Noticias del mercado

-

19:31

International Monetary Fund First Deputy Managing Director David Lipton: China should accelerate the implementation of reforms

International Monetary Fund (IMF) First Deputy Managing Director David Lipton said on Tuesday that China should accelerate the implementation of reforms.

"The near-term growth outlook has turned more buoyant due to recent policy support. The medium-term outlook, however, is more uncertain due to rapidly rising credit, structural excess capacity, and the increasingly large, opaque, and interconnected financial sector," he said.

"Addressing these vulnerabilities and ensuring the transition to more robust, sustainable, medium-term growth requires decisively implementing a pro-active and comprehensive policy package in a number of areas," Lipton added.

He pointed out that corporate debt in China was rising.

-

19:02

National Federation of Independent Business’s small-business optimism index for the U.S. rises to 93.8 in May

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index rose to 93.8 in May from 93.6 in April.

4 of 10 sub-indexes increased last month, 4 sub-indexes fell, while 2 were unchanged.

"The bottom line is that without an empowered small business sector, the economy will grow at a mediocre pace," NFIB Chief Economist Bill Dunkelberg said.

"Politicians in Washington credit any insignificant growth in the economy to their policies, but realistically, it's the increase in the population. At this point, we should expect the same slow growth for the rest of the year," he added.

-

18:44

Final industrial production in Japan climbs 0.5% in April

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Tuesday. Final industrial production in Japan climb 0.5% in April, up from the preliminary estimate of a 0.3% rise, after a 3.8% increase in March.

Industrial shipments rose 1.5% in April, while inventories slid 1.7%.

On a yearly basis, Japan's industrial production was down 3.3% in April, up from the preliminary estimate of a 3.5% drop, after a 0.2% rise in March.

-

18:38

U.S. business inventories increase 0.1% in April

The U.S. Commerce Department released the business inventories data on Tuesday. The U.S. business inventories rose 0.1% in April, missing expectations for a 0.2% gain, after a 0.3% increase in March. March's figure was revised down from a 0.4% rise.

Retail inventories fell 0.1% in April, wholesale inventories were up 0.6%, while manufacturing inventories decreased 0.1%.

Retail sales climbed 1.4% in April, while manufacturing sales were up 0.6%.

The business inventories/sales ratio declined to 1.40 months in April from 1.41 months in March. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:00

U.S.: Business inventories , April 0.1% (forecast 0.2%)

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1145-50 (EUR 820m)

USDJPY 104.75 (USD 225m) 105.50 (500m) 106.00 (USD 230m)

GBPUSD 1.4000 (GBP 257m) 1.4200 (218m)

EURGBP 0.7760 (EUR 444m) 0.7800 (360m) 0.7900 (435m)

AUDUSD 0.7200 (AUD 272m)

NZDUSD 0.6700 (NZD 2.13bln)

AUDJPY 79.90 (AUD 268m)

-

15:43

U.S. import price index increases by 1.4% in May

The U.S. Labor Department released its import and export prices data on Tuesday. The U.S. import price index increased by 1.4% in May, exceeding expectations for a 0.7% rise, after a 0.7% gain in April. It was the largest rise since March 2012.

April's figure was revised up from a 0.3% increase.

The rise was mainly driven by higher prices for fuel imports, which jumped 16.2% in May.

U.S. export prices climbed by 1.1% in May, after a 0.5% rise in April.

-

14:44

U.S. retail sales climb 0.5% in May

The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales climbed 0.5% in May, exceeding expectations for a 0.3% rise, after a 1.3% fall in April.

The increase was mainly driven by a rise in sales at service stations.

Sales at clothing retailers were up 0.8% in May, sales at building material and garden equipment stores decreased 1.8%, while sales at auto dealerships rose 0.5%.

Retail sales excluding automobiles rose 0.4% in May, in line with expectations, after a 0.8% gain in April.

Sales at service stations climbed 2.1% in May, while sales at furniture stores fell 0.1%.

-

14:31

U.S.: Retail Sales YoY, May 2.5%

-

14:30

U.S.: Retail sales, May 0.5% (forecast 0.3%)

-

14:30

U.S.: Import Price Index, May 1.4% (forecast 0.7%)

-

14:30

U.S.: Retail sales excluding auto, May 0.4% (forecast 0.4%)

-

14:21

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar on the latest poll results

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation June 3.2%

01:30 Australia National Australia Bank's Business Confidence May 5 3

04:30 Japan Industrial Production (MoM) (Finally) April 0.3% Revised From 3.8% 0.4% 0.5%

04:30 Japan Industrial Production (YoY) (Finally) April 0.2% -3.5% -3,3%

07:15 Switzerland Producer & Import Prices, m/m May 0.3% 0.1% 0.4%

07:15 Switzerland Producer & Import Prices, y/y May -2.4% -1.5% -1.2%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.3% Revised From 0.4% 0.3% 0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) May -0.7% -0.4% -0.7%

08:30 United Kingdom Producer Price Index - Input (MoM) May 0.9% 0.9% 2.6%

08:30 United Kingdom Producer Price Index - Input (YoY) May -7% Revised From -6.5% -5% -3.9%

08:30 United Kingdom Retail Price Index, m/m May 0.1% 0.3% 0.3%

08:30 United Kingdom Retail prices, Y/Y May 1.3% 1.4% 1.4%

08:30 United Kingdom HICP, m/m May 0.1% 0.3% 0.2%

08:30 United Kingdom HICP, Y/Y May 0.3% 0.4% 0.3%

08:30 United Kingdom HICP ex EFAT, Y/Y May 1.2% 1.3% 1.2%

09:00 Eurozone Industrial production, (MoM) April -0.7% Revised From -0.8% 0.8% 1.1%

09:00 Eurozone Industrial Production (YoY) April 0.2% 1.4% 2%

09:00 Eurozone Employment Change Quarter I 0.3% 0.3%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data from the U.S. The U.S. retail sales are expected to rise 0.3% in May, after a 1.3% gain in April.

The euro traded lower against the U.S. dollar despite the positive trade data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Tuesday. Industrial production in the Eurozone climbed 1.1% in April, exceeding expectations for a 0.8% gain, after a 0.7% drop in March. March's figure was revised up from a 0.8% decrease.

On a yearly basis, Eurozone's industrial production rise 2.0% in April, beating expectations for a 1.4% rise, after a 0.2% increase in March.

Eurozone's employment increased by 0.3% in the first quarter, after a 0.3% rise in the fourth quarter.

The British pound traded mixed against the U.S. dollar on the latest poll results. According to the latest polls, the majority of Britons would support Britain's exit from the European Union (EU).

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in May. Analysts had expected to rise to 0.4%.

The increase was mainly driven by rises in transport costs, restaurant and hotel bills and the price of telecommunication services.

On a monthly basis, U.K. consumer prices increased 0.2% in May, missing expectations for a 0.3% gain, after a 0.1% rise in April.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in May, missing expectations for an increase to 1.3%.

The consumer price inflation is below the Bank of England's 2% target.

The Swiss franc traded lower against the U.S. dollar. The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.4% in May, beating expectations for a 0.1% gain, after a 0.3% increase in April.

The rise was driven by higher prices for scrap and petroleum products.

On a yearly basis, producer and import prices plunged 1.2% in May, beating expectations for a 1.5% fall, after a 2.4% drop in April.

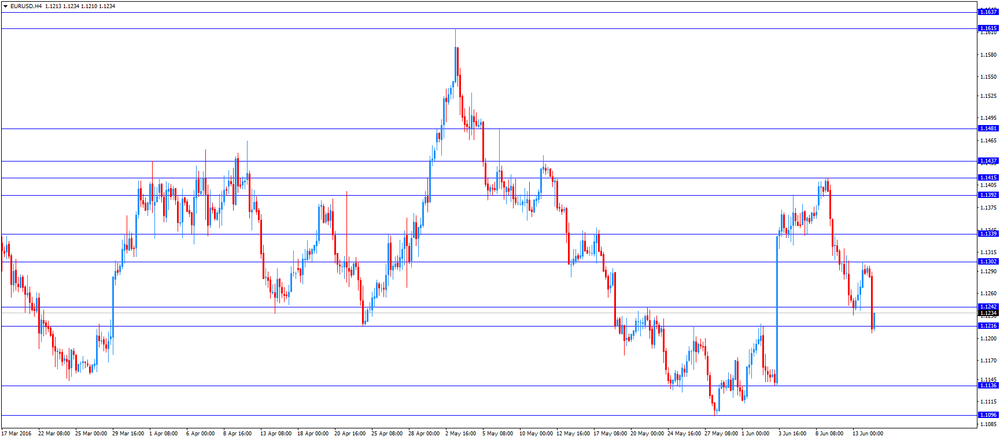

EUR/USD: the currency pair fell to $1.1207

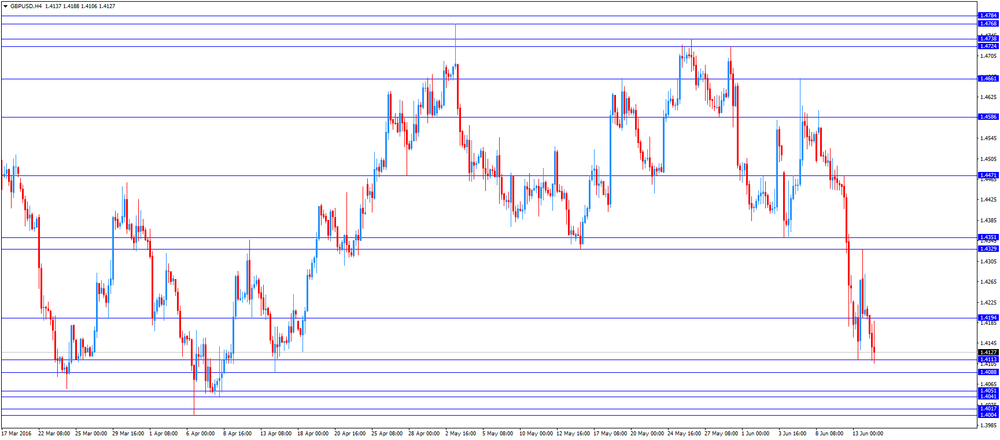

GBP/USD: the currency pair traded mixed

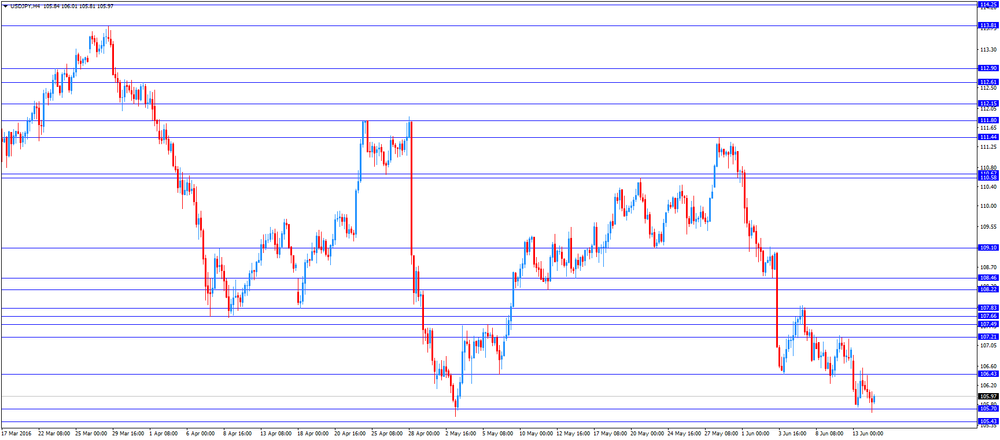

USD/JPY: the currency pair climbed to Y106.01

The most important news that are expected (GMT0):

12:30 U.S. Retail sales May 1.3% 0.3%

12:30 U.S. Retail Sales YoY May 3%

12:30 U.S. Retail sales excluding auto May 0.8% 0.4%

12:30 U.S. Import Price Index May 0.3% 0.7%

14:00 U.S. Business inventories April 0.4% 0.2%

22:45 New Zealand Current Account Quarter I -2.61 1.05

-

13:50

Orders

EUR/USD

Offers 1.1280 1.1300 1.1320 1.1355-60 1.1400 1.1420 1.1450

Bids 1.1230 1.1200 1.1185 1.1165 1.1150 1.1135 1.1100

GBP/USD

Offers 1.4150 1.4180-85 1.4200 1.4220 1.4250 1.4275-80 1.4300 1.4320 1.4355-60 1.4385 1.4400

Bids 1.4120 1.4100 1.4085 1.4065 1.4050 1.4030-35 1.4000 1.3985 1.3950

EUR/GBP

Offers 0.7980 0.8000 0.8020-25 0.8050

Bids 0.7950 0.7920 0.7900 0.7885 0.7865 0.7850 0.7820 0.7800

EUR/JPY

Offers 119.60 119.85 120.00 120.20-25 120.50 120.80 121.00

Bids 119.00 118.50 118.00

USD/JPY

Offers 106.00 106.20-25 106.50 106.85 107.00 107.20 107.50 107.80 108.00

Bids 105.70-75 105.50 105.00 104.70 104.50 104.00

AUD/USD

Offers 0.7420-25 0.7450 0.7485 0.7500 0.7520 0.7550

Bids 0.7380 0.7365 0.7350 0.7320 0.7300 0.7285 0.7270 0.7250

-

11:59

UK house price inflation increases 0.6% in April

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index increased at a seasonally adjusted rate of 0.6% in April, after a 1.1% gain in March.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 8.2% in April, after a 8.5% rise in March.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average house price was £209,000 in April, up from £207,700 in March.

-

11:53

Final consumer prices in Italy increase 0.3% in May

The Italian statistical office Istat released its final consumer price inflation data for Italy on Tuesday. Final consumer prices in Italy increased 0.3% in May, in line with the preliminary reading, after a 0.1% decrease in April.

The monthly increase was mainly driven by rises in prices of tobacco, of non-regulated energy products and of unprocessed food.

On a yearly basis, consumer prices declined 0.3% in May, in line with preliminary reading, after a 0.5% decline in April.

The increase was mainly driven by higher prices for tobacco and unprocessed food.

Final consumer price inflation excluding unprocessed food and energy prices rose to 0.6% year-on-year in May from 0.5% in April.

-

11:47

Final consumer price inflation in Spain rises 0.5% in May

The Spanish statistical office INE released its final consumer price inflation data on Tuesday. Consumer price inflation in Spain was up 0.5% in May, down from the preliminary reading of a 0.6% growth, after a 0.7% rise in April.

The monthly rise was mainly driven by an increase in communications, which climbed 2.4% in May.

On a yearly basis, consumer prices fell by 1.0% in May from a year ago, in line with preliminary reading, after a 1.1% decline in April.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:41

UK consumer price inflation remains unchanged at 0.3% year-on-year in May

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in May. Analysts had expected to rise to 0.4%.

The increase was mainly driven by rises in transport costs, restaurant and hotel bills and the price of telecommunication services.

On a monthly basis, U.K. consumer prices increased 0.2% in May, missing expectations for a 0.3% gain, after a 0.1% rise in April.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in May, missing expectations for an increase to 1.3%.

The Retail Prices Index increased to 1.4% year-on-year in May from 1.3% in April, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

-

11:34

Switzerland's producer and import prices rise in May

The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.4% in May, beating expectations for a 0.1% gain, after a 0.3% increase in April.

The rise was driven by higher prices for scrap and petroleum products.

The Import Price Index increased 0.4% in May, while producer prices rose 0.4%.

On a yearly basis, producer and import prices plunged 1.2% in May, beating expectations for a 1.5% fall, after a 2.4% drop in April.

The Import Price Index fell by 2.8% year-on year in May, while producer prices dropped 0.5%.

-

11:28

Eurozone's employment increases by 0.3% in the first quarter

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the first quarter, after a 0.3% rise in the fourth quarter.

Main contributors were Ireland (+0.7%), Spain and Luxembourg (all +0.8%).

On a yearly basis, employment in the Eurozone increased by 1.4% in the first quarter, after a 1.2% gain in the fourth quarter.

-

11:24

Eurozone’s industrial production climbs 1.1% in April

Eurostat released its industrial production data for the Eurozone on Tuesday. Industrial production in the Eurozone climbed 1.1% in April, exceeding expectations for a 0.8% gain, after a 0.7% drop in March. March's figure was revised up from a 0.8% decrease.

Non-durable consumer goods output jumped 1.6% in April, capital goods output increased 1.9%, while energy output rose 0.3%.

Intermediate goods output was up 0.4% in April, while durable consumer goods rose 2.3%.

On a yearly basis, Eurozone's industrial production rise 2.0% in April, beating expectations for a 1.4% rise, after a 0.2% increase in March.

Durable consumer goods climbed by 1.5% in April from a year ago, capital goods rose by 3.8%, non-durable consumer goods were up by 0.4%, while intermediate goods output increased by 1.5%.

Energy output rose by 1.3% in April from a year ago.

-

11:00

Eurozone: Industrial production, (MoM), April 1.1% (forecast 0.8%)

-

11:00

Eurozone: Industrial Production (YoY), April 2% (forecast 1.4%)

-

11:00

Eurozone: Employment Change, Quarter I 0.3%

-

10:47

National Australia Bank’s business confidence index falls to 3 points in May

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index fell to 3 points in May from 5 points in April.

"The Survey is suggesting further improvement for the non-mining sectors going into Q2, with some evidence that growth is becoming more broad-based," NAB Group Chief Economist Alan Oster said.

The main business conditions index remained unchanged at 10 points in May, while employment declined to 1 point from 4 points.

-

10:31

United Kingdom: HICP ex EFAT, Y/Y, May 1.2% (forecast 1.3%)

-

10:31

United Kingdom: Retail prices, Y/Y, May 1.4% (forecast 1.4%)

-

10:31

United Kingdom: Producer Price Index - Output (MoM), May 0.1% (forecast 0.3%)

-

10:31

United Kingdom: Producer Price Index - Input (MoM), May 2.6% (forecast 0.9%)

-

10:31

United Kingdom: Producer Price Index - Input (YoY) , May -3.9% (forecast -5%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , May -0.7% (forecast -0.4%)

-

10:30

United Kingdom: HICP, Y/Y, May 0.3% (forecast 0.4%)

-

10:30

United Kingdom: HICP, m/m, May 0.2% (forecast 0.3%)

-

10:30

United Kingdom: Retail Price Index, m/m, May 0.3% (forecast 0.3%)

-

10:25

Japan’s Finance Minister Taro Aso: the government will prevent further “speculation-driven” gains in the yen

Japan's Finance Minister Taro Aso said on Tuesday that the country's government would prevent further "speculation-driven" gains in the yen. He added that the government was ready to act if needed.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1145-50 (EUR 820m)

USD/JPY 104.75 (USD 225m) 105.50 (500m) 106.00 (USD 230m)

GBP/USD 1.4000 (GBP 257m) 1.4200 (218m)

EUR/GBP 0.7760 (EUR 444m) 0.7800 (360m) 0.7900 (435m)

AUD/USD 0.7200 (AUD 272m)

NZD/USD 0.6700 (NZD 2.13bln)

AUD/JPY 79.90 (AUD 268m)

-

10:11

The International Monetary Fund: Canada’s economy is adjusting well to lower oil prices

The International Monetary Fund (IMF) said in its report on Monday that Canada's economy was adjusting well to lower oil prices. The lender expects the economy to expand 1.7% in 2016 and 2.2% in 2017.

"A supportive monetary policy and exchange rate depreciation have helped cushion the effects of the oil shock," the IMF said.

-

09:15

Switzerland: Producer & Import Prices, y/y, May -1.2% (forecast -1.5%)

-

09:15

Switzerland: Producer & Import Prices, m/m, May 0.4% (forecast 0.1%)

-

08:26

Options levels on tuesday, June 14, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1456 (1944)

$1.1425 (706)

$1.1391 (71)

Price at time of writing this review: $1.1274

Support levels (open interest**, contracts):

$1.1186 (1682)

$1.1157 (2336)

$1.1126 (2403)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 36055 contracts, with the maximum number of contracts with strike price $1,1500 (5187);

- Overall open interest on the PUT options with the expiration date July, 8 is 70287 contracts, with the maximum number of contracts with strike price $1,0900 (11761);

- The ratio of PUT/CALL was 1.95 versus 1.90 from the previous trading day according to data from June, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.4437 (496)

$1.4343 (132)

$1.4248 (58)

Price at time of writing this review: $1.4160

Support levels (open interest**, contracts):

$1.4059 (3283)

$1.3963 (984)

$1.3867 (2817)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 17918 contracts, with the maximum number of contracts with strike price $1,5000 (2548);

- Overall open interest on the PUT options with the expiration date July, 8 is 36180 contracts, with the maximum number of contracts with strike price $1,4100 (3283);

- The ratio of PUT/CALL was 2.02 versus 2.06 from the previous trading day according to data from June, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:18

Asian session: The yen is the strongest among G10 currencies

Sterling extended its losses against the yen on Tuesday, falling by 1 percent at one point, on fears that Britain may vote to leave the European Union in a referendum less than 10 days away.

The British pound remained fragile near a two-month low against the dollar on Tuesday and the yen hovered near six-week highs against the U.S. currency on worries Britain may leave the European Union in a referendum less than 10 days away.

Two recent opinion polls show a lead for the "Leave" campaign. While many market players are sceptical about the polling, recent poll results do seem to suggest a momentum for "Leave" campaign, market players said.

The British pound fell 0.6 percent to $1.4185, edging back in the direction of a two-month low of $1.4117 that had been set on Monday.

The yen is the strongest among G10 currencies so far this month, and traded at 106.02 per dollar, near Monday's six-week high of 105.735 to the dollar.

A break of that level could lead to a test of its 18-month high of 105.55 set on May 3.

While the Bank of Japan's policy meeting on June 15-16 is a near-term focal point for the yen, the prevailing market expectation is for the BOJ to hold off from any additional monetary easing, said a trader for a Japanese bank in Singapore.

The BOJ will probably stand pat, especially since the impact of any additional monetary easing at this point could be limited while the market is preoccupied by the Brexit risk, the trader said.

The yen also stood near a three-year high against the euro, which slipped 0.3 percent to 119.68 yen after having fallen to 119.005 on Monday, a level last seen in February 2013.

The euro held steady at $1.1291, having recovered from Monday's low of $1.1233.

The euro is also vulnerable to threats of Brexit, which would hurt the euro zone economy and deal a serious blow to European integration.

At the same time, however, the currency could be helped by safe-haven flows as the euro is often used as a funding currency for bets in riskier assets.

Surprisingly soft U.S. employment data published earlier this month quashed expectations of a near-term rate hike by the U.S. Federal Reserve, underpinning the euro and other currencies against the dollar.

The Federal Reserve is set to meet on Tuesday and Wednesday, with market players waiting for clues about when the Fed might next look to move on rates.

EUR / USD: during the Asian session, the pair is trading in the range of $ 1.1280-1.1300

GBP / USD: during the Asian session, the pair is trading in the range of $ 1.4165-1.4215

USD / JPY: during the Asian session, the pair was trading in range Y105.80-106.45

Based on Reuters materials

-

06:34

Japan: Industrial Production (YoY), April -3,3% (forecast -3.5%)

-

06:32

Japan: Industrial Production (MoM) , April 0.5% (forecast 0.4%)

-

03:30

Australia: National Australia Bank's Business Confidence, May 3

-

00:28

Currencies. Daily history for Jun 13’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1287 +0,32%

GBP/USD $1,4213 -0,26%

USD/CHF Chf0,9639 -0,07%

USD/JPY Y106,11 -0,79%

EUR/JPY Y119,78 -0,49%

GBP/JPY Y150,8 -1,11%

AUD/USD $0,7383 +0,12%

NZD/USD $0,7051 -0,03%

USD/CAD C$1,2824 +0,37%

-

00:01

Schedule for today, Tuesday, Jun 14’2016:

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation June 3.2%

01:30 Australia National Australia Bank's Business Confidence May 5

04:30 Japan Industrial Production (MoM) (Finally) April 3.8% 0.3%

04:30 Japan Industrial Production (YoY) (Finally) April 0.2% -3.5%

07:15 Switzerland Producer & Import Prices, m/m May 0.3%

07:15 Switzerland Producer & Import Prices, y/y May -2.4%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.4% 0.4%

08:30 United Kingdom Producer Price Index - Output (YoY) May -0.7% -0.4%

08:30 United Kingdom Producer Price Index - Input (MoM) May 0.9% 0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) May -6.5% -5%

08:30 United Kingdom Retail Price Index, m/m May 0.1% 0.3%

08:30 United Kingdom Retail prices, Y/Y May 1.3% 1.4%

08:30 United Kingdom HICP, m/m May 0.1% 0.3%

08:30 United Kingdom HICP, Y/Y May 0.3% 0.4%

08:30 United Kingdom HICP ex EFAT, Y/Y May 1.2% 1.3%

09:00 Eurozone Industrial production, (MoM) April -0.8% 0.7%

09:00 Eurozone Industrial Production (YoY) April 0.2% 1.3%

09:00 Eurozone Employment Change Quarter I 0.3%

12:30 U.S. Retail sales May 1.3% 0.3%

12:30 U.S. Retail Sales YoY May 3%

12:30 U.S. Retail sales excluding auto May 0.8% 0.4%

12:30 U.S. Import Price Index May 0.3% 0.8%

14:00 U.S. Business inventories April 0.4% 0.2%

22:45 New Zealand Current Account Quarter I -2.61

-