Noticias del mercado

-

19:22

The International Energy Agency’s (IEA) monthly Oil Market Report: the oil market will rebalance in the second half of the year

The International Energy Agency (IEA) released its monthly Oil Market Report on Tuesday. The agency said that the oil market would rebalance in the second half of the year.

The IEA noted that global oil supply decreased by 950,000 barrels a day to averaged 95.4 million barrels a day in May compared with May 2015.

The agency upgraded its global oil demand forecast for 2016 by 100,000 barrels a day to 96.1 million barrels a day.

According to the IEA, OPEC production decreased by 110,000 barrels a day to 32.61 million barrels a day in May compared with the previous month. The increase was driven by higher output from Iran, Iraq and the United Arab Emirates.

Iran's rose by 80,000 barrels a day to 3.64 million barrels in May. It was the highest level since June 2011.

The IEA expects non-OPEC output to drop by 900,000 barrels a day to 56.8 million barrels in 2016.

-

17:40

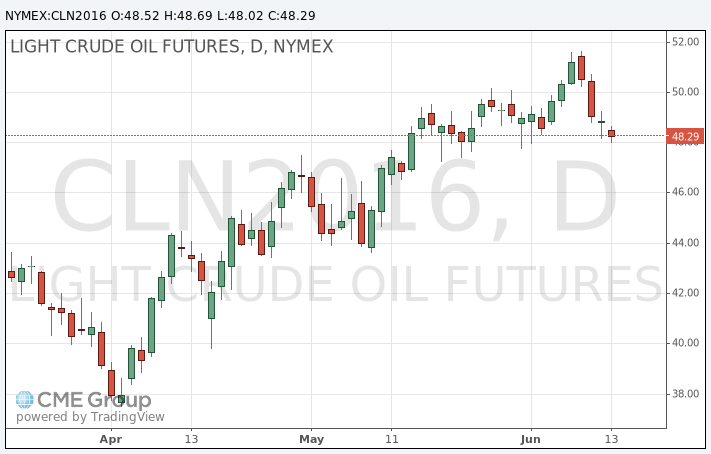

Oil prices fell

Oil prices fell Tuesday, pushed lower for the fourth consecutive day as market sentiment continued to turn, despite a bullish report from the International Energy Agency.

The global benchmark, Brent, was trading down 1.4% at $49.66 a barrel midmorning in London. Its U.S. counterpart, West Texas Intermediate, was down 1.6% at $48.09 a barrel.

The International Energy Agency on Tuesday revised its demand forecast upward for this year by 100,000 barrels a day, to 1.3 million barrels a day from 1.2 million barrels a day. The demand will be led by emerging markets in India and China as the manufacturing industry grows, the report said.

The IEA also released its first demand forecast for 2017, for 1.3 million barrels a day.

But the body warned that should supply be restored in Nigeria and Canada there could be a dip in prices. Nigerian output fell 250,000 barrels a day to 1.37 million barrels a day in June, levels not seen in almost 30 years.

Gains to demand were limited as the IEA indicated that supply was strong from elsewhere in the world. Oil output in Kuwait and the United Arab Emirates was up in May by 120,000 barrels a day and 70,000 barrels a day, respectively.

Despite the report, market bullishness is dissipating as U.S. production shows signs of recovering. Late on Monday, the U.S.-based Genscape Inc. tipped a 525,000-barrel increase in U.S. crude stockpiles in the week ended June 10. Last Friday, Baker Hughes Inc. reported the number of rigs drilling for oil in the U.S. rose for the second-straight week.

"The worry is that when prices reach $60 a barrel, we will see new investments in shale exploration," Barnabas Gan, an economist at OCBC said.

The American Petroleum Institute will release fresh estimates Tuesday on the level of U.S. crude stocks, which could send prices tumbling further if it predicts a significant stock build.

Also hurting prices, financial markets have had a higher sense of risk aversion in the lead-up to Britain's referendum on leaving the European Union, known as "Brexit," on June 23.

"Oil prices are unable to ignore this negative market sentiment, especially since the majority of speculative financial investors are continuing to bet on climbing oil prices," said the Germany-based Commerzbank.

According to some analysts, in the scenario that Britain leaves the EU, the British pound will likely take a hit and the greenback will appreciate. As oil trading is conducted in dollars, a strong dollar usually bodes badly for those who trade in foreign currencies.

-

17:22

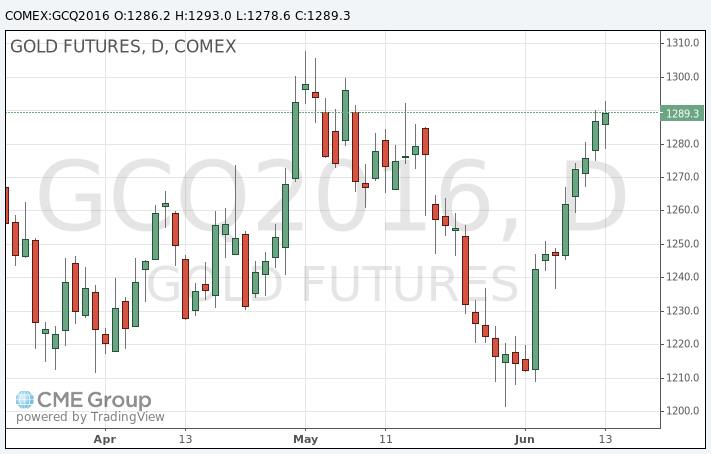

Gold turned lower

Gold futures turned lower on Tuesday, with prices struggling to hold ground near their highest level in five weeks.

Gold futures had been catching a strong bid as investors sought the relative safety of haven assets ahead of next week's "Brexit" referendum and a tandem of closely watched central-bank meetings.

Gold for August delivery shed $1.50, or 0.1%, to $1,285.40 an ounce.

Worries remained heightened that a U.K. referendum on European Union membership-set for June 23 and expected to be fully tallied on June 24-will result in a British exit from the bloc, and potentially stir uncertainty in the market. European stocks fell for a fifth straight day on Tuesday, while bonds were in demand, driving yields on the 10-year German bund into negative territory for the first time ever. U.S. stocks traded mostly lower.

"We have focused on the vote and its potential impact on markets, but we have not factored in potentially devastating set of 'ripple' effects," said Julian Phillips, founder of and contributor to GoldForecaster.com.

Those include the possibility of heavy outflows of capital from Britain and its effects on the euro and the impact on global growth, he said. "The scene is gold-positive and, consequently, silver-positive," said Phillips.

This week, the U.S.'s Federal Open Market Committee and Bank of Japan are holding interest-rate policy meetings that could impact precious-metals trading. The Federal Reserve isn't expected to announce any change in key policy in its statement Wednesday but it could lay some groundwork for future action. Higher interest rates tend to push up the dollar and cut the appeal of nonyielding assets including gold.

U.S. retail sales data may give the Fed more reason to lean toward a rate increase. Sales at U.S. retailers rose a solid 0.5% in May after an even larger gain in the prior month.

"The Fed frequently makes an impact on the gold market in the short term and is important for traders to focus on, but long-term [gold] owners are better served ignoring Fed noise and focusing on gold's important benefits as a diversification," said Mark O'Byrne, research director at GoldCore.

"The 'no hike' is likely being priced in but we could see gold hit the $1,300 level, prior to a correction on the way to the next level of resistance at $1,400," he said.

Over in Japan, central-bank officials could work to talk down yen when they meet Wednesday and Thursday, as a stronger home currency hurts exports.

"Japanese Finance Minister Taro Aso delivered another round of currency intervention warnings, signaling that quick and speculative movements in the FX market may warrant a response," Pissouros noted.

Pissouros said Aso will closely watch the Brexit referendum given its potential impact on global markets.

-

00:30

Commodities. Daily history for Jun 13’2016:

(raw materials / closing price /% change)

Oil 48.56 -0.65%

Gold 1,286.80 -0.01%

-