Noticias del mercado

-

17:39

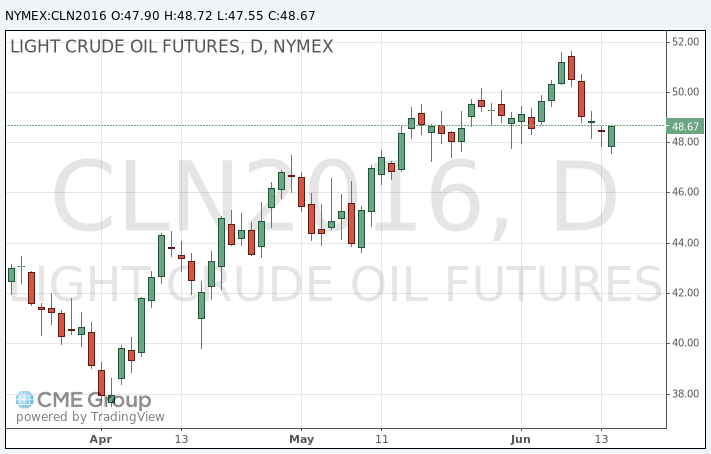

Oil futures settled lower

Oil futures settled lower Wednesday, pressured by concerns over global energy demand following disappointing U.S. economic data and ahead of the U.K. referendum scheduled for next week.

A modest weekly decline in U.S. crude supplies and the Federal Reserve's decision to stand pat on interest rates failed to offer much support for prices.

July West Texas Intermediate crude fell 48 cents, or 1%, to settle at $48.01 a barrel on the New York Mercantile Exchange, marking a fifth session decline in a row. The August contract for Brent lost 86 cents, or 1.7%, at $48.97 a barrel.

WTI oil futures had fallen below $48, but pared losses and saw a brief tick higher after the U.S. Energy Information Administration reported that U.S. crude supplies fell by 900,000 barrels for the week ended June 10. That contradicted the 1.2 million-barrel increase reported by the American Petroleum Institute late Tuesday, but still came in short of the 1.4 million-barrel decline expected by analysts polled by S&P Global Platts.

"The headline crude-oil number was less bullish than expected, but not as bearish as the API number-so basically a wash," Tyler Richey.

About a half-hour before WTI prices settled, the Fed announced that it would leave interest rates unchanged and it adopted a dovish stance on the outlook for monetary policy.

"The revisions to the 'dot plot' within the FOMC release that showed 6 members now only expect one rate hike in 2016," up from just one member at the last meeting, said Richey. That "was a dovish development and we are seeing the dollar correct lower as a result."

'Uncertainties about the health of the U.S. economy is the reason for the dollar weakness. That isn't necessarily a bullish thing for oil from a demand standpoint.'

"Traditionally, a weaker dollar would be supportive of oil prices, but…uncertainties about the health of the U.S. economy is the reason for the dollar weakness. That isn't necessarily a bullish thing for oil from a demand standpoint," he said.

-

17:27

New loans in China rise to 985.5 billion yuan in May

The People's Bank of China (PBoC) released its new loans data on Wednesday. New loans in local currency in China were 985.5 billion yuan in May, up from April's 555.6 billion yuan.

M2 money supply jumped by 11.8% year-on-year in May.

Total social financing increased to 146.33 trillion yuan in May from 751 billion yuan in April.

-

17:20

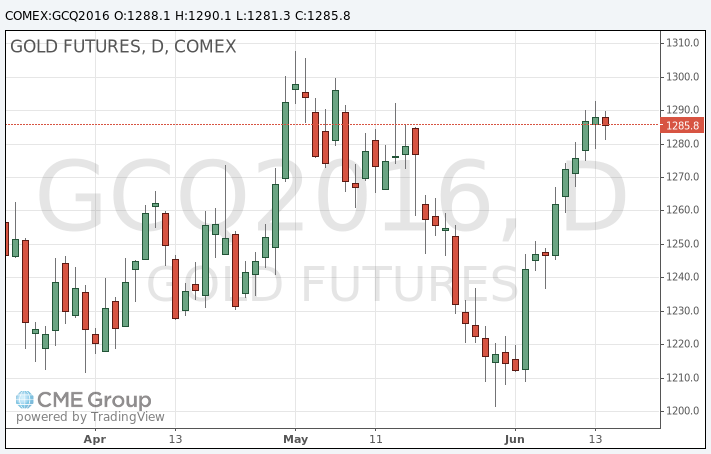

Gold fell

Gold has been billed as a 'wonder investment' in portfolios: apparently it can help protect against inflation or deflation, political, financial or economic chaos and much more besides, so it's no wonder that we're seeing interest in this commodity soar at the moment as investors find themselves in a moment of political turbulence on both sides of the Atlantic.

However, some caution is warranted here. Odysseus famously plugged his crew's ears with beeswax and had himself strapped to the mast to resist the call of the sirens. I would simply suggest that gold should occupy no more than low single digits in percentage terms as a proportion of your total investible assets - calls to hold significantly more, no matter how honeyed the voices, should be strongly resisted.

Perhaps the most alluring part of gold's story right now seems to be its role as a safe port in the storm. In a world seemingly beset with more than usual levels of monetary, economic and political uncertainty, gold, with its thousands of years of practice as a store of value, seems to shine brightly as an investment prospect.

Most would agree that a safe asset should have a relatively stable value during times of market stress. If we assume that such times tend to see equity markets fall sharply, gold's historical record over the long run is far from perfect on this count.

Even without that blemished relative record, investors should be wary of havens where the price has jumped around so dramatically - even when just viewed over the past five years. Nonetheless, if enough investors believe gold to be a haven then it may well act as one.

Some argue that gold is not for protection against expected changes in inflation, but rather the unexpected. This is more difficult to weigh, as the tricky procedure of decomposing inflation into its expected and unexpected components is more art than science. However, based on some (admittedly crude) empirical work, the long-run relationship between gold and unexpected inflation looks entirely unremarkable.

One area where there is an undeniably strong relationship is between gold and real bond yields.

-

17:09

U.S. crude inventories fall by 0.9 million barrels to 531.5 million in the week to June 10

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 0.9 million barrels to 531.5 million in the week to June 10.

Analysts had expected U.S. crude oil inventories to decline by 2.27 million barrels.

Gasoline inventories decreased by 2.63 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 904,000 barrels.

U.S. crude oil imports decreased by 83,000 barrels per day.

Refineries in the U.S. were running at 90.2% of capacity, down from 90.9% the previous week.

Oil production declined to 8.716 million barrels a day last week from 8.745 million barrels a day in the previous week.

-

10:23

Morgan Stanley: oil prices could drop toward $30 a barrel due to the global oil oversupply

Morgan Stanley said on Tuesday that oil prices could drop toward $30 a barrel due to the global oil oversupply. The lender noted that the recent rise in oil prices was led by a lower oil output, mainly driven by supply disruptions in Canada and Nigeria. According to Morgan Stanley, the global supply could rise as outages are likely to fade, inventories are still high, and the U.S. supply could increase due to higher current oil prices.

-

00:33

Commodities. Daily history for Jun 14’2016:

(raw materials / closing price /% change)

Oil 47.90 -1.22%

Gold 1,288.50 +0.03%

-