Noticias del mercado

-

14:55

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

-

14:30

U.S.: Initial Jobless Claims, December 267 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, December 2195 (forecast 2210)

-

13:52

Orders

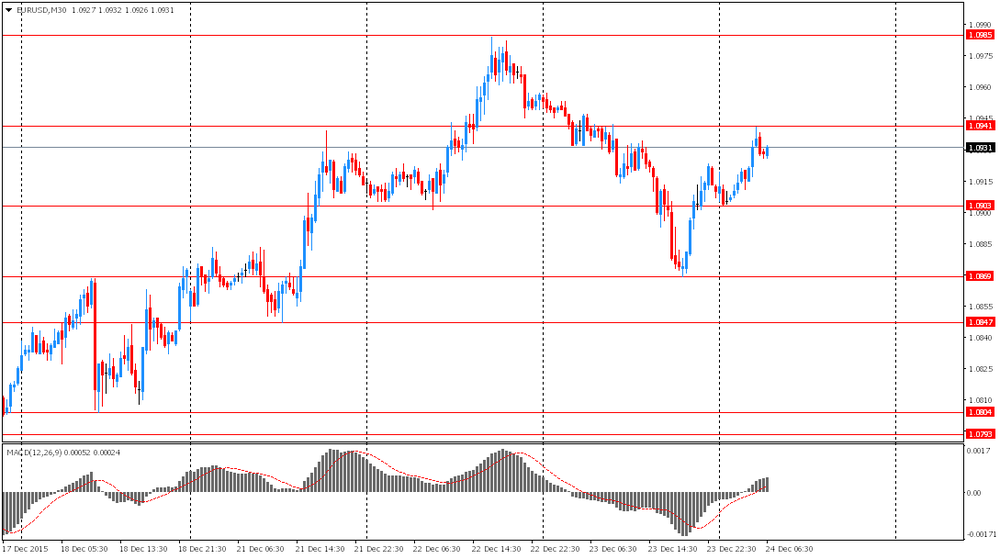

EUR/USD

Offers 1.0985 1.1000 1.1025-30 1.1050 1.1080 1.1100

Bids 1.0900 1.0880-85 1.0850-55 1.0830 1.0800 1.0780-85 1.0750

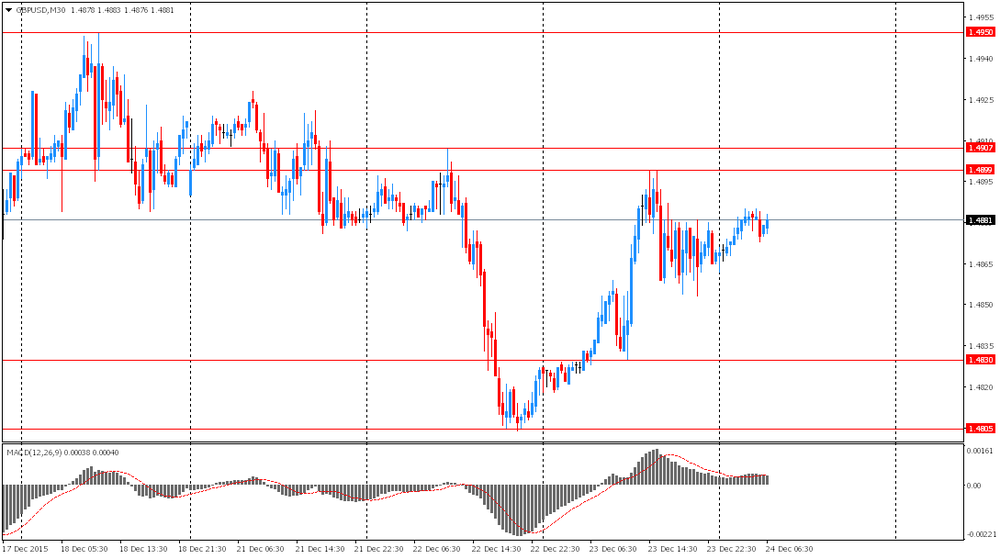

GBP/USD

Offers 1.4925-30 1.4950-55 1.4980-85 1.5000

Bids 1.4850 1.4820-25 1.4800 1.4785 1.4765 1.4750 1.4730 1.4700

EUR/GBP

Offers 0.7380 0.7400 0.7420 0.7450 0.7474 0.7500

Ордера на покупку 0.7320 0.7300 0.7275-80 0.7250

EUR/JPY

Offers 132.00 132.50 132.80 133.00 133.20 133.50 133.85 134.00

Bids 131.50 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.00 121.15 121.30 121.50-55 121.80 122.00 122.20 122.50

Bids 120.00 119.85 119.50

AUD/USD

Offers 0.7280 0.7300 0.7320-25 0.7345-50

Bids 0.7220 0.7200 0.7180 0.7150 0.7120-25 0.7100

-

10:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

-

10:31

United Kingdom: BBA Mortgage Approvals, November 45 (forecast 46.2)

-

08:34

Options levels on thursday, December 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1126 (7457)

$1.1054 (4750)

$1.1002 (5551)

Price at time of writing this review: $1.0935

Support levels (open interest**, contracts):

$1.0860 (1954)

$1.0802 (3056)

$1.0766 (6075)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56734 contracts, with the maximum number of contracts with strike price $1,1100 (7457);

- Overall open interest on the PUT options with the expiration date January, 8 is 73419 contracts, with the maximum number of contracts with strike price $1,0450 (8014);

- The ratio of PUT/CALL was 1.29 versus 1.30 from the previous trading day according to data from December, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1155)

$1.5102 (2596)

$1.5004 (432)

Price at time of writing this review: $1.4891

Support levels (open interest**, contracts):

$1.4794 (1706)

$1.4697 (1092)

$1.4598 (612)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 19031 contracts, with the maximum number of contracts with strike price $1,5100 (2596);

- Overall open interest on the PUT options with the expiration date January, 8 is 18994 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from December, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:55

Foreign exchange market. Asian session: the yen climbed

The yen rose after the release of minutes of November 18-19 Bank of Japan meeting. Minutes did not signal that the bank intends to take new steps at the next meeting. Most Board members noted underlying trend in inflation had been improving steadily. The minutes supported the yen.

The Australian dollar rose on gains in commodity prices. Declines in U.S. crude oil inventories intensified hopes for a return to a balanced market after the supply glut triggered sharp declines in oil prices.

Trading is not expected to be dynamic in the coming days. Many traders have already closed their positions ahead of the end of the year, which increases market volatility. Today markets in Germany and Italy will be closed. On December 25 markets in other European countries as well as in Canada, the U.S., Australia and New Zealand will be on holiday.

EUR/USD: the pair rose to $1.0940 in Asian trade

USD/JPY: the pair fell to Y120.50

GBP/USD: the pair rose to $1.4885

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom BBA Mortgage Approvals November 45.43 46.2

13:30 U.S. Continuing Jobless Claims December 2238 2210

13:30 U.S. Initial Jobless Claims December 271 270

23:30 Japan Household spending Y/Y November -2.4% -2.4%

23:30 Japan Unemployment Rate November 3.1% 3.2%

23:30 Japan Tokyo Consumer Price Index, y/y December 0.2% 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y December 0% 0.1%

23:30 Japan National Consumer Price Index, y/y November 0.3% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y November -0.1% 0.0%

-

02:33

Currencies. Daily history for Dec 23’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0911 -0,41%

GBP/USD $1,4869 +0,29%

USD/CHF Chf0,9906 +0,37%

USD/JPY Y120,91 -0,12%

EUR/JPY Y131,93 -0,54%

GBP/JPY Y179,78 +0,17%

AUD/USD $0,7233 -0,01%

NZD/USD $0,6792 -0,19%

USD/CAD C$1,3848 -0,51%

-

01:59

Schedule for today, Thursday, 24’2015:

(time / country / index / period / previous value / forecast)

06:00 Germany Bank Holiday

09:30 United Kingdom BBA Mortgage Approvals November 45.43 46.2

13:30 U.S. Continuing Jobless Claims December 2238 2210

13:30 U.S. Initial Jobless Claims December 271 270

23:30 Japan Household spending Y/Y November -2.4% -2.4%

23:30 Japan Unemployment Rate November 3.1% 3.2%

23:30 Japan Tokyo Consumer Price Index, y/y December 0.2% 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y December 0% 0.1%

23:30 Japan National Consumer Price Index, y/y November 0.3% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y November -0.1% 0.0%

-