Noticias del mercado

-

22:08

Major US stock indexes finished trading with a certain increase

Major US stock indices gained more percent on Thursday as England, it seems to lean toward membership in the European Union, which is a scenario that will avoid a possible financial crisis.

Markets around the world rang in the last two weeks as investors speculated on the implications of the UK release of the European soyuza.Sudya on the eve of the current situation of the popular vote, the more likely is the preservation of the country as part of the union, that is, the victory will win supporters version of "stay." Recent public opinion polls indicate that the majority of respondents are opposed to "Brexit".

In addition, after reporting growth in the US initial claims for unemployment benefits in the previous week, the Labor Department released a report which showed that in the week ended June 18, the number of initial applications for unemployment benefits fell to 259,000, a decrease of 18,000 the level of the previous week's 277 000. Economists had expected the unemployment initial applications for benefits fall to 270,000.

It should also be noted that sales of new buildings in the US fell in May to a maximum of more than eight years amid weakness in the three regions, but in general the housing market remains unchanged. The Commerce Department reported that new home sales fell by 6.0% to a seasonally adjusted annual rate of up to 551,000 units. The April sales pace was revised to 586 000 units to 619 000 units, it is still the highest since February 2008.

However, preliminary data from Markit Economics, showed that the index of business activity in the manufacturing sector rose in June to 51.4 points compared to 50.7 points in May. The latter value was the highest in the last three months. Economists had expected the index to rise to only 50.8 points.

Almost all the components of DOW index closed in positive territory (28 of 30). Outsider were shares of NIKE, Inc. (NKE, -0,93%). More rest up shares The Goldman Sachs Group, Inc. (GS, + 2,78%).

All Sector S & P Index showed an increase. The leader turned out to be the basic materials sector (+ 2.1%).

At the close:

Dow + 1.29% 18,011.07 +230.24

Nasdaq + 1.59% 4,910.04 +76.72

S & P + 1.34% 2,113.31 +27.86

-

21:00

Dow +0.99% 17,957.07 +176.24 Nasdaq +1.25% 4,893.93 +60.61 S&P +1.02% 2,106.79 +21.34

-

18:33

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes recorded their biggest percentage gains in a month on Thursday as Britain seemed to swing toward remaining in the European Union, a scenario that would avert a possible financial crisis. Markets across the globe have been rattled over the past two weeks as investors speculated about the consequences of Britain's exit from the European union, including the unraveling of the bloc.

Almost all Dow stocks in positive area (29 of 30). Top looser - NIKE, Inc. (NKE, -0,54%). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,71%).

All S&P sectors in positive area. Top gainer - Basic Materials (+1,9%).

At the moment:

Dow 17858.00 +170.00 +0.96%

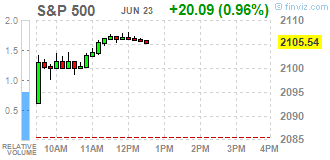

S&P 500 2097.50 +20.75 +1.00%

Nasdaq 100 4442.75 +48.25 +1.10%

Oil 49.42 +0.29 +0.59%

Gold 1265.40 -4.60 -0.36%

U.S. 10yr 1.73 +0.04

-

18:00

European stocks closed: FTSE 100 6,338.1 +76.91 +1.23% CAC 40 4,465.9 +85.87 +1.96% DAX 10,257.03 +185.97 +1.85%

-

17:56

WSE: Session Results

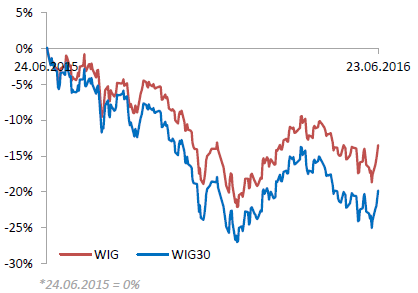

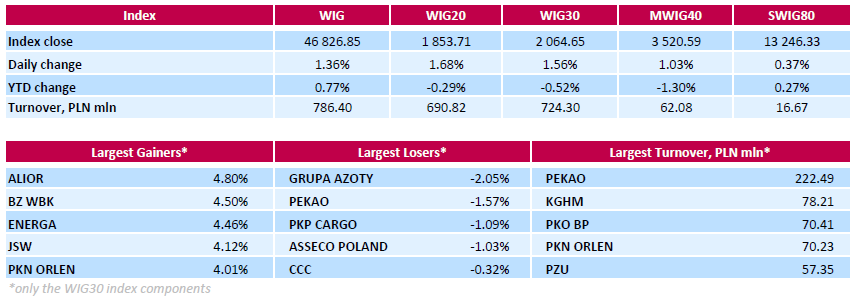

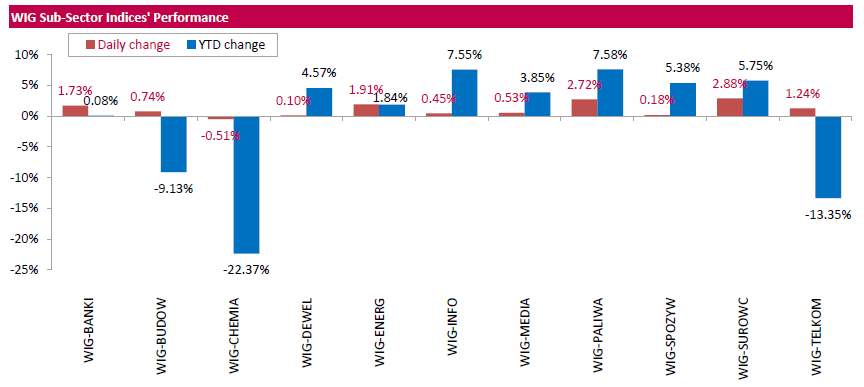

Polish equity market continued its upward surge on Thursday. The broad market measure, the WIG index, rose by 1.36%. Almost all sectors in the WIG generated positive returns. The only exception was chemicals sector (-0.51%). At the same time, materials (+2.88%) and oil and gas sector (+2.72%) were the best-performers.

The large-cap stocks' measure, the WIG30 Index, grew by 1.56%. Only six index constituents generated losses, with chemical producer GRUPA AZOTY (WSE: ATT) underperforming with a 2.05% decline. Bank PEKAO (WSE: PEO) emerged as the second worst-performing stock in the index basket, slumping by 1.57%. The stock came under pressure for the second straight day on the back of the announcement that Poland is interested in taking a controlling stake in the bank to increase its control over the Polish banking sector, currently 60-percent owned by foreign investors. On the plus side, banks ALIOR (WSE: ALR) and BZ WBK (WSE: BZW) were the biggest advancers, gaining 4.8% and 4.5% respectively. They were followed by genco ENERGA (WSE: ENG), coking coal miner JSW (WSE: JSW) and oil refiner PKN ORLEN (WSE: PKN), which grew by 4.46%, 4.12% and 4.01% respectively.

-

15:53

WSE: After start on Wall Street

The market in the US started trading from a growth forced by European stock markets. This is the result of investors optimism who are waiting for the results of the British referendum on Brexit. By this movement the S&P500 approaching to a key resistance level at 2,134 points, although today it's still too far to this level to be tested.

-

15:32

U.S. Stocks open: Dow +0.80%, Nasdaq +0.81%, S&P +0.75%

-

15:07

Before the bell: S&P futures +0.91%, NASDAQ futures +0.93%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,238.35 +172.63 +1.07%

Hang Seng 20,868.34 +73.22 +0.35%

Shanghai Composite 2,892.05 -13.50 -0.46%

FTSE 6,325.36 +64.17 +1.02%

CAC 4,450.06 +70.03 +1.60%

DAX 10,199.32 +128.26 +1.27%

Crude $49.82 (+1.40%)

Gold $1262.10 (-0.62%)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

173

1.77(1.0337%)

300

ALCOA INC.

AA

10.05

0.16(1.6178%)

27119

ALTRIA GROUP INC.

MO

66.38

0.23(0.3477%)

1151

Amazon.com Inc., NASDAQ

AMZN

715.43

4.83(0.6797%)

9619

Apple Inc.

AAPL

95.98

0.43(0.45%)

76657

AT&T Inc

T

41.47

0.17(0.4116%)

9354

Barrick Gold Corporation, NYSE

ABX

19.36

-0.29(-1.4758%)

55551

Boeing Co

BA

133.5

1.73(1.3129%)

1327

Caterpillar Inc

CAT

77.07

0.64(0.8374%)

2085

Chevron Corp

CVX

103.21

0.92(0.8994%)

290

Cisco Systems Inc

CSCO

28.95

0.23(0.8008%)

7618

Citigroup Inc., NYSE

C

43.45

0.77(1.8041%)

123441

Deere & Company, NYSE

DE

84.99

1.07(1.275%)

460

E. I. du Pont de Nemours and Co

DD

68.5

0.43(0.6317%)

564

Exxon Mobil Corp

XOM

91.83

0.66(0.7239%)

3916

Facebook, Inc.

FB

114.55

0.64(0.5618%)

120023

FedEx Corporation, NYSE

FDX

156.51

-0.00(-0.00%)

708

Ford Motor Co.

F

13.26

0.08(0.607%)

26365

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.78

0.28(2.4348%)

181974

General Electric Co

GE

31.06

0.28(0.9097%)

13370

General Motors Company, NYSE

GM

29.5

0.18(0.6139%)

2593

Goldman Sachs

GS

150.35

2.21(1.4918%)

13602

Google Inc.

GOOG

696

-1.46(-0.2093%)

15772

Hewlett-Packard Co.

HPQ

12.68

0.07(0.5551%)

300

Home Depot Inc

HD

128.4

0.80(0.627%)

20431

HONEYWELL INTERNATIONAL INC.

HON

116.5

-0.07(-0.06%)

200

Intel Corp

INTC

32.55

0.26(0.8052%)

3527

International Business Machines Co...

IBM

153.46

0.54(0.3531%)

6552

Johnson & Johnson

JNJ

117.02

0.56(0.4808%)

1000

JPMorgan Chase and Co

JPM

63.57

0.86(1.3714%)

10323

McDonald's Corp

MCD

121.32

0.70(0.5803%)

1121

Merck & Co Inc

MRK

57.3

0.26(0.4558%)

100

Microsoft Corp

MSFT

51.37

0.38(0.7452%)

32262

Nike

NKE

55

0.43(0.788%)

3580

Pfizer Inc

PFE

34.67

0.20(0.5802%)

4500

Procter & Gamble Co

PG

83.9

0.33(0.3949%)

4095

Starbucks Corporation, NASDAQ

SBUX

56.09

0.48(0.8632%)

2265

Tesla Motors, Inc., NASDAQ

TSLA

195.4

-1.26(-0.6407%)

151680

The Coca-Cola Co

KO

45.07

0.21(0.4681%)

1567

Travelers Companies Inc

TRV

112.83

1.00(0.8942%)

685

Twitter, Inc., NYSE

TWTR

16.32

0.19(1.1779%)

144224

UnitedHealth Group Inc

UNH

139.17

1.27(0.921%)

1485

Verizon Communications Inc

VZ

54.3

0.27(0.4997%)

2000

Visa

V

77.41

0.88(1.1499%)

14718

Wal-Mart Stores Inc

WMT

72.25

0.50(0.6969%)

1906

Walt Disney Co

DIS

99.5

0.71(0.7187%)

296

Yahoo! Inc., NASDAQ

YHOO

37.65

0.29(0.7762%)

2690

Yandex N.V., NASDAQ

YNDX

22.25

0.45(2.0642%)

719

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Home Depot (HD) upgraded to Buy from Neutral at Nomura; target $155

Downgrades:

Tesla Motors (TSLA) downgraded to Equal-Weight from Overweight at Morgan Stanley; target lowered to $245 from $333

Other:

Amazon (AMZN) initiated with a Buy at Maxim Group; target $825

Boeing (BA) initiated with a Overweight at Morgan Stanley; target $153

Alphabet (GOOG) target lowered to $830 from $950 at Evercore ISI; maintain Buy

Wal-Mart (WMT) resumed with a Buy at Nomura; target $81

-

13:15

WSE: Mid session comment

After another survey, in which the preponderance of supporters to remain the UK in the Union grows to 52 percent versus 48 percent of opponents, we have further strengthen of the belief that there will be no Brexit. This belief is shed on the markets increasingly, so the capital waiting for the final outcome of the referendum partially comes already on the market. The result is obvious - more and more increases on the equity markets, and the stronger euro and the British pound.

Improvement of sentiment results in reaching by the WIG20 index the level of 1,850 points. Growing chances of avoidance of Brexit may bring less volatility on tomorrow's opening at the expense of today's, which discounts the victory of supporters of stay.

-

09:21

WSE: After opening

WIG20 index opened at 1820.28 points (-0.15%)*

WIG 46133.06 -0.14%

WIG30 2028.77 -0.20%

mWIG40 3488.48 0.11%

*/ - change to previous close

Neutral start, with the relatively low activity. A complete standstill takes place in the second and third line of values (the mWIG40 & sWIG80 indices). It may be assumed that if after the referendum the trading will begin sharply, for dating will be taken shares of relatively high liquidity. After 8 minutes of trading only KGH and Pekao exceed PLN one million of turnover. In Euroland the DAX gained approx. 0.6%.

-

08:21

WSE: Before opening

Finally we have this day, when the British vote in the nervously awaited referendum on staying or leaving the European Union. The referendum started at 8:00 (Warsaw time) and should be completed before 23:00. The first official message has to relate the attendance is expected half an hour after midnight. The first partial results are expected from 1:30 on Friday, where around 6:00 will be already known the result of the 80% of districts. The final result is expected at 8:00 (Warsaw time) on Friday, that is, before the opening of the next session.

The market should be calmer today and wait for the outcome of the vote, with the exception that some of its members may have information about the result earlier than others and this can disrupt the peace places.

The behavior of Asian parquets is balanced, where the Nikkei increases are offset by a worse behavior of other markets, led by a decline in China. Yesterday's session on Wall Street was not too good and ended up with cosmetic drop of the S&P500. In the morning, however, the contracts gain of approx. 0.5% and yesterday's declines are made up for.

The Warsaw market well behaved yesterday, especially banks sector excluding Pekao (WSE: PEO). Today, there is a information about the possibility of sale of the bank Pekao by UniCredit.

-

08:15

Asia-Pacific stock markets closed higher:

Major stock indices in Asia-Pacific region are traded in the green zone on the background of lower risk associated with the forthcoming referendum on the withdrawal of Great Britain from the European Union.

Quotes on the Tokyo Stock Exchange rise. Bidders also fear that the possible withdrawal of Great Britain from the EU structure will lead to a sharp appreciation of the yen and a negative impact on Japanese companies, whose business is closely linked to Europe.

During Asian session was published the preliminary data on the index of business activity in the manufacturing sector of Japan. The index of business activity was 47.8, below analysts' expectations of 48.2. The previous value was 47.7.

Shares of the largest exporters traded steadily: Toyota Motor Corp gained 0.4%, while Honda Motor Co and Panasonic Corp increased capitalization by 1.5% each.

Shares of Japan's largest financial corporations Sumitomo Mitsui Financial Group and Mitsubishi UFJ Financial Group rising 0.8%.

Nikkei 225 16,134.22 +68.50 +0.43%

Hang Seng 20,858.25 +63.13 +0.30%

S & P / ASX 200 5,278.9 +7.95 +0.15%

Shanghai Composite 2,881.64 -23.91 -0.82%

Topix 1,292.44 +7.83 +0.61%

-

00:32

Stocks. Daily history for Jun 22’2016:

(index / closing price / change items /% change)

Nikkei 225 16,065.72 -103.39 -0.64 %

Hang Seng 20,795.12 +126.68 +0.61 %

S&P/ASX 200 5,270.95 -3.41 -0.06 %

Shanghai Composite 2,905.77 +27.21 +0.95 %

FTSE 100 6,261.19 +34.64 +0.56 %

CAC 40 4,380.03 +12.79 +0.29 %

Xetra DAX 10,071.06 +55.52 +0.55 %

S&P 500 2,085.45 -3.45 -0.17 %

NASDAQ Composite 4,833.32 -10.44 -0.22 %

Dow Jones 17,780.83 -48.90 -0.27 %

-