Noticias del mercado

-

22:06

U.S. stocks climbed

U.S. stocks climbed, with the S&P 500 Index on track to halt its longest losing streak since February, amid shifting speculation on whether Britain will remain in the European Union.

Equities recovered from a 1 percent selloff as both sides suspended campaigning on whether Britain should leave the EU after Labour Party lawmaker Jo Cox was murdered as she met constituents in her electoral district. She was in favor of remaining in the EU, fueling speculation voters will be more likely to choose remain in next week's referendum. Phone companies and utilities rallied, while energy producers were mired in the longest retreat in almost 10 months as crude continued to fall.

"Recent polls have shown Brexit is too close to call, or leaning in the direction of leaving," said Mark Luschini, chief investment strategist at Philadelphia-based Janney Montgomery Scott LLC, which manages $54 billion. "That campaign cooling a bit could provide relief to investors that think further campaigning will help drive votes in the direction of a Brexit. How sticky of a sentiment that will be is yet to be determined."

Traders noted the rebound in equities coincided with a deterioration in chances Britons would elect to leave the EU as tracked by Oddschecker's survey of bookmakers' implied probability. Those odds slipped below 38 after surpassing 44 hours earlier. Others said a rebound in markets was unsurprising given how fast stocks fell at the open, with the S&P 500 going as low as 2,050.37, roughly where it began a 1.4 percent rally on May 24.

Investors were also shrugging off anxiety over the growth outlook after the Federal Reserve yesterday scaled back its projections for interest-rate increases, indicating the economy remains mixed, while also citing Britain's June 23 referendum on EU membership as a factor in its decision to stand pat. Chair Janet Yellen pointed to more permanent forces that could hold down rates for longer, namely slow productivity growth and aging societies. Officials also now expect a slower pace of hikes in both 2017 and 2018.

The Bank of Japan refrained from expanding monetary stimulus ahead of a domestic election and the U.K.'s June 23 Brexit vote, while the Swiss National Bank and Bank of England also kept rates unchanged.

Equities were on track to end a retreat spurred as investors weighed the potential fallout from the U.K. referendum, with a series of polls indicating more Britons favor leaving the EU. Sentiment has soured from just a week ago, when the S&P 500 rose to within 0.6 percent of a record on optimism that a mix of low rates and moderate economic growth would continue to support higher stock prices. The gauge had rallied as much as 16 percent from a 22-month low in February.

"Central banks have sounded the alarm over a potential Brexit, with chiefs of the Fed, Bank of Japan, Bank of Canada and Swiss National Bank all citing next week's vote as a potential disruption to the global economy. Yellen said yesterday the decision could have consequences for financial markets, and "in turn for the U.S. economic outlook." Traders have cut back their bets on a Fed rate increase, pricing in only a 4 percent chance of a July boost and less than 40 percent odds of one as late as February 2017.

While policy makers still aren't seeing enough momentum in the economy to warrant higher borrowing costs, a report today showed the cost of living in the U.S. excluding food and fuel rose in May, propelled by rising rents. Separately, jobless claims increased more than expected last week, reflecting a jump in California that otherwise masked steady progress in the U.S. labor market. Another gauge showed confidence among homebuilders climbed to a five-month high in June.

-

21:00

DJIA 17700.74 60.57 0.34%, NASDAQ 4831.76 -3.17 -0.07%, S&P 500 2073.36 1.86 0.09%

-

18:03

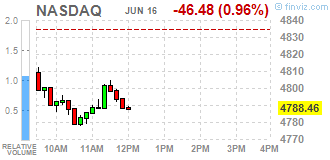

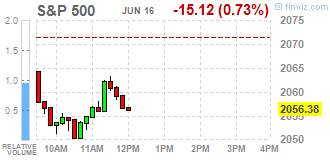

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell the sixth day, a streak unseen since August, as the Federal Reserve's comments about an economic slowdown and the prospect of Britain's possible exit from the European Union spooked investors. The Fed kept short-term interest rates unchanged on Wednesday but said it continued to expect two rate hikes this year. Fed Chair Janet Yellen sounded caution that the central bank needed to see more clear signs of economic strength before lifting rates.

Most all of Dow stocks in negative area (22 of 30). Top looser - NIKE, Inc. (NKE, -2,04%). Top gainer - Merck & Co. Inc. (MRK, +1,93%).

Most of all S&P sectors in negative area. Top looser - Basic Materials (-1,2%). Top gainer - Utilities (+0,3%).

At the moment:

Dow 17467.00 -85.00 -0.48%

S&P 500 2050.00 -13.50 -0.65%

Nasdaq 100 4365.25 -40.25 -0.91%

Oil 46.39 -1.62 -3.37%

Gold 1312.30 +24.00 +1.86%

U.S. 10yr 1.56 -0.04

-

18:01

European stocks close: stocks closed lower on uncertainty over Britain's membership in the European Union

Stock closed lower on uncertainty over Britain's membership in the European Union (EU). According to the latest polls, the majority of Britons would support Britain's exit from the European Union (EU).

Market participants also eyed the economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.4% in May, exceeding expectations for a 0.3% gain, after a flat reading in April.

On a yearly basis, Eurozone's final consumer price inflation increased to -0.1% in May from -0.2% in April, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in May, rents increased by 0.07%, tobacco rose by 0.07%, fuel prices for transport declined by 0.53%, heating oil prices decreased by 0.20%, while gas prices were down by 0.13%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 0.8% in May from 0.7 in April, in line with the preliminary reading.

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its June meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged.

The central bank warned about the consequences in case of the country's exit from the European Union (EU). According to the central bank, the possible Britain's exit from the EU was the largest risk to UK financial markets global financial markets.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 0.9% in May, exceeding expectations for a 0.2% gain, after a 1.9% rise in April. April's figure was revised up from a 1.3% increase.

The increase was mainly driven by a rise in clothing and footwear.

Food sales were up 1.1% in May, while non-food store sales increased 0.7%.

On a yearly basis, retail sales in the U.K. jumped 6.0% in May, beating forecasts of a 3.9% increase, after a 5.2% rise in April. April's figure was revised up from a 4.3% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,950.48 -16.32 -0.27 %

DAX 9,550.47 -56.24 -0.59 %

CAC 40 4,153.01 -18.57 -0.45 %

-

18:00

European stocks closed: FTSE 5950.48 -16.32 -0.27%, DAX 9550.47 -56.24 -0.59%, CAC 4153.01 -18.57 -0.45%

-

17:43

WSE: Session Results

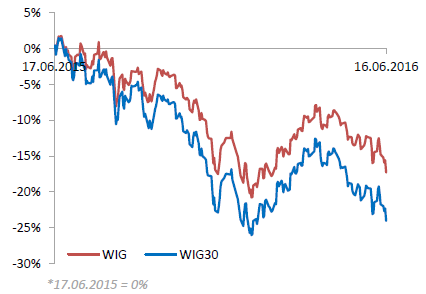

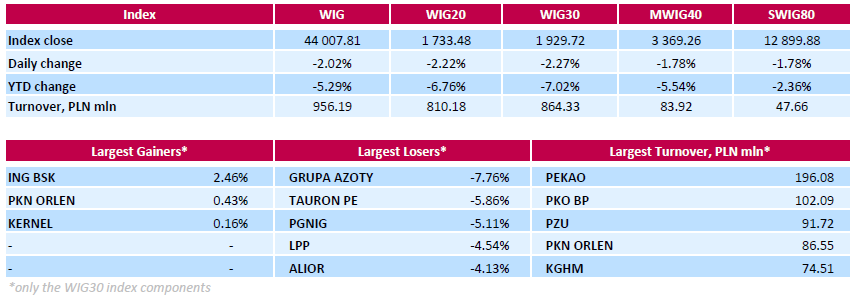

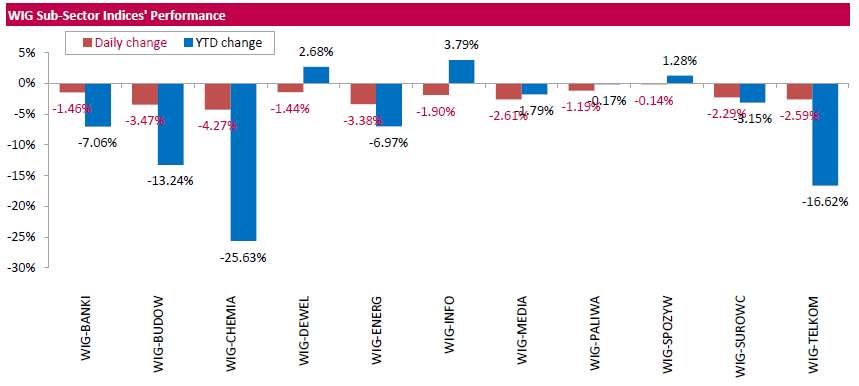

Polish equity market closed lower on Thursday. The broad market measure, the WIG index, declined by 2.02%. All sectors in the WIG retreated, with chemicals (-4.27%) lagging behind.

The large-cap stocks' gauge, the WIG30 Index, fell by 2.27%. A majority of the index components recorded losses, with chemical producer GRUPA AZOTY (WSE: ATT) underperforming with a 7.76% decline. Other major laggards were genco TAURON PE (WSE: TPE), oil and gas producer PGNIG (WSE: PGN) and clothing retailer LPP (WSE: LPP), which dropped by 5.86%, 5.11% and 4.54% respectively. At the same time, the handful advancers included bank ING BSK (WSE: ING), oil refiner PKN ORLEN (WSE: PKN) and agricultural producer KERNEL (WSE: KER), which gained 2.46%, 0.43% and 0.16% respectively.

-

17:08

Bank of England's Monetary Policy Committee June minutes: the BoE warns about the consequences in case of Britain’s exit from the European Union

The Bank of England's Monetary Policy Committee (MPC) released its June meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged.

The consumer price inflation in the U.K. was 0.3% in May, below the central bank's 2% target. The BoE noted that inflation was driven by a drop in energy and food prices, adding that this effect would dissipate over the next year.

The central bank warned about the consequences in case of the country's exit from the European Union (EU). According to the central bank, the possible Britain's exit from the EU was the largest risk to UK financial markets global financial markets.

The central bank said that Britain's economy slowed in the first quarter and was expected to decelerate in the second quarter as uncertainty around Britain's membership in the European Union (EU) weighed on the economy.

The BoE noted that the domestic private sector remained resilient, while consumer confidence was robust.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles".

The BoE also said that the referendum was the main risk to the outlook.

"A vote to leave the EU could materially alter the outlook for output and inflation, and therefore the appropriate setting of monetary policy. Households could defer consumption and firms delay investment, lowering labour demand and causing unemployment to rise. Through financial market and confidence channels, there are also risks of adverse spill-overs to the global economy," the central bank noted.

-

16:44

Swiss National Bank Chairman Thomas Jordan: the SNB will intervene in the foreign exchange market if needed

The Swiss National Bank (SNB) Chairman Thomas Jordan said in a press conference on Thursday that the central bank would intervene in the foreign exchange market if needed. He pointed out that the franc remained significantly overvalued.

Jordan noted that the Swiss economy was expanding moderately this year.

The SNB chairman also said that the SNB would monitor the results of the referendum on Britain's membership in the European Union, and it would act if needed.

"Next week's UK referendum on whether to remain in the EU may cause uncertainty and turbulence to increase. We will be monitoring the situation closely and will take measures if required," Jordan noted.

-

16:27

New motor vehicle sales in Australia slide 1.1% in May

The Australian Bureau of Statistics released its new motor vehicle sales data on Thursday. New motor vehicle sales in Australia slid 1.1% in May, after a 1.9% drop in April. April's figure was revised up from a 2.5% fall.

Sales of passenger vehicles declined 3.0% in May, sales of sports utility vehicles were up 1.4%, while sales of other vehicles plunged 1.7%.

On a yearly basis, new motor vehicle sales climbed 1.7% in May, after a 2.8% increase in April. April's figure was revised up from a 2.4% rise.

-

16:21

MI consumer inflation expectations in Australia increase to 3.5% in June

The Melbourne Institute (MI) released its inflation expectations for Australia on Thursday. The MI consumer inflation expectations in Australia increased to 3.5% in June from 3.2% in May.

69.3% respondents expected inflation to decline within the 0‐5% range in June, up from 68.3% in April.

-

16:10

NAHB housing market index rises to 60 in June

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Thursday. The NAHB housing market index increased to 60 in June from 58 in May, exceeding expectations for an increase to 59.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index climbed to 47 in June from 44 in April, the current sales conditions sub-index rose to 64 from 63, while the sub-index measuring sales expectations in the next six months increased to 70 from 65.

"Builders in many markets across the nation are reporting higher traffic and more committed buyers at their job sites," the NAHB Chairman Ed Brady.

"Rising home sales, an improving economy and the fact that the HMI gauge measuring future sales expectations is running at an eight-month high are all positive factors indicating that the housing market should continue to move forward in the second half of 2016," the NAHB Chief Economist Robert Dietz said.

-

15:56

Greek unemployment rate increases to 24.9% in the first quarter

The Hellenic Statistical Authority released its labour market data for Greece on Thursday. The Greek unemployment rate increased to 24.9% in the first quarter from 24.4% in the fourth quarter.

The number of unemployed people rose by 1.7% in the first quarter from the previous quarter.

The youth unemployment rate was up to 50.9% in the first quarter from 49.0% in the fourth quarter.

-

15:53

WSE: After start on Wall Street

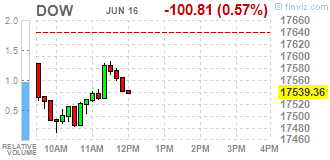

Wall Street as well as other markets start with a noticeable gap slump. The decrease above 0.6 percent of the indices S&P500 and DJIA brings the market to new weekly lows. Fear about Brexit is therefore considerable, and the chances of calming doubtful. Unfortunately, we may not see today a variable that could significantly change sentiment. Strong dollar indicates an increase in risk aversion. Unfortunately, the fear in the world before the referendum in the UK and tomorrow's settlement of contracts will mean that it is worth to be careful with technical signals.

-

15:33

U.S. Stocks open: Dow -0.44%, Nasdaq -0.49%, S&P -0.44%

-

15:26

Before the bell: S&P futures -0.51%, NASDAQ futures -0.53%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 15,434.14 -485.44 -3.05%

Hang Seng 20,038.42 -429.10 -2.10%

Shanghai Composite 2,873.48 -13.73 -0.48%

FTSE 5,909.26 -57.54 -0.96%

CAC 4,137.43 -34.15 -0.82%

DAX 9,486.48 -120.23 -1.25%

Crude $47.09 (-1.92%)

Gold $1311.60 (+1.81%)

-

15:08

Bank of England keeps its interest rate on hold at 0.5% in June

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

15:06

Philadelphia Federal Reserve Bank’s manufacturing index climbs to 4.7 in June

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to 4.7 in June from -1.8 in May.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Firms responding to the Manufacturing Business Outlook Survey reported little growth this month. Though the indicator for general activity was positive in June, other broad indicators continued to reflect general weakness in business conditions," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index fell to -2.1 in June from -0.5 in May.

The new orders index decreased to -3.0 in June from -1.9 in May.

The prices paid index rose to 23.0 in June from 15.7 in May, while the prices received index slid to 3.9 from 14.8.

The number of employees index was down to -10.9 in June from -3.3 in May.

According to the report, the future general activity index fell to 29.8 in June from 36.1 in May.

-

14:58

U.S. consumer price inflation rises 0.2% in May

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation rose 0.2% in May, missing expectations for a 0.3% gain, after a 0.4% increase in April.

The index was mainly driven by higher energy prices, which climbed 1.2% in May.

Shelter costs climbed 0.4% in May, medical care costs were up 0.3%, while food prices decreased 0.2%.

On a yearly basis, the U.S. consumer price index decreased to 1.0% in May from 1.1% in April. Analysts had expected the index to rise 1.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in May, in line with expectations, after a 0.2% increase in April.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 2.2% in May from 2.1% in April, in line with forecasts.

The consumer price index is not preferred Fed's inflation measure.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.29

-0.16(-1.6931%)

43128

Amazon.com Inc., NASDAQ

AMZN

711.75

-2.51(-0.3514%)

9298

Apple Inc.

AAPL

96.35

-0.79(-0.8133%)

156296

Barrick Gold Corporation, NYSE

ABX

21.18

0.68(3.3171%)

221155

Boeing Co

BA

129.32

-0.84(-0.6454%)

300

Chevron Corp

CVX

100.02

-0.61(-0.6062%)

3102

Cisco Systems Inc

CSCO

28.51

-0.14(-0.4887%)

3127

Citigroup Inc., NYSE

C

41.7

-0.31(-0.7379%)

31330

Exxon Mobil Corp

XOM

89.5

-0.66(-0.732%)

8299

Facebook, Inc.

FB

114

-0.60(-0.5236%)

62758

FedEx Corporation, NYSE

FDX

159.4

-0.26(-0.1628%)

900

Ford Motor Co.

F

12.93

-0.08(-0.6149%)

4121

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.72

-0.28(-2.5455%)

297095

General Electric Co

GE

30.23

-0.13(-0.4282%)

31354

General Motors Company, NYSE

GM

28.74

-0.12(-0.4158%)

6552

Goldman Sachs

GS

145

-1.16(-0.7937%)

5970

Google Inc.

GOOG

716.6

-2.32(-0.3227%)

2891

Intel Corp

INTC

31.49

-0.12(-0.3796%)

19564

International Business Machines Co...

IBM

150.41

-0.27(-0.1792%)

237

Johnson & Johnson

JNJ

116.35

-0.06(-0.0515%)

611

JPMorgan Chase and Co

JPM

61.5

-0.47(-0.7584%)

35520

McDonald's Corp

MCD

122.25

0.00(0.00%)

150

Merck & Co Inc

MRK

57

0.91(1.6224%)

171609

Microsoft Corp

MSFT

49.55

-0.14(-0.2817%)

12170

Nike

NKE

53.41

-0.90(-1.6572%)

17093

Pfizer Inc

PFE

34.62

-0.17(-0.4886%)

4210

Procter & Gamble Co

PG

82.54

-0.41(-0.4943%)

552

Starbucks Corporation, NASDAQ

SBUX

55.35

-0.00(-0.00%)

421

Tesla Motors, Inc., NASDAQ

TSLA

217.6

-0.10(-0.0459%)

9982

The Coca-Cola Co

KO

44.3

-0.71(-1.5774%)

10708

Twitter, Inc., NYSE

TWTR

15.83

-0.13(-0.8145%)

67484

Verizon Communications Inc

VZ

52.8

-0.04(-0.0757%)

490

Visa

V

77.58

-0.59(-0.7548%)

976

Wal-Mart Stores Inc

WMT

70.99

-0.13(-0.1828%)

601

Walt Disney Co

DIS

97.89

-0.38(-0.3867%)

2249

Yahoo! Inc., NASDAQ

YHOO

37.38

0.06(0.1608%)

24588

Yandex N.V., NASDAQ

YNDX

20.74

-0.44(-2.0774%)

5900

-

14:46

Initial jobless claims rise to 277,000 in the week ending June 11

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 11 in the U.S. increased by 13,000 to 277,000 from 264,000 in the previous week. Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 67th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 45,000 to 2,157,000 in the week ended June 04.

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Yahoo! (YHOO) upgraded to Buy at Citigroup

Downgrades:

Other:

UnitedHealth (UNH) initiated with an Outperform at Bernstein

Amazon (AMZN) target raised to $820 from $800 at Pacific Crest

-

14:38

Foreign investors purchase C$15.52 billion of Canadian securities in April

Statistics Canada released foreign investment figures on Thursday. Foreign investors purchased C$15.52 billion of Canadian securities in April, after an investment of C$17.05 billion in March. March's figure was revised down from C$17.17 billion.

The investment was led by debt instruments.

Canadian investors added C$4.67 billion of foreign securities in March, mainly debt instruments.

-

13:17

WSE: Mid session comment

The morning phase in Warsaw indicates that below 1,750 points there is no sellers. For several days the market sends a signal that the existing levels of supply may not start the downward wave. With no doubt, it helps a similar arrangement on the core markets, where the German DAX recovered some of the losses. In the case of the DAX helps encounter with 9,500 points. In the context of relatively easy stabilization in the region of 1,750 points it is worth noting that the contract for the US S&P500 index lost barely 0.2 percent. If investors in the US sustain this relatively small decline, in the second half of the session we may see a upward pressure from the environment, which will facilitate for the bulls a higher close.

The absolute leader of decrease in companies from the WIG20 index is now Orange Polska (WSE: OPL; -2.98%). The fall below the minimum of several years is a sign of great weakness of that shares and of course promises to attack of the level of PLN 5,00 in the near future.

At 13:00 (Warsaw time) the WIG20 index was at 1,747 points (-1.47%) and achieved the turnover of PLN 166 mln.

-

12:09

European stock markets mid session: stocks traded lower on uncertainty over Britain's membership in the European Union

Stock indices traded lower on uncertainty over Britain's membership in the European Union (EU). According to the latest polls, the majority of Britons would support Britain's exit from the European Union (EU).

Market participants also eyed the economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.4% in May, exceeding expectations for a 0.3% gain, after a flat reading in April.

On a yearly basis, Eurozone's final consumer price inflation increased to -0.1% in May from -0.2% in April, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in May, rents increased by 0.07%, tobacco rose by 0.07%, fuel prices for transport declined by 0.53%, heating oil prices decreased by 0.20%, while gas prices were down by 0.13%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 0.8% in May from 0.7 in April, in line with the preliminary reading.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 0.9% in May, exceeding expectations for a 0.2% gain, after a 1.9% rise in April. April's figure was revised up from a 1.3% increase.

The increase was mainly driven by a rise in clothing and footwear.

Food sales were up 1.1% in May, while non-food store sales increased 0.7%.

On a yearly basis, retail sales in the U.K. jumped 6.0% in May, beating forecasts of a 3.9% increase, after a 5.2% rise in April. April's figure was revised up from a 4.3% gain.

The Bank of England (BoE) is scheduled to release its interest rate decision at 11:00 GMT. Analysts expect the central bank to keep its monetary policy unchanged.

Current figures:

Name Price Change Change %

FTSE 100 5,935.14 -31.66 -0.53 %

DAX 9,534.01 -72.70 -0.76 %

CAC 40 4,148.53 -23.05 -0.55 %

-

12:04

Swiss National Bank keeps its rates steady at -0.75% in March, but it upgrades its economic inflation forecasts

The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed.

The SNB noted that the Swiss franc was still significantly overvalued.

Inflation was upgraded to -0.4% in 2016 from the previous forecast of -0.8%. The central bank expects inflation to be 0.3% in 2017, up from the previous forecast of 0.1%.

The upward revision was driven by a recent rise in oil prices.

The central bank noted that global economy was expected to expand moderately over the coming quarters, adding the referendum on Britain's membership in the European Union was a risk to the outlook.

The SNB expects the Swiss economy to grow between 1% and 1.5%, unchanged from its previous estimate.

-

11:55

State Secretariat for Economic Affairs keeps unchanged its GDP forecasts for 2016 and 2017

The State Secretariat for Economic Affairs (SECO) released its GDP and inflation forecasts on Thursday. The agency kept unchanged its growth forecasts at 1.4% in 2016 and 1.8% in 2017.

"There is still uncertainty about the potential recovery that may occur during the rest of 2016 and in 2017 in those sectors which have suffered heavily from the weak European economy and strong Swiss franc over the past few years," the SECO said.

The agency noted that the referendum on Britain's membership in the European Union was also a risk to the Swiss economy.

The average annual unemployment rate is expected to be 3.6% this year and 3.5% next year.

The consumer price inflation is expected to be -0.4% in 2016, up from the previous estimate of -0.6%, and +0.3% in 2017, up from the previous estimate of 0.2%.

-

11:46

The Bank of Japan Governor Haruhiko Kuroda: the inflation target will be reached by March 2018

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Thursday that Japan's economy was expanding moderately like a trend. He pointed out that inflation was picking up toward 2% target, which will be reached by March 2018.

-

11:26

UK retail sales climb 0.9% in May

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 0.9% in May, exceeding expectations for a 0.2% gain, after a 1.9% rise in April. April's figure was revised up from a 1.3% increase.

The increase was mainly driven by a rise in clothing and footwear.

Food sales were up 1.1% in May, while non-food store sales increased 0.7%.

On a yearly basis, retail sales in the U.K. jumped 6.0% in May, beating forecasts of a 3.9% increase, after a 5.2% rise in April. April's figure was revised up from a 4.3% gain.

-

11:20

Eurozone's harmonized consumer price index rises 0.4% in May

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.4% in May, exceeding expectations for a 0.3% gain, after a flat reading in April.

On a yearly basis, Eurozone's final consumer price inflation increased to -0.1% in May from -0.2% in April, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in May, rents increased by 0.07%, tobacco rose by 0.07%, fuel prices for transport declined by 0.53%, heating oil prices decreased by 0.20%, while gas prices were down by 0.13%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 0.8% in May from 0.7 in April, in line with the preliminary reading.

-

11:12

The Fed keeps its interest rate unchanged in June

The Fed released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed reviewed its interest rate forecasts. The Fed said at its June monetary policy meeting that interest rate will be 0.90% by the end of the year, down from 1.00% in March, 1.6% in 2017, down from 1.9% in March.

Only two members of the Federal Open Market Committee (FOMC) expect two or more interest rate hikes this year, down from 7 in March. 6 members expect only one interest rate hike in 2016, up from 1 in March.

The Fed said in its statement that the job creation slowed, while the economy was picking up.

The Fed cut its growth and inflation forecasts. The U.S. economy is expected to expand 2.0% this year, down from the previous estimate of 2.2%, and 2.0% in 2017, down from the previous estimate of 2.1%.

-

10:55

The Bank of Greece expects Greece’s economy to contract by 0.3% this year

The Bank of Greece said in its monetary policy report on Wednesday that Greece's economy was expected to contract by 0.3% this year, after contracting by 0.5% in the first quarter. But the central bank expects the economy to rebound in the second half of the year due to the latest tranche from the bailout programme.

The Bank of Greece noted that that the country's creditors should lower their targets for primary budget surplus for 2018 to 2% from 3.5%.

-

10:45

Bank of Japan keeps its interest rate unchanged at -0.1% in June

The Bank of Japan (BoJ) released its interest rate decision on Thursday. The central bank kept its interest rate unchanged at -0.1% as widely expected by analysts. The monetary base target remained unchanged at 275 trillion yen, while the central bank said that it will expand its monetary base at an annual pace of 80 trillion yen as expected by analysts.

The BoJ said that the country's economy continued to recover moderately, but exports and production were sluggish due to the slowdown in emerging economies.

The central bank expect inflation to be slightly negative or about 0% for the time being.

-

10:23

Australia's unemployment rate remains unchanged at 5.7% in May

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate remained unchanged at 5.7% in May, in line with expectations.

The number of employed people in Australia increased by 17,900 in May, beating forecast of a rise by 15,000, after a gain by 900 in April. April's figure was revised down from a rise by 10,800.

Full-time employment was flat in May, while part-time employment climbed by 17,900.

The participation rate remained unchanged at 64.8% in May.

-

10:14

New Zealand's economy expanded at 0.7% in the first quarter

Statistics New Zealand released its GDP data on late Wednesday evening. New Zealand's GDP rose 0.7% in the first quarter, exceeding expectations for a 0.5% increase, after a 0.9% gain in the fourth quarter.

The increase was driven mainly by a rise in construction.

The overall services sector rose 0.8% in the first quarter, construction climbed 4.9%, while the manufacturing sector declined 0.4%.

On a yearly basis, New Zealand's GDP climbed by 2.8% in the first quarter, beating expectations for a 2.6% growth, after a 2.3% rise in the first quarter.

-

09:13

WSE: After opening

The WIG20 futures (WSE: FW20M16) began the day with a strong bang down in the reaction of the morning's declines in core markets. As for the reasons for falls, we may actually talk about their accumulation. After yesterday's declines at the end of the US session, which are more the result of fear about Brexit (the Fed was neutral yesterday), today the Bank of Japan decided to suspend the existing scale of quantitative easing. In response, we have a large appreciation of the yen and more than 3 percent of the Nikkei index fall. This mix will now excuse for the sell-off of risky assets markets.

WIG20 index opened at 1758.15 points (-0.83%)*

WIG 44438.79 -1.06%

WIG30 1946.32 -1.43%

mWIG40 3416.69 -0.40%

*/ - change to previous close

The WIG20 opened with gap, which throws index in the region of the June lows, and after three days of defense the support, demand side must seek again the arguments for raising prices.

-

08:22

WSE: Before opening

Yesterday's FOMC Statement and Janet Yellen conference seem to be without significance. Both the publication of the communicate and opinions of Ms. Yellen did not cause serious reactions on equity markets. US Federal Reserve merely confirmed what the markets have been known long before, in the present context there is simply no place for a quick increase in interest rates, and monetary policy depends on macroeconomic data, which forces the Fed to postpone increases until the data will allow to raise the price of loans. At the end of trading the S&P500 went from the region of 2,080 pts. in the region of 2,070 pts., which means decline by 0.18 percent. Both the scale of changes, and the lack of strong movements in key trading hours indicate that the market was not surprised at any point.

Currently the contract for the S&P500 is traded in the red, which may mean a return to the scenario of declines that have taken place during the previous session. That is why Europe should start the day with slight withdrawal. In the following hours investor's attention will attract Brexit issue again, which becomes the main theme of the market till 23 of June.

From the perspective of the Warsaw market, yesterday's FOMC Statement can be considered as positive for emerging markets and indirectly for the WSE and the Polish zloty. Unfortunately, Brexit generates risk aversion, and such events are always manifested by supply on markets like Warsaw. Yesterday the defense by the WIG20 the 1,750 points level allows us to look with optimism in the coming days, although it may not be forgotten that approaching the third Friday of the month and the day of settlement of contracts on the WIG20. In short, to the volatility of the markets generated by Brexit and reactions to the Fed statement should be also added the volatility, which will appear tomorrow in the final hour of the session. The whole is not conducive to long-term scenario plotting and today the market should focus on reproducing movements of the underlying markets.

-

07:16

Global Stocks

Stocks across Europe finished higher Wednesday as investors took on risk after five straight days of losses and ahead of the Federal Reserve's monetary-policy decision.

The search for safety has been driven in part by a series of opinion polls showing support for a "Brexit" in the June 23 referendum on whether the U.K. should leave the European Union.

U.S. stocks relinquished modest gains and closed lower on Wednesday, stretching a losing streak to five days, as investors weighed the Federal Reserve's decision to delay rate increases.

The Fed acknowledged that hiring slowed and that business fixed investment was soft and signaled a slower approach on raising borrowing costs.

Asian stocks turned lower on Thursday and the yen surged after the Bank of Japan refrained from taking further stimulus steps, hours after the Federal Reserve's own review had struck a cautious note on its policy outlook.

The BOJ kept monetary policy steady and stuck to its optimistic view of the economy on Thursday, even as renewed yen rises and slumping stock prices threaten to derail a fragile economic recovery.

While the BOJ's decision did not come as a big surprise, expectations that the central bank will take action next month increased. But for now uncertainty over whether Britain will vote to quit the European Union is strengthening the yen because of the Japanese currency's safe-haven status.

-

00:31

Stocks. Daily history for Jun 15’2016:

(index / closing price / change items /% change)

Nikkei 225 15,919.58 +60.58 +0.38 %

Hang Seng 20,467.52 +79.99 +0.39 %

Shanghai Composite 2,887.21 +45.02 +1.58 %

FTSE 100 5,966.8 +43.27 +0.73 %

CAC 40 4,171.58 +41.25 +1.00 %

Xetra DAX 9,606.71 +87.51 +0.92 %

S&P 500 2,071.5 -3.82 -0.18 %

NASDAQ Composite 4,834.93 -8.62 -0.18 %

Dow Jones 17,640.17 -34.65 -0.20 %

-