Noticias del mercado

-

22:15

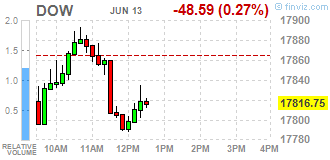

U.S. stocks dropped

U.S. stocks dropped, with the S&P 500 Index falling to a three-week low, as investors wavered amid a pair of coming central-bank events and Britain's vote on European Union membership that have sowed anxiety.

Equities swung between gains and losses before a retreat accelerated as European stocks closed at their lowest in almost four months. A measure of volatility posted the biggest two-day jump since a selloff last August. Raw-material, industrial and technology shares fell the most, losing more than 1.1 percent. LinkedIn Corp. soared 47 percent after Microsoft Corp. said it's buying the company in a deal valued at $26.2 billion. Microsoft sank 2.6 percent.

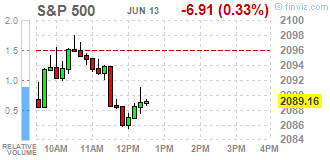

The S&P 500 fell 0.8 percent to 2,079.14 at 4 p.m. in New York, marking the longest losing streak in a month and the worst three days of losses since Feb. 9.

As evidence of increasing worry, the CBOE Volatility Index surged more than 20 percent Monday, the most since December and the biggest back-to-back jump since Aug. 24, the day last summer's swoon bottomed. A preference for safety was also apparent today as U.S. Treasuries extended a rally to a fifth day, the longest since February.

Recent declines have signaled a shift in sentiment after as much as $3.3 trillion was added to equities since mid-February. Investors are reassessing the rally amid lackluster economic growth and concerns about the potential fallout from a June 23 referendum that will determine Britain's membership in the European Union.

Also keeping investors on edge is the Federal Reserve's monetary policy review on Wednesday, despite no change predicted for interest rates. Based on Fed funds futures prices, traders don't see at least even odds for a rate increase before February. The Bank of Japan also has a policy meeting scheduled this week.

-

21:00

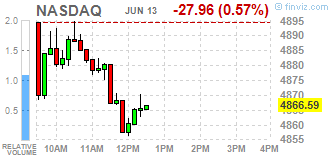

DJIA 17786.21 -79.13 -0.44%, NASDAQ 4864.29 -30.26 -0.62%, S&P 500 2085.92 -10.15 -0.48%

-

18:34

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes little changed on Monday, a day before the Federal Reserve commences its policy meeting. The U.S. Federal Reserve Open Market Committee (FOMC) will meet on Tuesday and Wednesday to decide when to raise interest rates for the second time in nearly a decade.

Most all of Dow stocks in negative area (23 of 30). Top looser - Microsoft Corporation (MSFT, -2,88%). Top gainer - Exxon Mobil Corporation (XOM, +0,91%).

All S&P sectors in negative area. Top looser - Conglomerates (-1,0%).

At the moment:

Dow 17720.00 -56.00 -0.32%

S&P 500 2079.25 -8.00 -0.38%

Nasdaq 100 4427.25 -30.75 -0.69%

Oil 48.83 -0.24 -0.49%

Gold 1286.40 +10.50 +0.82%

U.S. 10yr 1.61 -0.03

-

18:00

European stocks close: stocks closed lower on uncertainty over Britain’s membership in the EU

Stock closed lower on uncertainty over Britain's membership in the European Union (EU). According to the ORB poll for The Independent on Friday, 55% of respondents would support Britain's exit from the EU, while 45% of respondents would vote for the campaign "Remain". ORB surveyed 2,000 people.

The European Central Bank (ECB) Governing Council member Jens Weidmann said on Monday that there was no need for more stimulus measures, adding that the current stimulus measures needed more time to take effect.

"The current monetary environment requires no further easing," he said.

Weidmann noted that the ECB's quantitative easing was appropriate as inflation was low. But he pointed out that the risks and side effects of the stimulus measures would rise over time.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,044.97 -70.79 -1.16 %

DAX 9,657.44 -177.18 -1.80 %

CAC 40 4,227.02 -79.70 -1.85 %

-

18:00

European stocks closed: FTSE 6059.64 -56.12 -0.92%, DAX 9657.44 -177.18 -1.80%, CAC 4240.24 -66.48 -1.54%

-

17:43

WSE: Session Results

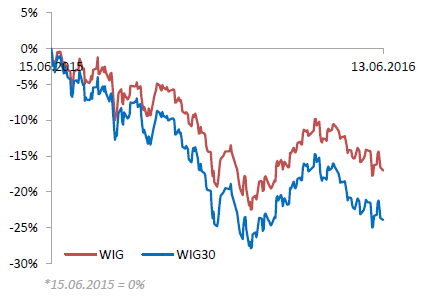

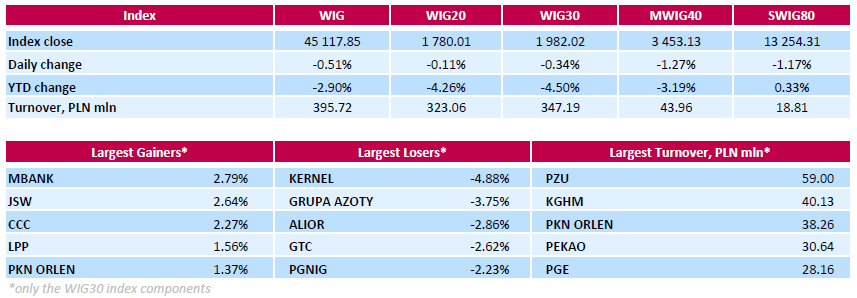

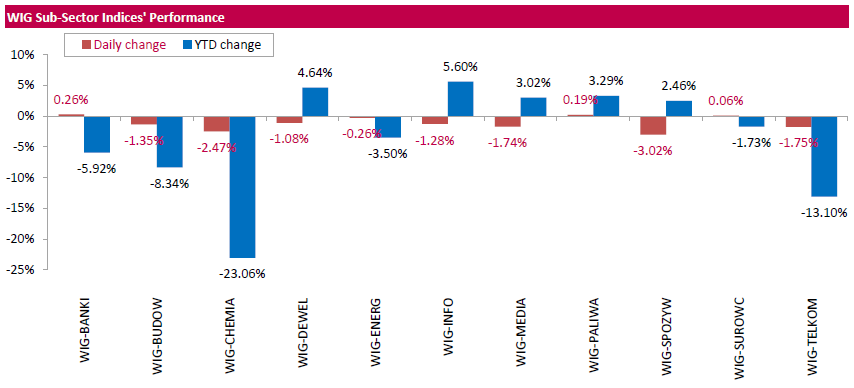

Polish equity market closed lower on Monday. The broad market measure, the WIG index, lost 0.51%. Except for banking sector (+0.26%), oil and gas (+0.19%) and materials (+0.06%), every sector in the WIG Index declined, with food sector (-3.02%) lagging behind.

The large-cap benchmark, the WIG30 Index, fell by 0.34%. Within the index components, agricultural producer KERNEL (WSE: KER) was the worst-performing name, tumbling by 4.88%. The other notable losers were chemical producer GRUPA AZOTY (WSE: ATT), bank ALIOR (WSE: ALR) and property developer GTC (WSE: GTC), which plunged by 3.75%, 2.86% and 2.62% respectively. On the other side of the ledger, bank MBANK (WSE: MBK), coking coal miner JSW (WSE: JSW) and footwear retailer CCC (WSE: CCC) topped the advancers list, gaining 2.79%, 2.64% and 2.27% respectively.

-

17:29

U.K. leading economic index is flat in April

The Conference Board (CB) released its leading economic index for the U.K. on Monday. The leading economic index (LEI) was flat in April, after a flat reading in March.

The coincident index rose 0.3% in April, after a 0.1% decline in March.

-

16:50

Fitch Ratings affirms UK’s sovereign debt rating at 'AA+'

Fitch Ratings has affirmed UK's sovereign debt rating at 'AA+' on Friday. The outlook is stable.

"The UK's ratings benefit from a high-income, diversified and flexible economy. The credible macroeconomic policy framework and sterling's international reserve currency status further support the ratings," Fitch said in its statement.

The agency noted that it believed Britain's exit from the European Union (EU) would have only a moderate negative on the UK's outlook.

The agency expects the French economy to expand 1.9% in 2016 and 2.0% in 2017.

-

16:43

European Central Bank purchases €17.73 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €17.73 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.49 billion of covered bonds, and €131 million of asset-backed securities.

The central bank purchased €348 million of corporate bonds on June 08.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion.

-

15:58

WSE: After start on Wall Street

Thursday's session on Wall Street was a warning that being close by the S&P500 to the all time record level causes market uncertainty. Friday brought no response, but the market reaction indicates that the majority does not share the belief in the possibility of overcome the 2,134 points. Today and tomorrow we should, however, expect some form of sedation that will be associated with the anticipation of the Wednesday's FOMC statement.

Poor posture of European markets, decline on Wall Street and the weakening of the zloty, it is not a blend, on which investors may build growth, but the daily chart of the WIG20 constantly indicates that at current levels we may see the balance between supply and demand. Technical context favors bulls. Support being in the region of 1,750 points could provoke market to rebound.

-

15:32

U.S. Stocks open: Dow -0.28%, Nasdaq -0.47%, S&P -0.31%

-

15:26

Before the bell: S&P futures -0.32%, NASDAQ futures -0.59%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 16,019.18 -582.18 -3.51%

Hang Seng 20,512.99 -529.65 -2.52%

Shanghai Composite 2,832.51 -94.65 -3.23%

FTSE 6,064.31 -51.45 -0.84%

CAC 4,241.93 -64.79 -1.50%

DAX 9,692.61 -142.01 -1.44%

Crude $48.46 (-1.24%)

Gold $1289.10 (+1.03%)

-

15:16

Fitch Ratings affirms France’s sovereign debt rating at 'AA'

Fitch Ratings has affirmed France's sovereign debt rating at 'AA' on Friday. The outlook is stable.

"France's ratings balance a wealthy and diversified economy, track record of relative macro-financial stability, strong and effective civil and social institutions with a high general government debt/GDP ratio and fiscal deficit," Fitch said in its statement.

The agency expects the French economy to expand 1.4% in 2016 and 2017.

Fitch expects France's government deficit to decline to 3.3% of GDP in 2016 and 2.9% in 2017 from 3.6% in 2015.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.44

-0.05(-0.5269%)

29569

ALTRIA GROUP INC.

MO

65.56

-0.005(-0.0076%)

3098

Amazon.com Inc., NASDAQ

AMZN

715.9

-2.01(-0.28%)

26137

American Express Co

AXP

64.36

-0.61(-0.9389%)

100

Apple Inc.

AAPL

98.24

-0.59(-0.597%)

140511

AT&T Inc

T

40.26

-0.07(-0.1736%)

3085

Barrick Gold Corporation, NYSE

ABX

20.26

0.65(3.3146%)

164077

Chevron Corp

CVX

101.44

-0.54(-0.5295%)

2801

Cisco Systems Inc

CSCO

28.92

-0.11(-0.3789%)

4050

Citigroup Inc., NYSE

C

43.45

-0.45(-1.0251%)

28353

Exxon Mobil Corp

XOM

89.52

-0.46(-0.5112%)

1070

Facebook, Inc.

FB

116.01

-0.61(-0.5231%)

217023

Ford Motor Co.

F

13.07

-0.03(-0.229%)

65415

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.34

-0.02(-0.193%)

67099

General Electric Co

GE

29.92

-0.12(-0.3995%)

39550

General Motors Company, NYSE

GM

28.88

-0.18(-0.6194%)

9777

Goldman Sachs

GS

148.92

-0.97(-0.6471%)

3199

Google Inc.

GOOG

717

-2.41(-0.335%)

1028

HONEYWELL INTERNATIONAL INC.

HON

115.89

-0.79(-0.6771%)

450

Intel Corp

INTC

31.93

-0.11(-0.3433%)

8207

International Business Machines Co...

IBM

151.7

-0.67(-0.4397%)

209

International Paper Company

IP

42.88

-0.30(-0.6948%)

100

Johnson & Johnson

JNJ

117

-0.01(-0.0085%)

950

JPMorgan Chase and Co

JPM

63.5

-0.34(-0.5326%)

4885

Merck & Co Inc

MRK

56.35

-0.00(-0.00%)

278

Microsoft Corp

MSFT

49.9

-1.58(-3.0692%)

1055180

Nike

NKE

54.93

-0.18(-0.3266%)

5487

Pfizer Inc

PFE

35.09

-0.20(-0.5667%)

4880

Starbucks Corporation, NASDAQ

SBUX

54.67

-0.195(-0.3554%)

2453

Tesla Motors, Inc., NASDAQ

TSLA

220.69

1.90(0.8684%)

27221

The Coca-Cola Co

KO

45.6

-0.04(-0.0876%)

2053

Travelers Companies Inc

TRV

112

-1.81(-1.5904%)

180

Twitter, Inc., NYSE

TWTR

14.58

0.56(3.9943%)

1058607

Verizon Communications Inc

VZ

52.5

-0.17(-0.3228%)

1452

Visa

V

79.37

-0.81(-1.0102%)

17589

Walt Disney Co

DIS

96.99

-0.35(-0.3596%)

4692

Yahoo! Inc., NASDAQ

YHOO

36.63

-0.20(-0.543%)

9388

Yandex N.V., NASDAQ

YNDX

21.8

-0.04(-0.1832%)

1450

-

14:48

Fitch Ratings affirms Japan's sovereign debt rating at 'A' but downgrades the outlook to negative

Fitch Ratings has affirmed Japan's sovereign debt rating at 'A' on Monday. The outlook has been lowered to negative from stable.

The downgrade was driven by the delay of the scheduled consumption tax rise.

"The Outlook revision primarily reflects Fitch's decreased confidence in the Japanese authorities' commitment to fiscal consolidation," Fitch said.

-

13:24

WSE: Mid session comment

At the beginning of the morning part of the quotations on the Warsaw parquet appeared to be quite a familiar image, means, after the low opening the demand side had trouble with the departure from this level. In such situations, time works to the disadvantage of the demand side, that is, the longer fails to initiate the approach, the more grow the chances of developing repricing. The market could not stand the pressure and after the mWIG and the sWIG reached new levels of intraday minima the WIG20 joined this group too. Among the components of the WIG20 index on a particularly negative mention deserves PZU, where the decline has exceeded 3.5% and this stocks are also the leader of turnover.

Over the time, the level of activity steadily decreased, and in mid-session the WIG20 index was at the level of 1,770 points (-0,64%) and with the turnover a bit less than PLN 150 mln.

-

12:03

European stock markets mid session: stocks traded lower on uncertainty over Britain’s membership in the EU

Stock indices traded lower on uncertainty over Britain's membership in the European Union (EU). According to the ORB poll for The Independent on Friday, 55% of respondents would support Britain's exit from the EU, while 45% of respondents would vote for the campaign "Remain". ORB surveyed 2,000 people.

The European Central Bank (ECB) Governing Council member Jens Weidmann said on Monday that there was no need for more stimulus measures, adding that the current stimulus measures needed more time to take effect.

"The current monetary environment requires no further easing," he said.

Weidmann noted that the ECB's quantitative easing was appropriate as inflation was low. But he pointed out that the risks and side effects of the stimulus measures would rise over time.

Current figures:

Name Price Change Change %

FTSE 100 6,084.01 -31.75 -0.52 %

DAX 9,708.32 -126.30 -1.28 %

CAC 40 4,244.94 -61.78 -1.43 %

-

11:59

European Central Bank Governing Council member Jens Weidmann: there is no need for more stimulus measures

The European Central Bank (ECB) Governing Council member Jens Weidmann said on Monday that there was no need for more stimulus measures, adding that the current stimulus measures needed more time to take effect.

"The current monetary environment requires no further easing," he said.

Weidmann noted that the ECB's quantitative easing was appropriate as inflation was low. But he pointed out that the risks and side effects of the stimulus measures would rise over time.

-

11:51

Foreign direct investment inflows in China fall by an annual rate of 1.0% in May

China's Ministry of Commerce released its foreign direct investment (FDI) data on Monday. Foreign direct investment inflows in China fell to $8.89 billion in May, down 1.0% from a year earlier. It was the first fall since December 2015.

FDI climbed 3.8% year-over-year to $54.19 billion in the January-May period.

Investment in the manufacturing sector slid 3.2% the January-May period, while foreign investment in the services sector climbed 7% in the January-May period.

-

11:44

Japan’s business survey index (BSI) of manufacturers' sentiment drops to -11.1 in the second quarter

Japan's Ministry of Finance and the Cabinet Office released its quarterly survey on late Sunday evening. The business survey index (BSI) of manufacturers' sentiment dropped to -11.1 in the second quarter from -7.9 in first quarter.

The BSI for manufacturers in the third quarter of 2016 is expected to rise to 7.0.

-

11:05

OECD: the European Central Bank should keep its quantitative easing over the coming two years

The Organization for Economic Cooperation and Development (OECD) said on Friday that the European Central Bank (ECB) should keep its quantitative easing over the coming two years.

"In fact, explicitly accepting that inflation could go beyond 2% over the next two years without triggering a tightening of monetary policy could make monetary policy more effective at influencing expectations, which is crucial when interest rates are at the zero lower bound," OECD said.

-

10:37

ORB poll for The Independent: 55% of respondents would support Britain’s exit from the EU

According to the ORB poll for The Independent on Friday, 55% of respondents would support Britain's exit from the EU, while 45% of respondents would vote for the campaign "Remain".

ORB surveyed 2,000 people.

-

10:11

China’s industrial production increases 6.0% year-on-year in May

The National Bureau of Statistics said on Monday that China's industrial production increased 6.0% year-on-year in May, exceeding expectations for a 5.9% rise, after a 6.0% gain in April.

On a monthly base, the country's industrial production was up 0.45% in May, after a 0.47% rise in April.

Fixed-asset investment in China climbed 9.6% year-on-year in the January - May period, missing forecasts for a 10.5% growth, after a 10.5% rise in the January - April period.

Retail sales in China increased 10.0% year-on-year in May, missing expectations for a 10.1% gain, after a 10.1% rise in April.

On a monthly base, retail sales increased 0.76% in May, after a 0.80% gain in April.

-

09:13

WSE: After opening

After weak Friday's session on the markets and today's continuation of these moods during the Asian session, futures on the WIG20 (WSE: FW20M16) began a new week of decline of approx. 0.8%.

WIG20 index opened at 1770.85 points (-0.63%)*

WIG 44965.76 -0.84%

WIG30 1969.80 -0.95%

mWIG40 3472.42 -0.72%

*/ - change to previous close

In the first seconds of trading prevails, of course, solid red, as was already indicated by the futures market already. The advantage of this situation is at least that the initial deviation activates some turnover among the WIG20 components, where it was customary origins of Monday's session were very lazy. The leaders of trading are KGH, PZU, PKO and PGE. This means that we slowly begin to have at hand the minima from the beginning of June and, in theory, demand should try a little more actively defend them.

-

08:20

WSE: Before opening

Friday's session on Wall Street ended with no surprises. The US market fell in the first minutes of the session and till the end of the day there was no new content. Reasons for the decline in US stock prices were largely the same as in Europe. The decline in profitability of debt and capital flight to "safe havens", rising of the dollar and falling of oil prices.

Currently we see decline in trading of futures on the S&P500, which will have it's significance for openings in Europe. We constantly see the pressure on the currency market, where overestimated are EURUSD and USDJPY pairs - classical behavior when the stock markets appear aversion to the risk. Asian markets show a clear decline, the Nikkei index is currently falling more than 3 percent.

The price of oil also drops , but important for the WIG20 and KGHM, the price of copper recorded strong growth, associated with the defense of the contracts the psychological barrier of 200 US cents per pound. All of the morning mixture is declining and this should translate into the red beginning of the day in Europe.

-

07:01

Global Stocks

European stocks sold off Friday, hobbled by sharp declines in bank and commodity shares, while investors flocked to the fixed-income market.

Bank stocks were under pressure as concerns about the industry's profitability returned to the fore. Bond yields hitting record lows world-wide highlighted those concerns On Wednesday, the European Central Bank started purchasing corporate bonds, although bank bonds are excluded from the program.

U.S. stocks closed lower Friday, with only blue chips holding onto slight gains for the week, as anxiety over a possible exit of the U.K. from the European Union and a drop in oil prices weighed on markets. The Dow Jones Industrial Average DJIA, -0.67% fell 119.85 points, or 0.7%, to close at 17,865.34, for a weekly gain of 0.3%. The S&P 500 Index SPX, -0.92% declined 19.41 points, or 0.9%, to finish at 2,096.07, for a loss of 0.2% on the week. The Nasdaq Composite Index COMP, -1.29% dropped 64.07 points, or 1.3%, to close at 4,894.55, for a weekly loss of 1%. Oil futures CLN6, -1.32% slipped back below $50 a barrel, settling down 3% at $49.07.

June 13 Japanese stocks stumbled to a five-week low on Monday as Brexit woes sapped risk appetite and hit equities globally.

Continuing strength in the safe-haven yen, which advanced to a one-month high versus the dollar and reached a three-year peak against the euro, added further pressure on Tokyo equities.

Global risk assets have taken a beating on growing concerns a referendum next week could push Britain out of the European Union and hurt the global economy.

Volatility is expected to remain high with the Federal Reserve and Bank of Japan holding policy meetings later this week.

Exporters suffered losses on the appreciating yen.

Panasonic Corp fell 4.4 percent, Toshiba Corp lost 5.4 percent, and Advantest Corp dropped 3.4 percent. Toyota Motor Corp and Nissan Motor Co Ltd each shed 3.2 percent.

-

04:06

Nikkei 225 16,120.22 -481.14 -2.90 %, Hang Seng 20,506.52 -536.12 -2.55 %, Shanghai Composite 2,892.46 -34.70 -1.19 %

-

00:45

Stocks. Daily history for Jun 10’2016:

(index / closing price / change items /% change)

Nikkei 225 16,601.36 -67.05 -0.40 %

Hang Seng 21,042.64 -255.24 -1.20 %

S&P/ASX 200 5,312.6 -49.34 -0.92 %

FTSE 100 6,115.76 -116.13 -1.86 %

CAC 40 4,306.72 -98.89 -2.24 %

Xetra DAX 9,834.62 -254.25 -2.52 %

S&P 500 2,096.07 -19.41 -0.92 %

NASDAQ Composite 4,894.55 -64.07 -1.29 %

Dow Jones Industrial Average 17,865.34 -119.85 -0.67 %

-