Noticias del mercado

-

21:01

DJIA 17704.03 -29.07 -0.16%, NASDAQ 4807.96 -36.95 -0.76%, S&P 500 2073.67 -4.32 -0.21%

-

18:00

European stocks closed: FTSE 6021.09 70.61 1.19%, DAX 9631.36 80.89 0.85%, CAC 4193.83 40.82 0.98%

-

17:27

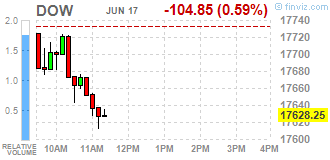

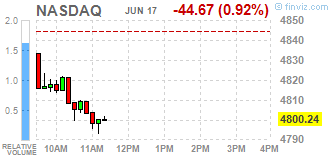

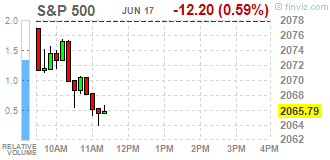

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell as Apple dragged down on Friday even as investors remained wary of global economic growth worries and an impending referendum on Britain's European Union membership. Britain will vote on June 23, an event that has weaved in uncertainty across the globe, battering stocks and bond yields for the past week and spiking demand for safe-haven assets such as gold and the yen.

Most all of Dow stocks in negative area (23 of 30). Top looser - Merck & Co. Inc. (MRK, -2,80%). Top looser - Caterpillar Inc. (CAT, +0,96%).

Most of all S&P sectors in negative area. Top looser - Healthcare (-1,1%). Top gainer - Conglomerates (+1,2%).

At the moment:

Dow 17532.00 -111.00 -0.63%

S&P 500 2056.00 -14.50 -0.70%

Nasdaq 100 4357.25 -59.50 -1.35%

Oil 48.00 +1.26 +2.70%

Gold 1290.00 -8.40 -0.65%

U.S. 10yr 1.61 +0.05

-

15:56

WSE: After start on Wall Street

Today's session on the Warsaw Stock Exchange takes place in a dreamy atmosphere. The turnover on companies from the WIG20 index did not exceed PLN 300 mln, therefore increases are not reliable.

In a moment the clear picture of the session will be replaced by a radical increase in volatility and that will completely disrupt the image of today's trading. The summary of the week is a drop in the WIG20 by about 2 percent and deepening the wave of sell-off, which lasts from April. More importantly, the levels of weeks closing is just close to the new minimum of downward wave. The lowest closing of the year was 1,727 points. But even without this element, the weekly chart invites us to look into the area of the January minimum. The new week with a referendum in the UK and elections in Spain may also be difficult, or - the remaining Great Britain in the EU - will bring a strong rebound of the third month repricing.

-

15:32

U.S. Stocks open: Dow -0.12%, Nasdaq -0.29%, S&P -0.13%

-

15:03

Before the bell: S&P futures -0.10%, NASDAQ futures -0.06%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 15,599.66 +165.52 +1.07%

Hang Seng 20,169.98 +131.56 +0.66%

Shanghai Composite 2,885.04 +12.22 +0.43%

FTSE 6,019.2 +68.72 +1.15%

CAC 4,193.18 +40.17 +0.97%

DAX 9,633.16 +82.69 +0.87%

Crude $47.24 (+2.23%)

Gold $1292.50 (-0.45%)

-

14:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.46

0.07(0.7455%)

22189

Amazon.com Inc., NASDAQ

AMZN

718.5

0.99(0.138%)

5224

Apple Inc.

AAPL

96.99

-0.56(-0.5741%)

216911

AT&T Inc

T

40.5

0.01(0.0247%)

1325

Barrick Gold Corporation, NYSE

ABX

20.4

0.34(1.6949%)

92375

Caterpillar Inc

CAT

75.49

0.50(0.6668%)

2828

Chevron Corp

CVX

101.17

0.10(0.0989%)

4261

Citigroup Inc., NYSE

C

42.28

0.16(0.3799%)

7735

E. I. du Pont de Nemours and Co

DD

67.03

0.11(0.1644%)

201

Exxon Mobil Corp

XOM

91.5

0.28(0.307%)

3325

Facebook, Inc.

FB

114.15

-0.24(-0.2098%)

37633

Ford Motor Co.

F

13.16

0.04(0.3049%)

21690

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.06

0.28(2.5974%)

131427

General Electric Co

GE

30.57

-0.07(-0.2285%)

8850

General Motors Company, NYSE

GM

29.19

0.17(0.5858%)

2340

Goldman Sachs

GS

147.5

0.87(0.5933%)

513

Google Inc.

GOOG

708.85

-1.51(-0.2126%)

3653

Home Depot Inc

HD

127.36

0.00(0.00%)

200

Intel Corp

INTC

31.75

0.06(0.1893%)

1701

JPMorgan Chase and Co

JPM

62.44

0.22(0.3536%)

12380

Merck & Co Inc

MRK

57.71

0.21(0.3652%)

2023

Microsoft Corp

MSFT

50.45

0.06(0.1191%)

5997

Nike

NKE

53.55

0.08(0.1496%)

1825

Starbucks Corporation, NASDAQ

SBUX

55.49

-0.04(-0.072%)

946

Tesla Motors, Inc., NASDAQ

TSLA

217.83

-0.10(-0.0459%)

9078

The Coca-Cola Co

KO

45.1

-0.21(-0.4635%)

582

Twitter, Inc., NYSE

TWTR

16

0.13(0.8192%)

49859

Verizon Communications Inc

VZ

53.43

-0.03(-0.0561%)

1200

Visa

V

78.6

0.25(0.3191%)

1829

Wal-Mart Stores Inc

WMT

71

-0.30(-0.4208%)

135

Walt Disney Co

DIS

98.02

-0.36(-0.3659%)

8329

Yahoo! Inc., NASDAQ

YHOO

37.42

0.03(0.0802%)

3473

Yandex N.V., NASDAQ

YNDX

21.52

0.43(2.0389%)

2469

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target lowered to $115 at RBC Capital Mkts

-

13:11

WSE: Mid session comment

The first part of the session did not bring any solstice and the WIG20 returned to the area of 1750 points. There is also no signals of overcome the resistance created there, and barely PLN 175 mln of turnover is the weak result and signaling distance of investors to rebound. The Warsaw market copies behavior of the German DAX, which at 13:00 is gaining about 1 percent, while the WIG20 index rising 0.9 percent. If in the first half we failed to earn anything important, that any market movement in the second half will be condemned to confrontation with final hour of contracts settlement. Thus, it appears that for technically reliable trade we will have to wait.

-

12:09

Germany's Ifo institute upgrades its growth forecasts for Germany

Germany's Ifo institute upgraded its growth forecasts for Germany on Thursday. Germany's economy is expected to expand 1.8% in 2016, up from the previous estimate of 1.6%, and 1.6% in 2017, up from the previous estimate of 1.5%. The upward revision was driven by a strong labour market and higher state spending on refugees.

-

12:01

Finland’s Finance Minister Alexander Stubb: Britain’s exit from the European Union will have the same effect for Europe like the bankruptcy of Lehman Brothers in the U.S.

Finland's Finance Minister Alexander Stubb said on Thursday that Britain's exit from the European Union (EU) would have the same effect for Europe like the bankruptcy of Lehman Brothers in the U.S.

"We're in the midst of one of the most historic weeks in the history of European integration," he added.

-

11:55

Japan’s Finance Minister Taro Aso is concerned about “one-sided, rapid and speculative” moves of the yen

Japan's Finance Minister Taro Aso said on Friday that he was concerned about "one-sided, rapid and speculative" moves of the yen. He pointed out that the government was ready to act to prevent these moves if needed.

-

11:53

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decrease to 42.1 in in the week ended June 12

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 42.1 in in the week ended June 12 from 43.5 the prior week.

The decrease was driven by drops in all sub-indexes. The measure of views of the economy was down to 32.7 from 32.9, the buying climate index slid to 38.0 from 40.3, while the personal finances index dropped to 55.8 from 57.4.

-

09:25

WSE: After opening

The WIG20 futures began the day from rebound about 6 points above yesterday's close. After a very weak Thursday's session in Warsaw the Americans introduced an element of calming, which after an initial decline managed to finish the day in positive territory moving away the specter of testing an important support.

WIG20 index opened at 1739.54 points (+0.35%)*

WIG 44242.42 0.53%

WIG30 1943.86 0.73%

mWIG40 3375.22 0.18%

*/ - change to previous close

The growth in the European markets allows to open the quotation of the WIG20 with rise. But the graph of the WIG20 constantly stays below supports, so the signal of looking into the region of 1,650 pts., remains valid. To complete the theme of the British referendum is still plenty of time, so the problem will come back. It's hard to say whether our reflection proves to be forward-looking. Certainly not subsided yet the risks, which in previous days negatively affected the mood. Investors who would like to catch a hole should wait to back above 1,750 points.

-

08:16

WSE: Before opening

Yesterday's session on Wall Street ended with increases in the major indexes. In the case of the S&P500 growth was 0.3 percent. In the comments there is information that the growth in the US is a response to speculation about a possible postponement of the referendum in the UK, after the assassination of one of the parliamentarians, but much simpler explanation is the thesis that the share prices on Wall Street fell for five days, and it's time for correction.

The positive climate - reinforced on the currency market by the dollar weakening against the euro - moved to Asia, where the Nikkei gaining 1.2 percent supported by the weakening of the yen. Chinese markets are on green side, so we may talk about a return of appetite for risk, but rather a reduction in risk aversion. In this context, we can expect growth in Europe. However, the factors that spurred last supply have not disappeared. Markets nervous waiting for the new week in which the United Kingdom will decide on his future in the European Union and Spain on the composition of the new parliament.

From the point of view of the Warsaw market, sentiment improvement in the environment will help to recover from yesterday's sell-off. Stronger European markets and stronger zloty should help the bulls at the opening, but during the day there will be new surveys from the UK on Brexit, which may limit the scale of optimism. We must also remember that today expire June's derivatives series and waiting for the hour of contracts settlement will be another element that will not allow the bulls to get involved in the market with full conviction.

-

01:02

Stocks. Daily history for Jun 16’2016:

(index / closing price / change items /% change)

Nikkei 225 15,434.14 -485.44 -3.05 %

Hang Seng 20,038.42 -429.10 -2.10 %

S&P/ASX 200 5,145.99 -1.07 -0.02 %

Shanghai Composite 2,873.48 -13.73 -0.48 %

FTSE 100 5,950.48 -16.32 -0.27 %

CAC 40 4,153.01 -18.57 -0.45 %

Xetra DAX 9,550.47 -56.24 -0.59 %

S&P 500 2,077.99 +6.49 +0.31 %

NASDAQ Composite 4,844.92 +9.98 +0.21 %

Dow Jones 17,733.1 +92.93 +0.53 %

-