Noticias del mercado

-

17:40

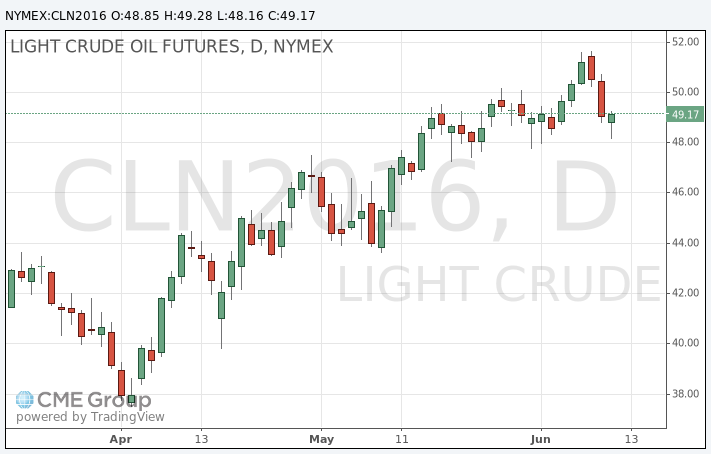

Oil prices wavered between losses and gains

Oil futures wavered between losses and gains on Monday, as a second-straight weekly rise in the U.S. oil-rig count pointed to a possible uptick in production.

Recently weak economic data and the coming Brexit vote in the U.K. and Federal Reserve meeting on monetary policy also raised concerns about a potential slowdown in crude demand, but a decline in the U.S. dollar offered some support for dollar-denominated oil prices.

Baker Hughes Inc. said late Friday the number of rigs drilling for oil in the U.S. rose by three in the week ended June 10, the second straight weekly increase.

"While the actual increase is minuscule compared to the 1,000+ rigs that have come offline in the past 18 months, it allows for speculation about the stabilization of U.S. crude production and the potential rebound," said Daniel Holder, commodity analyst at Schneider Electric. "The market since Thursday has taken this speculation as bearish, since the oversupplied global market will take longer to rebalance if U.S. shale production returns."

The U.S. Energy Information Administration will release its monthly update on U.S. shale output later Monday. Last month, it forecast a decline of 113,000 barrels a day to about 4.8 million barrels a day in June.

"There signs that U.S. oil producers are beginning to drill for crude again now that prices have recovered to around $50 a barrel," said Fawad Razaqzada, chief technical analyst at Forex.com and City Index, referring to the latest rig-count data.

"This is something that we have repeatedly warned about in recent weeks as oil prices surged higher," he said in a note Monday. "Although the oil rally could still go north of $60 and reach even $70, this serves as a reminder that the global supply glut is unlikely to be eradicated completely any time soon."

Oil prices have also suffered on the back of "risk aversion," said Razaqzada.

He said that investors are "spooked about the prospects of a U.K. exit from the [European Union], the economic impact of a potential U.S. rate rise this summer, and renewed demand concerns out of China."

The Fed will issue a statement on monetary policy on Wednesday. The U.K., meanwhile, will hold a Brexit vote on June 23.

Analysts say given the lackluster U.S. jobs report last month, central bankers will likely keep interest rates where they are. The weaker-than-expected jobs data also raised worries that demand will weaken.

Changes in the interest rates have an impact on the U.S. dollar, and thus also on dollar-denominated commodities such as oil. On Monday, the ICE U.S. Dollar Index inched lower, providing support for oil.

On the New York Mercantile Exchange, July West Texas Intermediate crude edged up by 2 cents to $49.09 a barrel following a gain of roughly 0.9% last week.

August Brent crude fell 3 cents to trade at $50.57 a barrel on London's ICE Futures exchange, after briefly falling below $50 a barrel for the first time in a week.

-

17:20

Gold rose

Gold prices on Monday hit levels not seen in weeks, as investors sought safety in the precious metal, prompted by nervousness around the Brexit referendum and a pair of high-profile central bank meetings.

Prices rose as investors piled into the yen, with the dollar USDJPY, -0.57% off about 1% against the Japanese currency. A stronger dollar makes assets pegged to the greenback, such as gold, less attractive to buyers purchasing with other monetary units.

Worries that a U.K. referendum in European Union membership, set for June 23, will result in a British exit from the bloc were churning afresh on Monday. Stocks in Europe SXXP, -1.29% dropped to two-month lows. In Asia, the sea of red was led by a 3.5% drop for the Nikkei 225 index NIK, -3.51%

The Federal Open Market Committee and Bank of Japan both meet this week, though the Federal Reserve isn't expected to announce any change in key policy in its statement Wednesday.

Analysts at Commerzbank said in a note to clients on Monday that gold has "recouped all of the losses it had suffered following the publication of the minutes of the last meeting of the U.S. Federal Reserve." The analysts said a further decline in government bond yields is also helping support gold.

Gold for August delivery rose $11, or 0.9%, to $1,286.90 an ounce, on the heels of booking its second-weekly gain in a row last week.

-

17:03

OPEC’s monthly report: OPEC’s output declines in May

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Monday. OPEC's output declined by 100,000 barrels per day (bpd) to 32.36 million bpd in May, according to the report. The decline was driven by lower output from Nigeria, Venezuela and Iraq.

Supply from non-OPEC members is expected to fall by 740,000 bpd in 2016 compared to the last year, while the U.S. oil output is expected to decline by 420,000 bpd.

Global oil demand is expected to climb by 1.20 million bpd in 2016, unchanged from April, OPEC noted.

OPEC noted that the oil market would rebalance by the end of the year.

"The expected improvement in global economic conditions should result in a more balanced oil market toward the end of the year," OPEC said.

-

11:51

Foreign direct investment inflows in China fall by an annual rate of 1.0% in May

China's Ministry of Commerce released its foreign direct investment (FDI) data on Monday. Foreign direct investment inflows in China fell to $8.89 billion in May, down 1.0% from a year earlier. It was the first fall since December 2015.

FDI climbed 3.8% year-over-year to $54.19 billion in the January-May period.

Investment in the manufacturing sector slid 3.2% the January-May period, while foreign investment in the services sector climbed 7% in the January-May period.

-

10:23

The number of active U.S. oil rigs rises by 3 to 328 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. oil rigs rose by 3 to 328 last week. It was the second consecutive rise.

The number of gas rigs increased by 3 to 85.

Combined oil and gas rigs climbed by 6 to 414.

-

10:11

China’s industrial production increases 6.0% year-on-year in May

The National Bureau of Statistics said on Monday that China's industrial production increased 6.0% year-on-year in May, exceeding expectations for a 5.9% rise, after a 6.0% gain in April.

On a monthly base, the country's industrial production was up 0.45% in May, after a 0.47% rise in April.

Fixed-asset investment in China climbed 9.6% year-on-year in the January - May period, missing forecasts for a 10.5% growth, after a 10.5% rise in the January - April period.

Retail sales in China increased 10.0% year-on-year in May, missing expectations for a 10.1% gain, after a 10.1% rise in April.

On a monthly base, retail sales increased 0.76% in May, after a 0.80% gain in April.

-

00:46

Commodities. Daily history for Jun 10’2016:

(raw materials / closing price /% change)

Oil 48.88 -0.39%

Gold 1,276.30 +0.03%

-