Noticias del mercado

-

22:45

New Zealand: Trade Balance, mln, September -1222 (forecast -800)

-

18:00

European stocks closed: FTSE 100 6,417.02 -27.06 -0.42% CAC 40 4,897.13 -26.51 -0.54% DAX 10,801.34 +6.80 +0.06%

-

16:58

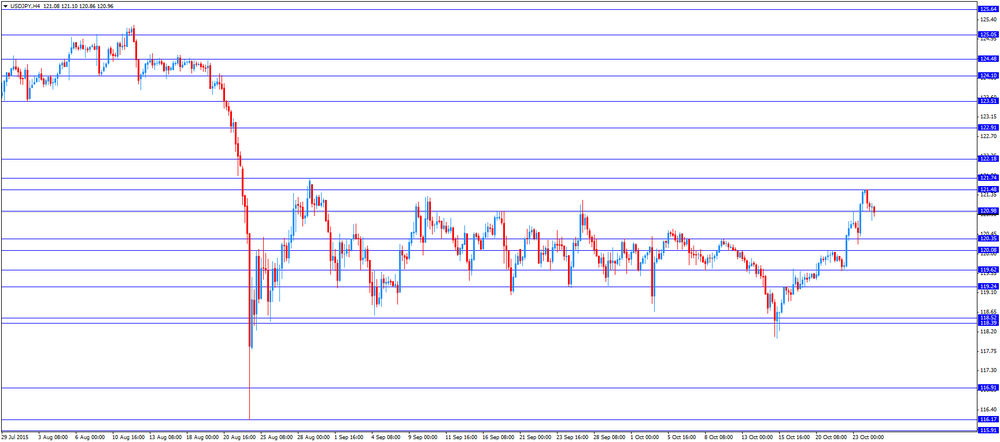

According to a key economic adviser to Japanese Prime Minister Shinzo Abe, there is no need for further stimulus measures

-

16:22

European Central Bank purchases €12.25 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.25 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference last Thursday that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December. He noted that the Governing Council discussed the possibility to cut interest rates, but the decision was not made. Draghi pointed out that the central bank will expand its asset-buying programme if needed to boost inflation toward the 2% target.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €2.03 billion of covered bonds, and €200 million of asset-backed securities.

-

15:13

New home sales in the U.S. slides 11.5% in September

The U.S. Commerce Department released new home sales data on Monday. New home sales dropped 11.5% to a seasonally adjusted annual rate of 468,000 units in September from 529,000 units in August. August's figure was revised down from 552,000 units. It was the highest figure since February 2008.

Analysts had expected new home sales to reach 550,000 units.

The decline was driven by lower sales in the Northeast. New home sales in the Northeast plunged 61.8% in September.

This data points to a cooling in the U.S. housing market.

-

15:00

U.S.: New Home Sales, September 468 (forecast 550)

-

14:57

Bundesbank’s monthly report: the underlying trend in the German economy remains strong

The German Bundesbank released its monthly economic report on Monday. The central bank said that the underlying trend in the German economy remains strong, but it lost some momentum.

"The upward momentum of overall economic activity in Germany continued in the third quarter," the central bank said.

Households' real income benefited from higher wages and lower energy prices, according to the report.

The Bundesbank pointed out that the construction sector lost momentum.

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 1.2bln) 120.50 (322m) 121.50 (350m)

EUR/USD 1.0930 (EUR 338m) 1.1000 (1.1bln) 1.1050-60 (427m)

USD/CAD 1.3200 (USD 420m) 1.3350 (700m)

AUD/USD 0.7275-80 (AUD 491m)

NZD/USD 0.6530 (NZD 918m)

AUD/NZD 1.0650 (AUD 300m)

-

14:36

CBI industrial order books balance decreases to -18% in October

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance dropped to -18% in October from -7% in September.

Ona quarterly basis, the CBI industrial order books balance declined to -8% in the third quarter from +9% in the second quarter. It was the lowest reading since October 2012.

"Manufacturers have been struggling with weak export demand for several months, because of the strength of the pound and subdued global growth. But now they're also facing pressure back home as domestic demand is easing," the CBI director of economics Rain Newton-Smith said.

-

14:29

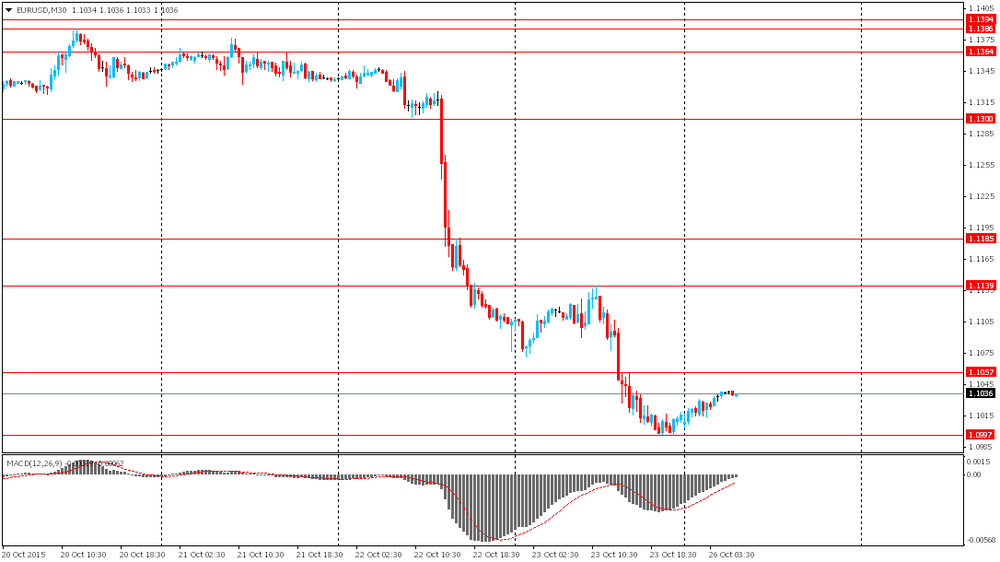

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the better-than-expected economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

09:00 Germany IFO - Expectations October 103.3 102.4 103.8

09:00 Germany IFO - Current Assessment October 114 113.5 112.6

09:00 Germany IFO - Business Climate October 108.5 107.8 108.2

09:30 United Kingdom BBA Mortgage Approvals September 46.6 Revised From 46.74 44.5

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the U.S. new home sales data. New home sales in the U.S. are expected to decline to 550,000 units in September from 552,000 units in August.

The euro traded lower against the U.S. dollar despite the better-than-expected economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index fell to 108.2 in October from 108.5 in September, beating expectations for a decline to 107.8.

"Companies were slightly less satisfied with their current business situation than in September. Optimism with a view to future business developments nevertheless continued to grow. The German economy is proving remarkably resilient in view of this autumn's multiple challenges," Ifo President Hans-Werner Sinn said.

He added that the Volkswagen scandal had no impact on the German automotive industry.

The Ifo current conditions index declined to 112.6 from 114.0. Analysts had expected the index to fell to 113.5.

The Ifo expectations index rose to 103.8 from 103.3. Analysts had expected the index to decrease to 102.4.

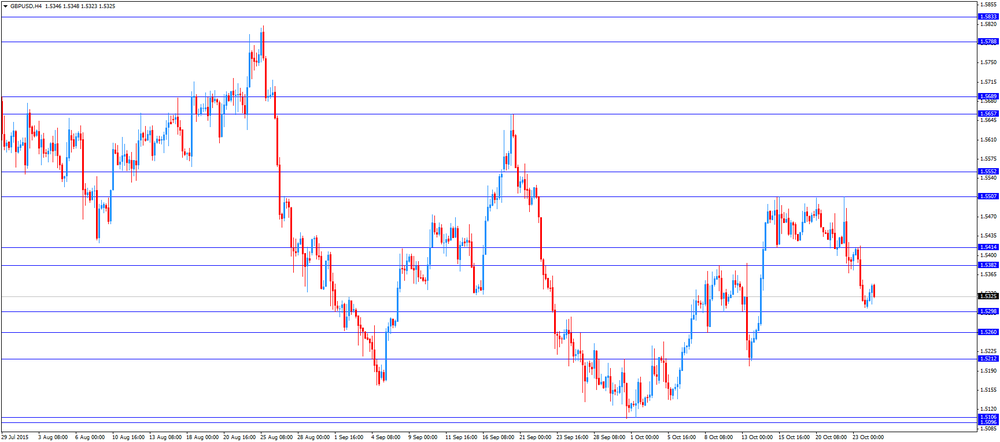

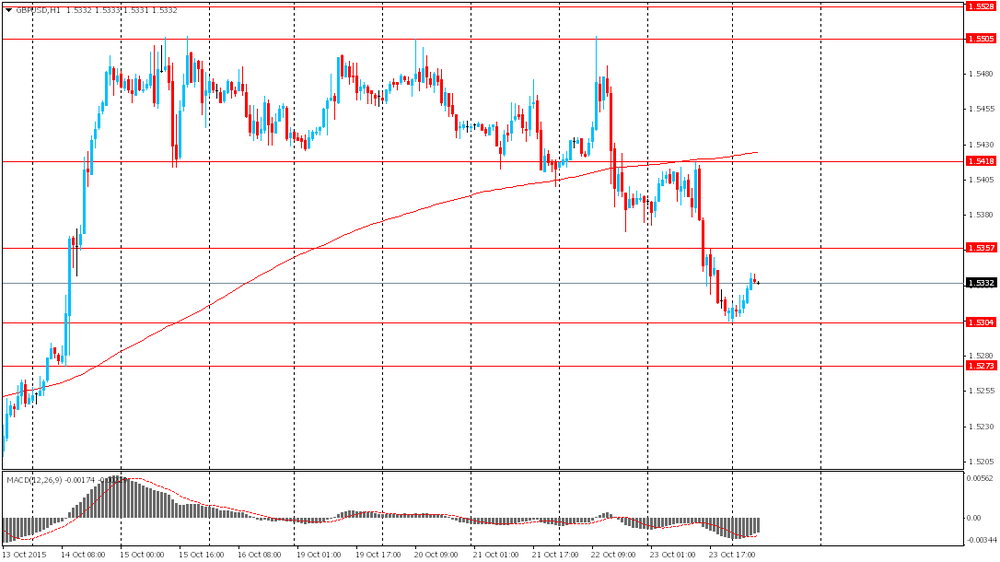

The British pound traded mixed against the U.S. dollar after the release of the negative economic data from the U.K. The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance dropped to -18% in October from -7% in September.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Monday. The number of mortgage approvals decreased to 44,489 in September from 46,567 in August. August's figure was revised down from 46,743.

"Borrowing figures in the mortgage market remain strong as customers take advantage of record low interest rates. In particular, remortgaging remains high as savvy customers secure attractive deals ahead of a possible rate rise," the chief economist at the BBA, Richard Woolhouse, said.

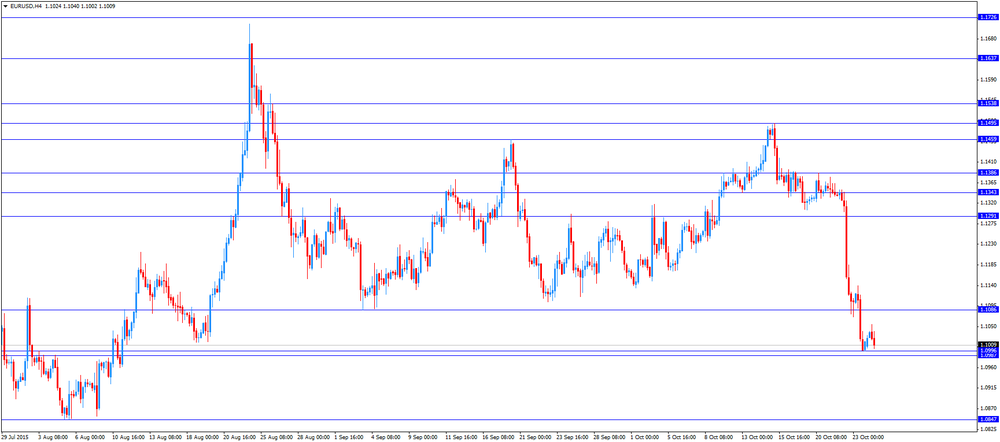

EUR/USD: the currency pair declined to $1.1002

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. New Home Sales September 552 550

21:45 New Zealand Trade Balance, mln September -1035 -800

-

14:00

Orders

EUR/USD

Offers 1.1050 1.1075-80 1.1100 1.1125 1.1150 1.1175-80 1.1200

Bids 1.1000 1.0985 1.0960 1.0930 1.0900 1.0885 1.0850 1.0830 1.0800

GBP/USD

Offers 1.5350 1.5380-85 15400 1.5420-25 1.5445-50 1.5480 1.5500-10 1.5525-30 1.5550

Bids 1.5320 1.5300 1.5285 1.5265 1.5250 1.5220 1.5200 1.5175-80 1.5150

EUR/GBP

Offers 0.7225-30 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7175-80 0.7165 0.7150 0.7130 0.7100 0.7085 0.7050

EUR/JPY

Offers 133.75-80 134.00 134.20-25 134.50 134.80 135.00 135.25 135.50

Bids 133.30 133.00 132.80 132.50 132.25-30 132.00

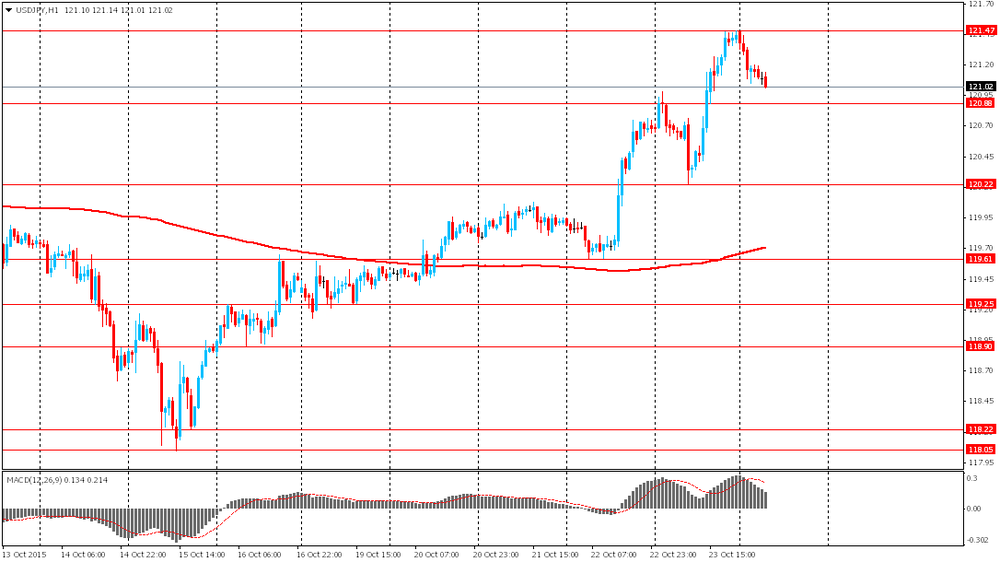

USD/JPY

Offers 121.00 121.20 121.35 121.50 121.80 122.00 122.25 122.50

Bids 120.75 120.50 120.20-25 120.00 119.80-85 119.50 119.25-30 119.00

AUD/USD

Offers 0.7280-85 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400

Bids 0.7250 0.7225-30 0.7200 0.7180-85 0.7150 0.7125-30 0.7100

-

11:17

Number of mortgage approvals in the U.K. declines to 44,489 in September

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Monday. The number of mortgage approvals decreased to 44,489 in September from 46,567 in August. August's figure was revised down from 46,743.

"Borrowing figures in the mortgage market remain strong as customers take advantage of record low interest rates. In particular, remortgaging remains high as savvy customers secure attractive deals ahead of a possible rate rise," the chief economist at the BBA, Richard Woolhouse, said.

-

11:03

Spanish producer prices decline 0.9% in September

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Monday. The Spanish producer prices dropped 0.9% in September, after a 1.7% fall in August.

On a yearly basis, producer price inflation in Spain fell 3.6% in September, after a 2.2% decline in August. Producer prices have been declining since July 2014.

Producer prices excluding energy climbed 0.4% year-on-year in September, after a 0.6% rise in August.

Energy prices slid 14.2% year-on-year in September.

-

10:35

German Ifo business confidence index falls to 108.2 in October

German Ifo Institute released its business confidence figures for Germany on Monday. German business confidence index fell to 108.2 in October from 108.5 in September, beating expectations for a decline to 107.8.

"Companies were slightly less satisfied with their current business situation than in September. Optimism with a view to future business developments nevertheless continued to grow. The German economy is proving remarkably resilient in view of this autumn's multiple challenges," Ifo President Hans-Werner Sinn said.

He added that the Volkswagen scandal had no impact on the German automotive industry.

The Ifo current conditions index declined to 112.6 from 114.0. Analysts had expected the index to fell to 113.5.

The Ifo expectations index rose to 103.8 from 103.3. Analysts had expected the index to decrease to 102.4.

-

10:30

United Kingdom: BBA Mortgage Approvals, September 44.5

-

10:27

International Monetary Fund: the slowdown in the Chinese economy could drag North Asia region into recession

The International Monetary Fund (IMF) said last week that the slowdown in the Chinese economy could drag North Asia region, which includes Japan, South Korea, Hong Kong and Taiwan, into recession. The lender expects the region to expand 5.5% this year. It is the weakest growth since the global financial crisis.

-

10:20

The Bank of Japan could lower its growth and inflation forecasts this week

Reuters reported on Friday that the Bank of Japan (BoJ) will lower its growth and inflation forecasts for this fiscal year ending on March 31, 2016 at its monetary policy meeting this week. But forecasts for next year will remain almost unchanged, the source with direct knowledge of the matter said.

Forecasts could be changed ahead of the announcement, according to the source.

-

10:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 1.2bln) 120.50 (322m) 121.50 (350m)

EUR/USD 1.0930 (EUR 338m) 1.1000 (1.1bln) 1.1050-60 (427m)

USD/CAD 1.3200 (USD 420m) 1.3350 (700m)

AUD/USD 0.7275-80 (AUD 491m)

NZD/USD 0.6530 (NZD 918m)

AUD/NZD 1.0650 (AUD 300m)

-

10:01

Reuters reports the International Monetary Fund will add the yuan to its basket of reserve currencies soon

Reuters reported on Sunday that the International Monetary Fund (IMF) officials said that the IMF will add the yuan to its basket of reserve currencies soon. The lender will decide in November.

"Everything is on course technically and there is no obvious political obstacle. The report leans clearly towards including the RMB in the (basket) but leaves the decision for the board," one IMF official said.

-

10:00

Germany: IFO - Business Climate, October 108.2 (forecast 107.8)

-

10:00

Germany: IFO - Current Assessment , October 112.6 (forecast 113.5)

-

10:00

Germany: IFO - Expectations , October 103.8 (forecast 102.4)

-

07:54

Foreign exchange market. Asian session: the Australian dollar rose on China's rate cut

The pound rose on an interview with Bank of England Governor Mark Carney. He said that a rate hike is probable, but not determined yet. Carney added that when the consumer price index rises the central bank will warn about its intention to raise the benchmark rate and only after that proceeds to action. He underlined that increase in interest rates would be modest and gradual.

The Australian dollar rose amid a rate cut by the central bank of China (the fifth cut this year). The People's Bank of China lowered its one-year deposit rate by 25 basis points to 1.5% and its one-year lending rate by 25 basis points to 4.35%. The reserve requirement ratio was lowered by 50 basis points. China is Australia's major trading partner, that's why positive news supports the AUD.

This week is full of economic data and important events. Tomorrow the Federal Reserve will start its monetary policy meeting and announce its decision on Wednesday. Not many experts expect to see changes in policymakers' statements.

EUR/USD: the pair rose to $1.1040 in Asian trade

USD/JPY: the pair fell to Y121.00

GBP/USD: the pair rose to $1.5340

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Germany IFO - Expectations October 103.3 102.4

09:00 Germany IFO - Current Assessment October 114 113.5

09:00 Germany IFO - Business Climate October 108.5 107.8

09:30 United Kingdom BBA Mortgage Approvals September 46.74

14:00 U.S. New Home Sales September 552 550

21:45 New Zealand Trade Balance, mln September -1035 -800

-

07:00

Options levels on monday, October 26, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1236 (1756)

$1.1166 (545)

$1.1112 (349)

Price at time of writing this review: $1.1036

Support levels (open interest**, contracts):

$1.0976 (5027)

$1.0946 (3792)

$1.0900 (4026)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 41781 contracts, with the maximum number of contracts with strike price $1,1500 (3317);

- Overall open interest on the PUT options with the expiration date November, 6 is 53838 contracts, with the maximum number of contracts with strike price $1,0900 (5423);

- The ratio of PUT/CALL was 1.29 versus 1.28 from the previous trading day according to data from October, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5602 (1204)

$1.5503 (2296)

$1.5406 (1420)

Price at time of writing this review: $1.5330

Support levels (open interest**, contracts):

$1.5291 (2777)

$1.5195 (2919)

$1.5098 (1917)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20744 contracts, with the maximum number of contracts with strike price $1,5350 (2608);

- Overall open interest on the PUT options with the expiration date November, 6 is 21100 contracts, with the maximum number of contracts with strike price $1,5200 (2919);

- The ratio of PUT/CALL was 1.02 versus 1.01 from the previous trading day according to data from October, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:46

Currencies. Daily history for Oct 23’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1016 -0,81%

GBP/USD $1,5312 -0,50%

USD/CHF Chf0,9783 +0,55%

USD/JPY Y121,44 +0,63%

EUR/JPY Y133,82 -0,16%

GBP/JPY Y185,97 +0,14%

AUD/USD $0,7215 +0,04%

NZD/USD $0,6750 -0,44%

USD/CAD C$1,3164 +0,55%

-