Noticias del mercado

-

20:20

American focus: the US dollar rose against the euro

The US dollar rose against the euro on Wednesday as some investors once again began to open short positions in the single currency, waiting for further divergence in monetary policy between the central banks of the eurozone and the United States.

Reduced trading volumes due to the holiday season still make the dollar traded in narrow ranges, even after being released on Wednesday, data showed the stability of the US economy amid rising consumer confidence.

Orders for durable goods remained unchanged in November, but a key indicator of business investment fell, indicating the weak demand in the US manufacturing sector. This was reported in the statement of the Ministry of Commerce.

According to the data, new orders for durable goods were approximately unchanged in November compared with the previous month. Economists had expected orders to decline by 0.6% last month after rising 2.9% in October.

The manufacturing sector, which accounts for about 12% of GDP, significantly affected this year amid falling prices for oil and gas. In addition, weakness abroad and a stronger dollar led to a decline in demand for US exports.

In turn, the US Commerce Department announced that in November the amount of personal income, ie profit before tax from wages and investments, increased by 0.3% after rising 0.4% in October. Meanwhile, the volume of personal spending rose 0.3% after a zero change in the previous month. Economists had expected revenues to grow by 0.2% and expenditures by 0.3%.

Consumer spending is the foundation of the US economy, as over two thirds of GDP. Strong spending in recent months allowed the economy to grow steadily, in spite of numerous obstacles, including a stronger dollar and weak external demand. Recall that in the 3rd quarter, GDP grew by 2.0%. Many economists believe that in the 4-quarter the economy expanded by about the same amount.

Today's report also showed that spending on goods rose by 0.6%, which was mainly due to purchases of durable goods. Meanwhile, the cost of services rose 0.2%.

Even with higher costs, we maintain a decent level of household savings. According to the data, the personal savings rate fell to 5.5% in November from 5.6% the previous month, but remained in second place from the beginning of 2013.

The price index for personal consumption expenditures - the preferred inflation gauge for the Fed - remained unchanged compared to October, but rose by 0.4% per annum. The base index, which excludes prices of food and energy, rose by 0.1% in monthly terms and 1.3% per annum.

The final results of the studies submitted by Thomson-Reuters and the Institute of Michigan, revealed in December US consumers felt more optimistic about the economy than last month.

According to published reports, this month the index of consumer sentiment rose to 92.6 points compared with a final reading of 91.3 points in November and the preliminary value of 91.8 points in November. According to experts the average index should reach 92.0 points.

Pound previously increased significantly against the dollar, recouping all the lost positions yesterday. Support currency had good data on Britain's balance of payments, which helped neutralize the negative of the GDP report. The Office for National Statistics (ONS) reported that the current account deficit in the third quarter amounted to 17.460 billion pounds, the equivalent of 3.7 percent of GDP. The size of the deficit in the second quarter was revised up to 17.5 billion. 16.8 billion pounds. Pounds. Experts expect that the deficit will rise to 21.5 billion. Lbs. No increase in the deficit was mainly due to a reduction of payments to foreign owners of British assets. The Bank of England believes that the large current account deficit of the balance of payments poses a threat to financial stability in the country.

Another report showed that the UK economy grew in the 3rd quarter, less than previously thought. GDP grew by 0.4 percent in the third quarter. Recall that in the preliminary and revised report reported economic growth of 0.5 percent. Analysts had expected that the economy will expand by 0.5 percent. Weaker growth in the services sector, especially in finuslug was the main reason for the revision of the GDP, said the ONS. Activity in the services sector rose by 0.6 percent compared with a preliminary estimate of 0.7 percent. Construction output fell by 1.9 percent instead of 2.2 percent. The volume of production grew by 0.2 percent, in line with the previous estimate. In annual terms, GDP growth was also revised downward - to 2.1 per cent from the previous reading of 2.3 percent. It was predicted that the economy will grow by 2.3 per cent. The ONS also lowered its growth estimate for the period from April to June to 0.5 per cent from 0.7 per cent in quarterly terms and to 2.3 percent from 2.4 percent in annual terms.

The Canadian dollar has confirmed its dependence on the dynamics of oil prices and increased by 0.3%, despite the weak data in Canada. Oil prices rose to two-week mark after a significant decline in US inventories.

Meanwhile, the USD / CAD pair on Wednesday briefly rose to C $ 1.3938 after the data were published by Canadian GDP for October and retail sales, which were worse than expected.

Canadian economic growth "paused" in October, as a rebound in the oil and gas sector was offset by a decline in the manufacturing sector and retail trade. This according to a report by Statistics Canada.

Gross domestic product remained unchanged in October, contrary to expectations of a 0.2 percent increase. Zero change followed a decline of 0.5 percent in September, which is not revised.

The Canadian economy was in a mild recession in the first half, hit by cheap oil, which is the largest export to Canada. Although growth resumed in the third quarter, the latest data point to weakness at the beginning of the 4th quarter.

Activities in the oil and gas industry increased by 0.8 percent in October, recovering from a sharp drop in September caused some difficulties in production and the suspension of work. However, this improvement was offset by a 0.3 percent decline in production and a fall of 1.4 percent in housing and communal services due to a decrease in natural gas consumption.

The retail sector also had a negative impact on the results - in October it recorded a drop of 0.4 percent. Most of decreased sales of food and beverages.

In the category of transport and warehousing services noted a drop of 0.4 percent, mainly due to the reduction in freight transport services.

In addition, Statistics Canada reported that retail sales in October rose less than expected, as the increase in the segment of cars and clothes have been overshadowed by a decline in food stores.

According to the data at the end of October, sales rose by 0.1 percent, which was worse than forecasts of experts at the level of 0.4 percent. Meanwhile, the September figure was revised to improve - to 0.4 percent from 0.5 percent. In volume terms, sales in October fell 0.3 percent.

-

16:30

U.S.: Crude Oil Inventories, December -5.877 (forecast 1.5)

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, December 92.6 (forecast 92)

-

16:00

U.S.: New Home Sales, November 490 (forecast 505)

-

14:53

Option expiries for today's 10:00 ET NY cut

USD/JPY:120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD:1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD:1.4875 (GBP 150m)

AUD/USD:0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY:131.65 (EUR 465m)

-

14:31

Canada: Retail Sales YoY, October 1.9%

-

14:31

Canada: Retail Sales ex Autos, m/m, October 0.0% (forecast 0.4%)

-

14:30

U.S.: Durable Goods Orders , November 0% (forecast -0.6%)

-

14:30

U.S.: Personal Income, m/m, November 0.3% (forecast 0.2%)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, November 1.3% (forecast 1.4%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , November -0.1% (forecast 0.0%)

-

14:30

Canada: GDP (m/m) , October 0.0% (forecast 0.2%)

-

14:30

U.S.: Durable goods orders ex defense, -1.5% (forecast -0.2%)

-

14:30

U.S.: PCE price index ex food, energy, m/m, November 0.1% (forecast 0.1%)

-

14:30

Canada: Retail Sales, m/m, October 0.1% (forecast 0.4%)

-

13:44

Orders

EUR/USD

Offers 1.0950 1.0960 1.0985 1.1000 1.1025-30 1.1050 1.1080 1.1100

Bids 1.0900 1.0880-85 1.0850-55 1.0830 1.0800 1.0780-85 1.0750

GBP/USD

Offers 1.4865 1.4885 1.4900 1.4925-30 1.4950-55 1.4980-85 1.5000

Bids 1.4820-25 1.4800 1.4785 1.4765 1.4750 1.4730 1.4700

EUR/GBP

Offers 0.7375-80 0.7400 0.7420 0.7450 0.7474 0.7500

Bids 0.7350 0.7320 0.7300 0.7275-80 0.7250

EUR/JPY

Offers 132.50 132.80 133.00 133.20 133.50 133.85 134.00

Bids 132.00 131.80 131.50 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.15 121.30 121.50-55 121.80 122.00 122.20 122.50

Bids 120.85-90 120.60-65 120.50 120.30 120.00 119.85 119.50

AUD/USD

Offers 0.7250 0.7280 0.7300 0.7320-25 0.7345-50

Bids 0.7220 0.7200 0.7180 0.7150 0.7120-25 0.7100

-

13:00

U.S.: MBA Mortgage Applications, December 7.3%

-

10:41

Option expiries for today's 10:00 ET NY cut

USD/JPY:120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD:1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD:1.4875 (GBP 150m)

AUD/USD:0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY:131.65 (EUR 465m)

-

10:30

United Kingdom: Current account, bln , Quarter III -17.5 (forecast -21.5)

-

10:30

United Kingdom: GDP, y/y, Quarter III 2.1% (forecast 2.3%)

-

10:30

United Kingdom: GDP, q/q, Quarter III 0.4% (forecast 0.5%)

-

09:01

France: GDP, Y/Y, Quarter III 1.1% (forecast 1.2%)

-

09:00

Switzerland: KOF Leading Indicator, December 96.6 (forecast 99.1)

-

08:45

France: GDP, q/q, Quarter III 0.3% (forecast 0.3%)

-

08:26

Options levels on wednesday, December 22, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1136 (7603)

$1.1072 (4764)

$1.1004 (2659)

Price at time of writing this review: $1.0931

Support levels (open interest**, contracts):

$1.0850 (3216)

$1.0775 (5829)

$1.0688 (5094)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56150 contracts, with the maximum number of contracts with strike price $1,1100 (7603);

- Overall open interest on the PUT options with the expiration date January, 8 is 73163 contracts, with the maximum number of contracts with strike price $1,0450 (7986);

- The ratio of PUT/CALL was 1.30 versus 1.33 from the previous trading day according to data from December, 22

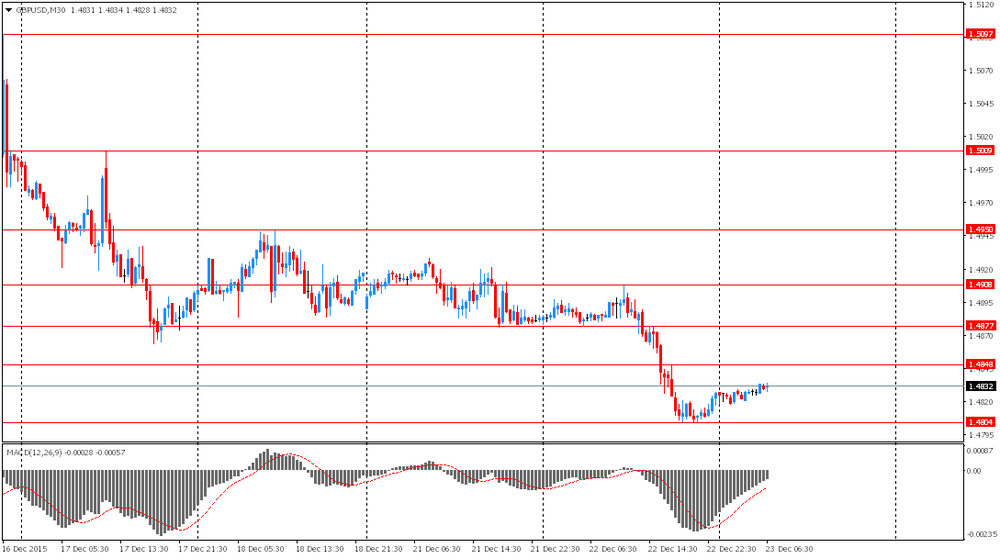

GBP/USD

Resistance levels (open interest**, contracts)

$1.5101 (2617)

$1.5003 (440)

$1.4906 (73)

Price at time of writing this review: $1.4851

Support levels (open interest**, contracts):

$1.4792 (1645)

$1.4695 (1069)

$1.4597 (607)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 18913 contracts, with the maximum number of contracts with strike price $1,5100 (2617);

- Overall open interest on the PUT options with the expiration date January, 8 is 18802 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.99 versus 1.00 from the previous trading day according to data from December, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:03

Foreign exchange market. Asian session: the dollar edged up

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:50 U.S. Personal spending November 0.0% Revised From 0.0% 0.3% 0.3%

The U.S. dollar climbed against the euro on U.S. personal spending data. The corresponding index rose by 0.3% ($40.2 billion) in November compared to October. The reading was in line with expectations. The data were published early this time (00:50 GMT instead of 13:30 GMT). The full report including inflation and income indicators will be released at the usual time.

Trading is not expected to be dynamic this week. At the same time many traders have already closed their positions ahead of the end of the year, which increases market volatility. On Thursday, December 24, markets in Germany and Italy will be closed. On December 25 markets in other European countries as well as in Canada, the U.S., Australia and New Zealand will be on holiday.

The New Zealand dollar slightly rose on trade balance data. The deficit came in at -NZ$779 million in November, while analysts had expected the deficit to expand to -NZ$900 million. Exports rose to $4.08 billion compared to $3.83 reported previously and $3.9 billion expected. Imports rose too and came in at $4.86 billion versus $4.75 billion expected.

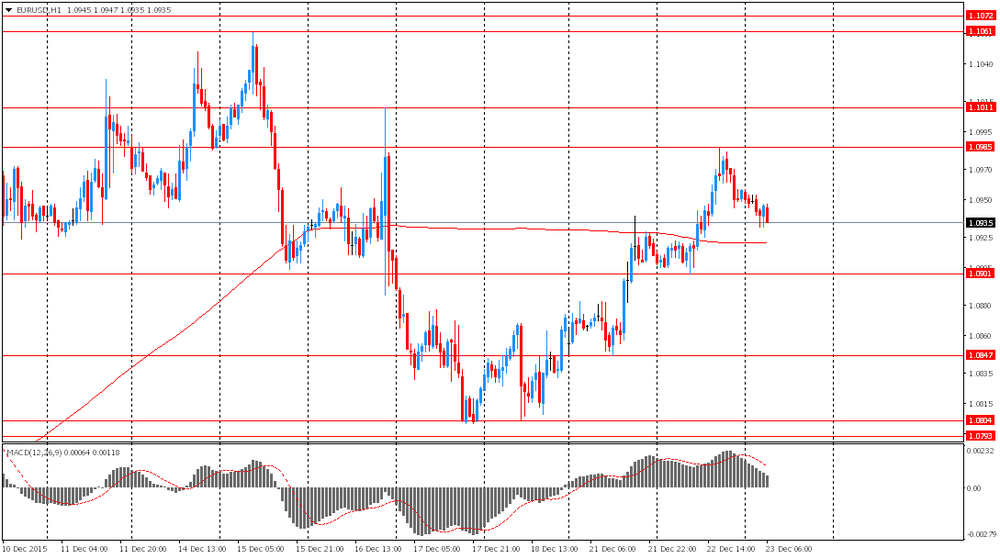

EUR/USD: the pair fluctuated within $1.0930-50 in Asian trade

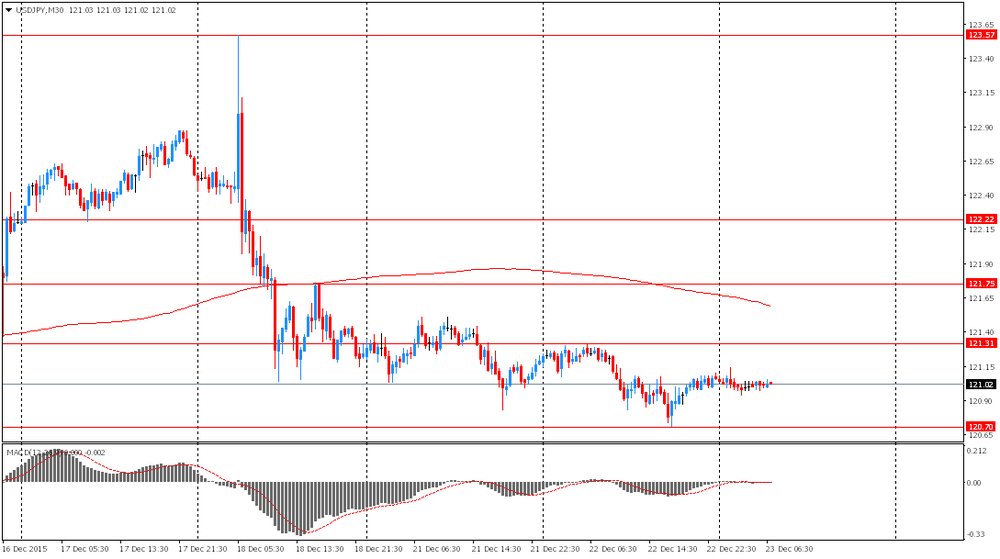

USD/JPY: the pair traded within Y120.95-15

GBP/USD: the pair rose to $1.4850

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France GDP, q/q (Finally) Quarter III 0.0% 0.3%

07:45 France GDP, Y/Y (Finally) Quarter III 1.1% 1.2%

08:00 Switzerland KOF Leading Indicator December 97.9 99.1

09:30 United Kingdom Current account, bln Quarter III -16.8 -21.5

09:30 United Kingdom GDP, q/q (Finally) Quarter III 0.7% 0.5%

09:30 United Kingdom GDP, y/y (Finally) Quarter III 2.4% 2.3%

12:00 U.S. MBA Mortgage Applications December -1.1%

13:30 Canada Retail Sales, m/m October -0.5% 0.4%

13:30 Canada Retail Sales YoY October 1.2%

13:30 Canada Retail Sales ex Autos, m/m October -0.5% 0.4%

13:30 Canada GDP (m/m) October -0.5% 0.2%

13:30 U.S. Durable Goods Orders November 3.0% -0.6%

13:30 U.S. Durable Goods Orders ex Transportation November 0.5% 0.0%

13:30 U.S. Durable goods orders ex defense 3.2% -0.2%

13:30 U.S. Personal Income, m/m November 0.4% 0.2%

13:30 U.S. PCE price index ex food, energy, m/m November 0.0% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y November 1.3% 1.4%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) December 91.3 92

15:00 U.S. New Home Sales November 495 505

15:30 U.S. Crude Oil Inventories December 4.801 1.5

23:50 Japan Monetary Policy Meeting Minutes

-

01:04

Currencies. Daily history for Dec 22’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0956 +0,39%

GBP/USD $1,4826-0,38%

USD/CHF Chf0,9869 -0,53%

USD/JPY Y121,06 -0,10%

EUR/JPY Y132,64 +0,28%

GBP/JPY Y179,48 -0,49%

AUD/USD $0,7234 +0,65%

NZD/USD $0,6805 +0,66%

USD/CAD C$1,3918 -0,28%

-

00:03

Schedule for today, Wednesday, 23’2015:

(time / country / index / period / previous value / forecast)

07:45 France GDP, q/q (Finally) Quarter III 0.0% 0.3%

07:45 France GDP, Y/Y (Finally) Quarter III 1.1% 1.2%

08:00 Switzerland KOF Leading Indicator December 97.9 99.1

09:30 United Kingdom Current account, bln Quarter III -16.8 -21.5

09:30 United Kingdom GDP, q/q (Finally) Quarter III 0.7% 0.5%

09:30 United Kingdom GDP, y/y (Finally) Quarter III 2.4% 2.3%

12:00 U.S. MBA Mortgage Applications December -1.1%

13:30 Canada Retail Sales, m/m October -0.5% 0.5%

13:30 Canada Retail Sales YoY October 1.2%

13:30 Canada Retail Sales ex Autos, m/m October -0.5% 0.4%

13:30 Canada GDP (m/m) October -0.5% 0.3%

13:30 U.S. Durable Goods Orders November 3.0% -0.6%

13:30 U.S. Durable Goods Orders ex Transportation November 0.5% 0.0%

13:30 U.S. Durable goods orders ex defense 3.2% -0.2%

13:30 U.S. Personal Income, m/m November 0.4% 0.2%

13:30 U.S. Personal spending November 0.1% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m November 0.0% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y November 1.3% 1.4%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) December 91.3 92

15:00 U.S. New Home Sales November 495 505

15:30 U.S. Crude Oil Inventories December 4.801

23:50 Japan Monetary Policy Meeting Minutes

-