Noticias del mercado

-

17:43

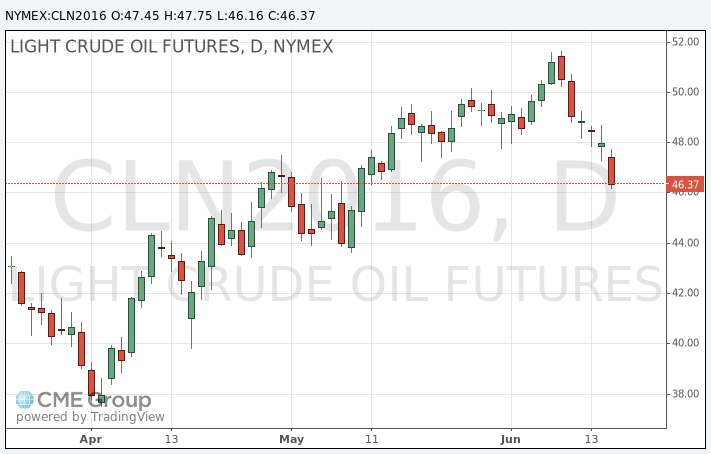

Oil at one-month low

Oil prices slumped 3 percent to hit a one-month low on Thursday, sliding a sixth straight day for the longest bear run since January, as the dollar's rally on fears of Britain's exit from the EU hammered commodities priced in the currency.

Also weighing on the oil complex were uninspiring drawdown data on U.S. crude inventories in spite of peak summer driving demand in the United States.

Brent crude futures' front-month contact was down at $47.20 per barrel.

Brent has lost about $5 a barrel, or nearly 10 percent, since the six-day slide began on June 9. Prior to that, it hit an eight-month high of nearly $53.

The front-month in U.S. crude's West Texas Intermediate (WTI) futures fell to $46.16 a barrel.

The dollar was up 0.7 percent, on track to its largest one-day gain in two months, as equity and other global markets were gripped by fear that Britain will vote in a week to leave the European Union, triggering economic slowdown on the continent and beyond.

"It is mainly risk aversion ahead of the Brexit vote next week, so we see some profit-taking on recent long positions ahead of this event," said Hans van Cleef, senior energy economist at ABN Amro in Amsterdam.

The dollar was also underpinned by hints from the Federal Reserve on Wednesday that there may be two U.S. rate hikes this year despite slower-than-expected growth. A stronger dollar makes oil and other commodities priced in the greenback less appealing to holders of the euro and other currencies.

U.S. crude inventory drawdowns over the last month have not provided much support to oil prices.

The U.S. Energy Information Administration said domestic crude inventories USOILC=ECI fell 933,000 barrels last week, less than half the 2.3-million-barrel decrease forecast.

On Thursday, market intelligence firm Genscape reported a decline of 76,317 barrels in stockpiles at the Cushing, Oklahoma delivery point for WTI futures during the week to June 14, traders who saw the data said. In the previous week to June 7, Genscape reported a drawdown of 299,058 barrels at Cushing.

"With investor positions already at a record high since the beginning of the year, they might want to reduce some of the risks," said Abhishek Deshpande, lead oil analyst at Natixis.

-

17:18

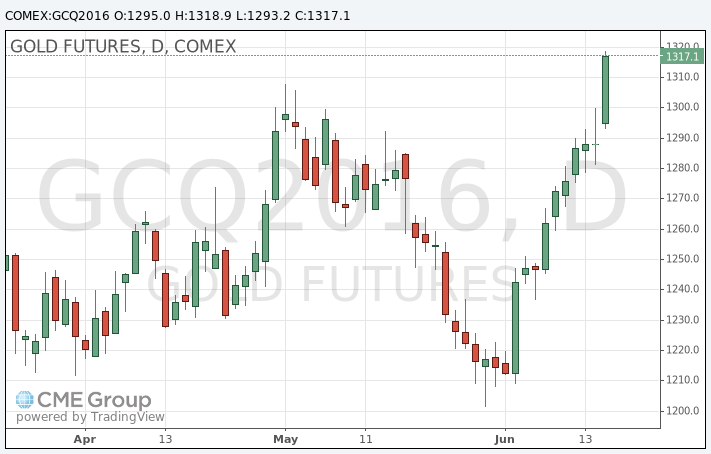

Gold surged to the highest in almost two years

Gold surged to the highest in almost two years as the outlook for low U.S. interest rates and concern that the U.K. will leave the European Union boosted demand for a haven. Base metals declined amid concerns the global economy is losing steam.

Bullion advanced for a seventh day after the Federal Reserve reined in its projection for rate increases over the next two years. Fed Chair Janet Yellen said Wednesday that the U.K.'s June 23 referendum on whether to leave the EU was a factor in holding rates steady.

With recent polls showing U.K. voters favor leaving the bloc, investors are exiting equities and piling into precious metals. Gold holdings in exchange-traded funds are at the highest since October 2013 and silver-backed funds are at a record. Prices of both metals have surged more than 23 percent this year.

The economy seems at risk because of the threat of "Brexit, a China slowdown and doubts from the Fed that the U.S. economy may be performing sub-optimally," Bart Melek, the head of commodity strategy at TD Securities in Toronto, said in a telephone interview.

The number of Fed officials who see just a single rate hike this year rose to six, from one in March. The odds of a rate increase by December have dropped to 29 percent from 76 percent at the start of this month, Fed funds futures show. Low borrowing costs boost the appeal of owning precious metals, which don't pay interest.

Gold will rally if Britons choose to exit the EU, reaching $1,350 within a week of the vote, according to a survey of traders and analysts. Should a majority choose to remain in the bloc, bullion might slide to $1,250, it showed.

Gold futures for August delivery rose to $1,318.90 an ounce on the Comex in New York, after touching the highest since August 2014. The metal headed for a seventh day of gains, the longest stretch since March 2015.

-

14:46

Initial jobless claims rise to 277,000 in the week ending June 11

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 11 in the U.S. increased by 13,000 to 277,000 from 264,000 in the previous week. Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 67th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 45,000 to 2,157,000 in the week ended June 04.

-

11:12

The Fed keeps its interest rate unchanged in June

The Fed released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed reviewed its interest rate forecasts. The Fed said at its June monetary policy meeting that interest rate will be 0.90% by the end of the year, down from 1.00% in March, 1.6% in 2017, down from 1.9% in March.

Only two members of the Federal Open Market Committee (FOMC) expect two or more interest rate hikes this year, down from 7 in March. 6 members expect only one interest rate hike in 2016, up from 1 in March.

The Fed said in its statement that the job creation slowed, while the economy was picking up.

The Fed cut its growth and inflation forecasts. The U.S. economy is expected to expand 2.0% this year, down from the previous estimate of 2.2%, and 2.0% in 2017, down from the previous estimate of 2.1%.

-

00:32

Commodities. Daily history for Jun 15’2016:

(raw materials / closing price /% change)

Oil 47.64 -0.77%

Gas 2.59 -0.19%

-