Noticias del mercado

-

22:07

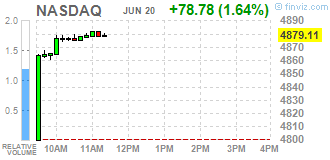

Major US stock indexes finished trading with an increase

Major stock indexes Wall Street rose moderately Monday after opinion polls showed the UK increased opportunity to stay in the European Union.

So, published on the eve of public opinion polls recorded the growth of the country's conservation supporters within the EU and reducing the share of support "Breksa". The Opinium poll 44% of respondents support the preservation of the country in the EU and as much support output. YouGov poll shows supporters of the country's excess saving in the EU over the supporters of "Breksita" - 44% versus 43%, respectively. Lose supporters "Brexit" and Survation poll - 45% against 42%. Despite the change of sentiment among the British, the uncertainty about the possible outcome of the popular vote remains extremely high. In the next few days, investors will continue to be directed to the British referendum, which is scheduled for June 23 and the outcome of which will very much depend on further developments in the financial markets.

Oil prices are on track to achieve most of the two-day growth of the past month, as investor confidence in riskier assets increased.

Traders also await speech by Fed Yellen in Congress hoping to get clues on the timing of interest rate rises ..

Almost all the components of DOW index finished trading in positive territory (29 of 30). More rest up shares The Boeing Company (BA, + 2,41%). Outsider were shares of Cisco Systems, Inc. (CSCO, -0,21%).

All Sector S & P Index showed an increase. The leader turned out to be the basic materials sector (+ 1.5%).

At the close:

Dow + 0.73% 17,804.94 +129.78

Nasdaq + 0.77% 4,837.21 +36.87

S & P + 0.58% 2,083.27 +12.05

-

21:00

Dow +1.16% 17,880.65 +205.49 Nasdaq +1.31% 4,863.23 +62.89 S&P +1.02% 2,092.39 +21.17

-

18:00

European stocks closed: FTSE 100 6,204 +182.91 +3.04% CAC 40 4,340.76 +146.93 +3.50% DAX 9,962.02 +330.66 +3.43%

-

17:37

WSE: Session Results

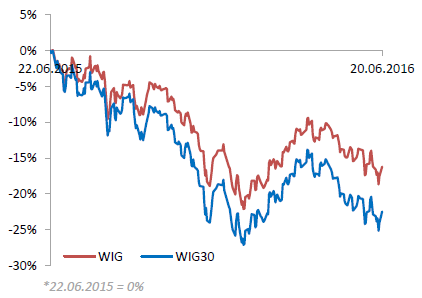

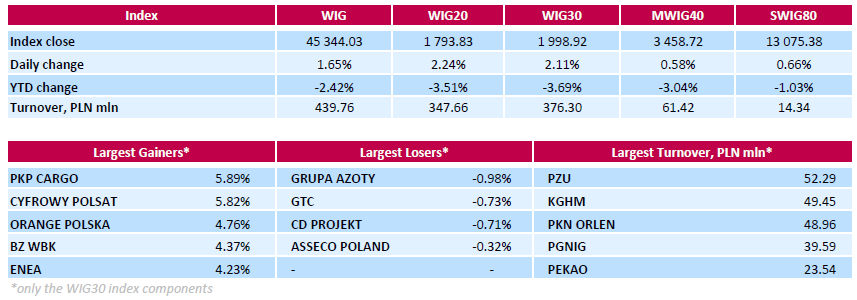

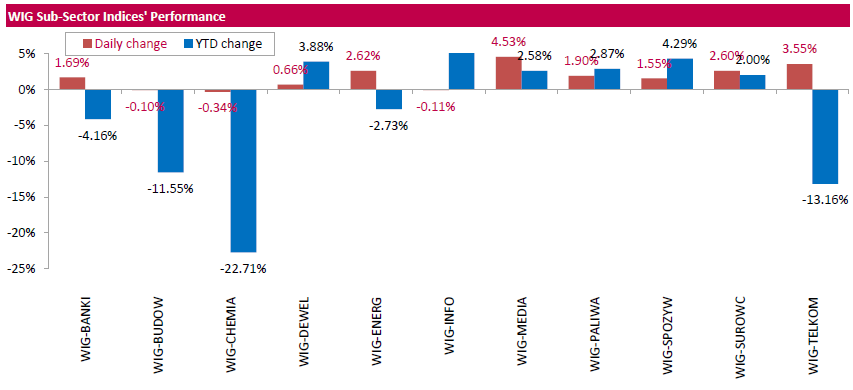

Polish equity market surged on Monday. The broad market measure, the WIG index, rose by 1.65%. The WIG sub-sector indices were mainly higher with media (+4.53%) outperforming

The large-cap stocks' measure, the WIG30 Index, gained 2.11%. In the WIG30, only four index constituents generated losses. Chemical producer GRUPA AZOTY (WSE: ATT) led the underperformers with a 0.98% decline, followed by property developer GTC (WSE: GTC), videogame developer CD PROJEKT (WSE: CDR) and IT-company ASSECO POLAND (WSE: ACP), which fell by 0.73%, 0.72% and 0.32% respectively. On the plus side, railway freight transport operator PKP CARGO (WSE: PKP) and media group CYFROWY POLSAT (WSE: CPS) were the biggest advancers, climbing by 5.89% and 5.82% respectively. Other noticeable risers were telecommunication services provider ORANGE POLSKA (WSE: OPL), bank BZ WBK (WSE: BZW) and genco ENEA (WSE: ENA), which gained between 4.23% and 4.76%.

-

17:24

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes sharply higher on Monday, with the S&P and the Dow recovering last week's losses, after polls over the weekend showed an increased possibility of Britain remaining in the European Union. Global markets went into a tizzy last week as investors unsure over the fallout of Britain's vote on Thursday fled to safe-haven assets such as the yen and gold.

Oil prices were on track to mark their largest two-day rise in a month as investor confidence in the risky asset rose and the strength of the dollar weakened.

Almost all of Dow stocks in positive area (29 of 30). Top looser - Verizon Communications Inc. (VZ, -0,54%). Top gainer - The Boeing Company (BA, +2,83%).

Almost of all S&P sectors also in positive area. Top looser - Utilities (-0,3%). Top gainer - Financial (+2,0%).

At the moment:

Dow 17810.00 +251.00 +1.43%

S&P 500 2088.25 +29.25 +1.42%

Nasdaq 100 4434.75 +75.25 +1.73%

Oil 49.75 +1.19 +2.45%

Gold 1287.50 -7.30 -0.56%

U.S. 10yr 1.67 +0.06

-

15:51

WSE: After start on Wall Street

Today the markets record a significant improvement in sentiment, but the sudden change of climate concerns mainly large companies, and changes in indexes of smaller and medium-size are not so clear and oscillate about 0.5%. The mWIG40 index clearly increased on Friday, when the sWIG80 was weaker. In a wider perspective, the two segments undergo cooling after successful performance at the beginning of the year. The scale of the current two-day growth is not significant enough to seriously undermine the corrective nature of trade.

Global optimism can also be seen on Wall Street and the market in the US has initiated trading just above the consolidation of the last days. Generally, the Americans do not care about Brexit, but benefit from warming of investment climate.

-

15:33

U.S. Stocks open: Dow +0.77%, Nasdaq +1.28%, S&P +1.02%

-

15:10

Before the bell: S&P futures +1.30%, NASDAQ futures +1.31%

U.S. stock-index futures rose after the latest polls showed the U.K. campaign to remain in the European Union is gaining ground before Thursday's referendum.

Global Stocks:

Nikkei 15,965.3 +365.64 +2.34%

Hang Seng 20,510.2 +340.22 +1.69%

Shanghai Composite 2,888.59 +3.49 +0.12%

FTSE 6,230.77 +209.68 +3.48%

CAC 4,349.13 +155.30 +3.70%

DAX 9,987.5 +356.14 +3.70%

Crude $49.02 (+2.17%)

Gold $1287.30 (-0.58%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

171

2.06(1.2194%)

566

ALCOA INC.

AA

9.79

0.21(2.1921%)

37407

ALTRIA GROUP INC.

MO

65.8

0.40(0.6116%)

4154

Amazon.com Inc., NASDAQ

AMZN

713.97

7.58(1.0731%)

33402

Apple Inc.

AAPL

95.95

0.62(0.6504%)

266011

AT&T Inc

T

40.97

0.24(0.5892%)

28886

Barrick Gold Corporation, NYSE

ABX

19.4

-0.71(-3.5306%)

134338

Boeing Co

BA

132.49

2.67(2.0567%)

2509

Caterpillar Inc

CAT

77.44

1.51(1.9887%)

1693

Chevron Corp

CVX

103

1.43(1.4079%)

1034

Cisco Systems Inc

CSCO

29.15

0.20(0.6908%)

12544

Citigroup Inc., NYSE

C

43.44

0.96(2.2599%)

30538

Deere & Company, NYSE

DE

86.55

0.55(0.6395%)

900

Exxon Mobil Corp

XOM

91.51

0.79(0.8708%)

24172

Facebook, Inc.

FB

113.85

0.83(0.7344%)

183255

Ford Motor Co.

F

13.46

0.20(1.5083%)

70899

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.63

0.49(4.3986%)

311003

General Electric Co

GE

30.89

0.29(0.9477%)

57532

General Motors Company, NYSE

GM

29.64

0.41(1.4027%)

19304

Goldman Sachs

GS

148.25

2.61(1.7921%)

3554

Google Inc.

GOOG

698.1

6.38(0.9223%)

10848

Hewlett-Packard Co.

HPQ

13.19

0.07(0.5335%)

595

Home Depot Inc

HD

128.7

1.56(1.227%)

1170

Intel Corp

INTC

32.04

0.28(0.8816%)

10806

International Business Machines Co...

IBM

153.25

1.26(0.829%)

2111

Johnson & Johnson

JNJ

116.6

1.12(0.9699%)

1210

JPMorgan Chase and Co

JPM

63.5

1.22(1.9589%)

15306

Merck & Co Inc

MRK

56.67

0.78(1.3956%)

670

Microsoft Corp

MSFT

50.62

0.49(0.9775%)

10911

Nike

NKE

54.65

0.94(1.7501%)

10904

Pfizer Inc

PFE

34.52

0.30(0.8767%)

5009

Procter & Gamble Co

PG

83.65

0.52(0.6255%)

6289

Starbucks Corporation, NASDAQ

SBUX

55.8

0.49(0.8859%)

4490

Tesla Motors, Inc., NASDAQ

TSLA

219

3.53(1.6383%)

27617

The Coca-Cola Co

KO

45.06

0.27(0.6028%)

8525

Twitter, Inc., NYSE

TWTR

16.36

0.26(1.6149%)

167305

UnitedHealth Group Inc

UNH

139.51

1.82(1.3218%)

2900

Verizon Communications Inc

VZ

54.07

0.29(0.5392%)

9848

Visa

V

78

1.01(1.3119%)

3735

Wal-Mart Stores Inc

WMT

71.32

0.37(0.5215%)

1809

Walt Disney Co

DIS

100.02

1.02(1.0303%)

42581

Yahoo! Inc., NASDAQ

YHOO

37.36

0.42(1.137%)

23810

Yandex N.V., NASDAQ

YNDX

22.53

1.10(5.133%)

6150

-

14:57

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Pfizer (PFE) target lowered to $40 from $42 at Jefferies

-

13:10

WSE: Mid session comment

Today's a very good attitude of European markets (DAX + 3.38%) results with back of our parquet to area of today's highs, which means pausing dangerous process of subsidence of the morning, very short, breaking. For our bulls maintaining of the observed result to the end of the session will already be a success, based on which they may work on the development in the future. The problem, however, remains low turnover, which indicates a revocation of supply and the continued lack of serious decisions to trade. It does not help here a Monday aura and empty macro calendar.

In the mid-session the WIG20 index was at the level of 1,794 points (2.29%) with turnover of less than PLN 150 mln.

-

12:40

European Stocks mid session

Stock markets in Europe rallied due mostly to the recovery of the banking sector, as renewed hope that the UK will decide to stay in the EU, boosting investors appetite for risk.

The composite index of the largest companies in the region Euro Stoxx 600 rose by 3.3% - to 336.63 points.

As the poll showed, held June 18 by Survation, 45% of respondents were in favor, to maintain membership in the EU, 42% - against. Prior to this, the data indicated that Brexit supporters camp wins, but the death of a British Member of Parliament Joe Cox forced politicians to suspend the election campaign that changed the balance of power.

Meanwhile bookmakers estimate the chances of the UK exit from the EU to 31% against 44% in the middle of last week.

Producer prices in Germany declined at a slower pace in May, Destatis data showed.

Shares of Royal Bank of Scotland and Lloyds gained 7.5% and 5.8%, respectively, amid signs that Britain decides to stay in the EU.

The capitalization of the Italian bank UniCredit rose 4.9%. Italian media reported that the new CEO of the bank may be the former Minister of Economic Development, Infrastructure and Transport Corrado Passera.

Spanish BBVA Bank increased its market value by 2.7% on news that the Bank approved a strategic development plan in March this year, not informing the market participants. The plan aims to increase the profitability and efficiency of the bank.

Volkswagen AG's stock price rose by 3.1%. According to informed sources, the automaker intends to submit to regulators in the United States plan to eliminate violations in vehicles with diesel engines until the end of this month. The plan calls for expenditures of about $ 10 billion.

The market value of Bayer AG increased by 2.2%. According to rumors, the company is in talks with investment banks about a possible sale of its business for the production of radiological equipment. Cost could be around $ 3 billion.

Share price Adidas AG increased by 2.2% from the figures that the sporting goods manufacturer has signed another four-year sponsorship deal with the national football team of Germany.

Allianz shares rose 3.2% after the German insurer announced the acquisition of Zurich Assurances Maroc, a branch of Zurich Insurance Company in Morocco.

Taylor Wimpey shares soared 5.4% after Deutsche Bank analysts confirmed their rating to "buy."

At this moment

FTSE 6182.44 161.35 2.68%

DAX 9952.37 321.01 3.33%

CAC 4328.91 135.08 3.22%

-

09:13

WSE: After opening

The new, September series, future contracts on the WIG20 index (WSE: FW20U16) started the day from increase by as much as 1.79% (1,762 points). Surrounded contract for the DAX gained up 2.5%, and the reaction of the Polish market is a simple to this movement. Its scale is very large, which can suppress the subsequent volatility, because the same opening leads to a substantial shift. In the case of a weak markets, which include the GPW, as high opening generally may lead to difficulties in continuation.

WIG20 index opened at 1764.76 points (+0.59%)

WIG 45001.12 0.88%

WIG30 1980.69 1.18%

mWIG40 3451.32 0.37%

*/ - change to previous close

Cash market opens up with quite modest increase of 0.59% to 1,764 points, which enables for rapid continuation of growth towards the level of 1,780 points. The turnover is not spectacular, but not bad for a Monday.

-

08:19

WSE: Before opening

We start a week, during which will be held on the last inflected by all the cases, the referendum in the UK. On Sunday, the campaign was resumed before the vote and appeared the next polls. All point to win of people who want to stay within the framework of European structures, which stimulates in the morning appetite for risk after a difficult last week.

Contracts in the US are rising by approx. 1%, while indexes in Asia, outside of China, gain a similar scale. A weakening of the yen supports the Japanese market, where the Nikkei gaining over 2%. Today's macroeconomic calendar is empty, so rather nothing, but the latest polls from the UK, should attract the attention of investors.

Increasing this morning by more than 0.8% the price of copper should be supported for the Warsaw Stock Exchange, which recently remained weaker compare to foreign markets, but as a rule guided by external sentiment, which should be supported today. If we look at the probability of Brexit, calculated by the bookmakers ratings, it fell below 30%. This may herald the end of the hysteria associated with the referendum and the fear of its negative outcome.

-

07:19

Global Stocks

European stocks finished higher Friday, with investors reassessing the prospect of the U.K. leaving the European Union in the wake of a British lawmaker's killing.

The Stoxx Europe 600 SXXP, +1.40% rose 1.4% to 325.76, with all sectors pushing higher. Bank shares were leading the financial sector SXFR, +2.74% higher after being hit in recent sessions on concerns the banking industry will suffer in the event of a "Brexit."

Stocks moved higher after campaigning was suspended for a second day by both the "leave" and "remain" sides of the Brexit debate following the killing of lawmaker Jo Cox on Thursday. Cox, a 41-year-old Labour Party member, was a vocal supporter of the U.K. remaining in the EU.

Before Cox's death, markets "had been increasingly concerned by a vote to leave and this has pulled a recovery in sterling and equities," while "safe haven plays which were so strong yesterday morning have receded with the yen and gold both corrective once more," Perry said.

Shares of U.S. companies with a higher-than-average reliance on British sales could face a rude awakening should the U.K. vote to exit the European Union on Thursday.

Stocks finished the week lower on so-called Brexit worries and in the wake of a June Federal Reserve policy meeting that underscored a slower approach to rate increases given shaky economic growth. The Dow Jones Industrial Average DJIA, -0.33% declined 1.1% for the week, while the S&P 500 index SPX, -0.33% shed 1.2%, and the Nasdaq Composite Index COMP, -0.92% fell 1.9%. Both the S&P 500 and Nasdaq logged a second week of losses.

Asian stocks gained as some fears that Britain would vote to leave the European Union abated on Monday, boosting a recovery in both sterling and investors' taste for risk assets.

Safe-haven assets and currencies like gold, government bonds and the yen retreated.

Australian stocks added 1.2 percent and South Korea's Kospi .KS11 rose 1.1 percent.

Japan's Nikkei .N225 climbed more than 2 percent, helped by a retreat in the recently bullish yen.

"Those who were risk averse are reversing their positions," said Yoshinori Shigemi, global market strategist at JPMorgan Asset Management in Tokyo.

"Sentiment was extremely negative last week, but it's recovering now, though we should not be overly optimistic."

Three British opinion polls ahead of the EU membership referendum on June 23 showed the "Remain" camp recovering some momentum, although the overall picture remained one of an evenly split electorate.

-

04:07

Nikkei 225 15,931.59 +331.93 +2.13 %, Hang Seng 20,343.29+173.31 +0.86 %, Shanghai Composite 2,882.4 -2.70 -0.09 %

-

00:37

Stocks. Daily history for Jun 17’2016:

(index / closing price / change items /% change)

Hang Seng 20,169.98 +131.56 +0.66 %

S&P/ASX 200 5,162.66 +16.68 +0.32 %

Shanghai Composite 2,885.04 +12.22 +0.43 %

Topix 1,250.83 +9.27 +0.75 %

FTSE 100 6,021.09 +70.61 +1.19 %

CAC 40 4,193.83 +40.82 +0.98 %

Xetra DAX 9,631.36 +80.89 +0.85 %

S&P 500 2,071.22 -6.77 -0.33 %

NASDAQ Composite 4,800.34 -44.58 -0.92 %

Dow Jones 17,675.16 -57.94 -0.33 %

-