.69 -1.38%

Gold 1273.70 -18.40 -1.42%

U.S. 10yr 1.68 +0.01

-

17:38

Tomorrow’s main events

On Wednesday, a moderate number of important data will be published. At 12:30 GMT, Canada will publish the retail sales data for April. The indicator characterizes the level of consumer spending and demand. In addition to the basic values the indicator is calculated excluding car sales, because their size is very variable. The indicator excluding cars provides objective information. It is expected that total sales rose 1.1% after contracting 1.0% in March.

Also at 12:30 GMT the United States will release the index of economic activity from the Federal Reserve Bank of Chicago. The index is calculated as a weighted average of 85 economic indicators. These figures relate to the following categories: production and income; employment, unemployment; private consumption and the housing market; sales, orders, inventory. The resulting index is a summary measure of the factors common to these economic data

At 14:00 GMT the United States will present a report on home sales in the secondary market in May. The indicator reflects the number of homes sold in the secondary market of the US real estate. It may give an idea about the optimism of consumers and their ability to buy expensive things. These data, because of the nature of real estate market, subject to seasonal fluctuations. This indicator is published in the annual sales pace adjusted for seasonality (seasonally adjusted sales for the month multiplied by 12). The forecasts show a rise to 5.5 million from 5.45 million in April.

At 14:30 GMT the US Department of Energy will report on changes in stocks of crude oil.

-

17:36

WSE: Session Results

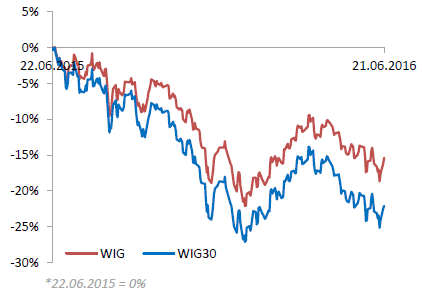

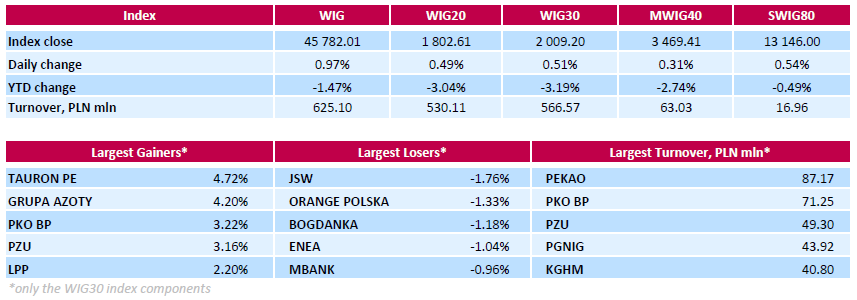

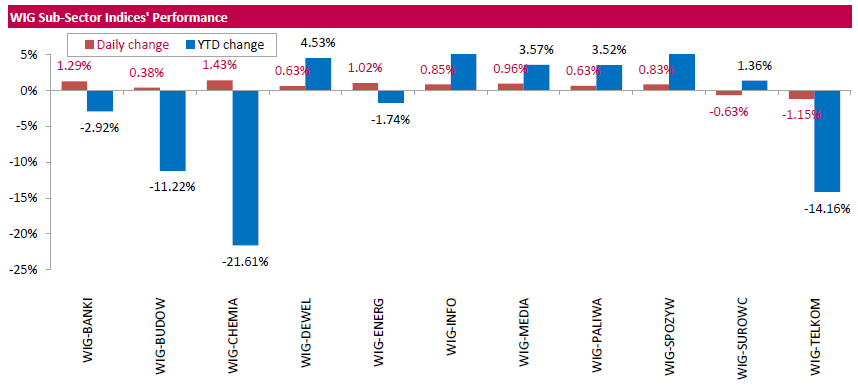

Polish equity market surged on Tuesday. The broad market measure, the WIG index, rose by 0.97%. Except for materials (-0.63%) and telecoms (-1.15%), every sector in the WIG Index rose, with chemicals (+1.43%) outperforming.

The large-cap stocks' measure, the WIG30 Index, gained 0.51%. In the index basket, genco TAURON PE (WSE: TPE) and chemical producer GRUPA AZOTY (WSE: ATT) were the biggest advancers, climbing by 4.72% and 4.2% respectively. Other noticeable risers were bank PKO BP (WSE: PKO), insurer PZU (WSE: PZU), railway freight transport operator PKP CARGO (WSE: PKP) and two retailers CCC (WSE: CCC) and LPP (WSE: LPP), which added between 1.96% and 3.22%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) and telecommunication services provider ORANGE POLSKA (WSE: OPL) led the decliners, dropping by 1.76% and 1.33% respectively. They were followed by thermal coal miner BOGDANKA (WSE: LWB) and genco ENEA (WSE: ENA), which tumbled by 1.18 % and 1.04% respectively.

-

17:31

Gold price fell more than 1% as sentiment improves

Gold is much cheaper today, which was associated with decreased risk appetite and expectations of UK remaining in the EU. The pressure on the precious metal also led to a strengthening of the US dollar.

In the last few weeks the price of gold has increased significantly amid concerns about the possible withdrawal of Britain from the EU. However, two public opinion poll published on Monday showed that the majority of Britons support the "remain" camp" although the third survey revealed that the number of Brexit voters have the majority.

The trading dynamics have also been influenced by the Federal Reserve Chairman Yellen's statements. "The FOMC will raise rates gradually, paying attention to both the current dynamics of the GDP, employment and consumer prices, and the prospects of macroeconomic indicators", - said Yellen. According to Yellen, the world economy is still vulnerable and a potential exit of Great Britain from the EU can have serious economic consequences not only for the country itself but also for the world, including the United States. "Brexit may have a significant adverse economic consequences," - she said.

Gold reserves, located in the reserves of the largest ETF fund SPDR GOLD Trust, rose on Monday by 0.10 percent, to 908.77 tonnes (the highest rate since September 2013).

The cost of the August gold futures on the COMEX fell to $ 1273.3 per ounce.

-

16:50

Yellen: US financial vulnerability "moderate"

- China continues to "face significant challenges"

- The economic outlook is uncertain, monetary policy is not a foregone conclusion in advance course

- The course of the Fed interest rate will depend on the economic and financial situation

- The Fed expects that the economic situation will continue to improve

- Yellen expects the economy will evolve in such a way to justify "a gradual rise in interest rates"

- Current policy allows for inflation below the target level, ambiguous indicators of employment growth

- Careful policy allows economic growth.

- Low interest rates for the Fed to justify a cautious approach to the implementation of monetary policy

- The Committee expects that inflation will rise to 2% in the medium term

- The data indicate a "significant improvement" in regard to GDP in the 2nd quarter

- Consumer spending "increased significantly" in recent months,

- Visible cautious signs that wages may begin to grow

- The rate of improvement in the labor market appears to have slowed

- Brexit "may create risks for financial stability"

- US Financial vulnerability "moderate"

- Fed rarely used guidelines after crisis

-

16:15

Opening remarks of FED chairwomen, Janet Yellen, in front of the US senate

-

Cautious approach on rates allows time to assess if economic growth is rebounding and if outlook for labor market, inflation will improve

-

Available indicators point to 'noticeable step-up' in Q2 GDP. Consumer spending helped by solid income growth

-

Fed to assess whether growth, jobs and inflation will gain

-

China faces significant challenges to rebalancing

-

Pickup in household spending makes her optimistic that jobs market and overall economy will improve over next few months

-

Reiterates that FOMC expects to gradually raise rates

-

Tentative signs of wage growth finally picking up

-

Watching jobs market carefully to see if slowdown transitory

-

Stock market forward P/E ratios well above three-decade median.

-

-

16:05

Strong offers hitting EUR/USD after Draghi’s comments

Dowish stuff from ECB's president, Mario Draghi, caused a sharp decline on eur/usd. The main comment was that euro zone's inflation dinamics remain subdued and in this case, another leg on monetary stimulus could not be excluded.

-

15:55

WSE: After start on Wall Street

The US market has opened up with a small rise and behaves relatively poor compare to still optimistic Europe. It is clearly seen that the fears of the British referendum, is there much less popular. It should also be noted that the US market is relatively stronger than the Euroland, so the possible information about staying UK in the structures of the EU does not necessarily prove sufficient fuel to a permanent "dump" of the US indices to new highs of long-term bull market. From the other side, if the Brexit would happen, it might be the convenient excuse to expand downward.

On the Warsaw market we are dealing with a noticeable weakening of the zloty against the dollar. At first a little disappointing (after calming weekend) surveys vs. Brexit and later, debilitating Eurodollar, speech of Mario Dragi were translated into USDPLN upward motion.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1200 (EUR 269m) 1.1215-20 (435m) 1.1300 (561m) 1.1325 (204m) 1.1410 (317m) 1.1500 (211m)

USD/JPY 104.00 (USD 250m) 104.60-65 (450m)

GBP/USD 1.4450 (GBP 358m) 1.4600 (200m)

EUR/GBP 0.7800 (EUR 230m)

AUD/USD 0.7200 (AUD 269m) 0.7360-65 (551m) 0.7400 (203m)

NZD/USD 0.6905 (NZD 201m)

USD/CAD 1.3150 (USD 427m)

-

15:33

U.S. Stocks open: Dow +0.23%, Nasdaq +0.24%, S&P +0.23%

-

15:16

ECB, Draghi: recovery in Eurozone has gained momentum since the start of the year

- expect recovery to proceed at a moderate but steady pace.

- investment levels unsatisfactory, EU level action needed.

- progress on a capital markets union essential to develop a favourable environment for productive investment.

- ECB is ready for all contingencies on UK referendum.

- ready to act by using all tools available in our mandate if necessary.

-

15:11

Before the bell: S&P futures +0.25%, NASDAQ futures +0.24%

U.S. stock-index futures pared gains as oil extended losses.

Global Stocks:

Nikkei 16,169.11 +203.81 +1.28%

Hang Seng 20,668.44 +158.24 +0.77%

Shanghai Composite 2,878.9 -9.91 -0.34%

FTSE 6,194.16 -9.84 -0.16%

CAC 4,361.53 +20.77 +0.48%

DAX 10,005.19 +43.17 +0.43%Crude $49.10 (-1.72%)

Gold $1276.90 (-1.18%)

-

15:04

New Brexit poll: 44% leave, 45% remain

-

14:57

European session: The calm before the storm

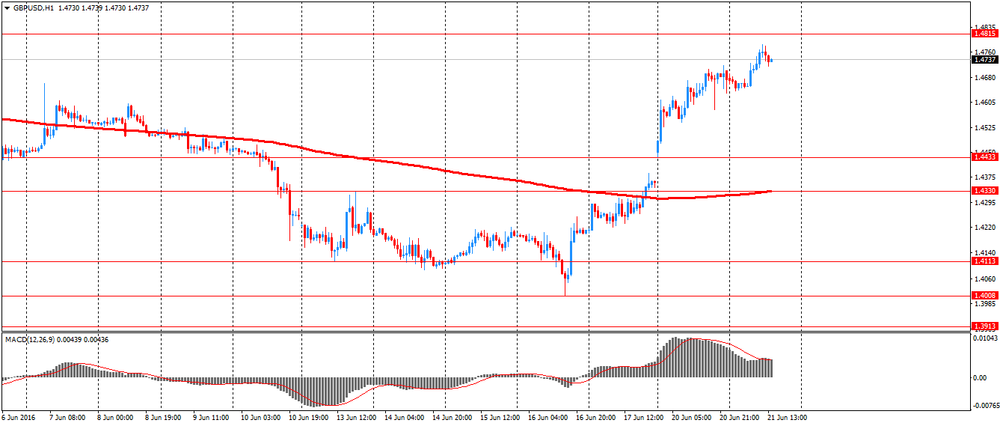

The British pound continued to rise at the begining of the session but now is underway a retracement due to a new survey which shows 44% leave, 45% remain.

Two polls on Monday indicated that the remain camp has restored a number of losses in the run-up to the referendum. The probability of a "remain" vote on Thursday rose to 78% after falling below 60% last week, according to the latest Betfair data. "Polls seem to indicate a growing support for" remain ", but the fact is that we do not know anything for sure until we see the results," - said Kёsuke Suzuki from Societe Generale.

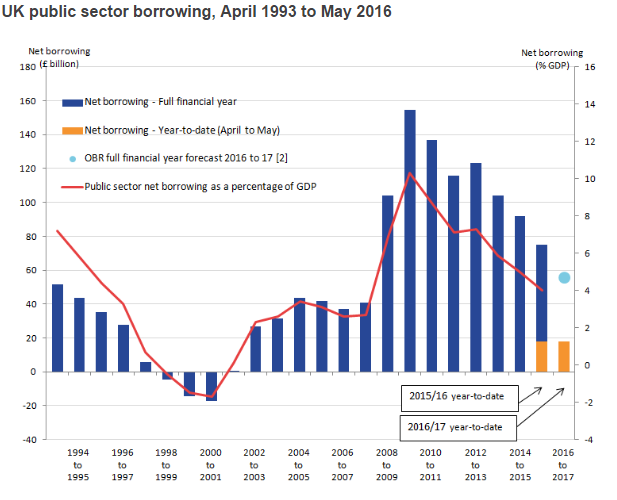

Economic data also provided support for the pound. UK budget deficit narrowed in May, data released by the Office for National Statistics on Tuesday. Net borrowing of the public sector (PSNB) decreased by 0.4 billion pounds last year to 9.7 billion pounds in May. However, it was higher than the forecast level of 9.4 billion pounds.

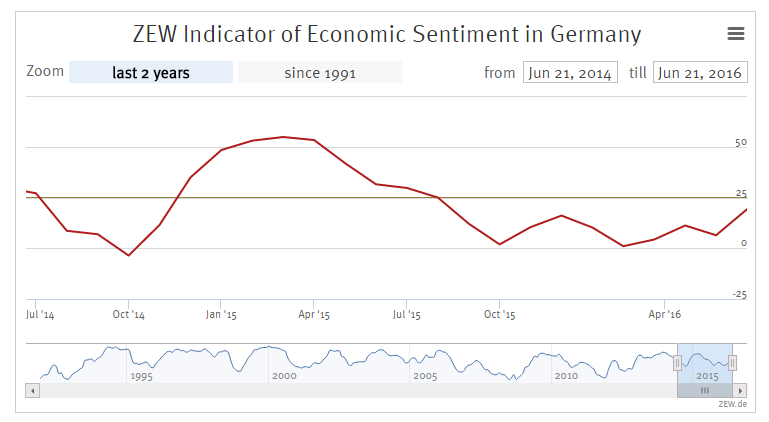

The euro rose against the dollar after the release of strong data regarding the sentiment in the business environment of the ZEW Institute in Germany, but then fell back to the opening price. The indicator of economic confidence in Germany has strengthened sharply in June. The index of economic sentiment unexpectedly rose to 19.2 from 6.4 in the previous month. Forecasts showed 4.7 points in June. In addition, the current situation index rose by 1.4 points to 54.5 in June. Forecast was 53.0.

"Improving economic sentiment indicates that the financial market experts have expressed confidence in the stability of the German economy," said ZEW President Achim Wambach. "However, the general economic conditions remain difficult. In addition to the weak global economic dynamics, referendum on EU membership in the UK, which causes uncertainty," said Wambach.

The indicator of economic sentiment in the euro zone rose by 3.4 points to 20.2 points in June. Meanwhile, the current situation indicator fell by 0.8 points to minus 10.0 points.

The US dollar was steady. Speech by US Federal Reserve Janet Yellen is expected at 14:00 GMT in the Senate Banking Committee. On Wednesday, she will present a semi-annual report to the US Senate. On Thursday, Yellen will present this report to the House of Representatives.

"Yellen may underline concerns about the US economy, which will put pressure on the dollar", - says chief strategist at SMBC Friend Securities Toshihiko Matsuno.

The yen depreciated vs the US dollar and the euro after a significant strengthening over the past few days. Over the previous seven sessions the yen gained 3% on the back of strong demand for "safe haven" assets amid fears of possible exit of Great Britain from the European Union.

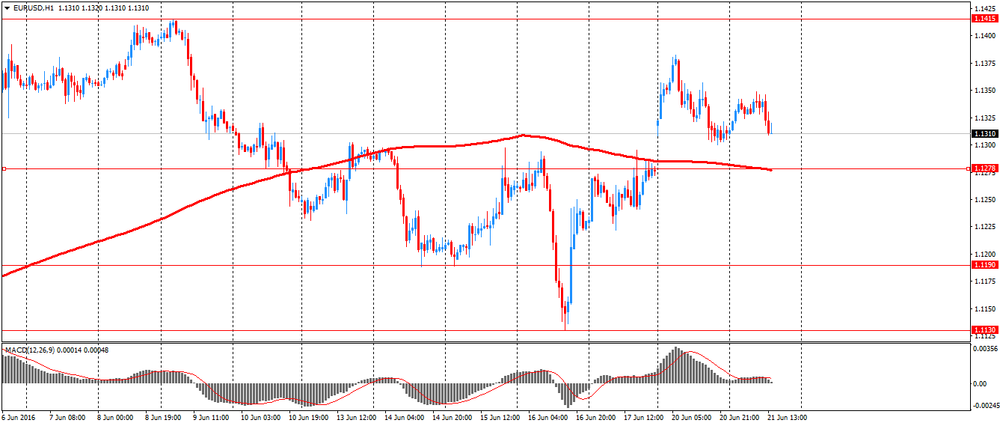

EUR / USD: during the European session, the pair rose to $ 1.1349, and then fell to $ 1.1309

GBP / USD: during the European session, the pair rose to $ 1.4782 then the poll came and now we are 100 pips lower in a very sharp move. Imagine what will happen when the exit-polls will be published.

USD / JPY: during the European session, the pair rose to Y104.74

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.76

0.00(0.00%)

55350

Amazon.com Inc., NASDAQ

AMZN

716.93

2.92(0.409%)

9796

American Express Co

AXP

62.3

-0.00(-0.00%)

1044

Apple Inc.

AAPL

95.1

-0.00(-0.00%)

76164

AT&T Inc

T

40.87

0.09(0.2207%)

1993

Barrick Gold Corporation, NYSE

ABX

19.25

-0.51(-2.581%)

147620

Boeing Co

BA

133.85

1.10(0.8286%)

2730

Caterpillar Inc

CAT

76.75

0.32(0.4187%)

315

Chevron Corp

CVX

101.4

-1.21(-1.1792%)

228

Cisco Systems Inc

CSCO

28.84

0.04(0.1389%)

297

Citigroup Inc., NYSE

C

42.84

0.04(0.0935%)

40181

Exxon Mobil Corp

XOM

90.81

-0.31(-0.3402%)

2723

Facebook, Inc.

FB

113.7

0.33(0.2911%)

64924

FedEx Corporation, NYSE

FDX

165

0.53(0.3222%)

12020

Ford Motor Co.

F

13.42

0.00(0.00%)

27546

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.52

-0.03(-0.2597%)

298157

General Electric Co

GE

30.88

0.05(0.1622%)

16620

Goldman Sachs

GS

148.31

0.56(0.379%)

2383

Google Inc.

GOOG

697.93

4.22(0.6083%)

1775

International Business Machines Co...

IBM

153.96

0.35(0.2279%)

490

JPMorgan Chase and Co

JPM

62.6

0.23(0.3688%)

8110

Microsoft Corp

MSFT

50.24

0.17(0.3395%)

7765

Starbucks Corporation, NASDAQ

SBUX

55.43

0.05(0.0903%)

1840

Tesla Motors, Inc., NASDAQ

TSLA

221

1.30(0.5917%)

6161

The Coca-Cola Co

KO

44.8

-0.18(-0.4002%)

198

Twitter, Inc., NYSE

TWTR

16.42

0.08(0.4896%)

22531

United Technologies Corp

UTX

103.49

1.79(1.7601%)

200

Verizon Communications Inc

VZ

53.7

-0.06(-0.1116%)

1148

Visa

V

77.7

0.36(0.4655%)

2010

Wal-Mart Stores Inc

WMT

71

-0.10(-0.1406%)

1309

Walt Disney Co

DIS

99.75

0.18(0.1808%)

2532

Yahoo! Inc., NASDAQ

YHOO

37.4

0.11(0.295%)

3820

Yandex N.V., NASDAQ

YNDX

22

0.19(0.8712%)

700

-

14:41

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

NIKE (NKE) target lowered to $67 from $74 at Jefferies

-

14:09

Where to sell GBP/USD? - Morgan Stanley

Morgan Stanley analysts think that GBP/USD should remain bid for now, with a chance of testing levels around 1.50. However, this pre-vote rally would provide a selling opportunity with a target of 1.35 reached under the condition of Britain staying with the EU, but struggling to consolidate its balance sheets. Leaving swings in political uncertainties aside, sterling has become increasingly dependent on commodity price swings and the evolution of global risk appetite.

Its internal and external imbalances would leave GBP vulnerable as investors becoming more sensitive to credit risks.The UK's 'triple deficit' position suggests it building up savings. The increasingly declining return of investment will likely make it difficult to find adequate domestic investment returns within the UK, suggesting the UK turning into a capital exporter, which would weaken GBP.

This is why a Remain vote could provide a good opportunity to sell GBP into strength.

-

13:49

Orders

EUR/USD

Offers : 1.1350-55 1.1375-80 1.1400 1.1420 1.1450

Bids: 1.1320 1.1300 1.1280-85 1.1250 1.1220-25 1.1200

GBP/USD

Offers : 1.4735-40 1.4750 1.4770 1.4800 1.4830 1.4830 1.4850

Bids: 1.4645-50 1.4625-30 1.4600 1.4580 1.4550 1.4530-35 1.4500-05 1.4485 1.4465 1.4450 1.4430 1.4400

EUR/GBP

Offers : 0.7730 0.7750 0.7785 0.7800 0.7825-30 0.7850 0.7885 0.7900 0.7930 0.7950

Bids: 0.7700-0.7695 0.7670 0.7650 0.7630 0.7600

EUR/JPY

Offers : 118.70-75 119.00 119.20 119.50 119.85 120.00 120.30 120.50

Bids: 118.20 118.00 117.80 117.50-60 117.30 117.00

USD/JPY

Offers : 104.50-55 104.80-85 105.00 105.30-35105.50 105.80 106.00 106.50 106.85 107.00

Bids: 104.20 104.00 103.80-85 103.50 103.25 103.00 102.75-80 102.50 102.00

AUD/USD

Offers : 0.7500 0.7520 0.7550 0.7570 0.7600

Bids: 0.7455-60 0.7420 0.7400 0.7385 0.7370 0.7350

-

13:31

Manufacturing conditions strengthened slightly in the UK - CBI

According to CBI the survey of 482 manufacturers reported that total order books strengthened slightly in the three months to June led by the food and drink sector, and motor vehicles & transport.

Key findings:

-

20% of businesses reported an increase in total orders and 23% a decrease, giving a rounded balance of -2%

-

13% of businesses reported an increase in export orders and 27% a decrease, resulting in a balance of -14%

-

30% of businesses reported a rise in output volumes, and 19% a decrease, giving a balance of +11%

-

Output is expected to increase over the next three months, with 35% companies expecting a rise and 13% expecting a decrease, leaving a rounded balance of +23%

-

Average prices are expected to be broadly unchanged over the next quarter, with 9% companies expecting an increase and 9% expecting a decrease, giving a rounded balance of +1%

-

15% of businesses reported stocks as more than adequate to meet demand, and 5% less than adequate, leaving a balance of +10%.

"The recent fall in the pound appears to have done little for our exporters. It may be that the growing uncertainty in the run-up to the EU referendum, combined with global risks elsewhere, has offset some of the benefits of a weaker currency at this time."

"But while British manufacturers had a tricky start to the year, there are more positive signs as output and demand stabilise." Rain Newton-Smith, CBI Chief Economist said.

-

-

13:09

WSE: Mid session comment

In the almost all markets we may see stagnation today, under which attaches the Warsaw Stock Exchange as well.

From the point of view of signals, it is important to defense the ground gained yesterday, but it was hard to expect a different scenario, when nothing has changed about the Brexit from yesterday. Yesterday's gap is a comfortable level of support, which break would spoil the climate again. There is also not particular desire to build any further movement. As usual, the only hope is that the Americans may enliven some volatility in the afternoon.

-

13:09

European stocks traded mixed. FTSE declined moderatly

European stocks traded mixt and in tight ranges, as markets took a pause after a sharp rise in the previous session, focused on the upcoming statement by European Central Bank President Mario Draghi and Federal Reserve's Janet Yellen. The risk is enhanced due to the possibility of UK withdrawal from the European Union (Brexit).

The composite index of the largest companies in the region Stoxx Europe 600 rose so far by 0.17% - to 338.25 points.

A referendum on Britain's membership in the EU will be held June 23 and the results of public opinion polls are also mixed.

For example, a survey conducted by ORB for the newspaper The Telegraph, showed that 53% of Brexit's supporters is 44%, remain - 42%.

"There is a feeling that in the last days before the referendum more Britons favored the remain within the EU, but the number of votes" for "and" against "seems almost equal", - stated in the review of research firm Davy Research, published on Tuesday.

Renowned investor George Soros waits for a sharp weakening of the pound sterling in the case of a leave vote..

"I expect that devaluation will be more powerful and more destructive than the 15% fall of the pound, in September 1992, when I was lucky enough to secure a substantial profit at the expense of the Bank of England and the British government," - he wrote in a newspaper column in The Guardian.

Mining companies stocks are falling. The price of BHP Billiton shares dropped to 1,6%, Rio Tinto - by 1.7%.

Rio Tinto, one of the largest mining companies in the world, announced the appointment of new heads of departments in the field of iron ore and copper mining.

Shares of the German manufacturer of forklifts Kion Group fell during trading by 2,8%. The company announced the acquisition of US logistics company Dematic Corp. for about $ 2.1 billion.

Volkswagen shares gained 1% after german prosecutors opened an investigation against the former Chief Executive Officer Martin Winterkorn, and the head of division of cars Herbert Diess because they failed to inform investors quickly enough of the potential losses associated with the scandal of falsified emissions level.

At the moment:

FTSE 6188.55 -15.45 -0.25%

DAX 9963.34 1.32 0.01%

CAC 4349.79 9.03 0.21%

-

12:08

Review of financial and economic press

Russian oil is sold with a record discount because of Iran

Discount on Russian Urals brand oil reached two years record because of the returning Iranian oil to the European market. It is reported by Bloomberg citing interviewed traders who follow the indicative in the Platts oil prices.

WSJ: expansion of the Panama Canal could change the world trade

Large-scale expansion of the Panama Canal, which is scheduled for June 26, may be of great importance to world trade in the long term, writes The Wall Street Journal.

Operation of the gas pipeline "Nord Stream" will be suspended

Functioning of "Nord Stream" gas pipeline will be suspended from 9 to 17 August. It is stated in the materials of the Nord Stream pipeline operators, Opal and Nel, transmits RNS. According to the agency, in the pipeline system will be carried out scheduled maintenance.

George Soros has predicted decline of the pound by 20% in the case of Brexit

Billionaire George Soros has predicted that the fall of the pound in case of Brexit would be stronger than in the "Black Wednesday" of 1992. According to his forecasts, the decline may take the pound to parity vs euro.

Trump fired the head of his election headquarters

US presidential candidate from the Republican Party, billionaire Donald Trump fired the head of his election headquarters Corey Lewandowski. It is reported by the The New York Times.

-

11:20

ZEW: strong increase in economic sentiment

The ZEW Indicator of Economic Sentiment for Germany has increased in June 2016. The index has improved by 12.8 points compared to the previous month, now standing at 19.2 points (long-term average: 24.4 points)."The improvement of economic sentiment indicates that the financial market experts have confidence in the resilience of the German economy. However, general economic conditions remain challenging. Apart from the weak global economic dynamics, it is mainly the EU referendum in Great Britain which causes uncertainty," says Professor Achim Wambach, President of ZEW.

The assessment of the current situation in Germany has slightly improved. Growing by 1.4 points, the index now stands at 54.5 points.

Financial market experts' sentiment concerning the economic development of the Eurozone has improved. ZEW's Indicator of Economic Sentiment for the Eurozone has increased by 3.4 points to a reading of 20.2 points. Falling by 0.8 points in June 2016, the indicator for the current situation in the euro area has dropped to a value of minus 10.0 points.

-

11:00

Germany: ZEW Survey - Economic Sentiment, June 19.2 (forecast 4.7)

-

11:00

Eurozone: ZEW Economic Sentiment, June 20.2 (forecast 15.3)

-

10:41

Oil is trading lower

This morning, New York crude oil futures for WTI fell by 0.68% to $ 50.21 per barrel. At the same time, Brent oil futures were down 0.89% to $ 50.20 per barrel. Thus, the black gold is trading to the downside, amid growing expectations of Britain's remain in the European Union on the results of the referendum on 23 June. Shale oil producers are considering increasing production, a lot longer than was expected from Saudis and OPEC.

-

10:36

UK public sector net borrowing down to 9.1 bln in May

Public sector net borrowing (excluding public sector banks) decreased by £16.7 billion to £74.9 billion in the complete financial year ending March 2016 (April 2015 to March 2016), compared with the previous financial year. This £74.9 billion represents a £0.9 billion increase to the initial estimate of the complete financial year borrowing published in the March 2016 statistical bulletin.

Public sector net borrowing (excluding public sector banks) increased by £0.2 billion to £17.9 billion in the current financial year-to-date (April to May 2016) compared with the same period in 2015.

Public sector net debt (excluding public sector banks) at the end of May 2016 was £1,606.9 billion, equivalent to 83.7% of gross domestic product (GDP); an increase of £49.6 billion compared with May 2015.

Central government net cash requirement decreased by £26.5 billion to £58.1 billion in the complete financial year ending March 2016 (April 2015 to March 2016), compared with the previous financial year.

-

10:30

United Kingdom: PSNB, bln, May -9.14 (forecast -9.35)

-

09:59

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1200 (EUR 269m) 1.1215-20 (435m) 1.1300 (561m) 1.1325 (204m) 1.1410 (317m) 1.1500 (211m)

USD/JPY 104.00 (USD 250m) 104.60-65 (450m)

GBP/USD 1.4450 (GBP 358m) 1.4600 (200m)

EUR/GBP 0.7800 (EUR 230m)

AUD/USD 0.7200 (AUD 269m) 0.7360-65 (551m) 0.7400 (203m)

NZD/USD 0.6905 (NZD 201m)

USD/CAD 1.3150 (USD 427m)

-

09:50

Major stock markets after opening: DAX 9,939.37-22.65-0.23%, CAC 40 4,326.47-14.29-0.33%, FTSE 100 6,168.29-35.71-0.58%

-

09:42

Euro could rise even if Brexit happens, according to some analysts

Mizuho Bank chief economist Daisuke Karakama says in a note that euro may soon gain ground, even assuming that Britain votes to leave the Europe Union later this week. Should Britain vote to exit the EU, the euro would likely strengthen against the pound, but weaken against the dollar. Karakama says the euro would likely fall to around $1.10 (it's now at $1.1345) should Britain exit, but "such a move [would] be only short-lived." Karakama says he doesn't think a Brexit would meaningfully weaken the European Union's political power, adding that U.K. has often sought special treatment in the E.U. and hindered the bloc's decision making

-

09:25

WSE: After opening

WIG20 index opened at 1775.08 points (-1.05%)

WIG 45197.91 -0.32%

WIG30 1976.20 -1.14%

mWIG40 3459.70 0.03%

*/ - change to previous close

The cash market starts from a fall of -1.05% to 1,775 points at modest turnover and overpowering influence of cleaved dividends. The combination of these two companies (Orange Polska - WSE: OPL and Pekao - WSE: PEO) generate almost 1% disparity between the WIG20 and futures market. We may see it well on the smaller change of the WIG index, which lost about 0.3%. After all we need to underline the return to the area of yesterday's opening gap, which is the nearest support. Shares of Orange and Pekao after cutting dividends gain, which somewhat dampens the negative effect of dividend payments. At the current level of the WIG20 index the market returns to the framework of consolidation from the beginning of last week.

-

09:13

Important events of the day

In addition to the events mentioned in the economic calendar:

- 13:00 GMT the ECB president Mario Draghi will deliver a speech.

- 14:00 GMT the Federal Reserve Board of Governors Chairman Janet Yellen testifies.

- 15:00 GMT the ECB president Mario Draghi will deliver a speech.

- 8:30 GMT FOMC member Jerome Powell will deliver a speech.

-

08:31

Asian session: The British pound eased against the dollar

The British pound eased against the dollar on Tuesday, a day after posting its biggest daily gain in 7 years on the back of opinion polls that swung in favor of the campaign for Britain to stay in the European Union.

Two opinion polls on Monday showed that the "Remain" camp has recovered some ground in Britain's European Union referendum debate.

The implied probability of a "Remain" vote in Thursday's referendum rose to around 78 percent after falling as low as 60 percent last Thursday, according to odds from gaming website Betfair. For the latest Reuters news on the referendum including full multimedia coverage, click

The British pound GBP=D4 eased 0.1 percent in Asian trade to $1.4658, having pulled back from a three-week high of $1.4721 set on Monday. It rose 2.1 percent on Monday, its biggest daily gain since late 2008.

The euro rose 0.5 percent against sterling to 77.31 pence EURGBP=D4, regaining a bit of ground after setting a near three-week low of 76.925 pence EURGBP=D4 on Monday.

Against the dollar, the euro EUR= edged up 0.1 percent to $1.1326 EUR=.

The dollar index =USD .DXY stood at 93.582, holding above a one-month low of 93.425 hit earlier this month, as the market awaited U.S. Federal Reserve Chair Janet Yellen's testimony before the Senate Banking Committee at 10 a.m. local time (1400 GMT).

The dollar edged up 0.1 percent to 104.01 yen JPY=. Earlier on Tuesday, the dollar slipped to 103.58 yen, bringing the yen close to its 22-month high of 103.555 set last Thursday.

"At the root of the yen's strength lie diminishing yield gaps between Japan and the U.S. Since expectations of further easing in Japan have waned, Japanese exporters' bids tend to support the yen," said Koichi Yoshikawa, executive director of finance at Standard Chartered Bank.

After the yen's latest rise, Japanese Finance Minister Taro Aso said on Tuesday that Japan would respond to rapid currency moves in line with G7/G20 agreements, although the country would not intervene in the market so "easily".

The dollar briefly fell from around 104.10 yen to 103.85 yen or so after Aso's comments, but later stabilized.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1310-30

GBP / USD: during the Asian session, the pair is trading in the range of $ 1.4640-1.4710

USD / JPY: during the Asian session, the pair was trading in range Y103.60-104.45

Based on Reuters materials

-

08:24

Options levels on tuesday, June 21, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1480 (2814)

$1.1445 (2068)

$1.1419 (712)

Price at time of writing this review: $1.1332

Support levels (open interest**, contracts):

$1.1273 (2349)

$1.1221 (1449)

$1.1190 (2539)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 35103 contracts, with the maximum number of contracts with strike price $1,1500 (4149);

- Overall open interest on the PUT options with the expiration date July, 8 is 85665 contracts, with the maximum number of contracts with strike price $1,0900 (15874);

- The ratio of PUT/CALL was 2.44 versus 2.46 from the previous trading day according to data from June, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5016 (3442)

$1.4921 (371)

$1.4827 (1917)

Price at time of writing this review: $1.4704

Support levels (open interest**, contracts):

$1.4571 (456)

$1.4474 (633)

$1.4377 (703)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 20218 contracts, with the maximum number of contracts with strike price $1,5000 (3442);

- Overall open interest on the PUT options with the expiration date July, 8 is 39095 contracts, with the maximum number of contracts with strike price $1,4100 (3303);

- The ratio of PUT/CALL was 1.93 versus 1.90 from the previous trading day according to data from June, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

WSE: Before opening

Yesterday's session in the US ended with modest growth, a bit higher than 0.5%. The end of the session on Wall Street was not optimistic and proximity to historical records once again made itself felt. In Asia moods are correct, but beyond increasing by more than 1% of the Japanese Nikkei index the market is rather quiet. Contracts on the S&P500 are currently traded at a neutral level. So, everything points to the fact that today's session promises to be quieter.

In the macro calendar we will see today readings of the ZEW index, which is the initial announcement to be published later the Ifo index. It will not be a breakthrough in the course of the day, but a significant overshoot of expectations can cause a reaction. Later, the Fed chairman will present the semi-annual report on monetary policy in front ot the US Senate Banking committee. This report remains somewhat in the shadow of the Brexit risk on the one hand, and on the other we just had a meeting of the FOMC with press conference, so it is difficult to expect any new revelations.

On the Warsaw market today will be cut the dividend from the shares of Orange (WSE: OPL; dividend yield of 4.55%) and Pekao (WSE: PEO; dividend yield 5.86%). This will have a negative impact on the WIG20, which should in some way strengthen the resistance at around 1,800 points.

-

08:23

Swiss trade balance increased in May

In May 2016, the foreign trade hit at a steady pace of growth . Both exports and imports rose corrected for working days at 6% each . Without adjustments exports fell by 3.6% , while imports rose by 4.1%. In both approaches , the chemical-pharmaceutical products trade was down significantly. The trade balance recorded a large surplus of Chf 3.8 billion.

-

08:01

Bank of America Merril Lynch: targets for GBP/USD and USD/JPY on Brexit

BofA analysts are expecting both GBP/USD and GBP/JPY to be the major causalities as Brexit triggers a broader risk-off wave.

"Our Japanese strategists believe USD/JPY is likely to fall decisively below ¥100 and is technically vulnerable to a move toward ¥95. The MoF's intervention probability would increase, in our view.

In our view, a vote to Leave would have a spill-over effect into EUR/USD where an initial 3-5% sell-off cannot be discounted.

Within European FX, CHF is likely to be the main beneficiary as geopolitical risks become more concentrated into Europe.

We would expect further pressure on EUR/DKK, but fully expect the peg to hold as the Danish central bank ramps up its balance sheet. The subsequent reaction in GBP will depend on how quickly the UK government is able to remove the tail risk of protracted uncertainty on the UK's new trading arrangements. The channel through which this is important will be the funding of the current account deficit and only a speedy resolution to negotiations would lead to a modest GBP recovery. However, in all shades of Leave, we believe there will likely be a structurally lower equilibrium level for the pound".

-

08:00

Switzerland: Trade Balance, May 3.79 (forecast 2.88)

-

07:53

Bank of Japan meeting minutes: inflation projections revised down

Bank of Japan board members revised down inflation forecast for the next year, pushing the expected date of achieving the inflation target of 2% at a later date.

"Lowering the inflation outlook for the fiscal 2016 mainly due to slowing economic growth, wages, and not on the price of oil,". Now it is expected that inflation will be 0.5%, while in January forecast was 0.8%.

One member of the Board said that the lack of action at the April meeting does not change the position of the central bank.

"We need a little more time before the measures of monetary policy impact the economy. It is necessary to assess the risks at each meeting, and to take new measures if necessary"

-

06:31

Japan: All Industry Activity Index, m/m, April 1.3% (forecast 1.3%)

-

04:04

Nikkei 225 15,982.45 +17.15 +0.1 %, Hang Seng 20,617.89 +107.69 +0.5 %,Shanghai Composite 2,900.17 +11.36 +0.4 %

-

03:32

Australia: House Price Index (QoQ), Quarter I -0.2% (forecast 0.8%)

-

01:03

Commodities. Daily history for Jun 20’2016:

(raw materials / closing price /% change)

Oil 49.16 -0.43%

Gold 1,292.00 -0.01%

-

01:02

Stocks. Daily history for Jun 20’2016:

(index / closing price / change items /% change)

HANG SENG 20,519.83 +349.85 +1.73%

S&P/ASX 200 5,256.8 +94.14 +1.82%

TOPIX 1,279.19 +28.36 +2.27%

SHANGHAI COMP 2,888.59 +3.49 +0.12%

FTSE 100 6,204 +182.91 +3.04%

CAC 40 4,340.76 +146.93 +3.50%

Xetra DAX 9,962.02 +330.66 +3.43%

S&P 500 2,083.25 +12.03 +0.58%

NASDAQ Composite 4,837.21 +36.88 +0.77%

Dow Jones 17,804.87 +129.71 +0.73%

-

01:01

Currencies. Daily history for Jun 20’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1311 +0,31%

GBP/USD $1,4673 +2,15%

USD/CHF Chf0,9617 +0,24%

USD/JPY Y103,96 -0,17%

EUR/JPY Y117,60 +0,14%

GBP/JPY Y152,55 +1,97%

AUD/USD $0,7455 +0,85%

NZD/USD $0,7107 +0,73%

USD/CAD C$1,2801 -0,71%

-

00:01

Schedule for today, Tuesday, Jun 21’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia House Price Index (QoQ) Quarter I 0.2%

01:30 Australia RBA Meeting's Minutes

04:30 Japan All Industry Activity Index, m/m April 0.1%

06:00 Switzerland Trade Balance May 2.50

08:30 United Kingdom PSNB, bln May -6.58 -9.5

09:00 Eurozone ZEW Economic Sentiment June 16.8

09:00 Germany ZEW Survey - Economic Sentiment June 6.4 5

13:00 Eurozone ECB President Mario Draghi Speaks

14:00 U.S. Fed Chairman Janet Yellen Speaks

22:45 New Zealand Visitor Arrivals May 8%

-