Noticias del mercado

-

17:08

Bank of England's Monetary Policy Committee June minutes: the BoE warns about the consequences in case of Britain’s exit from the European Union

The Bank of England's Monetary Policy Committee (MPC) released its June meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged.

The consumer price inflation in the U.K. was 0.3% in May, below the central bank's 2% target. The BoE noted that inflation was driven by a drop in energy and food prices, adding that this effect would dissipate over the next year.

The central bank warned about the consequences in case of the country's exit from the European Union (EU). According to the central bank, the possible Britain's exit from the EU was the largest risk to UK financial markets global financial markets.

The central bank said that Britain's economy slowed in the first quarter and was expected to decelerate in the second quarter as uncertainty around Britain's membership in the European Union (EU) weighed on the economy.

The BoE noted that the domestic private sector remained resilient, while consumer confidence was robust.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles".

The BoE also said that the referendum was the main risk to the outlook.

"A vote to leave the EU could materially alter the outlook for output and inflation, and therefore the appropriate setting of monetary policy. Households could defer consumption and firms delay investment, lowering labour demand and causing unemployment to rise. Through financial market and confidence channels, there are also risks of adverse spill-overs to the global economy," the central bank noted.

-

16:44

Swiss National Bank Chairman Thomas Jordan: the SNB will intervene in the foreign exchange market if needed

The Swiss National Bank (SNB) Chairman Thomas Jordan said in a press conference on Thursday that the central bank would intervene in the foreign exchange market if needed. He pointed out that the franc remained significantly overvalued.

Jordan noted that the Swiss economy was expanding moderately this year.

The SNB chairman also said that the SNB would monitor the results of the referendum on Britain's membership in the European Union, and it would act if needed.

"Next week's UK referendum on whether to remain in the EU may cause uncertainty and turbulence to increase. We will be monitoring the situation closely and will take measures if required," Jordan noted.

-

16:27

New motor vehicle sales in Australia slide 1.1% in May

The Australian Bureau of Statistics released its new motor vehicle sales data on Thursday. New motor vehicle sales in Australia slid 1.1% in May, after a 1.9% drop in April. April's figure was revised up from a 2.5% fall.

Sales of passenger vehicles declined 3.0% in May, sales of sports utility vehicles were up 1.4%, while sales of other vehicles plunged 1.7%.

On a yearly basis, new motor vehicle sales climbed 1.7% in May, after a 2.8% increase in April. April's figure was revised up from a 2.4% rise.

-

16:21

MI consumer inflation expectations in Australia increase to 3.5% in June

The Melbourne Institute (MI) released its inflation expectations for Australia on Thursday. The MI consumer inflation expectations in Australia increased to 3.5% in June from 3.2% in May.

69.3% respondents expected inflation to decline within the 0‐5% range in June, up from 68.3% in April.

-

16:10

NAHB housing market index rises to 60 in June

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Thursday. The NAHB housing market index increased to 60 in June from 58 in May, exceeding expectations for an increase to 59.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index climbed to 47 in June from 44 in April, the current sales conditions sub-index rose to 64 from 63, while the sub-index measuring sales expectations in the next six months increased to 70 from 65.

"Builders in many markets across the nation are reporting higher traffic and more committed buyers at their job sites," the NAHB Chairman Ed Brady.

"Rising home sales, an improving economy and the fact that the HMI gauge measuring future sales expectations is running at an eight-month high are all positive factors indicating that the housing market should continue to move forward in the second half of 2016," the NAHB Chief Economist Robert Dietz said.

-

16:00

U.S.: NAHB Housing Market Index, June 60 (forecast 59)

-

15:56

Greek unemployment rate increases to 24.9% in the first quarter

The Hellenic Statistical Authority released its labour market data for Greece on Thursday. The Greek unemployment rate increased to 24.9% in the first quarter from 24.4% in the fourth quarter.

The number of unemployed people rose by 1.7% in the first quarter from the previous quarter.

The youth unemployment rate was up to 50.9% in the first quarter from 49.0% in the fourth quarter.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 473m) 1.1075 (241m) 1.1200 (413m) 1.1250 (309m) 1.1280 (243m) 1.1300 (428m) )

USD/JPY 105.00 (USD 400m) 106.00 (USD 450m) 106.65 (310m) 107.00 (450m) 108.00 (415m)

GBP/USD 1.4000 (GBP 1.06bln) 1.4050 (1.33bln) 1.4200 (365m) 1.4300 (278m) 1.4350-55 (415m)

EUR/GBP 0.7720 (EUR 200m) 0.7930 (297m) 0.8000 (215m)

USD/CHF 0.9740 (USD 250m)

AUD/USD 0.7270 (AUD 370m) 0.7300 (392m) 0.7425 (399m) 0.7450 (333m) 0.7500 (221m)

NZD/USD 0.6950 (NZD 200m)

USD/CAD 1.3140 (356m)

-

15:08

Bank of England keeps its interest rate on hold at 0.5% in June

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

15:06

Philadelphia Federal Reserve Bank’s manufacturing index climbs to 4.7 in June

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to 4.7 in June from -1.8 in May.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Firms responding to the Manufacturing Business Outlook Survey reported little growth this month. Though the indicator for general activity was positive in June, other broad indicators continued to reflect general weakness in business conditions," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index fell to -2.1 in June from -0.5 in May.

The new orders index decreased to -3.0 in June from -1.9 in May.

The prices paid index rose to 23.0 in June from 15.7 in May, while the prices received index slid to 3.9 from 14.8.

The number of employees index was down to -10.9 in June from -3.3 in May.

According to the report, the future general activity index fell to 29.8 in June from 36.1 in May.

-

14:58

U.S. consumer price inflation rises 0.2% in May

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation rose 0.2% in May, missing expectations for a 0.3% gain, after a 0.4% increase in April.

The index was mainly driven by higher energy prices, which climbed 1.2% in May.

Shelter costs climbed 0.4% in May, medical care costs were up 0.3%, while food prices decreased 0.2%.

On a yearly basis, the U.S. consumer price index decreased to 1.0% in May from 1.1% in April. Analysts had expected the index to rise 1.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in May, in line with expectations, after a 0.2% increase in April.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 2.2% in May from 2.1% in April, in line with forecasts.

The consumer price index is not preferred Fed's inflation measure.

-

14:46

Initial jobless claims rise to 277,000 in the week ending June 11

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 11 in the U.S. increased by 13,000 to 277,000 from 264,000 in the previous week. Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 67th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 45,000 to 2,157,000 in the week ended June 04.

-

14:38

Foreign investors purchase C$15.52 billion of Canadian securities in April

Statistics Canada released foreign investment figures on Thursday. Foreign investors purchased C$15.52 billion of Canadian securities in April, after an investment of C$17.05 billion in March. March's figure was revised down from C$17.17 billion.

The investment was led by debt instruments.

Canadian investors added C$4.67 billion of foreign securities in March, mainly debt instruments.

-

14:31

U.S.: Continuing Jobless Claims, June 2157 (forecast 2120)

-

14:31

U.S.: CPI excluding food and energy, m/m, May 0.2% (forecast 0.2%)

-

14:31

Canada: Foreign Securities Purchases, April 15.52

-

14:30

U.S.: CPI, Y/Y, May 1% (forecast 1.1%)

-

14:30

U.S.: CPI, m/m , May 0.2% (forecast 0.3%)

-

14:30

U.S.: Current account, bln, Quarter I -124.7 (forecast -125)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, May 2.2% (forecast 2.2%)

-

14:30

U.S.: Initial Jobless Claims, June 277 (forecast 270)

-

14:30

U.S.: Philadelphia Fed Manufacturing Survey, June 4.7

-

14:23

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the Bank of England's interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) May -1.9% Revised From -2.5% -1.1%

01:30 Australia New Motor Vehicle Sales (YoY) May 2.8% Revised From 2.4% 1.7%

01:30 Australia RBA Bulletin

01:30 Australia Unemployment rate May 5.7% 5.7% 5.7%

01:30 Australia Changing the number of employed May 0.9 Revised From 10.8 15 17.9

02:30 Australia RBA Assist Gov Lowe Speaks

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275 275

06:30 Japan BOJ Press Conference

07:30 Switzerland SNB Interest Rate Decision -0.75% -0.75% -0.75%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:00 Eurozone ECB Economic Bulletin

08:30 United Kingdom Retail Sales (MoM) May 1.9% Revised From 1.3% 0.2% 0.9%

08:30 United Kingdom Retail Sales (YoY) May 5.2% Revised From 4.3% 3.9% 6%

09:00 Eurozone Harmonized CPI May 0% 0.3% 0.4%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May -0.2% -0.1% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) May 0.7% 0.8% 0.8%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

11:00 United Kingdom Bank of England Minutes

11:00 United Kingdom Asset Purchase Facility 375 375 375

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 6,000 to 270,000 last week.

The U.S. consumer price inflation is expected to remain unchanged at 1.1% year-on-year in May.

The U.S. consumer price index excluding food and energy is expected to increase to 2.2% year-on-year in May from 2.1% in April.

The euro traded lower against the U.S. dollar. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.4% in May, exceeding expectations for a 0.3% gain, after a flat reading in April.

On a yearly basis, Eurozone's final consumer price inflation increased to -0.1% in May from -0.2% in April, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in May, rents increased by 0.07%, tobacco rose by 0.07%, fuel prices for transport declined by 0.53%, heating oil prices decreased by 0.20%, while gas prices were down by 0.13%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 0.8% in May from 0.7 in April, in line with the preliminary reading.

The British pound traded lower against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected. All members voted to keep the central bank's monetary policy unchanged.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 0.9% in May, exceeding expectations for a 0.2% gain, after a 1.9% rise in April. April's figure was revised up from a 1.3% increase.

The increase was mainly driven by a rise in clothing and footwear.

Food sales were up 1.1% in May, while non-food store sales increased 0.7%.

On a yearly basis, retail sales in the U.K. jumped 6.0% in May, beating forecasts of a 3.9% increase, after a 5.2% rise in April. April's figure was revised up from a 4.3% gain.

The Swiss franc traded lower against the U.S. dollar. The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed. The SNB noted that the Swiss franc was still significantly overvalued.

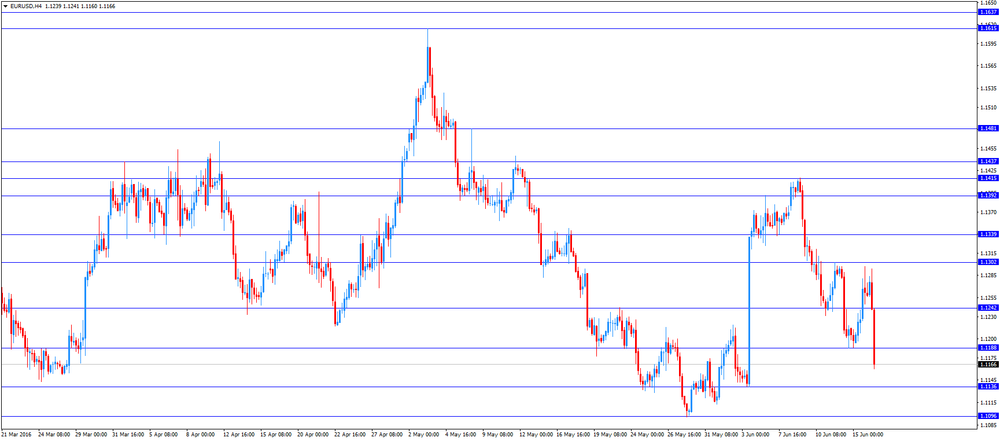

EUR/USD: the currency pair declined to $1.1160

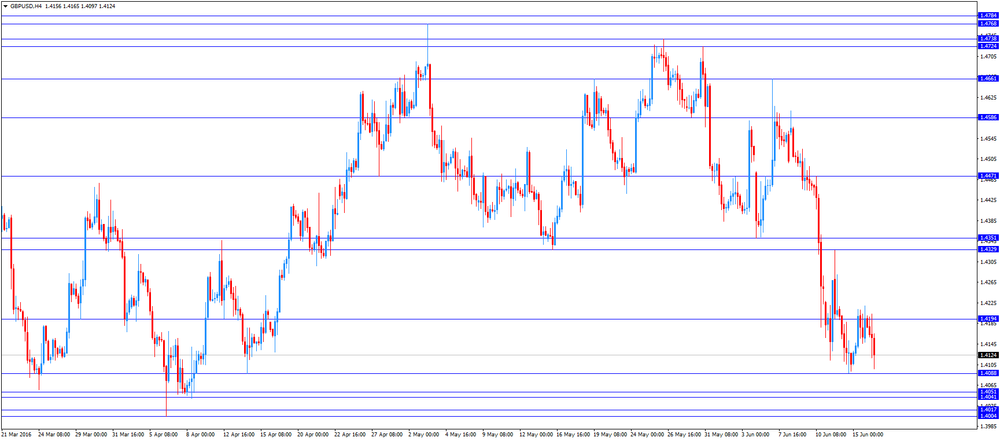

GBP/USD: the currency pair fell to $1.4097

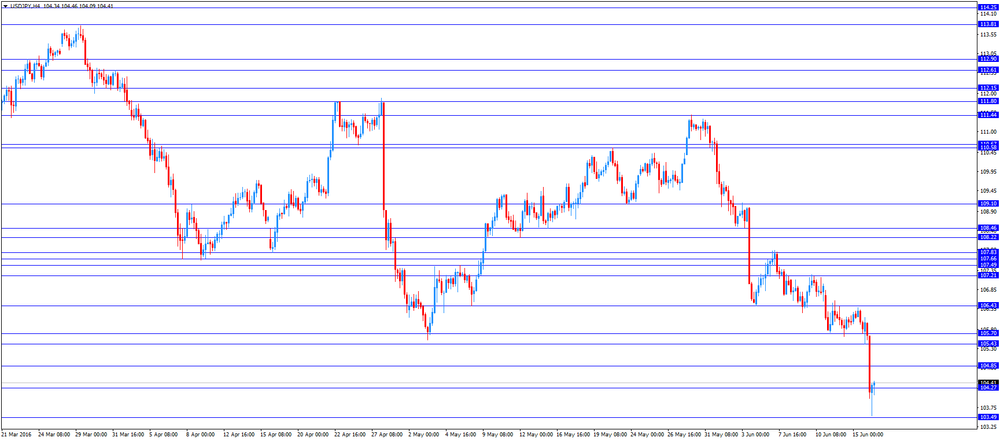

USD/JPY: the currency pair rose to Y104.46

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases April 17.17

12:30 U.S. Current account, bln Quarter I -125.3 -125

12:30 U.S. Philadelphia Fed Manufacturing Survey June -1.8

12:30 U.S. Initial Jobless Claims June 264 270

12:30 U.S. CPI, m/m May 0.4% 0.3%

12:30 U.S. CPI, Y/Y May 1.1% 1.1%

12:30 U.S. CPI excluding food and energy, m/m May 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May 2.1% 2.2%

14:00 U.S. NAHB Housing Market Index June 58 59

20:00 United Kingdom BOE Gov Mark Carney Speaks

22:30 New Zealand Business NZ PMI May 56.5

-

13:59

Orders

EUR/USD

Offers 1.1300 1.1320 1.1355-60 1.1400 1.1420 1.1450 1.1480 1.1500

Bids 1.1250 1.1235 1.1220 1.1200 1.1185 1.1170-75 1.1150 1.1135 1.1100

GBP/USD

Offers 1.4180 1.4200 1.4220-25 1.4250 1.4275-80 1.4300 1.4320 1.4355-60 1.4380 1.4400

Bids 1.4120 1.4100 1.4085 1.4065 1.4050 1.4030-35 1.4000 1.3985 1.3950

EUR/GBP

Offers 0.7980-85 0.8000 0.8020-25 0.8050

Bids 0.7930 0.7900 0.7885 0.7865 0.7850 0.7820 0.7800

EUR/JPY

Offers 117.80 118.00 118.50 118.80 119.00 119.55-60 119.85 120.00

Bids 116.80 116.50 116.00 115.50 115.00

USD/JPY

Offers 104.50 104.75-80 105.00 105.30-35 105.50 105.80 106.00 106.50 106.85 107.00

Bids 104.00 103.75 103.50 103.25 103.00 102.75-80 102.50

AUD/USD

Offers 0.7400 0.7420-25 0.7450 0.7485 0.7500 0.7520 0.7550

Bids 0.7320-25 0.7300 0.7285 0.7270 0.7250

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

13:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

12:04

Swiss National Bank keeps its rates steady at -0.75% in March, but it upgrades its economic inflation forecasts

The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed.

The SNB noted that the Swiss franc was still significantly overvalued.

Inflation was upgraded to -0.4% in 2016 from the previous forecast of -0.8%. The central bank expects inflation to be 0.3% in 2017, up from the previous forecast of 0.1%.

The upward revision was driven by a recent rise in oil prices.

The central bank noted that global economy was expected to expand moderately over the coming quarters, adding the referendum on Britain's membership in the European Union was a risk to the outlook.

The SNB expects the Swiss economy to grow between 1% and 1.5%, unchanged from its previous estimate.

-

11:55

State Secretariat for Economic Affairs keeps unchanged its GDP forecasts for 2016 and 2017

The State Secretariat for Economic Affairs (SECO) released its GDP and inflation forecasts on Thursday. The agency kept unchanged its growth forecasts at 1.4% in 2016 and 1.8% in 2017.

"There is still uncertainty about the potential recovery that may occur during the rest of 2016 and in 2017 in those sectors which have suffered heavily from the weak European economy and strong Swiss franc over the past few years," the SECO said.

The agency noted that the referendum on Britain's membership in the European Union was also a risk to the Swiss economy.

The average annual unemployment rate is expected to be 3.6% this year and 3.5% next year.

The consumer price inflation is expected to be -0.4% in 2016, up from the previous estimate of -0.6%, and +0.3% in 2017, up from the previous estimate of 0.2%.

-

11:46

The Bank of Japan Governor Haruhiko Kuroda: the inflation target will be reached by March 2018

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Thursday that Japan's economy was expanding moderately like a trend. He pointed out that inflation was picking up toward 2% target, which will be reached by March 2018.

-

11:26

UK retail sales climb 0.9% in May

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 0.9% in May, exceeding expectations for a 0.2% gain, after a 1.9% rise in April. April's figure was revised up from a 1.3% increase.

The increase was mainly driven by a rise in clothing and footwear.

Food sales were up 1.1% in May, while non-food store sales increased 0.7%.

On a yearly basis, retail sales in the U.K. jumped 6.0% in May, beating forecasts of a 3.9% increase, after a 5.2% rise in April. April's figure was revised up from a 4.3% gain.

-

11:20

Eurozone's harmonized consumer price index rises 0.4% in May

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.4% in May, exceeding expectations for a 0.3% gain, after a flat reading in April.

On a yearly basis, Eurozone's final consumer price inflation increased to -0.1% in May from -0.2% in April, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in May, rents increased by 0.07%, tobacco rose by 0.07%, fuel prices for transport declined by 0.53%, heating oil prices decreased by 0.20%, while gas prices were down by 0.13%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 0.8% in May from 0.7 in April, in line with the preliminary reading.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, May 0.8% (forecast 0.8%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, May -0.1% (forecast -0.1%)

-

11:00

Eurozone: Harmonized CPI, May 0.4% (forecast 0.3%)

-

10:55

The Bank of Greece expects Greece’s economy to contract by 0.3% this year

The Bank of Greece said in its monetary policy report on Wednesday that Greece's economy was expected to contract by 0.3% this year, after contracting by 0.5% in the first quarter. But the central bank expects the economy to rebound in the second half of the year due to the latest tranche from the bailout programme.

The Bank of Greece noted that that the country's creditors should lower their targets for primary budget surplus for 2018 to 2% from 3.5%.

-

10:45

Bank of Japan keeps its interest rate unchanged at -0.1% in June

The Bank of Japan (BoJ) released its interest rate decision on Thursday. The central bank kept its interest rate unchanged at -0.1% as widely expected by analysts. The monetary base target remained unchanged at 275 trillion yen, while the central bank said that it will expand its monetary base at an annual pace of 80 trillion yen as expected by analysts.

The BoJ said that the country's economy continued to recover moderately, but exports and production were sluggish due to the slowdown in emerging economies.

The central bank expect inflation to be slightly negative or about 0% for the time being.

-

10:30

United Kingdom: Retail Sales (MoM), May 0.9% (forecast 0.2%)

-

10:30

United Kingdom: Retail Sales (YoY) , May 6% (forecast 3.9%)

-

10:23

Australia's unemployment rate remains unchanged at 5.7% in May

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate remained unchanged at 5.7% in May, in line with expectations.

The number of employed people in Australia increased by 17,900 in May, beating forecast of a rise by 15,000, after a gain by 900 in April. April's figure was revised down from a rise by 10,800.

Full-time employment was flat in May, while part-time employment climbed by 17,900.

The participation rate remained unchanged at 64.8% in May.

-

10:14

New Zealand's economy expanded at 0.7% in the first quarter

Statistics New Zealand released its GDP data on late Wednesday evening. New Zealand's GDP rose 0.7% in the first quarter, exceeding expectations for a 0.5% increase, after a 0.9% gain in the fourth quarter.

The increase was driven mainly by a rise in construction.

The overall services sector rose 0.8% in the first quarter, construction climbed 4.9%, while the manufacturing sector declined 0.4%.

On a yearly basis, New Zealand's GDP climbed by 2.8% in the first quarter, beating expectations for a 2.6% growth, after a 2.3% rise in the first quarter.

-

10:01

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 473m) 1.1075 (241m) 1.1200 (413m) 1.1250 (309m) 1.1280 (243m) 1.1300 (428m) )

USD/JPY 105.00 (USD 400m) 106.00 (USD 450m) 106.65 (310m) 107.00 (450m) 108.00 (415m)

GBP/USD 1.4000 (GBP 1.06bln) 1.4050 (1.33bln) 1.4200 (365m) 1.4300 (278m) 1.4350-55 (415m)

EUR/GBP 0.7720 (EUR 200m) 0.7930 (297m) 0.8000 (215m)

USD/CHF 0.9740 (USD 250m)

AUD/USD 0.7270 (AUD 370m) 0.7300 (392m) 0.7425 (399m) 0.7450 (333m) 0.7500 (221m)

NZD/USD 0.6950 (NZD 200m)

USD/CAD 1.3140 (356m)

-

09:30

Switzerland: SNB Interest Rate Decision, -0.75% (forecast -0.75%)

-

08:28

Options levels on thursday, June 16, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1425 (2026)

$1.1395 (689)

$1.1361 (71)

Price at time of writing this review: $1.1282

Support levels (open interest**, contracts):

$1.1229 (2353)

$1.1184 (1669)

$1.1127 (2387)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 36083 contracts, with the maximum number of contracts with strike price $1,1500 (5299);

- Overall open interest on the PUT options with the expiration date July, 8 is 76175 contracts, with the maximum number of contracts with strike price $1,0900 (13276);

- The ratio of PUT/CALL was 2.11 versus 2.03 from the previous trading day according to data from June, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.4433 (529)

$1.4338 (150)

$1.4243 (115)

Price at time of writing this review: $1.4162

Support levels (open interest**, contracts):

$1.4059 (3338)

$1.3963 (1048)

$1.3867 (2826)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 19634 contracts, with the maximum number of contracts with strike price $1,5000 (3163);

- Overall open interest on the PUT options with the expiration date July, 8 is 39097 contracts, with the maximum number of contracts with strike price $1,4100 (3338);

- The ratio of PUT/CALL was 1.99 versus 2.01 from the previous trading day according to data from June, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:26

Asian session: The yen rose

The dollar hit a 21-month low against the yen on Thursday as the yen surged broadly after the Bank of Japan held off from expanding its monetary stimulus.

The yen also hit multi-year highs against the euro and sterling as well as the Australian dollar, as ongoing worries that Britain may vote next week to leave the European Union dampened risk appetite, prompting investors to head for the safe-haven Japanese currency.

The greenback had already been under pressure after the U.S. Federal Reserve lowered its economic growth forecasts, cementing expectations that it will have to skip tightening next month, even as the Fed still signaled it was planning to raise rates twice this year.

Fed Chair Janet Yellen was not clear on whether a rate increase could come at the next policy meeting in late July, but investors decided that the absence of any hint meant no hike next month, with interest rate futures effectively pricing out a July rate hike.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1260-85GBP / USD: during the Asian session, the pair is trading in the range of $ 1.4060-1.4200

USD / JPY: on Asian session the pair fell to the level of Y104.00

-

04:52

Japan: BoJ Interest Rate Decision, -0.1% (forecast -0.1%)

-

03:32

Australia: New Motor Vehicle Sales (YoY) , May 1.7%

-

03:31

Australia: New Motor Vehicle Sales (MoM) , May -1.1%

-

03:31

Australia: New Motor Vehicle Sales (MoM) , May -1.1%

-

03:30

Australia: Unemployment rate, May 5.7% (forecast 5.7%)

-

03:30

Australia: Changing the number of employed, May 17.9 (forecast 15)

-

00:45

New Zealand: GDP y/y, Quarter I 2.8% (forecast 2.6%)

-

00:45

New Zealand: GDP q/q, Quarter I 0.7% (forecast 0.5%)

-

00:29

Currencies. Daily history for Jun 15’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1262 +0,50%

GBP/USD $1,4194 +0,61%

USD/CHF Chf0,9613 -0,22%

USD/JPY Y105,99 -0,02%

EUR/JPY Y119,36+0,46%

GBP/JPY Y150,44 +0,59%

AUD/USD $0,7402 +0,77%

NZD/USD $0,7036 +0,82%

USD/CAD C$1,2916 +0,40%

-

00:02

Schedule for today, Thursday, Jun 16’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia New Motor Vehicle Sales (MoM) May -2.5%

01:30 Australia New Motor Vehicle Sales (YoY) May 2.4%

01:30 Australia RBA Bulletin

01:30 Australia Unemployment rate May 5.7% 5.7%

01:30 Australia Changing the number of employed May 10.8 15

02:30 Australia RBA Assist Gov Lowe Speaks

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275

06:30 Japan BOJ Press Conference

07:30 Switzerland SNB Interest Rate Decision -0.75% -0.75%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:00 Eurozone ECB Economic Bulletin

08:30 United Kingdom Retail Sales (MoM) May 1.3% 0.2%

08:30 United Kingdom Retail Sales (YoY) May 4.3% 3.9%

09:00 Eurozone Harmonized CPI May 0% 0.3%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May -0.2% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) May 0.7% 0.8%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Bank of England Minutes

11:00 United Kingdom Asset Purchase Facility 375 375

12:30 Canada Foreign Securities Purchases April 17.17

12:30 U.S. Current account, bln Quarter I -125.3 -125

12:30 U.S. Continuing Jobless Claims June 2095 2120

12:30 U.S. Philadelphia Fed Manufacturing Survey June -1.8

12:30 U.S. Initial Jobless Claims June 264 270

12:30 U.S. CPI, m/m May 0.4% 0.3%

12:30 U.S. CPI, Y/Y May 1.1% 1.1%

12:30 U.S. CPI excluding food and energy, m/m May 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May 2.1% 2.2%

14:00 U.S. NAHB Housing Market Index June 58 59

20:00 United Kingdom BOE Gov Mark Carney Speaks

22:30 New Zealand Business NZ PMI May 56.5

-