Noticias del mercado

-

22:09

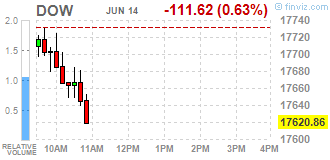

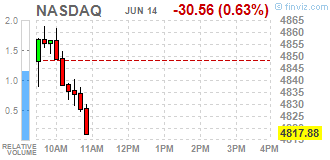

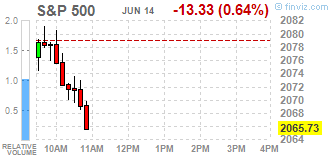

U.S. stocks retreated for a fourth day

U.S. stocks retreated for a fourth day, the longest since February, amid growing uncertainty about the U.K.'s future in the European Union and as investors awaited Wednesday's Federal Reserve announcement.

Equities fell, but not before staging a furious rebound amid gains in technology and consumer staples shares, rising from the day's lows in the final hour to pare much of the session's losses that reached as much as 0.7 percent in the S&P 500 Index.

The selloff is occurring just days after the S&P 500 hit its highest in almost 11 months, buoyed by optimism that low rates, steady job gains and modest growth would continue to support rising stock prices. Sentiment has shifted, with the potential fallout from a June 23 vote on Britain's membership of the EU increasingly unsettling global markets. Britain's largest-selling newspaper now backs a so-called Brexit, while five polls in the past 24 hours put the "Leave" campaign ahead of "Remain."

As policy makers and investors scrutinize data to weigh U.S. growth, a report today showed retail sales rose more than forecast in May, indicating consumer spending will help boost second-quarter growth. A separate gauge showed inflation pressures are building. The costs of goods imported into the U.S. climbed 1.4 percent in May, the biggest gain in four years.

Although traders are pricing in zero chance of a rate move tomorrow, Chair Janet Yellen's commentary afterward will be parsed for hints on the trajectory of borrowing costs. At least even odds for a rate increase have been pushed out to February 2017.

The S&P 500 had rallied as much as 16 percent from a 22-month low in February to within 0.6 percent of an all-time high, before its four-day slide amid growth worries and Brexit anxiety. The benchmark is less than 3 percent from its record set nearly 13 months ago, and has gone the longest without a fresh high outside of a bear market since 1984.

"Brexit is adding fuel to the fire for risk-averse investors," said Jasper Lawler, an analyst at CMC Markets Plc in London. "Markets are already worried about slowing global growth and the inability of central-bank policy to stem the decline. Global growth concerns are present because we don't know where the Fed is on that, but depending on the language they use, this could cause the market to gain again."

-

21:00

DJIA 17607.84 -124.64 -0.70%, NASDAQ 4821.06 -27.38 -0.56%, S&P 500 2065.56 -13.50 -0.65%

-

19:31

International Monetary Fund First Deputy Managing Director David Lipton: China should accelerate the implementation of reforms

International Monetary Fund (IMF) First Deputy Managing Director David Lipton said on Tuesday that China should accelerate the implementation of reforms.

"The near-term growth outlook has turned more buoyant due to recent policy support. The medium-term outlook, however, is more uncertain due to rapidly rising credit, structural excess capacity, and the increasingly large, opaque, and interconnected financial sector," he said.

"Addressing these vulnerabilities and ensuring the transition to more robust, sustainable, medium-term growth requires decisively implementing a pro-active and comprehensive policy package in a number of areas," Lipton added.

He pointed out that corporate debt in China was rising.

-

19:22

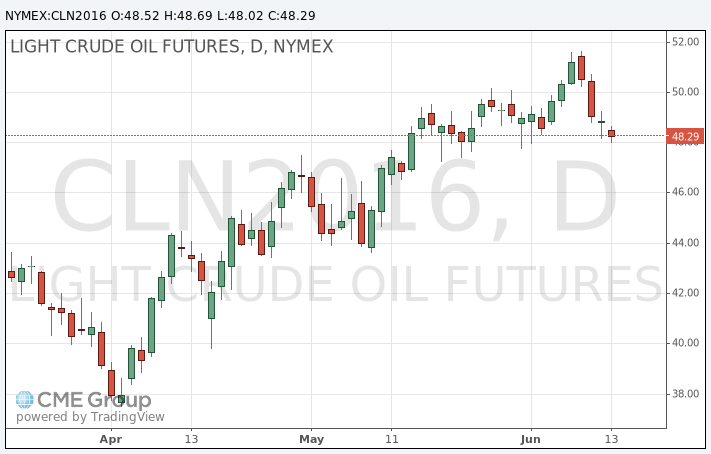

The International Energy Agency’s (IEA) monthly Oil Market Report: the oil market will rebalance in the second half of the year

The International Energy Agency (IEA) released its monthly Oil Market Report on Tuesday. The agency said that the oil market would rebalance in the second half of the year.

The IEA noted that global oil supply decreased by 950,000 barrels a day to averaged 95.4 million barrels a day in May compared with May 2015.

The agency upgraded its global oil demand forecast for 2016 by 100,000 barrels a day to 96.1 million barrels a day.

According to the IEA, OPEC production decreased by 110,000 barrels a day to 32.61 million barrels a day in May compared with the previous month. The increase was driven by higher output from Iran, Iraq and the United Arab Emirates.

Iran's rose by 80,000 barrels a day to 3.64 million barrels in May. It was the highest level since June 2011.

The IEA expects non-OPEC output to drop by 900,000 barrels a day to 56.8 million barrels in 2016.

-

19:02

National Federation of Independent Business’s small-business optimism index for the U.S. rises to 93.8 in May

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index rose to 93.8 in May from 93.6 in April.

4 of 10 sub-indexes increased last month, 4 sub-indexes fell, while 2 were unchanged.

"The bottom line is that without an empowered small business sector, the economy will grow at a mediocre pace," NFIB Chief Economist Bill Dunkelberg said.

"Politicians in Washington credit any insignificant growth in the economy to their policies, but realistically, it's the increase in the population. At this point, we should expect the same slow growth for the rest of the year," he added.

-

18:51

European stocks close: stocks closed lower on uncertainty over Britain’s membership in the EU

Stock closed lower on uncertainty over Britain's membership in the European Union (EU). According to the latest polls, the majority of Britons would support Britain's exit from the European Union (EU).

Market participants also eyed the economic data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Tuesday. Industrial production in the Eurozone climbed 1.1% in April, exceeding expectations for a 0.8% gain, after a 0.7% drop in March. March's figure was revised up from a 0.8% decrease.

On a yearly basis, Eurozone's industrial production rise 2.0% in April, beating expectations for a 1.4% rise, after a 0.2% increase in March.

Eurozone's employment increased by 0.3% in the first quarter, after a 0.3% rise in the fourth quarter.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in May. Analysts had expected to rise to 0.4%.

The increase was mainly driven by rises in transport costs, restaurant and hotel bills and the price of telecommunication services.

On a monthly basis, U.K. consumer prices increased 0.2% in May, missing expectations for a 0.3% gain, after a 0.1% rise in April.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in May, missing expectations for an increase to 1.3%.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,923.53 -121.44 -2.01 %

DAX 9,519.2 -138.24 -1.43 %

CAC 40 4,130.33 -96.69 -2.29 %

-

18:44

Final industrial production in Japan climbs 0.5% in April

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Tuesday. Final industrial production in Japan climb 0.5% in April, up from the preliminary estimate of a 0.3% rise, after a 3.8% increase in March.

Industrial shipments rose 1.5% in April, while inventories slid 1.7%.

On a yearly basis, Japan's industrial production was down 3.3% in April, up from the preliminary estimate of a 3.5% drop, after a 0.2% rise in March.

-

18:38

U.S. business inventories increase 0.1% in April

The U.S. Commerce Department released the business inventories data on Tuesday. The U.S. business inventories rose 0.1% in April, missing expectations for a 0.2% gain, after a 0.3% increase in March. March's figure was revised down from a 0.4% rise.

Retail inventories fell 0.1% in April, wholesale inventories were up 0.6%, while manufacturing inventories decreased 0.1%.

Retail sales climbed 1.4% in April, while manufacturing sales were up 0.6%.

The business inventories/sales ratio declined to 1.40 months in April from 1.41 months in March. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

18:00

European stocks closed: FTSE 5923.53 -121.44 -2.01%, DAX 9519.20 -138.24 -1.43%, CAC 4130.33 -96.69 -2.29%

-

17:40

Oil prices fell

Oil prices fell Tuesday, pushed lower for the fourth consecutive day as market sentiment continued to turn, despite a bullish report from the International Energy Agency.

The global benchmark, Brent, was trading down 1.4% at $49.66 a barrel midmorning in London. Its U.S. counterpart, West Texas Intermediate, was down 1.6% at $48.09 a barrel.

The International Energy Agency on Tuesday revised its demand forecast upward for this year by 100,000 barrels a day, to 1.3 million barrels a day from 1.2 million barrels a day. The demand will be led by emerging markets in India and China as the manufacturing industry grows, the report said.

The IEA also released its first demand forecast for 2017, for 1.3 million barrels a day.

But the body warned that should supply be restored in Nigeria and Canada there could be a dip in prices. Nigerian output fell 250,000 barrels a day to 1.37 million barrels a day in June, levels not seen in almost 30 years.

Gains to demand were limited as the IEA indicated that supply was strong from elsewhere in the world. Oil output in Kuwait and the United Arab Emirates was up in May by 120,000 barrels a day and 70,000 barrels a day, respectively.

Despite the report, market bullishness is dissipating as U.S. production shows signs of recovering. Late on Monday, the U.S.-based Genscape Inc. tipped a 525,000-barrel increase in U.S. crude stockpiles in the week ended June 10. Last Friday, Baker Hughes Inc. reported the number of rigs drilling for oil in the U.S. rose for the second-straight week.

"The worry is that when prices reach $60 a barrel, we will see new investments in shale exploration," Barnabas Gan, an economist at OCBC said.

The American Petroleum Institute will release fresh estimates Tuesday on the level of U.S. crude stocks, which could send prices tumbling further if it predicts a significant stock build.

Also hurting prices, financial markets have had a higher sense of risk aversion in the lead-up to Britain's referendum on leaving the European Union, known as "Brexit," on June 23.

"Oil prices are unable to ignore this negative market sentiment, especially since the majority of speculative financial investors are continuing to bet on climbing oil prices," said the Germany-based Commerzbank.

According to some analysts, in the scenario that Britain leaves the EU, the British pound will likely take a hit and the greenback will appreciate. As oil trading is conducted in dollars, a strong dollar usually bodes badly for those who trade in foreign currencies.

-

17:38

WSE: Session Results

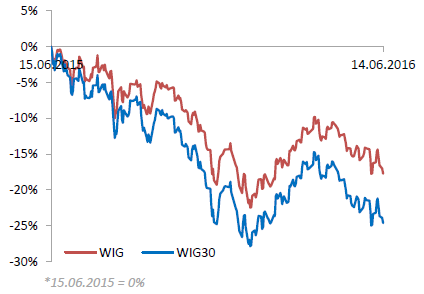

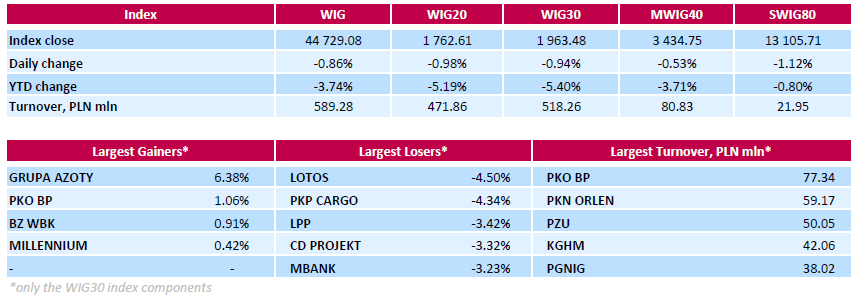

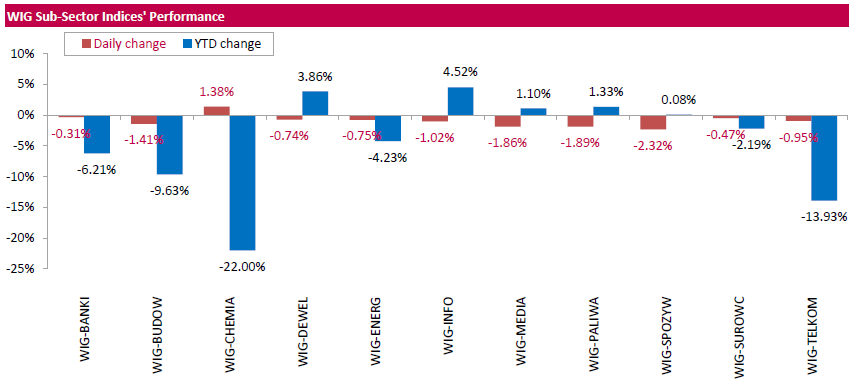

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, fell by 0.86%. All sectors, but for chemicals (+1.38%), were down, with food stocks (-2.32%) lagging behind.

The large-cap stocks' measure, the WIG30 Index lost 0.94%. A majority of the index components recorded declines. Oil refiner LOTOS (WSE: LTS) and railway freight transport operator PKP CARGO (WSE: PKP) were the weakest names, tumbling by 4.5% and 4.34% respectively. They were followed by clothing retailer LPP (WSE: LPP), videogame developer CD PROJEKT (WSE: CDR), bank MBANK (WSE: MBK) and agricultural producer KERNEL (WSE: KER), which plunged by 3.12%-3.42%. On the other side of the ledger, chemical producer GRUPA AZOTY (WSE: ATT) led a handful of gainers, as the stock jumped by 6.38% after four consecutive sessions of declines. Other advancers included three banking sector names PKO BP (WSE: PKO), BZ WBK (WSE: BZW) and MILLENNIUM (WSE: MIL), adding between 0.42% and 1.06%.

-

17:22

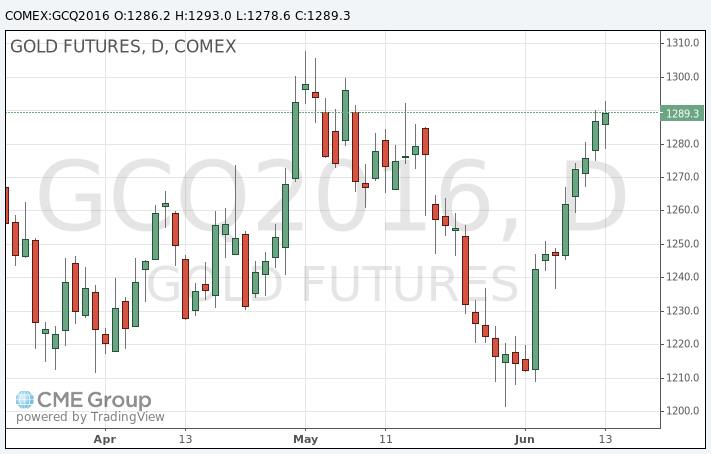

Gold turned lower

Gold futures turned lower on Tuesday, with prices struggling to hold ground near their highest level in five weeks.

Gold futures had been catching a strong bid as investors sought the relative safety of haven assets ahead of next week's "Brexit" referendum and a tandem of closely watched central-bank meetings.

Gold for August delivery shed $1.50, or 0.1%, to $1,285.40 an ounce.

Worries remained heightened that a U.K. referendum on European Union membership-set for June 23 and expected to be fully tallied on June 24-will result in a British exit from the bloc, and potentially stir uncertainty in the market. European stocks fell for a fifth straight day on Tuesday, while bonds were in demand, driving yields on the 10-year German bund into negative territory for the first time ever. U.S. stocks traded mostly lower.

"We have focused on the vote and its potential impact on markets, but we have not factored in potentially devastating set of 'ripple' effects," said Julian Phillips, founder of and contributor to GoldForecaster.com.

Those include the possibility of heavy outflows of capital from Britain and its effects on the euro and the impact on global growth, he said. "The scene is gold-positive and, consequently, silver-positive," said Phillips.

This week, the U.S.'s Federal Open Market Committee and Bank of Japan are holding interest-rate policy meetings that could impact precious-metals trading. The Federal Reserve isn't expected to announce any change in key policy in its statement Wednesday but it could lay some groundwork for future action. Higher interest rates tend to push up the dollar and cut the appeal of nonyielding assets including gold.

U.S. retail sales data may give the Fed more reason to lean toward a rate increase. Sales at U.S. retailers rose a solid 0.5% in May after an even larger gain in the prior month.

"The Fed frequently makes an impact on the gold market in the short term and is important for traders to focus on, but long-term [gold] owners are better served ignoring Fed noise and focusing on gold's important benefits as a diversification," said Mark O'Byrne, research director at GoldCore.

"The 'no hike' is likely being priced in but we could see gold hit the $1,300 level, prior to a correction on the way to the next level of resistance at $1,400," he said.

Over in Japan, central-bank officials could work to talk down yen when they meet Wednesday and Thursday, as a stronger home currency hurts exports.

"Japanese Finance Minister Taro Aso delivered another round of currency intervention warnings, signaling that quick and speculative movements in the FX market may warrant a response," Pissouros noted.

Pissouros said Aso will closely watch the Brexit referendum given its potential impact on global markets.

-

17:00

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Tuesday as investors kept to the sidelines ahead of the Federal Reserve's policy meeting and a referendum on Britain's European Union membership. The Federal Open Market Committee (FOMC) will commence its two-day meeting on Tuesday to decide whether the U.S. economy has recovered enough to be able to absorb an interest rate hike. While traders have discounted a hike this month, they will parse Fed Chair Janet Yellen's speech at a conference on Wednesday for clues on the health of the economy and the trajectory of hikes.

Most all of Dow stocks in negative area (22 of 30). Top looser - American Express Company (AXP, -2,79%). Top looser - General Electric Company (GE, +0,62%).

All S&P sectors in negative area. Top looser - Conglomerates (-1,2%).

At the moment:

Dow 17546.00 -93.00 -0.53%

S&P 500 2059.25 -10.50 -0.51%

Nasdaq 100 4398.25 -20.50 -0.46%

Oil 48.25 -0.63 -1.29%

Gold 1288.30 +1.40 +0.11%

U.S. 10yr 1.60 -0.01

-

16:00

U.S.: Business inventories , April 0.1% (forecast 0.2%)

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1145-50 (EUR 820m)

USDJPY 104.75 (USD 225m) 105.50 (500m) 106.00 (USD 230m)

GBPUSD 1.4000 (GBP 257m) 1.4200 (218m)

EURGBP 0.7760 (EUR 444m) 0.7800 (360m) 0.7900 (435m)

AUDUSD 0.7200 (AUD 272m)

NZDUSD 0.6700 (NZD 2.13bln)

AUDJPY 79.90 (AUD 268m)

-

15:43

U.S. import price index increases by 1.4% in May

The U.S. Labor Department released its import and export prices data on Tuesday. The U.S. import price index increased by 1.4% in May, exceeding expectations for a 0.7% rise, after a 0.7% gain in April. It was the largest rise since March 2012.

April's figure was revised up from a 0.3% increase.

The rise was mainly driven by higher prices for fuel imports, which jumped 16.2% in May.

U.S. export prices climbed by 1.1% in May, after a 0.5% rise in April.

-

15:37

WSE: After start on Wall Street

On the broad market we may clearly see a continuation of the weak sentiment. Riskier assets like stocks become cheaper, the safer ones, as the Japanese yen and German bonds more expensive. And here curiosity, the yields of German bonds fell today below 0 percent (first time ever) are they have negative interest.

The causes of this phenomenon should be mainly seen in market fundamentals, particularly damaging for markets is spectrum of Brexit.

In these sentiments was also start of trading on Wall Street. Withdrawal is not big, but at the last session the problem were rather weak endings, than neutral beginnings. Chart of the S&P500 index indicates that the departure from the region of the record of all time and the upper limit of several months of consolidation gaining momentum.

-

15:32

U.S. Stocks open: Dow -0.15%, Nasdaq -0.11%, S&P -0.16%

-

15:13

Before the bell: S&P futures -0.30%, NASDAQ futures -0.35%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 15,859 -160.18 -1.00%

Hang Seng 20,387.53 -125.46 -0.61%

Shanghai Composite 2,842.92 +9.85 +0.35%

FTSE 5,969.75 -75.22 -1.24%

CAC 4,156.81 -70.21 -1.66%

DAX 9,578.4 -79.04 -0.82%

Crude $48.19 (-1.41%)

Gold $1287.50 (+0.05%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.26

-0.06(-0.6438%)

35432

Amazon.com Inc., NASDAQ

AMZN

714

-1.24(-0.1734%)

7298

American Express Co

AXP

63.69

0.02(0.0314%)

186

AMERICAN INTERNATIONAL GROUP

AIG

54.2

-0.20(-0.3676%)

300

Apple Inc.

AAPL

97.32

-0.02(-0.0205%)

48789

AT&T Inc

T

40.13

-0.06(-0.1493%)

1048

Barrick Gold Corporation, NYSE

ABX

20.31

0.09(0.4451%)

99940

Caterpillar Inc

CAT

75.2

-0.03(-0.0399%)

1000

Chevron Corp

CVX

101.7

-0.40(-0.3918%)

17209

Citigroup Inc., NYSE

C

42.9

-0.26(-0.6024%)

45625

Exxon Mobil Corp

XOM

90.26

-0.33(-0.3643%)

7121

Facebook, Inc.

FB

114

0.05(0.0439%)

70097

Ford Motor Co.

F

12.99

0.01(0.077%)

23820

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.24

-0.16(-1.5385%)

128640

General Electric Co

GE

29.76

-0.07(-0.2347%)

24818

Goldman Sachs

GS

148

-0.63(-0.4239%)

2230

Google Inc.

GOOG

716.04

-2.32(-0.323%)

851

Home Depot Inc

HD

127.25

-0.58(-0.4537%)

600

Intel Corp

INTC

32.16

-0.01(-0.0311%)

6120

International Business Machines Co...

IBM

150.57

-0.71(-0.4693%)

894

JPMorgan Chase and Co

JPM

62.65

-0.62(-0.9799%)

55954

Microsoft Corp

MSFT

49.99

-0.15(-0.2992%)

32137

Nike

NKE

54.76

-0.15(-0.2732%)

1350

Pfizer Inc

PFE

34.56

-0.18(-0.5181%)

2765

Procter & Gamble Co

PG

82.38

-0.19(-0.2301%)

187

Starbucks Corporation, NASDAQ

SBUX

55.1

0.06(0.109%)

4870

Tesla Motors, Inc., NASDAQ

TSLA

218.58

0.71(0.3259%)

10865

Twitter, Inc., NYSE

TWTR

14.95

0.40(2.7491%)

155876

Visa

V

78

-0.40(-0.5102%)

2027

Wal-Mart Stores Inc

WMT

70.3

-0.23(-0.3261%)

935

Walt Disney Co

DIS

97.39

-0.18(-0.1845%)

3735

Yahoo! Inc., NASDAQ

YHOO

36.79

0.32(0.8774%)

14453

Yandex N.V., NASDAQ

YNDX

21.2

-0.28(-1.3035%)

1410

-

14:44

U.S. retail sales climb 0.5% in May

The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales climbed 0.5% in May, exceeding expectations for a 0.3% rise, after a 1.3% fall in April.

The increase was mainly driven by a rise in sales at service stations.

Sales at clothing retailers were up 0.8% in May, sales at building material and garden equipment stores decreased 1.8%, while sales at auto dealerships rose 0.5%.

Retail sales excluding automobiles rose 0.4% in May, in line with expectations, after a 0.8% gain in April.

Sales at service stations climbed 2.1% in May, while sales at furniture stores fell 0.1%.

-

14:40

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Altria (MO) initiated with a Buy at Berenberg; target $74

-

14:31

U.S.: Retail Sales YoY, May 2.5%

-

14:30

U.S.: Retail sales, May 0.5% (forecast 0.3%)

-

14:30

U.S.: Import Price Index, May 1.4% (forecast 0.7%)

-

14:30

U.S.: Retail sales excluding auto, May 0.4% (forecast 0.4%)

-

14:21

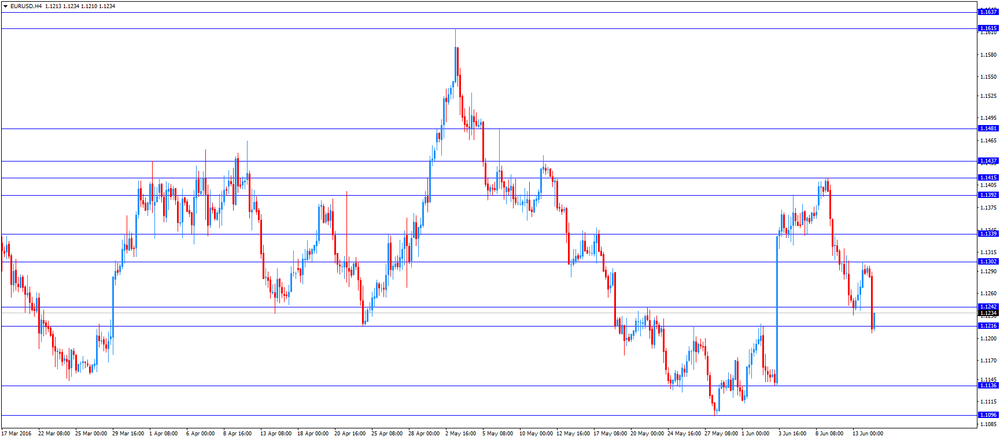

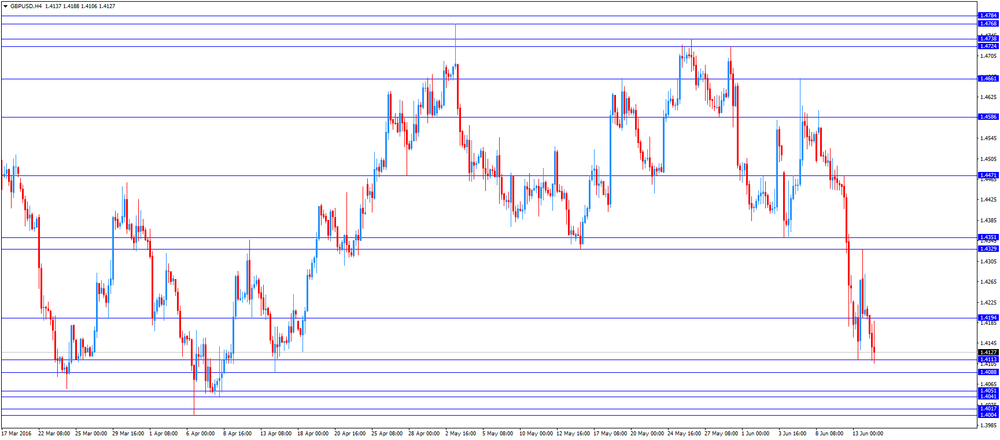

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar on the latest poll results

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation June 3.2%

01:30 Australia National Australia Bank's Business Confidence May 5 3

04:30 Japan Industrial Production (MoM) (Finally) April 0.3% Revised From 3.8% 0.4% 0.5%

04:30 Japan Industrial Production (YoY) (Finally) April 0.2% -3.5% -3,3%

07:15 Switzerland Producer & Import Prices, m/m May 0.3% 0.1% 0.4%

07:15 Switzerland Producer & Import Prices, y/y May -2.4% -1.5% -1.2%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.3% Revised From 0.4% 0.3% 0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) May -0.7% -0.4% -0.7%

08:30 United Kingdom Producer Price Index - Input (MoM) May 0.9% 0.9% 2.6%

08:30 United Kingdom Producer Price Index - Input (YoY) May -7% Revised From -6.5% -5% -3.9%

08:30 United Kingdom Retail Price Index, m/m May 0.1% 0.3% 0.3%

08:30 United Kingdom Retail prices, Y/Y May 1.3% 1.4% 1.4%

08:30 United Kingdom HICP, m/m May 0.1% 0.3% 0.2%

08:30 United Kingdom HICP, Y/Y May 0.3% 0.4% 0.3%

08:30 United Kingdom HICP ex EFAT, Y/Y May 1.2% 1.3% 1.2%

09:00 Eurozone Industrial production, (MoM) April -0.7% Revised From -0.8% 0.8% 1.1%

09:00 Eurozone Industrial Production (YoY) April 0.2% 1.4% 2%

09:00 Eurozone Employment Change Quarter I 0.3% 0.3%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data from the U.S. The U.S. retail sales are expected to rise 0.3% in May, after a 1.3% gain in April.

The euro traded lower against the U.S. dollar despite the positive trade data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Tuesday. Industrial production in the Eurozone climbed 1.1% in April, exceeding expectations for a 0.8% gain, after a 0.7% drop in March. March's figure was revised up from a 0.8% decrease.

On a yearly basis, Eurozone's industrial production rise 2.0% in April, beating expectations for a 1.4% rise, after a 0.2% increase in March.

Eurozone's employment increased by 0.3% in the first quarter, after a 0.3% rise in the fourth quarter.

The British pound traded mixed against the U.S. dollar on the latest poll results. According to the latest polls, the majority of Britons would support Britain's exit from the European Union (EU).

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in May. Analysts had expected to rise to 0.4%.

The increase was mainly driven by rises in transport costs, restaurant and hotel bills and the price of telecommunication services.

On a monthly basis, U.K. consumer prices increased 0.2% in May, missing expectations for a 0.3% gain, after a 0.1% rise in April.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in May, missing expectations for an increase to 1.3%.

The consumer price inflation is below the Bank of England's 2% target.

The Swiss franc traded lower against the U.S. dollar. The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.4% in May, beating expectations for a 0.1% gain, after a 0.3% increase in April.

The rise was driven by higher prices for scrap and petroleum products.

On a yearly basis, producer and import prices plunged 1.2% in May, beating expectations for a 1.5% fall, after a 2.4% drop in April.

EUR/USD: the currency pair fell to $1.1207

GBP/USD: the currency pair traded mixed

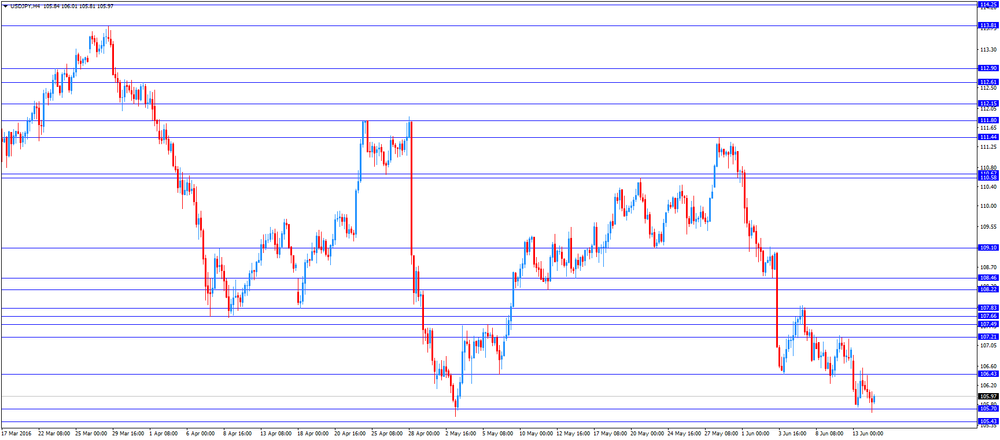

USD/JPY: the currency pair climbed to Y106.01

The most important news that are expected (GMT0):

12:30 U.S. Retail sales May 1.3% 0.3%

12:30 U.S. Retail Sales YoY May 3%

12:30 U.S. Retail sales excluding auto May 0.8% 0.4%

12:30 U.S. Import Price Index May 0.3% 0.7%

14:00 U.S. Business inventories April 0.4% 0.2%

22:45 New Zealand Current Account Quarter I -2.61 1.05

-

13:50

Orders

EUR/USD

Offers 1.1280 1.1300 1.1320 1.1355-60 1.1400 1.1420 1.1450

Bids 1.1230 1.1200 1.1185 1.1165 1.1150 1.1135 1.1100

GBP/USD

Offers 1.4150 1.4180-85 1.4200 1.4220 1.4250 1.4275-80 1.4300 1.4320 1.4355-60 1.4385 1.4400

Bids 1.4120 1.4100 1.4085 1.4065 1.4050 1.4030-35 1.4000 1.3985 1.3950

EUR/GBP

Offers 0.7980 0.8000 0.8020-25 0.8050

Bids 0.7950 0.7920 0.7900 0.7885 0.7865 0.7850 0.7820 0.7800

EUR/JPY

Offers 119.60 119.85 120.00 120.20-25 120.50 120.80 121.00

Bids 119.00 118.50 118.00

USD/JPY

Offers 106.00 106.20-25 106.50 106.85 107.00 107.20 107.50 107.80 108.00

Bids 105.70-75 105.50 105.00 104.70 104.50 104.00

AUD/USD

Offers 0.7420-25 0.7450 0.7485 0.7500 0.7520 0.7550

Bids 0.7380 0.7365 0.7350 0.7320 0.7300 0.7285 0.7270 0.7250

-

13:13

WSE: Mid session comment

The weakening of the zloty, drop of the EURUSD rate and about 1 percent loss of the CAC and the DAX indices did not give the Warsaw market a large opportunities in the first half of the session. Support at the level of 1,748 points has been tested again and again saw the defense of the minimum from the first session of June. The task of the bulls is not easy because the pressure from the environment, which dominated from the end of the previous week and continues to this day, does not allow to expect significant growth without the help of the core markets. However, the attempt to defend 1,750 points confirms that in the area of psychological and technical barriers the market is closer to keep balance. If in the second half of the day the environment will perform a correction movement of current decreases, it may be expected to replicate yesterday's scenario of reflection from the support.

At the halfway point of quotations the WIG20 index reported the level of 1,756 points (-1.31%) with the turnover of PLN 176 mln.

-

12:03

European stock markets mid session: stocks traded lower on uncertainty over Britain’s membership in the EU

Stock indices traded lower on uncertainty over Britain's membership in the European Union (EU).

Market participants also eyed the economic data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Tuesday. Industrial production in the Eurozone climbed 1.1% in April, exceeding expectations for a 0.8% gain, after a 0.7% drop in March. March's figure was revised up from a 0.8% decrease.

On a yearly basis, Eurozone's industrial production rise 2.0% in April, beating expectations for a 1.4% rise, after a 0.2% increase in March.

Eurozone's employment increased by 0.3% in the first quarter, after a 0.3% rise in the fourth quarter.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in May. Analysts had expected to rise to 0.4%.

The increase was mainly driven by rises in transport costs, restaurant and hotel bills and the price of telecommunication services.

On a monthly basis, U.K. consumer prices increased 0.2% in May, missing expectations for a 0.3% gain, after a 0.1% rise in April.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in May, missing expectations for an increase to 1.3%.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 5,967.77 -77.20 -1.28 %

DAX 9,550.41 -107.03 -1.11 %

CAC 40 4,167.15 -59.87 -1.42 %

-

11:59

UK house price inflation increases 0.6% in April

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index increased at a seasonally adjusted rate of 0.6% in April, after a 1.1% gain in March.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 8.2% in April, after a 8.5% rise in March.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average house price was £209,000 in April, up from £207,700 in March.

-

11:53

Final consumer prices in Italy increase 0.3% in May

The Italian statistical office Istat released its final consumer price inflation data for Italy on Tuesday. Final consumer prices in Italy increased 0.3% in May, in line with the preliminary reading, after a 0.1% decrease in April.

The monthly increase was mainly driven by rises in prices of tobacco, of non-regulated energy products and of unprocessed food.

On a yearly basis, consumer prices declined 0.3% in May, in line with preliminary reading, after a 0.5% decline in April.

The increase was mainly driven by higher prices for tobacco and unprocessed food.

Final consumer price inflation excluding unprocessed food and energy prices rose to 0.6% year-on-year in May from 0.5% in April.

-

11:47

Final consumer price inflation in Spain rises 0.5% in May

The Spanish statistical office INE released its final consumer price inflation data on Tuesday. Consumer price inflation in Spain was up 0.5% in May, down from the preliminary reading of a 0.6% growth, after a 0.7% rise in April.

The monthly rise was mainly driven by an increase in communications, which climbed 2.4% in May.

On a yearly basis, consumer prices fell by 1.0% in May from a year ago, in line with preliminary reading, after a 1.1% decline in April.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:41

UK consumer price inflation remains unchanged at 0.3% year-on-year in May

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in May. Analysts had expected to rise to 0.4%.

The increase was mainly driven by rises in transport costs, restaurant and hotel bills and the price of telecommunication services.

On a monthly basis, U.K. consumer prices increased 0.2% in May, missing expectations for a 0.3% gain, after a 0.1% rise in April.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in May, missing expectations for an increase to 1.3%.

The Retail Prices Index increased to 1.4% year-on-year in May from 1.3% in April, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

-

11:34

Switzerland's producer and import prices rise in May

The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.4% in May, beating expectations for a 0.1% gain, after a 0.3% increase in April.

The rise was driven by higher prices for scrap and petroleum products.

The Import Price Index increased 0.4% in May, while producer prices rose 0.4%.

On a yearly basis, producer and import prices plunged 1.2% in May, beating expectations for a 1.5% fall, after a 2.4% drop in April.

The Import Price Index fell by 2.8% year-on year in May, while producer prices dropped 0.5%.

-

11:28

Eurozone's employment increases by 0.3% in the first quarter

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the first quarter, after a 0.3% rise in the fourth quarter.

Main contributors were Ireland (+0.7%), Spain and Luxembourg (all +0.8%).

On a yearly basis, employment in the Eurozone increased by 1.4% in the first quarter, after a 1.2% gain in the fourth quarter.

-

11:24

Eurozone’s industrial production climbs 1.1% in April

Eurostat released its industrial production data for the Eurozone on Tuesday. Industrial production in the Eurozone climbed 1.1% in April, exceeding expectations for a 0.8% gain, after a 0.7% drop in March. March's figure was revised up from a 0.8% decrease.

Non-durable consumer goods output jumped 1.6% in April, capital goods output increased 1.9%, while energy output rose 0.3%.

Intermediate goods output was up 0.4% in April, while durable consumer goods rose 2.3%.

On a yearly basis, Eurozone's industrial production rise 2.0% in April, beating expectations for a 1.4% rise, after a 0.2% increase in March.

Durable consumer goods climbed by 1.5% in April from a year ago, capital goods rose by 3.8%, non-durable consumer goods were up by 0.4%, while intermediate goods output increased by 1.5%.

Energy output rose by 1.3% in April from a year ago.

-

11:00

Eurozone: Industrial production, (MoM), April 1.1% (forecast 0.8%)

-

11:00

Eurozone: Industrial Production (YoY), April 2% (forecast 1.4%)

-

11:00

Eurozone: Employment Change, Quarter I 0.3%

-

10:47

National Australia Bank’s business confidence index falls to 3 points in May

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index fell to 3 points in May from 5 points in April.

"The Survey is suggesting further improvement for the non-mining sectors going into Q2, with some evidence that growth is becoming more broad-based," NAB Group Chief Economist Alan Oster said.

The main business conditions index remained unchanged at 10 points in May, while employment declined to 1 point from 4 points.

-

10:31

United Kingdom: HICP ex EFAT, Y/Y, May 1.2% (forecast 1.3%)

-

10:31

United Kingdom: Retail prices, Y/Y, May 1.4% (forecast 1.4%)

-

10:31

United Kingdom: Producer Price Index - Output (MoM), May 0.1% (forecast 0.3%)

-

10:31

United Kingdom: Producer Price Index - Input (MoM), May 2.6% (forecast 0.9%)

-

10:31

United Kingdom: Producer Price Index - Input (YoY) , May -3.9% (forecast -5%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , May -0.7% (forecast -0.4%)

-

10:30

United Kingdom: HICP, Y/Y, May 0.3% (forecast 0.4%)

-

10:30

United Kingdom: HICP, m/m, May 0.2% (forecast 0.3%)

-

10:30

United Kingdom: Retail Price Index, m/m, May 0.3% (forecast 0.3%)

-

10:25

Japan’s Finance Minister Taro Aso: the government will prevent further “speculation-driven” gains in the yen

Japan's Finance Minister Taro Aso said on Tuesday that the country's government would prevent further "speculation-driven" gains in the yen. He added that the government was ready to act if needed.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1145-50 (EUR 820m)

USD/JPY 104.75 (USD 225m) 105.50 (500m) 106.00 (USD 230m)

GBP/USD 1.4000 (GBP 257m) 1.4200 (218m)

EUR/GBP 0.7760 (EUR 444m) 0.7800 (360m) 0.7900 (435m)

AUD/USD 0.7200 (AUD 272m)

NZD/USD 0.6700 (NZD 2.13bln)

AUD/JPY 79.90 (AUD 268m)

-

10:11

The International Monetary Fund: Canada’s economy is adjusting well to lower oil prices

The International Monetary Fund (IMF) said in its report on Monday that Canada's economy was adjusting well to lower oil prices. The lender expects the economy to expand 1.7% in 2016 and 2.2% in 2017.

"A supportive monetary policy and exchange rate depreciation have helped cushion the effects of the oil shock," the IMF said.

-

09:15

WSE: After opening

WIG20 index opened at 1777.15 points (-0.16%)*

WIG 45007.47 -0.24%

WIG30 1976.46 -0.28%

mWIG40 3442.63 -0.30%

*/ - change to previous close

Europe has started from light falls, which include sell-off in the US and deterioration in sentiment signaled by the appreciation of the yen against the dollar and the weakening of the euro against the dollar. Also weakens the zloty, so the atmosphere is not conducive for the bulls in Warsaw and after first transactions the WIG20 lost 0.7 percent. The decline does not negate yesterday's rebound from the region in 1,750 pts., but also indicates that the market is closer the to stabilize at current levels than to ending the decline of the last three sessions.

-

09:15

Switzerland: Producer & Import Prices, y/y, May -1.2% (forecast -1.5%)

-

09:15

Switzerland: Producer & Import Prices, m/m, May 0.4% (forecast 0.1%)

-

08:26

WSE: Before opening

The first session of the week on Wall Street ended with solidarity decline in the major indexes, which gave up 0.7 to 0.9 percent. The main reason was a mix of concerns about the outcome of the referendum on Brexit and growing uncertainty about the Wednesday statement of the Federal Open Market Committee ( FOMC). The German DAX yesterday lost 1.8 percent and close at session minimums.

Contracts on the S&P500 are currently traded at a slight positive territory (+0.10%).

Macro calendar will bring today important readings from Europe - industrial production - and from the US - retail sales and data on international trade. The reports should have an impact on the relationship between the dollar and the euro, so indirectly also on the condition of the zloty pairs - USDPLN and EURPLN. The WIG20 sensitivity on the strength or weakness of the Polish currency is known, so at the time of publication data, we may expect some changes also on the Warsaw Stock Exchange.

On the Warsaw market the third day of declines of the WIG20 merged with defense support levels at around 1,750 points. Perhaps today's session does not answer the question about the future direction, because in all markets is seen waiting for Wednesday's FOMC Statement, but by the end of the week we may receive signals indicating the superiority of one of the parties.

-

08:26

Options levels on tuesday, June 14, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1456 (1944)

$1.1425 (706)

$1.1391 (71)

Price at time of writing this review: $1.1274

Support levels (open interest**, contracts):

$1.1186 (1682)

$1.1157 (2336)

$1.1126 (2403)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 36055 contracts, with the maximum number of contracts with strike price $1,1500 (5187);

- Overall open interest on the PUT options with the expiration date July, 8 is 70287 contracts, with the maximum number of contracts with strike price $1,0900 (11761);

- The ratio of PUT/CALL was 1.95 versus 1.90 from the previous trading day according to data from June, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.4437 (496)

$1.4343 (132)

$1.4248 (58)

Price at time of writing this review: $1.4160

Support levels (open interest**, contracts):

$1.4059 (3283)

$1.3963 (984)

$1.3867 (2817)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 17918 contracts, with the maximum number of contracts with strike price $1,5000 (2548);

- Overall open interest on the PUT options with the expiration date July, 8 is 36180 contracts, with the maximum number of contracts with strike price $1,4100 (3283);

- The ratio of PUT/CALL was 2.02 versus 2.06 from the previous trading day according to data from June, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:18

Asian session: The yen is the strongest among G10 currencies

Sterling extended its losses against the yen on Tuesday, falling by 1 percent at one point, on fears that Britain may vote to leave the European Union in a referendum less than 10 days away.

The British pound remained fragile near a two-month low against the dollar on Tuesday and the yen hovered near six-week highs against the U.S. currency on worries Britain may leave the European Union in a referendum less than 10 days away.

Two recent opinion polls show a lead for the "Leave" campaign. While many market players are sceptical about the polling, recent poll results do seem to suggest a momentum for "Leave" campaign, market players said.

The British pound fell 0.6 percent to $1.4185, edging back in the direction of a two-month low of $1.4117 that had been set on Monday.

The yen is the strongest among G10 currencies so far this month, and traded at 106.02 per dollar, near Monday's six-week high of 105.735 to the dollar.

A break of that level could lead to a test of its 18-month high of 105.55 set on May 3.

While the Bank of Japan's policy meeting on June 15-16 is a near-term focal point for the yen, the prevailing market expectation is for the BOJ to hold off from any additional monetary easing, said a trader for a Japanese bank in Singapore.

The BOJ will probably stand pat, especially since the impact of any additional monetary easing at this point could be limited while the market is preoccupied by the Brexit risk, the trader said.

The yen also stood near a three-year high against the euro, which slipped 0.3 percent to 119.68 yen after having fallen to 119.005 on Monday, a level last seen in February 2013.

The euro held steady at $1.1291, having recovered from Monday's low of $1.1233.

The euro is also vulnerable to threats of Brexit, which would hurt the euro zone economy and deal a serious blow to European integration.

At the same time, however, the currency could be helped by safe-haven flows as the euro is often used as a funding currency for bets in riskier assets.

Surprisingly soft U.S. employment data published earlier this month quashed expectations of a near-term rate hike by the U.S. Federal Reserve, underpinning the euro and other currencies against the dollar.

The Federal Reserve is set to meet on Tuesday and Wednesday, with market players waiting for clues about when the Fed might next look to move on rates.

EUR / USD: during the Asian session, the pair is trading in the range of $ 1.1280-1.1300

GBP / USD: during the Asian session, the pair is trading in the range of $ 1.4165-1.4215

USD / JPY: during the Asian session, the pair was trading in range Y105.80-106.45

Based on Reuters materials

-

07:01

Global Stocks

European stocks dropped to their lowest in more than three months Monday, with bank shares among decliners as investors faced heightened concerns about the Brexit vote on whether the U.K. should cut ties with the European Union.

The moves on European markets followed sharp losses across Asian stocks, with sent Japan's Nikkei Average NIK, -1.45% tumbling by 3.5%.

U.S. stocks fell for a third straight session Monday, with the S&P 500 and the Dow Jones Industrial Average finishing at their lowest close since May 24 as investors turned increasingly jittery ahead of a Federal Reserve policy meeting and a looming vote on the U.K.'s membership in the European Union.

The Dow Jones Industrial Average DJIA, -0.74% shed 132.86 points, or 0.7%, to end at 17,732.48, while the S&P 500 SPX, -0.81% slid 17.01 points, or 0.8%, to finish at 2,079.06. The tech-heavy Nasdaq Composite COMP, -0.94% was down 46.11 points, or 0.9%, to close at 4,848.44, its lowest finish since May 23.

Asian stocks slipped on Tuesday ahead of the U.S. Federal Reserve's two-day meeting that begins later in the day, amid growing worries this month's referendum in Britain could see it exit the European Union.

Uncertainty over this week's Federal Reserve policy meeting has weighed on markets, though the U.S. central bank is widely expected to leave rates unchanged after the much weaker-than-expected May nonfarm payrolls report.

The Bank of England, Swiss National Bank and the Bank of Japan will also meet this week, and are similarly expected to stand pat on policy with the Brexit vote looming.

-

06:34

Japan: Industrial Production (YoY), April -3,3% (forecast -3.5%)

-

06:32

Japan: Industrial Production (MoM) , April 0.5% (forecast 0.4%)

-

04:03

Nikkei 225 15,823.7 -195.48 -1.22 %, Hang Seng 20,502.55 -10.44 -0.05 %, Shanghai Composite 2,834.37 +1.30 +0.05 %

-

03:30

Australia: National Australia Bank's Business Confidence, May 3

-

00:30

Commodities. Daily history for Jun 13’2016:

(raw materials / closing price /% change)

Oil 48.56 -0.65%

Gold 1,286.80 -0.01%

-

00:29

Stocks. Daily history for Jun 13’2016:

(index / closing price / change items /% change)

Nikkei 225 16,019.18 -582.18 -3.51 %

Hang Seng 20,512.99 -529.65 -2.52 %

Shanghai Composite 2,832.51 -94.65 -3.23 %

FTSE 100 6,044.97 -70.79 -1.16 %

CAC 40 4,227.02 -79.70 -1.85 %

Xetra DAX 9,657.44 -177.18 -1.80 %

S&P 500 2,079.06 -17.01 -0.81 %

NASDAQ Composite 4,848.44 -46.11 -0.94 %

Dow Jones 17,732.48 -132.86 -0.74 %

-

00:28

Currencies. Daily history for Jun 13’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1287 +0,32%

GBP/USD $1,4213 -0,26%

USD/CHF Chf0,9639 -0,07%

USD/JPY Y106,11 -0,79%

EUR/JPY Y119,78 -0,49%

GBP/JPY Y150,8 -1,11%

AUD/USD $0,7383 +0,12%

NZD/USD $0,7051 -0,03%

USD/CAD C$1,2824 +0,37%

-

00:01

Schedule for today, Tuesday, Jun 14’2016:

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation June 3.2%

01:30 Australia National Australia Bank's Business Confidence May 5

04:30 Japan Industrial Production (MoM) (Finally) April 3.8% 0.3%

04:30 Japan Industrial Production (YoY) (Finally) April 0.2% -3.5%

07:15 Switzerland Producer & Import Prices, m/m May 0.3%

07:15 Switzerland Producer & Import Prices, y/y May -2.4%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.4% 0.4%

08:30 United Kingdom Producer Price Index - Output (YoY) May -0.7% -0.4%

08:30 United Kingdom Producer Price Index - Input (MoM) May 0.9% 0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) May -6.5% -5%

08:30 United Kingdom Retail Price Index, m/m May 0.1% 0.3%

08:30 United Kingdom Retail prices, Y/Y May 1.3% 1.4%

08:30 United Kingdom HICP, m/m May 0.1% 0.3%

08:30 United Kingdom HICP, Y/Y May 0.3% 0.4%

08:30 United Kingdom HICP ex EFAT, Y/Y May 1.2% 1.3%

09:00 Eurozone Industrial production, (MoM) April -0.8% 0.7%

09:00 Eurozone Industrial Production (YoY) April 0.2% 1.3%

09:00 Eurozone Employment Change Quarter I 0.3%

12:30 U.S. Retail sales May 1.3% 0.3%

12:30 U.S. Retail Sales YoY May 3%

12:30 U.S. Retail sales excluding auto May 0.8% 0.4%

12:30 U.S. Import Price Index May 0.3% 0.8%

14:00 U.S. Business inventories April 0.4% 0.2%

22:45 New Zealand Current Account Quarter I -2.61

-