Noticias del mercado

-

20:00

DJIA 17559.31 -63.74 -0.36%, NASDAQ 5018.19 -16.51 -0.33%, S&P 500 2061.68 -9.50 -0.46%

-

18:01

European stocks closed: FTSE 6365.27 -51.75 -0.81%, DAX 10692.19 -109.15 -1.01%, CAC 40 4847.07 -50.06 -1.02%

-

18:00

European stocks close: stocks closed lower on weak corporate earnings and as oil prices declined

Stock indices closed lower on weak corporate earnings and as oil prices declined. Oil prices hit 2-months-low on concerns over the global oil oversupply.

BASF shares fell as the company lowered its full-year forecast.

Meanwhile, the economic data from the Europe was mainly negative. The European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.9% in September from last year, missing expectations for a 5.0% gain, after a 4.9 % increase in August. August's figure was revised up from a 4.8% rise.

Loans to the private sector in the Eurozone climbed 1.1% in September from the last year, in line with expectations, after a 1.0% gain in August.

The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the second quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction and manufacturing sectors. Construction fell 2.2% in the third quarter, production declined 0.3%, while services rose 0.7%.

"The economy overall is still expanding steadily. However, the sectoral pattern is mixed," the ONS chief economist Joe Grice said.

On a yearly basis, the preliminary U.K. GDP increased 2.3% in the third quarter, missing forecasts of a 2.4% rise, after a 2.4% gain in the second quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,365.27 -51.75 -0.81 %

DAX 10,692.19 -109.15 -1.01 %

CAC 40 4,847.07 -50.06 -1.02 %

-

17:54

WSE: Session Results

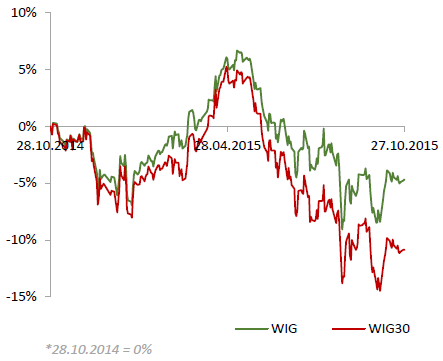

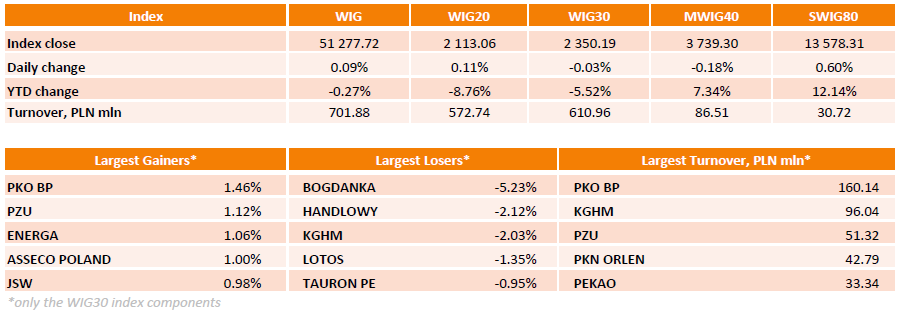

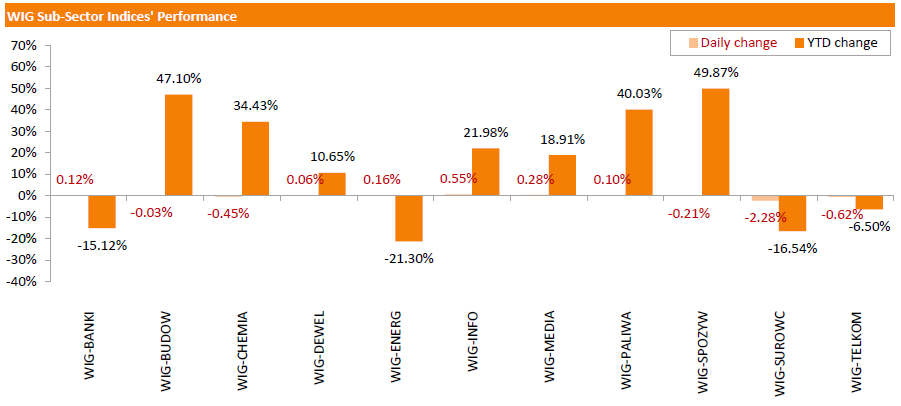

Polish equity market was modestly higher on Tuesday, with the broad market measure, the WIG index, edging up 0.09%. Sector-wise, materials (-2.28%) tumbled the most, while technology names (+0.55%) fared the best.

The large-cap stocks' benchmark, the WIG30 Index, inched down 0.03%. In the index basket, BOGDANKA (WSE: LWB) continued to retreat, losing 5.23%. Other major laggards were HANDLOWY (WSE: BHW), KGHM (WSE: KGH) and LOTOS (WSE: LTS), plunging by 2.12%, 2.03 and 1.35% respectively. On the other side of the ledger, PKO BP (WSE: PKO), PZU (WSE: PZU), ENERGA (WSE: ENG) and ASSECO POLAND (WSE: ACP) were the strongest performers, gaining 1%-1.46%.

-

17:34

Bank of England Deputy Governor Minouche Shafik: the normalisation process of the monetary policy may pose a risk to financial stability

Bank of England (BoE) Deputy Governor Minouche Shafik said on Tuesday that the normalisation process of the monetary policy may pose a risk to financial stability.

"Order-flow imbalances could preface a prolonged period of volatility, a severe reduction in market liquidity, and ultimately a loss of confidence in the ability of markets to contribute to sustainable growth. In short, there is a risk to financial stability," she said.

Shafik added that the improvement of the transparency could help to address this risk.

"Monetary policy makers in the US and UK will likely consider it appropriate to gradually tighten monetary policy should the recovery in their respective economies continue," BoE deputy governor said.

-

17:14

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday after mixed earnings reports from major U.S. companies, weaker-than-expected data and further declines in crude oil prices.

Investors are also watching the Federal Reserve, which began its two-day policy meeting. While expectations of a rate hike this week are slim, traders will focus on the Fed's statement on Wednesday for clues on the timing of a liftoff. Corporate results remain in sharp focus as investors scrutinize the reports for the measures companies are taking to grow revenue and protect profit margins.

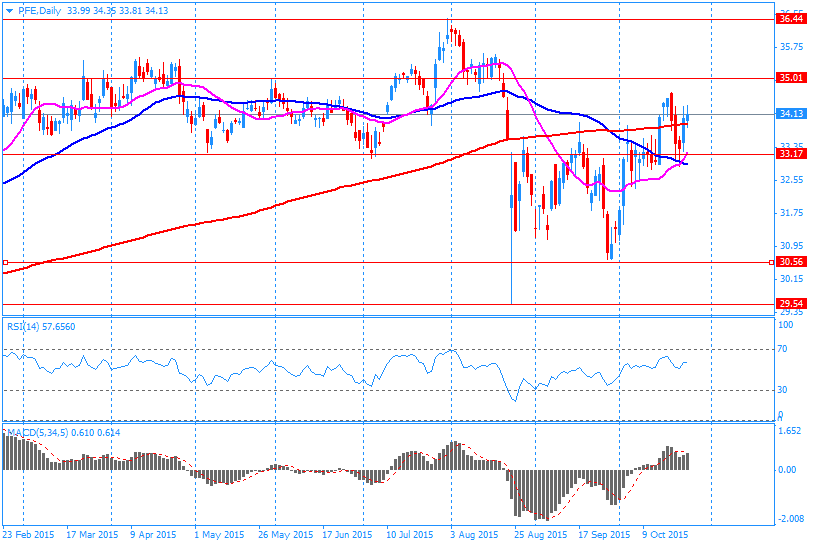

Most of Dow stocks in negative area (21 of 30). Top looser - Chevron Corporation (CVX, -1.77%). Top gainer - Pfizer Inc. (PFE, +2.66%).

Most of S&P index sectors in negative area. Top looser - Basic Materials (-1.7%). Top gainer - Healthcare (+0,9%).

At the moment:

Dow 17491.00 -40.00 -0.23%

S&P 500 2055.50 -6.75 -0.33%

Nasdaq 100 4623.50 +7.25 +0.16%

Oil 42.96 -1.02 -2.32%

Gold 1167.00 +0.80 +0.07%

U.S. 10yr 2.01 -0.05

-

16:22

European Central Bank Governing Council member Ewald Nowotny: active fiscal and structural policies are needed to fight deflation

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Tuesday that monetary policy alone cannot fight deflation. Active fiscal and structural policies are needed, he added.

"We need active fiscal policy, we need elements of structural policy that also would increase demand but we also have to see that there may be strong underlying forces," he said.

-

15:55

Richmond Fed Manufacturing Index increases to -1 in October

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing rose to -1 in October from -5 in September.

The increase was driven by a rise in new orders. New orders subindex was up to 0 from -12.

Shipments subindex decline to -4 in October from -3 in September.

"Order backlogs and shipments declined, while new orders levelled off. Manufacturing employment remained soft, growing at the same pace as a month ago. The average workweek shortened and average wages rose moderately," the survey said.

-

15:17

U.S. consumer confidence index slides to 97.6 in October

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 97.6 in October from 102.6 in September, missing expectations for a rise to 103.0. September's figure was revised down from 103.0.

The decline was mainly driven by the worse outlook for current conditions. The present conditions index fell to 112.1 in October from 120.3 in September.

The Conference Board's consumer expectations index for the next six months decreased to 88.0 in October from 90.8 in September.

"Consumers were less positive in their assessment of present-day conditions, in particular the job market, and were moderately less optimistic about the short-term outlook. Despite the decline, consumers still rate current conditions favourably, but they do not anticipate the economy strengthening much in the near-term," the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was down to 22.2% in October from 24.8% in September.

-

14:56

U.S. preliminary services purchasing managers' index declines to 54.4 in October

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) declined to 54.4 in October from 55.1 in September. It was the lowest level since January.

Analysts had expected the index to remain unchanged at 55.1.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a slowdown in new business growth and a weaker employment growth.

"Combined with the manufacturing results released last week, the services PMI survey indicates that the pace of economic growth slowed in October to the weakest since January, when business was hit by extreme weather," Markit Chief Economist Chris Williamson.

He added that the figures suggest that the U.S. economy was expanding at an annual rate of 1.8% at the beginning of the fourth quarter.

-

14:37

U.S. Stocks open: Dow -0.38%, Nasdaq -0.20%, S&P -0.37%

-

14:29

Before the bell: S&P futures -0.23%, NASDAQ futures -0.09%

U.S. stock-index futures slipped before the Federal Reserve begins a two-day monetary policy meeting amid mixed earnings reports and as data showed orders for business equipment unexpectedly declined.

Global Stocks:

Nikkei 18,777.04 -170.08 -0.90%

Hang Seng 23,142.73 +26.48 +0.11%

Shanghai Composite 3,434.27 +4.69 +0.14%

FTSE 6,385.66 -31.36 -0.49%

CAC 4,861.61 -35.52 -0.73%

DAX 10,732.02 -69.32 -0.64%

Crude oil 43.39 (-1.34%)

Gold $1167.19 (+0.15%)

-

14:19

S&P/Case-Shiller home price index rises 5.1% in August

The S&P/Case-Shiller home price index increased 5.1% in August, in line with expectations, after a 5.0% gain in July.

San Francisco, Denver and Dallas were the largest contributors to the rise, where prices climbed by 10.7%, 10.7% and 9.4%, respectively.

"Home prices continue to climb at a 4% to 5% annual rate across the country. Most other recent housing indicators also show strength," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index rose by a seasonally adjusted 0.4% rate in August.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

13:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yahoo! Inc., NASDAQ

YHOO

35.40

5.99%

823.3K

Pfizer Inc

PFE

35.08

2.69%

146.3K

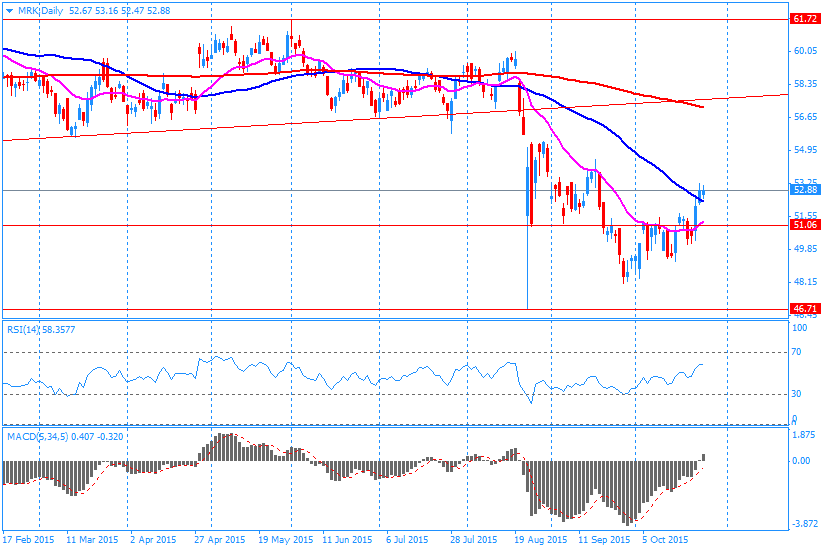

Merck & Co Inc

MRK

53.91

1.89%

2.9K

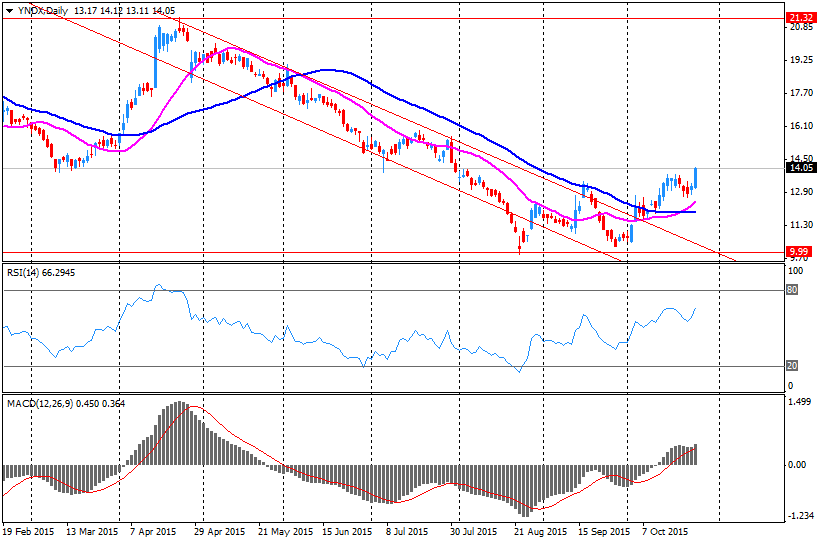

Yandex N.V., NASDAQ

YNDX

14.25

1.42%

203.0K

Twitter, Inc., NYSE

TWTR

31.32

1.39%

92.5K

Barrick Gold Corporation, NYSE

ABX

7.58

1.07%

0.2K

ALCOA INC.

AA

8.81

0.46%

23.2K

Apple Inc.

AAPL

115.75

0.41%

295.5K

Starbucks Corporation, NASDAQ

SBUX

63.62

0.30%

3.8K

Tesla Motors, Inc., NASDAQ

TSLA

215.50

0.11%

3.8K

Wal-Mart Stores Inc

WMT

58.07

0.09%

0.1K

Procter & Gamble Co

PG

77.55

0.08%

7.0K

Johnson & Johnson

JNJ

100.00

0.06%

0.1K

Amazon.com Inc., NASDAQ

AMZN

609.00

0.06%

1.1K

Visa

V

78.17

-0.01%

1.0K

Boeing Co

BA

146.54

-0.11%

92.9K

AT&T Inc

T

33.60

-0.18%

0.7K

Walt Disney Co

DIS

113.25

-0.24%

0.3K

Hewlett-Packard Co.

HPQ

28.00

-0.25%

4.5K

Facebook, Inc.

FB

103.50

-0.26%

19.0K

Home Depot Inc

HD

124.65

-0.29%

0.4K

McDonald's Corp

MCD

111.83

-0.31%

0.8K

Cisco Systems Inc

CSCO

28.85

-0.35%

25.1K

Verizon Communications Inc

VZ

46.18

-0.39%

0.5K

Citigroup Inc., NYSE

C

52.90

-0.40%

2.5K

General Electric Co

GE

29.43

-0.41%

2.4K

Intel Corp

INTC

34.40

-0.55%

1.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.95

-0.58%

12.8K

Microsoft Corp

MSFT

53.93

-0.59%

141.7K

E. I. du Pont de Nemours and Co

DD

60.00

-0.61%

0.6K

ALTRIA GROUP INC.

MO

61.00

-0.65%

0.4K

Exxon Mobil Corp

XOM

80.64

-0.71%

2.7K

Deere & Company, NYSE

DE

76.94

-0.74%

0.3K

Chevron Corp

CVX

88.07

-0.79%

0.9K

The Coca-Cola Co

KO

42.25

-0.80%

0.2K

FedEx Corporation, NYSE

FDX

156.00

-1.18%

0.3K

Caterpillar Inc

CAT

70.60

-1.29%

1.0K

General Motors Company, NYSE

GM

35.19

-1.35%

10.6K

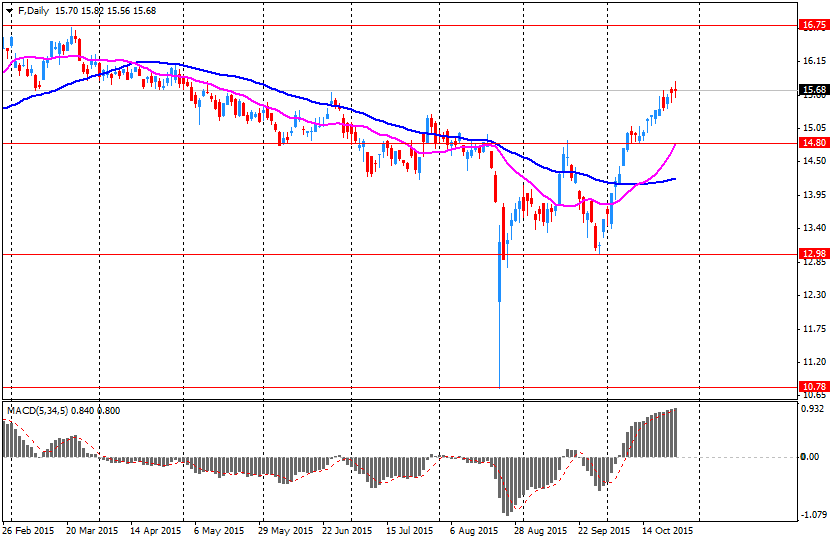

Ford Motor Co.

F

15.02

-4.21%

333.3K

-

13:55

U.S. durable goods orders fall 1.2% in September

The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders decreased 1.2% in September, in line with expectations, after a 3.0% drop in August. August's figure was revised down from a 2.3% fall.

The decline was partly driven by a weak demand for transportation equipment, which slid by 2.9% in September.

The U.S. durable goods orders excluding transportation fell 0.4% in September, missing expectations for a flat reading, after a 0.9% decrease in August. August's figure was revised down from a flat reading.

The U.S. durable goods orders excluding defence dropped 2.0 % in September, after a 2.1% decline in August. August's figure was revised down from a 1.0% decrease.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

-

13:41

-

13:27

-

13:21

Company News: Merck (MRK) Q3 profit beats expectations

Merck reported Q3 earnings of $0.96 per share (versus $0.9 in Q3 FY 2014), beating analysts' consensus of $0.92.

The company's revenues amounted to $10.100 bln (-4.3% y/y), in line with consensus estimate of $10.078 bln.

Merck expects FY15 EPS of $3.55-3.60 (above consensus of $3.50) and revenues of $39.2-39.8 bln (in line with consensus of $39.64 bln).

MRK rose to $53.55 (+1.21%) in pre-market trading.

-

13:09

-

13:02

Company News: Yandex (YNDX) Q3 results beat analyst estimates

Yandex reported Q3 earnings of RUB 10.80 per share (versus RUB 0.31 in Q3 FY 2014), beating analysts' consensus of RUB 10.08.

The company's revenues amounted to RUB 15.439 bln (+18.2% y/y), beating consensus estimate of $14.991 bln.

Yandex increased its previously announced revenue guidance to +14-16% y/y in ruble terms from +11-13% y/y.

YNDX rose to $14.37 (+2.28%) in pre-market trading.

-

12:03

European stock markets mid session: stocks traded lower on weak corporate earnings

Stock indices traded lower on weak corporate earnings. BASF shares fell as the company lowered its full-year forecast, while Novartis shares declined on the weaker-than-expected third quarter earnings.

Meanwhile, the economic data from the Europe was mainly negative. The European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.9% in September from last year, missing expectations for a 5.0% gain, after a 4.9 % increase in August. August's figure was revised up from a 4.8% rise.

Loans to the private sector in the Eurozone climbed 1.1% in September from the last year, in line with expectations, after a 1.0% gain in August.

The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the second quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction and manufacturing sectors. Construction fell 2.2% in the third quarter, production declined 0.3%, while services rose 0.7%.

"The economy overall is still expanding steadily. However, the sectoral pattern is mixed," the ONS chief economist Joe Grice said.

On a yearly basis, the preliminary U.K. GDP increased 2.3% in the third quarter, missing forecasts of a 2.4% rise, after a 2.4% gain in the second quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,394.14 -22.88 -0.36 %

DAX 10,776.86 -24.48 -0.23 %

CAC 40 4,880.49 -16.64 -0.34 %

-

11:56

German newspaper Sueddeutsche Zeitung reports lenders will not transfer a €2 billion bailout tranche to Greece

The German newspaper Sueddeutsche Zeitung reported on Tuesday that lenders will not transfer a €2 billion bailout tranche to Greece as the Greek government missed to implement required reforms. The paper noted that the government approved only 14 of 48 required reforms.

-

11:50

European Union Commission Vice-President Valdis Dombrovskis: the Greek government should recapitalise biggest Greek bank by the end of the year

European Union Commission Vice-President Valdis Dombrovskis said on Tuesday that the Greek government should recapitalise biggest Greek bank by the end of the year.

"We all agree to finalize bank recapitalization by end of this year," he said.

-

11:30

UBS consumption index rises to 1.65 in September

UBS released its consumption index for Switzerland on Tuesday. The UBS consumption index increased to 1.65 in September from 1.64 in August. August's figure was revised up from 1.63.

The increase was partly driven by a rise in automobiles sales.

"Lower prices for foreign-produced consumer goods in Swiss francs, such as automobiles, may be the likely reason," the bank said.

The lender noted that the low interest rate supported purchases of consumer durables.

-

11:22

M3 money supply in the Eurozone rises 4.9% in September from last year

The European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.9% in September from last year, missing expectations for a 5.0% gain, after a 4.9 % increase in August. August's figure was revised up from a 4.8% rise.

Loans to the private sector in the Eurozone climbed 1.1% in September from the last year, in line with expectations, after a 1.0% gain in August.

-

11:15

U.K. gross domestic product (GDP) climbs 0.5% in the third quarter

The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the second quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction and manufacturing sectors. Construction fell 2.2% in the third quarter, production declined 0.3%, while services rose 0.7%.

"The economy overall is still expanding steadily. However, the sectoral pattern is mixed," the ONS chief economist Joe Grice said.

On a yearly basis, the preliminary U.K. GDP increased 2.3% in the third quarter, missing forecasts of a 2.4% rise, after a 2.4% gain in the second quarter.

-

11:07

Moody’s: the U.S. government will be able to pay money, regardless if the debt limit will be raised or not

Moody's Investors Service said on Monday that the U.S. government will be able to pay money, regardless if the debt limit will be raised or not.

"Even if the debt limit is not raised, we believe the government will order its payment priorities to allow the Treasury to continue servicing its debt obligations," Moody's Senior Vice President Steven Hess said.

The U.S. government needs to cut expenditures by 11% across fiscal 2016 to stay in the black if the debt limit deal will not be reached.

-

11:03

New Zealand’s trade deficit widens to NZ$1,222 million in September

Statistics New Zealand released its trade data on late Monday evening. New Zealand's trade deficit widened to NZ$1,222 million in September from NZ$1,079 million in August. August's figure was revised up from a deficit of NZ$1,035 million.

Analysts had expected the deficit to decline to NZ$800 million.

Exports rose 2.0% year-on-year in September, while imports decreased by 1.2%.

"The value of imports from China has increased across most commodities for the last 12 months. Mobile phones and laptops led the increase, up a quarter of a billion dollars," Statistics NZ international statistics senior manager Jason Attewell said.

-

10:49

Number of unemployed people in France declines 0.7% in September

The French Labour Ministry released its labour market data on Monday. The number of unemployed people in France fell by 0.7% in September. It was the biggest monthly decline since 2007.

The unemployment in France has continued to increase since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment despite a rise in economic growth.

-

07:59

Global Stocks: U.S. stock indices mostly declined

U.S. stock indices mostly retreated on Monday with energy stocks leading declines amid weak oil prices.

The Dow Jones Industrial Average fell 23.65, or 0.1%, to 17,623.05. The S&P 500 declined 3.97 points, or 0.2%, to 2,071.18 (its energy sector fell 2.5%). The Nasdaq Composite Index climbed 2.84, or less than 0.1%, to 5,034.70.

Monday session was range bound as investors were cautious ahead of a Federal Reserve's meeting and prepared for quarterly earnings reports from 170 companies on the S&P 500 due this week.

In U.S. futures markets, traders put a 4% probability on a Fed rate hike at this week's policy meeting. They put a 33% chance on an increase in December.

This morning in Asia Hong Kong Hang Seng fell 0.81%, or 186.83, to 22,929.42. China Shanghai Composite Index lost 1.82%, or 62.25, to 3.367.33. The Nikkei fell 0.92%, or 174.51, to 18,772.61.

Asian indices were weighed by declines in commodity prices and China industrial profits data.

The National Bureau of Statistics reported that profits of Chinese industrial companies fell 0.1% y/y in September compared to an 8.8% plunge in August. "Even though the rate of industrial losses narrowed in September, given that downward pressure on the industrial economy continues, the industrial profit outlook is still not optimistic," the NBS said.

-

03:01

Nikkei 225 18,915.62 -31.50 -0.17 %, Hang Seng 23,008.17 -108.08 -0.47 %, Shanghai Composite 3,409.14 -20.44 -0.60 %

-

00:31

Stocks. Daily history for Sep Oct 26’2015:

(index / closing price / change items /% change)

Nikkei 225 18,947.12 +121.82 +0.65 %

Hang Seng 23,116.25 -35.69 -0.15 %

Shanghai Composite 3,430.36 +17.92 +0.53 %

FTSE 100 6,417.02 -27.06 -0.42 %

CAC 40 4,897.13 -26.51 -0.54 %

Xetra DAX 10,801.34 +6.80 +0.06 %

S&P 500 2,071.18 -3.97 -0.19 %

NASDAQ Composite 5,034.7 +2.84 +0.06 %

Dow Jones 17,623.05 -23.65 -0.13 %

-