Noticias del mercado

-

17:32

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar after a speech by the Bank of Canada Governor Stephen Poloz

The U.S. dollar traded higher against the most major currencies after the better-than-expected U.S. economic data. The number of initial jobless claims in the week ending March 21 in the U.S. fell by 9,000 to 282,000 from 291,000 in the previous week, beating expectations for a rise by 4,000.

Markit's preliminary services PMI for the U.S. rose to 58.6 in March from 57.1 in February, exceeding expectations for a gain to 57.2.

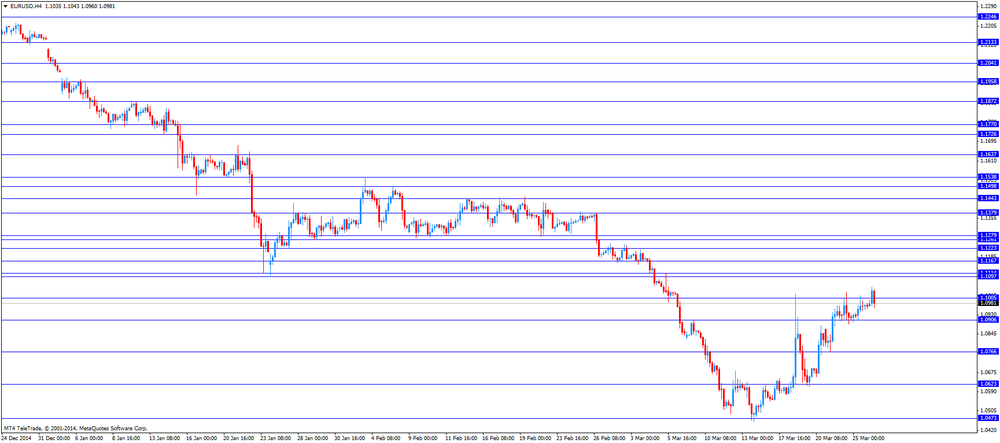

The euro traded lower against the U.S. dollar. Concerns over Greece's bailout programme weighed on the euro.

The Gfk German consumer confidence index increased to 10.0 in April from 9.7 in March, beating forecasts for a rise to 9.8.

Eurozone's adjusted M3 money supply rose 3.7% in February, missing expectations for a 4.3% increase, after a 3.7 gain in January. January's figure was revised down from a 4.1% rise.

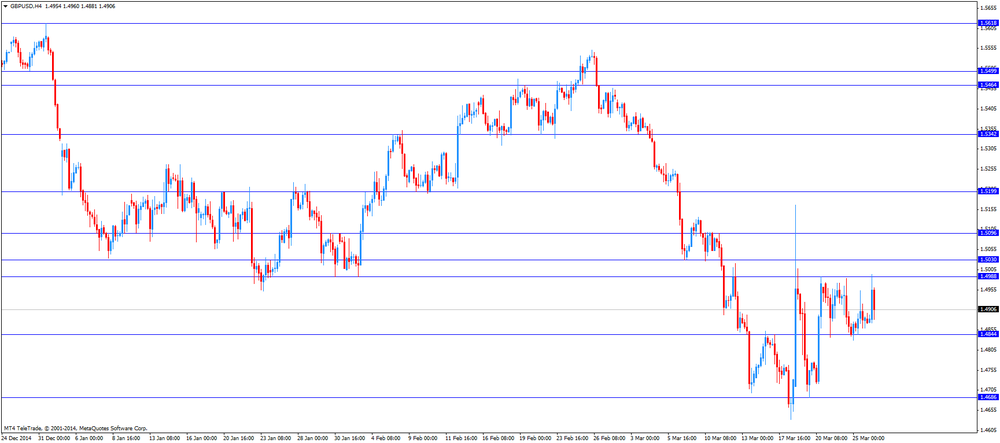

The British pound traded lower against the U.S. dollar. Retail sales in the U.K. increased 0.7% in February, exceeding expectations for a 0.4% rise, after a 0.1% gain in January. January's figure was revised up from a 0.3% drop.

The increase was driven by a drop in store prices.

On a yearly basis, retail sales in the U.K. climbed 5.7% in February, after a 5.9% increase in January. January's figure was revised up from a 5.4% rise.

The Confederation of British Industry (CBI) retail sales balance climbed to 18% in March from 1% in February, missing expectations for an increase to 20%.

The CBI director of economics, Rain Newton-Smith, said that he expects "growth to continue through Easter".

The Canadian dollar traded lower against the U.S. dollar after a speech by the Bank of Canada Governor Stephen Poloz. He said that interest rate cut was needed to deal with falling oil prices.

Poloz noted that falling oil prices weighed on the economic growth and the interest rate cut has given the central bank time to monitor the situation.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

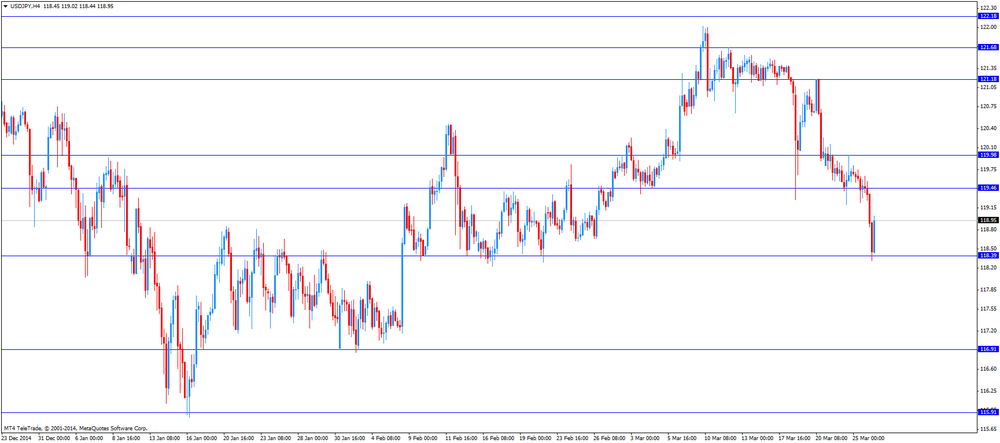

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen rose against the greenback due to a weaker U.S. dollar. There were released no major economic reports in Japan.

-

17:02

European Central Bank Mario Draghi: that stimulus measures by the ECB are strengthening the “cyclical recovery”, not structural

The European Central Bank (ECB) President, Mario Draghi, said in Rome on Thursday that there was already evidence that quantitative easing was working.

He pointed out that stimulus measures by the ECB are strengthening the "cyclical recovery", not structural.

Draghi noted that the central bank cannot buy Greek government bonds because "it does not purchase government bonds of countries that are in a programme with the IMF and the European Commission when the review of this programme has not been completed".

The ECB president said that the ECB also does not purchase due to low Greece's credit rating and due to high percentage of purchased bonds.

Draghi expects that the central bank's asset buying program will reach €60 billion by the end of March.

-

16:28

Bank of Canada Governor Stephen Poloz: interest rate cut was needed to deal with falling oil prices

The Bank of Canada (BoC) Governor Stephen Poloz defended the central bank's interest rate cut in London on Thursday. He said that interest rate cut was needed to deal with falling oil prices. Oil is Canada's top export.

Poloz noted that falling oil prices weighed on the economic growth and the interest rate cut has given the central bank time to monitor the situation.

The BoC governor pointed out the central bank will continue to follow its monetary policy to achieve its 2% inflation target.

-

15:49

Atlanta Federal Reserve Bank President Dennis Lockhart: the recent weak U.S. economic data is temporary

The Atlanta Federal Reserve Bank President Dennis Lockhart said at an investment education conference in Detroit on Thursday that he is confident that the recent weak U.S. economic data is temporary. He added that the weak economic data do not indicate a slowdown in the U.S. economy.

But Lockhart noted that consumers are "bit cautious".

The Atlanta Federal Reserve Bank president also said that he wants "to be able to move deliberately" towards interest higher rates when the Fed starts to raise its interest rate.

He believes that the divergence of monetary policy among major central banks was behind the recent increase of the U.S. dollar.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

15:04

European Central Bank Governing Council member Jens Weidmann: the central bank should monitor closely “signs of speculative excesses on asset markets”

The European Central Bank (ECB) Governing Council member and Bundesbank President Jens Weidmann said on Wednesday that the central bank should monitor closely "signs of speculative excesses on asset markets" as European stock and bond markets rose rapidly in the past weeks.

He noted that he did not see a deflationary spiral in the Eurozone. Low inflation is driven by falling energy prices, the Bundesbank president said.

Quantitative easing by the ECB could lead that governments will lose motivation to implement reforms, Weidmann pointed out.

-

14:47

U.S.: Services PMI, February 58.6 (forecast 57.2)

-

14:45

CBI retail sales balance climbed to 18% in March

The Confederation of British Industry released its retail sales balance data on Thursday. The CBI retail sales balance climbed to 18% in March from 1% in February, missing expectations for an increase to 20%.

The CBI director of economics, Rain Newton-Smith, said that he expects "growth to continue through Easter". "The outlook ahead is looking bright, with household incomes buoyed by zero inflation and improving pay packets, which will continue to encourage spending," he added.

Sales expectations for next month declined to +21% from +27% in March, the lowest level since February 2014.

-

14:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0850 (E888mn), $1.0900 (E519mn), $1.1025 (E459mn)

USD/JPY: Y119.15 ($221mn), Y119.50 ($334mn), Y120.00 ($1.3bn)

AUD/USD: $0.7895-0.7900 (A$1bn), $0.7800 (A$450mn), $0.7700 (A$631mn)

NZD/USD: $0.7500 ($524mn), $0.7525 ($400mn)

USD/CAD: C$1.2300 ($210mn), C$1.2850 ($380mn)

EUR/JPY: Y131.75 (E175mn), Y132.00 (E234mn)

EUR/GBP: stg0.7325 (E200mn)

-

14:09

Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. jobless claims

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany Gfk Consumer Confidence Survey April 9.7 9.8 10.0

09:00 Eurozone M3 money supply, adjusted y/y February +3.7% +4.3% +4.0%

09:00 Eurozone Private Loans, Y/Y February -0.2% +0.1% -0.1%

09:30 United Kingdom Retail Sales (MoM) February +0.1% +0.4% 0.7%

09:30 United Kingdom Retail Sales (YoY) February +5.9% 5.7%

11:00 United Kingdom CBI retail sales volume balance March 1 20 18

12:30 U.S. Continuing Jobless Claims March 2,422 2,416K

12:30 U.S. Initial Jobless Claims March 291 295 282K

13:00 U.S. FOMC Member Dennis Lockhart Speaks

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. jobless claims. The number of initial jobless claims in the week ending March 21 in the U.S. fell by 9,000 to 282,000 from 291,000 in the previous week, beating expectations for a rise by 4,000.

The euro declined against the U.S. dollar. Concerns over Greece's bailout programme weighed on the euro.

The Gfk German consumer confidence index increased to 10.0 in April from 9.7 in March, beating forecasts for a rise to 9.8.

Eurozone's adjusted M3 money supply rose 3.7% in February, missing expectations for a 4.3% increase, after a 3.7 gain in January. January's figure was revised down from a 4.1% rise.

The British pound traded mixed against the U.S. dollar after the better-than-expected retail sales from the U.K. Retail sales in the U.K. increased 0.7% in February, exceeding expectations for a 0.4% rise, after a 0.1% gain in January. January's figure was revised up from a 0.3% drop.

The increase was driven by a drop in store prices.

On a yearly basis, retail sales in the U.K. climbed 5.7% in February, after a 5.9% increase in January. January's figure was revised up from a 5.4% rise.

The Confederation of British Industry (CBI) retail sales balance climbed to 18% in March from 1% in February, missing expectations for an increase to 20%.

The CBI director of economics, Rain Newton-Smith, said that he expects "growth to continue through Easter".

The Canadian dollar traded mixed against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz.

EUR/USD: the currency pair declined to $1.0960

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y119.02

The most important news that are expected (GMT0):

13:30 Canada BOC Gov Stephen Poloz Speaks

20:00 Canada Annual Budget

23:30 Japan Household spending Y/Y February -5.1 -3.1

23:30 Japan Unemployment Rate February 3.6% 3.5%

23:30 Japan Tokyo Consumer Price Index, y/y March +2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y March +2.2% +2.2%

23:30 Japan National Consumer Price Index, y/y February +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y February +2.2% +2.1%

23:50 Japan Retail sales, y/y February -2.0% -1.4%

-

14:00

Orders

EUR/USD

Offers

Bids 1.0925/20

GBP/USD

Offers 1.5020/25 1.4995/500

Bids 1.4915/00

EUR/JPY

Offers 132.00 131.50

Bids 130.00 129.50 129.00

USD/JPY

Offers 120.00 119.20

Bids 118.00 117.50

EUR/GBP

Offers 0.7390

Bids

AUD/USD

Offers 0.8000 0.7950 0.7920 0.7900

Bids 0.7805/00 0.7750

-

13:32

U.S.: Initial Jobless Claims, March 282K (forecast 295)

-

13:32

U.S.: Continuing Jobless Claims, March 2,416K

-

13:15

Number of unemployed people in France by 0.4% in February

French labour ministry released its labour market data on late Wednesday. The number of unemployed people in France by 0.4% or 12,800 to 3.49 million in February.

In January, unemployment fell for the first time since August 2014.

-

12:02

United Kingdom: CBI retail sales volume balance, March 18 (forecast 20)

-

11:35

U.K. Retail Sales rose above estimates

Retail Sales for February rose +0.7% compared to a decline in January of -0.3% and above estimates predicting an increase of +0.4%. Year on year Sales rose +5.7% according to the Office for National Statistics.

A lower inflation rate and real wage growth boosted sales. Lower costs for food and energy were the main drivers.

-

11:15

Eurozone: M3 Money Supply rose less-than-expected, Private Loans decreased

Today the ECB reported Eurozone's M3 money supply grew +4% in February, less than the expected +4.3% and but at a faster pace than in January (+3.7%).

Loans to the private sector declined and remained in negative territory for almost 3 years now. Private Loans declined by -0.1%, at the same pace as a year ago, below an estimated increase of +0.1%.

-

11:12

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0850 (E888mn), $1.0900 (E519mn), $1.1025 (E459mn)

USD/JPY: Y119.15 ($221mn), Y119.50 ($334mn), Y120.00 ($1.3bn)

AUD/USD: $0.7895-0.7900 (A$1bn), $0.7800 (A$450mn), $0.7700 (A$631mn)

NZD/USD: $0.7500 ($524mn), $0.7525 ($400mn)

USD/CAD: C$1.2300 ($210mn), C$1.2850 ($380mn)

EUR/JPY: Y131.75 (E175mn), Y132.00 (E234mn)

EUR/GBP: stg0.7325 (E200mn)

-

10:20

Press Review: SNB says spent $27 billion to defend franc before dropping peg

BLOOMBERG

Currency War Is Now a Dud as Windfall From Devaluations Vanishes

(Bloomberg) -- Currency wars, it turns out, may not be worth fighting right now.

While weaker exchange rates have at times throughout history helped stoke economic growth by making countries' exports cheaper, the benefits are becoming hard to find.

Nowhere is this more apparent than in developing nations, where currencies have slumped 24 percent on average against the dollar since 2011. Despite this, their annual export growth rate has slowed to 4 percent in the past four years from 8 percent during the previous decade, according to the CPB Netherlands Bureau for Economic Policy Analysis. In Brazil, the real's 48 percent plunge since the start of 2011 has done little to revive an economy heading for its worst performance in 25 years.

REUTERS

SNB says spent $27 billion to defend franc before dropping peg

(Reuters) - The Swiss National Bank (SNB) spent 25.8 billion Swiss francs ($26.91 billion) defending the currency late last year before abandoning its peg as too costly for the country's economy, it said on Thursday.

The SNB shocked markets in January when it removed the 1.20 per euro cap on the Swiss franc, sending the currency soaring, stocks plunging and sparking fears for Switzerland's export reliant economy.

The SNB has argued that it had to abandon the franc's three-year-old cap against the euro, but the decision is still reverberating, with politicians stepping up their criticism of the SNB as the economy falters in part due to the strong franc.

Source: http://www.reuters.com/article/2015/03/26/us-swiss-snb-idUSKBN0MM0OX20150326

BLOOMBERG

A Murky, Sloppy Muddle: How Greece's Exit From Euro Could Happen

(Bloomberg) -- With the fight to keep Greece in the euro now in its sixth year, everyone is running out of patience. More importantly, Prime Minister Alexis Tsipras's government in Athens is running out of money.

While bond yields suggest investors expect Greece to stay in the euro, economists such as UniCredit Bank AG's Erik Nielsen say it may be just a matter of time before he's forced to print a new currency.

Adopting the euro was always supposed to be a one-way ticket, so there is no legal precedent or political roadmap for an exit. If you're waiting for a formal announcement of a clear resolution, you may be waiting a long time.

-

10:01

Eurozone: Private Loans, Y/Y, February -0.1% (forecast +0.1%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, February 4.0% (forecast +4.3%)

-

09:30

German Consumer Confidence rose from 9.7 to 10.0

Consumer Confidence in the Eurozone's largest economy rose again - the powerhouse of the E.U. is on track for a strong recovery. Today the GFK Institut für Marktforschung reported the Consumer Confidence Survey for April.

The survey of about 2000 consumers showed an increase of the index from a previous reading of 9.7 to 10, beating estimates of 9.8.

The GFK Institute named a weaker euro as a consequence of the ECB's low interest rates policy and lower energy costs as main drivers of the increase. The German economy is very export-oriented and therefore amongst the biggest winners from a weakening single currency.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany Gfk Consumer Confidence Survey April 9.7 9.8 10.0

The U.S. dollar is trading mixed against its major peers adding gains against the commodity currencies - the Australian and New Zealand's dollar but losing against the euro, the pound and the yen. The weaker-than-expected U.S. durable goods orders data weighed on the currency. Durable goods orders dropped 1.4% in February, missing expectations for a 0.2% increase, after a 2.0% rise in January. January's figure was revised down from a 2.8% increase.

The U.S. durable goods orders excluding transportation declined 0.4% in February, missing expectations for a 0.4% gain, after a 0.7% decrease in January. January's figure was revised down from a 0.3% gain.

The euro is trading higher against the greenback continuing yesterday's gains on solid German data.

The Australian dollar declined against the U.S. dollar. Yesterday the RBA published its biannual Financial Stability Review. The bank said that housing picked up as mortgage rates followed a cut to record lows of the benchmark interest rate to 2.25% in February and warned that there is a risk of a large re-pricing in the commercial property sector.

New Zealand's dollar lost against the greenback during the Asian session in the absence of any major data from the region. It's the third day of straight losses.

The Japanese yen traded rose against the greenback on Thursday, ahead of a set of data including Household Spending, Unemployment Rate and the National Consumer Price Index. Today the BoJ said in a statement that the structural problems of the Japanese economy including a loss of competitiveness and low demand for capital goods are getting better and that exports are likely to get a boost from the weaker yen.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling rose against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone M3 money supply, adjusted y/y February +4.1% +4.3%

09:00 Eurozone Private Loans, Y/Y February -0.1% +0.1%

09:30 United Kingdom Retail Sales (MoM) February -0.3% +0.4%

09:30 United Kingdom Retail Sales (YoY) February +5.4%

11:00 United Kingdom CBI retail sales volume balance March 1 20

12:30 U.S. Continuing Jobless Claims March 2417

12:30 U.S. Initial Jobless Claims March 291 295

13:00 U.S. FOMC Member Dennis Lockhart Speaks

13:30 Canada BOC Gov Stephen Poloz Speaks

13:45 U.S. Services PMI (Preliminary) February 57.1 57.2

20:00 Canada Annual Budget

23:30 Japan Household spending Y/Y February -5.1 -3.1

23:30 Japan Unemployment Rate February 3.6% 3.5%

23:30 Japan Tokyo Consumer Price Index, y/y March +2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y March +2.2% +2.2%

23:30 Japan National Consumer Price Index, y/y February +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y February +2.2% +2.1%

23:50 Japan Retail sales, y/y February -2.0% -1.4%

-

08:20

Options levels on thursday, March 26, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1212 (3717)

$1.1128 (2113)

$1.1062 (4513)

Price at time of writing this review: $1.0993

Support levels (open interest**, contracts):

$1.0910 (3222)

$1.0854 (2544)

$1.0779 (5729)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 67802 contracts, with the maximum number of contracts with strike price $1,1000 (4513);

- Overall open interest on the PUT options with the expiration date April, 2 is 79751 contracts, with the maximum number of contracts with strike price $1,0600 (7544);

- The ratio of PUT/CALL was 1.18 versus 1.13 from the previous trading day according to data from March, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1213)

$1.5101 (1678)

$1.5003 (1444)

Price at time of writing this review: $1.4894

Support levels (open interest**, contracts):

$1.4794 (1303)

$1.4697 (2012)

$1.4598 (1410)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 27052 contracts, with the maximum number of contracts with strike price $1,5100 (1678);

- Overall open interest on the PUT options with the expiration date April, 2 is 28832 contracts, with the maximum number of contracts with strike price $1,5050 (2327);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from March, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Gfk Consumer Confidence Survey, April 10.0 (forecast 9.8)

-

02:28

Currencies. Daily history for Mar 25’2015:

(pare/closed(GMT +2)/change, %)

EUR/JPY $1,0971 +0,48%

GBP/USD $1,4884 +0,27%

USD/CHF Chf0,9598 +0,16%

USD/JPY Y119,47 -0,21%

EUR/JPY Y131,07 +0,27%

GBP/JPY Y177,84 +0,07%

AUD/USD $0,7845 -0,36%

NZD/USD $0,7607 -0,43%

USD/CAD C$1,2511 +0,10%

-

02:01

Schedule for today, Thursday, Mar 26’2015:

(time / country / index / period / previous value / forecast)

07:00 Germany Gfk Consumer Confidence Survey April 9.7 9.8

09:00 Eurozone M3 money supply, adjusted y/y February +4.1% +4.3%

09:00 Eurozone Private Loans, Y/Y February -0.1% +0.1%

09:30 United Kingdom Retail Sales (MoM) February -0.3% +0.4%

09:30 United Kingdom Retail Sales (YoY) February +5.4%

11:00 United Kingdom CBI retail sales volume balance March 1 20

12:30 U.S. Continuing Jobless Claims March 2417

12:30 U.S. Initial Jobless Claims March 291 295

13:00 U.S. FOMC Member Dennis Lockhart Speaks

13:30 Canada BOC Gov Stephen Poloz Speaks

13:45 U.S. Services PMI (Preliminary) February 57.1 57.2

20:00 Canada Annual Budget

23:30 Japan Household spending Y/Y February -5.1 -3.1

23:30 Japan Unemployment Rate February 3.6% 3.5%

23:30 Japan Tokyo Consumer Price Index, y/y March +2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y March +2.2% +2.2%

23:30 Japan National Consumer Price Index, y/y February +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y February +2.2% +2.1%

23:50 Japan Retail sales, y/y February -2.0% -1.4%

-