Noticias del mercado

-

18:12

Greece cut its forecast for economic growth for 2015 to 1.4% from a previous estimate of 2.5%, according to a Greek senior government official

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies ahead of a speech by the Fed Chair Janet Yellen

The U.S. dollar traded mixed against the most major currencies ahead of a speech by the Fed Chair Janet Yellen (19:45 GMT).

The final University of Michigan's consumer sentiment index was 93.0 in March, exceeding expectations for a rise to 92.5, up from the preliminary estimate of 91.2.

The final U.S. GDP rose at an annual rate of 2.2% in the fourth quarter, missing expectations for a 2.4% growth. A previous estimate was 2.2%.

The personal consumption expenditures (PCE) price index declined 0.4% in the fourth quarter.

The personal consumption expenditures (PCE) price index excluding food and energy increased 1.1%.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone. Concerns over Greece's debt problems weighed on the euro.

The British pound traded lower against the U.S. dollar. Comments by the Bank of England (BoE) Governor Mark Carney supported the pound. He said in Frankfurt on Friday that the central bank's next move will be interest rate hike.

The U.K. house price index increased 0.1% in March, missing expectations for 0.2% gain, after a 0.1% decline in February.

On a yearly basis, the U.K. house price inflation fell to 5.1% in March from 5.7% in February.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the mixed economic data from Japan. Japan's national consumer price index (CPI) remained fell to an annual rate of 2.2% in February from 2.4% in January.

Japan's national CPI excluding fresh food declined to an annual rate of 2.0% in February from 2.2% in January, missing expectations for a decrease to 2.1%.

Retail sales in Japan dropped 1.8% in February, missing forecasts of a 1.4% decrease, after a 2.0% fall in January.

Japan's unemployment rate decreased to 3.5% in February from 3.6% in January, in line with expectations.

Tokyo's CPI remained unchanged at an annual rate of 2.3% in March.

Tokyo's CPI excluding fresh food remained unchanged at an annual rate of 2.2% in March, in line with expectations.

Household spending in Japan dropped at annual rate of 2.9% in February, beating forecasts of a 3.1% decrease, after a 5.1% fall in January.

-

17:03

Bundesbank President Jens Weidmann: debt in the Eurozone has reached the “danger zone”

The Bundesbank President Jens Weidmann said in Frankfurt on Friday that debt in the Eurozone has reached the "danger zone" as public debt totalled 91% and corporate debt - 105%.

Weidmann noted that a European solution may be required for the regulatory treatment of sovereign debt.

"Sovereign debt needs to be backed by capital, and exposure to a single sovereign must be capped, just as is the case for any private debtor", the Bundesbank president said.

-

16:27

Fed Vice Chairmann Stanley Fischer: the nonbank financial system is less vulnerable to shocks today

The Fed Vice Chairmann Stanley Fischer said in Frankfurt on Friday that the nonbank financial system is less vulnerable to shocks today.

"Regulators need to respond to existing regulatory gaps and to keep pace with further changes," Fischer noted.

The Fed vice chairman also said that regulators have not enough information about the activities of hedge funds.

-

15:10

Bank of England Chief Economist Andy Haldane: central banks might coordinate tools for dealing with specific markets

The Bank of England (BoE) Chief Economist Andy Haldane said on Friday that central banks around the world might coordinate tools for dealing with specific markets.

"There may be greater scope to coordinate macroprudential tools," Haldane said. He added that macroprudential tools should "operate on an asset-class basis, rather than on a national basis".

Haldane surprised market participants last week when he said a drop in inflation meant the central bank could cut its interest rate further.

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, March 93 (forecast 92.5)

-

14:48

Bank of England Deputy Governor Ben Broadbent: it is unlikely that the U.K. economy will suffer from a low inflation

The Bank of England (BoE) Deputy Governor, Ben Broadbent, said in London on Friday that it is unlikely that the U.K. economy will suffer from a low inflation. "The likelihood of a broad and protracted deflation, afflicting wages as well as prices, is pretty low," Broadbent said.

He noted that inflation declined due to falling oil prices. Negative price growth is temporary and positive for the economy, he added.

Broadbent expects the consumer inflation to increase in early 2016.

The BoE deputy governor also said that wages will grow as unemployment declined.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0875 (E956mn), $1.1000(E3.1bn)

USD/JPY: Y118.30-35($500mn), Y119.00($1.48bn), Y119.45-50($400mn)

EUR/GBP: Gbp0.7330(E200mn), Gbp0.7350(E140mn)

USD/CHF: Chf0.9700($216mn)

AUD/USD: $0.7700(A$1.5bn), $0.7775(A$275mn), $0.8015(A$450mn)

NZD/USD: $0.7730(NZ$517mn)

USD/CAD: C$1.2465(C$675mn), C$1.2500($278mn), C$1.2525($242mn)

-

14:27

Bank of England Governor Mark Carney: the central bank's next move will be interest rate hike

The Bank of England (BoE) Governor Mark Carney said in at a Bundesbank conference Frankfurt on Friday that the central bank's next move will be interest rate hike.

-

14:08

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 United Kingdom Nationwide house price index March -0.1% +0.2% 0.1%

07:00 United Kingdom Nationwide house price index, y/y March +5.7% 5.1%

08:00 United Kingdom MPC Member Andy Haldane Speaks

08:45 United Kingdom BOE Gov Mark Carney Speaks

09:15 United Kingdom MPC Member Dr Ben Broadbent Speaks

10:30 U.S. FED Vice Chairman Stanley Fischer Speaks

12:30 U.S. PCE price index, q/q Quarter IV +1.2% -0.4%

12:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.4% 1.1%

12:30 U.S. GDP, q/q (Finally) Quarter IV +2.2% +2.4% 2.2%

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. economic data. The final U.S. GDP rose at an annual rate of 2.2% in the fourth quarter, missing expectations for a 2.4% growth. A previous estimate was 2.2%.

The personal consumption expenditures (PCE) price index declined 0.4% in the fourth quarter.

The personal consumption expenditures (PCE) price index excluding food and energy increased 1.1%.

The euro traded slightly higher against the U.S. dollar in the absence of any major economic reports from the Eurozone. Concerns over Greece's debt problems weighed on the euro.

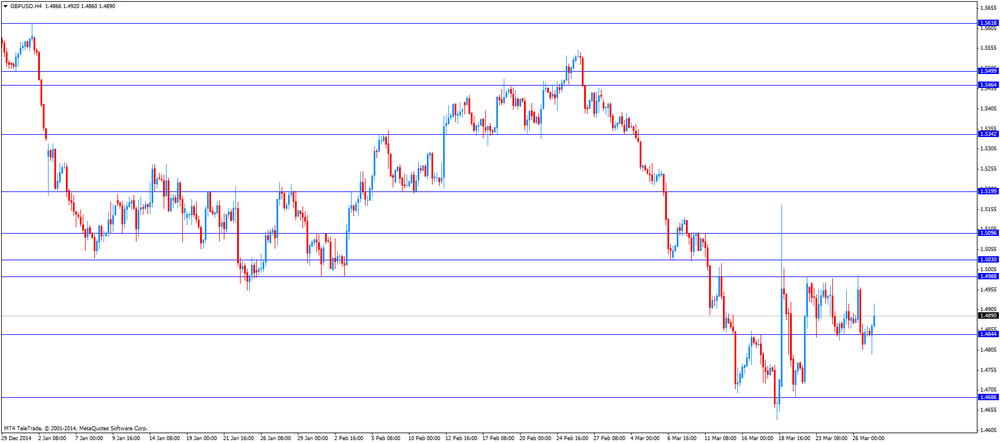

The British pound traded higher against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney. He said in Frankfurt on Friday that the central bank's next move will be interest rate hike.

The U.K. house price index increased 0.1% in March, missing expectations for 0.2% gain, after a 0.1% decline in February.

On a yearly basis, the U.K. house price inflation fell to 5.1% in March from 5.7% in February.

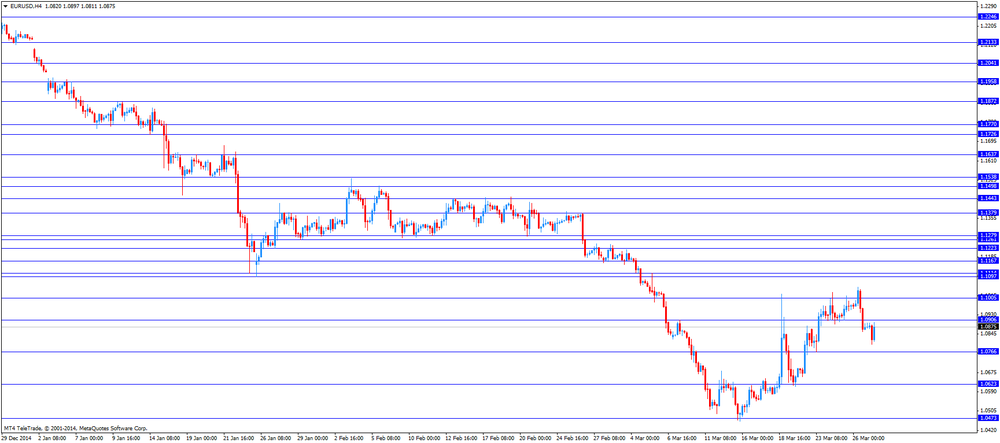

EUR/USD: the currency pair rose to $1.0897

GBP/USD: the currency pair increased to $1.4920

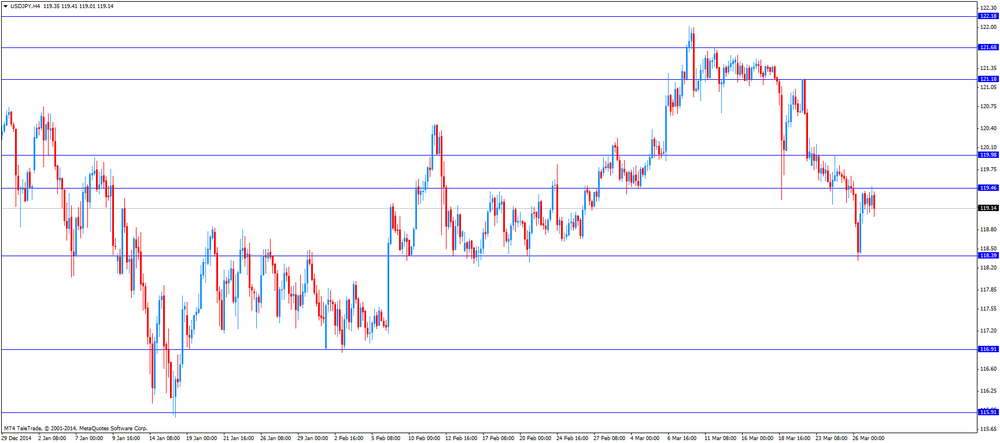

USD/JPY: the currency pair fell to Y119.01

The most important news that are expected (GMT0):

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) March 91.2 92.5

19:45 U.S. Fed Chairman Janet Yellen Speaks

-

13:50

Orders

EUR/USD

Offers 1.0900-10

Bids 1.0800 1.0785/80

GBP/USD

Offers 1.4995/500 1.4950

Bids 1.4785/80 1.4760/50 1.4725/20 1.4710/00 1.4685/80

EUR/JPY

Offers 131.00 130.50 130.00

Bids 129.00 128.50 128.20/00 127.50

USD/JPY

Offers 120.50 120.00 119.50

Bids 119.10/00 118.65/60 118.00

EUR/GBP

Offers 0.7390

Bids 0.7210/00

AUD/USD

Offers 0.7900 0.7850

Bids 0.7750 0.7700 0.7650

-

13:31

U.S.: GDP, q/q, Quarter IV 2.2% (forecast +2.4%)

-

13:31

U.S.: PCE price index, q/q, Quarter IV -0.4%

-

13:31

U.S.: PCE price index ex food, energy, q/q, Quarter IV 1.1%

-

13:23

Swiss National Bank Governing Board Member Fritz Zurbruegg: the central bank is ready to intervene in the foreign exchange market if needed

The Swiss National Bank (SNB) Governing Board Member Fritz Zurbruegg said on Thursday that the central bank is ready to intervene in the foreign exchange market if needed.

The SNB reported in its annual report that it spent CHF25.8 billion ($26.9 billion) on defending the cap in late 2014.

Zurbruegg noted that the Swiss franc remains overvalued. He said that he does not expect a sustained negative inflation or a deflationary spiral.

-

13:08

German Finance Minister Wolfgang Schaeuble: low interest rate in the Eurozone is causing “huge problems” for Germany

German Finance Minister Wolfgang Schaeuble said on Thursday that low interest rate in the Eurozone is causing "huge problems" for Germany. He noted that the current monetary policy by the European Central Bank (ECB) could lead to "misallocations of resources".

Schaeble pointed out that he did not want to criticise the ECB because it was a structural problem.

-

11:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0875 (E956mn), $1.1000(E3.1bn)

USD/JPY: Y118.30-35($500mn), Y119.00($1.48bn), Y119.45-50($400mn)

EUR/GBP: Gbp0.7330(E200mn), Gbp0.7350(E140mn)

USD/CHF: Chf0.9700($216mn)

AUD/USD: $0.7700(A$1.5bn), $0.7775(A$275mn), $0.8015(A$450mn)

NZD/USD: $0.7730(NZ$517mn)

USD/CAD: C$1.2465(C$675mn), C$1.2500($278mn), C$1.2525($242mn)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers ahead of U.S. GDP data

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 United Kingdom Nationwide house price index March -0.1% +0.2% +0.1%

The U.S. dollar is trading mixed against its major peers adding again gains against the commodity currencies - the Australian and New Zealand's dollar for a fourth consecutive day. Yesterday data showed that U.S. jobless claims fell and the services PMI hit a six-month high. Today a set of important U.S. data including the GDP and the Reuters/Michigan Consumer Sentiment Index will be in the focus. FED Chair Janet Yellen and FED Vice Chairman Stanley Fischer are scheduled to speak today at Federal Reserve Bank of San Francisco Conference.

The Australian dollar declined against the U.S. dollar in the absence of any major data from the region.

New Zealand's dollar booked losses against the greenback during the Asian session in the absence of any major data from the region. It's the fourth day of straight losses.

The Japanese yen rose against the greenback on Friday after a set of mixed economic data was reported yesterday. Household spending declined -2.9%, less than the expected reading of -3.1%. The Japanese Unemployment Rate for February declined from a previous reading of 3.6% to 3.2%, below the estimated 3.5%. The Tokyo Consumer Price Index for March remained unchanged at +2.3%. Excluding fresh food the reading was unchanged at +2.2%. The National Consumer Price Index grew less at a pace of +2.2% compared to +2.4% a year earlier. Ex-fresh food the National CPI rose +2.0%, below expectations of an increase of +2.1%. Retail Sales in Japan declined by -1.8% in February, less than the -2.0% a year ago but above estimates on a decrease by -1.4%.

EUR/USD: the euro traded almost flat against the greenback

USD/JPY: the U.S. dollar traded flat against the yen

GPB/USD: Sterling lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:30 U.S. FED Vice Chairman Stanley Fischer Speaks

12:30 U.S. PCE price index, q/q Quarter IV +1.2%

12:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.4%

12:30 U.S. GDP, q/q (Finally) Quarter IV +2.2% +2.4%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) March 91.2 92.5

19:45 U.S. Fed Chairman Janet Yellen Speaks

-

08:15

Options levels on friday, March 27, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1134 (4513)

$1.1000 (2125)

$1.0946 (2426)

Price at time of writing this review: $1.0878

Support levels (open interest**, contracts):

$1.0812 (4001)

$1.0754 (6133)

$1.0678 (2955)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 67835 contracts, with the maximum number of contracts with strike price $1,1000 (4513);

- Overall open interest on the PUT options with the expiration date April, 2 is 80983 contracts, with the maximum number of contracts with strike price $1,0600 (7513);

- The ratio of PUT/CALL was 1.19 versus 1.18 from the previous trading day according to data from March, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.5101 (1643)

$1.5003 (1424)

$1.4906 (1637)

Price at time of writing this review: $1.4840

Support levels (open interest**, contracts):

$1.4793 (1467)

$1.4696 (2017)

$1.4598 (1439)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 27263 contracts, with the maximum number of contracts with strike price $1,5100 (1643);

- Overall open interest on the PUT options with the expiration date April, 2 is 29329 contracts, with the maximum number of contracts with strike price $1,5050 (2332);

- The ratio of PUT/CALL was 1.08 versus 1.07 from the previous trading day according to data from March, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:00

Currencies. Daily history for Mar 26’2015:

(pare/closed(GMT +2)/change, %)

EUR/JPY $1,0874 -0,89%

GBP/USD $1,4850 -0.23%

USD/CHF Chf0,9633 +0,36%

USD/JPY Y119,21 -0,22%

EUR/JPY Y129,61 -1,13%

GBP/JPY Y177,03 -0,46%

AUD/USD $0,7827 -0,23%

NZD/USD $0,7592 -0,20%

USD/CAD C$1,2485 -0,21%

-

00:51

Japan: Retail sales, y/y, February -1.8% (forecast -1.4%)

-

00:34

Japan: Unemployment Rate, February 3.2% (forecast 3.5%)

-

00:34

Japan: National CPI Ex-Fresh Food, y/y, February 2.2% (forecast +2.1%)

-

00:33

Japan: National Consumer Price Index, y/y, February 2.2%

-

00:33

Japan: Household spending Y/Y, February -2.9% (forecast -3.1)

-

00:04

Schedule for today, Friday, Mar 27’2015:

(time / country / index / period / previous value / forecast)

10:30 U.S. FED Vice Chairman Stanley Fischer Speaks

12:30 U.S. PCE price index, q/q Quarter IV +1.2%

12:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.4%

12:30 U.S. GDP, q/q (Finally) Quarter IV +2.2% +2.4%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) March 91.2 92.5

19:45 U.S. Fed Chairman Janet Yellen Speaks

-