Noticias del mercado

-

23:59

Schedule for today, Tuesday, Mar 31’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m February 1.8%

00:00 New Zealand ANZ Business Confidence February 34.4

00:30 Australia Private Sector Credit, m/m February 0.6% 0.5%

00:30 Australia Private Sector Credit, y/y February 6.2%

01:30 Japan Labor Cash Earnings, YoY February 1.3% 0.7%

05:00 Japan Housing Starts, y/y February -13.0% -7.0%

06:00 Germany Retail sales, real adjusted February 2.9% -0.9%

06:00 Germany Retail sales, real unadjusted, y/y February 5.3% 3.7%

06:45 France Consumer spending February 0.6% 0.3%

06:45 France Consumer spending, y/y February 2.6%

07:55 Germany Unemployment Change March -20 -10

07:55 Germany Unemployment Rate s.a. March 6.5% 6.5%

08:30 United Kingdom Business Investment, q/q Quarter IV -1.4%

08:30 United Kingdom Business Investment, y/y Quarter IV 2.1%

08:30 United Kingdom Current account, bln Quarter IV -27.0 -21.2

08:30 United Kingdom GDP, q/q (Finally) Quarter IV 0.5% 0.5%

08:30 United Kingdom GDP, y/y (Finally) Quarter IV 2.7%` 2.7%

09:00 Eurozone Unemployment Rate February 11.2% 11.2%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) March -0.3% -0.3%

12:00 U.S. FOMC Member Laсker Speaks

12:30 Canada GDP (m/m) January 0.3% 0.2%

12:50 U.S. FOMC Member Dennis Lockhart Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y January 4.5% 4.6%

13:45 U.S. Chicago Purchasing Managers' Index March 45.8 52.5

14:00 U.S. Consumer confidence March 96.4 96.6

20:30 U.S. API Crude Oil Inventories March 4.8

22:30 Australia AIG Manufacturing Index March 45.4

23:50 Japan BoJ Tankan. Manufacturing Index Quarter I 12 14

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter I 16 17

-

17:33

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the mostly better-than-expected U.S. economic data

The U.S. dollar traded higher against the most major currencies after the mostly better-than-expected U.S. economic data. Pending home sales in the U.S. rose 3.1% in February, exceeding expectations for a 0.5% increase, after a 1.2% gain in January. January's figure was revised down from a 1.7% rise.

Personal spending was up 0.1% in February, missing expectations for 0.3% gain, after a 0.2% fall in January.

Consumer spending makes more than two-thirds of U.S. economic activity.

The increase was driven by higher spending on services. Spending on services gained 0.2% in February. Higher heating bills may lead to the increase.

Spending on goods fell 0.1% in February.

Personal income climbed 0.4% in February, exceeding expectations for a 0.3% increase, after a 0.4% rise in January. January's figure was revised up from a 0.3% gain.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in February, in line with expectations, after a 0.1% rise in January.

On a yearly basis, the PCE price index excluding food and index rose 1.4% in February, after a 1.3% increase in January.

The greenback was also supported by Friday's comments by Federal Reserve Chairwomen Janet Yellen. She said on Friday that the Fed is considering to raise its interest rate "later this year" even though this may slow the U.S. economy. The interest rate hike will be depend on the economic data, Yellen noted.

The euro traded lower against the U.S. dollar. Concerns over Greece's debt problems remained to weigh on the euro. The Greek government is expected to submit its new reform programme.

German preliminary consumer price index rose 0.5% in March, exceeding expectations for a 0.4% increase, after a 0.9% gain in February.

On a yearly basis, German preliminary consumer price index increased to 0.3% in March from 0.1% in February, in line with expectations.

Consumer prices rose as energy prices rebounded in March.

The British pound traded slightly higher against the U.S. dollar. Net lending to individuals in the U.K. increased by £2.5 billion in February, in line with expectations, after a £2.4 billion gain in January.

The number of mortgages approvals in the U.K. rose to 60,760 in February from 60,707 in January, missing expectations for an increase to 62,000. It was the highest level since August 2014.

The Canadian dollar traded lower against the U.S. dollar despite the better-than-expected Canadian raw materials purchase price index. The Raw Materials Price Index (RMPI) jumped 6.1% in February, exceeding expectations for a 5.1% rise, after a 7.8% drop in January. January's figure was revised down from a 7.7% decrease.

It was the first gain since June 2014.

The rise was driven by higher prices for crude energy products. Crude energy products jumped 16.0% in February, the largest rise since March 2009.

The Swiss franc traded lower against the U.S. dollar. The KOF leading indicator increased to 90.8 in March from 90.3 in February, beating expectations for a decrease to 89.1. February's figure was revised up from 90.1.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

The Japanese yen fell against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback after the weak industrial production data from Japan. Preliminary industrial production in Japan dropped 3.4% in February, after a 3.7% rise in January.

-

16:52

U.S. pending home sales soars 3.1% in February

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. rose 3.1% in February, exceeding expectations for a 0.5% increase, after a 1.2% gain in January. January's figure was revised down from a 1.7% rise.

The NAR's chief economist Lawrence Yun said that pending home sales were driven by strengthening labour market, mortgage rates and higher demand. But he added that "the underlying obstacle - especially for first-time buyers - continues to be the depressed level of homes available for sale".

-

16:00

U.S.: Pending Home Sales (MoM) , February 3.1% (forecast 0.5%)

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0700 (E1.7bn), $1.0900(E362mn), $1.0950(529mn), $1.1000(E622mn)

USD/JPY: Y118.70($650mn), Y119.00($250m)

EUR/JPY: Y128.50(790mn), Y131.00(E698mn)

AUD/USD: $0.7685(A$255mn)

USD/CAD: C$1.2440(C$280mn), C$1.2475-80($540mn), C$1.2540($440mn), C$1.2570($320mn), C$1.2600($443mn)

-

15:43

U.S. personal spending rises 0.1% in February

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending was up 0.1% in February, missing expectations for 0.3% gain, after a 0.2% fall in January.

Consumer spending makes more than two-thirds of U.S. economic activity.

The increase was driven by higher spending on services. Spending on services gained 0.2% in February. Higher heating bills may lead to the increase.

Spending on goods fell 0.1% in February.

Personal income climbed 0.4% in February, exceeding expectations for a 0.3% increase, after a 0.4% rise in January. January's figure was revised up from a 0.3% gain.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in February, in line with expectations, after a 0.1% rise in January.

On a yearly basis, the PCE price index excluding food and index rose 1.4% in February, after a 1.3% increase in January.

The PCE index are below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

15:04

Canadian industrial product and raw materials price indexes increased in February

Statistics Canada released its industrial product and raw materials price indexes on Monday. The Industrial Product Price Index (IPPI) rose 1.8% in February, beating forecasts for a 0.6% gain, after a 0.3% decrease in January. January's figure was revised up from a 0.4% decline.

It was the first increase since August 2014. The increase was driven by higher prices for energy and petroleum products.

Energy and petroleum products soared 8.8% in February, the first rise since June 2014 and the largest increase since June 2009.

The Raw Materials Price Index (RMPI) jumped 6.1% in February, exceeding expectations for a 5.1% rise, after a 7.8% drop in January. January's figure was revised down from a 7.7% decrease.

It was the first gain since June 2014.

The rise was driven by higher prices for crude energy products. Crude energy products jumped 16.0% in February, the largest rise since March 2009.

-

14:32

U.S.: Personal Income, m/m, February 0.4% (forecast 0.3%)

-

14:32

U.S.: Personal spending , February 0.1% (forecast 0.3%)

-

14:32

U.S.: PCE price index ex food, energy, m/m, February 0.1% (forecast 0.1%)

-

14:32

U.S.: PCE price index ex food, energy, Y/Y, February 1.4%

-

14:31

Canada: Industrial product prices, m/m, February 1.8% (forecast 0.6%)

-

14:31

Canada: Raw Material Price Index, February 6.1% (forecast 5.1%)

-

14:02

Germany: CPI, m/m, March 0.5% (forecast 0.4%)

-

14:02

Germany: CPI, y/y , March 0.3% (forecast 0.3%)

-

14:00

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's debt problems

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Switzerland KOF Leading Indicator March 90.3 Revised From 90.1 89.1 90.8

08:30 United Kingdom Mortgage Approvals February 61 62 61

08:30 United Kingdom Net Lending to Individuals, bln February 2.4 2.5 2.5

09:00 Eurozone Business climate indicator March 0.07 0.18 0.23

09:00 Eurozone Economic sentiment index March 102.1 103.1 103.9

09:00 Eurozone Industrial confidence March -4.7 -4.0 -2.9

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. Personal income in the U.S. is expected to rise 0.3% in February, after a 0.4% gain in January.

Personal spending in the U.S. is expected to gain 0.3% in February, after a 0.2% increase in January.

The personal consumption expenditures (PCE) price index excluding food and energy is expected to increase 0.1% in February.

Pending home sales in the U.S. are expected to climb 0.5% in February, after a 1.7% increase in January.

The greenback was supported by Friday's comments by Federal Reserve Chairwomen Janet Yellen. She said on Friday that the Fed is considering to raise its interest rate "later this year" even though this may slow the U.S. economy. The interest rate hike will be depend on the economic data, Yellen noted.

The euro traded lower against the U.S. dollar as concerns over Greece's debt problems weighed on the euro. The Greek government is expected to submit its new reform programme.

The British pound traded lower against the U.S. dollar after the mixed economic data from the U.K. Net lending to individuals in the U.K. increased by £2.5 billion in February, in line with expectations, after a £2.4 billion gain in January.

The number of mortgages approvals in the U.K. rose to 60,760 in February from 60,707 in January, missing expectations for an increase to 62,000. It was the highest level since August 2014.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian raw materials purchase price index. Canada's raw materials purchase price index is expected to rise 5.1% in February, after a 7.7% drop in January.

The Swiss franc traded lower against the U.S. dollar despite the better-than-expected KOF leading indicator. The KOF leading indicator increased to 90.8 in March from 90.3 in February, beating expectations for a decrease to 89.1. February's figure was revised up from 90.1.

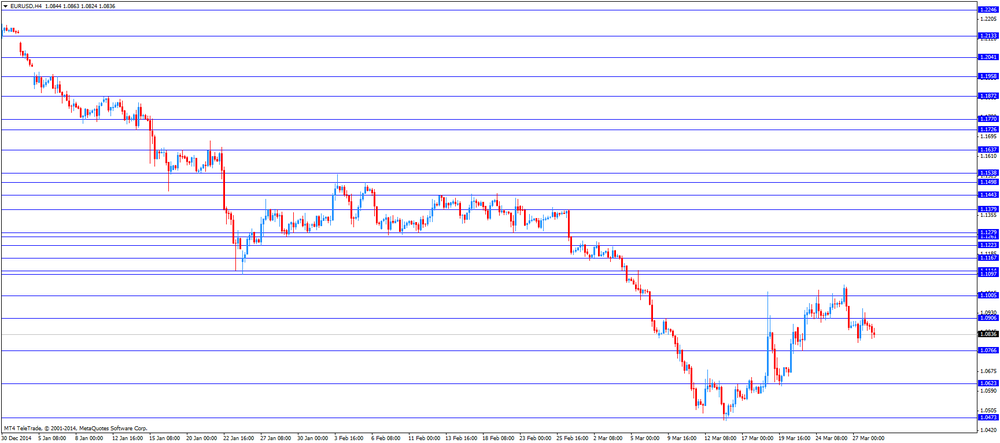

EUR/USD: the currency pair fell to $1.0819

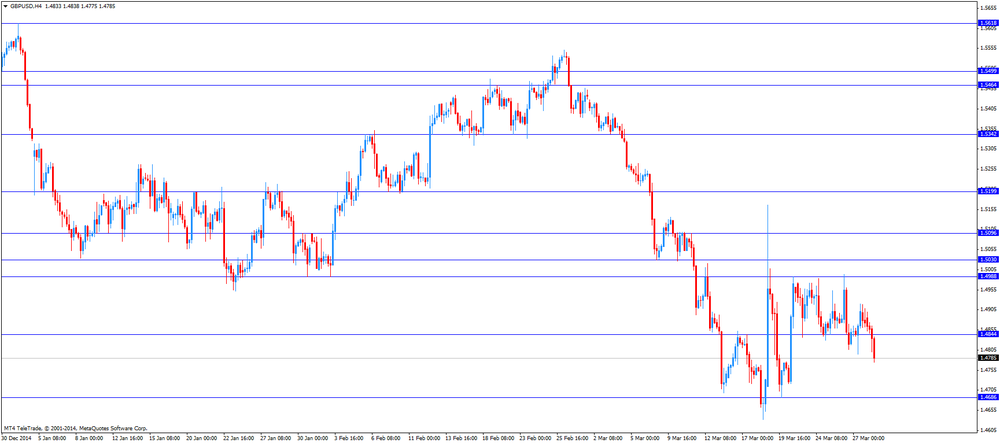

GBP/USD: the currency pair decreased to $1.4775

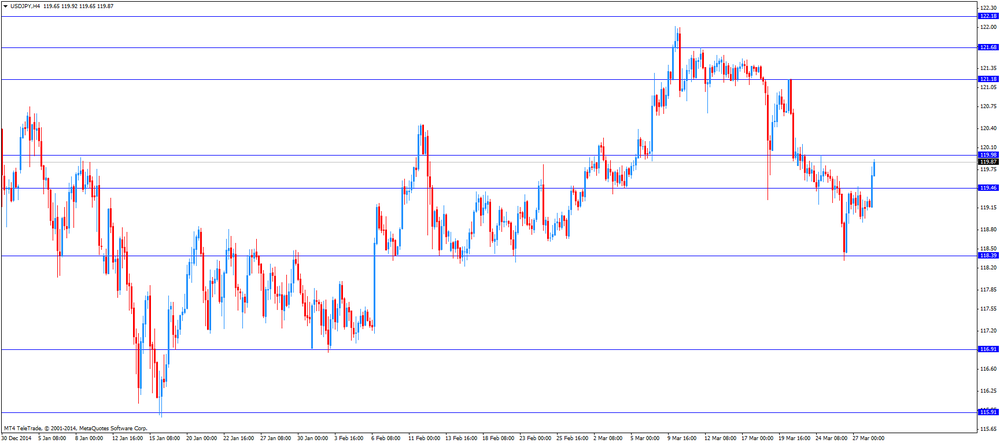

USD/JPY: the currency pair rose to Y119.92

The most important news that are expected (GMT0):

12:00 Germany CPI, m/m (Preliminary) March 0.9% 0.4%

12:00 Germany CPI, y/y (Preliminary) March 0.1% 0.3%

12:30 Canada Raw Material Price Index February -7.7% 5.1%

12:30 U.S. Personal Income, m/m February 0.3% 0.3%

12:30 U.S. Personal spending February -0.2% 0.3%

12:30 U.S. PCE price index ex food, energy, m/m February 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y February 1.3%

14:00 U.S. Pending Home Sales (MoM) February 1.7% 0.5%

21:45 New Zealand Building Permits, m/m February -3.8%

23:15 U.S. FED Vice Chairman Stanley Fischer Speaks

-

13:45

Orders

EUR/USD

Offers 1.1115 1.1100 1.1050 1.0100 1.0950

Bids 1.0800 1.0785/80 1.0765 1.0700 1.0660/55

GBP/USD

Offers 1.4995/500 1.4950 1.4920

Bids 1.4760/50 1.4725/20 1.4710/00 1.4685/80

EUR/JPY

Offers 131.00 130.50-40 130.00

Bids 129.00 128.50 128.20/00 127.50

USD/JPY

Offers 121.20 121.00 120.50 120.00

Bids 119.90/00 118.65/60 118.35 118.00

EUR/GBP

Offers 0.7400 0.7390/85 0.7340

Bids 0.7300 0.7265 0.7210/00

AUD/USD

Offers 0.7900 0.7880 0.7850 0.7825 0.7800 0.7780

Bids 0.7650-60 0.7610 0.7590 0.7560

-

13:33

Fed Chairwomen Janet Yellen: the Fed is considering to raise its interest rate “later this year”

The Federal Reserve Chairwomen Janet Yellen said on Friday that the Fed is considering to raise its interest rate "later this year" even though this may slow the U.S. economy. The interest rate hike will be depend on the economic data, she noted.

Yellen pointed out the Fed will choose "gradualist approach" to raise its interest rate.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0700 (E1.7bn), $1.0900(E362mn), $1.0950(529mn), $1.1000(E622mn)

USD/JPY: Y118.70($650mn), Y119.00($250m)

EUR/JPY: Y128.50(790mn), Y131.00(E698mn)

AUD/USD: $0.7685(A$255mn)

USD/CAD: C$1.2440(C$280mn), C$1.2475-80($540mn), C$1.2540($440mn), C$1.2570($320mn), C$1.2600($443mn)

-

11:02

Eurozone: Business climate indicator , March 0.23 (forecast 0.18)

-

11:02

Eurozone: Economic sentiment index , March 103.9 (forecast 103.1)

-

11:02

Eurozone: Industrial confidence, March -2.9 (forecast -4.0)

-

10:32

United Kingdom: Net Lending to Individuals, bln, February 2.5 (forecast 2.5)

-

10:32

United Kingdom: Mortgage Approvals, February 61 (forecast 62)

-

09:30

Foreign exchange market. Asian session: U.S. dollar traded broadly stronger against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Switzerland KOF Leading Indicator March 90.1 89.1

The U.S. dollar is trading broadly higher against its major peers. On Friday data on U.S. GDP was reported. The final U.S. GDP rose at an annual rate of 2.2% in the fourth quarter, missing expectations for a 2.4% growth. A previous estimate was 2.2%. In Friday's highly anticipated speech FED chair Janet Yellen reiterated that the bank is going to hike rates gradually later this year although developments in the economy might have an impact on the timing. Today Personal Income, Personal Spending, Pending Home Sales and a speech of FED Vice Chairman Stanley Fischer will be in the focus.

The Australian dollar declined against the U.S. dollar for a fifth day in the absence of any major data from the region.

New Zealand's dollar booked losses against the greenback during the Asian session in the absence of any major data from the region. It's the fifth day of straight losses. At 21:45 GMT data on Building Permits will be reported.

The Japanese yen declined moderately against the greenback on Monday. Japanese Industrial Production shrank -3.4% in February, compared to a reading of +3.7% in January. Year on year Industrial Production came in at -2.6% compared to -2.8%.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Mortgage Approvals February 61 62

08:30 United Kingdom Net Lending to Individuals, bln February 2.4 2.5

09:00 Eurozone Business climate indicator March 0.07 0.18

09:00 Eurozone Economic sentiment index March 102.1 103.1

09:00 Eurozone Industrial confidence March -4.7 -4.0

12:00 Germany CPI, m/m (Preliminary) March 0.9% 0.4%

12:00 Germany CPI, y/y (Preliminary) March 0.1% 0.3%

12:30 Canada Industrial product prices, m/m February -0.4% 0.6%

12:30 Canada Raw Material Price Index February -7.7% 5.1%

12:30 U.S. Personal Income, m/m February 0.3% 0.3%

12:30 U.S. Personal spending February -0.2% 0.3%

12:30 U.S. PCE price index ex food, energy, m/m February 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y February 1.3%

14:00 U.S. Pending Home Sales (MoM) February 1.7% 0.5%

21:45 New Zealand Building Permits, m/m February -3.8%

23:05 United Kingdom Gfk Consumer Confidence March 1 1

23:15 U.S. FED Vice Chairman Stanley Fischer Speaks

-

09:00

Switzerland: KOF Leading Indicator, March 90.8 (forecast 89.1)

-

08:12

Options levels on monday, March 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1137 (4852

$1.1006 (2016)

$1.0947 (2643)

Price at time of writing this review: $1.0870

Support levels (open interest**, contracts):

$1.0805 (2513)

$1.0769 (8291)

$1.0730 (3079)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 68761 contracts, with the maximum number of contracts with strike price $1,1000 (4852);

- Overall open interest on the PUT options with the expiration date April, 2 is 83580 contracts, with the maximum number of contracts with strike price $1,0800 (8291);

- The ratio of PUT/CALL was 1.22 versus 1.19 from the previous trading day according to data from March, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5101 (1628)

$1.5003 (143)

$1.4906 (1602)

Price at time of writing this review: $1.4840

Support levels (open interest**, contracts):

$1.4795 (1384)

$1.4698 (2031)

$1.4599 (1408)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 27547 contracts, with the maximum number of contracts with strike price $1,5100 (1628);

- Overall open interest on the PUT options with the expiration date April, 2 is 29203 contracts, with the maximum number of contracts with strike price $1,5050 (2331);

- The ratio of PUT/CALL was 1.06 versus 1.08 from the previous trading day according to data from March, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:52

Japan: Industrial Production (YoY), February -2.6%

-

01:52

Japan: Industrial Production (MoM) , February -3.4%

-

01:01

Currencies. Daily history for Mar 27’2015:

(pare/closed(GMT +2)/change, %)

EUR/JPY $1,0883 +0,08%

GBP/USD $1,4872 +0,15%

USD/CHF Chf0,962 -0,14%

USD/JPY Y119,14 -0,06%

EUR/JPY Y129,73 +0,09%

GBP/JPY Y177,19 +0,09%

AUD/USD $0,7749 -1,01%

NZD/USD $0,7568 -0,32%

USD/CAD C$1,2608 +0,98%

-

00:02

Schedule for today, Monday, Mar 30’2015:

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator March 90.1 89.1

08:30 United Kingdom Mortgage Approvals February 61 62

08:30 United Kingdom Net Lending to Individuals, bln February 2.4 2.5

09:00 Eurozone Business climate indicator March 0.07 0.18

09:00 Eurozone Economic sentiment index March 102.1 103.1

09:00 Eurozone Industrial confidence March -4.7 -4.0

12:00 Germany CPI, m/m (Preliminary) March 0.9% 0.4%

12:00 Germany CPI, y/y (Preliminary) March 0.1% 0.3%

12:30 Canada Industrial product prices, m/m February -0.4% 0.6%

12:30 Canada Raw Material Price Index February -7.7% 5.1%

12:30 U.S. Personal Income, m/m February 0.3% 0.3%

12:30 U.S. Personal spending February -0.2% 0.3%

12:30 U.S. PCE price index ex food, energy, m/m February 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y February 1.3%

14:00 U.S. Pending Home Sales (MoM) February 1.7% 0.5%

21:45 New Zealand Building Permits, m/m February -3.8%

23:05 United Kingdom Gfk Consumer Confidence March 1 1

23:15 U.S. FED Vice Chairman Stanley Fischer Speaks

-