Noticias del mercado

-

22:00

U.S.: Net Long-term TIC Flows , April -79.6

-

22:00

U.S.: Total Net TIC Flows, April 80.4

-

20:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

17:48

Greek import prices climb 1.3% in April

The Hellenic Statistical Authority released its import prices data for Greece on Wednesday. Greek import prices climbed 1.3% in April, after a 1.4% rise in March.

On a yearly basis, import prices dropped 7.9% in April, after a 7.8% decline in March.

Import prices for energy plunged by 28.5% year-on-year in April, price for durable consumer goods were flat, while price for non-durable consumer goods increased by 0.1%.

Prices of capital goods rose 0.2% year-on-year in April, while intermediate goods prices decreased 2.6%.

-

17:43

European Central Bank Vice President Vitor Constancio: negative deposit rates have limits

The European Central Bank (ECB) Vice President Vitor Constancio said on Wednesday that negative deposit rates has limits, adding that the central bank should monitor "the possible occurrence of undesirable side-effects".

He also said that inflation in 2018 could be higher that estimated by the ECB.

Constancion pointed out that the central bank would continue to implement its stimulus measures.

-

17:27

New loans in China rise to 985.5 billion yuan in May

The People's Bank of China (PBoC) released its new loans data on Wednesday. New loans in local currency in China were 985.5 billion yuan in May, up from April's 555.6 billion yuan.

M2 money supply jumped by 11.8% year-on-year in May.

Total social financing increased to 146.33 trillion yuan in May from 751 billion yuan in April.

-

16:59

U.S. industrial production falls 0.4% in May

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production fell 0.4% in May, missing expectations for a 0.2% decrease, after a 0.6% rise in April. April's figure was revised down from a 0.7% increase.

The decrease was mainly driven by a drop in utilities. Mining output rose 0.2% in May, while utilities production slid 1.0%.

Manufacturing output was down 0.4% in May, after a 0.2% increase in April.

Capacity utilisation rate decreased to 74.9% in May from 75.3% in April, missing expectations for a fall to 75.2%. April's figure was revised down from 75.4%.

-

16:30

U.S.: Crude Oil Inventories, June -0.933 (forecast -2.27)

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1000 (EUR 473m) 1.1075 (241m) 1.1200 (413m) 1.1250 (309m) 1.1280 (243m) 1.1300 (428m) )

USDJPY 105.00 (USD 400m) 106.00 (USD 450m) 106.65 (310m) 107.00 (450m) 108.00 (415m)

GBPUSD 1.4000 (GBP 1.06bln) 1.4050 (1.33bln) 1.4200 (365m) 1.4300 (278m) 1.4350-55 (415m)

EURGBP 0.7720 (EUR 200m) 0.7930 (297m) 0.8000 (215m)

USDCHF 0.9740 (USD 250m)

AUDUSD 0.7270 (AUD 370m) 0.7300 (392m) 0.7425 (399m) 0.7450 (333m) 0.7500 (221m)

NZDUSD 0.6950 (NZD 200m)

USDCAD 1.3140 (356m)

-

15:15

U.S.: Capacity Utilization, May 74.9% (forecast 75.2%)

-

15:15

U.S.: Industrial Production (MoM), May -0.4% (forecast -0.2%)

-

15:15

U.S.: Industrial Production YoY , May -1.4%

-

14:58

NY Fed Empire State manufacturing index jumps to 6.01 in June

The New York Federal Reserve released its survey on Wednesday. The NY Fed Empire State manufacturing index jumped to 6.01 in June from -9.02 in May, exceeding expectations for an increase to -4.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The June 2016 Empire State Manufacturing Survey indicates that business activity expanded modestly for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to 10.90 in June from -5.54 in May, while the shipments index rose to 9.32 from -1.94.

The general business conditions expectations index for the next six months jumped to 34.84 in June from 28.48 in May.

The price-paid index jumped to 18.37 in June from 16.67 in May.

The index for the number of employees declined to 0.00 in June from 2.08 in May.

-

14:49

U.S. producer prices rise 0.4% in May

The U.S. Commerce Department released the producer price index figures on Wednesday. The U.S. producer price index rose 0.4% in May, exceeding expectations for a 0.3% gain, after a 0.2% increase in April.

The increase was mainly driven by a rise in services and energy prices.

Energy prices increased 2.8% in May, wholesale food prices increased 0.3%.

Services prices were up 0.2% in May, while prices for goods rose 0.7%.

On a yearly basis, the producer price index fell 0.1% in May, in line with expectations, after a flat reading in April.

The producer price index excluding food and energy increased 0.3% in April, exceeding expectations for a 0.1% rise, after a 0.1% gain in April.

On a yearly basis, the producer price index excluding food and energy climbed 1.2% in May, beating forecasts of a 1.0% gain, after a 0.9% rise in April.

-

14:41

Canadian manufacturing shipments climb 1.0% in April

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments climbed 1.0% in April, beating expectations for a 0.6% increase, after a 0.9% drop in March.

The increase was mainly driven by higher sales in the petroleum and coal product, transportation equipment, and primary metal industries. Transportation equipment sales rose 2.1% in April, sales of petroleum and coal products jumped 8.3%, while sales of primary metals increased 3.9%.

Inventories decreased 0.4% in April, mainly driven by a drop in transportation equipment.

-

14:36

U.K. household finance index increases to 44.2 in June

Markit Economics and financial information provider Ipsos Mori released its household finance index (HFI) for the U.K. on Wednesday. The household finance index increased to 44.2 in June from 42.3 in May.

The index measuring the outlook for financial well-being over the coming twelve months remained unchanged at 49.6 in June.

The current inflation perceptions index declined to 68.0 in June from 68.1% in May.

The index measuring expected living costs over the twelve months was down to 82.4 in June from 82.7% in May.

52% of respondents expects the Bank of England's monetary policy to tighten next over next 12 months.

"UK households reported a relatively subdued financial strain in June. Thanks largely to improvements across the labour market, Markit's HFI picked up from May's 22-month low," economist at Markit, Philip Leake, said.

-

14:31

Canada: Manufacturing Shipments (MoM), April 1.0% (forecast 0.6%)

-

14:30

U.S.: PPI excluding food and energy, m/m, May 0.3% (forecast 0.1%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, May 1.2% (forecast 1%)

-

14:30

U.S.: PPI, y/y, May -0.1% (forecast -0.1%)

-

14:30

U.S.: PPI, m/m, May 0.4% (forecast 0.3%)

-

14:14

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the U.K. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence June 8.5% -1.0%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.2% Revised From 2.0% 2.1% 2.3%

08:30 United Kingdom Average Earnings, 3m/y April 2.0% Revised From 2.1% 1.7% 2.0%

08:30 United Kingdom ILO Unemployment Rate April 5.1% 5.1% 5%

08:30 United Kingdom Claimant count May 6.4 Revised From -2.4 -0.1 -0.4

09:00 Eurozone Trade balance unadjusted April 28.6 26 27.5

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the Fed's interest rate decision. Analysts expect the Fed to keep its interest rate unchanged.

The U.S. PPI is expected to increase 0.3% in May, after a 0.2% rise in April.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in May, after a 0.1% gain in April.

The U.S. industrial production is expected to decline 0.2% in May, after a 0.7% rise in April.

The euro traded mixed against the U.S. dollar. Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus declined to €27.5 billion in April from €28.6 billion in March, beating expectations for a fall to €26 billion. Exports fell at an unadjusted annual rate of 1.0% in April, while imports dropped 5.0%.

The British pound traded higher against the U.S. dollar on the U.K. labour market data. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate declined to 5.0% in the February to April quarter from 5.1% in the January to March quarter. It was the lowest level since October 2005.

Analysts had expected the unemployment rate to remain unchanged.

Average weekly earnings, excluding bonuses, climbed by 2.3% in the February to April quarter, exceeding expectations for a 2.1% rise, after a 2.2% gain in the January to March quarter. The previous quarter's figure was revised up from a 2.1% rise.

Average weekly earnings, including bonuses, rose by 2.0% in the February to April quarter, exceeding expectations for a 1.7% gain, after a 2.0% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the manufacturing shipments data from Canada. Canadian manufacturing shipments are expected to rise 0.6% in April, after a 0.9% fall in March.

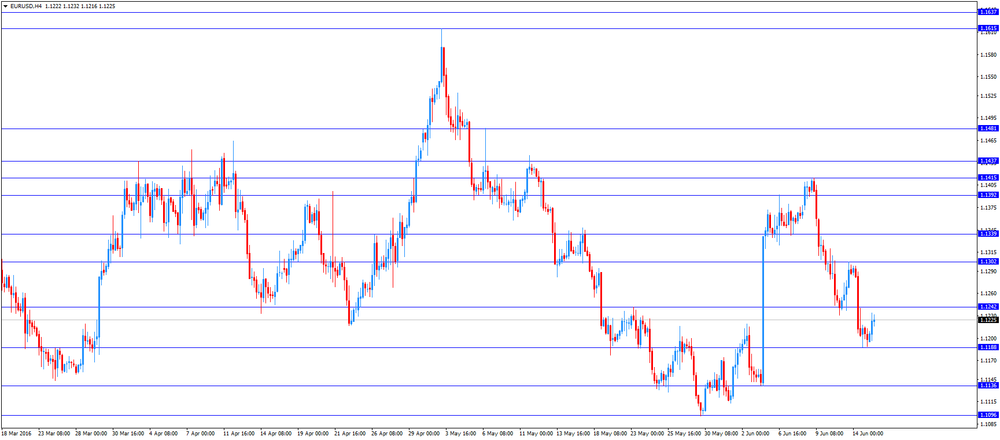

EUR/USD: the currency pair traded mixed

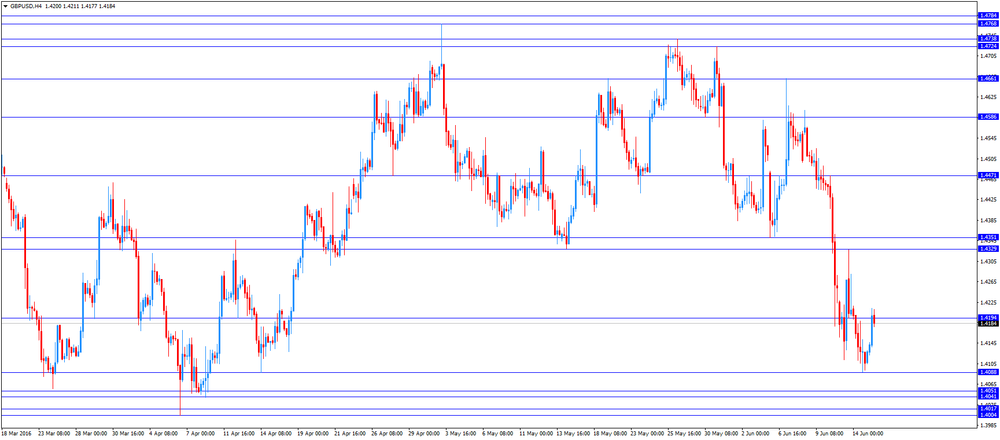

GBP/USD: the currency pair rose to $1.4213

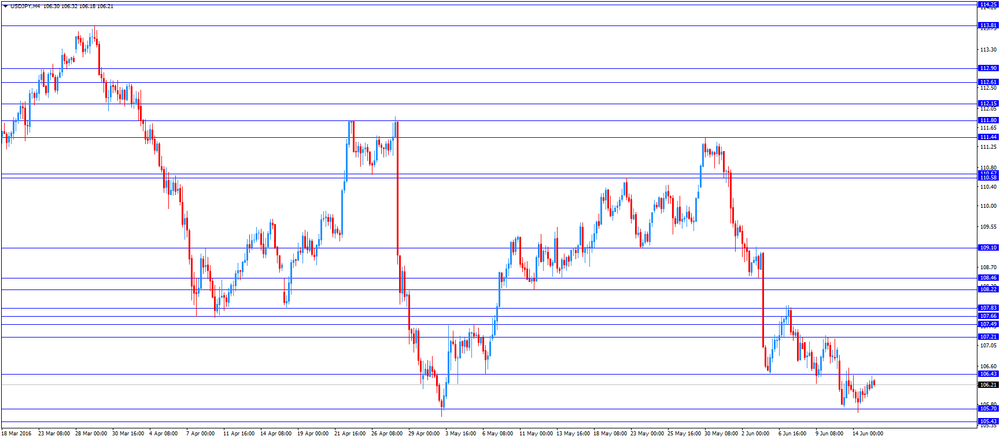

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) April -0.9% 0.6%

12:30 U.S. PPI, m/m May 0.2% 0.3%

12:30 U.S. PPI, y/y May 0% -0.1%

12:30 U.S. PPI excluding food and energy, m/m May 0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y May 0.9% 1%

13:15 U.S. Capacity Utilization May 75.4% 75.2%

13:15 U.S. Industrial Production (MoM) May 0.7% -0.2%

13:15 U.S. Industrial Production YoY May -1.1%

14:00 Eurozone ECB's Jens Weidmann Speaks

14:30 U.S. Crude Oil Inventories June -3.226 -2.27

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter I 0.9% 0.5%

22:45 New Zealand GDP y/y Quarter I 2.3% 2.6%

23:55 Canada BOC Gov Stephen Poloz Speaks

-

13:49

Orders

EUR/USD

Offers 1.1235 1.1250 1.1280 1.1300 1.1320 1.1355-60 1.1400

Bids 1.1200 1.1185 1.1170-75 1.1150 1.1135 1.1100

GBP/USD

Offers 1.4180-85 1.4200 1.4220 1.4250 1.4275-80 1.4300 1.4320 1.4355-60

Bids 1.4120 1.4100 1.4085 1.4065 1.4050 1.4030-35 1.4000 1.3985 1.3950

EUR/GBP

Offers 0.7950 0.7980 0.8000 0.8020-25 0.8050

Bids 0.7900 0.7885 0.7865 0.7850 0.7820 0.7800

EUR/JPY

Offers 119.55-60 119.85 120.00 120.25-30 120.50 120.80 121.00

Bids 119.00 118.80 118.50 118.00

USD/JPY

Offers 106.50 106.85 107.00 107.20 107.50 107.80-85 108.00

Bids 106.00 105.70-75 105.50 105.00 104.70 104.50 104.00

AUD/USD

Offers 0.7400 0.7420-25 0.7450 0.7485 0.7500 0.7520 0.7550

Bids 0.7350 0.7320 0.7300 0.7285 0.7270 0.7250

-

11:43

French final consumer price inflation rises 0.4% in May

The French statistical office Insee released its final consumer price inflation for France on Wednesday. The French consumer price inflation rose 0.4% in May, in line with the preliminary reading, after a 0.1% increase in April.

On a yearly basis, the consumer price index were flat in May, up from the preliminary reading of -0.1%, after a 0.2% decline in April.

Fresh food prices rose 5.8% year-on-year in May, services prices climbed by 1.0%, while petroleum products prices dropped by 10.4%.

-

11:37

Westpac’s consumer confidence index for Australia falls 1.0% in June

Westpac Bank released its consumer confidence index for Australia on Wednesday. The index fell 1.0% in June, after a 8.5% rise in May.

"Coming after an 8.5% surge in May, the small decline in June mostly represents a consolidation at improved levels," Westpac Senior Economist Matthew Hassan said.

"Last month's surprise rate cut from the RBA was the main catalyst behind May's rally and although confidence has slipped back a touch in June this is a fairly common pattern following an interest rate driven bounce," he added.

-

11:32

New Zealand’s seasonally adjusted current account deficit turns into a surplus of NZ$1.31 billion in the first quarter

Statistics New Zealand released its current account data on late Tuesday evening. New Zealand's seasonally adjusted current account deficit turned into a surplus of NZ$1.31 billion in the first quarter from a deficit of NZ$2.89 billion in the fourth quarter, exceeding expectations for a NZ$1.05 billion surplus. The fourth quarter's figure was revised down from a deficit of NZ$2.61 billion.

The services surplus rose by NZ$116 million to NZ$1.1 billion in the first quarter from the previous quarter, while the goods deficit dropped by NZ$247 million to NZ$515 million.

"Generally, foreign-owned New Zealand companies earned lower profits this. This meant there was a decrease in investment income paid to foreign investors," international statistics manager Stuart Jones said.

-

11:22

U.K. unemployment rate declines to 5.0% in the February to April quarter, the lowest level since October 2005

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate declined to 5.0% in the February to April quarter from 5.1% in the January to March quarter. It was the lowest level since October 2005.

Analysts had expected the unemployment rate to remain unchanged.

The claimant count fell by 400 people in May, beating expectations for a decrease by 100, after an increase of 6,400 people in April. April's figure was revised down from a 2,400 fall.

U.K. unemployment in the February to April period was 1.67 million, down 20,000 compared with January to March.

The employment rate was 74.2% in the February to April quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.3% in the February to April quarter, exceeding expectations for a 2.1% rise, after a 2.2% gain in the January to March quarter. The previous quarter's figure was revised up from a 2.1% rise.

Average weekly earnings, including bonuses, rose by 2.0% in the February to April quarter, exceeding expectations for a 1.7% gain, after a 2.0% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:10

Eurozone's unadjusted trade surplus declines to €27.5 billion in April

Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus declined to €27.5 billion in April from €28.6 billion in March, beating expectations for a fall to €26 billion.

Exports fell at an unadjusted annual rate of 1.0% in April, while imports dropped 5.0%.

-

11:00

Eurozone: Trade balance unadjusted, April 27.5 (forecast 26)

-

10:54

Britain’s Chancellor George Osborne: the exit from the European Union would harm the country’s economy

Britain's Chancellor George Osborne warned on Wednesday that the exit from the European Union (EU) would harm the country's economy.

"Quitting the EU would hit investment, hurt families and harm the British economy," he said.

Osborne pointed out that the government could raise taxes and cut spending in case of the exit from the EU.

-

10:31

United Kingdom: Average earnings ex bonuses, 3 m/y, April 2.3% (forecast 2.1%)

-

10:30

United Kingdom: ILO Unemployment Rate, April 5% (forecast 5.1%)

-

10:30

United Kingdom: Claimant count , May -0.4 (forecast -0.1)

-

10:30

United Kingdom: Average Earnings, 3m/y , April 2.0% (forecast 1.7%)

-

10:09

U.S. index provider Morgan Stanley Capital International (MSCI) Inc. will not add domestic Chinese stocks to its key benchmark index

U.S. index provider Morgan Stanley Capital International (MSCI) Inc. said on Tuesday that it will not add domestic Chinese stocks (Chinese A shares, which are listed in Shanghai and Shenzhen and denominated in yuan) to its key benchmark index this year.

"International institutional investors clearly indicated that they would like to see further improvements in the accessibility of the China A shares market before its inclusion in the MSCI Emerging Markets Index," MSCI managing director and global head of research, Remy Briand, said in a statement.

"In keeping with its standard practice, MSCI will monitor the implementation of the recently announced policy changes and will seek feedback from market participants," he added.

-

10:05

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 473m) 1.1075 (241m) 1.1200 (413m) 1.1250 (309m) 1.1280 (243m) 1.1300 (428m) )

USD/JPY 105.00 (USD 400m) 106.00 (USD 450m) 106.65 (310m) 107.00 (450m) 108.00 (415m)

GBP/USD 1.4000 (GBP 1.06bln) 1.4050 (1.33bln) 1.4200 (365m) 1.4300 (278m) 1.4350-55 (415m)

EUR/GBP 0.7720 (EUR 200m) 0.7930 (297m) 0.8000 (215m)

USD/CHF 0.9740 (USD 250m)

AUD/USD 0.7270 (AUD 370m) 0.7300 (392m) 0.7425 (399m) 0.7450 (333m) 0.7500 (221m)

NZD/USD 0.6950 (NZD 200m)

USD/CAD 1.3140 (356m)

-

08:30

Options levels on wednesday, June 15, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1407 (1996)

$1.1369 (707)

$1.1328 (71)

Price at time of writing this review: $1.1219

Support levels (open interest**, contracts):

$1.1175 (2341)

$1.1136 (1673)

$1.1085 (2361)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 36141 contracts, with the maximum number of contracts with strike price $1,1500 (5297);

- Overall open interest on the PUT options with the expiration date July, 8 is 73207 contracts, with the maximum number of contracts with strike price $1,0900 (13317);

- The ratio of PUT/CALL was 2.03 versus 1.95 from the previous trading day according to data from June, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.4431 (499)

$1.4336 (132)

$1.4242 (112)

Price at time of writing this review: $1.4172

Support levels (open interest**, contracts):

$1.4054 (3283)

$1.3958 (1009)

$1.3862 (2816)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 19220 contracts, with the maximum number of contracts with strike price $1,5000 (3030);

- Overall open interest on the PUT options with the expiration date July, 8 is 38714 contracts, with the maximum number of contracts with strike price $1,4100 (3283);

- The ratio of PUT/CALL was 2.01 versus 2.02 from the previous trading day according to data from June, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:18

Asian session: Sterling steadied

The euro nursed losses against the dollar on Wednesday as the benchmark German government bond yield turned negative for the first time due to worries that Britain might vote next week to leave the European Union, while investors stayed cautions ahead of a Federal Reserve's policy decision later in the global day.

The yen gave back a bit of ground against the dollar as a bounce by recently battered Tokyo stocks slightly improved investor risk appetite for the time being.

The dollar edged up 0.2 percent to 106.260 yen, having bounced from an overnight low of 105.630 thanks to Tuesday's upbeat May U.S. retail sales data. A drop below 105.55 would take the greenback to its lowest level since October 2014.

In addition to safe-haven bids for the yen, the dollar has been on the back foot against its Japanese counterpart as prospects of the Fed raising rates this month have been dashed by soft U.S. data, notably the much weaker-than-expected May non-farm payrolls report.

The Fed concludes its two-day Federal Open Market Committee (FOMC) meeting later on Wednesday.

The likelihood of the Fed hiking interest rates will be very low while Brexit worries dominate action in the financial markets.

That said, the FOMC meeting will still garner attention as it will give the market a chance to gauge the Fed's stance on rate hikes at the July meeting and beyond.

Sterling steadied at $1.4120 after recovering slightly from a two-month low of $1.4091 plumbed Tuesday on Brexit fears.

The Australian dollar traded at $0.7355, within reach of a one-month high of $0.7505 touched last week.

That high was reached as the Reserve Bank of Australia (RBA) appeared less dovish than some had expected last week, when it left interest rates unchanged and did not hint at an explict easing bias. Lower commodity prices, however, have since capped the Aussie.

EUR / USD: during the Asian session, the pair is trading in the range of $ 1.1190-1.1215

GBP / USD: during the Asian session, the pair is trading in the range of $ 1.4090-1.4150

USD / JPY: during the Asian session, the pair was trading in range Y105.95-106.30

Based on Reuters materials

-

02:32

Australia: Westpac Consumer Confidence, June -1.0%

-

00:45

New Zealand: Current Account , Quarter I -1.31 (forecast 1.05)

-

00:31

Currencies. Daily history for Jun 14’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1206 -0,72%

GBP/USD $1,4107 -0,75%

USD/CHF Chf0,9634 -0,05%

USD/JPY Y106,01 -0,09%

EUR/JPY Y118,81 -0,82%

GBP/JPY Y149,55 -0,84%

AUD/USD $0,7345 -0,52%

NZD/USD $0,6978 -1,05%

USD/CAD C$1,2864 +0,31%

-

00:02

Schedule for today, Wednesday, Jun 15’2016:

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation June 3.2%

01:30 Australia National Australia Bank's Business Confidence May 5

04:30 Japan Industrial Production (MoM) (Finally) April 3.8% 0.3%

04:30 Japan Industrial Production (YoY) (Finally) April 0.2% -3.5%

07:15 Switzerland Producer & Import Prices, m/m May 0.3%

07:15 Switzerland Producer & Import Prices, y/y May -2.4%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.4% 0.4%

08:30 United Kingdom Producer Price Index - Output (YoY) May -0.7% -0.4%

08:30 United Kingdom Producer Price Index - Input (MoM) May 0.9% 0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) May -6.5% -5%

08:30 United Kingdom Retail Price Index, m/m May 0.1% 0.3%

08:30 United Kingdom Retail prices, Y/Y May 1.3% 1.4%

08:30 United Kingdom HICP, m/m May 0.1% 0.3%

08:30 United Kingdom HICP, Y/Y May 0.3% 0.4%

08:30 United Kingdom HICP ex EFAT, Y/Y May 1.2% 1.3%

09:00 Eurozone Industrial production, (MoM) April -0.8% 0.7%

09:00 Eurozone Industrial Production (YoY) April 0.2% 1.3%

09:00 Eurozone Employment Change Quarter I 0.3%

12:30 U.S. Retail sales May 1.3% 0.3%

12:30 U.S. Retail Sales YoY May 3%

12:30 U.S. Retail sales excluding auto May 0.8% 0.4%

12:30 U.S. Import Price Index May 0.3% 0.8%

14:00 U.S. Business inventories April 0.4% 0.2%

22:45 New Zealand Current Account Quarter I -2.61

-