Noticias del mercado

-

17:09

Saudi Arabian oil minister Ali al-Naimi: the market should determine oil prices

Saudi Arabian oil minister Ali al-Naimi said on Tuesday that the market should determine oil prices.

"Prices are a function of supply and demand," he said.

al-Naimi also said that the country was considering to cut energy subsidies. This decision would lead to a rise its domestic energy prices. Domestic energy prices in Saudi Arabia are among the lowest in the world.

-

16:41

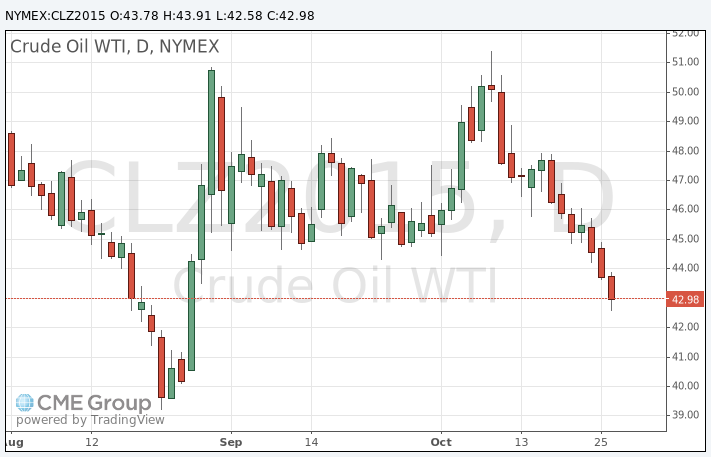

Oil prices hit 2-months-low

Oil prices fell on concerns over the global oil oversupply. Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

The EIA will also release its latest estimates of U.S. oil output.

According to the U.S. Energy Information Administration (EIA) last Wednesday, U.S. crude inventories increased by 8.03 million barrels to 476.6 million in the week to October 16. It was the fourth consecutive increase.

WTI crude oil for December delivery declined to $42.58 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $46.80 a barrel on ICE Futures Europe.

-

16:29

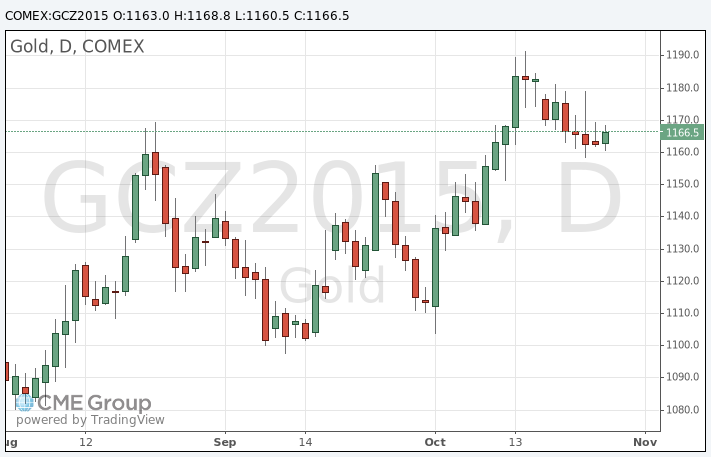

Gold price climbs ahead of the release of the Fed's monetary policy meeting results on Wednesday

Gold price rose ahead of the release of the Fed's monetary policy meeting results on Wednesday. The Fed's monetary policy meeting begins today.

It is unlikely that the Fed will change its monetary policy at its October meeting. Market participants will closely monitor the Fed's statement for signals when the Fed will start its raising interest rates. Most market participants expect that the Fed will not start raising its interest rates this year.

December futures for gold on the COMEX today increased to 1168.80 dollars per ounce.

-

10:53

International Energy Agency (IEA) Executive Director Fatih Birol: oil prices could rise from mid-2016 on a lower investment in the oil industry

The International Energy Agency (IEA) Executive Director Fatih Birol said on Monday that oil prices could rise from mid-2016 on a lower investment in the oil industry.

"If it comes true, this will be the first time in two decades we will see oil investments declining for two consecutive years," he said.

Birol pointed out that oil investments already dropped by more than 20% in 2015.

-

08:19

Oil prices fell amid signs of full storages

West Texas Intermediate futures for December delivery plunged to $43.46 (-1.18%), while Brent crude fell to $47.16 (-0.80%). Goldman Sachs wrote that distillate storage utilization was "alarmingly high" in both the U.S. and Europe.

Goldman Sachs indicated there was a probability of "15 to 30% each winter month" in Europe that storage tanks would be filled with a warmer-than-expected winter being a key risk. However, European weather forecasts are close to seasonal averages.

Meanwhile the greatest near-term concern remains China's economic growth.

-

08:02

Gold stabilized ahead of a Fed meeting

Gold is currently at $1,164.80 (-0.12%) as the Federal Reserve begins its two-day policy meeting later today. Investors are waiting for hints on the timing of rate hike in the U.S.

Most market participants don't expect the Fed to raise rates at this week's meeting, but they will be looking for signs of readiness to do so in December. Fed policymakers' messages suggest that they have been concerned over slow global economic growth and mixed domestic data. That's why some analysts believe that the first rate hike in nearly a decade will not be conducted before 2016.

-

00:33

Commodities. Daily history for Sep Oct 26’2015:

(raw materials / closing price /% change)

Oil 43.83 -0.34%

Gold 1,163.30 -0.25%

-