Noticias del mercado

-

23:59

Schedule for today, Wednesday, Oct 28’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia CPI, q/q Quarter III 0.7% 0.6%

00:30 Australia CPI, y/y Quarter III 1.5% 1.7%

00:30 Australia Trimmed Mean CPI q/q Quarter III 0.6% 0.5%

00:30 Australia Trimmed Mean CPI y/y Quarter III 2.2% 2.4%

07:00 Germany Gfk Consumer Confidence Survey November 9.6 9.4

07:45 France Consumer confidence October 97 97

11:00 U.S. MBA Mortgage Applications October 11.8%

14:30 U.S. Crude Oil Inventories October 8.028

18:00 U.S. Fed Interest Rate Decision 0.25%

18:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.75% 2.75%

20:00 New Zealand RBNZ Rate Statement

23:50 Japan Industrial Production (MoM) (Preliminary) September -1.2% -0.5%

23:50 Japan Industrial Production (YoY) (Preliminary) September -0.4%

-

17:34

Bank of England Deputy Governor Minouche Shafik: the normalisation process of the monetary policy may pose a risk to financial stability

Bank of England (BoE) Deputy Governor Minouche Shafik said on Tuesday that the normalisation process of the monetary policy may pose a risk to financial stability.

"Order-flow imbalances could preface a prolonged period of volatility, a severe reduction in market liquidity, and ultimately a loss of confidence in the ability of markets to contribute to sustainable growth. In short, there is a risk to financial stability," she said.

Shafik added that the improvement of the transparency could help to address this risk.

"Monetary policy makers in the US and UK will likely consider it appropriate to gradually tighten monetary policy should the recovery in their respective economies continue," BoE deputy governor said.

-

17:18

-

16:22

European Central Bank Governing Council member Ewald Nowotny: active fiscal and structural policies are needed to fight deflation

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Tuesday that monetary policy alone cannot fight deflation. Active fiscal and structural policies are needed, he added.

"We need active fiscal policy, we need elements of structural policy that also would increase demand but we also have to see that there may be strong underlying forces," he said.

-

15:55

Richmond Fed Manufacturing Index increases to -1 in October

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing rose to -1 in October from -5 in September.

The increase was driven by a rise in new orders. New orders subindex was up to 0 from -12.

Shipments subindex decline to -4 in October from -3 in September.

"Order backlogs and shipments declined, while new orders levelled off. Manufacturing employment remained soft, growing at the same pace as a month ago. The average workweek shortened and average wages rose moderately," the survey said.

-

15:17

U.S. consumer confidence index slides to 97.6 in October

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 97.6 in October from 102.6 in September, missing expectations for a rise to 103.0. September's figure was revised down from 103.0.

The decline was mainly driven by the worse outlook for current conditions. The present conditions index fell to 112.1 in October from 120.3 in September.

The Conference Board's consumer expectations index for the next six months decreased to 88.0 in October from 90.8 in September.

"Consumers were less positive in their assessment of present-day conditions, in particular the job market, and were moderately less optimistic about the short-term outlook. Despite the decline, consumers still rate current conditions favourably, but they do not anticipate the economy strengthening much in the near-term," the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was down to 22.2% in October from 24.8% in September.

-

15:00

U.S.: Consumer confidence , October 97.6 (forecast 103)

-

15:00

U.S.: Richmond Fed Manufacturing Index, October -1

-

14:56

U.S. preliminary services purchasing managers' index declines to 54.4 in October

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) declined to 54.4 in October from 55.1 in September. It was the lowest level since January.

Analysts had expected the index to remain unchanged at 55.1.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a slowdown in new business growth and a weaker employment growth.

"Combined with the manufacturing results released last week, the services PMI survey indicates that the pace of economic growth slowed in October to the weakest since January, when business was hit by extreme weather," Markit Chief Economist Chris Williamson.

He added that the figures suggest that the U.S. economy was expanding at an annual rate of 1.8% at the beginning of the fourth quarter.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 374m) 120.20-25 (330m) 120.60-65 (400m)

EUR/USD 1.1000 (EUR 363m) 1.1250 (1.1bln)

GBP/USD 1.5400 (GBP 175m)

USD/CAD 1.3000 (USD 241m)

AUD/USD 0.7225 (AUD 393m) 0.7250 (1.46bln)

AUD/JPY 85.50 (AUD 331m)

-

14:45

U.S.: Services PMI, October 54.4 (forecast 55.1)

-

14:19

S&P/Case-Shiller home price index rises 5.1% in August

The S&P/Case-Shiller home price index increased 5.1% in August, in line with expectations, after a 5.0% gain in July.

San Francisco, Denver and Dallas were the largest contributors to the rise, where prices climbed by 10.7%, 10.7% and 9.4%, respectively.

"Home prices continue to climb at a 4% to 5% annual rate across the country. Most other recent housing indicators also show strength," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index rose by a seasonally adjusted 0.4% rate in August.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

14:08

Foreign exchange market. European session: the U.S. dollar traded against the most major currencies after the release of the weaker-than-expected U.S. durable goods orders data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Switzerland UBS Consumption Indicator September 1.64 Revised From 1.63 1.65

09:00 Eurozone Private Loans, Y/Y September 1.0% 1.1% 1.1%

09:00 Eurozone M3 money supply, adjusted y/y September 4.9% Revised From 4.8% 5% 4.9%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter III 0.7% 0.6% 0.5%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter III 2.4% 2.4% 2.3%

12:30 U.S. Durable Goods Orders September -3.0% Revised From -2.3% -1.2% -1.2%

12:30 U.S. Durable Goods Orders ex Transportation September -0.9% Revised From 0.0% 0% -0.4%

12:30 U.S. Durable goods orders ex defense -2.1% Revised From -1% -2%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August 5.0% 5.1% 5.1%

The U.S. dollar traded against the most major currencies after the release of the weaker-than-expected U.S. durable goods orders data. The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders decreased 1.2% in September, in line with expectations, after a 3.0% drop in August. August's figure was revised down from a 2.3% fall.

The decline was partly driven by a weak demand for transportation equipment, which slid by 2.9% in September.

The U.S. durable goods orders excluding transportation fell 0.4% in September, missing expectations for a flat reading, after a 0.9% decrease in August. August's figure was revised down from a flat reading.

The S&P/Case-Shiller home price index increased 5.1% in August, in line with expectations, after a 5.0% gain in July.

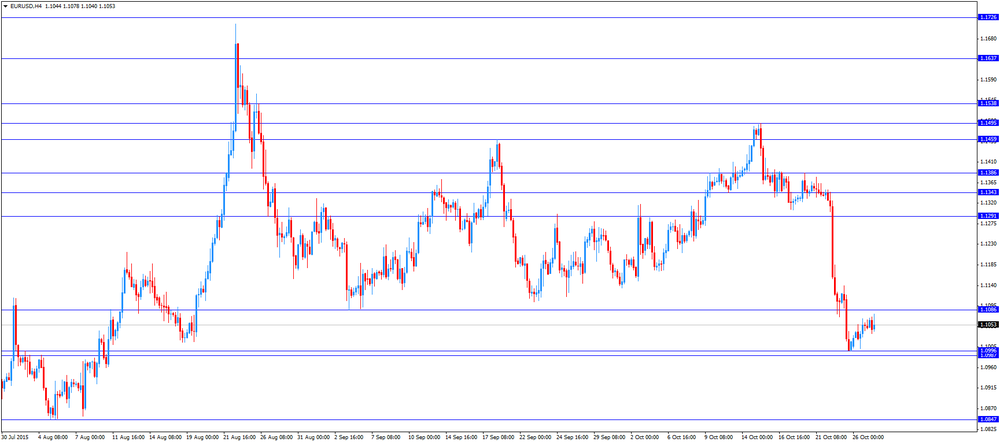

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.9% in September from last year, missing expectations for a 5.0% gain, after a 4.9 % increase in August. August's figure was revised up from a 4.8% rise.

Loans to the private sector in the Eurozone climbed 1.1% in September from the last year, in line with expectations, after a 1.0% gain in August.

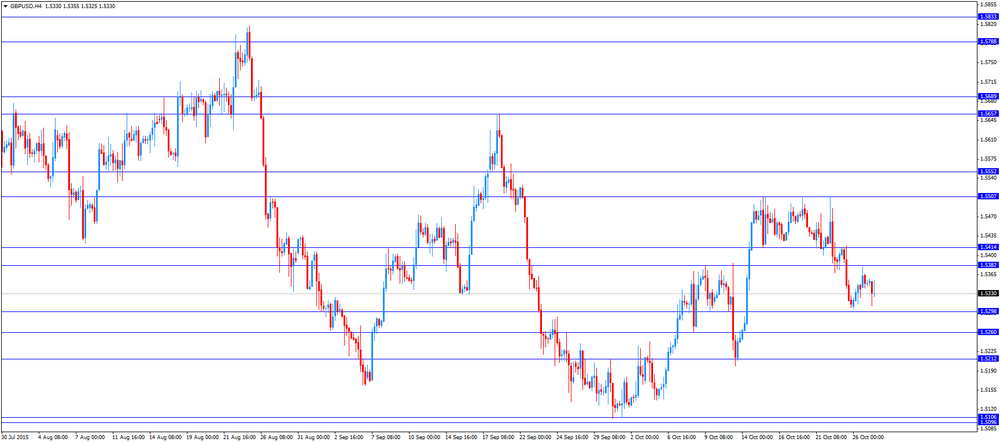

The British pound traded mixed against the U.S. dollar after the release of the weaker-than-expected economic data from the U.K. The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the second quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction and manufacturing sectors. Construction fell 2.2% in the third quarter, production declined 0.3%, while services rose 0.7%.

"The economy overall is still expanding steadily. However, the sectoral pattern is mixed," the ONS chief economist Joe Grice said.

On a yearly basis, the preliminary U.K. GDP increased 2.3% in the third quarter, missing forecasts of a 2.4% rise, after a 2.4% gain in the second quarter.

The Swiss franc traded mixed against the U.S. dollar. UBS released its consumption index for Switzerland on Tuesday. The UBS consumption index increased to 1.65 in September from 1.64 in August. August's figure was revised up from 1.63.

The increase was partly driven by a rise in automobiles sales.

"Lower prices for foreign-produced consumer goods in Swiss francs, such as automobiles, may be the likely reason," the bank said.

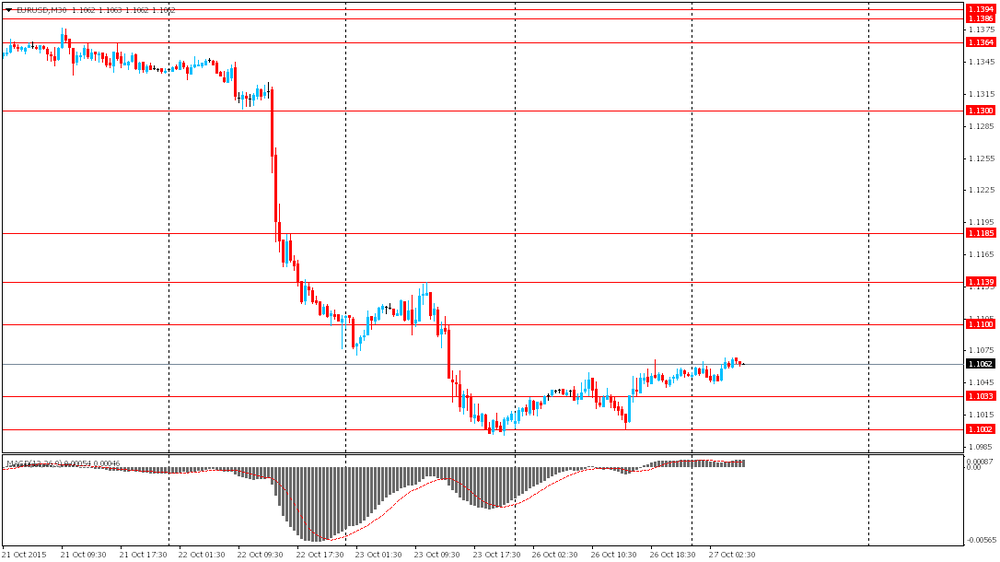

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

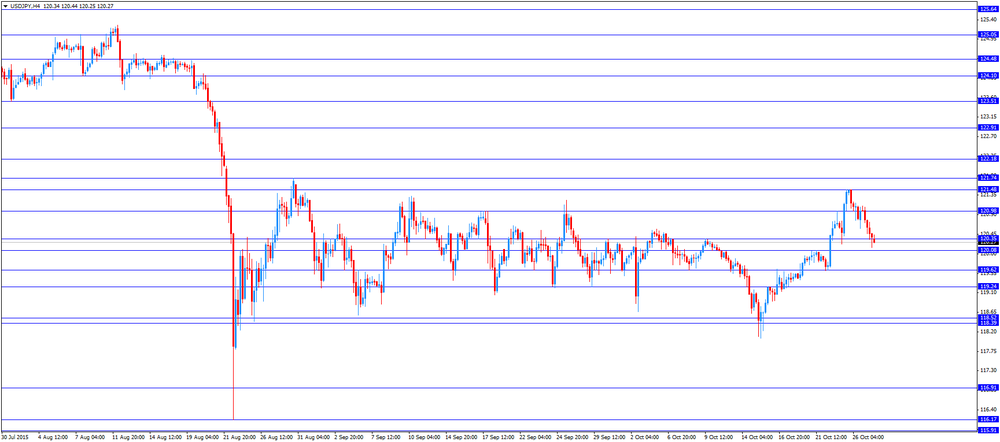

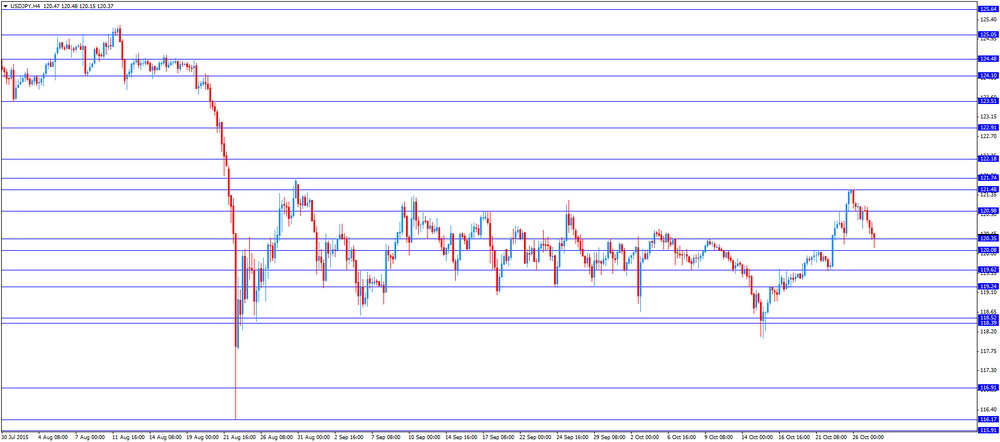

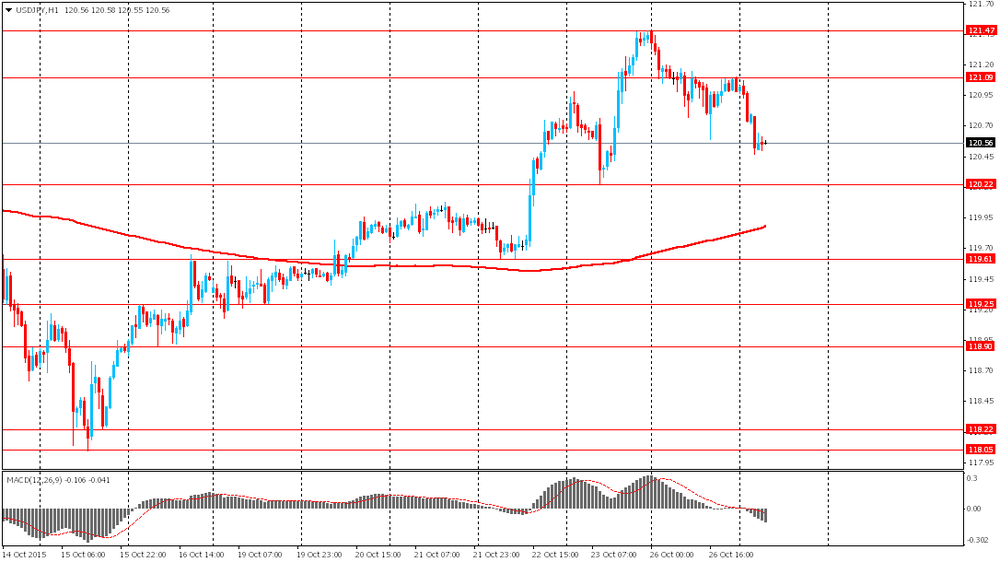

USD/JPY: the currency pair declined to Y120.33

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Preliminary) October 55.1 55.1

14:00 U.S. Richmond Fed Manufacturing Index October -5

14:00 U.S. Consumer confidence October 103 103

16:20 Canada Gov Council Member Lane Speaks

23:50 Japan Retail sales, y/y September 0.8% 0.4%

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, August 5.1% (forecast 5.1%)

-

13:55

U.S. durable goods orders fall 1.2% in September

The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders decreased 1.2% in September, in line with expectations, after a 3.0% drop in August. August's figure was revised down from a 2.3% fall.

The decline was partly driven by a weak demand for transportation equipment, which slid by 2.9% in September.

The U.S. durable goods orders excluding transportation fell 0.4% in September, missing expectations for a flat reading, after a 0.9% decrease in August. August's figure was revised down from a flat reading.

The U.S. durable goods orders excluding defence dropped 2.0 % in September, after a 2.1% decline in August. August's figure was revised down from a 1.0% decrease.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

-

13:46

Orders

EUR/USD

Offers 1.1075-80 1.1100 1.1125 1.1150 1.1175-80 1.1200 1.1220 1.1250

Bids 1.1025-30 1.1000 1.0985 1.0960 1.0930 1.0900 1.0885 1.0850

GBP/USD

Offers 1.5355-60 1.5380-85 15400 1.5420-25 1.5445-50 1.5480 1.5500-10 1.5525-30 1.5550

Bids 1.5320 1.5300 1.5285 1.5265 1.5250 1.5220 1.5200 1.5175-80 1.5150

EUR/GBP

Offers 0.7225-30 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7175-80 0.7165 0.7150 0.7130 0.7100 0.7085 0.7050

EUR/JPY

Offers 133.30 133.50-60 133.75-80 134.00 134.20-25 134.50

Bids 132.75-80 132.50 132.25-30 132.00 131.80 131.50 131.30 131.00

USD/JPY

Offers 120.65 120.80 121.00 121.20 121.35 121.50 121.80 122.00 122.25 122.50

Bids 120.20-25 120.00 119.80-85 119.50 119.25-30 119.00 118.80 118.50

AUD/USD

Offers 0.7265 0.7280-85 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400

Bids 0.7225-30 0.7200 0.7180-85 0.7150 0.7125-30 0.7100

-

13:30

U.S.: Durable goods orders ex defense, -2%

-

13:30

U.S.: Durable Goods Orders , September -1.2% (forecast -1.2%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , September -0.4% (forecast 0%)

-

11:56

German newspaper Sueddeutsche Zeitung reports lenders will not transfer a €2 billion bailout tranche to Greece

The German newspaper Sueddeutsche Zeitung reported on Tuesday that lenders will not transfer a €2 billion bailout tranche to Greece as the Greek government missed to implement required reforms. The paper noted that the government approved only 14 of 48 required reforms.

-

11:50

European Union Commission Vice-President Valdis Dombrovskis: the Greek government should recapitalise biggest Greek bank by the end of the year

European Union Commission Vice-President Valdis Dombrovskis said on Tuesday that the Greek government should recapitalise biggest Greek bank by the end of the year.

"We all agree to finalize bank recapitalization by end of this year," he said.

-

11:30

UBS consumption index rises to 1.65 in September

UBS released its consumption index for Switzerland on Tuesday. The UBS consumption index increased to 1.65 in September from 1.64 in August. August's figure was revised up from 1.63.

The increase was partly driven by a rise in automobiles sales.

"Lower prices for foreign-produced consumer goods in Swiss francs, such as automobiles, may be the likely reason," the bank said.

The lender noted that the low interest rate supported purchases of consumer durables.

-

11:22

M3 money supply in the Eurozone rises 4.9% in September from last year

The European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.9% in September from last year, missing expectations for a 5.0% gain, after a 4.9 % increase in August. August's figure was revised up from a 4.8% rise.

Loans to the private sector in the Eurozone climbed 1.1% in September from the last year, in line with expectations, after a 1.0% gain in August.

-

11:15

U.K. gross domestic product (GDP) climbs 0.5% in the third quarter

The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the second quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction and manufacturing sectors. Construction fell 2.2% in the third quarter, production declined 0.3%, while services rose 0.7%.

"The economy overall is still expanding steadily. However, the sectoral pattern is mixed," the ONS chief economist Joe Grice said.

On a yearly basis, the preliminary U.K. GDP increased 2.3% in the third quarter, missing forecasts of a 2.4% rise, after a 2.4% gain in the second quarter.

-

11:07

Moody’s: the U.S. government will be able to pay money, regardless if the debt limit will be raised or not

Moody's Investors Service said on Monday that the U.S. government will be able to pay money, regardless if the debt limit will be raised or not.

"Even if the debt limit is not raised, we believe the government will order its payment priorities to allow the Treasury to continue servicing its debt obligations," Moody's Senior Vice President Steven Hess said.

The U.S. government needs to cut expenditures by 11% across fiscal 2016 to stay in the black if the debt limit deal will not be reached.

-

11:03

New Zealand’s trade deficit widens to NZ$1,222 million in September

Statistics New Zealand released its trade data on late Monday evening. New Zealand's trade deficit widened to NZ$1,222 million in September from NZ$1,079 million in August. August's figure was revised up from a deficit of NZ$1,035 million.

Analysts had expected the deficit to decline to NZ$800 million.

Exports rose 2.0% year-on-year in September, while imports decreased by 1.2%.

"The value of imports from China has increased across most commodities for the last 12 months. Mobile phones and laptops led the increase, up a quarter of a billion dollars," Statistics NZ international statistics senior manager Jason Attewell said.

-

10:49

Number of unemployed people in France declines 0.7% in September

The French Labour Ministry released its labour market data on Monday. The number of unemployed people in France fell by 0.7% in September. It was the biggest monthly decline since 2007.

The unemployment in France has continued to increase since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment despite a rise in economic growth.

-

10:30

United Kingdom: GDP, q/q, Quarter III 0.5% (forecast 0.6%)

-

10:30

United Kingdom: GDP, y/y, Quarter III 2.3% (forecast 2.4%)

-

10:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 374m) 120.20-25 (330m) 120.60-65 (400m)

EUR/USD 1.1000 (EUR 363m) 1.1250 (1.1bln)

GBP/USD 1.5400 (GBP 175m)

USD/CAD 1.3000 (USD 241m)

AUD/USD 0.7225 (AUD 393m) 0.7250 (1.46bln)

AUD/JPY 85.50 (AUD 331m)

-

10:01

Eurozone: Private Loans, Y/Y, September 1.1% (forecast 1.1%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, September 4.9% (forecast 5%)

-

08:32

Options levels on tuesday, October 27, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1237 (2100)

$1.1171 (841)

$1.1122 (402)

Price at time of writing this review: $1.1056

Support levels (open interest**, contracts):

$1.1001 (3102)

$1.0958 (3091)

$1.0899 (1441)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 42796 contracts, with the maximum number of contracts with strike price $1,1500 (3311);

- Overall open interest on the PUT options with the expiration date November, 6 is 53891 contracts, with the maximum number of contracts with strike price $1,0900 (5270);

- The ratio of PUT/CALL was 1.26 versus 1.29 from the previous trading day according to data from October, 26

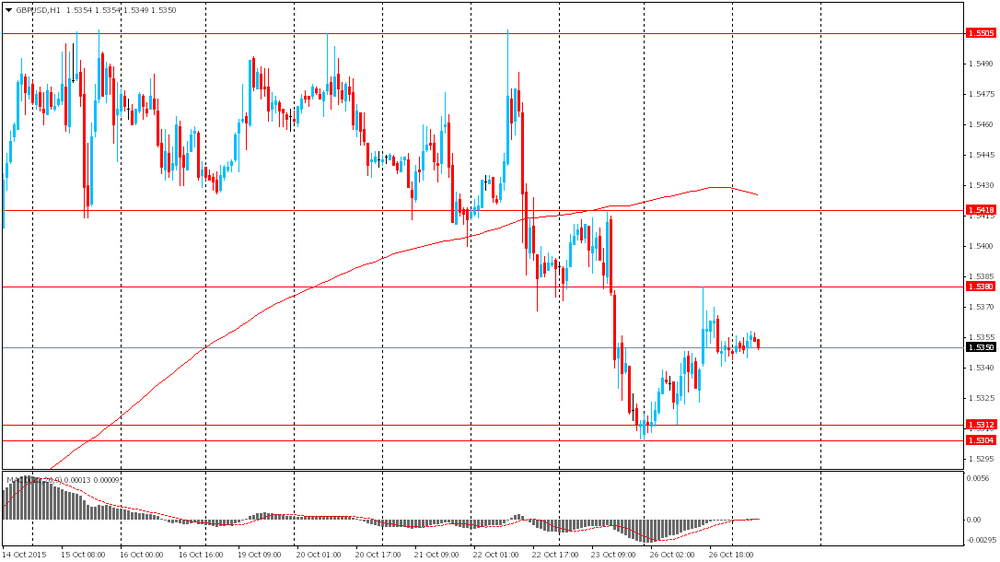

GBP/USD

Resistance levels (open interest**, contracts)

$1.5602 (1193)

$1.5503 (2304)

$1.5406 (1397)

Price at time of writing this review: $1.5344

Support levels (open interest**, contracts):

$1.5293 (2738)

$1.5197 (2935)

$1.5098 (1920)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20841 contracts, with the maximum number of contracts with strike price $1,5350 (2580);

- Overall open interest on the PUT options with the expiration date November, 6 is 21150 contracts, with the maximum number of contracts with strike price $1,5200 (2935);

- The ratio of PUT/CALL was 1.01 versus 1.02 from the previous trading day according to data from October, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Switzerland: UBS Consumption Indicator, September 1.65

-

07:57

Foreign exchange market. Asian session: the euro little changed

The euro little changed against the U.S. dollar ahead of a Fed meeting, which starts later today. Most market participants expect the Fed to hold onto soft monetary policy and postpone a rate increase till 2016. Such expectations are likely to weigh on the greenback and support the euro in the short-term outlook. Tomorrow the Federal Reserve will only publish its monetary policy statement, there will be no conference. Investors will study the statement to see clues on the timing a rate hike.

The yen gained due to its safe-haven status as sources reported that a U.S. warship sailed near China's artificial islands in the South China Sea.

The New Zealand dollar is under the pressure amid a weak report on the country's trade balance. The indicator came in at -Nz$1,222 million compared to expectations for -Nz$825 million. Exports fell to Nz$3.69 billion, while imports rose to Nz$4.91 billion.

EUR/USD: the pair fluctuated within $1.1035-70 in Asian trade

USD/JPY: the pair fell to Y120.45

GBP/USD: the pair traded within $1.5345-60

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland UBS Consumption Indicator September 1.63

09:00 Eurozone Private Loans, Y/Y September 1.0% 1.1%

09:00 Eurozone M3 money supply, adjusted y/y September 4.8% 5%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter III 0.7% 0.6%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter III 2.4% 2.4%

12:30 U.S. Durable Goods Orders September -2.3% -1.2%

12:30 U.S. Durable Goods Orders ex Transportation September 0.0% 0%

12:30 U.S. Durable goods orders ex defense -1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August 5.0% 5.1%

13:45 U.S. Services PMI (Preliminary) October 55.1 55.1

14:00 U.S. Richmond Fed Manufacturing Index October -5

14:00 U.S. Consumer confidence October 103 103

16:20 Canada Gov Council Member Lane Speaks

23:50 Japan Retail sales, y/y September 0.8% 0.4%

-

00:30

Currencies. Daily history for Oct 26’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1052 +0,33%

GBP/USD $1,5349 +0,24%

USD/CHF Chf0,9825 +0,43%

USD/JPY Y120,98 -0,38%

EUR/JPY Y133,71 -0,08%

GBP/JPY Y185,69 -0,15%

AUD/USD $0,7242 +0,37%

NZD/USD $0,6773 +0,34%

USD/CAD C$1,3159 -0,04%

-

00:01

Schedule for today, Tuesday, Oct 27’2015:

(time / country / index / period / previous value / forecast)

7:00 Switzerland UBS Consumption Indicator September 1.63

09:00 Eurozone Private Loans, Y/Y September 1.0% 1.1%

09:00 Eurozone M3 money supply, adjusted y/y September 4.8% 5%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter III 0.7% 0.6%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter III 2.4% 2.4%

12:30 U.S. Durable Goods Orders September -2.3% -1.3%

12:30 U.S. Durable Goods Orders ex Transportation September 0.0% 0%

12:30 U.S. Durable goods orders ex defense -1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August 5.0% 5.1%

13:45 U.S. Services PMI (Preliminary) October 55.1 55.1

14:00 U.S. Richmond Fed Manufacturing Index October -5

14:00 U.S. Consumer confidence October 103 102.9

16:20 Canada Gov Council Member Lane Speaks

23:50 Japan Retail sales, y/y September 0.8% 0.4%

-