Noticias del mercado

-

22:06

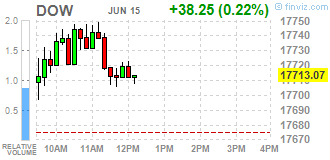

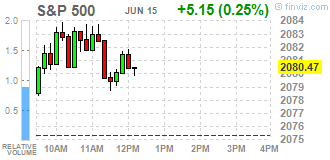

U.S. stocks erased gains

U.S. stocks erased gains in a late-day collapse after the Federal Reserve held pat on interest rates, with mixed American growth and a sluggish global economy heightening concern the effectiveness of central-bank stimulus has reached its limits.

The S&P 500 Index fell 0.2 percent to 2,071.82 at 4 p.m. in New York, erasing a climb of 0.5 percent, and posting a fifth straight drop, the longest since February. Losses accelerated in the final half hour of trading after crude oil sold off.

"The Fed scaling back the indicated pace of rate hikes can be construed as them not seeing requisite strength -- there's a malaise that's set into the economy," said Bill Schultz, who oversees $1.2 billion as chief investment officer at McQueen, Ball & Associates Inc. in Bethlehem, Pennsylvania. "Without something to push equities higher, besides low rates, we're losing steam here. With uncertainty around the British vote later this month, the path of least resistance seems to be down at this point."

-

22:00

U.S.: Net Long-term TIC Flows , April -79.6

-

22:00

U.S.: Total Net TIC Flows, April 80.4

-

21:02

DJIA 17733.27 58.45 0.33%, NASDAQ 4861.39 17.84 0.37%, S&P 500 2082.43 7.11 0.34%

-

20:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

18:18

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Wednesday after four days of losses as lower chances of an interest rate hike whet investor appetite for risk. Fed Chair Janet Yellen had hinted at higher chances of a rate hike than the markets had priced in, but weak May jobs data and economic repercussions of a possible Brexit forced her to take a dovish stance last week.

Dow stocks mixed (14 in positive area, 16 in negative). Top looser - Intel Corporation (INTC, -1,07%). Top gainer - The Home Depot, Inc. (HD, +1,64%).

Most of S&P sectors in negative area. Top looser - Utilities (-0,7%). Top gainer - Conglomerates (+0,8%).

At the moment:

Dow 17629.00 +57.00 +0.32%

S&P 500 2072.75 +6.75 +0.33%

Nasdaq 100 4421.25 +3.25 +0.07%

Oil 48.40 -0.09 -0.19%

Gold 1287.90 -0.20 -0.02%

U.S. 10yr 1.59 -0.01

-

18:07

European stocks close: stocks closed higher ahead of the Fed’s interest rate decision

Stock closed higher ahead of the release of the Fed's interest rate decision later in the day. Analysts expect the Fed to keep its interest rate unchanged.

Market participants also eyed the economic data from the Eurozone. Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus declined to €27.5 billion in April from €28.6 billion in March, beating expectations for a fall to €26 billion. Exports fell at an unadjusted annual rate of 1.0% in April, while imports dropped 5.0%.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate declined to 5.0% in the February to April quarter from 5.1% in the January to March quarter. It was the lowest level since October 2005.

Analysts had expected the unemployment rate to remain unchanged.

Average weekly earnings, excluding bonuses, climbed by 2.3% in the February to April quarter, exceeding expectations for a 2.1% rise, after a 2.2% gain in the January to March quarter. The previous quarter's figure was revised up from a 2.1% rise.

Average weekly earnings, including bonuses, rose by 2.0% in the February to April quarter, exceeding expectations for a 1.7% gain, after a 2.0% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,966.8 +43.27 +0.73 %

DAX 9,606.71 +87.51 +0.92 %

CAC 40 4,171.58 +41.25 +1.00 %

-

18:00

European stocks closed: FTSE 5966.80 43.27 0.73%, DAX 9606.71 87.51 0.92%, CAC 4171.58 41.25 1.00%

-

17:48

Greek import prices climb 1.3% in April

The Hellenic Statistical Authority released its import prices data for Greece on Wednesday. Greek import prices climbed 1.3% in April, after a 1.4% rise in March.

On a yearly basis, import prices dropped 7.9% in April, after a 7.8% decline in March.

Import prices for energy plunged by 28.5% year-on-year in April, price for durable consumer goods were flat, while price for non-durable consumer goods increased by 0.1%.

Prices of capital goods rose 0.2% year-on-year in April, while intermediate goods prices decreased 2.6%.

-

17:43

European Central Bank Vice President Vitor Constancio: negative deposit rates have limits

The European Central Bank (ECB) Vice President Vitor Constancio said on Wednesday that negative deposit rates has limits, adding that the central bank should monitor "the possible occurrence of undesirable side-effects".

He also said that inflation in 2018 could be higher that estimated by the ECB.

Constancion pointed out that the central bank would continue to implement its stimulus measures.

-

17:39

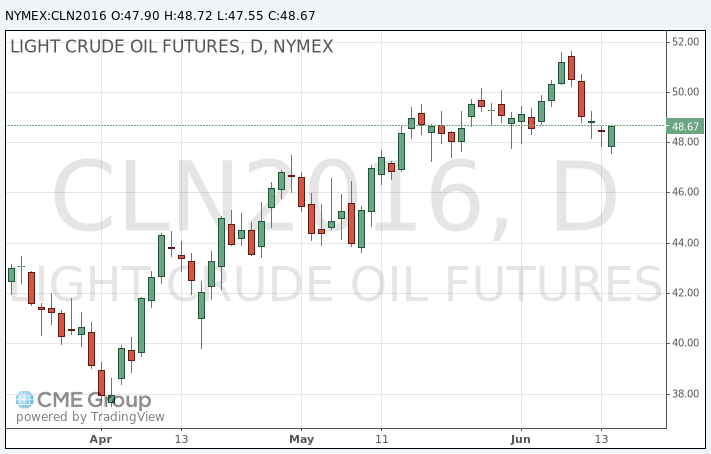

Oil futures settled lower

Oil futures settled lower Wednesday, pressured by concerns over global energy demand following disappointing U.S. economic data and ahead of the U.K. referendum scheduled for next week.

A modest weekly decline in U.S. crude supplies and the Federal Reserve's decision to stand pat on interest rates failed to offer much support for prices.

July West Texas Intermediate crude fell 48 cents, or 1%, to settle at $48.01 a barrel on the New York Mercantile Exchange, marking a fifth session decline in a row. The August contract for Brent lost 86 cents, or 1.7%, at $48.97 a barrel.

WTI oil futures had fallen below $48, but pared losses and saw a brief tick higher after the U.S. Energy Information Administration reported that U.S. crude supplies fell by 900,000 barrels for the week ended June 10. That contradicted the 1.2 million-barrel increase reported by the American Petroleum Institute late Tuesday, but still came in short of the 1.4 million-barrel decline expected by analysts polled by S&P Global Platts.

"The headline crude-oil number was less bullish than expected, but not as bearish as the API number-so basically a wash," Tyler Richey.

About a half-hour before WTI prices settled, the Fed announced that it would leave interest rates unchanged and it adopted a dovish stance on the outlook for monetary policy.

"The revisions to the 'dot plot' within the FOMC release that showed 6 members now only expect one rate hike in 2016," up from just one member at the last meeting, said Richey. That "was a dovish development and we are seeing the dollar correct lower as a result."

'Uncertainties about the health of the U.S. economy is the reason for the dollar weakness. That isn't necessarily a bullish thing for oil from a demand standpoint.'

"Traditionally, a weaker dollar would be supportive of oil prices, but…uncertainties about the health of the U.S. economy is the reason for the dollar weakness. That isn't necessarily a bullish thing for oil from a demand standpoint," he said.

-

17:39

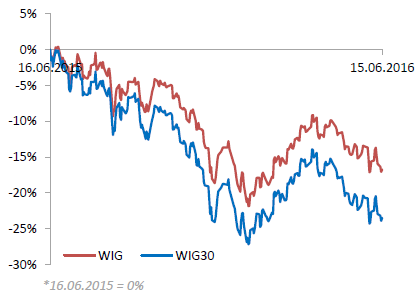

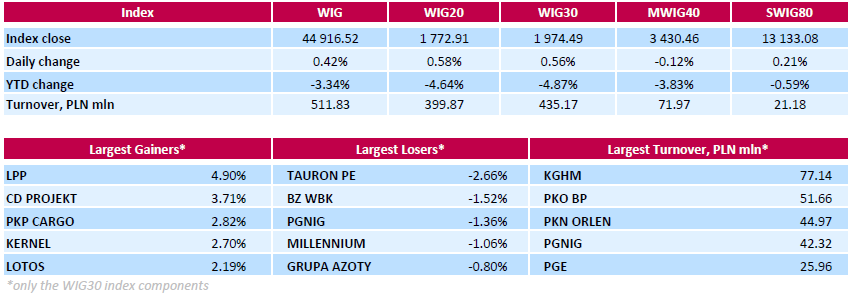

WSE: Session Results

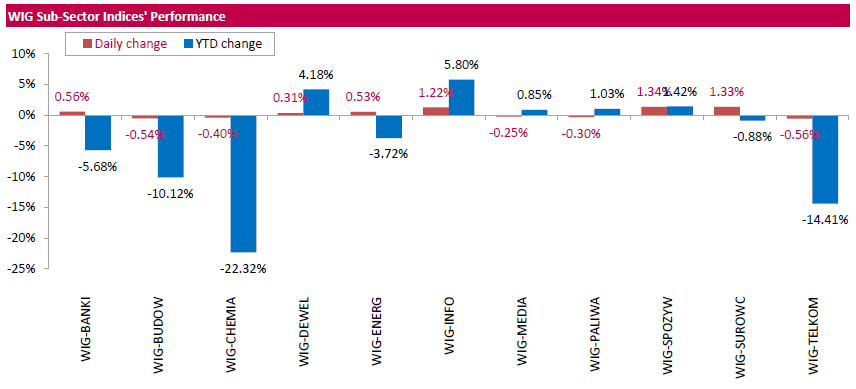

The Polish equity market advanced on Wednesday. The market broad measure, the WIG Index, added 0.42%. Sector performance within the WIG Index was mixed. Materials (+1.33%) and food (+1.34%) stocks were the growth leaders in the WIG, while telecommunication sector names (-0.56%) were the poorest performers.

The large-cap stocks' measure, the WIG30 Index, posted a 0.56% gain. Within the index components, clothing retailer LPP (WSE: LPP) and videogame developer CD PROJEKT (WSE: CDR), generated the biggest advances, up 4.9% and 3.71% respectively. Other noticeable gainers included railway freight transport operator PKP CARGO (WSE: PKP), agricultural producer KERNEL (WSE: KER), oil refiner LOTOS (WSE: LTS) and genco ENERGA (WSE: ENG), which rebounded by 2.14%-2.82%.

-

17:27

New loans in China rise to 985.5 billion yuan in May

The People's Bank of China (PBoC) released its new loans data on Wednesday. New loans in local currency in China were 985.5 billion yuan in May, up from April's 555.6 billion yuan.

M2 money supply jumped by 11.8% year-on-year in May.

Total social financing increased to 146.33 trillion yuan in May from 751 billion yuan in April.

-

17:20

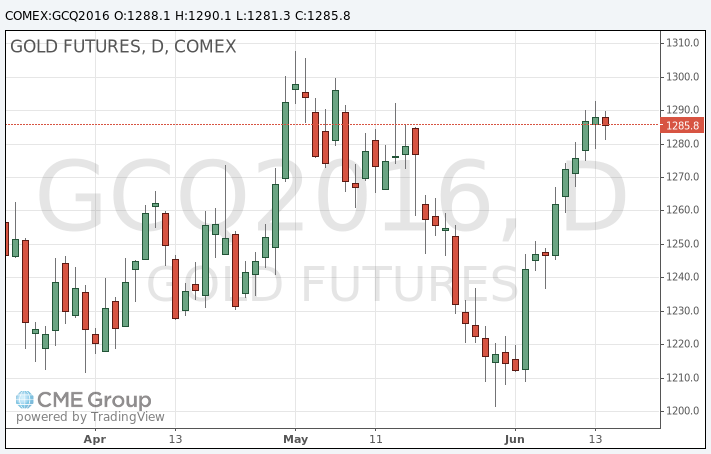

Gold fell

Gold has been billed as a 'wonder investment' in portfolios: apparently it can help protect against inflation or deflation, political, financial or economic chaos and much more besides, so it's no wonder that we're seeing interest in this commodity soar at the moment as investors find themselves in a moment of political turbulence on both sides of the Atlantic.

However, some caution is warranted here. Odysseus famously plugged his crew's ears with beeswax and had himself strapped to the mast to resist the call of the sirens. I would simply suggest that gold should occupy no more than low single digits in percentage terms as a proportion of your total investible assets - calls to hold significantly more, no matter how honeyed the voices, should be strongly resisted.

Perhaps the most alluring part of gold's story right now seems to be its role as a safe port in the storm. In a world seemingly beset with more than usual levels of monetary, economic and political uncertainty, gold, with its thousands of years of practice as a store of value, seems to shine brightly as an investment prospect.

Most would agree that a safe asset should have a relatively stable value during times of market stress. If we assume that such times tend to see equity markets fall sharply, gold's historical record over the long run is far from perfect on this count.

Even without that blemished relative record, investors should be wary of havens where the price has jumped around so dramatically - even when just viewed over the past five years. Nonetheless, if enough investors believe gold to be a haven then it may well act as one.

Some argue that gold is not for protection against expected changes in inflation, but rather the unexpected. This is more difficult to weigh, as the tricky procedure of decomposing inflation into its expected and unexpected components is more art than science. However, based on some (admittedly crude) empirical work, the long-run relationship between gold and unexpected inflation looks entirely unremarkable.

One area where there is an undeniably strong relationship is between gold and real bond yields.

-

17:09

U.S. crude inventories fall by 0.9 million barrels to 531.5 million in the week to June 10

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 0.9 million barrels to 531.5 million in the week to June 10.

Analysts had expected U.S. crude oil inventories to decline by 2.27 million barrels.

Gasoline inventories decreased by 2.63 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 904,000 barrels.

U.S. crude oil imports decreased by 83,000 barrels per day.

Refineries in the U.S. were running at 90.2% of capacity, down from 90.9% the previous week.

Oil production declined to 8.716 million barrels a day last week from 8.745 million barrels a day in the previous week.

-

16:59

U.S. industrial production falls 0.4% in May

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production fell 0.4% in May, missing expectations for a 0.2% decrease, after a 0.6% rise in April. April's figure was revised down from a 0.7% increase.

The decrease was mainly driven by a drop in utilities. Mining output rose 0.2% in May, while utilities production slid 1.0%.

Manufacturing output was down 0.4% in May, after a 0.2% increase in April.

Capacity utilisation rate decreased to 74.9% in May from 75.3% in April, missing expectations for a fall to 75.2%. April's figure was revised down from 75.4%.

-

16:30

U.S.: Crude Oil Inventories, June -0.933 (forecast -2.27)

-

15:49

WSE: After start on Wall Street

In the afternoon we met the next data from the US, which fit into the side of doubt about the condition of the US economy. The decline in industrial production of 0.4 percent will be important for GDP growth in the second quarter. The data are simply recession and certainly the Fed will not tighten monetary policy, not only on today's FOMC meeting, but also on the next.

Start of Wall Street on the green side helps the Warsaw market to continued today's freeze in anticipation of tomorrow morning. On the threshold of the final hour of the session the market looks exactly as it appeared after the first hour. Increase of the WIG20 is the echo of increases in other markets, although the increase in WIG20 is about half the size of the DAX growth.

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1000 (EUR 473m) 1.1075 (241m) 1.1200 (413m) 1.1250 (309m) 1.1280 (243m) 1.1300 (428m) )

USDJPY 105.00 (USD 400m) 106.00 (USD 450m) 106.65 (310m) 107.00 (450m) 108.00 (415m)

GBPUSD 1.4000 (GBP 1.06bln) 1.4050 (1.33bln) 1.4200 (365m) 1.4300 (278m) 1.4350-55 (415m)

EURGBP 0.7720 (EUR 200m) 0.7930 (297m) 0.8000 (215m)

USDCHF 0.9740 (USD 250m)

AUDUSD 0.7270 (AUD 370m) 0.7300 (392m) 0.7425 (399m) 0.7450 (333m) 0.7500 (221m)

NZDUSD 0.6950 (NZD 200m)

USDCAD 1.3140 (356m)

-

15:34

U.S. Stocks open: Dow +0.22%, Nasdaq +0.22%, S&P +0.21%

-

15:24

Before the bell: S&P futures +0.26%, NASDAQ futures +0.18%

U.S. stock-index futures inched higher before the outcome of the Federal Reserve's policy meeting..

Global Stocks:

Nikkei 15,919.58 +60.58 +0.38%

Hang Seng 20,467.52 +79.99 +0.39%

Shanghai Composite 2,886.92 +44.74 +1.57%

FTSE 5,978.27 +54.74 +0.92%

CAC 4,187.22 +56.89 +1.38%

DAX 9,627.87 +108.67 +1.14%

Crude $48.87 (-1.28%)

Gold $1287.00 (-0.09%)

-

15:15

U.S.: Capacity Utilization, May 74.9% (forecast 75.2%)

-

15:15

U.S.: Industrial Production (MoM), May -0.4% (forecast -0.2%)

-

15:15

U.S.: Industrial Production YoY , May -1.4%

-

14:58

NY Fed Empire State manufacturing index jumps to 6.01 in June

The New York Federal Reserve released its survey on Wednesday. The NY Fed Empire State manufacturing index jumped to 6.01 in June from -9.02 in May, exceeding expectations for an increase to -4.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The June 2016 Empire State Manufacturing Survey indicates that business activity expanded modestly for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to 10.90 in June from -5.54 in May, while the shipments index rose to 9.32 from -1.94.

The general business conditions expectations index for the next six months jumped to 34.84 in June from 28.48 in May.

The price-paid index jumped to 18.37 in June from 16.67 in May.

The index for the number of employees declined to 0.00 in June from 2.08 in May.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.21

0.11(1.2088%)

27550

3M Co

MMM

168.5

0.89(0.531%)

850

ALTRIA GROUP INC.

MO

65.39

0.09(0.1378%)

480

Amazon.com Inc., NASDAQ

AMZN

720.74

1.44(0.2002%)

10105

American Express Co

AXP

61.4

0.33(0.5404%)

1288

Apple Inc.

AAPL

97.76

0.30(0.3078%)

70778

Barrick Gold Corporation, NYSE

ABX

19.77

-0.02(-0.1011%)

47068

Caterpillar Inc

CAT

75.02

0.16(0.2137%)

760

Chevron Corp

CVX

101.03

-0.25(-0.2468%)

995

Cisco Systems Inc

CSCO

28.5

-0.46(-1.5884%)

84119

Citigroup Inc., NYSE

C

42.2

0.24(0.572%)

33158

Exxon Mobil Corp

XOM

90.25

-0.18(-0.199%)

1760

Facebook, Inc.

FB

115.24

0.30(0.261%)

78873

Ford Motor Co.

F

12.92

0.08(0.6231%)

25350

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.51

0.30(2.9383%)

437008

General Electric Co

GE

30.45

0.01(0.0329%)

28313

General Motors Company, NYSE

GM

28.95

0.12(0.4162%)

3200

Goldman Sachs

GS

146.75

0.56(0.3831%)

2430

Google Inc.

GOOG

720.76

2.49(0.3467%)

180

Home Depot Inc

HD

125.52

0.28(0.2236%)

3648

Intel Corp

INTC

32.13

-0.01(-0.0311%)

1426

International Business Machines Co...

IBM

150.73

-0.33(-0.2185%)

310

Johnson & Johnson

JNJ

117.36

0.24(0.2049%)

1112

JPMorgan Chase and Co

JPM

62.25

0.17(0.2738%)

7319

Merck & Co Inc

MRK

56.2

-0.05(-0.0889%)

300

Microsoft Corp

MSFT

50

0.17(0.3412%)

7242

Nike

NKE

54.25

0.13(0.2402%)

3630

Pfizer Inc

PFE

35.01

0.02(0.0572%)

4074

Procter & Gamble Co

PG

83.46

0.11(0.132%)

8405

Starbucks Corporation, NASDAQ

SBUX

55.77

0.20(0.3599%)

2325

Tesla Motors, Inc., NASDAQ

TSLA

217.8

2.84(1.3212%)

12056

Twitter, Inc., NYSE

TWTR

15.67

0.31(2.0182%)

290609

United Technologies Corp

UTX

101.46

0.27(0.2668%)

111

Visa

V

78.93

0.36(0.4582%)

750

Wal-Mart Stores Inc

WMT

70.85

-0.10(-0.1409%)

344

Walt Disney Co

DIS

98

-0.40(-0.4065%)

10960

Yahoo! Inc., NASDAQ

YHOO

37.45

0.05(0.1337%)

4095

Yandex N.V., NASDAQ

YNDX

21.21

0.10(0.4737%)

300

-

14:49

U.S. producer prices rise 0.4% in May

The U.S. Commerce Department released the producer price index figures on Wednesday. The U.S. producer price index rose 0.4% in May, exceeding expectations for a 0.3% gain, after a 0.2% increase in April.

The increase was mainly driven by a rise in services and energy prices.

Energy prices increased 2.8% in May, wholesale food prices increased 0.3%.

Services prices were up 0.2% in May, while prices for goods rose 0.7%.

On a yearly basis, the producer price index fell 0.1% in May, in line with expectations, after a flat reading in April.

The producer price index excluding food and energy increased 0.3% in April, exceeding expectations for a 0.1% rise, after a 0.1% gain in April.

On a yearly basis, the producer price index excluding food and energy climbed 1.2% in May, beating forecasts of a 1.0% gain, after a 0.9% rise in April.

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Cisco Systems (CSCO) downgraded to Neutral from Buy at Goldman

Other:

Procter & Gamble (PG) initiated with a Buy at Jefferies; target $95

-

14:41

Canadian manufacturing shipments climb 1.0% in April

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments climbed 1.0% in April, beating expectations for a 0.6% increase, after a 0.9% drop in March.

The increase was mainly driven by higher sales in the petroleum and coal product, transportation equipment, and primary metal industries. Transportation equipment sales rose 2.1% in April, sales of petroleum and coal products jumped 8.3%, while sales of primary metals increased 3.9%.

Inventories decreased 0.4% in April, mainly driven by a drop in transportation equipment.

-

14:36

U.K. household finance index increases to 44.2 in June

Markit Economics and financial information provider Ipsos Mori released its household finance index (HFI) for the U.K. on Wednesday. The household finance index increased to 44.2 in June from 42.3 in May.

The index measuring the outlook for financial well-being over the coming twelve months remained unchanged at 49.6 in June.

The current inflation perceptions index declined to 68.0 in June from 68.1% in May.

The index measuring expected living costs over the twelve months was down to 82.4 in June from 82.7% in May.

52% of respondents expects the Bank of England's monetary policy to tighten next over next 12 months.

"UK households reported a relatively subdued financial strain in June. Thanks largely to improvements across the labour market, Markit's HFI picked up from May's 22-month low," economist at Markit, Philip Leake, said.

-

14:31

Canada: Manufacturing Shipments (MoM), April 1.0% (forecast 0.6%)

-

14:30

U.S.: PPI excluding food and energy, m/m, May 0.3% (forecast 0.1%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, May 1.2% (forecast 1%)

-

14:30

U.S.: PPI, y/y, May -0.1% (forecast -0.1%)

-

14:30

U.S.: PPI, m/m, May 0.4% (forecast 0.3%)

-

14:14

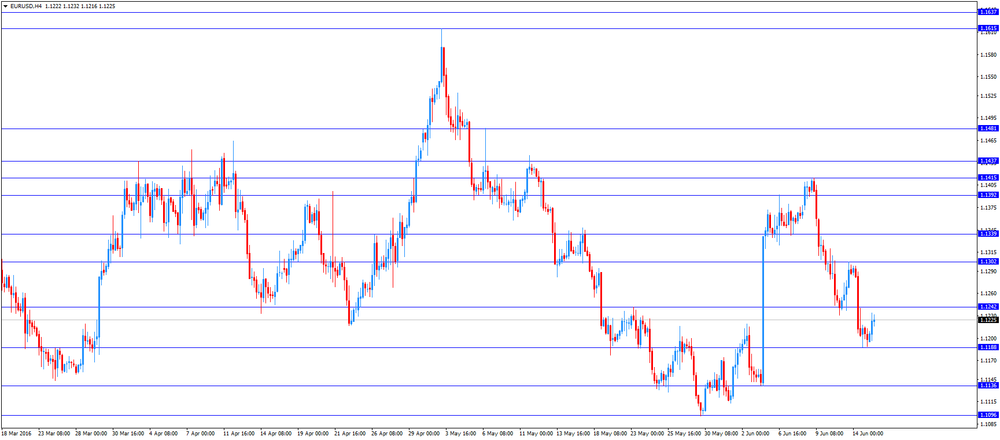

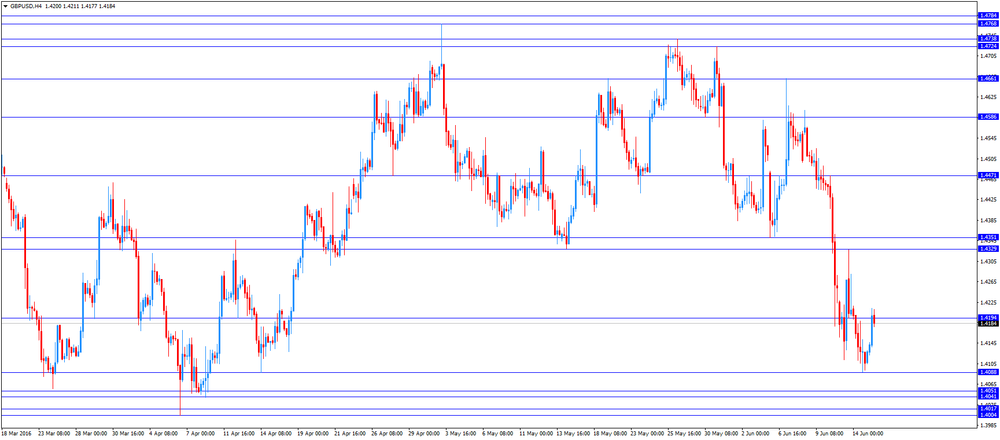

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the U.K. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence June 8.5% -1.0%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.2% Revised From 2.0% 2.1% 2.3%

08:30 United Kingdom Average Earnings, 3m/y April 2.0% Revised From 2.1% 1.7% 2.0%

08:30 United Kingdom ILO Unemployment Rate April 5.1% 5.1% 5%

08:30 United Kingdom Claimant count May 6.4 Revised From -2.4 -0.1 -0.4

09:00 Eurozone Trade balance unadjusted April 28.6 26 27.5

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the Fed's interest rate decision. Analysts expect the Fed to keep its interest rate unchanged.

The U.S. PPI is expected to increase 0.3% in May, after a 0.2% rise in April.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in May, after a 0.1% gain in April.

The U.S. industrial production is expected to decline 0.2% in May, after a 0.7% rise in April.

The euro traded mixed against the U.S. dollar. Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus declined to €27.5 billion in April from €28.6 billion in March, beating expectations for a fall to €26 billion. Exports fell at an unadjusted annual rate of 1.0% in April, while imports dropped 5.0%.

The British pound traded higher against the U.S. dollar on the U.K. labour market data. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate declined to 5.0% in the February to April quarter from 5.1% in the January to March quarter. It was the lowest level since October 2005.

Analysts had expected the unemployment rate to remain unchanged.

Average weekly earnings, excluding bonuses, climbed by 2.3% in the February to April quarter, exceeding expectations for a 2.1% rise, after a 2.2% gain in the January to March quarter. The previous quarter's figure was revised up from a 2.1% rise.

Average weekly earnings, including bonuses, rose by 2.0% in the February to April quarter, exceeding expectations for a 1.7% gain, after a 2.0% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the manufacturing shipments data from Canada. Canadian manufacturing shipments are expected to rise 0.6% in April, after a 0.9% fall in March.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.4213

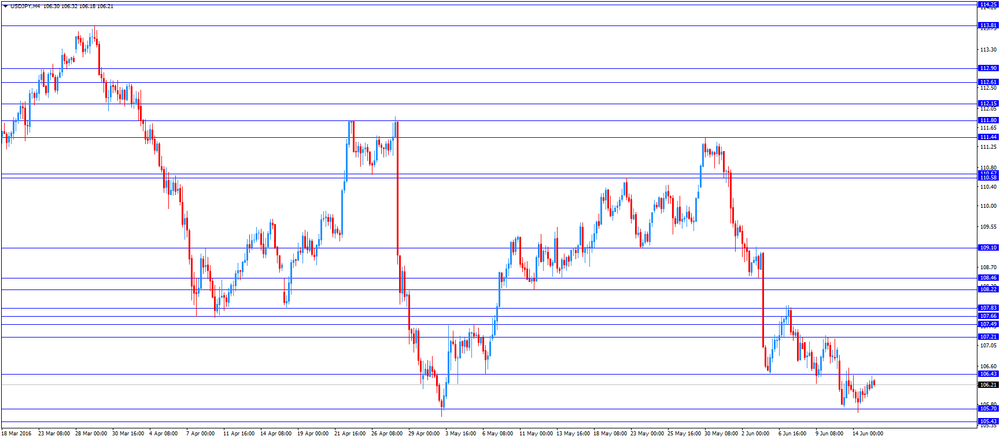

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) April -0.9% 0.6%

12:30 U.S. PPI, m/m May 0.2% 0.3%

12:30 U.S. PPI, y/y May 0% -0.1%

12:30 U.S. PPI excluding food and energy, m/m May 0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y May 0.9% 1%

13:15 U.S. Capacity Utilization May 75.4% 75.2%

13:15 U.S. Industrial Production (MoM) May 0.7% -0.2%

13:15 U.S. Industrial Production YoY May -1.1%

14:00 Eurozone ECB's Jens Weidmann Speaks

14:30 U.S. Crude Oil Inventories June -3.226 -2.27

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter I 0.9% 0.5%

22:45 New Zealand GDP y/y Quarter I 2.3% 2.6%

23:55 Canada BOC Gov Stephen Poloz Speaks

-

13:49

Orders

EUR/USD

Offers 1.1235 1.1250 1.1280 1.1300 1.1320 1.1355-60 1.1400

Bids 1.1200 1.1185 1.1170-75 1.1150 1.1135 1.1100

GBP/USD

Offers 1.4180-85 1.4200 1.4220 1.4250 1.4275-80 1.4300 1.4320 1.4355-60

Bids 1.4120 1.4100 1.4085 1.4065 1.4050 1.4030-35 1.4000 1.3985 1.3950

EUR/GBP

Offers 0.7950 0.7980 0.8000 0.8020-25 0.8050

Bids 0.7900 0.7885 0.7865 0.7850 0.7820 0.7800

EUR/JPY

Offers 119.55-60 119.85 120.00 120.25-30 120.50 120.80 121.00

Bids 119.00 118.80 118.50 118.00

USD/JPY

Offers 106.50 106.85 107.00 107.20 107.50 107.80-85 108.00

Bids 106.00 105.70-75 105.50 105.00 104.70 104.50 104.00

AUD/USD

Offers 0.7400 0.7420-25 0.7450 0.7485 0.7500 0.7520 0.7550

Bids 0.7350 0.7320 0.7300 0.7285 0.7270 0.7250

-

13:13

WSE: Mid session comment

The first half of trading session on the Warsaw parquet was marked by low activity. The very beginning pointed out that it will be another session to wait out and so far nothing on this issue has change. A mix of low turnover and low volatility makes that wait for the Fed is combined with the suspension of the market in anticipation of the next pulse. In the result the WIG20 drifts in areas that not activate the buyers, but also slid out of the potential of market supply. If we add to this the fact that the departure from the support is cosmetic, there is really no reason to trade. In fact, the graph of the WIG20 indicates that today's growth is rather part of the consolidation over 1,750 points than a signal of market's return to increases.

At the halfway point of the session the WIG20 index was at 1,770 points (+0,45%) with the turnover of PLN 144 mln. Gains on European exchanges exceed 1%.

-

12:00

European stock markets mid session: stocks traded higher ahead of the Fed’s interest rate decision

Stock indices traded higher ahead of the release of the Fed's interest rate decision later in the day. Analysts expect the Fed to keep its interest rate unchanged.

Market participants also eyed the economic data from the Eurozone. Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus declined to €27.5 billion in April from €28.6 billion in March, beating expectations for a fall to €26 billion. Exports fell at an unadjusted annual rate of 1.0% in April, while imports dropped 5.0%.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate declined to 5.0% in the February to April quarter from 5.1% in the January to March quarter. It was the lowest level since October 2005.

Analysts had expected the unemployment rate to remain unchanged.

Average weekly earnings, excluding bonuses, climbed by 2.3% in the February to April quarter, exceeding expectations for a 2.1% rise, after a 2.2% gain in the January to March quarter. The previous quarter's figure was revised up from a 2.1% rise.

Average weekly earnings, including bonuses, rose by 2.0% in the February to April quarter, exceeding expectations for a 1.7% gain, after a 2.0% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Current figures:

Name Price Change Change %

FTSE 100 5,976.02 +52.49 +0.89 %

DAX 9,615.85 +96.65 +1.02 %

CAC 40 4,181.61 +51.28 +1.24 %

-

11:43

French final consumer price inflation rises 0.4% in May

The French statistical office Insee released its final consumer price inflation for France on Wednesday. The French consumer price inflation rose 0.4% in May, in line with the preliminary reading, after a 0.1% increase in April.

On a yearly basis, the consumer price index were flat in May, up from the preliminary reading of -0.1%, after a 0.2% decline in April.

Fresh food prices rose 5.8% year-on-year in May, services prices climbed by 1.0%, while petroleum products prices dropped by 10.4%.

-

11:37

Westpac’s consumer confidence index for Australia falls 1.0% in June

Westpac Bank released its consumer confidence index for Australia on Wednesday. The index fell 1.0% in June, after a 8.5% rise in May.

"Coming after an 8.5% surge in May, the small decline in June mostly represents a consolidation at improved levels," Westpac Senior Economist Matthew Hassan said.

"Last month's surprise rate cut from the RBA was the main catalyst behind May's rally and although confidence has slipped back a touch in June this is a fairly common pattern following an interest rate driven bounce," he added.

-

11:32

New Zealand’s seasonally adjusted current account deficit turns into a surplus of NZ$1.31 billion in the first quarter

Statistics New Zealand released its current account data on late Tuesday evening. New Zealand's seasonally adjusted current account deficit turned into a surplus of NZ$1.31 billion in the first quarter from a deficit of NZ$2.89 billion in the fourth quarter, exceeding expectations for a NZ$1.05 billion surplus. The fourth quarter's figure was revised down from a deficit of NZ$2.61 billion.

The services surplus rose by NZ$116 million to NZ$1.1 billion in the first quarter from the previous quarter, while the goods deficit dropped by NZ$247 million to NZ$515 million.

"Generally, foreign-owned New Zealand companies earned lower profits this. This meant there was a decrease in investment income paid to foreign investors," international statistics manager Stuart Jones said.

-

11:22

U.K. unemployment rate declines to 5.0% in the February to April quarter, the lowest level since October 2005

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate declined to 5.0% in the February to April quarter from 5.1% in the January to March quarter. It was the lowest level since October 2005.

Analysts had expected the unemployment rate to remain unchanged.

The claimant count fell by 400 people in May, beating expectations for a decrease by 100, after an increase of 6,400 people in April. April's figure was revised down from a 2,400 fall.

U.K. unemployment in the February to April period was 1.67 million, down 20,000 compared with January to March.

The employment rate was 74.2% in the February to April quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.3% in the February to April quarter, exceeding expectations for a 2.1% rise, after a 2.2% gain in the January to March quarter. The previous quarter's figure was revised up from a 2.1% rise.

Average weekly earnings, including bonuses, rose by 2.0% in the February to April quarter, exceeding expectations for a 1.7% gain, after a 2.0% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:10

Eurozone's unadjusted trade surplus declines to €27.5 billion in April

Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus declined to €27.5 billion in April from €28.6 billion in March, beating expectations for a fall to €26 billion.

Exports fell at an unadjusted annual rate of 1.0% in April, while imports dropped 5.0%.

-

11:00

Eurozone: Trade balance unadjusted, April 27.5 (forecast 26)

-

10:54

Britain’s Chancellor George Osborne: the exit from the European Union would harm the country’s economy

Britain's Chancellor George Osborne warned on Wednesday that the exit from the European Union (EU) would harm the country's economy.

"Quitting the EU would hit investment, hurt families and harm the British economy," he said.

Osborne pointed out that the government could raise taxes and cut spending in case of the exit from the EU.

-

10:31

United Kingdom: Average earnings ex bonuses, 3 m/y, April 2.3% (forecast 2.1%)

-

10:30

United Kingdom: ILO Unemployment Rate, April 5% (forecast 5.1%)

-

10:30

United Kingdom: Claimant count , May -0.4 (forecast -0.1)

-

10:30

United Kingdom: Average Earnings, 3m/y , April 2.0% (forecast 1.7%)

-

10:23

Morgan Stanley: oil prices could drop toward $30 a barrel due to the global oil oversupply

Morgan Stanley said on Tuesday that oil prices could drop toward $30 a barrel due to the global oil oversupply. The lender noted that the recent rise in oil prices was led by a lower oil output, mainly driven by supply disruptions in Canada and Nigeria. According to Morgan Stanley, the global supply could rise as outages are likely to fade, inventories are still high, and the U.S. supply could increase due to higher current oil prices.

-

10:09

U.S. index provider Morgan Stanley Capital International (MSCI) Inc. will not add domestic Chinese stocks to its key benchmark index

U.S. index provider Morgan Stanley Capital International (MSCI) Inc. said on Tuesday that it will not add domestic Chinese stocks (Chinese A shares, which are listed in Shanghai and Shenzhen and denominated in yuan) to its key benchmark index this year.

"International institutional investors clearly indicated that they would like to see further improvements in the accessibility of the China A shares market before its inclusion in the MSCI Emerging Markets Index," MSCI managing director and global head of research, Remy Briand, said in a statement.

"In keeping with its standard practice, MSCI will monitor the implementation of the recently announced policy changes and will seek feedback from market participants," he added.

-

10:05

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 473m) 1.1075 (241m) 1.1200 (413m) 1.1250 (309m) 1.1280 (243m) 1.1300 (428m) )

USD/JPY 105.00 (USD 400m) 106.00 (USD 450m) 106.65 (310m) 107.00 (450m) 108.00 (415m)

GBP/USD 1.4000 (GBP 1.06bln) 1.4050 (1.33bln) 1.4200 (365m) 1.4300 (278m) 1.4350-55 (415m)

EUR/GBP 0.7720 (EUR 200m) 0.7930 (297m) 0.8000 (215m)

USD/CHF 0.9740 (USD 250m)

AUD/USD 0.7270 (AUD 370m) 0.7300 (392m) 0.7425 (399m) 0.7450 (333m) 0.7500 (221m)

NZD/USD 0.6950 (NZD 200m)

USD/CAD 1.3140 (356m)

-

09:20

WSE: After opening

WIG20 index opened at 1766.96 points (+0.25%)*

WIG 44874.83 0.33%

WIG30 1972.39 0.45%

mWIG40 3425.75 -0.26%

*/ - change to previous close

Better than expected end of the session on Wall Street and a weakening of the yen merged with the expected increases on European markets and the stronger zloty. As a result, the WIG20 index started the day with rise. The increase shows the ideal defense of 1,750 points area. Most important, however, that the graph is moving away 1,750 points and minimizes the risk of a decline at an important level, which would be an invitation to test the January hole.

Looking from a distance on the topic of Brexit and its impact on markets, we should wait to 23.06 . None of the larger players will not be in hurry, which may mean reduced turnover. In turn, each new survey can be clearly reflected in the illiquid market.

-

08:30

Options levels on wednesday, June 15, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1407 (1996)

$1.1369 (707)

$1.1328 (71)

Price at time of writing this review: $1.1219

Support levels (open interest**, contracts):

$1.1175 (2341)

$1.1136 (1673)

$1.1085 (2361)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 36141 contracts, with the maximum number of contracts with strike price $1,1500 (5297);

- Overall open interest on the PUT options with the expiration date July, 8 is 73207 contracts, with the maximum number of contracts with strike price $1,0900 (13317);

- The ratio of PUT/CALL was 2.03 versus 1.95 from the previous trading day according to data from June, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.4431 (499)

$1.4336 (132)

$1.4242 (112)

Price at time of writing this review: $1.4172

Support levels (open interest**, contracts):

$1.4054 (3283)

$1.3958 (1009)

$1.3862 (2816)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 19220 contracts, with the maximum number of contracts with strike price $1,5000 (3030);

- Overall open interest on the PUT options with the expiration date July, 8 is 38714 contracts, with the maximum number of contracts with strike price $1,4100 (3283);

- The ratio of PUT/CALL was 2.01 versus 2.02 from the previous trading day according to data from June, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

WSE: Before opening

Tuesday was the fifth consecutive day of growing risk aversion and a flight of capital to safe havens. Uncertainty among investors is increasing with the approach of the expected decision of central banks (the Fed on Wednesday, on Thursday the Bank of Japan) and the outcome of the referendum on June 23 (Brexit). The result of this uncertainty was further declines in the vast majority of stock markets, the strengthening of currencies such as the dollar, yen and franc, as well as further declines in yields of belonging to the safest bonds.

Tuesday's session on Wall Street ended in a series of successive declines in the major indexes. The broad S&P500 loss was less than 0.2 percent. Current quotations of the contract for the S&P 500 is slightly positive which should give pros opening of European markets. However it is difficult to count on the fireworks when the variables that caused recent declines remain in force.

In case of the WIG20, the most important will be the condition of the zloty, which strength or weakness have this year crucial impact for sentiment towards blue chips. With the strengthening of the zloty - difficult before the release of the FOMC statement - activity on the demand side will be easier.

If today and tomorrow any new information will not appear, the balance of power seems relatively clear. The chart of the WIG20 shows two options for the index:

1. The decrease under the area of support in the region of 1,750 points will open the way to a meeting with the January lows set in the vicinity of 1,650 points.

2. Defense of 1,750 points directs attention to the June highs in the region of 1,850 points and may trigger speculation about the formation of a double bottom, when the potential for growth can be estimated at more than 100 points.

-

08:18

Asian session: Sterling steadied

The euro nursed losses against the dollar on Wednesday as the benchmark German government bond yield turned negative for the first time due to worries that Britain might vote next week to leave the European Union, while investors stayed cautions ahead of a Federal Reserve's policy decision later in the global day.

The yen gave back a bit of ground against the dollar as a bounce by recently battered Tokyo stocks slightly improved investor risk appetite for the time being.

The dollar edged up 0.2 percent to 106.260 yen, having bounced from an overnight low of 105.630 thanks to Tuesday's upbeat May U.S. retail sales data. A drop below 105.55 would take the greenback to its lowest level since October 2014.

In addition to safe-haven bids for the yen, the dollar has been on the back foot against its Japanese counterpart as prospects of the Fed raising rates this month have been dashed by soft U.S. data, notably the much weaker-than-expected May non-farm payrolls report.

The Fed concludes its two-day Federal Open Market Committee (FOMC) meeting later on Wednesday.

The likelihood of the Fed hiking interest rates will be very low while Brexit worries dominate action in the financial markets.

That said, the FOMC meeting will still garner attention as it will give the market a chance to gauge the Fed's stance on rate hikes at the July meeting and beyond.

Sterling steadied at $1.4120 after recovering slightly from a two-month low of $1.4091 plumbed Tuesday on Brexit fears.

The Australian dollar traded at $0.7355, within reach of a one-month high of $0.7505 touched last week.

That high was reached as the Reserve Bank of Australia (RBA) appeared less dovish than some had expected last week, when it left interest rates unchanged and did not hint at an explict easing bias. Lower commodity prices, however, have since capped the Aussie.

EUR / USD: during the Asian session, the pair is trading in the range of $ 1.1190-1.1215

GBP / USD: during the Asian session, the pair is trading in the range of $ 1.4090-1.4150

USD / JPY: during the Asian session, the pair was trading in range Y105.95-106.30

Based on Reuters materials

-

07:03

Global Stocks

European stocks booked a fifth consecutive decline on Tuesday as heightened "Brexit" worries unsettled equity investors.

Polls: European stocks hit intraday lows Tuesday afternoon and losses sharpened into the close of trading as Reuters reported that the European Central Bank is preparing to publicly say it will support the financial markets, along with the Bank of England, if the U.K. votes in favor of leaving the EU. A referendum on the issue is slated for June 23, with the risk of an U.K.-EU breakup known as Brexit.

Investors have been seeking shelter in the bond market ahead of the referendum. Polls released Tuesday and Monday suggested that voters were in favor of leaving the EU. Among the surveys, market research firm TNS said 47% of likely voters back a Brexit, compared with 40% who are opposed.

A Sunday Times/YouGov poll showed 46% of Britons support leaving the EU, while 39% wish to remain.

U.S. stocks fell for a fourth straight session on Tuesday as the Federal Reserve kicked off its two-day policy meeting and fears over the U.K. voting to leave the European Union amped up. The Dow Jones Industrial Average DJIA, -0.33% fell 57.66 points, or 0.3%, to close at 17,674.82, as shares of American Express Co. AXP, -4.08% dropped more than 4%. The S&P 500 Index SPX, -0.18% declined 3.74 points, or 0.2%, to finish at 2,075.32, weighed down by the financials and materials sectors. The Nasdaq Composite Index COMP, -0.10% slipped 4.89 points, or 0.1%, to close at 4,843.55. Meanwhile, the CBOE Volatility Index VIX, -2.24% or so-called fear index, remained above 20.

Asian shares were slightly weaker but recovered from near three-week lows on Wednesday as markets digested U.S. index provider MSCI's decision not to include domestic Chinese equities in its indexes and Brexit fears drove investors to assets such as U.S. bonds and the yen.

Mainland Chinese shares, among Asia's worst performers this year, were mixed while Hong Kong slid, as markets, which had expected Chinese A-shares to be included in the emerging market index, considered the announcement.

MSCI's broadest index of Asia-Pacific shares outside Japan were down 0.1 percent. Japan's Nikkei reversed earlier losses to rise 0.7 percent.

MSCI in its decision said Beijing had more work to do in liberalising capital markets, and said it wanted more time to assess the effectiveness of the Qualified Foreign Institutional Investor (QFII) quota allocation scheme and capital mobility policy changes.

MSCI said it would consider China A shares' inclusion as part of its 2017 review and didn't rule out a potential off-cycle announcement should further positive developments occur ahead of June 2017.

-

04:03

Nikkei 225 15,892.22 +33.22 +0.21 %, Hang Seng 20,279.95 -107.58 -0.53 %, Shanghai Composite 2,834.97 -7.22 -0.25 %

-

02:32

Australia: Westpac Consumer Confidence, June -1.0%

-

00:45

New Zealand: Current Account , Quarter I -1.31 (forecast 1.05)

-

00:33

Commodities. Daily history for Jun 14’2016:

(raw materials / closing price /% change)

Oil 47.90 -1.22%

Gold 1,288.50 +0.03%

-

00:32

Stocks. Daily history for Jun 14’2016:

(index / closing price / change items /% change)

Nikkei 225 15,859 -160.18 -1.00 %

Hang Seng 20,387.53 -125.46 -0.61 %

S&P/ASX 200 5,203.26 -109.33 -2.06 %

Shanghai Composite 2,842.92 +9.85 +0.35 %

FTSE 100 5,923.53 -121.44 -2.01 %

CAC 40 4,130.33 -96.69 -2.29 %

Xetra DAX 9,519.2 -138.24 -1.43 %

S&P 500 2,075.32 -3.74 -0.18 %

NASDAQ Composite 4,843.55 -4.89 -0.10 %

Dow Jones 17,674.82 -57.66 -0.33 %

-

00:31

Currencies. Daily history for Jun 14’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1206 -0,72%

GBP/USD $1,4107 -0,75%

USD/CHF Chf0,9634 -0,05%

USD/JPY Y106,01 -0,09%

EUR/JPY Y118,81 -0,82%

GBP/JPY Y149,55 -0,84%

AUD/USD $0,7345 -0,52%

NZD/USD $0,6978 -1,05%

USD/CAD C$1,2864 +0,31%

-

00:02

Schedule for today, Wednesday, Jun 15’2016:

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation June 3.2%

01:30 Australia National Australia Bank's Business Confidence May 5

04:30 Japan Industrial Production (MoM) (Finally) April 3.8% 0.3%

04:30 Japan Industrial Production (YoY) (Finally) April 0.2% -3.5%

07:15 Switzerland Producer & Import Prices, m/m May 0.3%

07:15 Switzerland Producer & Import Prices, y/y May -2.4%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.4% 0.4%

08:30 United Kingdom Producer Price Index - Output (YoY) May -0.7% -0.4%

08:30 United Kingdom Producer Price Index - Input (MoM) May 0.9% 0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) May -6.5% -5%

08:30 United Kingdom Retail Price Index, m/m May 0.1% 0.3%

08:30 United Kingdom Retail prices, Y/Y May 1.3% 1.4%

08:30 United Kingdom HICP, m/m May 0.1% 0.3%

08:30 United Kingdom HICP, Y/Y May 0.3% 0.4%

08:30 United Kingdom HICP ex EFAT, Y/Y May 1.2% 1.3%

09:00 Eurozone Industrial production, (MoM) April -0.8% 0.7%

09:00 Eurozone Industrial Production (YoY) April 0.2% 1.3%

09:00 Eurozone Employment Change Quarter I 0.3%

12:30 U.S. Retail sales May 1.3% 0.3%

12:30 U.S. Retail Sales YoY May 3%

12:30 U.S. Retail sales excluding auto May 0.8% 0.4%

12:30 U.S. Import Price Index May 0.3% 0.8%

14:00 U.S. Business inventories April 0.4% 0.2%

22:45 New Zealand Current Account Quarter I -2.61

-